|

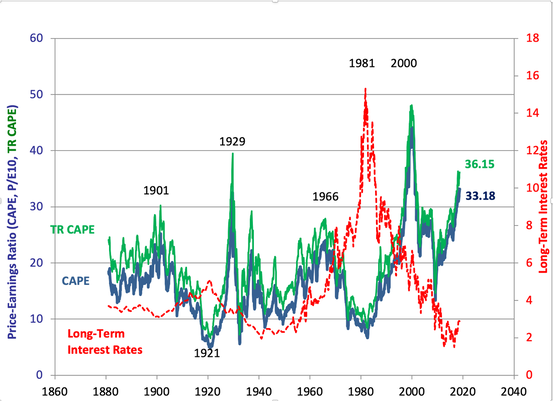

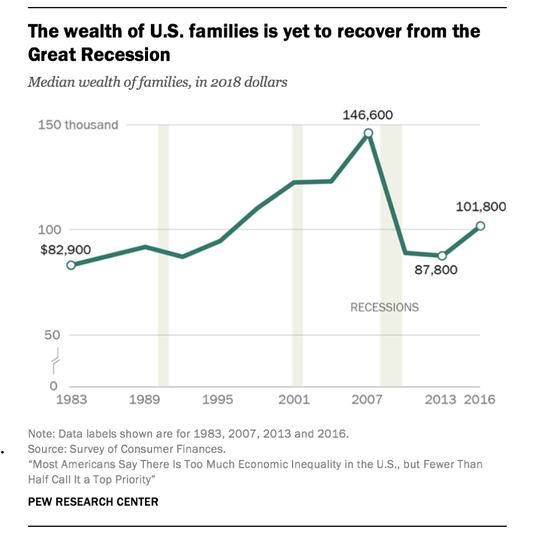

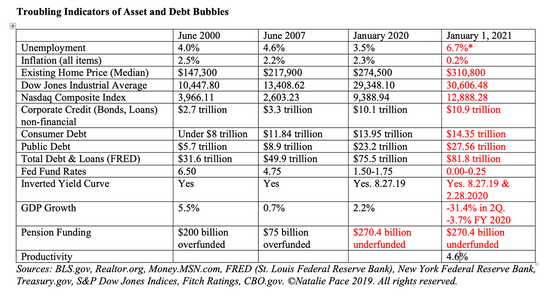

Would you pay $50 for a grande latte? How about paying $115 for a burrito at Chipotle? When we look at price this way, in a quotidien context, it’s easy to see when prices are outlandish. This is exactly what is happening today on Wall Street. Starbucks is trading at a price-earnings ratio of 135. Chipotle’s PE is 164. Tesla’s price-earnings ratio is 1377! The average PE is 16-17. Average PE As you can see in the chart below, which is provided by Nobel Prize winning economist Robert Shiller, there are only two times in history when price-earnings ratios were higher than they are today – in 2000 and in 1929. History books are full of pages on the Great Depression. However, are you aware that the NASDAQ Composite Index lost 78% from the March 2000 highs to the October 2002 lows (the last time PEs were this high)? NASDAQ took 15 years to crawl back to even. Stocks didn’t fare well in the Great Recession either. The Dow Jones Industrial Average slid 55%. The Dow Jones Industrial Average Oct. 2007-April 2009 Businesses are Borrowing from Peter to Pay Paul Outside of essential businesses and technology, there are many industries that have suffered during the pandemic. Sales are down 8% at Starbucks. Airline revenue is off by 80% or more. Casinos are ghost towns, with revenue losses of 80-90% year over year. Even before the pandemic, over half of the S&P500 had allowed their credit score to fall to the lowest rung of investment grade, or even into junk bond status (where Ford, many airlines, casinos and hotels, and even Netflix, Advanced Micro Devices and Yum! Brands are currently). That includes many banks and financial services corporations. According to the Federal Reserve’s Financial Stability Report from November of 2020, “Leverage at life insurance companies are at post-2008 highs and remain elevated at hedge funds relative to the past five years.” Additionally, “Prime [Money Market Funds] and fixed-income mutual funds remain vulnerable to funding strains and sudden redemptions, as demonstrated during the acute period of extreme market volatility and deteriorating asset prices earlier this year,” according to the report. Electric vehicles are on fire. Tesla’s sales growth was 40% in the most recent quarter. However, car sales typically don’t do well when people are out of work. GM and Chrysler declared bankruptcy in early 2009, during the Great Recession. Should Tesla, a company that lost almost a billion dollars last year and has annual sales of about $28.2 billion, be worth $669 billion – particularly in a pandemic? Toyota was the Tesla of the Great Recession, with its game-changing Prius hybrid. Toyota’s share price fell by 52% in the Great Recession. If You Wait for the Headlines, You’re Late 21st century investors are actually worth less today than there were in 1999, according to research provided by the Pew Research Center. So, while it’s tempting to buy stocks when you hear the markets going up every day, it’s also important to know when you are overpaying. The age-old investing aphorism is: Buy low, sell high. Today, people are buying high, hoping to sell higher, or are using a Buy & Hope strategy. That’s a very risky game for more than a few reasons. As you can see in the chart above, if you lost more than half in each of the last two recessions, and then were forced to hope and pray to recover from your losses in the bull markets, you are now worth less than you were two decades ago. In addition, when you lose more than half of your wealth, your credit score implodes. Financial hardship can destroy your health and is hell on your relationships. 21st century recessions have forced many North Americans to forego retirement, take on a 2nd job or move in with family. Intergenerational housing is higher today than it was in the Great Depression. Debtors get eviscerated by vicious debt collectors who want a pound of flesh. With consumer debt at an all-time high, learning from the past two downturns could be key to your fiscal, emotional and physical health. Another major problem with Buy & Hope, the Wall Street rollercoaster and buying high is that when the headlines hit and Main Street investors become aware of what is going on, the gap down has already occurred. Most people don’t even think about selling until the majority of the losses have already happened. The insider money always moves first. Congressional representatives sold stock after the January 2020 White House COVID-19 update – two months before the first stay-at-home order. Wall Street executives retired in droves. Stocks hit an all-time high on February 19, 2020. However, in an abrupt, effective-immediately, manner, Bob Iger, the CEO of Disney, gave the top job to Bob Chapek on February 25, 2020. On March 13, 2020, Bill Gates resigned from the Microsoft board. On March 16, 2020, Marilyn Hewson, the CEO of Hewlett Packard, stepped down. All of this happened before California issued the U.S.’s first stay-at-home order, on March 19, 2020. The crash from the February 19, 2020 highs to the March 23, 2020 lows was the fastest in history, with a drop of 35%. Yes, stock prices have recovered, but the economy itself still has many trouble areas, including the persistence of the pandemic. The 21st Century is Very Different from Last Century’s Economy On August 27, 2020, Federal Reserve Board Chairman Jerome Powell gave a revealing speech in Jackson Hole, Montana. He said: Before the Great Moderation, expansions typically ended in overheating and rising inflation. Since then, prior to the current pandemic-induced downturn, a series of historically long expansions had been more likely to end with episodes of financial instability, prompting essential efforts to substantially increase the strength and resilience of the financial system. We are currently in an episode of financial instability, which the Feds are trying to get us through by printing dollars and buying up everything in sight. That has resulted in an explosion of debt that was already unsustainable. The majority of this will have to be paid back. Some will be restructured. Economic Storms are Still on the Horizon We’re still in a pandemic, though thankfully there might be an end in sight thanks to the vaccine. Once the pandemic is over, things won’t return to normal immediately. There have been some structural changes in how we live and work. Borrowed money will have to be paid back. There are a lot of people out of work. Housing remains unaffordable in 65% of the U.S. And those $50 Latte and $115 burrito stock prices are very frothy. 21st century history tells us that when asset bubbles pop, the downturn is devastating. In the November 2020 Financial Stability Report, the Feds warned, “Asset prices remain vulnerable to significant declines, given a high degree of uncertainty around the course of the pandemic and the pace of the recovery.” Fix the Roof While the Sun is Still Shining While it’s tempting to party on Wall Street while everyone else is self-isolating from the virus, a better strategy is to have a sober plan that protects your wealth, is properly diversified, leans into the industries of tomorrow, underweights overleveraged, last-century dinosaurs and rebalances annually to keep things properly allocated. That time-proven, 21st century strategy is easy-as-a-pie chart. You can read about it in my books, learn them firsthand at my Jan. 16-18, 2021 Retreat or ring our office for an unbiased 2nd opinion and action plan. Call 310-430-2397 or email [email protected] to learn more. Buying high, Buy & Hope, or trying to jump out now and back in later (market timing) are all money-losing tricks that only novices attempt. Seasoned investors adopt a time-proven, 21st century strategy and then stick to their knitting. Wisdom is the cure and the time is now. Are you interested in learning an easy-as-a-pie-chart nest egg strategy that earned gains in the past two recessions and has outperformed the bull markets in between? Call 310-430-2397 or email [email protected] to register for our Jan. 16-18, 2021 Online Investor Educational Retreat.  Natalie Pace New Year, New You Wealth Empowerment Retreat. Jan. 16-18, 2021. Call 310-430-2397 or email [email protected] to learn more. Other Blogs of Interest Can Medmen Avoid Bankruptcy? Bitcoin is Back, Baby! Real Estate Prices are Going Up. And Down. Movie Theaters are in Trouble Airbnb Should Have a Spectacular IPO Today. Cannabis is Decriminalized. Stocks Triple. Airbnb's IPO. Should Hosts Invest? Gifts Under $5 and Free. Thanksgiving in a Pandemic. The Sustainability Silver Lining. Secretary Mnuchin Halts Bailouts Money Stress Killed My Friend Real Estate and Housing 2021. Challenges & Opportunities Real Estate in a Pandemic. Interview with Mike Fratantoni, the Chief Economist of the Mortgage Bankers Association. Bonds are Illiquid & Negative-Yielding. Annual Rebalancing is a Buy Low, Sell High Plan on Auto-Pilot. 5 Red Flags of a Financial Implosion Will Regeneron Be Approved Before the Election? Tesla Will Have an Outstanding Earnings Report Should You Wait Until After the Election to Fix Your Wealth Plan? The October Surprise Is Your Bank a Junk Bond Do Stocks Fare Better Under Democrats or Republicans? Put Your Money Where Your Heart Is. Crystal Ball for the Remainder of 2020 (Including the Election). Microcap Gaming Company Doubles 2Q 2020 Revenue. Apple & Tesla Stock Splits. Schwab's Chief Fixed Income Strategist on What's Safe. China's Tesla (Nio). 2Q Sales Soar. Why Are You Still Renting? (Errr. There is More Than This to Consider!) MedMen's Turnaround Plan Attracts A-List Board Members. Wealth Myths That Keep You Poor. Prosperity Truths That Make You Rich. Protecting Your Wealth and Home in a Recession. Technology and Silver are Golden. The Economy Contracts 32.9% in the 2nd Quarter of 2020. Real Estate: Feeling Equity Rich? Make Sure That Feeling Isn't Fleeting. Airline Revenue Plunges 86%. 10 Questions for College Success Bank Earnings Season. Crimes. Cronyism. Speculation. Real Estate Solutions for a Post-Pandemic World. Copper and Chile Update. Gold Soars. Some Gold Funds Tank. Will the Facebook Ad Boycott De-FANG Stocks? Why Did My Cannabis Stock Go Down? Which Countries Are Hot in a Global Pandemic? Is Your Financial Advisor Good at Navigating Stormy Seas? $10 Avocados, Lies, Damn Lies, Statistics & Wall Street Secrets. It's Never a Crash. Work From Home and Intergenerational Housing. Biotech Races for a Coronavirus Cure. Are You Worried About Money? May is a Good Time for Rebalancing. Is FDIC-Insured Cash at Risk of a Bank Bail-in Plan? Why Did my Bonds Lose Money? Cannabis Update. Recession Proof Your Life. Free Videocon Monday, May 10, 2020. The Recession will be Announced on July 30, 2020. Apple Reports Terrible Earnings. We Are in a Recession. Unemployment, Rising Stocks. What's Going On? 8 Money Myths, Money Pits, Scams and Conspiracy Theories. 21st Century Solutions for Protecting Your Home, Nest Egg & Job. Wall Street Insiders are Selling Like There is No Tomorrow. Why Are My Bonds Losing Money? Tomorrow is Going to be Another Tough Day. Price Matters. Stock Prices are Still Too High. Should You Ride Things Out? 7 Recession Indicators Corona Virus Update. The Bank Bail-in Plan on Your Dime. NASDAQ is Up 6X. CoronaVirus: Which Companies and Countries Will be Most Impacted. Is Tesla Worth GM and Ford Combined. Artificial Intelligence is on Fire. Is it Time to Buy S'More? Take the Retirement Challenge. 2020 Investor IQ Test. Answers to the 2020 Investor IQ Test. The Cannabis Capital Crunch and Stock Meltdown. Does Your Commute Pollute More Than Planes? Are Health Care Costs Killing Your Budget? 2020 Crystal Ball. The Benefits of Living Green. Featuring H.R.H. The Prince of Wales' Twin Eco Communities. What Love, Time and Charity Have to do with our Commonwealth. Interview with MacArthur Genius Award Winner Kevin Murphy. Unicorns Yesterday. Fairy Tales Today. IPO Losses Top $100 Billion. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable. However, NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors.  About Natalie Pace Natalie Wynne Pace is an Advocate for Sustainability, Financial Literacy & Women's Empowerment. She has been ranked as a No. 1 stock picker, above over 835 A-list pundits, by an independent tracking agency (TipsTraders). The ABCs of Money remained at or near the #1 Investing Basics e-book on Amazon for over 3 years (in its vertical), with over 120,000 downloads and a mean 5-star ranking. The 4th edition of The ABCs of Money was released on October 17, 2020. Natalie Pace's easy as a pie chart nest egg strategies earned gains in the last two recessions and have outperformed the bull markets in between. That is why her Investor Educational Retreats, books and private coaching are enthusiastically recommended by Nobel Prize winning economist Gary S. Becker, TD AMERITRADE chairman Joe Moglia, Kay Koplovitz and many Main Street investors who have transformed their lives using her Thrive Budget and investing strategies. Click to view a video testimonial from Nilo Bolden. Comments are closed.

|

AuthorNatalie Pace is the co-creator of the Earth Gratitude Project and the author of The Power of 8 Billion: It's Up to Us, The ABCs of Money, The ABCs of Money for College, The Gratitude Game and Put Your Money Where Your Heart Is. She is a repeat guest & speaker on national news shows and stages. She has been ranked the No. 1 stock picker, above over 830 A-list pundits, by an independent tracking agency, and has been saving homes and nest eggs since 1999. Archives

July 2024

Categories |

RSS Feed

RSS Feed