|

In my conversation last month with Rob McEwen, he was full of optimism for gold going forward, predicting (again) that the price of gold will ultimately soar to $5,000/ounce. According to McEwen, “When we start seeing interest rates moving up, it’s going to become more difficult for governments, corporations and individuals to deal with the rising interest rate. That’s when you have a period where people will start to look for gold.” Click to access my full interview with McEwen Mining’s Chief Owner Rob McEwen on BlogTalkRadio.com/NataliePace. There are likely to be a few potholes on that yellow brick road, however. In the April 16, 2018 first quarter production report, McEwen Mining indicated that gold and silver production is down 27% from the fourth quarter 2017. Part of this is explained by regularly scheduled maintenance at the San Jose Mine in Argentina. However, last year the drop in production between the 4th quarter and 1st quarter was only 6%. This portends bad news in the 1st quarter 2018 earnings results which should be released sometime in early May. Going forward, the new Black Fox mine will contribute to production, and there will be a new McEwen mine opening in Nevada. However, production in Mexico will continue to decline. McEwen Mining's SVP of Exploration Sylvain Guerard believes that “Black Fox remains under explored and there is room for additional discoveries.” At Gold Bar in Nevada, the company continues to develop new exploration targets. Rob McEwen reminded everyone on the earnings call of Feb. 26, 2018 that 2017-2019 will be years of building, toward the ultimate goal of McEwen Mining qualifying for inclusion on the S&P500. This requires wisdom, vision and M&A on the part of executives and patience from investors. As of April 16, 2018, McEwen had $52 million in cash, cash equivalents and precious metals, with no debt. The company needs about $67-$68 million in 2018 for the new Gold Bar Mine in Nevada, according to McEwen Mining CFO Andrew Elinesky. That means there will be a capital raise in 2018, which could be equity or debt, or a combination. That means that current investors, including Rob McEwen who owns 24% of McEwen Mining, are very likely to be diluted. There is also talk of the current dividend being suspended. There are few executives with the track record of Rob McEwen. Rob is the current Chief Owner of McEwen Mining and the former chairman and CEO of Goldcorp, a company he took from $500 million to over $8.5 billion in value, with a 31% annual compound growth rate during his tenure (yes, that beats Buffett). In his 20+ years in the industry, Rob has become a respected thought leader. He was appointed to the Order of Canada and is on the board of trustees for the X Prize. He’s an executive well worth banking on. My long-term prognosis for gold and McEwen Mining remains optimistic. However, the recent dive in production at McEwen, and the expected dismal 1st quarter 2018 earnings report, combined with a capital raise, could be more than investors can stomach. The last few years have been rough on gold bugs. That might continue in the short-term, particularly for McEwen Mining investors. McEwen is trading near its 52-week low. However, in 2015, the price did dive below a dollar a share. There is no authorized share repurchase plan at this time to help keep the share price buoyant. I would expect volatility in the McEwen Mining share price as the news of the production report and the first quarter reports hit the mainstream media. Natalie Wynne Pace is the co-creator of the Earth Gratitude project and the author of the Amazon bestsellers The Gratitude Game, The ABCs of Money and Put Your Money Where Your Heart Is (aka You Vs. Wall Street). She has been ranked as a No. 1 stock picker, above over 835 A-list pundits, by an independent tracking agency (TipsTraders). The ABCs of Money remained at or near the #1 Investing Basics e-book on Amazon for over 3 years (in its vertical). Call 310-430-2397 to learn more about how to receive a second opinion on your current budgeting and investing plan, and to attend our next Investor Empowerment Retreat. Important Disclaimers

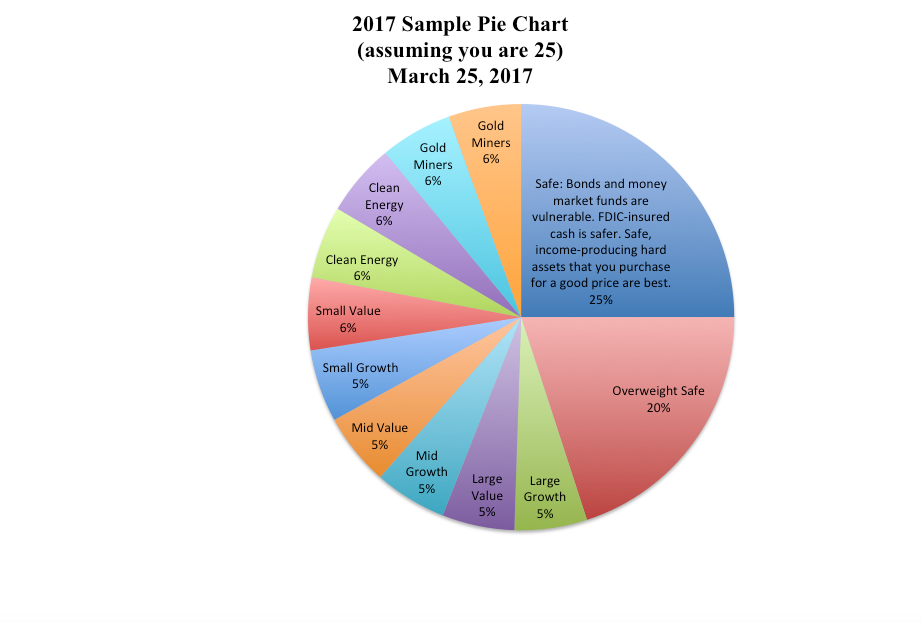

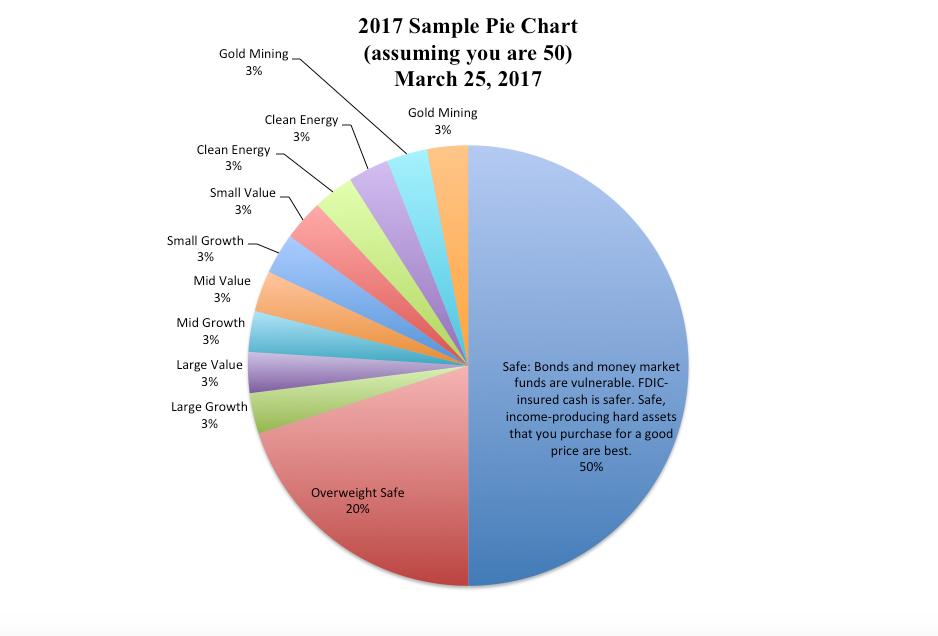

Please note: NataliePace.com does not act or operate like a broker. We report on financial news, and are one of the most trusted independently owned and operated financial news corporations in North America. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable however NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors. Dear Natalie: Are there any basic rules of investing? I just don’t know which boxes to check in my 401(k)? Signed Clueless Dear Smart Enough to Ask (Instead of Remaining Clueless): There are tried and true rules of investing, and a few things that used to work, which no longer work. You should always keep a percent equal to your age safe because as you get older you can’t afford the risk of the stock market. Then diversify your “at risk“ portion into small, medium, large, value and growth. I like to add in hot funds, as well, for improved performance. So, for instance, if you think that gold is hot, then have a slice of gold. If you think technology, China, Chile, Australia or another country or industry is hot, then have a slice of that, too. You really only need 10 funds to be diversified, and ten is easy to work with as a mathematical number. If you have pages and pages of stocks and bonds in your financial plan, then you have more risk and expenses than you realize, and you likely are not as diversified as you should be – despite all of the pages of investments. Every year you get a year older, and your investments will have some gains or some losses. So every year it is a good idea to print out what you have in your 401(k), and mock up what you should have, based on keeping a percent equal to your age safe and diversifying into 10 funds. Then you simply make what you do have look like what what you should have. The cool thing about annually rebalancing your 401(k) and investments is that it is a plan that allows you to buy low and sell high on auto-pilot. When a slice is much bigger than it should be, then you sell a little (selling high) and get more into your safe side. When a slice is thinner than it should be, then you might buy a little more at a lower price (buying low), or you might replace it with another fund that might perform better. Here are sample nest egg pie charts. At my investor educational retreats, I teach you a few more very important tricks of the trade to fine-tune your investments. What’s hot and what’s safe changes every year. It’s important to learn what’s safe in a world where there is far too much debt floating around, since, for anyone over 50, the safe side of our investments is the largest piece of the pie. This year, it is more difficult than ever to get safe, because bonds are in a bubble, money market funds have redemption gates and liquidity fees and many bank products, such as high-yield CDs and index based annuities or term life policies, are not as safe as you think. You could be vulnerable to losing money when the stock market goes down. Safe investments are supposed to protect you from stock market losses. Below is a good check list. 8 Basic Rules of Investing

If you don’t know how to do each of these 8 things, or if you’d like to dive deeper into what’s safe and what’s hot, then learning the ABC’s of Money that we all should’ve received in high school is your best investment. As Benjamin Franklin says, “If you think education is expensive, try ignorance.” The cost of ignorance in the Great Recession was that most Americans lost more than half of their retirement. Can you really afford to lose half again? About Natalie Pace Natalie Wynne Pace is the co-creator of the Earth Gratitude project and the author of the Amazon bestsellers The Gratitude Game, The ABCs of Money and Put Your Money Where Your Heart Is (aka You Vs. Wall Street). She has been ranked as a No. 1 stock picker, above over 835 A-list pundits, by an independent tracking agency (TipsTraders). The ABCs of Money remained at or near the #1 Investing Basics e-book on Amazon for over 3 years (in its vertical). Wondering if your plan is vulnerable to losing more than half again? Natalie Pace is also available for an unbiased second opinion on your current budgeting and investing strategy, through her private prosperity coaching. Call 310-430-2397 or email info @ NataliePace.com to learn more about her coaching and pricing, and if you are interested in learning more about our Investor Educational Retreats. Important Disclaimers

Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable however NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors. Are you excited about stocks? Do you have a plan to stay on top, even if the market continues to head south? Have you been burned a few times? Are you a little worried about staying in, when the headlines scream of record 1,175 Dow point drops in one day? As with all things, the more you know, the more success you’ll enjoy. Working smarter will always produce better results that just working harder. You wouldn’t expect yourself to write an essay if you didn’t know your ABCs, or to balance your checkbook if you had never learned how to add. So, learn Wall Street secrets to improve your Money While You Sleep gains. Wall Street Secrets They Don’t Want You To Know

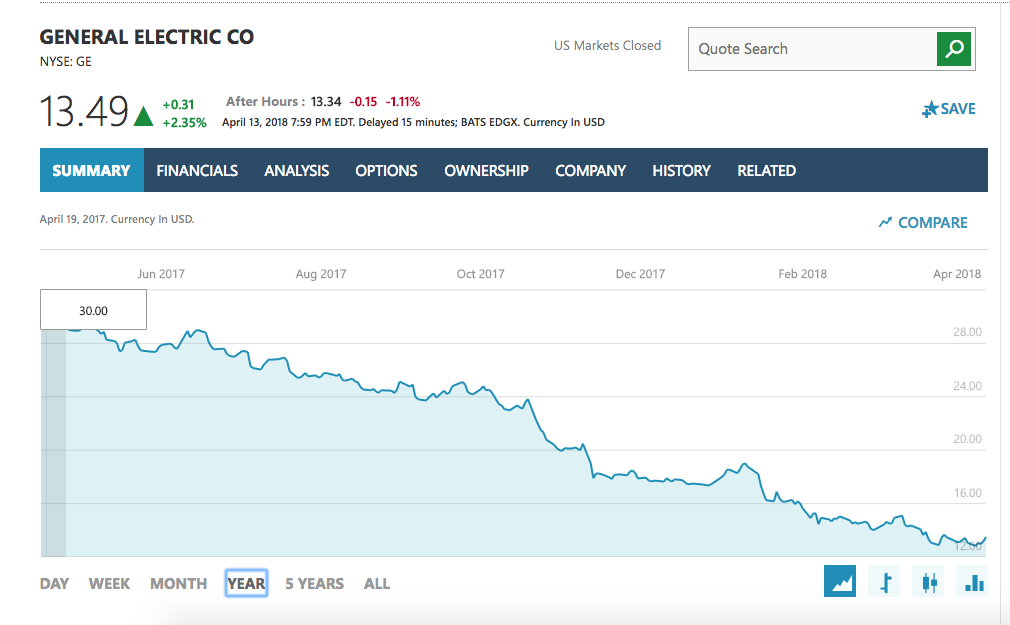

And here are the details… 1. The Dow Theory The Dow Theory has six considerations that indicate when a primary market trend change is on the horizon. 5 out of 6 of the points are indicating the beginning of a bear market. 2. The Biggest Fool Theory Many people wait for the institutional moves or analyst recommendations to make changes to their financial plan. The reasons that this strategy doesn’t work are many, including basic supply and demand principles. One of the little known Wall Street secrets, however, is The Biggest Fool Theory. Bankers, insiders, hedge fund managers and institutional investors all end up operating on the Biggest Fool theory, where everyone continues enjoying the bubble, even when there are clear indications it’s a bubble, for the profits – thinking that they’ll be the first out, and the Biggest Fool will be caught holding all of the losses. Everyone is a Big Fool for buying into a bubble. However, only the Biggest Fool doesn’t get out in time. The sad reality is that this stupid psychological greed fest lies at the heart of the bank meltdown in the Great Recession, when insiders knew that real estate was in a bubble, but the profits were so high that staying out could cost you your job. 3. The $3.2 Trillion Speculative Money Rollercoaster Hedge funds account for $3.2 trillion on Wall Street. This basically means that high frequency trading, stop losses, shorts and other derivative products will hasten the speed of any correction, making it almost impossible for the average Main Street investor to protect herself without having a solid, time-proven plan in place to begin with. Nilo Bolden used a pie chart that I drew on a napkin to earn gains in the Great Recession, when most people lost more than half of their nest egg. I used this plan in 2000, before the Dot Com Recession. In 2001, I almost tripled my money, when most people lost 78% of their NASDAQ stocks. 4. Catch a Falling Knife and Fat Fingers Secretary of the Treasury Henry Paulson first proposed financial reform (a bank bailout) to Congress on March 31, 2008. However, it wasn’t until the Lehman Bros. bankruptcy on September 15, 2008 that it became clear to the average American that the banks were failing. By Friday, Oct. 3, 2008, when President George W. Bush signed the TARP bailout, the stock market had already dropped almost 40%. The May 6, 2010 Fat Finger Flash Crash caused a trillion dollars in losses on Wall Street in just 36 minutes. This was largely caused by hedge funds using high frequency trading and order privileges to spoof the market into a downward spiral, which was designed to stop right above 10%, the point at which a market stop would kick in. Spoofing, layering and front-running were banned in 2015. However, industry experts believe that traders can still work in the shadows, despite improved monitoring, because regulators are “on bicycles, trying to catch Ferraris.” (John Bates, Traders Magazine, April 2015). The conversations that go on between bankers and regulators behind closed doors are quite different than the sound bytes (cover ups) that are spouted on TV. If you wait for the headlines that we’re in trouble, it’s too late to protect yourself. Far too many people, even very smart and educated people, sell low and buy high when listening to headlines because headlines create stomach acid and euphoria. Never let hormones run your investment strategy. 5. Think Capture Gains, Not Stop Losses Stop losses work great for brokerages, who rely upon fees for their revenue and income. However, with the seesaw volatility of stocks in the New Millennium, if you just changed your strategy to a “capture gains” strategy, you’d be profiting, instead of losing time and again. My easy-as-a-pie-chart nest egg strategies, with a few of my trademarked tricks, allow you to buy low and sell high with a simple annual rebalancing plan. In other words, a solid, time-proven plan that earns gains in recessions and outperforms the bull markets in between is less time and money than what you are currently spending. 6. Do What Warren Buffett Does, Not What He Says When the stock market weakens, you’ll find CNBC and other financial networks trotting out video of Warren Buffett saying that investors should just ignore their portfolios so they don’t screw them up. That is not what he does, however. In fact, Warren Buffett is often the first one out before bad news. In June of 2017 (or slightly before), Berkshire Hathaway sold 10.6 million shares of General Electric stock, worth $315 million. GE cut its dividend by half on November 13, 2017. Today, the company’s stock is worth less than half of what it was when Warren Buffett sold, at about $143 million. 7. Buy and Hold Doesn’t Work

Broker/salesmen who tout buy and hold are part of an old school system that is no longer relevant. Buy and Hold is a disastrous plan in today’s stagnant economy, which sees market losses of more than 50% every 8 years. While Buy and Hold investors are on a rollercoaster that costs them half of their nest egg every 8 years, Modern Portfolio Theory investors are able to enjoy profits, protect themselves from downturns, enjoy a solid plan and foundation for their wealth with a plan that costs less time and money than Buy and Hold. (When you lose half, that’s a lot of money, distress and lost sleep, and can force you to keep working, instead of retiring!) Investors like Nilo Bolden earned gains in the last two recessions, and can build upon that foundation in the years to come, instead of losing more than half and then crawling back to even. 8. Low Interest Rates Create Bubbles Low interest rates create bubbles. That is the real reason why the Federal Reserve board is increasing interest rates and tightening up money supply by selling off their Treasury Bills and mortgage-backed securities. In 2000, the bubble was Dot Com stocks. In 2008, the bubble was real estate and bank derivatives. In 2018, the bubbles are stocks and bonds, according to Alan Greenspan, the former chairman of the Federal Reserve Board. Warren Buffett agrees that stocks and bonds are too expensive (a bubble). Nobel Prize winning economists Robert Shiller says that the last two times stocks were this expensive were in 1929 and 2000, before the Great Depression and before the Dot Com Recession. 9. Brokers Are Salesmen, Not Surgeons If your financial plan is longer than a few pages (or conversely, if it is just one fund), then chances are that you are making the broker and brokerage rich, while riding the Wall Street rollercoaster up and down every eight years. Beware of REITs, annuities, dividend stocks, high-yield bonds and other funds that are paying the highest commissions these days. Salesmen tend to gravitate toward the higher commissions for personal gain. Many times their financial incentives are in opposition to their client’s needs. There is an inherent conflict of interest in the way that many (but not all) broker-salesmen are compensated. 10. Options Make the Brokerages Rich, Not the Investors Options trading has become more popular of late, with Main Street being sold into these strategies as a great second job or insurance policy. Your best insurance policy for your nest egg is a time-proven plan. Options rarely work out for Main Street investors, or other investors for that matter. In fact, Dr. Myron Scholes, one of the authors of options trading pricing, had one of the biggest hedge fund bailouts in history with his Long-Term Capital Management. However, due to the frequency of trades with options, and the extra fees charged, many online discount brokerages are making “bank” by selling you into options. 11. Trading on Headlines If you wait for the headlines to act, it is too late to protect yourself. Headlines are the reason why so many investors end up buying high and selling low. If you wait for the headline that the economy is in trouble, the markets are already low, and you end up selling low. If you buy into the headlines that the markets are at all-time highs and doing GREAT! Then you are buying high… This is clearly the opposite of what investors know to do. Buy low; sell high works, but it runs against your stomach acid, euphoria and headlines. If you want to learn and implement investing strategies that earn gains in recessions and smart budgeting choices that save thousands annually, then join me at my next Investor Educational Retreat. It’s a good idea to do this now, before the markets correct any further. You’ve got 3 to choose from, from our most affordable Wild West Retreat April 20-22, 2018, to our Space Coast Beachfront Florida Retreat June 9-11, 2018 and our Manhattan mini-retreat. Call 310-430-2397 to learn more. What are the perils of the 10-page (or more) financial plan?

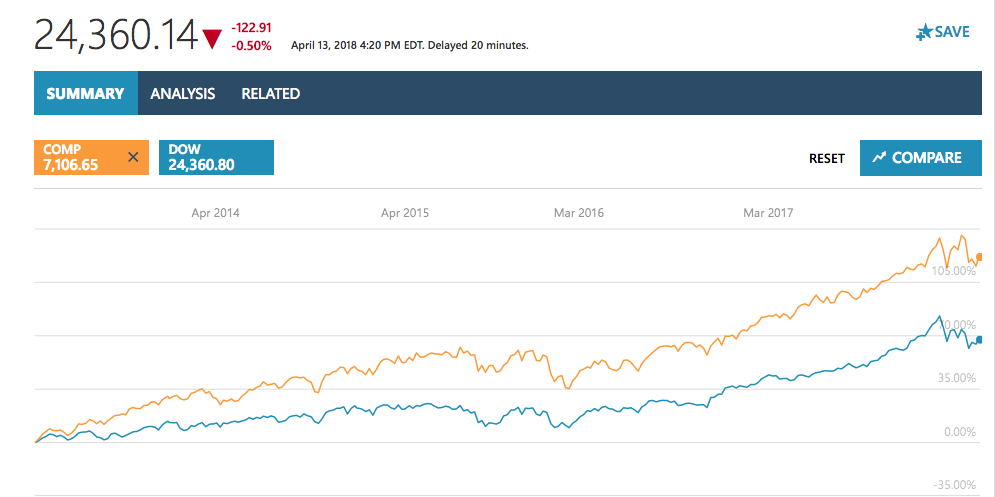

How? (The devil is in the details.)

Performance of The NASDAQ Composite Index During the Dot Com Recession Chart c/o Google Finance. © Google. Used with permission.

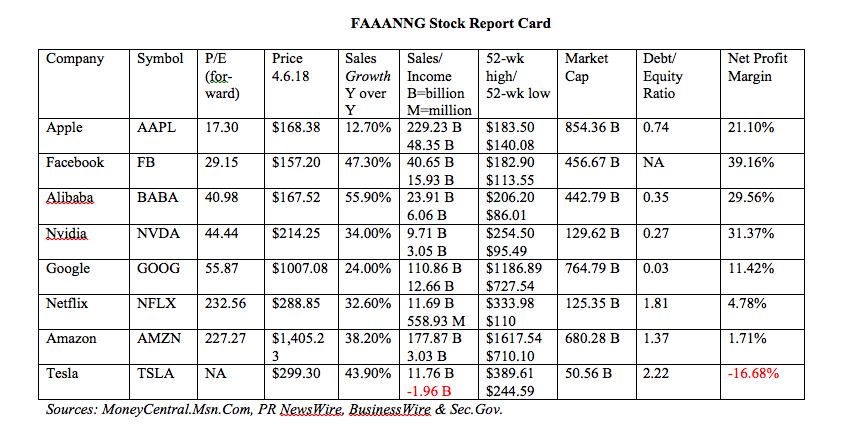

What’s the solution? Why not get an unbiased second opinion on your current budgeting and investing strategy, now while the markets are still high? (Call 310-430-2397 to learn more.) My easy-as-a-pie-chart nest egg strategies earned gains in both of the last two recessions and have outperformed the bull markets in between. "College students need this information before they get their first credit card. Young adults need it before they buy their first home. Empty nesters can use the information to downsize to a sustainable lifestyle, before they get into trouble." Joe Moglia, Chairman, TD AMERITRADE. "Many people, including educated men and women, often get into trouble when they neglect to follow simple and fundamental rules of the type provided [by Natalie]. This is why I recommend them with enthusiasm." Professor Gary S. Becker. Dr. Becker won the 1992 Nobel Prize in economics for his theories on human capital I’m not a broker-salesman. I don’t sell financial products. My goal is to empower Main Street, so that you can be the boss of your money. And I prefer to do this now, so that you can keep what you have before the next stock downturn. If you wait for the headlines that the economy is in trouble, it will be too late to protect yourself. Many times people come to me after they’ve lost half or more, which is better than not getting this information at all. However, clearly, I’d prefer to protect your retirement and teach you easy, smart systems that can earn gains in recessions and outperform the bull markets in between. While we’re at it, I’ll also share wealth strategies of royals and billionaires, so that you can save thousands annually in your budget with smarter choices for your big-ticket budget items. Blind faith in broker-salesmen, whose interests are not always in alignment with yours, has cost many Americans half of their nest egg every eight years. In 2000, Dot Com investors lost 78% of their stocks. In 2008, blue chip investors lost 55% (or more). When you add in the fees and commissions charged (sometimes hidden or opaque on your statements), the losses are even worse. Wisdom is the cure. Call 310-430-2397 or visit NataliePace.com to learn more. Attend the Florida Beachfront Space Coast Retreat to learn and implement the ABCs of Money that we all should have received in high school, while enjoying a fabulous vacation in the warm Atlantic Ocean. Register by April 18, 2018 and you’ll receive the best price and a complimentary private, prosperity coaching session (value $300). With Facebook facing Congressional inquiry and Amazon enduring the Tweet wrath of the White House, will these two kingpins of the amazing FAANNG* spin out and spiral down the NASDAQ Composite Index? NASDAQ has doubled over the last five years – even with the 2.28% pullback on Friday. (By comparison, the Dow Jones Industrial Average is up 61% over the same period.) However, is the party over? *Facebook, Amazon, Apple, Netflix, Nvidia and Google. It’s difficult for Americans to break their addictions. Despite the threatening eye of Washington on Facebook and Amazon, consumers continue to post their pics and order their flicks, books and gifts on these colossal platforms. There’s just no viable alternative. We’re hooked in, and everything is too easy and comfortable to leave. With Facebook, it’s almost like being a battered wife. We know better than to play around with those silly personality profiles, and aware that our information is going to be passed around and exploited, but hope that somehow the company will clean up and act differently (despite little evidence of that). “I have years of photos that don’t exist anywhere else, and many many friends and relatives I would have no other way of staying in touch with on a consistent basis,” one of my Facebook friends said, when asked if she would stay or go elsewhere. That doesn’t mean that NASDAQ investors are going to be back in the money anytime soon. Before these scandals broke, there was already ample evidence that these stocks were overpriced. Facebook is worth $457 billion, on net income of only $6 billion (and a price-to-earnings ratio of 29). Amazon is worth almost $700 billion on net income of $3 billion, and a PE of 227. According to Nobel Prize winning economist and Yale professor Robert Shiller, “The only time in history going back to 1881 when [stock prices have] been higher are, A: 1929 and B: 2000. We are at a high level, and its concerning. People should be cautious now.” FAANNG companies boast impressive revenue growth year over year, ranging from 13% (Apple) to 47% (Facebook). Nvidia and Facebook have almost unbelievable profit margins of 39% and 31%, respectively. However, the shadow truth of all of those sales is that companies are borrowing cheap money for their spending (consumers are borrowing at a high cost on credit cards) – and no one can continue borrowing from Peter to pay Paul forever. With consumer debt, public debt and asset prices higher than ever (yes, higher than before the Great Recession), we may be nearing the end of the free money party. That is certainly what the Federal Reserve is promoting with their current plan of deleveraging and raising interest rates. Facebook is projecting a deceleration in revenue growth in 2018, with a massive increase (up 45-60% over 2017) in total expenses – reversing the trends of 2017. Capital expenditures are projected to be in the range of $14-$15 billion. By comparison, full year cap ex in 2017 was $6.7 billion. Data centers, servers, office space and network infrastructure will all be a focus of the increased spending. The FAANNG companies have a market value of over $3 trillion. They are pretty much here to stay, and will continue to gobble up (acquire) their competition as long as they can. (Facebook owns Instagram, WhatsApp and other platforms.) When you are thinking about revenue growth, Amazon will continue to outperform Wal-Mart and Facebook will continue to dominate Twitter and Snap. However, that doesn’t mean that their share prices can’t weaken, particularly at the lofty PEs we’ve seen of late. Remember that investing should never be about market timing. Almost everyone is too late getting out and back in when they try jumping in and out on headlines -- essentially buying high and selling low when you let headlines and worry dominate your strategy. Diversifying, rebalancing, avoiding the bailouts, adding in hots, knowing what is safe in a world where bonds are in a bubble – this is a time-proven, superior strategy that is easy-as-a-pie-chart. That is why I call it the ABCs of Money that we all should have received in high school. Call 310-430-2397 to learn more. About Natalie Pace:

Natalie Pace is the author of The Gratitude Game and the Amazon bestsellers The ABCs of Money and You Vs. Wall Street (aka Put Your Money Where Your Heart Is in hard cover). Natalie has been saving homes and nest eggs for 14 years, while at the same time earning the ranking of No. 1 stock picker. Natalie Pace is a repeat guest on national television and radio shows such as Good Morning America, Fox News, CNBC, ABC-TV, Forbes.com, NPR and more. As a strong believer in giving back, she has been instrumental in raising tens of millions for public schools, financial literacy, the arts and underserved women and girls worldwide. Follow her on Twitter.com/NataliePace and Facebook.com/TheABCs of Money. For more information please visit NataliePace.com. Click to access a longer bio on Natalie Pace. IMPORTANT DISCLAIMER (PLEASE READ): Please note: NataliePace.com does not act or operate like a broker. We report on financial news, and are one of the most trusted independently owned and operated financial news corporations in the U.S. This article is intended to educate and inform individual investors, and, thus, to give investors a competitive edge in their personal decision-making. The publicly traded companies mentioned in this article are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be using the Hot News on Cool Stocks list or the Cooling Off list to trade their nest eggs. Your retirement plan should reflect a long, safe strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. IMPORTANT DISCLAIMER: Information has been obtained from sources believed to be reliable however NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors. |

AuthorNatalie Pace is the co-creator of the Earth Gratitude Project and the author of The Power of 8 Billion: It's Up to Us, The ABCs of Money, The ABCs of Money for College, The Gratitude Game and Put Your Money Where Your Heart Is. She is a repeat guest & speaker on national news shows and stages. She has been ranked the No. 1 stock picker, above over 830 A-list pundits, by an independent tracking agency, and has been saving homes and nest eggs since 1999. Archives

July 2024

Categories |

RSS Feed

RSS Feed