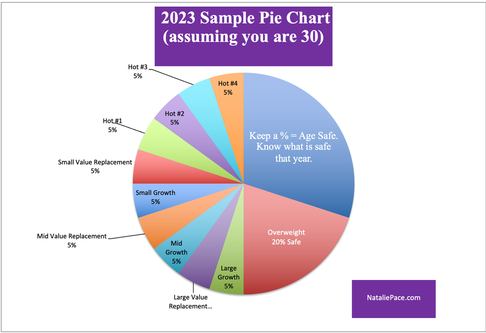

One of the most important things we can do to grow and protect our wealth is to rebalance our investments 1-3 times a year. Rebalancing with Natalie Pace's nest egg pie chart strategies is a buy low, sell high plan on auto-pilot. It takes the emotions out of our wealth plan, and puts them on the right side of the trade.

It's important to fix the roof while the sun is still shining. 21st Century recessions can cost investors more than half of their wealth, and then take years to crawl back to even. In the meantime, our FICO is shot and we could have trouble making ends meet.

Many of us are trusting someone else to protect our future and manage our wealth, without digging into the nitty-gritty of just how that is being done, or whether or not the strategy works in rough times. In the worst case scenario, I've seen a lot of people who have been misled about their investments and how protected their wealth is. (Click to learn more about that.) It's easy to make money in a secular bull market (stocks 2009-2021) and easy to lose (a lot) in a recession. That's why it's so important to adopt a plan that protects our wealth in hard times and compounds gains in rallies.

TESTIMONIALS

"Many people, including educated men and women, often get into trouble when they

neglect to follow simple and fundamental rules of the type provided [by Natalie].

This is why I recommend them with enthusiasm."

Professor Gary S. Becker. Dr. Becker won the 1992 Nobel Prize in economics for his theories on human

"College students need this information before they get their first credit card. Young adults need it before they buy their first home. Empty nesters can use the information to downsize to a sustainable lifestyle, before they get into trouble."

Joe Moglia, Chairman, TD AMERITRADE.

"Thank you Natalie for saving my retirement," Nilo Bolden.

So, Is Your Financial Plan a Pipe Dream?

Does it only work if the stock market goes up? Are you being lured into a risky and faulty strategy with charts that selectively shave the data to make the sale? If you’re being shown charts about how well you’ve done over the past five years, and are being instructed to just buy and hold, are you at greater risk than you realize? Are you aware that past performance has zero correlation with future performance?

21st Century recessions have wiped out investors twice. In the Great Recession, stocks dropped 55% and took about 6 years to make up losses (your wealth takes longer to come back than the markets do). In the Dot Com Recession, the NASDAQ Composite Index sank by 78% and took 15 years to crawl back to even. When we wait for the headlines that the economy is in a recession, it's too late to protect our wealth. We've already experienced most of the losses, and are closer to the bottom.

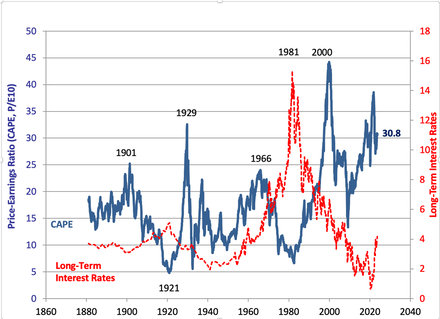

Using the Cape Ratio and Warren Buffett's favorite valuation Indicator, stocks are more expensive today than they were in the Great Recession, when stocks dropped by more than half, and almost as expensive as the Great Depression. (You know what happened there.) Howard Silverblatt, the senior index analyst of the S&P 500, also warned about expensive stocks in my interview with him from earlier this year (click to watch).

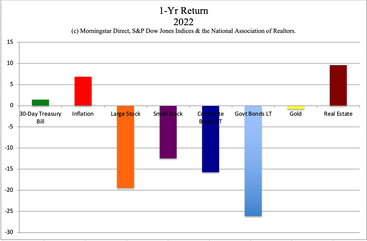

Rebalancing with Natalie Pace's nest egg pie chart strategies is a buy low, sell high plan on auto-pilot. This one-day course will provide participants with a pre-programmed Excel file that makes organizing your investments easy. Using this tool, and our free pie chart web apps, you can easily determine where you have too much concentration, where you can add more, and how you can protect your wealth from losses in a year where LT bonds lost more than the S&P500!

Market timing doesn't work. However, this simple pie chart system with 1-3 times a year rebalancing, earned gains in the Dot Com and Great Recessions and outperformed the bull markets in between.

Is the Rebalancing Master Class right for you? Take the Rebalancing IQ Test to determine to see how much you really know about rebalancing, and whether or not you can benefit from immersing yourself for a day in Natalie Pace’s wisdom to learn this invaluable wealth tool.

- What does rebalancing mean?

- Why do you need to rebalance?

- How often should you rebalance? Why?

- What is the easiest way to rebalance your nest egg?

- What are some of the fundamentals to properly diversifying your nest egg?

- Which assets go into your nest egg?

- Which assets do not go into your nest egg?

- Should you invest in individual companies in your nest egg?

- What is the difference between value and growth?

- Which companies go into which slice?

- What are the capitalization categories for small, mid and large caps?

- Why do we evaluate the funds we own to put them in the proper slice and category?

- What kind of funds do we want to avoid?

- What kind of funds do we want to own?

- What is an “everything and the kitchen sink” fund? Is this a fund we want to own? Why or why not?

- When do we switch out funds and pick something new?

- How many times a year should you rebalance?

- What are some key dates to consider rebalancing? Why?

- What kind of return are you aiming to achieve in your nest egg? Does this differ in the slices and on the safe or at-risk side?

- How can limit orders help your rebalancing?

- How do you determine your limit sell order price?

- What is the difference between a “Stop Loss” mindset and a “Capture Gains” mindset?

Email info @ NataliePace.com or call 310-430-2397 if you have any questions about this test, or about the answers, or if you are interested in registering for the Jan. 20, 2024 Rebalancing Your Nest Egg Master Class. Get answers to the IQ Test by clicking here.

This retreat will be online, giving you intimate access to Natalie Pace live, as well as a recording of the training. Call 310-430-2397 or email [email protected] to register NOW.

WHERE AND HOW MUCH:

Online

Early Bird Pricing (through Nov. 30, 2023)

$395/person

$150/person per additional person in the family.

(Volunteers: email [email protected] or call 310-430-2397 to learn more about our affordable 12-month all-access pass -- the best bargain we offer!)

Regular Pricing (after Nov. 30, 2023)

$525/person

$250/person per additional person in the family.

Call 310-430-2397 or email [email protected] to enroll now.

Get the best price when you register by Nov. 30, 2023.

Call 310-430-2397 or email [email protected] to learn more and register now!

MORE TESTIMONIALS

"We asked Natalie Pace for a second opinion on our investment portfolio. She researched and reviewed each stock and fund. She then explained to us in plain English how we were positioned in the market and how high our risk exposure was. Her knowledge was so profound that we decided to take her retreat in Arizona. My husband was still quite skeptical, but 20 minutes into the retreat he turned to me and said "Thank you." Stocks and investing are no longer rocket science. We give thanks just about every day that we met Natalie. I feel like I live on a different planet. I'm so grateful. Thank you for changing our lives, our peace of mind, our future and our vision of what is possible. We made a tectonic shift with you."

AC & AM

"Ten minutes into the first day I was already much smarter about investing than I ever thought I would be in my life and I knew I was in exactly the right place at this retreat. I am amazed at how EASY and FUN it is to make my money work for me and those I love. I think this kind of information should be compulsory in schools. I wish I'd learned this sooner." CM

“The only time in history going back to 1881 when [stock prices] have been higher are, A: 1929 and B: 2000. We are at a high level, and its concerning. People should be cautious now.” Robert Shiller, Nobel Prize winning economist and Yale professor of economics

I met a new financial advisor/money manager, David, at a conference. I wanted to trust someone since my knowledge was lacking in this arena. I asked David if he was a fiduciary. He said he was, that everything he did was for us. David had put us into a variety of high-risk investments that were good for him, in that they paid him a high commission! Many of these companies have been cash negative for years, borrowing from one investor to pay off another, and paying brokers a high commission to do that. We put in the paperwork last year to cash out of these. Nothing!!! Then we redid the paperwork in August. We did everything by the book. Waiting… waiting… nothing. David, the salesman who put us into these investments, is not even returning our calls!!!! Now, we’re in the process of filing complaints with FINRA, the SEC and the FTC on all of those involved. If I can impart any wisdom to you, it is to remember that “financial advisors” are sales people. They know how to listen and manipulate to serve their best interests, all the while making you believe that they truly are your friend. I am so angry at this system!!!! It is still hard for me to accept David’s lack of integrity and respect in not responding. I am grateful we are now educating ourselves. Studying with Natalie Pace is giving us this opportunity. I wish everyone could take these workshops. It would be great if this was taught in schools.

D&T, Indiana

Call 310-430-2397 or email [email protected] to learn more and to register now.

No Refunds. No Cancellations.

The Rebalancing Master Class works best when you do it after learning the strategies taught in our 3-day Investor Educational Retreat. For this reason, we only register individuals who have completed at least one retreat prior to the master class. (We may make an exception for financial industry professionals who know the pie chart system and regular rebalancing). Consider joining Natalie Pace at our Jan 13-15, 2024 retreat, which takes place the weekend before this master class. Visit the home page at NataliePace.com to view upcoming retreats. Call 310-430-2397 or email [email protected] to get additional information and to register.

Natalie Wynne Pace is an Advocate for SustainabilityFinancial Literacy & Women's Empowerment. Natalie is the bestselling author of The Power of 8 Billion: It's Up to Us and is the co-creator of the Earth Gratitude Project. She has been ranked as a No. 1 stock picker, above over 835 A-list pundits, by an independent tracking agency (TipsTraders). Her book The ABCs of Money remained at or near the #1 Investing Basics e-book on Amazon for over 3 years (in its vertical), with over 120,000 downloads and a mean 5-star ranking. The 5th edition of The ABCs of Money and the 2nd edition of Put Your Money Where Your Heart Is were released in 2021. Follow her on Instagram.

Natalie Pace's easy as a pie chart nest egg strategies earned gains in the last two recessions and have outperformed the bull markets in between. That is why her Investor Educational Retreats, books and private coaching are enthusiastically recommended by Nobel Prize winning economist Gary S. Becker, TD AMERITRADE chairman Joe Moglia, Kay Koplovitz and many Main Street investors who have transformed their lives using her Thrive Budget and investing strategies. Click to view a video testimonial from Nilo Bolden.

Natalie Wynne Pace is an Advocate for SustainabilityFinancial Literacy & Women's Empowerment. Natalie is the bestselling author of The Power of 8 Billion: It's Up to Us and is the co-creator of the Earth Gratitude Project. She has been ranked as a No. 1 stock picker, above over 835 A-list pundits, by an independent tracking agency (TipsTraders). Her book The ABCs of Money remained at or near the #1 Investing Basics e-book on Amazon for over 3 years (in its vertical), with over 120,000 downloads and a mean 5-star ranking. The 5th edition of The ABCs of Money and the 2nd edition of Put Your Money Where Your Heart Is were released in 2021. Follow her on Instagram.

Natalie Pace's easy as a pie chart nest egg strategies earned gains in the last two recessions and have outperformed the bull markets in between. That is why her Investor Educational Retreats, books and private coaching are enthusiastically recommended by Nobel Prize winning economist Gary S. Becker, TD AMERITRADE chairman Joe Moglia, Kay Koplovitz and many Main Street investors who have transformed their lives using her Thrive Budget and investing strategies. Click to view a video testimonial from Nilo Bolden.

Proudly powered by Weebly