|

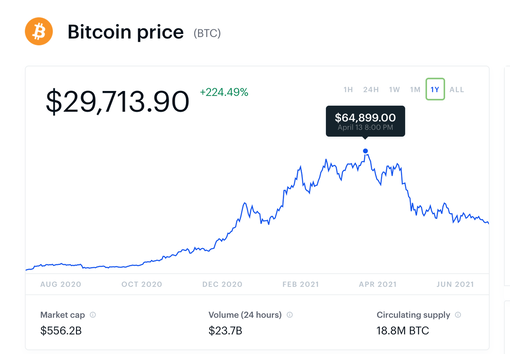

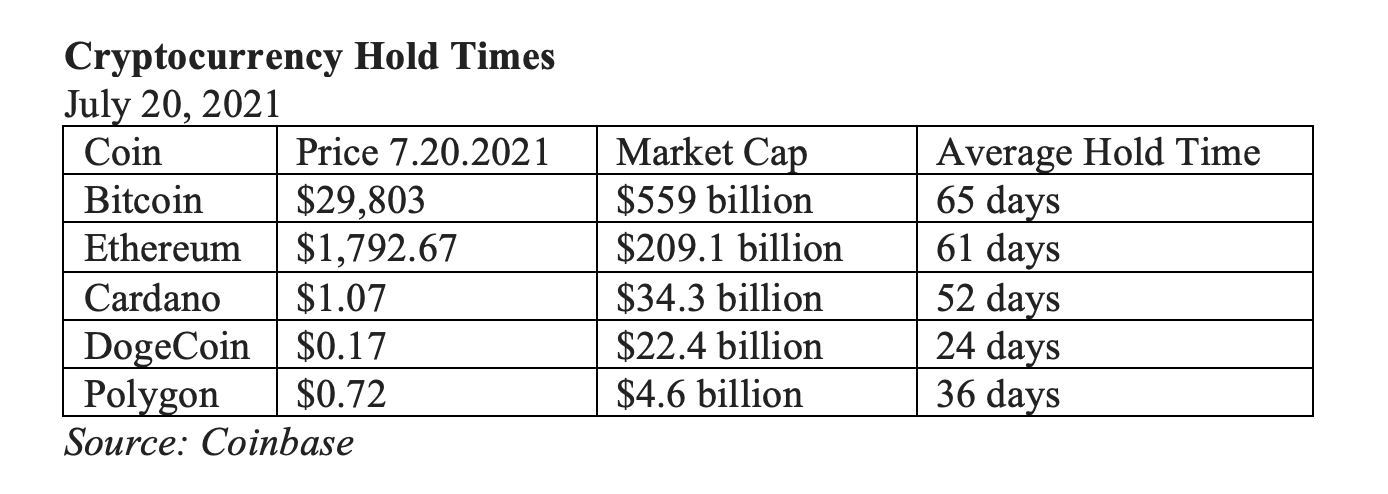

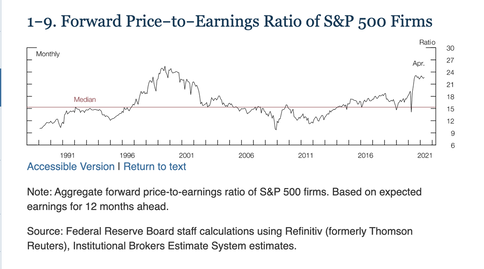

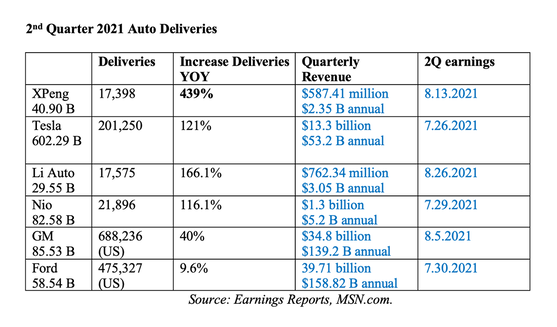

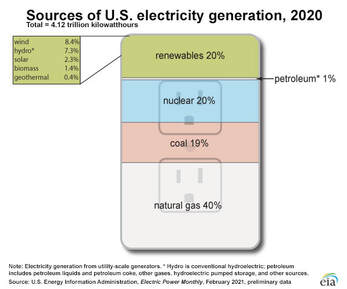

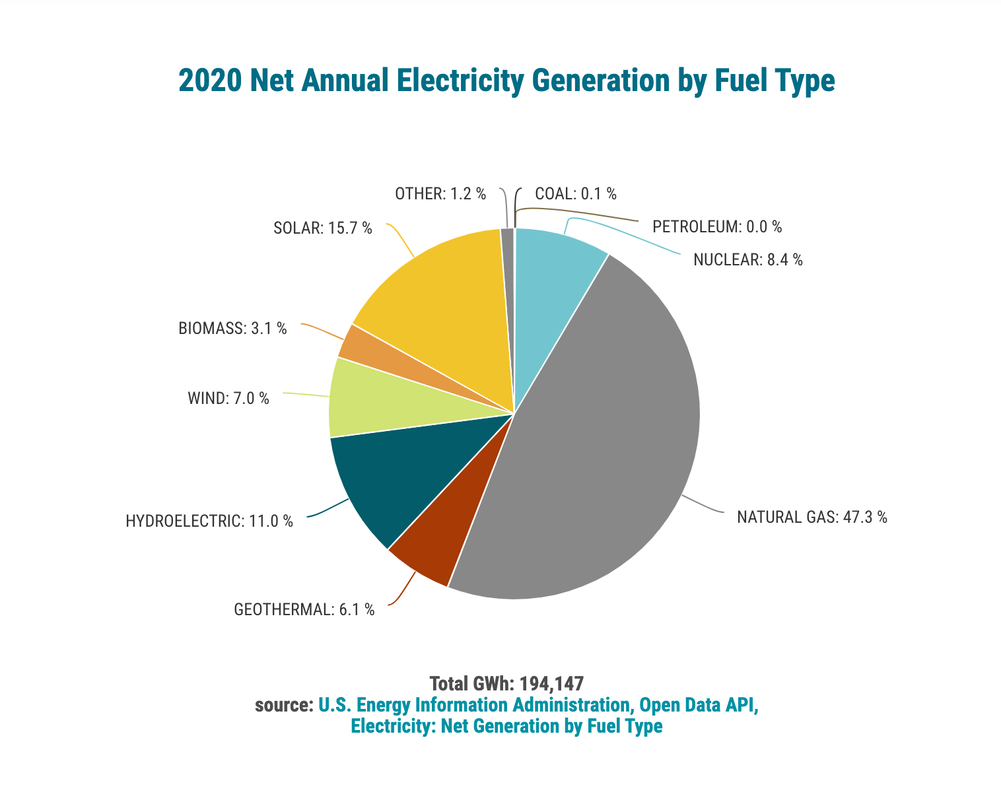

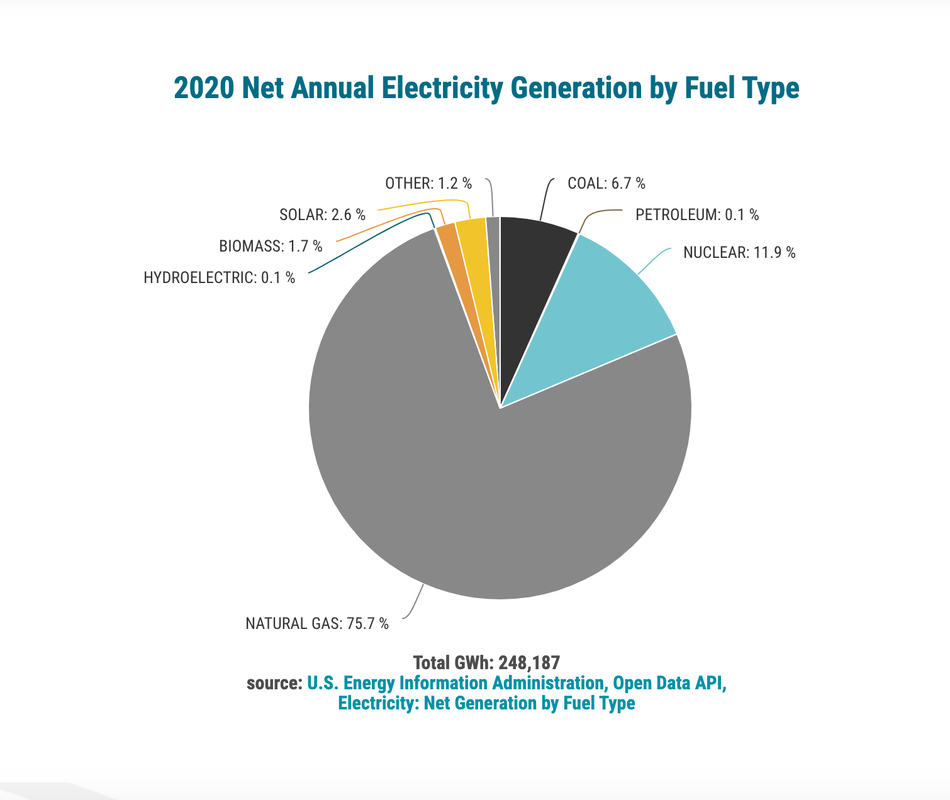

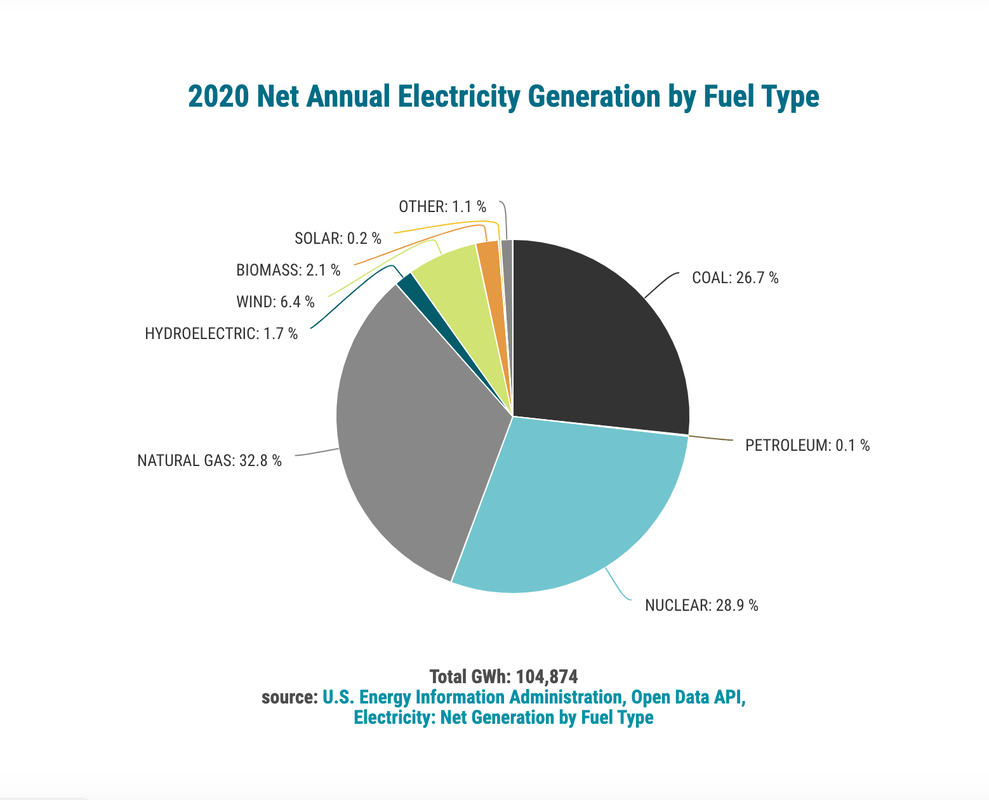

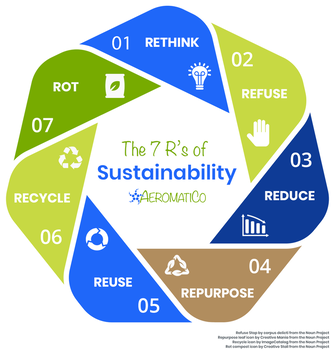

Trading for HOOD begins Thursday on the NASDAQ Stock Exchange. The price will be set on Wednesday. The company is currently looking for $38-$42/share, which equates to a market capitalization of about $33-$35 billion. The first meme stock brokerage is going public this week. In an unusual move designed to promote the company’s motto of “democratizing finance for all,” Robinhood is reserving up to one-third of its stock for its own clients. So, should you download the app and place your order? Impressive Growth vs. Regulatory Hot Water Robinhood’s revenue growth is very impressive at 309% year over year in the most recent quarter (1Q 2021), rising from $128 million to $525 million. Put into perspective, this should add up to over $2 billion in 2021 revenue. The 2nd quarter 2021 revenue is expected to be $546-574 million, an increase of 129% year over year, and 6.7% sequentially in the midpoint range. 2020 revenues were $959 million, with $7 million in net income. The company lost $1.4 billion dollars in 1Q 2021, mostly due to a one-time fair value write-down of its convertible notes and warrants. 2Q 2021 earnings will be hit with the $70 million fine imposed by FINRA on June 30, 2021, as well as reserves set aside to settle a money laundering matter with the New York State Department of Financial Services. Robinhood is expecting a 2Q 2021 net loss of $487 to $537 million, according to the S-1 filing. There will also be a one billion-dollar one-time charge in the 3rd quarter related to the IPO’s share-based compensation. With $4.8 billion in cash, and another $2 billion raised in the IPO, Robinhood should have enough capital to pay the fines and keep operating, even if 2021 remains in the red – unless something terrible happens. (With all of the Robinhood outages, trade halts, customer complaints, boycotts and regulators looking into everything, it does indeed seem as if something terrible is always happening. However, the company is savvy about SEO, which helps these stories to stay buried in searches.) Gamification: Memes, Emojis, Fractional Shares, Free Trading & Gold Margin Accounts About 50% of Robinhood clients are new to investing. Robinhood makes trading like a game, using emojis, lotteries, confetti, gifts and free stock to lure in retail investors. Unlike other brokerages, Robinhood offers fractional shares and crypto, but hasn’t yet entered into the retirement space. You’ll still have to rollover your IRAs and 401Ks elsewhere, although this is an area that Robinhood is looking to expand into. Robinhood’s gamification is an effective marketing ploy. However, it’s problematic in the financial services industry. Fiduciaries and regulators are constantly trying to figure out ways to educate and empower professionals and their clients to use risk tolerance and strategy, rather than emotions, to manage their wealth and future. Everything is sunny in a bull market. There are many heartbreaking examples of what happens when stocks head south, particularly with young, less-experienced investors. FINRA Fines Robinhood $70 Million On June 30th, 2021, FINRA (the financial services regulatory authority) levied the highest fine in its history on Robinhood. FINRA found multiple violations with Robinhood, including “millions of customers who received false or misleading information from the firm, millions of customers affected by the firm’s systems outages in March 2020, and thousands of customers the firm approved to trade options even when it was not appropriate for the customers to do so.” The false and misleading information included how much cash was in an account, downplaying the risk of trading options and approving margin trades for customers who didn’t understand the risk of a margin call. One Robinhood customer who had turned margin “off,” tragically took his own life in June 2020. According to FINRA, Robinhood had (allegedly) displayed an inaccurate negative cash balance in this investor’s account (and to other customers as well). There are strict regulations in place for determining whether or not a trader is experienced enough for options and margins trading. Robinhood assigned that task to bots that aren’t the Einsteins of the artificial intelligence industry. Apparently, the bots approved inexperienced traders who did not satisfy eligibility criteria or had other red flags in their accounts. Halted Trading on GameStop Other massive problems with Robinhood, which haven’t been problems at other brokerages, are power outages and restrictions on trading. Reddit’s Wall Street Bets traders are still infuriated about the GameStop trading fiasco, when Robinhood suspended trading of the stock during the height of the meme stock Short Squeeze. On March 2nd and 3rd, 2020, at the height of the volatility of the pandemic, Robinhood‘s website and app shut down. $12.6 million of FINRA’s fine is for restitution to “harmed” customers. Robinhood wrote in a blog on June 30, 2021 that the company is committed to enhanced customer support. Improvements include: more customer service support staff, better education, improved customer alerts and enhanced anti-fraud measures. Part of these measures were mandatory in the deal Robinhood made with FINRA. Reddit Boycott Robinhood is receiving a lot of negative publicity on Reddit‘s Wall Street Bets platform which is home to almost 11 million investors and traders. There you’ll find plenty of posts on “Robbing Hood,” comparing the company’s lack of customer service to having Beavis and Butthead as the call-center operators. There are posts with instructions on how to rollover your holdings to another brokerage and delete the app from your phone before the company’s IPO. No Lockup Period & Minimal Voting Rights New investors will have minimal voting rights. Existing employees and board members, with the exception of the founders and CFO, can sell up to 15% of their stock in the first day of trading. (The founders and CFO are limited to 5%.) Since Robinhood was founded in 2013, there is likely to be more than a few insiders who are ready to cash in their paper gains for dollars. In previous IPO insider liquidity events, the stock hits the board and then sinks the first day. Snap’s stock was underwater for 3 years. Zynga has never recovered to its IPO prices. Like Robinhood, Snap enjoyed amazing year-over-year revenue growth at its IPO, but struggled with multi-billion-dollar losses. Bottom Line There are 17.7 million monthly active users on Robinhood, according to the company’s S-1 filing. There are almost 11 million traders on Wall Street Bets. Will insider selling and the social media boycott doom Thursday’s Robinhood IPO? Should a company that only made $7 million last year be valued at $35 billion? When new investors rush in, while insiders sell sell sell, it can feel like trying to catch a falling knife. This is an unusual trading year, with an elevated appetite for risk. So, anything is possible. However, I’ll be looking for greener pastures in non-financial services industries for my investments in 2021. If you'd like to learn how to learn how to invest in great companies and manage volatile industries, like crypto, then join me for our 3-day Investor Educational Retreat. Our Company of the Year doubled in just two months, and we've had many Shoot the Moon stock picks in 2020 and 2021. You will also learn how to protect your wealth., while earning money while you sleep with a time-proven, 21st Century plan. Wisdom is the cure. It's time to become the boss of your money. Call 310-430-2397 or email [email protected] to learn more now.  Natalie Pace Financial Empowerment Retreat. Oct. 9-11, 2021. Call 310-430-2397 or email [email protected] to learn more. Families and friends registering together receive the best price. Click for testimonials & details. Other Blogs of Interest Will the Crypto Crash Hit Tesla, Square & Coinbase? China: GDP Soars. Share Prices Sink. The Competition Heats Up for Tesla & Nio. How Green in Your Love for the Planet? S&P500 Hits a New High. GDP Should be 7% in 2021! 2021 Financial Freedom Sweepstakes Will Work-From-Home and EVs Destroy the Oil Industry? Insurance and Hedge Funds are at Risk and Over-Leveraged. Office Buildings are Still Ghost Towns. Money Market Funds, FDIC, SIPC: Are Any of Them Safe? My 24-Year-Old is Itching to Buy a Condo. Should I Help Him? Will Cannabis be Decriminalized This Summer? The 12-Step Guide to Successful Investing. Gardeners Creating Sanctuary & Solutions in Food Deserts. 2021 Company of the Year Almost 5 Million Americans are Behind on Rent & Mortgage. Real Estate Hits All-Time High. Beyond Meat, Oatly & The Very Good Food Co. Is Cryptocurrency the New Gold? Rebalancing Your Nest Egg IQ Test. Answers to the Rebalancing Your Nest Egg IQ Test. Tesla & Nio Will Report Spectacular Earnings. The Coinbase IPO. Restore Our Earth on April 22nd (and Every Earth Day). Should You Sell in May and Go Away? Adding Shoot the Moon Performance to Your Nest Egg. Videoconferencing in a Post-Pandemic World (featuring Zoom & Teladoc). Sanctuary Sandwich Home. Multigenerational Housing. Interview with Lawrence Yun, the chief economist of the National Association of Realtors. 10 Budget Leaks That Cost $10,000 or More Each Year. The Stimulus Check. Party Like It's 1999. Kushner's Times Square Building Plunges 80% in Value. Will There be a Spring Rally? Cannabis and the Road to Decriminalization in the U.S. Hot ETFs Return Up to 50% Since October. Investor IQ Test 2021. Investor IQ Test Answers Shoot the Moon Stock Picks 2021 Crystal Ball. Would You Pay $50 for a Cafe Latte? Is Your Tesla Stock Overpriced? Can Medmen Avoid Bankruptcy? Bitcoin is Back, Baby! Real Estate Prices are Going Up. And Down. Cannabis is Decriminalized. Stocks Triple. Thanksgiving in a Pandemic. The Sustainability Silver Lining. Money Stress Killed My Friend Real Estate and Housing 2021. Challenges & Opportunities Real Estate in a Pandemic. Interview with Mike Fratantoni, the Chief Economist of the Mortgage Bankers Association. Bonds are Illiquid & Negative-Yielding. Annual Rebalancing is a Buy Low, Sell High Plan on Auto-Pilot. Is Your Bank a Junk Bond Put Your Money Where Your Heart Is. Schwab's Chief Fixed Income Strategist on What's Safe. China's Tesla (Nio). 2Q Sales Soar. Why Are You Still Renting? (Errr. There is More Than This to Consider!) Wealth Myths That Keep You Poor. Prosperity Truths That Make You Rich. Technology and Silver are Golden. Real Estate: Feeling Equity Rich? Make Sure That Feeling Isn't Fleeting. Airline Revenue Plunges 86%. 10 Questions for College Success. Is FDIC-Insured Cash at Risk of a Bank Bail-in Plan? 8 Money Myths, Money Pits, Scams and Conspiracy Theories. Why Are My Bonds Losing Money? The Bank Bail-in Plan on Your Dime. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable. However, NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors.  About Natalie Pace Natalie Wynne Pace is an Advocate for Sustainability, Financial Literacy & Women's Empowerment. She has been ranked as a No. 1 stock picker, above over 835 A-list pundits, by an independent tracking agency (TipsTraders). The ABCs of Money remained at or near the #1 Investing Basics e-book on Amazon for over 3 years (in its vertical), with over 120,000 downloads and a mean 5-star ranking. The 4th edition of The ABCs of Money was released on October 17, 2020. Natalie Pace's easy as a pie chart nest egg strategies earned gains in the last two recessions and have outperformed the bull markets in between. That is why her Investor Educational Retreats, books and private coaching are enthusiastically recommended by Nobel Prize winning economist Gary S. Becker, TD AMERITRADE chairman Joe Moglia, Kay Koplovitz and many Main Street investors who have transformed their lives using her Thrive Budget and investing strategies. Click to view a video testimonial from Nilo Bolden. Bitcoin High: $64,899/coin on April 13, 2021. Bitcoin Price: $29,713.90 on July 20, 2021 This week, two crypto founders announced that they were departing the industry. They have different reasons. One of them cited security concerns. The other one believes that the space has become rife with billionaire parasites essentially baiting and then sucking the life out of retail Main Street investors. According to Jackson Palmer, the founder of Dogecoin, “The cryptocurrency industry leverages a network of shady business connections, bought influencers and pay-for-play media outlets to perpetuate a cult-like “get rich quick” funnel designed to extract new money from the financially desperate and naive.” Anthony Di Iorio, the co-founder of Ethereum, doesn’t like the “risk profile” of crypto and believes that he would be safer personally if he were in a different industry. (He’s a billionaire, so personal security is undoubtedly a part of his future no matter where he focuses his attention.) Should the disenchantment of these mavericks be a concern? Yes. Executive exodus is always a red flag. Jeff Bezos stuck through Amazon through thick and thin – through three recessions. Andreessen and Horowitz have been all things technology throughout their careers. Tim Cook keeps figuring out new ways to put his products in our hands, and keep us glued to all things Apple. If you believe in pirating a corrupt industry, like fiat currency, then why not stay on board and finish the job? Palmer believes that "despite claims of 'decentralization,' the cryptocurrency industry is controlled by a powerful cartel of wealthy figures who, with time, have evolved to incorporate many of the same institutions tied to the existing centralized financial system they supposedly set out to replace." The exit of Di Iorio and Palmer doesn’t doom crypto to the grave, or wipe out the possibility that digital coins and blockchain will play a role in the future. Short-term traders might still make money by speculating. However, when you’re hearing that such-and-such coin is a buy and hold play because it will be the only thing of value in the future when the dollar becomes worthless, you’re in the clutches of those pay-to-play infomercials that Palmer is warning about. The average hold time for even the most well-known coins is in weeks, not years. For the purposes of this blog, I am focusing on a few of the companies that benefitted from the crypto rally in the first quarter, and how those companies will be impacted by the crypto crash of the second quarter. Square, Tesla and Coinbase will all announce results over the next few weeks. Tesla Tesla earnings: July 26, 2021 2:30 PT In the first quarter 2021 earnings call on April 27, 2021, Tesla CFO Zachary Kirkhorn talked up Bitcoin’s “liquidity,” and Tesla’s long-term commitment to the coin (although they’d captured gains in March on 10% of their $1.5 billion in holdings). The sale offered a “small gain” to the 1st quarter financials, according to Kirkhorn. Suddenly, an about-face occurred on May 12, 2021, when Elon Musk tweeted that Tesla would no longer accept Bitcoin, citing concerns over the amount of power used in mining and transacting with the cryptocurrency. Why was this an issue suddenly, when clearly any C-level should have known about the energy problem before plunking down a billion dollars? Did it have to do with the regulatory credits that Tesla receives for manufacturing electric vehicles. In the 1st quarter of 2021, credits offered a boost of $518 million to Tesla’s revenue. Can Tesla sell carbon credits to gas guzzling manufacturers when its currency is forged with coal emissions? Was it a moral or a financial incentive that set Tesla’s executives straight? Did regulators knock on the door, or was it investor activists, Grimes, a plummet in the price of Bitcoin or EARTHDAY.ORG that sobered Tesla’s leadership up? By the date of Elon’s Bitcoin Exit tweet, Bitcoins were trading down significantly from the high of $64,899 (hit on April 13, 2021), at $49,499/coin. Anything purchased with cryptocurrency before the Bitcoin suspension would have lost money. Tesla’s $1.5 billion in Bitcoin at the end of the 1st quarter would be worth about $895 million on June 30, 2021. Since cash and cash equivalents have to be recorded at fair value, this should have a negative impact on Tesla’s income. From a revenue perspective, however, Tesla will have a spectacular 2nd quarter. For the first time in the company’s history, more than 200,000 vehicles were produced and delivered (206,421 and 201,250, respectively). Deliveries are up 121% year over year, with production up 151%. That could put revenue in the range of $13.34 billion, which would be more than enough to absorb the drop in Bitcoin value, unless there were quite a large number of cars purchased with Bitcoin (unlikely?). We’ll know the details on July 26, 2021, when Tesla announces earnings. Square Square earnings: August 5, 2021 2 pm PT Square’s net income in the first quarter of 2021 was $39 million, with net revenue of $5.06 billion. Square’s net revenue included $3.51 billion of Bitcoin revenue (which was up 11X year over year). Square acknowledges that Bitcoin’s volume and price fluctuates, which will affect their bitcoin revenue. The question is, “How much?” Assuming Square’s Bitcoin revenue dropped 40% in the 2nd quarter due to the price correction, and Square’s other revenue remained constant, Square’s 2Q 2021 revenue could be in the range of $3.656 billion. That would still be impressive year-over-year growth of about 90%. Is that enough to justify a price-earnings ratio of 382? Should a company with under $200 million in annual net income be worth $111 billion? Coinbase Coinbase earnings August 13, 2021 (ish?) On April 13, 2021, Bitcoin’s market capitalization was over a trillion. Today, Bitcoin is worth $556.6 billion. While Coinbase forecasted in the 1st quarter earnings release that the 2nd quarter revenue was looking to meet or exceed the 1st quarter, that didn’t pan out. The crypto crash will materially impact Coinbase earnings. However, Bitcoin prices were in the $9,000/coin range in June of 2020. So, even though the 2nd quarter 2021 crash has been substantial (down by more than half from the high in April), prices are still 3X higher than a year ago. If Coinbase revenue drops by 40% to the $1 billion range (from $1.8 billion total revenue in the 1st quarter), it would still be up 5.4 times on a year-over-year basis. That kind of growth in today’s world is astonishing (outside of the COVID-19 vaccine manufacturers). However, when a company boosts a price-earnings ratio of 84.60, investors are looking for forward momentum. Having a 40% contraction on revenue quarter over quarter will concern investors. Bottom Line The crypto crash has caught many retail investors on the wrong side of the trade. (Downturns tend to be initiated by hedge funds and institutional investors.) But it will also impact the platforms and early adopters, such as Coinbase, Square and Tesla. Those three companies are trading at intergalactic multiples. When lofty valuations meet a crash in fundamentals, repricing and losses can occur. Investors have had a gluttonous appetite for risk, and 2021 GDP growth of 7.0% is the best in decades. Investors have become so forward-thinking -- looking beyond pandemics and crashes -- that a drop in share price is not a given, even with outlandish price-earnings ratios. I don’t expect crypto impairments to impact Tesla's earnings as much as Coinbase and Square, due to the impressively strong 2nd quarter deliveries of Tesla. Tesla’s income will be impacted by Bitcoin’s volatility, but the company should have room in the revenue growth to report solid earnings nonetheless. Both Coinbase and Square look solid compared to last year. But the plunge in quarter-over-quarter revenue might be too volatile for investors’ appetites, particularly since the revenue of both companies is highly dependent on Bitcoin and Ethereum. If the crypto executive exodus continues, cryptocurrency runs the risk of a continued rout, taking the revenue of these two companies down the drain with it. Learn more about Tesla, Coinbase and cryptocurrency in my previous blogs. (Click to access.) If you'd like to learn how to learn how to invest in great companies and manage volatile industries, like crypto,, then join me for our 3-day Investor Educational Retreat. You will also learn how to protect your wealth., while earning money while you sleep with a time-proven, 21st Century plan. Wisdom is the cure. It's time to become the boss of your money. Call 310-430-2397 or email [email protected] to learn more now.  Natalie Pace Financial Empowerment Retreat. Oct. 9-11, 2021. Call 310-430-2397 or email [email protected] to learn more. Families and friends registering together receive the best price. Click for testimonials & details. Other Blogs of Interest China: GDP Soars. Share Prices Sink. The Competition Heats Up for Tesla & Nio. How Green in Your Love for the Planet? S&P500 Hits a New High. GDP Should be 7% in 2021! 2021 Financial Freedom Sweepstakes Will Work-From-Home and EVs Destroy the Oil Industry? Insurance and Hedge Funds are at Risk and Over-Leveraged. Office Buildings are Still Ghost Towns. Money Market Funds, FDIC, SIPC: Are Any of Them Safe? My 24-Year-Old is Itching to Buy a Condo. Should I Help Him? Will Cannabis be Decriminalized This Summer? The 12-Step Guide to Successful Investing. Gardeners Creating Sanctuary & Solutions in Food Deserts. 2021 Company of the Year Almost 5 Million Americans are Behind on Rent & Mortgage. Real Estate Hits All-Time High. Beyond Meat, Oatly & The Very Good Food Co. Is Cryptocurrency the New Gold? Rebalancing Your Nest Egg IQ Test. Answers to the Rebalancing Your Nest Egg IQ Test. Tesla & Nio Will Report Spectacular Earnings. The Coinbase IPO. Restore Our Earth on April 22nd (and Every Earth Day). Should You Sell in May and Go Away? Adding Shoot the Moon Performance to Your Nest Egg. Videoconferencing in a Post-Pandemic World (featuring Zoom & Teladoc). Sanctuary Sandwich Home. Multigenerational Housing. Interview with Lawrence Yun, the chief economist of the National Association of Realtors. 10 Budget Leaks That Cost $10,000 or More Each Year. The Stimulus Check. Party Like It's 1999. Kushner's Times Square Building Plunges 80% in Value. Will There be a Spring Rally? Cannabis and the Road to Decriminalization in the U.S. Hot ETFs Return Up to 50% Since October. Investor IQ Test 2021. Investor IQ Test Answers Shoot the Moon Stock Picks 2021 Crystal Ball. Would You Pay $50 for a Cafe Latte? Is Your Tesla Stock Overpriced? Can Medmen Avoid Bankruptcy? Bitcoin is Back, Baby! Real Estate Prices are Going Up. And Down. Cannabis is Decriminalized. Stocks Triple. Thanksgiving in a Pandemic. The Sustainability Silver Lining. Money Stress Killed My Friend Real Estate and Housing 2021. Challenges & Opportunities Real Estate in a Pandemic. Interview with Mike Fratantoni, the Chief Economist of the Mortgage Bankers Association. Bonds are Illiquid & Negative-Yielding. Annual Rebalancing is a Buy Low, Sell High Plan on Auto-Pilot. Is Your Bank a Junk Bond Put Your Money Where Your Heart Is. Schwab's Chief Fixed Income Strategist on What's Safe. China's Tesla (Nio). 2Q Sales Soar. Why Are You Still Renting? (Errr. There is More Than This to Consider!) Wealth Myths That Keep You Poor. Prosperity Truths That Make You Rich. Technology and Silver are Golden. Real Estate: Feeling Equity Rich? Make Sure That Feeling Isn't Fleeting. Airline Revenue Plunges 86%. 10 Questions for College Success. Is FDIC-Insured Cash at Risk of a Bank Bail-in Plan? 8 Money Myths, Money Pits, Scams and Conspiracy Theories. Why Are My Bonds Losing Money? The Bank Bail-in Plan on Your Dime. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable. However, NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors.  About Natalie Pace Natalie Wynne Pace is an Advocate for Sustainability, Financial Literacy & Women's Empowerment. She has been ranked as a No. 1 stock picker, above over 835 A-list pundits, by an independent tracking agency (TipsTraders). The ABCs of Money remained at or near the #1 Investing Basics e-book on Amazon for over 3 years (in its vertical), with over 120,000 downloads and a mean 5-star ranking. The 4th edition of The ABCs of Money was released on October 17, 2020. Natalie Pace's easy as a pie chart nest egg strategies earned gains in the last two recessions and have outperformed the bull markets in between. That is why her Investor Educational Retreats, books and private coaching are enthusiastically recommended by Nobel Prize winning economist Gary S. Becker, TD AMERITRADE chairman Joe Moglia, Kay Koplovitz and many Main Street investors who have transformed their lives using her Thrive Budget and investing strategies. Click to view a video testimonial from Nilo Bolden. Now through midnight ET Wednesday, July 21, 2021, we'll be hosting a pop-up sale on the following items. $100 off registration for the online Oct. 9-11, 2021 Investor Education Retreat. (Cannot be combined with any other offer.) Buy One, Get One Free on any coaching package of 3 or more. Buy 3, get 3. Buy 6, get 6. You can using the coaching for an unbiased 2nd opinion on your current wealth strategy or college game plan. See below for testimonials. Coaching sessions cost $300/each. Get additional information by emailing [email protected] or calling 310-430-2397. Testimonials Through Natalie Pace, I have built up a nest egg from zero (having gone through bankruptcy 9 years ago due to over leveraging myself in real estate at too high of prices just before the crash) to 15K in less than 2 years through investments. I appreciate her discussion about the path to wisdom. I have even starting learning about and doing my first options trades! Suzie “Natalie helped me immensely in developing the confidence to get started. It’s daunting to begin to invest. I only wish I had met Natalie when I was 18 instead of 26.” Matthew "My investments grew enough in two months to pay for the retreat and all the associated lodging and travel expenses." Brenden “For me, at 50 years old, money and investing is finally clear and simple. Natalie’s retreat and her books The Gratitude Game and The ABCs of Money were key in changing my mindset.” Sarah "I doubled my nest egg with Natalie's picks!" Anita We asked Natalie Pace for a second opinion on our investment portfolio. She researched and reviewed each stock and fund. She then explained to us in plain English how we were positioned in the market and how high our risk exposure was. Her knowledge was so profound that we decided to take her retreat in Arizona. My husband was still quite skeptical, but 20 minutes into the retreat he turned to me and said "Thank you." Stocks and investing are no longer rocket science. We are finally able to take control of our money. We give thanks just about every day that we met Natalie. I feel like I live on a different planet. It's been a summer of miracles. Natalie contributed greatly to this. She added sanity and peace to my life. I am forever grateful. AC & AM My name is Isabella and I’m 11 years old. I’ve been a volunteer, along with my mom, for nearly 5 years. During the classes I’ve attended, I’ve researched various ETF’s and stocks. Doing classes with Natalie has always been fun. On the first day, you get printouts of pie charts, example stock report cards, and sheets to help you better understand how to make your own pie charts, when to buy and sell stocks, when to buy and hold until it’s time to sell when prices are high, how long to hold stocks, how to figure out when companies are going to go bankrupt, and much more. (You will be reviewing these.) After the class, you will know enough to do this at home! Isabella "College students need the information before they get their first credit card. Young adults need it before they buy their first home. Empty nesters can use the information to downsize to a sustainable lifestyle, before they get into trouble," Joe Moglia, chairman, TD AMERITRADE “Many people, including educated men and women, often get into trouble when they neglect to follow simple and fundamental rules of the type provided in this book. This is why I recommend it with enthusiasm.” Dr. Gary S. Becker. Dr. Becker won the 1992 Nobel prize in economics. University Professor, Department of Economics and Sociology and Professor, Graduate School of Business, The University of Chicago There are many strategies in Natalie Pace's book, The ABCs of Money for College, that prepare families - remember education is a family journey - to uplift and educate their children. Natalie also shares strategies for students who are not well-supported at home to create their own pathway to success. Given the central role that investments in the human capital of our children will play in the success of our children and our country, Natalie's book could not be more timely or important. Kevin M. Murphy, McArthur “Genius” Award winner. George J. Stigler Distinguished Service Professor of Economics, Department of Economics, The University of Chicago Booth School of Business “Natalie’s budgeting and investing strategies are easy to understand, easy to implement and effective. They also make daily life less stressful and far more fun. You sleep better at night knowing that your money is protected, and that you are not overspending to make ends meet. You can celebrate knowing that your retirement plans are compounding their gains, that your assets are protected, and that there will not be any toxic surprises when you open your bills. You gain peace of mind when your financial world is in order. I admire Natalie for her advice to Main Street, who can really benefit from her.” Kay Koplovitz, board director, Time Inc. (and more), founder USA Networks, and first female CEO of a network. "The Gratitude Game is a unique mash-up of sound financial advice and holistic, emotional philosophy to make us richer, but also happier. Somehow, Natalie Pace has made love, forgiveness and gratitude a part of a savvy investing strategy." Dennis Kneale, former anchor on CNBC and Fox Business and former managing editor of Forbes. No cash value. Offer expires at midnight ET Wednesday, July 21, 2021.  Natalie Pace Financial Empowerment Retreat. Oct. 9-11, 2021. Call 310-430-2397 or email [email protected] to learn more. Families and friends registering together receive the best price. Click for testimonials & details. Other Blogs of Interest China: GDP Soars. Share Prices Sink. The Competition Heats Up for Tesla & Nio. How Green in Your Love for the Planet? S&P500 Hits a New High. GDP Should be 7% in 2021! 2021 Financial Freedom Sweepstakes Will Work-From-Home and EVs Destroy the Oil Industry? Insurance and Hedge Funds are at Risk and Over-Leveraged. Office Buildings are Still Ghost Towns. Money Market Funds, FDIC, SIPC: Are Any of Them Safe? My 24-Year-Old is Itching to Buy a Condo. Should I Help Him? Will Cannabis be Decriminalized This Summer? The 12-Step Guide to Successful Investing. Gardeners Creating Sanctuary & Solutions in Food Deserts. 2021 Company of the Year Almost 5 Million Americans are Behind on Rent & Mortgage. Real Estate Hits All-Time High. Beyond Meat, Oatly & The Very Good Food Co. Is Cryptocurrency the New Gold? Rebalancing Your Nest Egg IQ Test. Answers to the Rebalancing Your Nest Egg IQ Test. Tesla & Nio Will Report Spectacular Earnings. The Coinbase IPO. Restore Our Earth on April 22nd (and Every Earth Day). Should You Sell in May and Go Away? Adding Shoot the Moon Performance to Your Nest Egg. Videoconferencing in a Post-Pandemic World (featuring Zoom & Teladoc). Sanctuary Sandwich Home. Multigenerational Housing. Interview with Lawrence Yun, the chief economist of the National Association of Realtors. 10 Budget Leaks That Cost $10,000 or More Each Year. The Stimulus Check. Party Like It's 1999. Kushner's Times Square Building Plunges 80% in Value. Will There be a Spring Rally? Cannabis and the Road to Decriminalization in the U.S. Hot ETFs Return Up to 50% Since October. Investor IQ Test 2021. Investor IQ Test Answers Shoot the Moon Stock Picks 2021 Crystal Ball. Would You Pay $50 for a Cafe Latte? Is Your Tesla Stock Overpriced? Can Medmen Avoid Bankruptcy? Bitcoin is Back, Baby! Real Estate Prices are Going Up. And Down. Cannabis is Decriminalized. Stocks Triple. Thanksgiving in a Pandemic. The Sustainability Silver Lining. Money Stress Killed My Friend Real Estate and Housing 2021. Challenges & Opportunities Real Estate in a Pandemic. Interview with Mike Fratantoni, the Chief Economist of the Mortgage Bankers Association. Bonds are Illiquid & Negative-Yielding. Annual Rebalancing is a Buy Low, Sell High Plan on Auto-Pilot. Is Your Bank a Junk Bond Put Your Money Where Your Heart Is. Schwab's Chief Fixed Income Strategist on What's Safe. China's Tesla (Nio). 2Q Sales Soar. Why Are You Still Renting? (Errr. There is More Than This to Consider!) Wealth Myths That Keep You Poor. Prosperity Truths That Make You Rich. Technology and Silver are Golden. Real Estate: Feeling Equity Rich? Make Sure That Feeling Isn't Fleeting. Airline Revenue Plunges 86%. 10 Questions for College Success. Is FDIC-Insured Cash at Risk of a Bank Bail-in Plan? 8 Money Myths, Money Pits, Scams and Conspiracy Theories. Why Are My Bonds Losing Money? The Bank Bail-in Plan on Your Dime. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable. However, NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors.  About Natalie Pace Natalie Wynne Pace is an Advocate for Sustainability, Financial Literacy & Women's Empowerment. She has been ranked as a No. 1 stock picker, above over 835 A-list pundits, by an independent tracking agency (TipsTraders). The ABCs of Money remained at or near the #1 Investing Basics e-book on Amazon for over 3 years (in its vertical), with over 120,000 downloads and a mean 5-star ranking. The 4th edition of The ABCs of Money was released on October 17, 2020. Natalie Pace's easy as a pie chart nest egg strategies earned gains in the last two recessions and have outperformed the bull markets in between. That is why her Investor Educational Retreats, books and private coaching are enthusiastically recommended by Nobel Prize winning economist Gary S. Becker, TD AMERITRADE chairman Joe Moglia, Kay Koplovitz and many Main Street investors who have transformed their lives using her Thrive Budget and investing strategies. Click to view a video testimonial from Nilo Bolden. The United States is in the middle of one of the best recovery years it has seen in decades, with a predicted GDP growth this year of up to 7%. (Click to read that blog.) That GDP growth has saved us from a credit downgrade by Fitch Ratings, although the outlook does remain negative. If we get the Debt Ceiling raised in time (hopefully before August 1 and definitely before we run out of money), it’s very likely that the U.S. will keep its AAA rating from Fitch for the rest of 2021. However, if you think the U.S. is having a gangbuster year, China is “off the charts,” to quote Sebastian Eckardt, the World Bank’s Lead Economist for China, in his podcast interview with Fitch Ratings on July 12, 2021. It’s rare when economists use language like that. They didn’t even bother mentioning the number, which was 18.3% GDP growth in the first quarter of 2021 for China. Economic Growth 2Q 2021 economic growth for China should be reported next week. In a Reuters’ poll of economists, the median forecast was 8.1% GDP growth year-on-year. The full year should be around 8.6%, which would be the highest GDP in a decade for China. Share Prices Before we jump all in, it’s important to remember that this is a recovery year. Companies have taken on a lot of debt to stay alive during the pandemic. Some companies and industries are in the middle of a structural shift and are unlikely to have the revenue they need to recover without restructuring. As just one example, be sure to read my report on office buildings in San Francisco and NYC. In many industries that are enjoying impressive revenue growth, such as technology and electric vehicles, the recovery is already priced into U.S. equities. If you look at the chart below, which came from the Federal Reserve Board, you can see that the forward PEs of the S&P 500 are as high now as they were in the Dot Com Recession. There was a wipe-out of up to 78% in the NASDAQ Composite Index between the high of March 2000 and the low of October 2002. It took 15 years to recover. So, it’s important to be mindful of price and valuation, even in an unprecedented year of GDP growth. Valuations Share prices on many Chinese companies have dropped dramatically. Alibaba is trading at $213/share. Last October, before Jack Ma went radio silent, Alibaba was trading at $319/share. Beijing scuttled Ma’s Ant Group IPO and fined Alibaba $2.8 billion in April. According to Alibaba’s co-founder and vice-chairman Joe Tsai (speaking on CNBC on June 15, 2021), the company is looking forward under the leadership of CEO Daniel Zhang. Jack Ma is now more focused on his charities and hobbies, and is no longer on the board of Alibaba. Even with all of the scrutiny and fines, Alibaba hit a new milestone of one billion annual active global consumers, with year-over-year revenue growth of 64% in the 1st quarter of 2021. The company swallowed the fine and reported a net loss of $836 million in the quarter, due to that one-time event. Alibaba is forecasting $144 billion in revenue in the 2022 fiscal year, representing an increase of almost 30%. Alibaba’s forward PE is 21. With 64% year-over-year sales growth, a 19% net profit margin, continued robust growth predicted in 2022 and a gangbuster GDP year for China, that’s very reasonable (unless the pandemic surges with a vengeance). By comparison, Amazon’s forward PE is 77. Amazon is boasting a respectable 44% year-over-year sales growth. However, the company’s price-earnings ratio is dramatically higher than Alibaba’s, with lower growth in the trailing earnings quarter. An ESG Star of the Stock Report Card Daqo Energy, which provides high purity polysilicon for the global solar PV industry, has a forward PE of just 9. Daqo Energy saw revenue growth of 52% in the first quarter. Since then, the average selling price of their product has gone from $11.90 per kilogram in the 1st quarter to $23-$25 per kilogram. In the 2nd quarter of 2020, during the pandemic, polysilicon prices dropped to just $7.5/kg. Even with a silicon supply chain bottleneck, Daqo is managing to stay on track for their deliveries without much increase in costs. So having their ASP double, without a meaningful escalation of expenses, should make for a pretty stunning earnings report in mid-August. Oddly, though investors rallied after the May earnings report, the price is lower today than it was when the report came out. Since hitting a high back in February of this year of $130 a share, Daqo has mostly been on a downtrend. The company is currently trading at $68 a share. Bottom Line As the author of Put Your Money Where Your Heart Is, I strongly believe in ESG investing. However, price is always something to factor in. That is why it is so exciting to find a solar company that is trading at half the price it was earlier this year, with an impressively low forward PE, right at the time that average selling price of their main product has doubled. If you'd like to learn how to learn how to pick and invest in great companies like Daqo, Alibaba, Nio, Tesla, XPeng and more, then join me for our 3-day Investor Educational Retreat. You will also learn how to properly diversify your 401k, IRA, insurance and pension, so that you can earn money while you sleep while protecting your wealth. Wisdom is the cure. It's time to become the boss of your money. Call 310-430-2397 or email [email protected] to learn more now.  Natalie Pace Financial Empowerment Retreat. Oct. 9-11, 2021. Call 310-430-2397 or email [email protected] to learn more. Families and friends registering together receive the best price. Click for testimonials & details. Other Blogs of Interest The Competition Heats Up for Tesla & Nio. How Green in Your Love for the Planet? S&P500 Hits a New High. GDP Should be 7% in 2021! 2021 Financial Freedom Sweepstakes Will Work-From-Home and EVs Destroy the Oil Industry? Insurance and Hedge Funds are at Risk and Over-Leveraged. Office Buildings are Still Ghost Towns. Money Market Funds, FDIC, SIPC: Are Any of Them Safe? My 24-Year-Old is Itching to Buy a Condo. Should I Help Him? Will Cannabis be Decriminalized This Summer? The 12-Step Guide to Successful Investing. Gardeners Creating Sanctuary & Solutions in Food Deserts. 2021 Company of the Year Almost 5 Million Americans are Behind on Rent & Mortgage. Real Estate Hits All-Time High. Beyond Meat, Oatly & The Very Good Food Co. Is Cryptocurrency the New Gold? Rebalancing Your Nest Egg IQ Test. Answers to the Rebalancing Your Nest Egg IQ Test. Tesla & Nio Will Report Spectacular Earnings. The Coinbase IPO. Restore Our Earth on April 22nd (and Every Earth Day). Should You Sell in May and Go Away? Adding Shoot the Moon Performance to Your Nest Egg. Videoconferencing in a Post-Pandemic World (featuring Zoom & Teladoc). Sanctuary Sandwich Home. Multigenerational Housing. Interview with Lawrence Yun, the chief economist of the National Association of Realtors. 10 Budget Leaks That Cost $10,000 or More Each Year. The Stimulus Check. Party Like It's 1999. Kushner's Times Square Building Plunges 80% in Value. Will There be a Spring Rally? Cannabis and the Road to Decriminalization in the U.S. Hot ETFs Return Up to 50% Since October. Investor IQ Test 2021. Investor IQ Test Answers Shoot the Moon Stock Picks 2021 Crystal Ball. Would You Pay $50 for a Cafe Latte? Is Your Tesla Stock Overpriced? Can Medmen Avoid Bankruptcy? Bitcoin is Back, Baby! Real Estate Prices are Going Up. And Down. Cannabis is Decriminalized. Stocks Triple. Thanksgiving in a Pandemic. The Sustainability Silver Lining. Money Stress Killed My Friend Real Estate and Housing 2021. Challenges & Opportunities Real Estate in a Pandemic. Interview with Mike Fratantoni, the Chief Economist of the Mortgage Bankers Association. Bonds are Illiquid & Negative-Yielding. Annual Rebalancing is a Buy Low, Sell High Plan on Auto-Pilot. Is Your Bank a Junk Bond Put Your Money Where Your Heart Is. Schwab's Chief Fixed Income Strategist on What's Safe. China's Tesla (Nio). 2Q Sales Soar. Why Are You Still Renting? (Errr. There is More Than This to Consider!) Wealth Myths That Keep You Poor. Prosperity Truths That Make You Rich. Technology and Silver are Golden. Real Estate: Feeling Equity Rich? Make Sure That Feeling Isn't Fleeting. Airline Revenue Plunges 86%. 10 Questions for College Success. Is FDIC-Insured Cash at Risk of a Bank Bail-in Plan? 8 Money Myths, Money Pits, Scams and Conspiracy Theories. Why Are My Bonds Losing Money? The Bank Bail-in Plan on Your Dime. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable. However, NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors.  About Natalie Pace Natalie Wynne Pace is an Advocate for Sustainability, Financial Literacy & Women's Empowerment. She has been ranked as a No. 1 stock picker, above over 835 A-list pundits, by an independent tracking agency (TipsTraders). The ABCs of Money remained at or near the #1 Investing Basics e-book on Amazon for over 3 years (in its vertical), with over 120,000 downloads and a mean 5-star ranking. The 4th edition of The ABCs of Money was released on October 17, 2020. Natalie Pace's easy as a pie chart nest egg strategies earned gains in the last two recessions and have outperformed the bull markets in between. That is why her Investor Educational Retreats, books and private coaching are enthusiastically recommended by Nobel Prize winning economist Gary S. Becker, TD AMERITRADE chairman Joe Moglia, Kay Koplovitz and many Main Street investors who have transformed their lives using her Thrive Budget and investing strategies. Click to view a video testimonial from Nilo Bolden. For the first time in Tesla’s history , the company delivered over 200,000 cars in the second quarter of 2021. The total delivery 201,250 vehicles, more than doubles the deliveries of last year in the same quarter (up 121%). GM and Ford remain the largest US-based auto manufactures with 688,236 and 475,327 vehicles sold in the US alone in the 2nd quarter, respectively. The greatest growth is being achieved by the Chinese electric vehicle manufacturers, however. Li Auto increased deliveries by 166%. XPeng’s year-over-year auto sales soared by 439%. Nio’s deliveries were 116% higher than last year. Nio specializes in the premium EV space, while XPeng is making a play for the Tesla 3 market. In April of this year, Nio became the top-selling brand in the electric SUV space in China, beating out Tesla’s 17% market share (Model Y) with 23%. Tesla’s Model Y was the top-selling EV in China in April with 5,520 cars sold. The new electric vehicle manufacturers are leaving Ford in the dust in terms of sales growth. Ford achieved a mere 9.6% increase in auto sales over last year’s pandemic-plagued 2nd quarter. General Motors is making a big play to transform their entire fleet to electric. GM has made it clear that the future is one of “zero crashes, zero emissions and zero congestion.” The company will release two EVs within the next 18 months, with the goal of 20 new EVs by 2023. GM has also made investments in lithium mining and batteries. The real question, however, is can American manufacturers compete with China’s ability to produce things at such a lower cost? Will American manufacturers lose the Chinese market to Chinese-based EV companies? How soon will Chinese auto manufacturers invade the European market? For now, the Chinese manufacturers are limited to the Chinese consumer, which is the largest vehicle market in the world. However, Nio is planning to expand into Europe within the next five years. XPeng received a 4-star review from a UK’s auto website, which said that its performance fares well with higher-priced competitors. Safety The Tesla S scored the highest safety ratings the NHTSA has ever given. XPeng has that honor In China. Nio’s safety was ranked even higher than Tesla’s by the Chinese. What Semiconductor Shortage? Auto industry experts have warned that inventory levels of the lowest they’ve ever seen. So far, the semiconductor shortage seems to be impacting the legacy car companies more. It may well be that the 3rd quarter is where the semiconductor shortage will have an even deeper negative impact. We should learn more about this in the second quarter earnings calls of each of the companies. The earnings season will likely start with Tesla, Nio, Ford and General Motors reporting at the end of July, followed by XPeng and Li Auto in August. Valuations on EVs are Astronomical As with many equities, the valuations on all the electric vehicle companies are astronomical. The excellent news of electric vehicles being on fire is already priced in. Tesla’s $602 billion market cap is larger than Nio, XPeng, Li Auto, Ford and General Motors combined, with a forward P/E of 152. The Chinese manufacturers are all still cash negative. When valuations are so high, the plunge can be rapid and steep, like trying to catch a falling knife. The drop can happen faster than you can protect your gains. Of course, the prices can also go higher, particularly since the U.S. and China are expected to have a gangbuster year of GDP growth, with 7.0% in the U.S. and 8.4% predicted in China. Trying to time when to jump in and out can be perilous to your profits. Regular rebalancing and capturing gains affords you the opportunity (and the cash) to buy low in the event of an unexpected downturn. As examples, both Nio and Tesla hit highs of $67 and $900 in January of this year, respectively, and dropped as low as $35 and $563 within three months of their summits. Both Tesla and Ford are Junk Bonds According to S&P Global, there is a one-in-three chance that Ford Motor Company will receive a downgrade from BB+ to BB in 2021. Tesla is at BB currently. Both of these are speculative ratings. However, the difference is that one company is growing rapidly and borrowing to build factories to keep up with demand. Ford will be using the profits from its recent $2 billion in senior unsecured convertible notes to pay off prior debts. Bottom Line Stocks are on fire hitting new highs every day. Electric vehicles are one of the fastest growing industries. Semiconductor shortages didn’t slow down EV sales in the second quarter, but could impact the third quarter. Investors tend to be forward thinking. There will be a mix of euphoria over amazing GDP growth, combined with concern over the semiconductor shortage and valuations, in the remaining months of 2021. Your best strategy will be to be properly diversified and to rebalance your investments on a regular basis. If you'd like to learn how to learn how to pick and invest in great companies like Nio, Tesla and XPeng, then join me for our 3-day Investor Educational Retreat. You will also learn how to properly diversify your 401k, IRA, insurance and pension, so that you can earn money while you sleep while protecting your wealth. Wisdom is the cure. It's time to become the boss of your money. Call 310-430-2397 or email [email protected] to learn more now.  Natalie Pace Financial Empowerment Retreat. Oct. 9-11, 2021. Call 310-430-2397 or email [email protected] to learn more. Families and friends registering together receive the best price. Click for testimonials & details. Other Blogs of Interest How Green in Your Love for the Planet? S&P500 Hits a New High. GDP Should be 7% in 2021! 2021 Financial Freedom Sweepstakes Will Work-From-Home and EVs Destroy the Oil Industry? Insurance and Hedge Funds are at Risk and Over-Leveraged. Office Buildings are Still Ghost Towns. Money Market Funds, FDIC, SIPC: Are Any of Them Safe? My 24-Year-Old is Itching to Buy a Condo. Should I Help Him? Will Cannabis be Decriminalized This Summer? The 12-Step Guide to Successful Investing. Gardeners Creating Sanctuary & Solutions in Food Deserts. 2021 Company of the Year Almost 5 Million Americans are Behind on Rent & Mortgage. Real Estate Hits All-Time High. Beyond Meat, Oatly & The Very Good Food Co. Is Cryptocurrency the New Gold? Rebalancing Your Nest Egg IQ Test. Answers to the Rebalancing Your Nest Egg IQ Test. Tesla & Nio Will Report Spectacular Earnings. The Coinbase IPO. Restore Our Earth on April 22nd (and Every Earth Day). Should You Sell in May and Go Away? Adding Shoot the Moon Performance to Your Nest Egg. Videoconferencing in a Post-Pandemic World (featuring Zoom & Teladoc). Sanctuary Sandwich Home. Multigenerational Housing. Interview with Lawrence Yun, the chief economist of the National Association of Realtors. 10 Budget Leaks That Cost $10,000 or More Each Year. The Stimulus Check. Party Like It's 1999. Kushner's Times Square Building Plunges 80% in Value. Will There be a Spring Rally? Cannabis and the Road to Decriminalization in the U.S. Hot ETFs Return Up to 50% Since October. Investor IQ Test 2021. Investor IQ Test Answers Shoot the Moon Stock Picks 2021 Crystal Ball. Would You Pay $50 for a Cafe Latte? Is Your Tesla Stock Overpriced? Can Medmen Avoid Bankruptcy? Bitcoin is Back, Baby! Real Estate Prices are Going Up. And Down. Cannabis is Decriminalized. Stocks Triple. Thanksgiving in a Pandemic. The Sustainability Silver Lining. Money Stress Killed My Friend Real Estate and Housing 2021. Challenges & Opportunities Real Estate in a Pandemic. Interview with Mike Fratantoni, the Chief Economist of the Mortgage Bankers Association. Bonds are Illiquid & Negative-Yielding. Annual Rebalancing is a Buy Low, Sell High Plan on Auto-Pilot. Is Your Bank a Junk Bond Put Your Money Where Your Heart Is. Schwab's Chief Fixed Income Strategist on What's Safe. China's Tesla (Nio). 2Q Sales Soar. Why Are You Still Renting? (Errr. There is More Than This to Consider!) Wealth Myths That Keep You Poor. Prosperity Truths That Make You Rich. Technology and Silver are Golden. Real Estate: Feeling Equity Rich? Make Sure That Feeling Isn't Fleeting. Airline Revenue Plunges 86%. 10 Questions for College Success. Is FDIC-Insured Cash at Risk of a Bank Bail-in Plan? 8 Money Myths, Money Pits, Scams and Conspiracy Theories. Why Are My Bonds Losing Money? The Bank Bail-in Plan on Your Dime. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable. However, NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors.  About Natalie Pace Natalie Wynne Pace is an Advocate for Sustainability, Financial Literacy & Women's Empowerment. She has been ranked as a No. 1 stock picker, above over 835 A-list pundits, by an independent tracking agency (TipsTraders). The ABCs of Money remained at or near the #1 Investing Basics e-book on Amazon for over 3 years (in its vertical), with over 120,000 downloads and a mean 5-star ranking. The 4th edition of The ABCs of Money was released on October 17, 2020. Natalie Pace's easy as a pie chart nest egg strategies earned gains in the last two recessions and have outperformed the bull markets in between. That is why her Investor Educational Retreats, books and private coaching are enthusiastically recommended by Nobel Prize winning economist Gary S. Becker, TD AMERITRADE chairman Joe Moglia, Kay Koplovitz and many Main Street investors who have transformed their lives using her Thrive Budget and investing strategies. Click to view a video testimonial from Nilo Bolden. What would happen if we put nature at the heart of every choice we make? Is it possible that we can Restore Our Home Planet? Take the 10-question quiz below to see just how green your love for Mother Earth is. 1. Do you use recycled toilet paper? Are you wiping your bottom with an ancient tree? The singing bears might be wining advertising awards, but they are failing the grade of sustainability. Many of us are purchasing toilet paper from companies that are denuding our forests. Trees and plants are one of the most important sources of carbon removal from the atmosphere. They also clean the air we breathe, moderate temperatures, provide shade and keep the soil moist and rich in nutrients. Check out the NRDC’s toilet paper report card below. 2. Do you take the stairs? Every button we push is connected to a power source. Imagine how expensive our electric bill would be if we installed an elevator in our home, instead of stairs. If we take the stairs in government buildings, there will be more civic funds for education, planting trees and other endeavors that create a better tomorrow. In many states, fossil fuels are still the primary power source for electricity. Every time we push a button, a coal power plant, or fracking company, or a nuclear power plant is firing up. Using less contributes to a more sustainable world, and it also leaves more money in our budget for things we might enjoy even more. Taking the stairs also promotes physical health. 3. Are you still working from home? In many cities across the developed world, 2020 offered the bluest skies we’ve seen in our lifetime. Carbon emissions were down 7% globally in 2020. The reduction contributed from nobody driving or flying anywhere was profound. During the height of the lockdowns, road transportation was down by half. In December of 2020, aviation travel was still reduced by 40%. If everyone returns to their normal commute, emissions will increase with the population growth. If we embrace working from home and videoconferencing for meetings, we can continue the transportation emissions reductions. 4. Are you purchasing organic food? Protecting our pollinators is key to survival. Many of the pesticides used by conventional farming are harmful to bees and butterflies. Organic food is rich in antioxidants, vitamins and is free of residue that can be unhealthful for humans as well. Just as importantly, however, it contributes to the preservation of the mini beasts that are essential for planetary plant health. 5. Have you done an air test on your home, school and office to see just how energy efficient your dwelling is? When you turn on the cooling in your home are you actually cooling the outside air? Do you have so many leaks that your unit has to stay on constantly in order to keep the inside cool or hot? A well-insulated home, combined with smart choices like curtains in the summer, can save you thousands of dollars every year. Typically, the investment will be minimal, and often it is tax deductible. There are still energy efficiency tax credits available In the United States and many other countries around the world. The money saved at school can be used for the arts, updated technology hardware and software and school gardens. Savings at the office are essential to profitability, which helps you to keep your job and receive raises. Of course, a reduction in fossil fuels and energy usage is a great way to show our love for the planet that nourishes and sustains us. 6. Do you bike or walk for local errands? A lot of people do large shopping trips by car. However, a backpack and a walk to the store can mean that you don’t have to get into a car at all (particularly if you’re working from home). For most people giving up their car adds up to thousands saved annually, when you factor in the car payment, the insurance, vehicle maintenance and gasoline. Foot and pedal power are clean energy that promote heart health. With obesity rates at 1/3 in the U.S., the value of a trend toward walking and biking cannot be overstated (source: CDC). If your city has not yet put in bike lanes, then becoming more active in your community plans will contribute to making your streets friendly to pedestrians and micro mobility. 7. Are you conserving water? Do you live in a desert with green grass in the front lawn? Does your yard reflect the natural habitat? Fresh water is something we all have an interest in preserving. Other ways to conserve water include grey water systems for plant watering. Smart landscaping techniques will keep the soil moist. In rural areas, you might even consider reed beds and other vegetation that offer natural filtration. Mark Nelson, one of the original Biospherians, has a book called The Wastewater Gardener. 8. Are you composting food waste? Up to 40% of food that is purchased is never eaten. Even if you are pretty efficient about buying only what you eat, there are still avocado pits, orange peels, egg shells and coffee grounds. Composting saves energy, protects the climate and returns valuable nutrients to the soil. Food waste can be up to 1/3 of a city’s garbage (source: Seattle.gov). In a landfill, it produces methane, which is harmful to the atmosphere. Many cities already allow composting in the yard bin. Again, if yours doesn’t, then it’s time to become more involved. 9. Do you live by the 7 Rs of sustainability? 10. Is your community powering with clean energy, or are you being deceived by marketing ads? Know the source of your power! Santa Monica, California, powers 100% with clean energy. Poundbury, England, installed their own anaerobic digester, which provides heating for their township and the surrounding community. Meanwhile, 60% of the U.S. power grid is powered by fossil fuels. Some states are greener than others, with California taking the lead at 44% renewable energy. Florida is one of the biggest polluters, with 83% fossil fuels (76% natural gas and 7% coal). Sometimes the utilities will brag that they’ve doubled their solar. In the case of Florida, that would be going from 1.3% to 2.6% solar. Remember that the cleanest energy source is the energy you don’t use, by taking the stairs, riding a bike, insulating your home and working from home. 11. Do your local schools and community have gardens? You can lower the temperature and increase the humidity in a neighborhood that is blighted by concrete by planting trees and gardens. Ron Finley transformed his home in a food desert into his own private Eden. School gardens offer fun ways for kids to learn about science and math, and to experience where their food comes from. It also promotes healthy eating. At the Edible Schoolyard, a garden project begun in 1995 by Alice Waters in Berkeley, California, one of the students told me her favorite snack was kale pesto! 12. Has your community dispensed with plastic bags and straws? In Poundbury, England, the children at Damers First School (with the help of their eco-teacher extraordinaire Edd Moore) wrote to the food distributors asking them to deliver their food without plastic coverings. They then went on to encourage a local shop to offer plastic-free produce. You can dispense your own milk at the shop, in addition to the fresh produce and bulk goods that are available. Individuals took it upon themselves to create Boomerang Bags – reusable cloth bags that anyone can use free of charge. (Many grocers sell canvas bags for a nominal fee.) 13. Are you still using single-use products and containers? Cloth diapers can be swapped out for disposable plastic ones. (They feel better on the baby’s bottom, too.) Diaper services make this easy and mess-free. Opt for drinking your coffee at home, or at cafes that serve in cups rather than disposable paper and plastic. Purchase stackable food storage containers which create more space in your refrigerator (particularly useful now that so many of us are eating at home more). EARTHDAY.ORG has a plastic calculator so that you can add up just how wasteful your habits truly are (or are not). Can you think of things I’ve forgotten? Do you wish to share something you’ve shifted in your own life? Please tag us on social media (links below) using the hashtag #EarthGratitude, so that we can like and reshare. The Earth Gratitude Project Earth Gratitude on YouTube Earth Gratitude on Instagram Earth Gratitude on Twitter Earth Gratitude on Facebook Please share this quiz with your community. Together, we can be the change we wish to see. Final Thoughts on: Financial Independence. Sustainability Independence. What is the true value of money, if not to offer us greater freedom to live the life of our dreams? What is the true value of life? Plants, animals, trees, rivers, oceans and mountains offer us our sustenance, but also joy and adventure. Everything is intertwined in a divine and sacred braid. There is not wealth without freedom. There is no life without biodiversity. They haven’t done a great job of preserving wealth and life for us. We must believe, achieve and create for ourselves. If we do this on a planetary scale, our climate anxiety can be exchanged for the hope of restoring our home planet for our children and grandchildren. This is worth taking a look at our habits and making our love for our planetary home more apparent. The blessings will be many and unexpected, and will include more money in your budget for the things you truly cherish and love doing, rather than the multitude of quite unsustainable traps that we’ve fallen collectively into. If you'd like to learn how to put your money where your heart is, and make sure that you're not profiting from polluters, then join me for our 3-day Investor Educational Retreat. If you don't know what you own in your 401k, IRA, insurance and pension, chances are quite high that you invest in the same companies that are destroying our planet. Wisdom is the cure. It's time to become the boss of your money.  Natalie Pace Financial Empowerment Retreat. Oct. 9-11, 2021. Call 310-430-2397 or email [email protected] to learn more. Families and friends registering together receive the best price. Click for testimonials & details. Other Blogs of Interest S&P500 Hits a New High. GDP Should be 7% in 2021! 2021 Financial Freedom Sweepstakes Will Work-From-Home and EVs Destroy the Oil Industry? Insurance and Hedge Funds are at Risk and Over-Leveraged. Office Buildings are Still Ghost Towns. Money Market Funds, FDIC, SIPC: Are Any of Them Safe? My 24-Year-Old is Itching to Buy a Condo. Should I Help Him? Will Cannabis be Decriminalized This Summer? The 12-Step Guide to Successful Investing. Gardeners Creating Sanctuary & Solutions in Food Deserts. 2021 Company of the Year Almost 5 Million Americans are Behind on Rent & Mortgage. Real Estate Hits All-Time High. Beyond Meat, Oatly & The Very Good Food Co. Is Cryptocurrency the New Gold? Rebalancing Your Nest Egg IQ Test. Answers to the Rebalancing Your Nest Egg IQ Test. Tesla & Nio Will Report Spectacular Earnings. The Coinbase IPO. Restore Our Earth on April 22nd (and Every Earth Day). Should You Sell in May and Go Away? Adding Shoot the Moon Performance to Your Nest Egg. Videoconferencing in a Post-Pandemic World (featuring Zoom & Teladoc). Sanctuary Sandwich Home. Multigenerational Housing. Interview with Lawrence Yun, the chief economist of the National Association of Realtors. 10 Budget Leaks That Cost $10,000 or More Each Year. The Stimulus Check. Party Like It's 1999. Kushner's Times Square Building Plunges 80% in Value. Will There be a Spring Rally? Cannabis and the Road to Decriminalization in the U.S. Hot ETFs Return Up to 50% Since October. Investor IQ Test 2021. Investor IQ Test Answers Shoot the Moon Stock Picks 2021 Crystal Ball. Would You Pay $50 for a Cafe Latte? Is Your Tesla Stock Overpriced? Can Medmen Avoid Bankruptcy? Bitcoin is Back, Baby! Real Estate Prices are Going Up. And Down. Cannabis is Decriminalized. Stocks Triple. Thanksgiving in a Pandemic. The Sustainability Silver Lining. Money Stress Killed My Friend Real Estate and Housing 2021. Challenges & Opportunities Real Estate in a Pandemic. Interview with Mike Fratantoni, the Chief Economist of the Mortgage Bankers Association. Bonds are Illiquid & Negative-Yielding. Annual Rebalancing is a Buy Low, Sell High Plan on Auto-Pilot. Is Your Bank a Junk Bond Put Your Money Where Your Heart Is. Schwab's Chief Fixed Income Strategist on What's Safe. China's Tesla (Nio). 2Q Sales Soar. Why Are You Still Renting? (Errr. There is More Than This to Consider!) Wealth Myths That Keep You Poor. Prosperity Truths That Make You Rich. Technology and Silver are Golden. Real Estate: Feeling Equity Rich? Make Sure That Feeling Isn't Fleeting. Airline Revenue Plunges 86%. 10 Questions for College Success. Is FDIC-Insured Cash at Risk of a Bank Bail-in Plan? 8 Money Myths, Money Pits, Scams and Conspiracy Theories. Why Are My Bonds Losing Money? The Bank Bail-in Plan on Your Dime. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable. However, NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors.  About Natalie Pace Natalie Wynne Pace is an Advocate for Sustainability, Financial Literacy & Women's Empowerment. She has been ranked as a No. 1 stock picker, above over 835 A-list pundits, by an independent tracking agency (TipsTraders). The ABCs of Money remained at or near the #1 Investing Basics e-book on Amazon for over 3 years (in its vertical), with over 120,000 downloads and a mean 5-star ranking. The 4th edition of The ABCs of Money was released on October 17, 2020. Natalie Pace's easy as a pie chart nest egg strategies earned gains in the last two recessions and have outperformed the bull markets in between. That is why her Investor Educational Retreats, books and private coaching are enthusiastically recommended by Nobel Prize winning economist Gary S. Becker, TD AMERITRADE chairman Joe Moglia, Kay Koplovitz and many Main Street investors who have transformed their lives using her Thrive Budget and investing strategies. Click to view a video testimonial from Nilo Bolden. |

AuthorNatalie Pace is the co-creator of the Earth Gratitude Project and the author of The Power of 8 Billion: It's Up to Us, The ABCs of Money, The ABCs of Money for College, The Gratitude Game and Put Your Money Where Your Heart Is. She is a repeat guest & speaker on national news shows and stages. She has been ranked the No. 1 stock picker, above over 830 A-list pundits, by an independent tracking agency, and has been saving homes and nest eggs since 1999. Archives

July 2024

Categories |

RSS Feed

RSS Feed