|

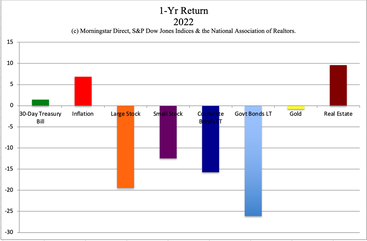

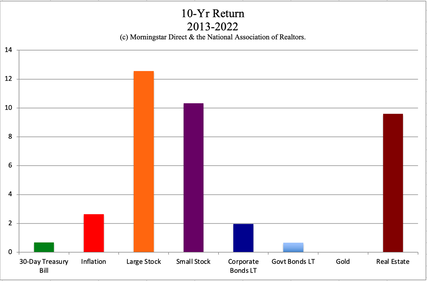

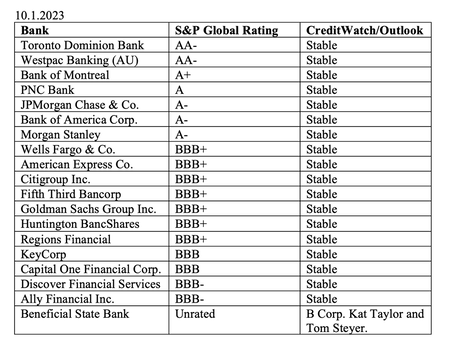

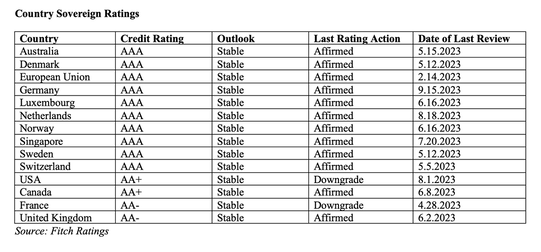

Bonds. Banks. The Treacherous Landscape of Keeping Our Money Safe. I’ve been reading Samuel Pepys diary. In it he describes the Great Fire of London, when he stashed his gold coins in a carriage, and then had his wife and father bury it in the yard of their country home. Over a year later in the dead of night, he and a trusted friend dug it up in the shadows, out of sight (they hoped) from their neighbors. After the first lode was recovered, they tallied everything up and discovered they were still about 100 coins shy of the total. So they spent the rest of the night sifting through dirt to try and find the missing pieces. In the end, Pepys was relieved that they had only lost about 20 to 30 gold coins. Pepys remarked in his diary, “How painful it is sometimes to keep money, as well as to get it.” This is a sentiment many bond investors and even bank depositors have felt this year, after learning that bonds lost more than stocks in 2022, and watching four major U.S. banks fail. First Republic Bank was A- rated when it had to be rescued. Heartland Tri-State Bank of Kansas didn’t make as many headlines as Silicon Valley Bank, Signature Bank and First Republic did, when it failed in July 2023. We’ve been warning against bonds since 2011. Savers and fixed income investors weren’t being paid to take on the risk, when rock-bottom interest rates encouraged speculation and discouraged pensioners and bondholders with almost no Return On Investment. Asset prices (stocks and real estate) and leverage (debt) soared to new heights, while long-term bonds lost value, and became illiquid and negative-yielding. There have been many failures attributed to bad bond bets. MF Global was one of the more high-profile bankruptcies in 2011. Silicon Valley Bank is another tragic example, as is the $100 billion paper bond losses on the books of the Bank of America. However, how many of us are aware that we are likely holding some of this dodgy paper in our own retirement accounts – even if it is being managed by a fiduciary financial advisor? A Better Way to Get Safe At the bottom of the Great Recession, it was fairly easy to invest in real estate, and do quite well. Anyone with a great deal of money in their liquid assets on the safe side could consider having a safe income-producing hard asset (like a 2nd home that they rented out) that they had purchased for a good price. The ongoing income was a safer yield than bonds were. Real estate is unaffordable in most areas these days. So, that strategy is on pause for now. However, there are other ways to produce income by thinking creatively about all of the bills we pay. (We cover this in depth at our Financial Freedom Retreat.) Of course, we’re always going to need liquidity and cash, too, which means figuring out a way to protect our money from losses, while taking advantage of the 5.5% interest rates that are available this year. This is tricky, but doable. Below are the areas we’ll cover in this blog. Bonds. Tricky, but Doable. Keep the Terms Short and the Creditworthiness High Duration Risk Credit Risk Liquidity FDIC. CDIC. Diversification SIPC. Money Market Funds. Bond Funds and Annuities. Employer Retirement Plans One More Rate Hike? And here is more information on each point. Bonds. Tricky, but Doable. I’m seeing a lot of managed plans that are supposed to be conservative, which are getting loaded up with risky junk bonds and loan products. Getting safe is not as simple as asking your fiduciary financial advisor to protect your wealth. It’s important to know what you own and why, and to read the fine print on your statements. Even highly educated, successful business people can have trouble reading their statements, especially when the information that they’re being told is quite different from what is lying there in the fine print on the statement itself. (Are you verifying what you own with the fine print, or just having faith in what you’re being told?) As just one example (there are many), one of my clients had been told that he was earning 5-7% yield on his portfolio, and that his safe investments protected him from all of the losses in stocks. The statement itself revealed that this was not the truth at all. Due to the losses in the value of the bonds, the return was 1.7% year to date (not 5-7%), compared to 13.9% ROI in stocks. 2022 was a down year for equities. However, stocks had a gangbuster 2021. Even with 2022’s poor performance, stocks earned 7.3% annualized over the 3-year period and 10-12.5% over the 10-year period. Keep the Terms Short and the Creditworthiness High In 2024, the best policy for bonds is going to be to continue to keep the terms short, and the credit worthiness high. The reason for that is duration risk and credit risk. According to the Financial Stability Report released by the Federal Reserve Board on Oct. 20, 2023, “Gross leverage—the ratio of debt to assets—of all publicly traded nonfinancial firms remained high by historical standards.” Net leverage is also elevated. When companies that are already burdened with high debt hit troubled times, one of the options that has to be thrown on the table is debt restructuring through bankruptcy proceedings. Johnson & Johnson, a AAA-rated Dow Jones Industrial Average component, is seeking bankruptcy protection to help settle its talc lawsuit liabilities. (Companies can restructure debt obligations while remaining in business. We’ve seen this in the airlines, retail and automakers industries.) Duration Risk “I am more concerned with the return of my money than the return on my money,” Will Rogers. When are you supposed to get your money back? Is it after you will have been dead for a couple of decades? When someone makes a promise to pay you back, it’s a good idea to know exactly when that’s going to occur, and what events might happen in between now and then that might prevent them from keeping their promise of paying you back. Some businesses are still borrowing for terms longer than 30 years. Even an AA+ rated company, like Apple, can run into challenges over that long of a period of time, just like AAA- Johnson & Johnson is currently facing. If the company gets a credit downgrade or needs to raise money again at a higher interest rate, the value of your existing bond plunges. There is an elevated risk in long-term bonds at this time, partly due to rampant leverage in today’s Debt World. However, there is also a lot of war, political instability, supply chain bottlenecks, inflation, strikes and other challenges to the peace and prosperity of Main Street and Wall Street. Typically, you’ll get a higher interest rate for taking on the additional risk of duration. However, we’re currently getting paid more for short-term bonds than long-term. That will change, which is why annual rebalancing of our wealth plan is important. Credit Risk With over half of the S&P 500 at or near junk-bond status, including most American banks, there are a lot of reasons to be conservative about who you loan money to (in your bond) and how long they have before they have to give it back. Commercial real estate is one industry that is vulnerable right now. However, casinos, cruise ships, hotels, airlines and auto manufacturers are also highly leveraged with low (junk bond) credit ratings. At minimum, it’s important to know the credit rating, leverage, revenue growth and future prospects of the entity you’re loaning the money to (not just the credit rating, as we learned with First Republic Bank and Johnson and Johnson). Liquidity Having access to your money is key, particularly in uncertain times. However, if you buy a risky bond, you might have difficulty finding someone to take it off your hands. If you are able to find a buyer, they’re going to want to buy it on the cheap. That is another reason why we don’t want to reach for yield in today’s overleveraged, volatile world. We risk having our safe assets become illiquid. Now would be a good time to separate the short-term, high quality bonds in our portfolio from the toxic, overleveraged, long-term. Yes, there is a chance that interest rates will start being cut in the future (as soon as late 2024?). While in a normal world, that would help the value of our existing bonds to increase, the matter is complicated when the bonds are low quality and long-term (unless the maturity date is very near). Unless there is a massive growth streak, these firms may have to unload some of their obligations in order to keep operating. Debt restructuring means everyone with a claim gets paid less than par. (Shareholders typically get shafted, which is why stocks are riskier than bonds.) FDIC. CDIC. When Silicon Valley Bank failed, there was one uninsured depositor with over $5 billion, and many other uninsured depositors, as well. I’m sure that played into why the FDIC, Treasury and Federal Reserve came together to embrace a rule that allowed them to make a one-time exception and cover uninsured depositors. These government institutions have taken steps since then to force banks to improve their balance sheets because they do not want to have any more bailouts. How much money do you have sitting at your bank? Is it above the FDIC levels? Why not consider a few FDIC-insured CDs in other creditworthy banks? Federally insured short-term CDs are paying a decent interest rate these days. Diversification Consider diversifying across banks, so that our wealth is federally insured as much as possible. We might also consider having treasury bills (in our own country). Here again, keep the terms short and the creditworthiness high. Long-term government bonds lost -26% of their value last year. They pay less than the short-term issues. Many brokerages make it easy to purchase short-term treasuries within our self-directed retirement accounts. Consider having rolling short-term maturity dates. As the landscape for bonds changes, there will come a time to start adding mid-term duration for the higher credit quality countries and companies with good growth prospects on the horizon. For now, there is a lot of risk in corporate bonds. However, there are also a few opportunities. Again, one must step gingerly to avoid illiquidity, negative yield, and principal loss. However, diversifying, while keeping the terms short (1-3 years) and the creditworthiness high, will go a long way to protecting us from today’s volatile, uncertain world. SIPC. Money Market Funds. Money market funds can lose value and are not FDIC insured. When they lose favor, the share price can plunge as investors run for the exits. (Money market funds had to be rescued in the Great Recession.) The SIPC is not as well-funded or as safe as federally insured banks. There are loopholes in the bank sweep programs that many brokerages offer as a way to get our cash FDIC-insured. I outline a lot of these challenges in my blog from June 2021. (Click to access.) Money market funds no longer have redemption gates. However, they are required to impose liquidity fees if too many people leave at the same time. Bond Funds and Annuities. Bond funds are also losing value. Many have expenses that knock the yield down by one percent or more. Bond funds, pension funds and insurance companies (annuity providers) have investments in illiquid long-term bonds; they loan to commercial real estate and other projects that will need to borrow in 2024 at a much higher rate than they did between 2009 and 2021. According to the Financial Stability Report, “Bond and loan funds that hold assets that can become illiquid during periods of stress remained susceptible to large redemptions. Life insurers continued to rely on a higher-than-average share of runnable liabilities.” Annuities are not federally insured; they are backed by the company that issues the promise. If they are tied to an index, they might also lose value in a recession. Employer Retirement Plans It can be difficult to get safe from the bond challenges in our employer retirement account. If we read the fine print on what is offered in the fixed income or safe category, and are confident that we have selected the best choice, then that’s a good start. However, there are a few other things to consider. One might be to deposit only up to the employer’s match into your employer retirement account, and put the rest into self-directed retirement accounts, including a Health Savings Account (if you’re an American). You’ll have more freedom and choices in your self-directed accounts than the couple of dozen mutual fund options available in your 401K or RSP. Having a more holistic approach to our wealth plan, rather than just depositing into our 401(k) or RSP and checking off the boxes as best we can, will make a huge difference in our quality of life today, and our security tomorrow. We cover all of this at our Financial Freedom Retreat, which is a complete money makeover. One More Rate Hike? The Summary of Economic Projections from the September 20, 2023 FOMC meeting indicated that there could be another rate hike in the November or December 2023 meeting, which is negative for bond values. The board members are also projecting rate cuts in 2024, which is positive. Of course, all of this is fluid and reliant on incoming data. According to Federal Reserve Board Chairman Jerome Powell in a speech to the Economic Club of New York, “Additional evidence of persistently above-trend growth, or that tightness in the labor market is no longer easing, could put further progress on inflation at risk and could warrant further tightening of monetary policy.” That’s Fed-speak for “interest rates could rise.” This uncertainty may appear to make it more difficult to separate the toxic bonds from those that will return to full value and get paid back in full, and will be something that most financial advisors will cite as a reason to do nothing. However, a general rule is that higher credit quality and shorter terms will reduce your risk, while risky bonds could continue to lose value due to the potential of a credit downgrade or debt restructuring (bankruptcy). A harsh recession would be the reason that interest rates get cut, which will be hard for the low credit quality companies to endure without an event that would be negative for bondholders. If you’d like an unbiased 2nd opinion on your personal plan, we offer that through our private coaching. Email [email protected] for pricing and information. Bottom Line Today my thoughts and prayers are with anyone displaced from their home, embroiled in the horrors of war, or trying to make ends meet in a world of inflation when life doesn’t add up. These hardships and tragedies are heartbreaking. And they also add risk to all of us. There’s a reason why peace and prosperity are interlinked so often in grammar. War, natural disasters, pandemics, bank failures, supply chain bottlenecks, skyrocketing debt, inflation, nationalism and elevated asset prices can be perilous to our fiscal health. Navigating to safety in such an environment requires careful planning and execution. While protecting our wealth is not going to end war and create peace on the planet, it can put us in a better position of operating from strength instead of fear, anger and distress. A healthier, wealthier you can make positive contributions to humanity and our shared home planet.  Join us for our Online New Year, New You Financial Freedom Retreat. Jan. 13-15, 2024. Email [email protected] or call 310-430-2397 to learn more. Register by Halloween to receive the best price and a complimentary 50-minute private prosperity coaching session (value $400). Click for testimonials, pricing, hours & details.  Join us for our Restormel Royal Immersive Adventure Retreat. March 8-15, 2024. Email [email protected] to learn more. Register with friends and family to receive the best price. Click for testimonials, pricing, hours & details. There is very limited availability, and you must register early to ensure that you get the exact room you want. This retreat includes an all-access pass to all of our online training for a full year for two!  Natalie Wynne Pace is an Advocate for Sustainability Financial Literacy & Women's Empowerment. Natalie is the bestselling author of The Power of 8 Billion: It's Up to Us and is the co-creator of the Earth Gratitude Project. She has been ranked as a No. 1 stock picker, above over 835 A-list pundits, by an independent tracking agency (TipsTraders). Her book The ABCs of Money remained at or near the #1 Investing Basics e-book on Amazon for over 3 years (in its vertical), with over 120,000 downloads and a mean 5-star ranking. The 5th edition of The ABCs of Money and the 2nd edition of Put Your Money Where Your Heart Is were released in 2021. Follow her on Instagram. Natalie Pace's easy as a pie chart nest egg strategies earned gains in the last two recessions and have outperformed the bull markets in between. That is why her Investor Educational Retreats, books and private coaching are enthusiastically recommended by Nobel Prize winning economist Gary S. Becker, TD AMERITRADE chairman Joe Moglia, Kay Koplovitz and many Main Street investors who have transformed their lives using her Thrive Budget and investing strategies. Click to view a video testimonial from Nilo Bolden. Check out Natalie Pace's Apple Podcast. Watch videoconferences and webinars on Youtube. Other Blogs of Interest 7 Rules of Investing Air B N Bust? Santa Rally 2023 or Time to Get Defensive? Barbie. Oppenheimer. Strikes. Streaming Wars. Netflix. Monero: A Token of Trust? 13 Lifestyle Choices to Reduce Waste, Pollution & CO2 & Save a Boatload of Dough. China Bans Apple 11-Point Green Checklist for Schools. Artificial Intelligence and Nvidia's Blockbuster Earnings Report Biotech in a Post-Pandemic World Summer Sweepstakes 10 Wealth Secrets of Billionaires and Royals. What Happened to Cannabis? Bank of America has $100 Billion in Bond Losses (on Paper) The USA AAA Credit Rating is on a Negative Watch. Lithium. Essential to EV Life. I'm Just Not Good at Investing. Investors Ask Natalie. Should I Buy an S&P500 Index Fund? Investors Ask Natalie. Bonds Lost More than Stocks in 2022. Tesla's Model Y is the Bestselling Car in the World. 2023 Company of the Year Sell in May and Go Away? Do Cybersecurity Risks Create Investor Opportunities? Writers Strike, While Streaming CEOs Rake In Hundreds of Millions Annually. I Lost $100,000. Investors Ask Natalie. Artificial Intelligence Report. Micron Banned in China. Intel Slashes Dividend. Buffett Loses $23 Billion. Branson's Virgin Orbit Declares Bankruptcy. Insurance Company Risks. Schwab Loses $41 Billion in Cash Deposits. The Debt Ceiling Crisis. What's at Stake? Fiat. Crypto. Gold. BRICS. Real Estate. Alternative Investments. BRICS Currency. Will the Dollar Become Extinct? Empty Office Buildings & Malls. Frozen Housing Market. The Online Global Earth Gratitude Celebration 7 Green Life Hacks The Debt Ceiling. Will the U.S. Stop Paying Bills in June? Fossil Fuels Touch Every Part of Our Lives Are There Any Safe, Green Banks? 8 Fires the Federal Reserve Board Needs to Put Out. 7 Ways to Stash Your Cash Now. Lessons from the Silicon Valley Bank Failure. The 2 Best Solar Stocks Which Countries Offer the Highest Yield for the Lowest Risk? Rebalance By the End of March Solar, EVs, Housing, HSAs -- the Highest-Yield in 2023? Are You Anxious or Depressed over Money? Why We Are Underweighting Banks and the Financial Industry. You Stream all the Channels. Should You Invest, Too? NASDAQ is Still Down -26%. Are Meta & Snap a Buy? 2023 Bond Strategy Emotions are Not Your Friend in Investing Investor IQ Test Investor IQ Test Answers Bonds Lost -26%, Silver Held Strong. 2023 Crystal Ball for Stocks, Bonds, Real Estate, Cannabis, Gold, Silver. Tilray: The Constellation Brands of Cannabis New Year, New Healthier You Tesla's $644 Billion Fall From Mars Silver's Quiet Rally. Save Thousands Annually With Smarter Energy Choices Is Your FDIC-Insured Cash Really Safe? Money Market Funds, FDIC, SIPC: Are Any of Them Safe? My 24-Year-Old is Itching to Buy a Condo. Should I Help Him? The 12-Step Guide to Successful Investing. Gardeners Creating Sanctuary & Solutions in Food Deserts. The Bank Bail-in Plan on Your Dime. Rebalancing Your Nest Egg IQ Test. Answers to the Rebalancing Your Nest Egg IQ Test. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable. However, NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors. Comments are closed.

|

AuthorNatalie Pace is the co-creator of the Earth Gratitude Project and the author of The Power of 8 Billion: It's Up to Us, The ABCs of Money, The ABCs of Money for College, The Gratitude Game and Put Your Money Where Your Heart Is. She is a repeat guest & speaker on national news shows and stages. She has been ranked the No. 1 stock picker, above over 830 A-list pundits, by an independent tracking agency, and has been saving homes and nest eggs since 1999. Archives

July 2024

Categories |

RSS Feed

RSS Feed