|

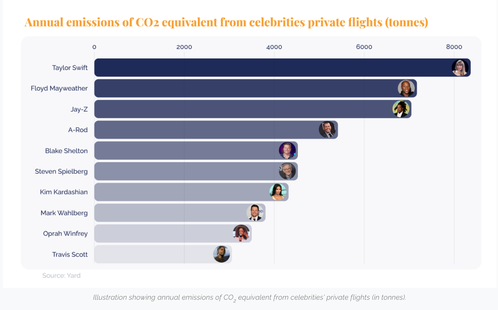

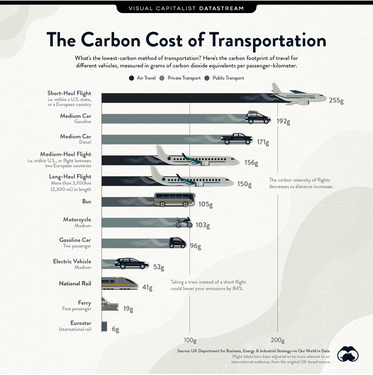

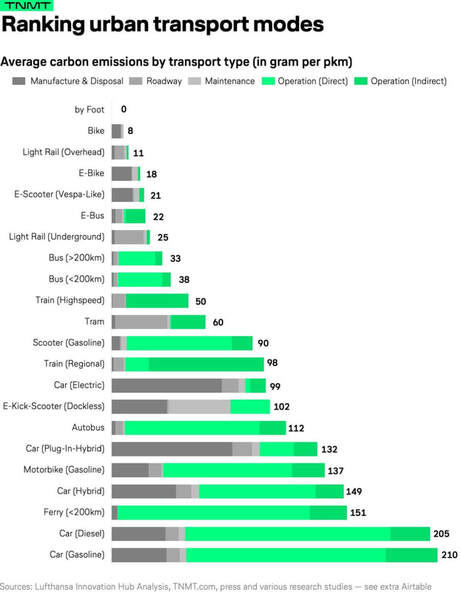

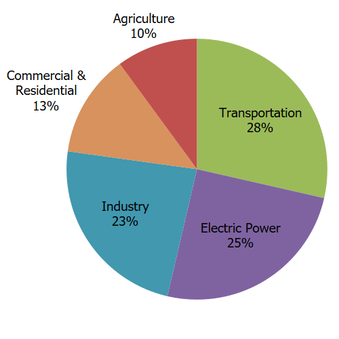

Celebrity Jet CO2. Green Washing. The Facts. Taylor Swift: The Average American Would Have to Live 600 Years to Match Her CO2 Emissions of 2022. How bad are commercial flights and cruise ships? Taylor Swift is in a league of her own these days, and it’s not just for being the only artist to win Album of the Year four times at the Grammys (congratulations on this monumental achievement), or because her Eras Tour is the highest-grossing music tour ever – surpassing a billion dollars in revenue (extraordinary). She is also being called out as the top CO2 emitter of all celebrities with private planes*. The emissions from her flight from Japan to Super Bowl Sunday on Feb. 11, 2024 were an estimated 40 tons of CO2. Total emissions from Swift’s private plane in 2022 were 9,293 tons (source: DGB Group), placing her at the top of celebrity plane polluters, followed by Floyd Mayweather, Jay-Z, A-Rod, Blake Shelton, Steven Spielberg, Kim Kardashian, Mark Wahlberg, Oprah Winfrey and Travis Scott – many of whom flew into Vegas for the Super Bowl. *Taylor Swift reportedly sold her Dassault Falcon 900 jet in January of 2024, after owning it since 2009. She allegedly purchases carbon offsets double the amount of her emissions. Offsets aren’t as effective as carbon drawdown and do nothing to actually remove the massive CO2 generated. Keep reading. Swift (and others) claim that their carbon credits offset their polluting ways. However, it’s quite important to note that the average American would have to live 600 years to contaminate the air as much as Taylor Swift did in just one year in 2022. It would take the average person living in France or the U.K. over 1,800 years to emit as much. (The U.S., Australia and Canada have 2-3 times the CO2 footprint of Europeans.) So, how bad is flying coach, especially compared to driving? What about cruise ships? See below for a graph of CO2 by transportation. As you can see, SUVs are worse on the environment than flying coach. CO2 by Transportation Private jets are in a horror league of their own, but cruise ships are terrible, as well. According to the Friends of the Earth analysis: One individual on a typical cruise ship emits roughly 421.43kg of CO² per day – more than double the emissions of most commercial flights. Alternatively, one individual staying in a high-end hotel, using carbon-heavy transportation and choosing higher carbon activities emits just 81.33 kg of CO² per day. The carbon footprint of an average land-based vacationer is around 51.88kg, less than one-eighth of the average cruisegoer. The lowest CO2 footprint is bike power. Followed by public transportation. In cities like Amsterdam, where bikes are everywhere, the denizens also enjoy greater health and far lower rates of obesity. Also, it bears repeating. Europeans often have a CO2 footprint of 5 or fewer tons per year per capita, while the Middle East, Australia, Canada, and the U.S. are 3X that. China is the biggest emitter by far, with 31% of the global CO2 emissions in 2020 (source: Union of Concerned Scientists). The greatest threat to our survivability on this beautiful planet is thinking that someone else will save things, while we continue on with business as usual. Celebrities are not immune from the effects of climate change. If we make excuses to keep our status quo, nothing improves. Let’s thank the scientists and environmental organizations for helping us to know better. Once we know better, it’s time to make the change. We can be the change we wish to see, and challenge leaders and famous folks to be accountable, too. While government leaders and celebrities may face a security risk if they fly coach, there are still many ways to substantially lower their CO2. There’s a massive difference between all and nothing. Additionally, if they have the resources for a private plane, they have the money to drawdown their emissions (not just “offset”). Below are just a few ways that all of us, including celebrities, can rethink our transportation CO2 footprint. Since transportation is the biggest CO2 emitter, reducing our personal footprint would be a game changer. We can also make smarter food, housing, electricity and consumption choices as well. Incidentally, green transportation is not just great for planetary health, but can also improve our physical and fiscal health. Did you know that most people spend more than $8000/annually on their personal vehicle, or that the dramatic rise in respiratory illnesses is directly linked to air pollution? Urban planner Brent Toderian consults with cities to eliminate congestion and reminds us that having too many cars on the road, even if they are electric, is an inefficient, gridlock transportation design. Making Smarter Transportation Choices: 6 Questions to Ask Ourselves Can I zoom instead of flying at least for the preparation stage of things? Can I plan my travel strategically, so I’m not zigzagging across the world? Is flying in a private plane necessary for my security, or am I using it as a party plane? Do I need a full-on bedroom in the sky, or will a cubby bed suffice? Can I downsize? Can the support team be incentivized to reduce their CO2 footprint? Instead of carbon offsets, should I invest in carbon drawdown, such as planting trees in a rainforest, donating to regenerative farming education, or sponsoring student gardens in public schools? And here is more color on each question… Can I zoom instead of flying at least for the preparation stage of things? Before the pandemic, I hosted our Financial Freedom Retreats in person. Occasionally, we’d have someone attending by videoconference, and it was always troublesome. That person typically felt isolated. Today, we host all of our initial retreats online, and save our in-person retreats for experienced individuals who have already attended the online training, and are ready to form deeper connections and partnerships. It’s actually easier for retreat attendees to see all of the power point presentations, to hear me up close and personal (as if I’m talking only to them), and to watch the training back to take the wisdom in more deeply. When everyone is on the same page, putting us all in the same location, in inspiring settings that offer experiential wisdom of what we’ve learned on paper, is far more powerful than taking people to a cool place and then sequestering them in a boardroom for 8+ hours each day. Can I plan my travel strategically, so I’m not zigzagging across the world? The Eras Tour coordinators, likely under the aegis of Taylor Swift, have planned the tour to minimize crisscrossing continents. She’ll be in Europe from early May through August. Swift might get a well-deserved break (writing/recording?) in September, followed by dates in the U.S. and Canada in October and November. If you have family on the opposite coast, rather than hopping back and forth multiple times throughout the year, can you take an extended visit once a year, dropping your travel CO2 by 2/3rds? Facetime and Zoom are great ways to stay connected in the interim. Is flying in a private plane necessary for my security, or am I using it as a party plane? This might be a fantasy scenario, but perhaps it will inspire creative thinking from some celebrities. Yes, it’s thrilling to attend the Super Bowl in person. However, if I’m also thinking of the future of my grandchildren, wouldn’t it be even more fun to sponsor a box where local underserved superstars attend the Super Bowl (perhaps inner-city high school athletes), while I host a party at home for my friends? Newscasters might love to feature the local students who get to experience the A-list treatment for the Big Game. Do I need a full-on bedroom in the sky, or will a cubby bed suffice? Can I downsize? The plane that Taylor Swift flew from Japan to the Super Bowl seats 17 passengers and has a master suite bedroom. Compare that to the first-class reclining seat, or the coach passenger leaning on strangers during snooze time. The larger the plane and the more weight (passengers, equipment or bedrooms), the more fuel is needed. On the flipside, The Prince and Princess of Wales (William and Catherine) took a commercial flight to France on September 9, 2023. In August, The Princess of Wales took Princess Charlotte and Prince Louis on an economy flight for their summer holiday in Balmoral. The couple have their Earth Shot Prize and are keenly aware of the message this sends with regard to their commitment to the environment. Can the support team be incentivized to reduce their CO2 footprint? When we place the planet at the top of our to-do list, our priorities and decisions become much easier. For high-profile celebrities, consulting an environmental expert on how to reduce their CO2 footprint by 30% annually would go a lot further in the public opinion and for the planet than purchasing carbon offsets, which do nothing to reduce CO2, or remove the pollutants from the damage they do. If the entire team is on board with the CO2 reduction plan, there can be even more incentives and rewards for the support team. Clif Bar offers employees up to $500 to purchase a commuter bike, if they agree to commute to work by bike at least twice a month, or use the bike frequently for local needs. Google’s GBike program offers bikes for getting around the headquarters’ campus, and loans bikes to employees who will use it at least 60% of the time to commute to work. “Treat the Earth like home” is one of the six principles of Dr. Bronner’s. Instead of carbon offsets, should I invest in carbon drawdown, such as planting trees in a rainforest, donating to regenerative farming education, or sponsoring student gardens in public schools? Nature is amazing. The waste of one animal or plant is the nutrition of another. We breathe and emit CO2. Plants and trees breathe that in, store it in the soil and give us clean food and air. In addition to reducing the CO2 footprint with smarter choices in all the ways that CO2 is emitted, why not complete the circle and draw down the CO2 emissions with charitable contributions to organizations that embrace nature’s remedies? Learn more about regenerative agriculture, student gardens, green tips, animal conservation and more in the Earth Gratitude docuseries (free) at https://earthgratitude.org. Bottom Line It’s easy to shrug and say, “Not my fault,” and continue doing what we do because what difference does it make while celebrities jet around to sports events and parties, while we bike with our backpacks to the grocery store. In that scenario, the ice caps keep melting. However, peer pressure is persuasive and facts are empowering. Social media can spark positive change. Call out the celebrities. Offer solutions. And take the challenge ourselves to reduce our own CO2 footprint. There is power in our consumer choices, and in our investing choices. Corporations can’t sell their gasoline, plastic, farm chemicals, celebrity jets, etc., if there is no one to buy them. We all need to make the connection between the source of our lifestyle, and our contribution to the problems. Celebrities have to realize that by partying in the sky, they are making the oil and gas companies rich and contributing to the environmental injustice of the communities affected by the fossil fuel industries – including the chemical spill in Palestine, Ohio, the Dead Zone in the Gulf of Mexico and Cancer Alley. When we think of our neighbors, or even the plight of fish, dolphins, whales and seafood, it's easier to do the right thing. Below are a few more blogs to take this conversation even deeper. 13 Lifestyle Choices to Reduce Waste, Pollution & CO2 and Save Thousands Annually. https://www.nataliepace.com/blog/september-18th-2023#/ 11-Point Green Checklist for Schools. https://www.nataliepace.com/blog/11-point-green-checklist-for-schools#/ ESG Investing: Missing the E (Environment) https://www.nataliepace.com/blog/the-dirty-truth-about-esg-investing-its-missing-the-e 10 Tips to Green Living https://www.nataliepace.com/blog/7-green-life-hacks#/ Cruise Ships Reward You For Investing. Is It Worth It? https://www.nataliepace.com/blog/cruise-ships-reward-you-for-investing-is-it-worth-it#/ Join us at our April 27-29, 2024 Spring Financial Freedom Retreat. Learn how to green your wealth plan, easy and efficacious nest egg strategies, how to get hot and diversified (including in artificial intelligence), and what's safe in a Debt World. You'll even discover how to save thousands annually with smarter big-ticket choices. Yes, it's a complete money makeover, which is a great way to start 2024! Email info@NataliePace.com to register. Learn the 15+ things you'll master and read testimonials in the flyer on the home page at NataliePace.com. Register by Feb. 29, 2024 to receive the best price. "Ten minutes into the first day I was already much smarter about investing than I ever thought I would be in my life and I knew I was in exactly the right place at this retreat. I am amazed at how EASY and FUN it is to make my money work for me and those I love. I think this kind of information should be compulsory in schools. I wish I'd learned this sooner." CM  Join us for our Restormel Royal Immersive Adventure Retreat. March 7-14, 2025. Email info@NataliePace.com to learn more. Register by April 30, 2024 to receive $200 off the regular price. Click for testimonials, pricing, hours & details. There is very limited availability, and you must register early to ensure that you get the exact room you want. This retreat includes an all-access pass to all of our online training for a full year for two and three 50-minute private, prosperity coaching sessions!  Natalie Wynne Pace is an Advocate for Sustainability, Financial Literacy & Women's Empowerment. Natalie is the bestselling author of The Power of 8 Billion: It's Up to Us and is the co-creator of the Earth Gratitude Project. She has been ranked as a No. 1 stock picker, above over 835 A-list pundits, by an independent tracking agency (TipsTraders). Her book The ABCs of Money remained at or near the #1 Investing Basics e-book on Amazon for over 3 years (in its vertical), with over 120,000 downloads and a mean 5-star ranking. The 5th edition of The ABCs of Money and the 2nd edition of Put Your Money Where Your Heart Is are the most recent releases of these books. Follow her on Instagram. Natalie Pace's easy as a pie chart nest egg strategies earned gains in the last two recessions and have outperformed the bull markets in between. That is why her Investor Educational Retreats, books and private coaching are enthusiastically recommended by Nobel Prize winning economist Gary S. Becker, TD AMERITRADE chairman Joe Moglia, Kay Koplovitz and many Main Street investors who have transformed their lives using her Thrive Budget and investing strategies. Click to view a video testimonial from Nilo Bolden. Watch videoconferences and webinars on Youtube. Other Blogs of Interest Copper: Essential to the Clean Energy Transition. Uh. Oh. More Bank Trouble. Are Amazon, Square and Other Tech Companies Ripping Us Off? Housing. Unaffordable. What Works? Case studies and creative solutions. Don't Reach for Yield. Closed-End Funds. 2024 Investor IQ Test. Answers to the 2024 Investor IQ Test. Apple's Woes Drag Down the Dow. The Winners & Losers of 2023. Ozempic, Magnificent 7 & Beyond. 2024 Crystal Ball. The Underperforming DJIA, Full of Fossil Fuels and Forever Chemicals. A Spectacular Year for 3 of the Magnificent 7. The Best ROI* (Almost 40%!) & 7 Life Hacks That Save Thousands. Portugal Eliminates Tax Advantages for Ex-Pats. Holiday Gift Giving on any Budget. Including No Budget. Once in a Century Events are Happening Every Day. The Crypto Winter Enters Its 3rd Year. Earn $50,000 or More in Interest. Safely. Finally. Freebies and Deals for Black Friday and Cyber Monday. Auto Strikes End. EV Price Wars Continue. WeWork's Bankruptcy. Half-Empty Office Buildings. Problems in our Personal Wealth Plan. Solutions for Unaffordable Housing. Cruise Ships Give Freebies to Investors. Should You Take the Bait? Should You Take a Cruise? Bonds. Banks. The Treacherous Landscape of Keeping Our Money Safe. 7 Rules of Investing Air B N Bust? Barbie. Oppenheimer. Strikes. Streaming Wars. Netflix. Monero: A Token of Trust? 13 Lifestyle Choices to Reduce Waste, Pollution & CO2 & Save a Boatload of Dough. China Bans Apple 11-Point Green Checklist for Schools. Artificial Intelligence and Nvidia's Blockbuster Earnings Report Biotech in a Post-Pandemic World 10 Wealth Secrets of Billionaires and Royals. What Happened to Cannabis? Bank of America has $100 Billion in Bond Losses (on Paper) Lithium. Essential to EV Life. I'm Just Not Good at Investing. Investors Ask Natalie. Should I Buy an S&P500 Index Fund? Investors Ask Natalie. Bonds Lost More than Stocks in 2022. Do Cybersecurity Risks Create Investor Opportunities? I Lost $100,000. Investors Ask Natalie. Artificial Intelligence Report. Micron Banned in China. Intel Slashes Dividend. Buffett Loses $23 Billion. Branson's Virgin Orbit Declares Bankruptcy. Insurance Company Risks. Schwab Loses $41 Billion in Cash Deposits. Fiat. Crypto. Gold. BRICS. Real Estate. Alternative Investments. BRICS Currency. Will the Dollar Become Extinct? The Online Global Earth Gratitude Celebration 7 Green Life Hacks Fossil Fuels Touch Every Part of Our Lives Are There Any Safe, Green Banks? 7 Ways to Stash Your Cash Now. Lessons from the Silicon Valley Bank Failure. Which Countries Offer the Highest Yield for the Lowest Risk? Why We Are Underweighting Banks and the Financial Industry. 2023 Bond Strategy Emotions are Not Your Friend in Investing Bonds Lost -26%, Silver Held Strong. Save Thousands Annually With Smarter Energy Choices Is Your FDIC-Insured Cash Really Safe? Money Market Funds, FDIC, SIPC: Are Any of Them Safe? My 24-Year-Old is Itching to Buy a Condo. Should I Help Him? The 12-Step Guide to Successful Investing. The Bank Bail-in Plan on Your Dime. Rebalancing Your Nest Egg IQ Test. Answers to the Rebalancing Your Nest Egg IQ Test. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable. However, NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors.

0 Comments