|

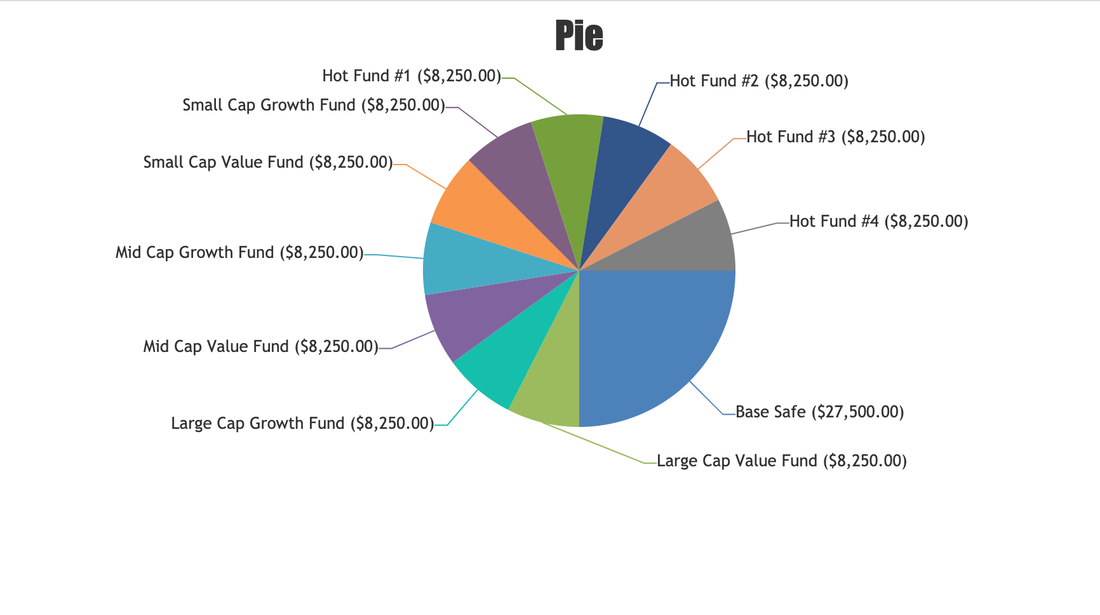

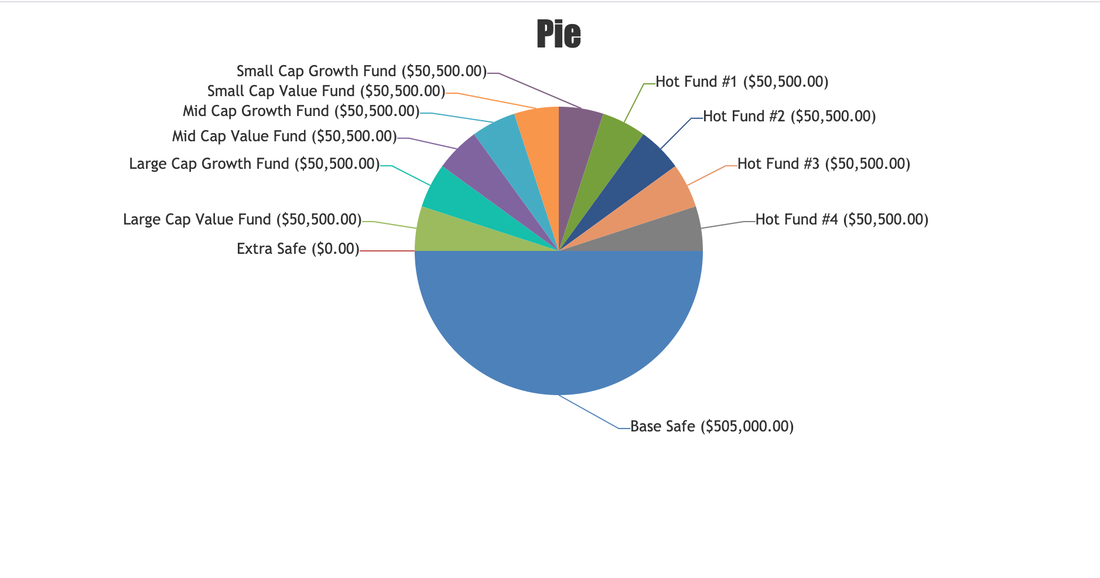

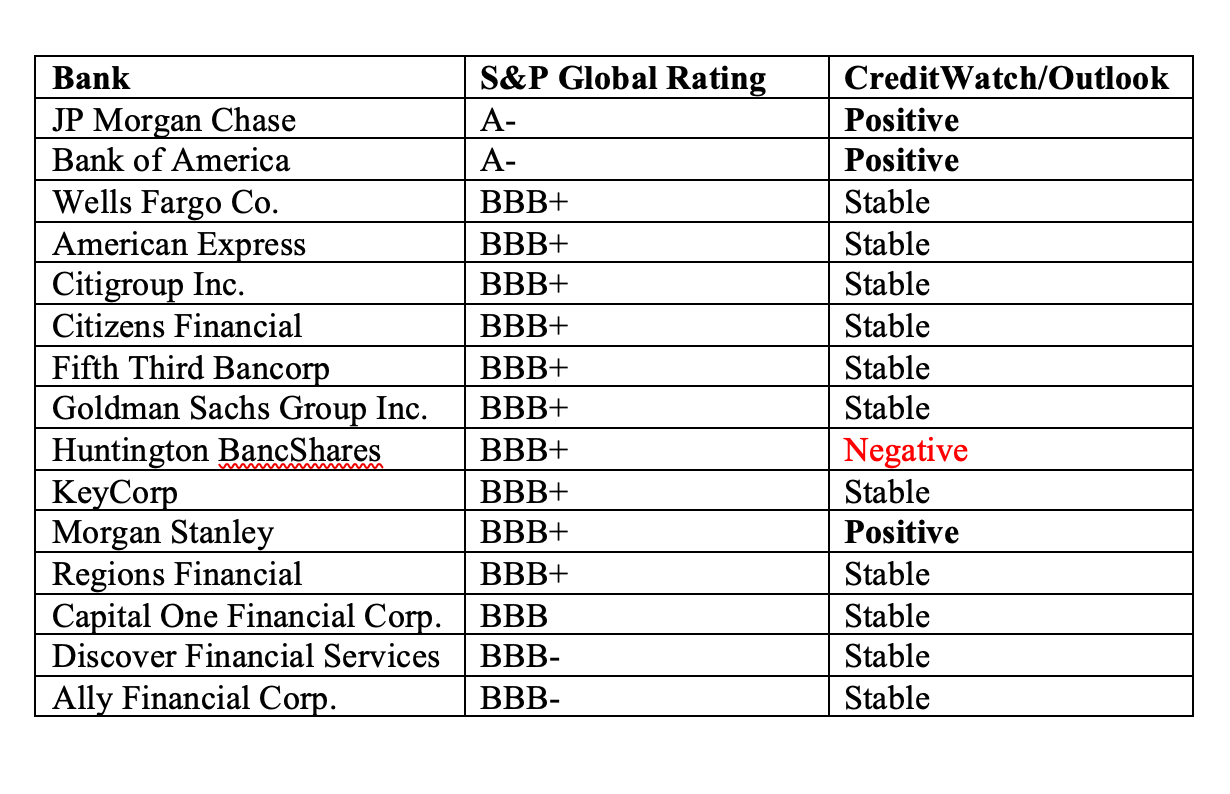

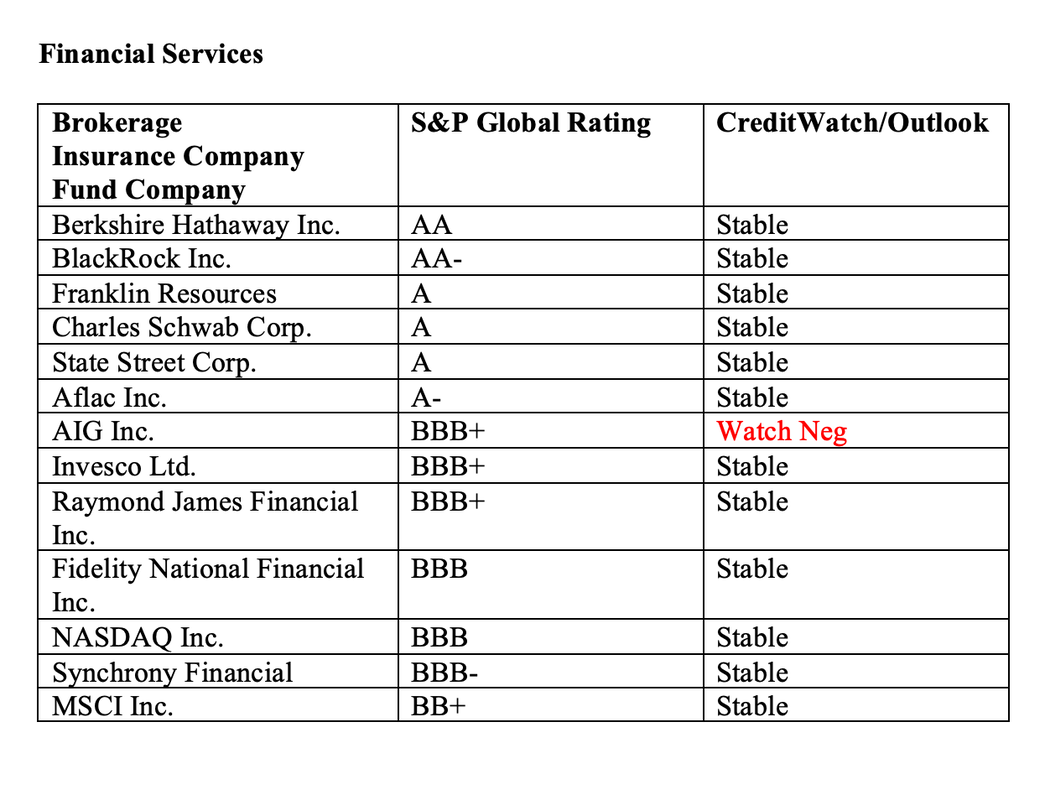

The 12-Step Guide to Successful Investing. Your easy-as-a-pie-chart plan to lasting wealth & money while you sleep. Follow the 12-step program below to get started. 12 Steps to The ABCs of Investing 1. Tithe 10% to your Buy My Own Island Fund. 2. Keep a percent equal to your age safe, not in stocks. 3. Overweight or underweight safe based on market conditions. 4. Know what is safe. 5. Diversify into 10 funds. 6. Underweight the bailouts & vulnerable companies or industries. 7. Get hot. 8. Rebalance 1-3 times a year. 9. Use limit orders to capture gains, not stop losses. 10. Be the boss of your money. 11. Buy & Hope is a last-century strategy. 12. Real estate. And here are more details on each step. 1. Tithe 10% to your Buy My Own Island Fund Remember to put 10% of your gross income into tax protected retirement accounts. (Rich people don’t put money in jars.) You want your investments in retirement accounts so that your wealth grows without you having to pay capital gains taxes. These plans are also financial predator proof (debt collectors can’t put a lien on your retirement accounts). Match your employer’s contribution in the 401(k), but not more, IMHO. The good news is that the employer’s contribution is free money. The bad news is there is not very much freedom of choice in your 401K. That’s why it’s important to also contribute to your Health Savings Account, your own IRA, your kids’ college or dependent IRA funds, etc. (The college funds should be coming out of your education fund.) Self-directed IRAs typically have freedom to invest in the universe of stocks and funds. This is where you can add in hot industries and countries that might not be found in your 401K selections. Name your funds with goals. That will make it more exciting to do your regular rebalancing, as you see just how much progress you are making toward the desired destination. 2. Keep a percent equal to your age safe, not in stocks. The rule of thumb is to always have a percentage equal to your age safe, not in stocks, equity funds, mutual funds, etc. Most people have far more at risk than they realize. The last two recessions have lost investors more than ½ of their at-risk investments. Simply keeping the proper amount safe protects your wealth from these devastating drops. 3. Overweight or underweight safe based on market conditions. In 2021, the U.S. economy is expected to grow at 6.5% GDP. That’s better than it’s done in decades. If stocks and real estate weren’t already so high priced, it would be smart to overweight into equities (stocks). When the economy is expected to contract, overweighting safe is a good idea. (This is something we encouraged before the last three recessions. Yes, the data is that reliable.) Basing your strategy on data is far better than running with your emotions, such as those risk tolerance questionnaires that many broker salesman will give you. Your emotions are rarely your friend in investing, particularly if you are a newbie. Most people have a lot of risk tolerance when stocks are high. Market tops are when you want to sell high and get more conservative, however. Few people have any tolerance for risk at the market bottom because they feel that we are in an Apocalypse. Often, they’ve already lost a lot of money. However, the market bottom is the time when you could be thinking about leaning into risk, particularly if the recovery is looking strong. 4. Know what is safe. We live in a world of debt, where many things are very highly leveraged. That adds credit risk to the “safe” side of the traditional retirement strategy. At the same time interest rates are at rock-bottom. So, you have credit risk and interest rate risk in bonds. Bonds are traditionally thought of as safe. However, today they are vulnerable to capital loss, and they can also be illiquid. Getting safe in 2021 is so tricky that we spend one full day on it at our Investor Educational Retreat. If you have a lot of bonds and wonder if you might be more vulnerable than you know, then I strongly encourage you to read the Bond section of The ABCs of Money. Consider getting an unbiased second opinion from me or attending our June 4-6, 2021 Investor Educational Retreat. We host retreats at least three times a year, so check out the NataliePace.com homepage for an upcoming retreat. Call 310-430-2397 or email [email protected] for pricing, testimonials and additional information. 5. Diversify into 10 funds. Diversifying into 10 funds makes your investment strategy easy-as-a-pie-chart. 10 funds are all you need for proper diversification, and they are far easier to manage when you’re doing your rebalancing session. If you have pages and pages of holdings, chances are you actually only have 2-4 slices, rather than the 10 funds. (That many holdings is a red flag that you are on the Buy & Hope, last-century strategy – riding the Wall Street rollercoaster and losing half of your wealth in recessions.) What are the 10 funds you should be diversified into? Small, medium and large, value and growth, and four hot industries or countries. See the sample pie chart below. FYI: the target date retirement funds are not well-diversified and typically perform below the market index. They do not allow you to rebalance regularly, which is an essential strategy in today’s world. 6. Underweight the bailouts & vulnerable companies and industries. Over half of the S&P500 is at or near junk bond status. There are companies that have very strong revenue growth, almost no debt and a boatload of cash (like many technology firms), there are also companies that have been borrowing from Peter to pay Paul for a very long time, have very low credit ratings, have very high debt, and are either losing revenue or have flat revenue growth (like Boeing, Ford, most of the major U.S. banks, and many more companies that were founded more than 50 years ago). General Electric is proof of what happens when you invest in highly leveraged companies for the dividends. So be careful of your value funds and dividend funds. We address that as well at the Investor Educational Retreat. 7. Get hot. Have you been seduced into the crypto craze? Even with the correction of the past month, Bitcoin is still up more than 3-fold on a 12-month basis. Whatever you think is going to Shoot the Moon this year, whether it is crypto, cannabis, electric vehicles, artificial intelligence or biotechnology, if you have a slice of it in your nest egg that can increase the performance and your wealth. Also, because shooting stars can drop back to Earth, the pie chart system and regular rebalancing helps you to be on the right side of the trade. If your slice of Bitcoin becomes 10 slices, as it did in April of this year, the pie-chart system is prompting you to sell high and trim your 10 slices back to one or two slices. Not only does that allow you to keep your money, it also affords you the opportunity and the emotional fortitude to buy more at a lower price, if the asset value tanks (and you still think it’s hot). 8. Rebalance 1-3 times a year. Rebalancing 1-3 times a year is one of the most important things that you can do. Every year you get a little bit older, and should have more on the safe side. In a bull market, your wealth increases. Most of your slices swell in size. When you compare a sample pie chart of what you should have with what you do have, rebalancing becomes easy and quite visual. If the slice is bigger than it should be, it is prompting you to sell high. Conversely if a correction has plunged prices and your slices are slim, they are prompting you to buy low. In this way, the system puts your emotions on the right side of the trade, whereas brokerage statements do quite the opposite, with losses in red and gains in green. The safe side and overweighting protect you from the plunge. Market timing doesn’t work. When you feel like selling, that’s usually the best time to buy, and vice versa. Rebalancing regularly is a buy low, sell high plan on auto-pilot. It’s important to remember that the reason people don’t buy low is that they cannot buy low. If they have suffered massive losses, they have no liquidity – no money on hand to take advantage of opportunities. When you are keeping an appropriate amount liquid, as the pie chart system instructs you to do, you have the capital to buy low. 9. Use limit orders to capture gains, not stop losses. Think capture gains, not stop losses. A lot of people think they should be using stop losses to prevent themselves from losing money. Your best protection from a correction is keeping a percent equal to your age safe. Overweight a little more (act older than you are) if you think the economy is weak. Because of the volatility in equities, bonds and real estate, if you set stop losses you will be losing over and over again. If you simply changed your strategy to a capture gains system, which is what the diversification and regular rebalancing is all about, then every time the markets shoot the moon, you’re selling high. Every time the stocks tank, you’re buying low. Limit orders can help this process. We talk about this at the retreat as well. 10. Be the boss of your money. Your accountant should be well-versed in tax strategies. Your broker-salesman should be helpful in setting up a new account, making a contribution, rolling over a 401(k) into an IRA and other brokerage transactions. Be careful getting stock tips or strategies from “financial advisors” (who are most often hired as salesmen) or accountants (who should be buried in tax strategies, not equity analysis). There are still a lot of brokerages and broker-salesman that adhere to the last-century Buy and Hope strategy, which has been a disaster in the 21st-Century. Be the boss of your money. Adhere to the time-proven 21st-century strategy of proper diversification and regular rebalancing. Your financial team works for you. It’s your money and your future at risk, not theirs. Once you know what a healthy nest egg looks like, you can take charge, rather than having blind faith that someone else is doing the right thing for your money. Select your financial team as if your life depends upon it because your lifestyle does. 11. Buy & Hope is a last-century strategy. Buy & hope is a strategy that has lost over half in the last two recessions. On this plan, investors have to use the bull markets to make up losses, rather than build their wealth. That is not a financial plan; that is a Wall Street rollercoaster. The easy-as-a-pie-chart nest egg strategy with annual rebalancing earned gains in the last two recessions and has outperformed the bull markets in between. It’s less time and less money. It’s easy and logical. It works. 12. Real estate is part of your wealth, but not part of your liquid assets (nest egg). When you were constructing your sample Nest Egg Pie Chart, do not include the equity you have in your home or any other hard asset in the line that asks for your liquid assets. Real estate and other hard assets are an important piece of your wealth. However, you want liquidity (savings, stocks, bonds) and stability (hard assets). Owning your own home is one of the best ways to build wealth – unless you purchase at too lofty of a price or buy more than you can afford. For important real estate strategies, read the Real Estate section of The ABCs of Money. This is also covered in our Investor Educational Retreats. My May 14, 2021 blog talks about how the real estate market will be impacted by the end of the eviction and foreclosure moratoria. Since almost five million Americans are behind on their payments, and real estate prices are unaffordable in many cities, is important to get your strategy from the data – not a real estate broker-salesman. You can personalize your own pie charts using our free web apps. Simply go to NataliePace.com and click on the app badge. Or you can email [email protected] with the subject line, “I want my free web apps.” Fix the Roof While the Sun is Still Shining You wouldn’t wait for the rain to see whether or not your roof is leaking. You want to make sure your house is secure before any natural disasters occur. In a world where financial disasters are coming pretty regularly, it’s a very good idea to make sure that your fiscal house is sound now, while stocks and real estate are hitting all-time highs. It’s very easy to be complacent when everything is going well. However, stocks and real estate can’t keep shooting the moon forever. Both are very expensive. In the 21st-century, the corrections come swift and deep. If you wait for the headlines that trouble has arrived, it is always too late to protect yourself. (The next headlines about the Debt Ceiling will happen at the end of July.) So, make sure that your wealth is properly diversified, hot & protected now. Fix the roof while the sun is still shining. Join us for our June 4-6, 2021 Financial Empowerment Retreat. (Click to learn more.) In 3 days, you'll learn how to pick hot funds and companies (like our 2021 Company of the Year, Moderna), and how to incorporate them into a well-diversified wealth plan. You'll discover how to protect your wealth and save thousands annually in your budget with smarter big-ticket choices. The retreat is a complete Money Makeover that will transform your life forever. Bring your friends, family and teens for an unbelievably low group rate. Call 310-430-2397 or email [email protected] to learn more now.  Natalie Pace Financial Empowerment Retreat. June 4-6, 2021. Call 310-430-2397 or email [email protected] to learn more. Receive the best price when you register with friends and family. Other Blogs of Interest Gardeners Creating Sanctuary & Solutions in Food Deserts. 2021 Company of the Year Almost 5 Million Americans are Behind on Rent & Mortgage. Real Estate Hits All-Time High. Beyond Meat, Oatly & The Very Good Food Co. Is Cryptocurrency the New Gold? Rebalancing Your Nest Egg IQ Test. Answers to the Rebalancing Your Nest Egg IQ Test. Tesla & Nio Will Report Spectacular Earnings. The Coinbase IPO. Restore Our Earth on April 22nd (and Every Earth Day). Should You Sell in May and Go Away? Adding Shoot the Moon Performance to Your Nest Egg. Videoconferencing in a Post-Pandemic World (featuring Zoom & Teladoc). Sanctuary Sandwich Home. Multigenerational Housing. Interview with Lawrence Yun, the chief economist of the National Association of Realtors. 10 Budget Leaks That Cost $10,000 or More Each Year. The Stimulus Check. Party Like It's 1999. Kushner's Times Square Building Plunges 80% in Value. Will There be a Spring Rally? Cannabis and the Road to Decriminalization in the U.S. Hot ETFs Return Up to 50% Since October. Investor IQ Test 2021. Investor IQ Test Answers Shoot the Moon Stock Picks 2021 Crystal Ball. Would You Pay $50 for a Cafe Latte? Is Your Tesla Stock Overpriced? Can Medmen Avoid Bankruptcy? Bitcoin is Back, Baby! Real Estate Prices are Going Up. And Down. Movie Theaters are in Trouble Airbnb Should Have a Spectacular IPO Today. Cannabis is Decriminalized. Stocks Triple. Airbnb's IPO. Should Hosts Invest? Gifts Under $5 and Free. Thanksgiving in a Pandemic. The Sustainability Silver Lining. Secretary Mnuchin Halts Bailouts Money Stress Killed My Friend Real Estate and Housing 2021. Challenges & Opportunities Real Estate in a Pandemic. Interview with Mike Fratantoni, the Chief Economist of the Mortgage Bankers Association. Bonds are Illiquid & Negative-Yielding. Annual Rebalancing is a Buy Low, Sell High Plan on Auto-Pilot. 5 Red Flags of a Financial Implosion Will Regeneron Be Approved Before the Election? Tesla Will Have an Outstanding Earnings Report Should You Wait Until After the Election to Fix Your Wealth Plan? The October Surprise Is Your Bank a Junk Bond Do Stocks Fare Better Under Democrats or Republicans? Put Your Money Where Your Heart Is. Crystal Ball for the Remainder of 2020 (Including the Election). Microcap Gaming Company Doubles 2Q 2020 Revenue. Apple & Tesla Stock Splits. Schwab's Chief Fixed Income Strategist on What's Safe. China's Tesla (Nio). 2Q Sales Soar. Why Are You Still Renting? (Errr. There is More Than This to Consider!) MedMen's Turnaround Plan Attracts A-List Board Members. Wealth Myths That Keep You Poor. Prosperity Truths That Make You Rich. Protecting Your Wealth and Home in a Recession. Technology and Silver are Golden. The Economy Contracts 32.9% in the 2nd Quarter of 2020. Real Estate: Feeling Equity Rich? Make Sure That Feeling Isn't Fleeting. Airline Revenue Plunges 86%. 10 Questions for College Success Bank Earnings Season. Crimes. Cronyism. Speculation. Real Estate Solutions for a Post-Pandemic World. Copper and Chile Update. Gold Soars. Some Gold Funds Tank. Will the Facebook Ad Boycott De-FANG Stocks? Why Did My Cannabis Stock Go Down? Which Countries Are Hot in a Global Pandemic? Is Your Financial Advisor Good at Navigating Stormy Seas? $10 Avocados, Lies, Damn Lies, Statistics & Wall Street Secrets. It's Never a Crash. Work From Home and Intergenerational Housing. Biotech Races for a Coronavirus Cure. Are You Worried About Money? May is a Good Time for Rebalancing. Is FDIC-Insured Cash at Risk of a Bank Bail-in Plan? Why Did my Bonds Lose Money? Cannabis Update. Recession Proof Your Life. Free Videocon Monday, May 10, 2020. The Recession will be Announced on July 30, 2020. Apple Reports Terrible Earnings. We Are in a Recession. Unemployment, Rising Stocks. What's Going On? 8 Money Myths, Money Pits, Scams and Conspiracy Theories. 21st Century Solutions for Protecting Your Home, Nest Egg & Job. Wall Street Insiders are Selling Like There is No Tomorrow. Why Are My Bonds Losing Money? Tomorrow is Going to be Another Tough Day. Price Matters. Stock Prices are Still Too High. Should You Ride Things Out? 7 Recession Indicators Corona Virus Update. The Bank Bail-in Plan on Your Dime. NASDAQ is Up 6X. CoronaVirus: Which Companies and Countries Will be Most Impacted. Is Tesla Worth GM and Ford Combined. Artificial Intelligence is on Fire. Is it Time to Buy S'More? Take the Retirement Challenge. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable. However, NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors.  About Natalie Pace Natalie Wynne Pace is an Advocate for Sustainability, Financial Literacy & Women's Empowerment. She has been ranked as a No. 1 stock picker, above over 835 A-list pundits, by an independent tracking agency (TipsTraders). The ABCs of Money remained at or near the #1 Investing Basics e-book on Amazon for over 3 years (in its vertical), with over 120,000 downloads and a mean 5-star ranking. The 4th edition of The ABCs of Money was released on October 17, 2020. Natalie Pace's easy as a pie chart nest egg strategies earned gains in the last two recessions and have outperformed the bull markets in between. That is why her Investor Educational Retreats, books and private coaching are enthusiastically recommended by Nobel Prize winning economist Gary S. Becker, TD AMERITRADE chairman Joe Moglia, Kay Koplovitz and many Main Street investors who have transformed their lives using her Thrive Budget and investing strategies. Click to view a video testimonial from Nilo Bolden. 21/7/2021 05:11:32 am

Thanks for sharing your comments. You can learn even more in my books, at our retreats & in our ongoing blog. Comments are closed.

|

AuthorNatalie Pace is the co-creator of the Earth Gratitude Project and the author of The Power of 8 Billion: It's Up to Us, The ABCs of Money, The ABCs of Money for College, The Gratitude Game and Put Your Money Where Your Heart Is. She is a repeat guest & speaker on national news shows and stages. She has been ranked the No. 1 stock picker, above over 830 A-list pundits, by an independent tracking agency, and has been saving homes and nest eggs since 1999. Archives

July 2024

Categories |

RSS Feed

RSS Feed