|

On July 26, 2018, the day after posting an outstanding quarterly earnings report, Facebook lost $119 billion in market value – for the biggest single-day loss for a public company in history, according to Thomson Reuters. What's behind the drop? Is it a buying opportunity, or should you un-friend the company stock before more sellers do?

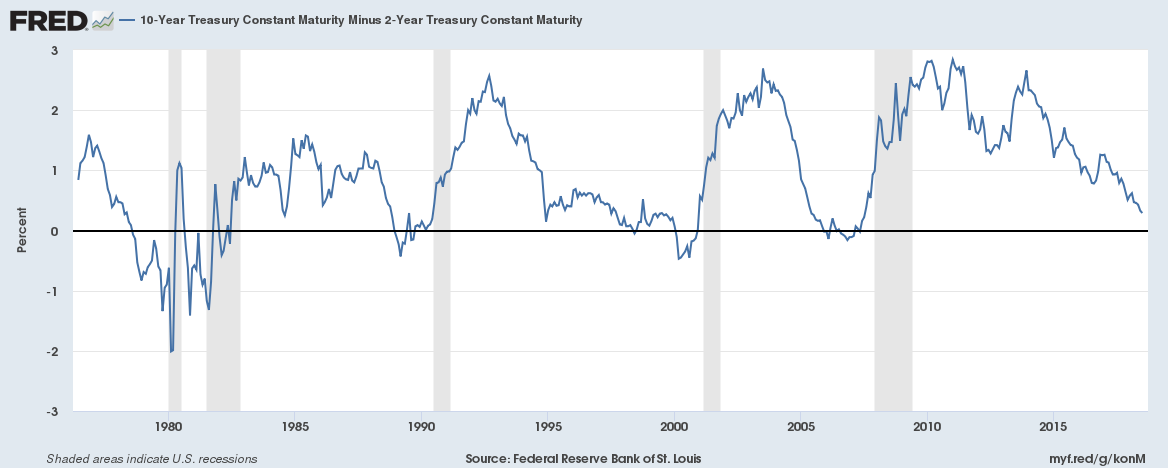

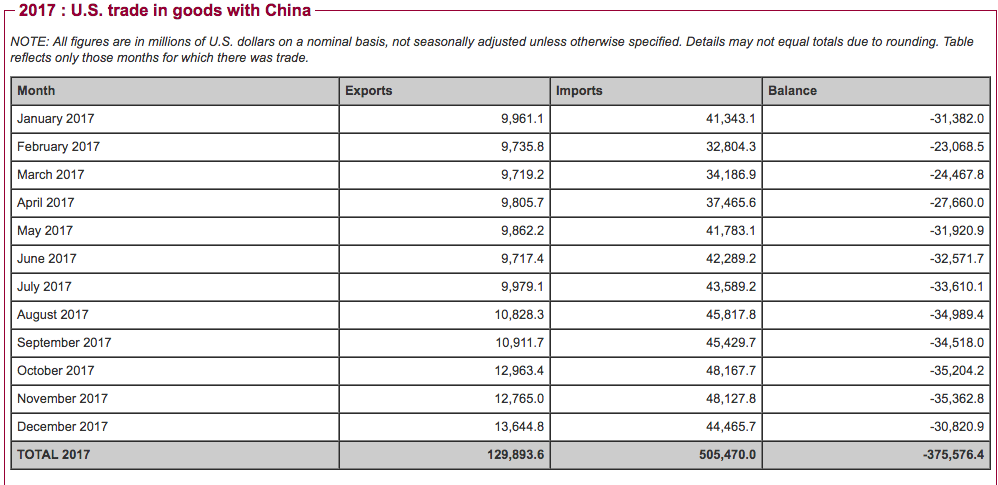

Facebook CEO Mark Zuckerberg saw his personal fortune drop by $15 billion last week. If you don’t already know this, you’re on vacation. However, the real question is, “Is this a buying opportunity?” or “Should you get out before Facebook plays out the fate of Myspace?” By the numbers, Facebook is running an astonishing business. There are 1.5 billion daily active users on Facebook platforms (including Facebook, Instagram and WhatsApp), making Facebook the clear winner in social networking worldwide. According to comScore, Inc., Facebook (and Messenger) has 70 million more users in the U.S. than Snap Inc. and over 50 million more than Twitter, with 6.6 times the time online of Snap. The year over year revenue growth at Facebook was up 42%, to $13.32 billion, with net income of $5.1 billion (up 31% over last year). That’s an operating margin of 44%. These are pipe dream achievements – something that Twitter or Snapchat (or Myspace back in the day) can only dream of. By comparison, Twitter was still cash negative last year and Snap Inc. lost $3.45 billion. For those who worry about the fickle nature of users, it is important to remember the history of migration from one social network to another. However, what Facebook has done quite well is to make their platforms very sticky. They have all of your family photos, and host many of your most cherished groups. Where would you move this? None of my friends migrated to another platform after the scandal, and the majority of the sites that popped up to take advantage of the situation were silly scams. Facebook also owns some of the fastest growing social apps in the world, including Instagram and WhatsApp, and is investing in some of the hottest areas on the Internet, specifically AI (Artificial Intelligence), AR (Augmented Reality) and VR (Virtual Reality). This ensures that Boomers stay on Facebook and Gen Z is welcomed in with the new apps. Analysts heard all of this on the earnings calls from Zuckerberg himself, and yet the selling fire was sparked. So what happened? Facebook reported that revenue growth will slow to only 20%-ish on the year. Costs are going to increase 50-60%, causing the operating margin to trim back to the mid-30s. Let me be clear. Revenue growth projections of 20% and operating margins of 35% are outstanding. That’s probably why, according to Reuters, “Of 47 analysts covering Facebook, 43 still rate the stock as “buy”, two rate it “hold” and only two rate it “sell”.” Their median target price is $219.30.” No U.S. social media company comes close to Facebook’s dominance. (There is a Chinese company that’s even more impressive, however.) Facebook claims they are working hard on the fake accounts, fake news and personal privacy and security settings. In fact, private user security is part of what is costing the company in revenue and cash going forward, that and currency headwinds, combined with newer products that haven’t been fully monetized yet. Investments in AI, AR and VR aren’t bringing in much revenue today, but could be the heavy-lifters of tomorrow. AI is being employed to improve monitoring of fake accounts, fake news and user abuse. Facebook has launched a new 3D VR headset called Oculus Go, which is selling for $199. With a market capitalization of almost half a trillion, $42 billion cash on hand and $7.8 billion remaining in the Facebook share repurchase program, investors should feel secure that the company is going to be around for a long, long time. That’s enough power to outlast the security scandal, particularly since users yawned at the news of Facebook selling their private info (which many of us already knew) and then looked away. If the Cambridge Analytica investigations steer into criminal activity, that could change. However, today, the NY Times reported that Facebook is working with the FBI to stem election campaign fake accounts and fake news, which prompted Senator Mark Warner of Virginia, the top Democrat on the Senate Intelligence Committee, to praise Facebook for “taking some steps to pinpoint and address” election meddling on social media. So, even the political focus is steering away from the scandal and into Facebook’s achievements. Despite Facebook’s clear command of social media, there is a concern about valuation – about the entire market in general – that could weigh on the share price. As Nobel Prize winning economist Robert Shiller has warned consistently this year, “The only time in history going back to 1881 when [price to earnings ratios have] been higher are, A: 1929 and B: 2000. We are at a high level, and its concerning. People should be cautious now.” In fact, it was likely profit-taking, more than fear of the future, that prompted most sellers last week. So, even though I’m bullish on Facebook – not at this price and not in the 10th year of an overvalued bull market. Americans aren’t unplugging from Facebook, and neither are analysts. However, making sure that your investments are balanced and diversified and not over-concentrated in any one area, even in something as hot as Facebook, is always a good idea. If you're interested in a second opinion on your current budgeting and investing strategy, or in attending one of my Investor Educational Retreats, call 310-430-2397 or email Heather @ NataliePace.com. 2Q 2018 GDP growth (advance) estimates will be released tomorrow morning. The estimates are falling between 2.7-3.8%. How will the report affect stocks? Your summer? The overall Economy? Will stocks soar, cascade or plummet? Stocks The first quarter 2018 GDP growth was 2.0%, so anything above that could spark a rally on Wall Street. Growth is good. A strong showing signals that the economy is strong and not buckling (at least yet) under the Tariff Wars. FYI: The advance estimates have a track record of coming in far higher than the actual data. Interest Rates and the Federal Reserve Board Meeting. July 31, 2018 – August 1, 2018. A strong GDP growth showing could prompt the Federal Reserve Board to raise interest rates. Whenever they do, Wall Street responds with a sell-off. According to the minutes and the financial projections from the June 14, 2018 meeting, Federal Reserve Board chairman Jerome Powell is determined to raise the Fed Fund rate. The rate is expected to hit 2.4% in 2018 (from the current 1.75-2.0%) and 3.4% by 2020. The Yield Curve If the Federal Reserve Board raises the Fed Fund Rate, the flat yield curve could go negative. All eyes are on that because there is a very strong correlation (almost 100%) between recessions and an inverted yield curve. Tariff Wars We won’t know the effect the Tariff Wars will have on GDP growth until at least the 3rd quarter because the tariffs only began on July 6, 2018. 3rd quarter GDP growth will be issued on October 26, 2018. The forecasters have already begun forecasting lower GDP growth, with the New York Federal Reserve Bank predicting that 3rd quarter 2018 GDP growth will be 2.4%. That is lower than the 2nd quarter 2018 GDP growth expectations, and far lower than the projections that the 3.0% and higher GDP growth projections that the current Administration used to justify their tax cuts. The bottom line is that a strong 2nd quarter 2018 GDP report could result in a Wall Street rally that is rather short-lived since the Federal Reserve Board meeting falls on the following week. The result could be a short rally the final days of July, followed by a pullback in early August, with even more trouble headed for the 3rd quarter report, which will be released at the end of October 2018. Of course, politicians want a strong economy to support the election. However, financial engineering and leverage can only carry an economy so far before the asset bubbles pop. I’ll keep you updated once the statistics come in on my social media pages at Twitter.com/NataliePace and Facebook.com/TheABCsofMoney. Below are links to additional blogs that help to explain the significant economic headwinds that the U.S. (and all of the developed world really) are facing. Remember that recessions are rarely “crashes.” More often they are cascades, with a drop that steadies out to a new (lower) normal, followed by another dive and plateau, and on. By the time the headlines that we are in a recession hit, we’re usually near the bottom. So, if you wait for the headlines to protect your assets from the next downturn, it will be too late. If you are interested in protecting your nest egg before the next recession, call 310-430-2397 to learn the ABCs of Money that we all should have received in high school. These easy strategies earned gains in the last two recessions and have outperformed the bull markets in between. Attend an Investor Educational Retreat and you can learn and implement these strategies in 3 fun-filled, life-transformational days, and go home with a financial foundation that can withstand the next economic storm. Interest Rates

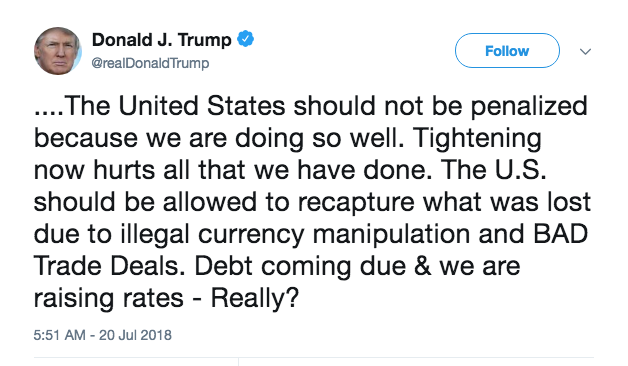

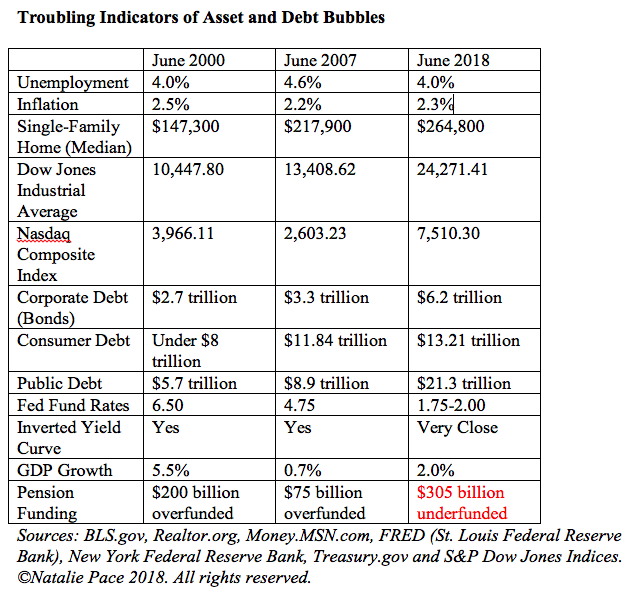

5 Harbingers of Recessions Block Chain and Cryptocurrency Social Security & Medicare Sell in May and Go Away? On Friday, July 20, 2018, the White House Tweet du Jour was a clear rebuke of the Federal Reserve Board’s policy of raising interest rates. The Federal Reserve Board is supposed to be independent from politics and the President – so that the board governors can have a long-term vision of what is best for the country. Previous Presidents have refrained from publicly commenting on Federal Reserve policy to show respect for FOMC independence. So, is the President meddling, or is he trying to save the U.S. economy from a misguided policy? Is raising the Fed Fund rate “penalizing” the U.S.? Is the economy doing as well as the President claims? What is the real reason that interest rates are on the rise, and how high will they go? Who wins and who loses with low interest rates? Is raising the Fed Fund rate “penalizing” the U.S.? Since the Great Recession, the Federal Reserve Board has adopted an “accommodative” stance, keeping interest rates rock bottom. This is a dangerous game on many fronts – one that all economists know well. And here are two reasons why. 1. Low Interest Rates Create Bubbles. In 2000, the free, easy money flowed into Dot Com stocks – many of which had been cash negative for five years or more and had little hope of breaking even. You couldn’t even load your shopping cart online before the dial-up connection crashed! In 2007, anyone with a pulse was getting a Liar’s Loan – culminating in the real estate bubble and crash. Today, Alan Greenspan, Warren Buffett and Nobel Prize winning economist Robert Shiller have all gone on record saying that stocks and bonds are in a bubble. In February of 2018, former Federal Reserve Board chairman Janet Yellen, said on CNBC, “It is a source of some concern that asset valuations are so high.” Each time before the crash, the headlines touted (and politicians bragged) that the party was just getting started. In 2000, it was eight years of prosperity and a New Economy. Today, everyone is enamored with their 5% dividends, unaware of the risk of capital loss and dividend cuts, except those General Electric investors who sobered up after losing half of their principal. Ignoring asset bubbles means that the fallout when they pop is more severe. This was one of the concerns raised in the June 12-13, 2018 Federal Reserve Board meeting. The minutes read, “Some participants raised the concern that a prolonged period in which the economy operated beyond potential could give rise to heightened inflationary pressures or to financial imbalances that could lead eventually to a significant economic downturn.” Investors lost 78% of their NASDAQ holdings in the Dot Com Recession and 55% of their Blue Chip value in the Great Recession. Over 10 million homes went to auction in the wake of the Great Recession and 5.2 million are still underwater today. Today’s assets are far more overvalued and troubling than they were in 2000 or 2008. (See below.) So, while the politicians point to unemployment and GDP growth (which isn’t that impressive at just 2.0% in the 1st quarter) as signs that the U.S. is doing great, if you include over-inflated assets like real estate, stocks and bonds, the unaffordable costs of housing, medical insurance, health care, transportation, utilities, taxes and education and the astronomical debt, today’s economy is nowhere near as healthy as the headlines tout.

2. The Feds Need More Tools to Deal With the Next Recession. When recessions kick in, lowering the Fed Fund rate can jumpstart economic activity. If rates are already rock bottom, as they are today nine years into the recovery, there’s no room to move and few ways to help. Is the economy doing as well as the President claims? Today’s Gig Economy has a very low Labor Participation rate -- the lowest seen since 2000. As a result of underemployment, stagnating wages, staggering student loan debt, and unaffordable housing, the U.S. now sports the highest consumer debt the nation has ever seen. People just can’t seem to get ahead without making ends meet on their credit card. Student loan debt has doubled over the past decade. GDP Growth has stalled out to a projected 2.8% for the year (below the promised 3% and higher). The public debt has soared to $21.3 trillion. Corporate debt is astronomical. U.S. Pensions and Other Post Employment Benefits are underfunded by more than half a trillion dollars. And the trustees for Social Security and Medicare just warned that depletion dates are already on the horizon. What is the real reason that interest rates are on the rise, and how high will they go? The projections are for the Fed Fund rate to rise to 2.4% this year, 3.1% next year and 3.4% in 2020. The asset bubbles are too staggering to be ignored, with high-profile individuals (such as Shiller, Greenspan, Yellen and Buffett) sounding warnings over the airwaves. There is troubling economic data. Tariffs have made it doubtful that GDP growth will hit its projections. So, there is a lot of pressure on the Federal Reserve Board to get more tools in its belt before the next downturn. Who wins and who loses with low interest rates? In truth, having policy that is too accommodative tends to create what some business leaders have called “Hot Potato,” others have called “The Biggest Fool Syndrome” and still others just refer to as bubbles. When money gets too free and easy, big business can borrow and speculate. The problem is that in a competitive business environment, everyone who can speculates, driving up asset prices, which then creates the Hot Potato and Biggest Fool Syndrome. Before the Great Recession, business leaders lumped toxic Liar Loan mortgages into SIVs and CDOs, purchased insurance from AIG and other insurance companies to make these high-risk assets look foolproof, gave them fancy names and then sold them to investors. Pretty much everyone who created the products knew there was a problem. The financial overleverage was beyond the levels seen since the Great Depression. However, profits were so high that selling mortgages to anyone with a heartbeat and then reselling the assets to unsuspecting investors simply had to be done. Banks, mortgage providers and even realtors couldn’t afford to stand on the sidelines and let their competitors profit hand over fist. The goal was just to not be the Biggest Fool left holding all of the toxic assets, like Lehman Bros., Bear Stearns and AIG were. And so a great game of Hot Potato ensued. In 2018, corporations have been able to borrow money very cheaply to buy back their own stock, pushing stock prices to all-time highs. Mortgages are low, pushing housing prices back to all-time highs. The average American loses big-time in this scenario because their savings are earning nothing, their stocks are losing more than half in the recessions. Main Street is being sold into the toxic assets, and their credit card interest rates are still 29%. When real estate prices correct, their mortgage could go underwater. Will Powell Buckle on the Pressure of the Tweets? In a press conference on June 13, 2018, Federal Reserve Board chairman Jerome Powell said clearly that his concern was “appropriate policy.” Keeping interest rates low is a short-term fix that politicians like to promote because it is easier to get elected when the economy is strong. That’s short-term thinking. It is the job of the Federal Reserve to have a longer vision, so that recessions can be milder, growth can continue and inflation can be kept at bay. Business cycles (bull markets and recessions) are inevitable. Making sure that recessions don’t become depressions is critically important. There will be a lot of eyes on the August 1, 2018 Federal Reserve Board press release and conference, to see if the Federal Reserve will raise rates again, and stay on target to hit a 2.4% Fed Fund rate in 2018. (The Fed Fund Rate is currently at 1.75-2.00%.) The flattened yield curve has economists worried, as an inverted yield curve is an event that is highly correlated with recessions. However, the fallout from keeping interest rates low could be far worse. In short, I’d be surprised if the Feds don’t raise interest rates at least twice this year, as they have indicated in their projections. Other Blogs of Interest How a Strong GDP Report Can Go Wrong. 5 Harbingers of Recessions. And how you can protect yourself. Cut Your Healthcare Costs in Half Interest Rates Keep Rising. Should you lock in a fixed? Social Security and Medicare Warn of Depletion. Warren Buffett on the Sidelines. GE Investors Lose Half. Can the American Consumer Carry This Economy. 4 Things the 1,175 Dow Drop on Monday Taught Us. If you want to make sure that you are safe and protected before the next recession and stock market downturn, come to my next Investor Educational Retreat. Call 310-430-2397 to learn more now. Over the past month, I’ve received numerous requests from people who are interested in retiring abroad. A Baby Boomer couple thinks they need to relocate in order to afford healthcare and end-of-life care. A Gen X-er wonders if she could invest in the next “hot vacation destination,” buy a 3-bedroom home and rent it on AirBNB. A grandmother is considering a cheap villa (just $50,000!) in Costa Rica as her winter home. So, is retiring abroad a good idea? As a world traveler, this is a question that I ask frequently of ex-pats. Perhaps the person who is the most excited about her homes abroad is the one who purchased three small flats in cities where she travels for work – one in Paris, one in New York City and another (for fun) in the French Alps. This woman has enough income and budgeted within her means, so she is not stuck living in any one of them. She purchased places she could easily afford, even without rental income. They are small flats, located in great walking neighborhoods, so she can actually host guests, which helps her businesses. That experience is very different from the expats I encountered in Costa Rica a few years back. Over dinner, an unhappy couple told me that with the inflation there, daily life had become as expensive as living in the States and made them feel poor and stuck. I recently returned from a month in India. Expats there can’t believe how far their money goes! However, they also have to endure the pollution, the perilous road conditions the poverty and the mosquitoes. Everyone I know who had a place in the South of France has sold it. The woman who wanted to buy a villa in Puerto Rico last year is very happy she drug her feet and never jumped on the opportunity.

Each one of these real life experiences highlights a different risk factor that you must consider. Rule #1 is to spend at least a month where you are thinking about moving. After 21-days, you’ll start feeling more like a local and less like a tourist. Ask questions of the locals and the ex-pats. Mingle with people other than the folks trying to sell you into the opportunity. What do the expats and the locals like about living there? What are the challenges? Are ex-pats welcomed or shunned by the locals? These are your neighbors. If you don’t fit into the ethos or the community, or ex-pats are unwelcome, then you have your answer. Don’t force yourself onto a community that is unwilling to embrace you. Below is a checklist that will help you to identify the red flags, the green lights, the caution signs and more. Because buying real estate is an investment, you also want to incorporate my 3-Ingredient Recipe for Cooking Up Profits. Buying Abroad Ex-Pat Check List

And here is a little more information on each point. 1. The 3-Ingredient Recipe for Cooking Up Profits ®.The 3-ingredient Recipe for Cooking Up Profits helps you to organize the data and information that you need to assemble in order to properly evaluate the opportunity as an investment. Here are the ingredients. 1. Start with what you know and love. 2. Pick the leader. 3. Buy low; sell high. Take each ingredient in order. One of the best tools to learn more is going to be your “kick the dirt” analysis – your month in the country and town you want to buy in, mingling with locals and ex-pats. The Index of Economic Freedom can also be very helpful to understand how well protected property rights and money freedom are. For additional information on the 3-Ingredient Recipe for Cooking Up Profits, read the chapter of the same name in my book Put Your Money Where Your Heart Is (aka You vs. Wall Street in paperback). 2. Know the Laws.Are property rights protected? Is the judicial system corrupt or backlogged, or does it run fairly and smoothly? 3. Know Your Neighbors.Are you living in an ex-pat community or with the locals? How friendly, happy and proactive are your neighbors? How expensive is the Homeowners Association dues and how restrictive are the rules? Is someone going to give you grief over the color you paint your home, or how you entertain, or if you rent your place on AirBNB? 4. Know Your History.Why is the homeowner so desperate to sell to you at such a low price? Of course, she will say that it’s nothing, and that you’re getting a great deal. You have to get your information from someone other than the broker/salesman and the seller. If you see, feel or hear anything that seems suspect, dig deeper. There are Eastern European countries that were a part of Russia a few years ago. Syria was the gem of the Middle East before it became a warzone. 5. Know The Local Culture.There are Red States and Blue States in the U.S. There is South Central and Beverly Hills in Los Angeles. Blood and tradition run thick. Know what you are stepping into, and what kind of shoes you’re going to need to navigate the streets and mingle with the locals. 6. Consider the Environment and Climate Change.India is one of the most polluted countries in the world. Air quality can be unhealthful, and clean water isn’t always easy to come by. I The first climate refugees in the U.S. are being evacuated from an island in Louisiana. Hurricanes are larger, with more frequency – affecting Japan in the Pacific, the islands in the Caribbean and the entire Eastern seaboard of the U.S., among other destinations. 7. Are The Locals “Your People?”Ideally, home is your sanctuary. Are you moving into a community that feels like your soul can sing there? Or are you motivated only by fear, trying to find something affordable, where you can die? Health care and housing costs are not the only consideration of retiring abroad. You also want to consider:

If you go through the analysis, and you still feel great about the opportunity, then it is more likely to be the right answer. If you jump in without looking, you might find yourself in a sand trap money pit. We can get into a bit of a swoon while on a vacation. Real life can have a rainbow over the horizon, but only when you plan well. If you are interested in learning more about successful investing, in smarter health insurance and health choices and in saving thousands annually in your budget when you stop making the billionaires rich at your expense, join me at my next Investor Educational Retreat. Call 310-430-2397 or email [email protected] to learn more. While the politicians tout low unemployment (4.0%) and economic growth (2.0%), there are troubling occurrences that are not making headlines, which many economists and Federal Reserve governors are concerned might dive the U.S. into a recession. Economic forecasting is a tricky business. However, some of the warning signs below are batting 1000 on predicting recessions. This late in the bull market, it will pay to know what’s really going on that is not being discussed on prime time and make sure that you’re protected – before the next downturn. If you wait for the headlines that the economy is in trouble, it will be too late to protect yourself. 5 Harbingers of Recessions. 1. Inverted Yield Curve. 2. Tariff Wars. 3. Warning Language in the Federal Reserve Minutes. 4. Bubbles. 5. Business Cycles. And here is additional information on each red flag. 1. Inverted Yield Curve. “Every U.S. recession in the past 60 years was preceded by an inverted yield curve,” according to Michael D. Bauer and Thomas M. Mertens of the San Francisco Federal Reserve Bank. Right now, the yield curve is flat, just a hair’s breath above the danger zone. With each Fed Fund rate hike, it becomes more likely that the yield curve will invert. So, keep an ear to the ground during the FOMC meetings for yield curve news. The next FOMC press releases are scheduled for August 1, September 26, November 8 and December 19, 2018. There are at least two more Fed Fund rate hikes expected in 2018. 2. Tariff Wars. In the world of economics, tariffs are as welcome as viruses are to doctors. They are unhealthy for the economy in general, and can lead to a lack of confidence in business planning and expenditures that can stall out growth and slam economies into recessions. While the trade imbalance is in need of being addressed, there are few data-driven experts who think that tariffs are the answer. The most infamous tariff war was the Smoot-Hawley Tariff Act of 1930, which many experts believe deepened the severity and extended the length of the Great Depression. 3. Warning Language in the Federal Reserve Minutes. The Federal Reserve under Chairman Ben Bernanke mentioned nothing of the inverted yield curve in the 2007 minutes, though this monumental event was surely discussed. Concerns over real estate, credit markets and subprime loans prompted the Feds to lower the Fed Fund rate. However, the official word was that the economy would slow in 2008, but still be growing. Thus, most Americans were blindsided by the severity of the Great Recession crisis. Under Chairman Jerome Powell, the June 13, 2018 meeting discussion included concern that the flattened yield curve might invert and spark a recession, or that “financial imbalances” might lead to a “significant economic downturn.” Powell is still staying close to his calming sound bytes in the press conferences. However, under Powell’s aegis, the FOMC minutes are far more transparent than his two predecessors allowed. 4. Bubbles. Warren Buffet has said that stocks and bonds are overpriced. Alan Greenspan went on Bloomberg TV and said that stocks and bonds are in a bubble. Robert Shiller continues to warn that stock prices are unsustainably high. Every troubling economic indicator that preceded the Great Recession is higher now. Housing prices, stock prices, bond prices, consumer debt and public debt are all far higher than they were in 2007 before stocks lost more than half of their value and 15 million homes were sent to auction, foreclosed on or received a loan modification. Low interest rates create bubbles, which is why the Federal Reserve Board is committed to increasing the Fed Fund rate to 3.4% by 2020. 5. Business Cycles. This is the 10th year of the current bull market. Recessions occur on average every 5.5 years. In the last two recessions, most people lost more than half of their retirement. Between 2000 and 2002, the NASDAQ Composite Index lost 78% of its value. Between 2007 and 2009, the Dow Jones Industrial Average lost 55% of its value. Buy and Hold doesn’t work on the Wall Street Rollercoaster of today. My easy-as-a-pie-chart nest egg strategies earned gains in both of the last two recessions, outperformed the bull markets in between and are less time and money than most people spend. What you can do about it. How you can protect yourself before the next market correction. Market corrections and recessions happen. Regularly. (There were two recessions under President George W. Bush.) You can profit from a growing economy, while protecting yourself from a downturn, easily, with the strategies listed directly below. Your 10-Step Recession-Proof Plan

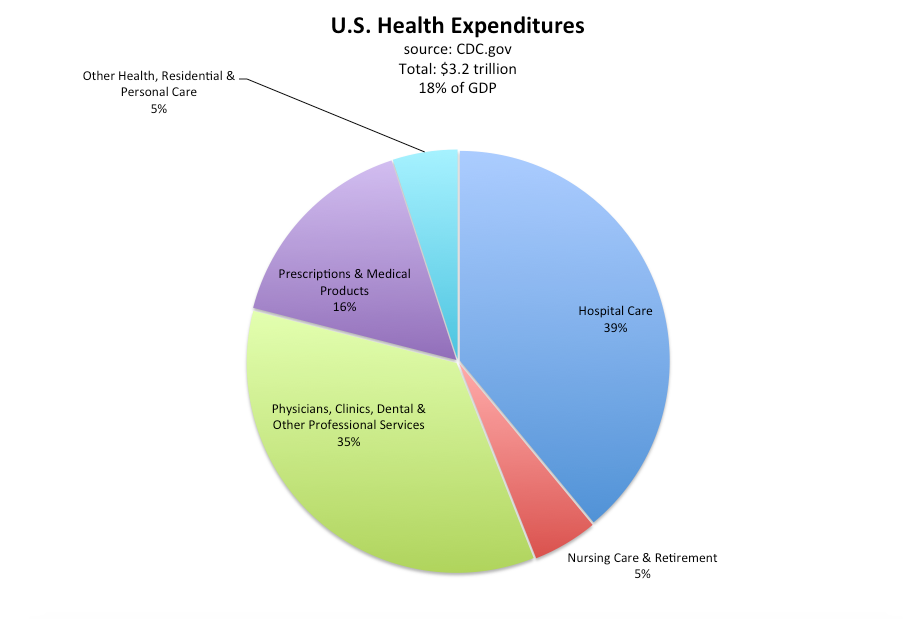

If you don’t fully understand how to do the 10-point list above, then your next move should be education. It’s time to learn the ABCs of Money that we all should have received in high school. Wisdom is the cure. Come to my Investor Educational Retreat (links below), or, at minimum, read my 3 books, with time-proven strategies that earn gains in recessions and outperform the bull markets in between. Call 310-430-2397 to learn more! Cut Your Health Care Costs in Half. Health Insurance costs have doubled since 2013. The average person spends almost $5,000 a year on health insurance, while having the burden of a $4,000 deductible or higher! Annual family health premiums total $12,252! And that’s just the insurance side of the equation. Once you add in the cost of health care (your deductibles, coinsurances and unqualified costs), an average family could be spending $20,000 or more each year. Health care is in the top three most expensive basic needs in the family budget, alongside housing and transportation. Medical costs are the number one reason that most people declare bankruptcy, causing hundreds of thousands of bankruptcies each year. (The estimates vary widely; bankruptcies increase dramatically during recessions.) What’s clear is that staying healthy now, reducing medical insurance and medical care costs as much as you can now and preparing for retirement is key, even if you just landed your first job. When you retire, Medicare has out-of-pocket costs including deductibles, coinsurances and uncovered services (like acupuncture and long-term care), and even premiums if you want a better plan. A Fidelity study claims that the average couple will need $280,000 to cover medical bills when they retire. Fortunately, there is one simple trick that can cut medical costs dramatically, while providing far better for tomorrow. The sooner you get this information and activate it in your own life, the more you’ll save now, and the more money you’ll have squirreled away for when you need it – when you get sick or retire. (If you are already retired, you don’t qualify.) For those of you thinking the simple answer is move to a country where medical costs are more affordable, that’s not my trick (although it might work out for you). If you’re only thinking of medical costs, then moving might be a solution. Nobody spends more on health care and health insurance than Americans do. Learn more about the over-priced medical industry in the U.S. in my blog on Social Security and Medicare. However, health care is not the only consideration of retiring abroad. You also want to consider:

My one simple trick to reducing your health insurance costs and providing far better for tomorrow is the Health Savings Account. This, combined with the 3 additional strategies that are listed below, can put the odds in your favor that you can live a richer life today, promote health and even have more dough for bucket list vacations. 4 Strategies to Cut Your Health Care Costs in Half (or More) 1. Save thousands annually (tens of thousands for some) with smarter health insurance choices. 2. The best long-term health care plan. 3. Is retiring abroad a good idea for your emotional, financial and physical health? 4. Health is the best health insurance. And here are more details. 1. Save thousands (tens of thousands for some) annually with smarter health insurance choices. If you are healthy and spending an arm and a leg on health insurance, then you should consider getting a catastrophic health care plan, which could cut your health insurance expenses in half or more, combined with a health savings account. The health savings account is where you’ll start building up the funds for the ultra-high deductible. As the years add up, you’ll find that you have the money built up in your HSA for your own long-term care (something that isn’t covered by Medicare). You get a tax credit for the HSA, and can even invest the funds to earn money while you sleep. Learn more about HSAs in my blog and at IRS.gov. 2. The best long-term health care plan. The Health Savings Account is your best long-term health care plan. Health insurance cancels if you miss a payment. Your HSA stays with you through thick and thin, no matter where you work, and acts as a great supplement to your retirement account. Health care costs increase dramatically as you age, so having an HSA is an important part of your retirement plan. If you are already retired, then you’ll need to develop a financial plan for your long-term care. (Get more than one opinion on this -- not just your "financial planner," who might have a strong incentive to just sell you more insurance that might not be your best plan.) 3. Is retiring abroad a good idea for your emotional, financial and physical health? When considering retiring abroad, consider your emotional, financial and physical health, in addition to the health care costs. Are you comfortable moving so far away from family? Are there other risks to where you are moving? Political? Environmental? Natural disasters? Economic? The South of France has long been a popular place for the world’s elite to own a home and/or yacht. Over the past few years, however, there has been an exodus of ownership (after the high profile terrorist attacks). Over 11,000 Puerto Rican residents are still without power – and up to 1/3 were without power four months after Hurricane Maria. It’s easy to fall in love with a foreign destination while on a vacation. Make sure that the bliss bubble can hold up after a hurricane or during political upheaval. 4. Health is the best health insurance. The truth is that eating right and exercising goes a long way to reducing your health care costs and increasing your income. (You can’t work if you can’t get out of bed.) Almost 40% of American adults are obese, with 18.5% obese children. The price tag of obesity is over $147 billion, adding about $1500/year, at minimum, to personal medical costs. Being fit is the best way to regulate your blood pressure and can keep the pain out of vulnerable joints. Aerobic activity keeps your mind active and alert. Getting an HSA is not an extra bill. It is one of the easiest ways to put money back into your family budget by cutting your health insurance premiums (many times by half or more), while also reducing your tax bill. (HSAs offer a tax credit.) If you are healthy and spending an arm and a leg on health insurance, then you owe it to yourself to learn more. (Your health insurance salesman is not going to be the best source of this information. She has an incentive to keep you paying high premiums.) If you are interested in learning more about how to save thousands annually with smarter big-ticket choices, in protecting your retirement, in living a richer life today and providing far better for tomorrow, then request a 2nd opinion on your current budgeting/investing strategy from my office. You can also join me at one of my next Investor Educational Retreats. Call 310-430-2397 or email Heather @ NataliePace.com to learn more.

|

AuthorNatalie Pace is the co-creator of the Earth Gratitude Project and the author of The Power of 8 Billion: It's Up to Us, The ABCs of Money, The ABCs of Money for College, The Gratitude Game and Put Your Money Where Your Heart Is. She is a repeat guest & speaker on national news shows and stages. She has been ranked the No. 1 stock picker, above over 830 A-list pundits, by an independent tracking agency, and has been saving homes and nest eggs since 1999. Archives

July 2024

Categories |

RSS Feed

RSS Feed