|

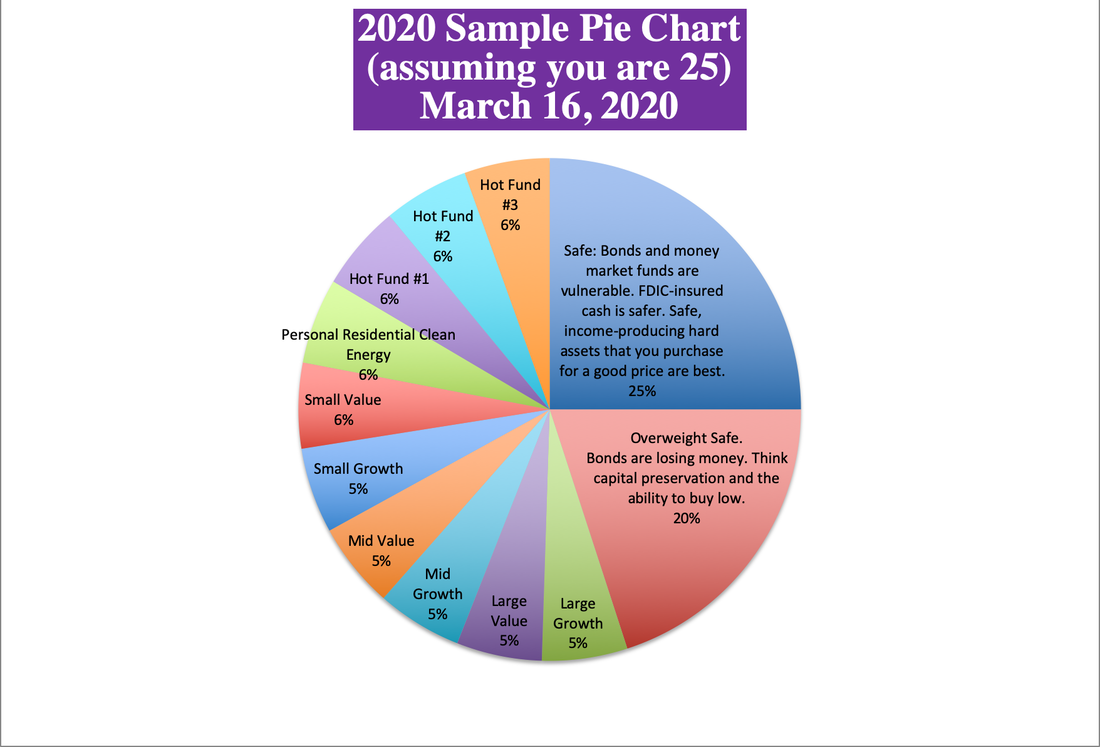

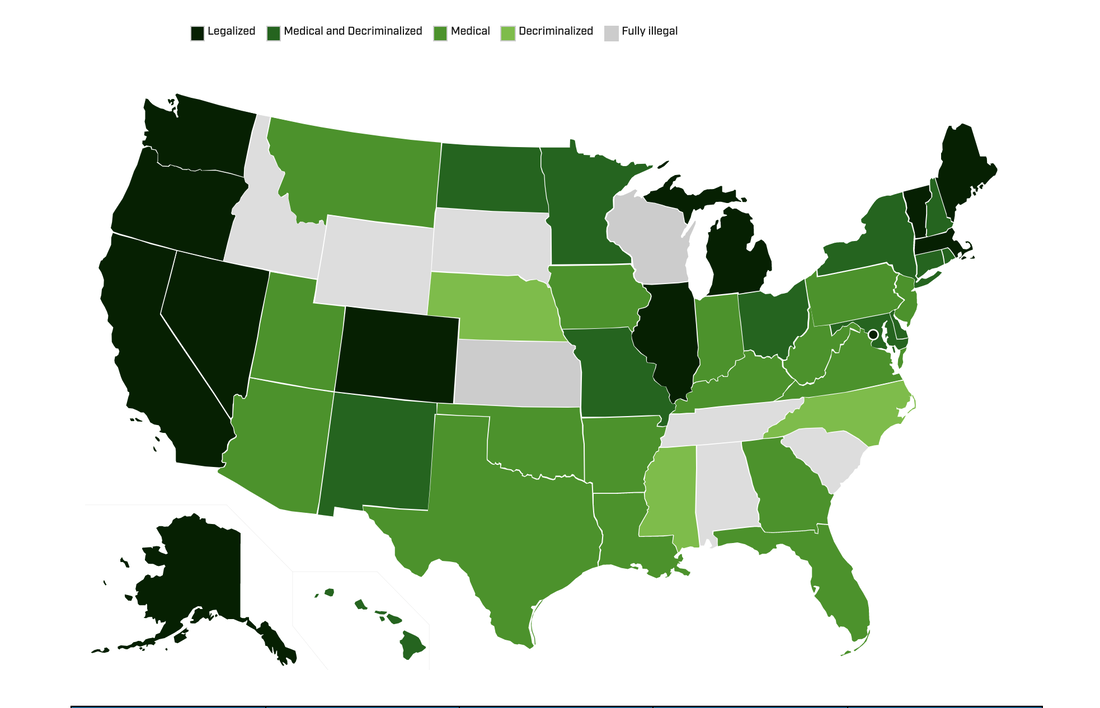

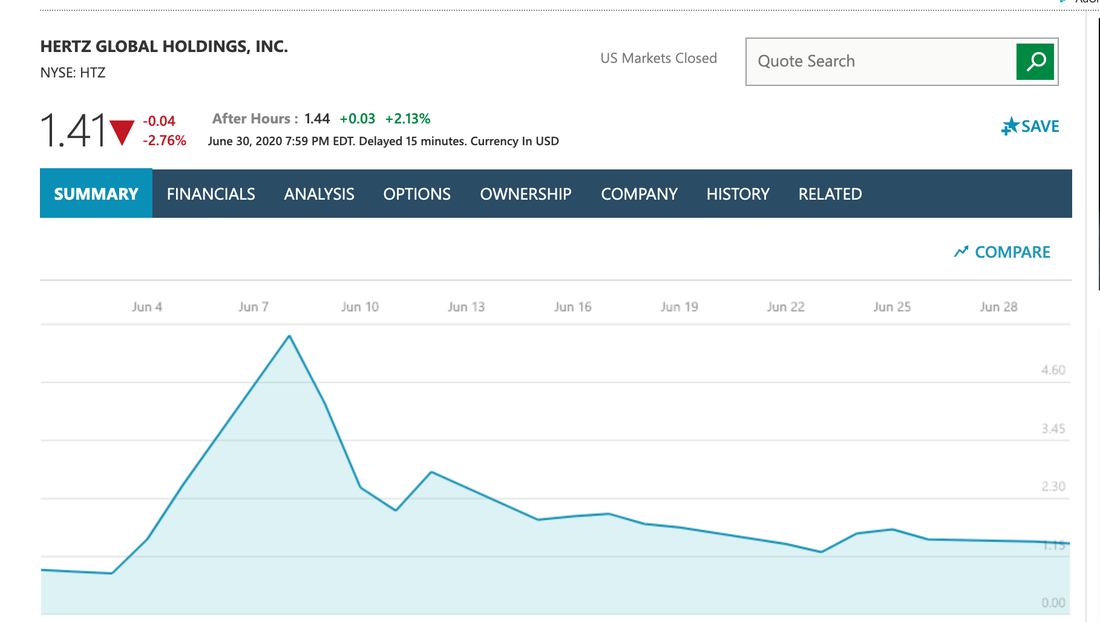

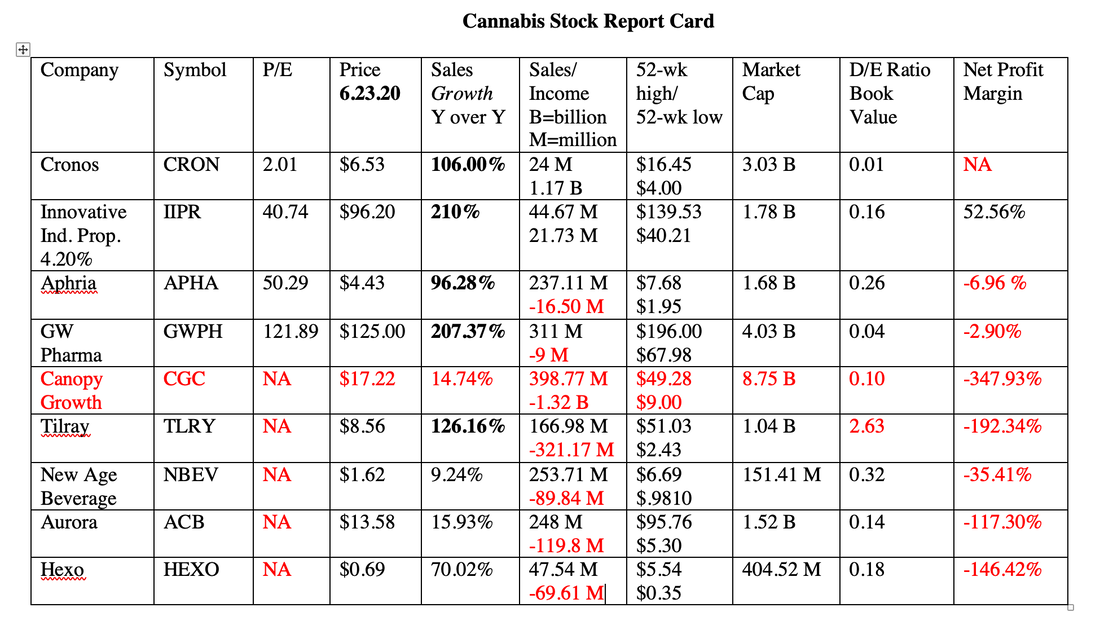

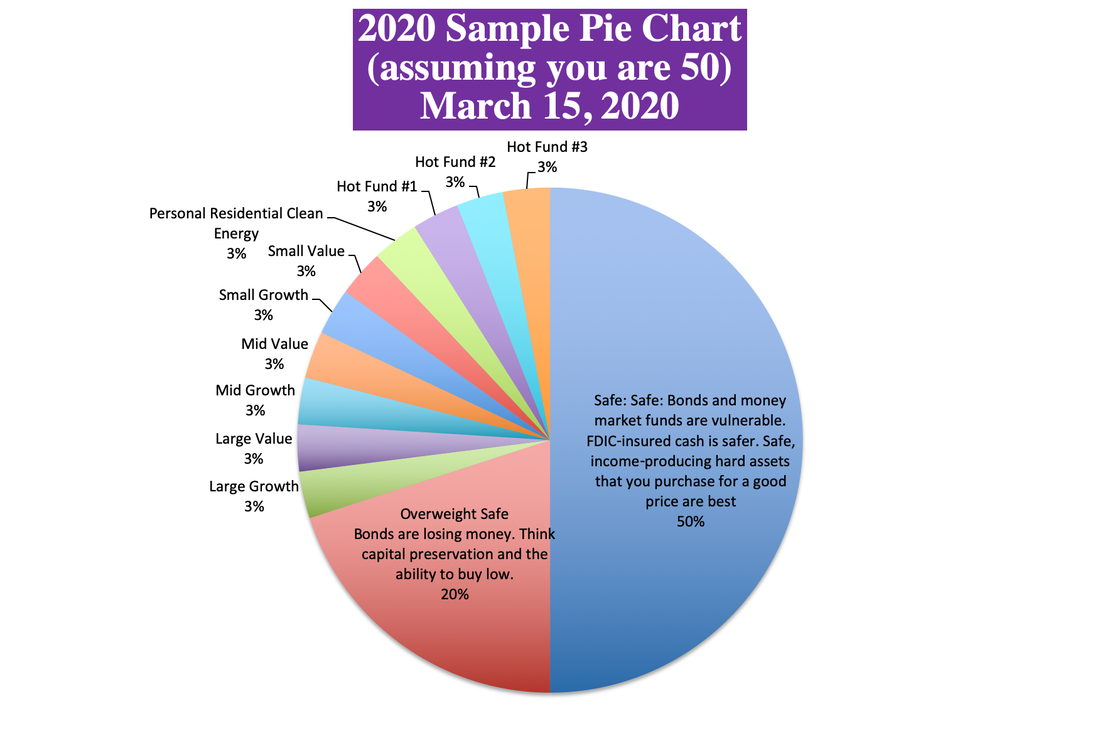

Why Did My Cannabis Stock Go Down? Investors Ask Natalie. The short answer is that cannabis stock went down for the same reason that Hertz stock soared from 40 cents a share to five dollars a share earlier this month, while the company was in bankruptcy. In the short run, things are a popularity contest or just what people do and talk about — herd mentality. In the long run, it always comes back to fundamentals. Some of history’s most cautionary tales are tales of herd mentality – such as what happened to stocks before the Great Depression, to Dot Com stocks before the Dot Com Recession and to stocks and real estate before the Great Recession. This time around, we have to add bonds and money market funds to the madness. The fundamentals on Hertz was that the company was in bankruptcy. So, the time Hertz stock spent at $5/share was limited to just a few hours on June 8th, 2020. Cannabis has been on the chopping block for over a year. If we look at the fundamentals, however, it's clear that customers are still high on the product. Aphria’s revenue in the last quarter was up 98% year-over-year. Tilray’s revenue growth was up 120%. Innovative Properties revenue grew 210%, with GW Pharmaceuticals coming in closely behind at 207% year-over-year growth. Nothing on Wall Street comes close to that kind of year-over-year sales growth. Of all of these companies, Aphria looks to be trading at the most attractive valuation. The company is helmed by the former CEO and founder of Hain Celestial, and boasts having Walter Robb, the former co-CEO of Whole Foods on its board. Tilray is partnered with Anheuser-Busch InBev for developing a CBD beverage. Their 1st product is a CBD tea under the brand Everie. Are You Suffering From Buy High, Sell Low Mentality? During the conversation with this coaching client, I discovered that she had doubled on her cryptocurrency and was up 30% on her large-cap growth and large-cap value stocks. When you are looking at your portfolio during the rebalancing time, you want to make sure that you are looking at everything. If you are focusing solely on the items in the red, then you might be suffering from Buy High, Sell Low mentality. Putting your positions/holdings in to a pie chart takes the emotions out of it, and also prompts you to execute that age-old winning investing strategy of Buy Low, Sell High.  Nest Egg Pie Charts (r) by Natalie Pace. Call 310-430-2397 or email [email protected] for more information. (c) 2020. All rights reserved. It’s easy to be tempted to sell when you think something is losing, and to swoon into the stratosphere when investments are making you money. However, that is a losing strategy when cryptocurrency can drop from $20,000 to $5,000/coin in a matter of months, and stocks can sink by 35% in just a few weeks. On the other hand, we’ve also seen Veritone rally from $2/share to $19/share in less than a month. And the 52-week swing in Tesla’s share price, which is currently at an all-time high, ranges from $200 to $1000/share. Even Elon Musk has tweeted that the share price is too high. Annual Rebalancing with the Nest Egg Pie Chart System is a Buy Low, Sell High Plan on Auto-Pilot When you are rebalancing, put all of your cannabis holdings into the same “slice.” Cryptocurrency would be another slice, even if you have several different types of coins. Separate your funds and other holdings by their size/style. (See the chart above for a sample.) After you know what you own, mock up a pie chart of what you should own. You can personalize your own pie chart using our free web apps. Once you have your sample and your current pies side-by-side, you simply make what you have look like what you should have. A slim slice, like your cannabis, would prompt you to buy more low. Of course, you want to be sure that you are picking the best companies, since there isn’t a well-established cannabis or CBD fund to purchase (and you have to create your own mini-fund). It’s never fun to buy low. However, if you’re right and you do, then you’ll be rewarded well for that bravery. If your cryptocurrency slice is taking up a third of your nest egg, largely because there has been a rally over the past year, then it is prompting you to sell high. If you think cryptocurrency will continue to be strong, then you’ll simply trim back the mega-slice to one or two hot slices. In this manner, you win no matter which way crypto heads. If it implodes, and you still believe in it, then you can buy low. If it rallies, then at your next rebalancing, you can take even more gains. Each Year, What’s Hot and What’s Safe Changes Each year, when you are rebalancing your nest egg, you want to take a closer look at what’s hot and what’s safe. Clean energy was the hottest thing going in 2007, and has been the worst performer on Wall Street ever since. Cryptocurrency was on fire in 2017, and tanked in 2018. On the safe side, money market funds were safe just a few years ago. However, in 2017, companies were allowed to put in redemption gates and liquidity fees. If those are to be enacted, it will happen in a recession, such as we are currently in. In fact, there have been a slew of mutual fund redemption suspensions – mostly concentrated in Europe, so far. Bonds are also a huge problem, due to more than half of the S&P500 being congregated at the lowest rung of investment grade – just above junk bond status. This particular coaching session revealed that this investor was suffering from Buy High, Sell Low mentality. When something goes down she freaks out and wants to sell it. When she’s in the money, she gets greedy and just wants more, more more! That is the way our emotions would have us do things. However, that is the exact opposite of the formula for success. People Don’t Buy Low Because They Can’t Buy Low A year ago, this particular investor had lost a lot on her cryptocurrency. That had her feeling terrible on multiple fronts. Her net worth was down. She couldn’t invest elsewhere because her money was tied up. The only thing she could do was to hope and pray that her crypto recovered. And it did! Investors who were waiting for their Dot Com stocks to recover from that recession had to wait 15 years. People who bought gold at the high in 2011 have been on the losing end of that trade for a decade. It’s important to remember that the reasons people don’t buy low is because…

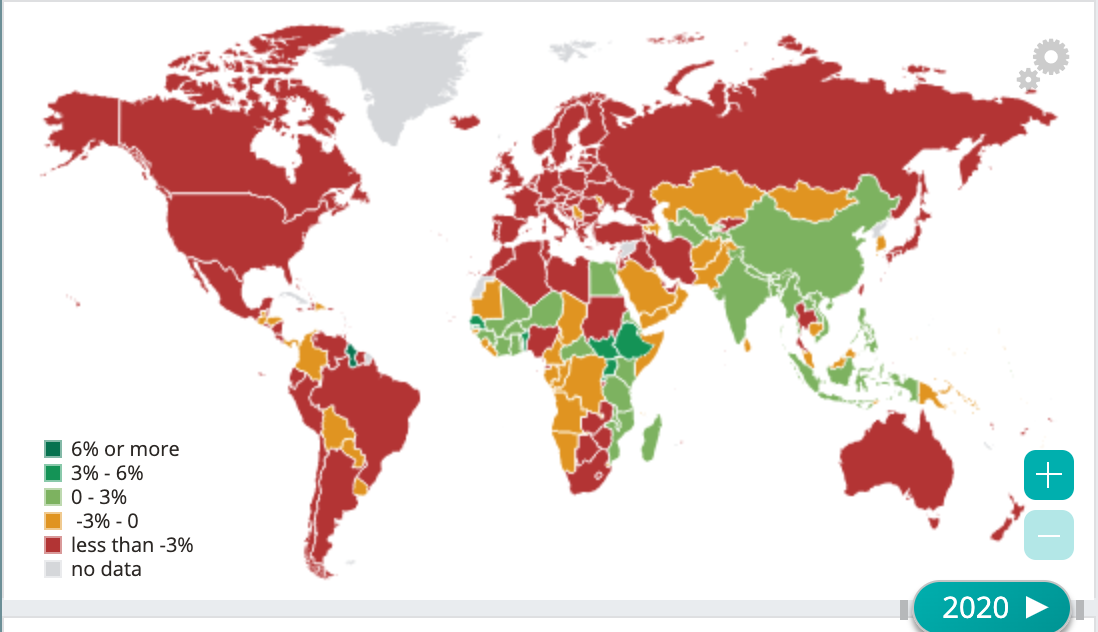

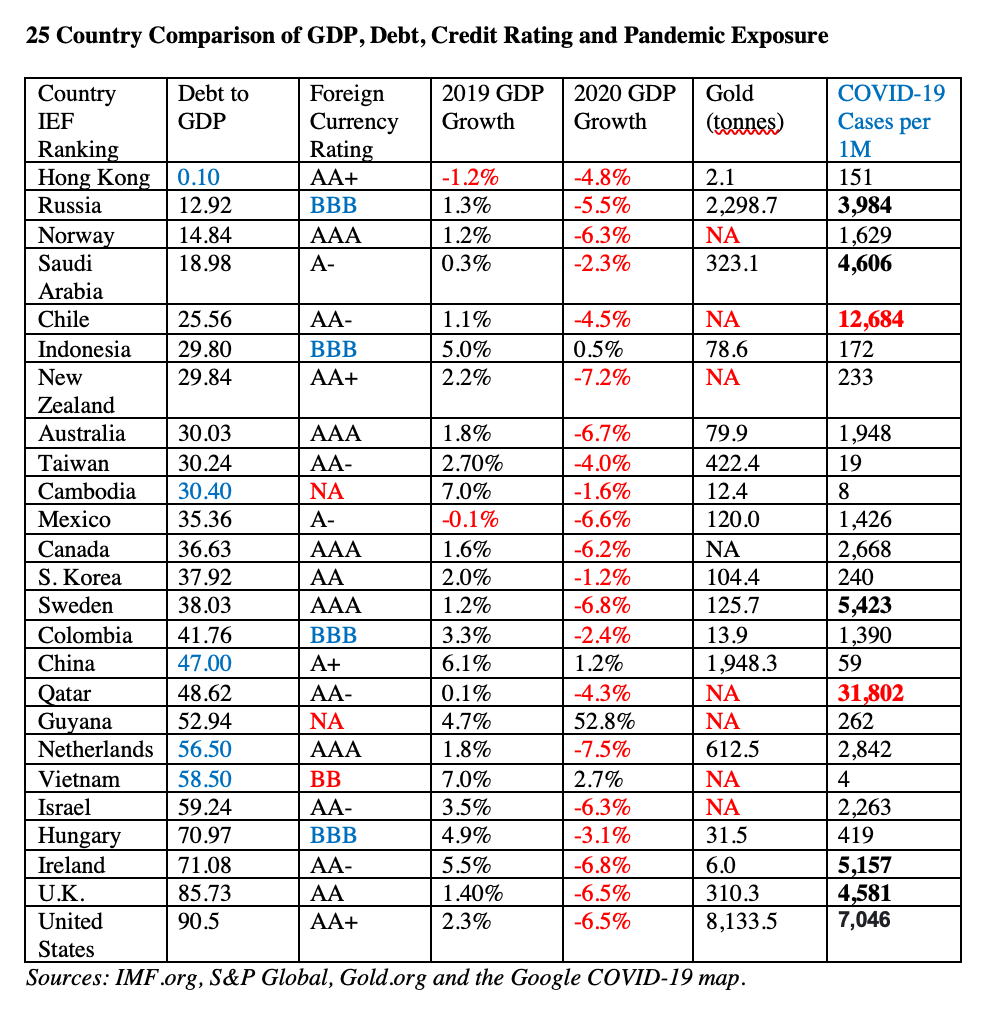

It’s a reminder that we want to check our emotions at the door when investing. The easiest way to do that is to adopt the time-proven system of the nest egg pie chart strategy, with 1-3 times a year rebalancing. Click to access a blogs with additional information on Buy High, Sell Low mentality and Annual Rebalancing. If you don’t know what you own, or how protected your wealth and retirement are, our Investor Educational Retreat or an unbiased 2nd opinion can offer you the information and wisdom you need now. Call 310-430-2397 or email [email protected] to learn more. Click on the banner ad below for additional information on the Oct. 2-4, 2020 Online Financial Empowerment Retreat. "Many people, including educated men and women, often get into trouble when they neglect to follow simple and fundamental rules of the type provided [by Natalie]. This is why I recommend them with enthusiasm." Professor Gary S. Becker. Dr. Becker won the 1992 Nobel Prize in economics for his theories on human "College students need this information before they get their first credit card. Young adults need it before they buy their first home. Empty nesters can use the information to downsize to a sustainable lifestyle, before they get into trouble." Joe Moglia, Chairman, TD AMERITRADE. Other Blogs of Interest Which Countries Are Hot in a Global Pandemic? Is Your Financial Advisor Good at Navigating Stormy Seas? $10 Avocados, Lies, Damn Lies, Statistics & Wall Street Secrets. It's Never a Crash. Work From Home and Intergenerational Housing. Biotech Races for a Coronavirus Cure. Are You Worried About Money? May is a Good Time for Rebalancing. Is FDIC-Insured Cash at Risk of a Bank Bail-in Plan? Why Did my Bonds Lose Money? Cannabis Update. Recession Proof Your Life. Free Videocon Monday, May 10, 2020. The Recession will be Announced on July 30, 2020. Apple Reports Terrible Earnings. We Are in a Recession. Unemployment, Rising Stocks. What's Going On? 8 Money Myths, Money Pits, Scams and Conspiracy Theories. 21st Century Solutions for Protecting Your Home, Nest Egg & Job. Wall Street Insiders are Selling Like There is No Tomorrow. Why Are My Bonds Losing Money? Tomorrow is Going to be Another Tough Day. Price Matters. Stock Prices are Still Too High. Should You Ride Things Out? 7 Recession Indicators Corona Virus Update. The Bank Bail-in Plan on Your Dime. NASDAQ is Up 6X. CoronaVirus: Which Companies and Countries Will be Most Impacted. Is Tesla Worth GM and Ford Combined. Artificial Intelligence is on Fire. Is it Time to Buy S'More? Take the Retirement Challenge. 2020 Investor IQ Test. Answers to the 2020 Investor IQ Test. The Cannabis Capital Crunch and Stock Meltdown. Does Your Commute Pollute More Than Planes? Are Health Care Costs Killing Your Budget? 2020 Crystal Ball. The Benefits of Living Green. Featuring H.R.H. The Prince of Wales' Twin Eco Communities. What Love, Time and Charity Have to do with our Commonwealth. Interview with MacArthur Genius Award Winner Kevin Murphy. Unicorns Yesterday. Fairy Tales Today. IPO Losses Top $100 Billion. Counting Blessings on Thanksgiving. Real Estate Prices Decline. Hong Kong Slides into a Recession. China Slows. They Trusted Him. Now He Doesn't Return Phone Calls. Beyond Meat's Shares Dive 67% in 2 Months. Price Matters. Will There be a Santa Rally? It's Up to Apple. Will JP Morgan Implode on Fairy Tales and Unicorns. Harness Your Emotions for Successful Investing. What the Ford Downgrade Means for Main Street. The Dow Dropped Over 1000 Points Do We Talk Ourselves into Recessions? Interview with Nobel Prize Winning Economist Robert J. Shiller. Ford is Downgraded to Junk. From Buried Alive in Bill to Buying Your Own Island. The Manufacturing Recession. An Interview with Liz Ann Sonders. Gold Mining ETFs Have Doubled. The Gold Bull Market Has Begun. The We Work IPO. The Highs and Hangovers of Investing in Cannabis. Recession Proof Your Life. China Takes a Bite Out of Apple Sales. Will the Dow Hit 30,000? A Check Up on the Economy Red Flags in the Boeing 2Q 2019 Earnings Report The Weakening Economy. Think Capture Gains, Not Stop Losses. Buy and Hold Works. Right? Wall Street Secrets Your Broker Isn't Telling You. Unaffordability: The Unspoken Housing Crisis in America. Are You Being Pressured to Buy a Home or Stocks? What's Your Exit Strategy? It's Time To Do Your Annual Rebalancing. Cannabis Crashes. Should You Get High Again? Are You Suffering From Buy High, Sell Low Mentality? Financial Engineering is Not Real Growth. The Zoom IPO. 10 Rally Killers. Fix the Roof While the Sun is Shining. Uber vs. Lyft. Which IPO Will Drive Returns? Boeing Cuts 737 Production by 20%. Earth Gratitude This Earth Day. Real Estate is Back to an All-Time High. The Lyft IPO Hits Wall Street. Should you take a ride? Cannabis Doubles. Did you miss the party? 12 Investing Mistakes Drowning in Debt? Get Solutions. CBD Oil for Sale. The High Cost of Free Advice. Apple's Real Problem in China: Huawei. 2018 is the Worst December Since the Great Depression. Will the Feds Raise Interest Rates? Should They? Learn what you're not being told in the MSM. Why FANG, Banks and Your Value Funds Are in Trouble. Russia Dumps Treasuries and Buys Gold OPEC and Russia Cut Oil Production. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable. However, NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors. The map below tells the story best. Few countries will be exempt from the economic toll of the pandemic. Worldwide Recession Only a few countries in Asia and Africa are expected to have any economic growth in 2020. North and South America, Europe, Russia, Australia, the Middle East and New Zealand have been hit very hard. The worst contractions are predicted for New Zealand, Australia, Europe, North America, Norway, Israel and Russia – ranging from -5.5% to -7.5% in annual GDP. South America isn’t much better. See below for IMF GDP growth projections, alongside other country-specific data. Pandemic Risk As you can see from the above comparison chart, those countries that were able to contain COVID-19 are faring better than those that are still embroiled in the pandemic. Vietnam, China and Indonesia are all expected to stay in the black for 2020. Guyana, a small, coastal South American country known for sugar, rice and timber, has recently become a producer of gold and oil (as of March 2020). GDP growth for Guyana is predicted to be a whopping 52.8% in 2020. Nothing else comes close. Liquidity Risk (i.e. you might be denied access to your money) Recently, there have been a number of redemption suspensions in global mutual funds, according to FitchRatings.com. According to Fitch, “Liquidity mismatches are most acute in funds investing in less liquid assets. Regulators have identified property, high-yield bond and emerging market debt funds as most vulnerable to liquidity risk.” However, liquidity stress has also been heightened in money market funds, Treasury bills, funds and even the U.S. dollar. The Federal Reserve has been purchasing Treasuries, mortgage-backed securities and junk bonds, and is printing money as fast as it can. However, in a speech on May 13, 2020, Jerome Powell admitted, “The scope and speed of this downturn are without modern precedent, significantly worse than any recession since World War II.” What’s Hot in a Global Recession? It’s a lot easier to lose money in a recession than it is to earn gains. So, first and foremost, you want to make sure that you are:

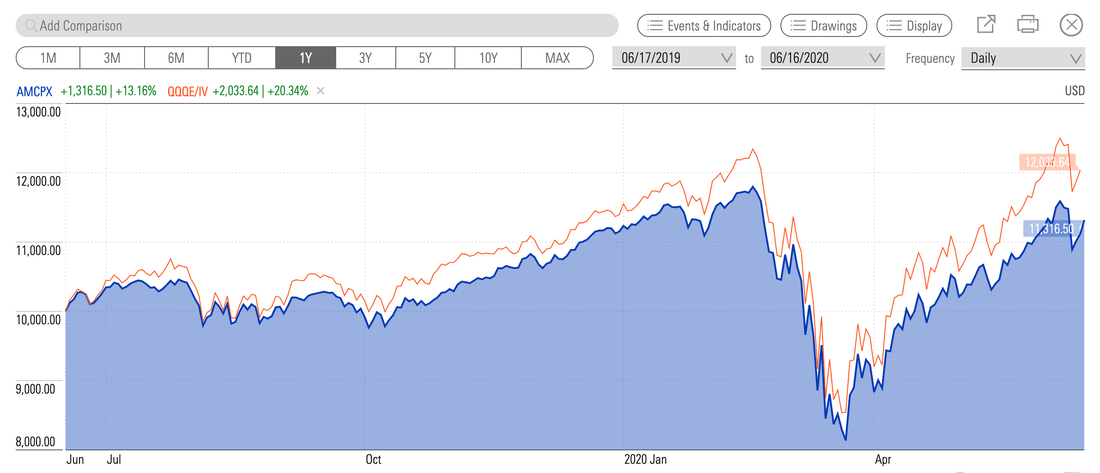

The redemption suspensions in mutual funds further complicate things. As Fitch Ratings noted in their report of June 21, 2020, “Redemption suspensions will force a fundamental investor re-appraisal of the liquidity that mutual funds can truly provide.” If the funds start losing value that will turn frustration into anger. See the sample pie chart below for an example of a personalized diversification strategy, based upon your age. Read my blog, “21st Century Solutions for a Post-Pandemic World” for additional information on how to get safe, protected, hot and diversified in a worldwide pandemic and recession. The ABCs of Money 3rd edition has important information on Debt, Budgeting, Real Estate, Stocks, Bonds and more. There are industries that can hold up in the pandemic. Leaning into them could help to preserve and grow your wealth – provided you do not overpay for the privilege. So, understanding what a good price and price-earnings ratio is will be key for successful investing today. Most equities and funds are trading near their all-time highs and are far above the average P/E (i.e. very expensive). Gold Gold has been strong. The current price per ounce of $1755 is near its all-time high of $1895, which was set in September 2011, after the U.S. was stripped of its AAA status by Standard and Poor’s (on August 5, 2011). Gold miner ETFs like RING (iShares) have rallied, while NUGT (Direxion) sank like a rock. What happened? It’s likely that Direxion was caught in a liquidity crisis. Direxion’s 3X bull fund was designed to increase at three times the speed of RING. However, instead, the fund sank like a rock on March 13, 2020, losing 87% of its value between February 24, 2020 and March 20, 2020. In the Spring rally, when RING shares doubled, NUGT was still in the red by 67%. Clearly the fund is not performing in the manner it is advertised. Though gold can perform well when people lose faith in stocks and the dollar, there is additional risk that the gold miners will have a terrible earnings report in 2Q 2020, due to mine closures. So, a safer bet at this time is an index that tracks the price of gold, like GLD (SPDR Gold Shares). With fund companies having liquidity issues, it’s important to invest in long-standing, reputable financial services corporations, rather than companies that you know little or nothing about. They may have other products that affect the liquidity of their company. Check out my interview with Rob McEwen, the chairman and Chief Owner of McEwen Mining on my YouTube.com/NataliePace channel. Subscribe there to be sure you don’t miss upcoming interviews and free videoconferences. FANG Facebook, Amazon, Apple, Nvidia, Netflix and Google have continued to be super stock performers. Getting hot in a FANG-heavy technology fund like TECB (iShares.com) is an easy way to add heat. However, the fund is trading near an all-time high. If you don’t have a hot slice of FANG, then you might consider a dollar-cost-averaging approach over the next 12-18 months, to ensure that you get exposure at a better price. All large-cap growth funds are not created equal. It would also be a good idea to check the holdings to make sure that you are FANG-rich there. Stay-at-Home Stocks Companies that deliver basic needs have been faring well, such as Amazon and Wal-Mart. However, many of these stocks are trading at very frothy prices. Amazon’s P/E is 128! Read my interview with Howard Silverblatt, the senior index analyst of S&P500® for additional information. I’ve noticed that many value funds are light on consumer staples, so it could pay to just add in your own consumer staples ETF, such as IYC (iShares.com). Again, consider dollar-cost-averaging to avoid buying high. Learn more in my Price Matters blog. Technology Semiconductors are typically harbingers of recessions. So, not all tech stocks are created equal. With ETFs, it is pretty easy to lean into subsections of an industry, such as a FANG-rich or artificial intelligence focused fund. Doing a Stock Report Card on companies/industry segments that you are interested in can reveal which companies are soaring and which are positioned to sink. (I teach this in my Investor Educational Retreats.) Artificial Intelligence In February of 2020, we featured Veritone at the Investor Educational Retreat as an example of a company at the forefront of AI. Veritone was partnered with Microsoft and Oracle to address the defense industry with its facial recognition product. Veritone’s stock popped from $2/share to $18. If you’re interested in learning more about finding hot stocks like Veritone, consider joining me for my Stock Master Class this Saturday, June 27, 2020. Email [email protected] to learn more. FYI: I also mentioned Veritone in my January 2020 Artificial Intelligence blog. Cannabis Cannabis has been destroyed by investors. However, the industry is still popular with its clients. Revenue growth at companies like Aphria and Tilray were still 96% and 126% year over year, respectively. Aphria’s price to book value is currently 0.89 (under 1.00). Aphria’s CEO is Irwin Simon, who steered Hain Celestial’s growth for 25 years as the founder/CEO/chairman. Walter Robb, the former co-CEO of Whole Foods, is on the board. There is no legacy fund company that offers a cannabis fund at this time, so you have to create your own fund with top-notch companies. Get additional information in my Cannabis blog. Utilities and Communication With so many of us Working From Home, you might be tempted to think that utilities are going to have a heyday. However, many of those office buildings have the air conditioning turned off. I just walked through a food court in a marquise mall in one of the most beloved destinations of the world, and it was a sauna, even though it was open and had one vendor selling food. Nonetheless, utilities and communication are a high priority, and most of us are going to put this bill on the top of the pile. This is an industry that might stay a little more buoyant, should stocks decide to test the lows we saw in mid-March (or worse, the lows we saw on February 9, 2009). Learn more in my Work From Home blog. Entertainment and Gaming Take Two: Grand Theft Auto Tencent: League of Legends & Fortnite Electronic Arts: Star Wars Zynga: Game of Thrones & Words with Friends Activision/Blizzard: Candy Crush & Call of Duty All of these companies increased sales in the last quarter, with the exception of Activision. Zynga and Take Two experienced the greatest revenue growth at 41% and 52%, respectively. The companies are also trading at high multiples. The good news is already priced in. It doesn’t hurt to put your favorite gaming companies on a Stock Shopping List, in case the Back to School Stock Sales in September offer up some deals. Full Disclosure: I have owned or currently own shares of companies and ETFs mentioned in this blog. If you don’t know what you own, or how protected your wealth and retirement are, the retreat or an unbiased 2nd opinion can offer you the information and wisdom you need now. Call 310-430-2397 or email [email protected] to learn more now. "Many people, including educated men and women, often get into trouble when they neglect to follow simple and fundamental rules of the type provided [by Natalie]. This is why I recommend them with enthusiasm." Professor Gary S. Becker. Dr. Becker won the 1992 Nobel Prize in economics for his theories on human "College students need this information before they get their first credit card. Young adults need it before they buy their first home. Empty nesters can use the information to downsize to a sustainable lifestyle, before they get into trouble." Joe Moglia, Chairman, TD AMERITRADE. Other Blogs of Interest Is Your Financial Advisor Good at Navigating Stormy Seas? $10 Avocados, Lies, Damn Lies, Statistics & Wall Street Secrets. It's Never a Crash. Work From Home and Intergenerational Housing. Biotech Races for a Coronavirus Cure. Are You Worried About Money? May is a Good Time for Rebalancing. Is FDIC-Insured Cash at Risk of a Bank Bail-in Plan? Why Did my Bonds Lose Money? Cannabis Update. Recession Proof Your Life. Free Videocon Monday, May 10, 2020. The Recession will be Announced on July 30, 2020. Apple Reports Terrible Earnings. We Are in a Recession. Unemployment, Rising Stocks. What's Going On? 8 Money Myths, Money Pits, Scams and Conspiracy Theories. 21st Century Solutions for Protecting Your Home, Nest Egg & Job. Wall Street Insiders are Selling Like There is No Tomorrow. Why Are My Bonds Losing Money? Tomorrow is Going to be Another Tough Day. Price Matters. Stock Prices are Still Too High. Should You Ride Things Out? 7 Recession Indicators Corona Virus Update. The Bank Bail-in Plan on Your Dime. NASDAQ is Up 6X. CoronaVirus: Which Companies and Countries Will be Most Impacted. Is Tesla Worth GM and Ford Combined. Artificial Intelligence is on Fire. Is it Time to Buy S'More? Take the Retirement Challenge. 2020 Investor IQ Test. Answers to the 2020 Investor IQ Test. The Cannabis Capital Crunch and Stock Meltdown. Does Your Commute Pollute More Than Planes? Are Health Care Costs Killing Your Budget? 2020 Crystal Ball. The Benefits of Living Green. Featuring H.R.H. The Prince of Wales' Twin Eco Communities. What Love, Time and Charity Have to do with our Commonwealth. Interview with MacArthur Genius Award Winner Kevin Murphy. Unicorns Yesterday. Fairy Tales Today. IPO Losses Top $100 Billion. Counting Blessings on Thanksgiving. Real Estate Prices Decline. Hong Kong Slides into a Recession. China Slows. They Trusted Him. Now He Doesn't Return Phone Calls. Beyond Meat's Shares Dive 67% in 2 Months. Price Matters. Will There be a Santa Rally? It's Up to Apple. Will JP Morgan Implode on Fairy Tales and Unicorns. Harness Your Emotions for Successful Investing. What the Ford Downgrade Means for Main Street. The Dow Dropped Over 1000 Points Do We Talk Ourselves into Recessions? Interview with Nobel Prize Winning Economist Robert J. Shiller. Ford is Downgraded to Junk. From Buried Alive in Bill to Buying Your Own Island. The Manufacturing Recession. An Interview with Liz Ann Sonders. Gold Mining ETFs Have Doubled. The Gold Bull Market Has Begun. The We Work IPO. The Highs and Hangovers of Investing in Cannabis. Recession Proof Your Life. China Takes a Bite Out of Apple Sales. Will the Dow Hit 30,000? A Check Up on the Economy Red Flags in the Boeing 2Q 2019 Earnings Report The Weakening Economy. Think Capture Gains, Not Stop Losses. Buy and Hold Works. Right? Wall Street Secrets Your Broker Isn't Telling You. Unaffordability: The Unspoken Housing Crisis in America. Are You Being Pressured to Buy a Home or Stocks? What's Your Exit Strategy? It's Time To Do Your Annual Rebalancing. Cannabis Crashes. Should You Get High Again? Are You Suffering From Buy High, Sell Low Mentality? Financial Engineering is Not Real Growth. The Zoom IPO. 10 Rally Killers. Fix the Roof While the Sun is Shining. Uber vs. Lyft. Which IPO Will Drive Returns? Boeing Cuts 737 Production by 20%. Earth Gratitude This Earth Day. Real Estate is Back to an All-Time High. The Lyft IPO Hits Wall Street. Should you take a ride? Cannabis Doubles. Did you miss the party? 12 Investing Mistakes Drowning in Debt? Get Solutions. CBD Oil for Sale. The High Cost of Free Advice. Apple's Real Problem in China: Huawei. 2018 is the Worst December Since the Great Depression. Will the Feds Raise Interest Rates? Should They? Learn what you're not being told in the MSM. Why FANG, Banks and Your Value Funds Are in Trouble. Russia Dumps Treasuries and Buys Gold OPEC and Russia Cut Oil Production. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable. However, NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors. Is Your Financial Advisor Good at Navigating Stormy Seas? 5 New Questions to Ask your Financial Advisor. Are you looking for someone to help you manage your money? Are you wondering if the financial advisor you have is good at navigating tough times? It’s easy for anyone to make money in a bull market. However, how well can your financial plan hold up in a recession? The last two recessions cost most Main Street investors more than half of their wealth. (The recession was announced on June 8, 2020 by the National Bureau of Economic Research.) Never confuse a bull market with wisdom or a well-designed strategy. Here are 5 questions to ask your financial planner to determine just how well s/he can handle the challenging economic environment that lies ahead. The answers reveal whether or not your CFP spends her day selling products to clients, or if she spends her day actually looking for the data and statistics needed to create a well-balanced and well-protected portfolio. We are in an unprecedented time, which will require a lot more skill to navigate successfully. 1. What’s the current unemployment rate? The wrong answer: 13.3%. The right answer: 16.3% with over 25 million Americans unemployed. Learn more in my blog “$10 Avocados. Lies. Damn Lies and Statistics.” 2. How much of my money should I keep safe? The Buy & Hope answer: That depends upon your risk tolerance. But the markets always come back, so don’t worry about short term fluctuations. The 21st Century truth. Buy & Hope investors have been riding a Wall Street rollercoaster losing more than half of their wealth in each of the last 2 recessions (the Dot Com Recession and the Great Recession). This cost many people their homes as well. Learn more in my Recession blog. Take steps to protect your home and wealth with the strategies outlined in my Recession-Proof Your Life blog. The right answer: Always keep a percentage equal to your age safe. Overweight safe in recessions, or in the late stage of the business cycle, to protect yourself. In today’s world, with so much leverage in the bond market, you also need to know what is safe. Learn more in my Bond blog. 3. What is safe? Ford was downgraded to junk in 2019. I’ve been seeing reports that over half of the S&P 500 is at the lowest rung just above junk bond status. The wrong answer: If you just keep your money in a savings account, you’ll be losing money because of inflation. At least in a bond, you will be making some income. The right answer: When companies are downgraded to junk bond status, the value of the bond itself goes down, your income is at risk of being canceled and if the company has to declare bankruptcy, then you are going to lose some of your principal investment. If you need to sell your bond, you may not be able to do it because no one will want to buy it. If you’re going to hold bonds you have to keep the credit worthiness at the highest rung and the terms short. Bond funds carry more risk because they can often include up to 20% junk bonds in the holdings. We are in an unprecedented recession. Only the most creditworthy companies were able to raise money before the bail-out in March 2020, and the hard times are not over yet. Also, we are in a period of deflation, not inflation. Learn more in my Bond blog. 4. What other products are safe for me to protect my principal, while also earning an income? The wrong answers: Money market funds, annuities or real estate investment trusts. You can earn an income with these products. (What you are not being told is that the higher risk products offer a higher commission.) The right answer. Money market funds now have redemption gates and liquidity fees, meaning that you could be denied access to your money or have to pay a fee to access your money. Rates are typically very high risk, with most of the companies showing cash negative gains over the past years, even while real estate prices rose to all-time highs. Read my blogs on real estate and work from home, FDIC-insured cash and what happened to a retired couple who were told that their REIT was guaranteed by real estate. (Click on the blue highlights to access these blogs.) So, what is safe in a world where bonds are overleveraged, and REITs are very high risk? Getting safe is a two-step process. The first step is to keep your money. The second step is to purchase safe, income-producing hard assets that you purchase for a good price, considering a post-pandemic world. There actually are a few of those products available today. We spend one full day on this at our investor educational retreat. The next retreat is in October 2-4, 2020. You can also read about What’s Safe in the 3rd Edition of The ABCs of Money. FYI: If you register for the Oct. 2020 Retreat by June 30, 2020, you receive the lowest price and a complimentary private, prosperity coaching session (value $300). Click on the retreat flyer to learn more and to read testimonials. 5. Are stocks too high? I’m getting dizzy from the rollercoaster ride. In March, I thought I’d lost so much, and now I’m wondering if I should take some money off the table, so that I don’t lose it again. Wrong answer: The stock market can fluctuate. But if you just hang on for the long term, everything will be OK. The right answer: Stocks are very close to an all-time high. In fact, the only two times in history that the price-earnings ratios were this high were in 1929, before the Great Depression, and in 2000 before the Dot Com Recession. We all know what happened in the Great Depression. In the Dot Com Recession, the NASDAQ Composite Index lost 78% of its value, and took 15 years to crawl back to its March 2000 highs. Learn more about pricing in my interview with the senior index analyst of the S&P500®, Howard Silverblatt and in my blog “$10 Avocados.” Bottom Line: If your financial advisor is consistently giving you the wrong answer or the fast, inaccurate data, then you are dealing with a salesman. If you want to verify just how much your plan is at risk, ask your current advisor for a chart of your portfolio performance for the last 15 years, compared to the S&P500®. Most plans are just riding up and down, losing more than half in each recession, and using the bull markets to earn back losses, instead of amassing gains. Additionally, most managed plans are performing about 2% below the index, due to fees. (See the chart below for an example.) The worst is not over. Many of the emergency funds that were authorized expire on September 30, 2020. The 2nd Quarter 2020 GDP Report that will be announced on July 30, 2020 is expected to be the worst on record. In 2020, GDP is projected to contract by -6.5% (source: Federal Reserve.gov). The last two recessions have taught us that when repricing occurs, most people lose more than half of their wealth. From the top to the bottom in stocks typically takes about 18 to 24 months. The high in real estate was in 2007, and the low bottomed out in 2011. It’s not a good idea to try to market time these things. Our easy-as-a-pie-chart system with annual rebalancing protects you and can earn gains safely. It’s less time, less money and a whole lot less worry. Simply rebalancing your nest egg annually allows you to capture gains and remain properly safe and diversified, if you use the pie charts as your guide. This is a Buy Low, Sell High plan on auto-pilot. So, whether you learn how to protect your wealth and diversify your investments by reading the 3rd Edition of The ABCs of Money, or by receiving an unbiased 2nd opinion on your current plan for me, or by attending our October 2020 Investor Educational Retreat, wisdom and time-proven systems are the cure, and the time is now. Having a strong financial house can protect your future from the financial storms on the horizon. You want to hire, assess and furlough your financial advisor like your life depends upon it because your lifestyle and future does. Blind faith, free advice and Buy & Hope have been very expensive strategies in the last two recessions of the 21st Century. They are unlikely to be a good strategy in the days ahead. If you don’t know what you own, or how protected your wealth and retirement are, the retreat or an unbiased 2nd opinion can offer you the information and wisdom you need now. Call 310-430-2397 or email [email protected] to learn more now. "Many people, including educated men and women, often get into trouble when they neglect to follow simple and fundamental rules of the type provided [by Natalie]. This is why I recommend them with enthusiasm." Professor Gary S. Becker. Dr. Becker won the 1992 Nobel Prize in economics for his theories on human "College students need this information before they get their first credit card. Young adults need it before they buy their first home. Empty nesters can use the information to downsize to a sustainable lifestyle, before they get into trouble." Joe Moglia, Chairman, TD AMERITRADE. Other Blogs of Interest $10 Avocados, Lies, Damn Lies, Statistics & Wall Street Secrets. It's Never a Crash. Work From Home and Intergenerational Housing. Biotech Races for a Coronavirus Cure. Are You Worried About Money? May is a Good Time for Rebalancing. Is FDIC-Insured Cash at Risk of a Bank Bail-in Plan? Why Did my Bonds Lose Money? Cannabis Update. Recession Proof Your Life. Free Videocon Monday, May 10, 2020. The Recession will be Announced on July 30, 2020. Apple Reports Terrible Earnings. We Are in a Recession. Unemployment, Rising Stocks. What's Going On? 8 Money Myths, Money Pits, Scams and Conspiracy Theories. 21st Century Solutions for Protecting Your Home, Nest Egg & Job. Wall Street Insiders are Selling Like There is No Tomorrow. Why Are My Bonds Losing Money? Tomorrow is Going to be Another Tough Day. Price Matters. Stock Prices are Still Too High. Should You Ride Things Out? 7 Recession Indicators Corona Virus Update. The Bank Bail-in Plan on Your Dime. NASDAQ is Up 6X. CoronaVirus: Which Companies and Countries Will be Most Impacted. Is Tesla Worth GM and Ford Combined. Artificial Intelligence is on Fire. Is it Time to Buy S'More? Take the Retirement Challenge. 2020 Investor IQ Test. Answers to the 2020 Investor IQ Test. The Cannabis Capital Crunch and Stock Meltdown. Does Your Commute Pollute More Than Planes? Are Health Care Costs Killing Your Budget? 2020 Crystal Ball. The Benefits of Living Green. Featuring H.R.H. The Prince of Wales' Twin Eco Communities. What Love, Time and Charity Have to do with our Commonwealth. Interview with MacArthur Genius Award Winner Kevin Murphy. Unicorns Yesterday. Fairy Tales Today. IPO Losses Top $100 Billion. Counting Blessings on Thanksgiving. Real Estate Prices Decline. Hong Kong Slides into a Recession. China Slows. They Trusted Him. Now He Doesn't Return Phone Calls. Beyond Meat's Shares Dive 67% in 2 Months. Price Matters. Will There be a Santa Rally? It's Up to Apple. Will JP Morgan Implode on Fairy Tales and Unicorns. Harness Your Emotions for Successful Investing. What the Ford Downgrade Means for Main Street. The Dow Dropped Over 1000 Points Do We Talk Ourselves into Recessions? Interview with Nobel Prize Winning Economist Robert J. Shiller. Ford is Downgraded to Junk. From Buried Alive in Bill to Buying Your Own Island. The Manufacturing Recession. An Interview with Liz Ann Sonders. Gold Mining ETFs Have Doubled. The Gold Bull Market Has Begun. The We Work IPO. The Highs and Hangovers of Investing in Cannabis. Recession Proof Your Life. China Takes a Bite Out of Apple Sales. Will the Dow Hit 30,000? A Check Up on the Economy Red Flags in the Boeing 2Q 2019 Earnings Report The Weakening Economy. Think Capture Gains, Not Stop Losses. Buy and Hold Works. Right? Wall Street Secrets Your Broker Isn't Telling You. Unaffordability: The Unspoken Housing Crisis in America. Are You Being Pressured to Buy a Home or Stocks? What's Your Exit Strategy? It's Time To Do Your Annual Rebalancing. Cannabis Crashes. Should You Get High Again? Are You Suffering From Buy High, Sell Low Mentality? Financial Engineering is Not Real Growth. The Zoom IPO. 10 Rally Killers. Fix the Roof While the Sun is Shining. Uber vs. Lyft. Which IPO Will Drive Returns? Boeing Cuts 737 Production by 20%. Earth Gratitude This Earth Day. Real Estate is Back to an All-Time High. The Lyft IPO Hits Wall Street. Should you take a ride? Cannabis Doubles. Did you miss the party? 12 Investing Mistakes Drowning in Debt? Get Solutions. CBD Oil for Sale. The High Cost of Free Advice. Apple's Real Problem in China: Huawei. 2018 is the Worst December Since the Great Depression. Will the Feds Raise Interest Rates? Should They? Learn what you're not being told in the MSM. Why FANG, Banks and Your Value Funds Are in Trouble. Russia Dumps Treasuries and Buys Gold OPEC and Russia Cut Oil Production. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable. However, NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors. Fun Fact: The Unemployment Rate is Really 16.3%, Not the Widely Reported 13.3%. Due to unemployed workers being falsely classified as employed by survey takers, the actual unemployment rate in May was approximately 16.3%, with 25.7 million unemployed (not 21 million unemployed, at 13.3%). The incorrect data was cited at the top of the Bureau of Labor Statistics news release, but was corrected at the bottom of the same news release in the fine print. The agency wrote that they didn’t correct the data because: “to maintain data integrity, no ad hoc actions are taken to reclassify survey responses.” Huh? (Click to read the press release for yourself. Just scroll to the bottom.) In fairness, there was an increase in employment in May, though many (40%) of the jobs were part-time, and thus lower-pay. (How many people do you know who are filling up shopping carts at grocery stores for stay-at-home customers?) The same false-classification issue was at play in the April 2020 report, which also wasn’t corrected. The April Employment Situation press release stated that 23.1 million Americans were unemployed, for an unemployment rate of 14.7%. In the fine print, the agency admitted that the rate of unemployment should be almost 5% higher – for approximately 19.5%, and over 30 million Americans, unemployed. Hopefully, statisticians and economists make the necessary corrections for the history books. However, when investors act upon false information it can be a very costly mistake. (Imagine trying to sue the BLS for misleading you into buying high.) So, what other important details are you missing in the headlines, by not reading the fine print? Ten Dollar Avocados. And Other Wall Street Shopping and Cooking Secrets. See below for 11 money traps to be aware of and avoid. Shopping Secrets $10 Avocados The Smart Money Always Moves 1st Marketing Nooses The Cramer & Motley Fool Affect We Are in a Recession Cooking Secrets That Unemployment Surprise on June 5, 2020 Financial Engineering is not Real Growth Buybacks and Dividends EPS: Massive Misses Junk Bond Issuance Airlines: Prepare for Massive Layoffs on October 1, 2020 And here is a little more information on each point. Shopping Secrets $10 Avocados. Stocks are trading at very high multiples. It’s like buying an avocado for $10/each. Price matters. As Warren Buffett noted in his CNBC interview of February 25, 2020, stocks are bonds can be good buys or bad buys. “It depends on the price,” he said. Learn more in my blog and video conference interview with the Senior Index Analyst of the S&P500 ® Howard Silverblatt, and in my GDP Report of April 29, 2020. The Smart Money Always Moves 1st. The markets dropped 35% between February 19th and March 23rd of this year – before most Main Street investors knew what was really going on. In the meantime, interest rates were slashed to zero and the liquidity for money market funds, mortgage-backed securities, Treasury Bills and even the U.S. dollar had dried up. In March, the Federal Reserve Board stepped in with trillions in relief. So, if you’re getting an email to act now or miss out, whether it is from your “financial advisor” or a hot tip from a friend, be careful. Stocks are trading high. These tips are typically agenda-related more than data-informed. Learn more in my blog, “It’s Never a Crash.” Marketing Nooses. Whether it is the BLS hiding the real data in the fine print, or your bank or insurance company doing the same with regard to the risk of your bond, money market, annuity or other bank/insurance product, beware of sales-speak that lures you into a seemingly safe or income-producing products. When interest rates are at zero, banks and insurance companies have a difficult time earning. We wouldn’t even have banks and insurance companies if most hadn’t been bailed out in 2008. Learn more in my blogs on FDIC-insured cash, bonds, REITs and money market funds. The Cramer & Motley Fool Affect. If you wait for the headlines, it’s always too late. You want to be picking your winners before Cramer or Motley Fool does. That way, you ride the tide up and can sell high, rather than buying high and watching in horror when the knife-like drop slashes your investment. In my Artificial Intelligence blog, I mentioned “one AI company, which is trading near its 52-week low, that is partnered with Microsoft on face recognition.” Attendees of the February 7, 2020 Stock Master Class and all of the retreats since then (there have been four) have watched Veritone’s share price soar from $2/share to $14/share. Learning how to pick stocks with a Stock Report Card is much easier and far more rewarding than chasing headlines. Join me at my June 13-15, 2020 Investor Educational Retreat to learn how. Call 310-430-2397 now with your questions and to register. We Are in a Recession. A recession doesn’t become official until two quarters of sequential contraction occur. The 1st quarter of 2020 had a contraction of 5%. The 2nd quarter of 2020 is predicted to drop another 12% sequentially and perhaps as low as 40% year-over-year. The 2nd quarter 2020 GDP announcement occurs on July 30, 2020 and is finalized on September 30, 2020. Learn more in my blogs, “The Recession Will be Announced on July 30, 2020” and “We Are in a Recession.” Cooking Secrets That Unemployment Surprise on June 5, 2020. One of the most astonishing examples of lies, damn lies and statistics turned out to be the most recent unemployment report that was misquoted all over the news, with few orgs bothering to read the fine print and correct their reporting. See the first paragraphs of this blog above for details. Financial Engineering. Corporate share repurchases increase the earnings per share and decrease the price to earnings ratio – something that investors like, but bondholders and investment banks are not fond of. Financial engineering is not real growth. At the end of the day, sales and income predict how well a company is doing. The 2nd quarter of 2020 is predicted to hit historic lows on both accounts. Learn more in my blogs, “The Recession Will Be Announced on July 30th” and “Financial Engineering.” Buybacks and Dividends. Companies set another buyback and dividend record in the 1st quarter of 2020, at $198 billion and $127 billion, respectively. However, many companies and most of the mega-banks have suspended their buybacks. 42 S&P500 companies have also suspended their dividends, with another 19 cutting the dividend. Many corporations that have borrowed Federal money, such as airlines and auto manufacturers, have agreed that the cash will not go toward share repurchases, dividends or executive bonuses. Without the support of corporate buybacks, and with dividend stocks not providing ample income to investors, can the stock market continue to trade near its all-time high, at prices that Howard Silverblatt says are a nose-bleed? Learn why May/June is a good time for rebalancing in my blog. EPS vs. Recession. The average earnings per share for the 1st quarter of 2020 in the S&P500 was predicted by Wall Street analysts to be $34.33/share. The S&P Dow Jones Indices gave a more modest prediction of $20/share. The actual earnings were $12.56/share – for a massive miss on both predictions. That kind of earnings miss is rare, and is directly correlated to difficult times. The 2nd quarter could easily be far worse, as the Street is predicting $23.58/share, with the S&P Dow Jones Indices agreeing at $23.66/share. Economists forecast that the 2nd quarter 2020 GDP will likely be a -12% contraction over 1Q 2020, and could be as high as -40% year-over-year. If that is the case, that could easily put earnings per share closer to $11/share. EPS forecasts and reported earnings typically stay pretty close together, except in recessions, when they can diverge dramatically. By example, the 4th quarter of 2008 offered the only negative earnings quarter in S&P500 ® index history, per Howard Silverblatt. Wall Street analysts had predicted $7.35/share earnings, with the S&P Dow Jones Indices believing the contraction would be limited to -$0.09/share. The results were -$23.25/share. The 2nd and 3rd quarters of 2008 were also big misses. The same trend held true in the Dot Com Recession. The first big miss was in the 4th quarter of 2000, when EPS dropped from $13.71/share to $9.07/share, sequentially. The 2nd, 3rd and 4th quarters of 2001 and 2002 were all big earnings misses, as well. As you can see in the charts below, when earnings implode, Wall Street plunges. Junk Bond Issuance. The Federal Reserve Board offered emergency liquidity to bonds, money market funds, mortgage-backed securities and even Treasury Bills in March 2020. However, many of these programs are set to expire on September 30, 2020, unless they are renewed. With over 50% of S&P500 companies at the lowest rung above junk bond status (or already downgraded to speculative status), there’s a lot of risk in bonds, with very little reward for taking on that risk. In addition to capital loss, you also risk that your bond becomes illiquid. Learn more in my Bond blog. Airlines: Prepare for Massive Layoffs on October 1, 2020. The CARES Act provides payroll support to over 750,000 airline personnel through September 30, 2020, according to a statement from Airlines for America President and CEO Nicholas E. Calio. However, with passenger travel down 97%, to levels not seen since 1954, and with 2,400 parked aircraft and burning through $10-12 billion a month, what happens to the airline industry on October 1, 2020? Travel bans around the world are further complicated by the new trend of Working from Home. Learn more in my blog. This may seem like a lot to keep track of. However, if you have an easy system that protects you from losses and allows you upside in bull markets, then all you have to do is rebalance annually, for a buy low, sell high system on auto-pilot. With a time-proven plan, you can actually take a vacation from having to mainline financial news, which is always late and many times can be misleading. The plan itself protects you best. Just like a well-designed home protects you from storms (so that you don’t have to listen to the weather channel 24/7), a well-designed financial home protects your money and wealth from the financial storms on the horizon. Wisdom is the cure. The time is now. Join me next weekend, June 13-15, 2020, for a 3-day Financial Empowerment Retreat that will change your life and relationship with money forever. If you don’t know what you own, or how protected your wealth and retirement are, the retreat or an unbiased 2nd opinion can offer you the information and wisdom you need now. Call 310-430-2397 or email [email protected] to learn more now.  Natalie Pace Financial Empowerment Retreat June 13-15, 2020. Call 310-430-2397 or email [email protected] to learn more. "Many people, including educated men and women, often get into trouble when they neglect to follow simple and fundamental rules of the type provided [by Natalie]. This is why I recommend them with enthusiasm." Professor Gary S. Becker. Dr. Becker won the 1992 Nobel Prize in economics for his theories on human "College students need this information before they get their first credit card. Young adults need it before they buy their first home. Empty nesters can use the information to downsize to a sustainable lifestyle, before they get into trouble." Joe Moglia, Chairman, TD AMERITRADE. Other Blogs of Interest It's Never a Crash. Work From Home and Intergenerational Housing. Biotech Races for a Coronavirus Cure. Are You Worried About Money? May is a Good Time for Rebalancing. Is FDIC-Insured Cash at Risk of a Bank Bail-in Plan? Why Did my Bonds Lose Money? Cannabis Update. Recession Proof Your Life. Free Videocon Monday, May 10, 2020. The Recession will be Announced on July 30, 2020. Apple Reports Terrible Earnings. We Are in a Recession. Unemployment, Rising Stocks. What's Going On? 8 Money Myths, Money Pits, Scams and Conspiracy Theories. 21st Century Solutions for Protecting Your Home, Nest Egg & Job. Wall Street Insiders are Selling Like There is No Tomorrow. Why Are My Bonds Losing Money? Tomorrow is Going to be Another Tough Day. Price Matters. Stock Prices are Still Too High. Should You Ride Things Out? 7 Recession Indicators Corona Virus Update. The Bank Bail-in Plan on Your Dime. NASDAQ is Up 6X. CoronaVirus: Which Companies and Countries Will be Most Impacted. Is Tesla Worth GM and Ford Combined. Artificial Intelligence is on Fire. Is it Time to Buy S'More? Take the Retirement Challenge. 2020 Investor IQ Test. Answers to the 2020 Investor IQ Test. The Cannabis Capital Crunch and Stock Meltdown. Does Your Commute Pollute More Than Planes? Are Health Care Costs Killing Your Budget? 2020 Crystal Ball. The Benefits of Living Green. Featuring H.R.H. The Prince of Wales' Twin Eco Communities. What Love, Time and Charity Have to do with our Commonwealth. Interview with MacArthur Genius Award Winner Kevin Murphy. Unicorns Yesterday. Fairy Tales Today. IPO Losses Top $100 Billion. Counting Blessings on Thanksgiving. Real Estate Prices Decline. Hong Kong Slides into a Recession. China Slows. They Trusted Him. Now He Doesn't Return Phone Calls. Beyond Meat's Shares Dive 67% in 2 Months. Price Matters. Will There be a Santa Rally? It's Up to Apple. Will JP Morgan Implode on Fairy Tales and Unicorns. Harness Your Emotions for Successful Investing. What the Ford Downgrade Means for Main Street. The Dow Dropped Over 1000 Points Do We Talk Ourselves into Recessions? Interview with Nobel Prize Winning Economist Robert J. Shiller. Ford is Downgraded to Junk. From Buried Alive in Bill to Buying Your Own Island. The Manufacturing Recession. An Interview with Liz Ann Sonders. Gold Mining ETFs Have Doubled. The Gold Bull Market Has Begun. The We Work IPO. The Highs and Hangovers of Investing in Cannabis. Recession Proof Your Life. China Takes a Bite Out of Apple Sales. Will the Dow Hit 30,000? A Check Up on the Economy Red Flags in the Boeing 2Q 2019 Earnings Report The Weakening Economy. Think Capture Gains, Not Stop Losses. Buy and Hold Works. Right? Wall Street Secrets Your Broker Isn't Telling You. Unaffordability: The Unspoken Housing Crisis in America. Are You Being Pressured to Buy a Home or Stocks? What's Your Exit Strategy? It's Time To Do Your Annual Rebalancing. Cannabis Crashes. Should You Get High Again? Are You Suffering From Buy High, Sell Low Mentality? Financial Engineering is Not Real Growth. The Zoom IPO. 10 Rally Killers. Fix the Roof While the Sun is Shining. Uber vs. Lyft. Which IPO Will Drive Returns? Boeing Cuts 737 Production by 20%. Earth Gratitude This Earth Day. Real Estate is Back to an All-Time High. The Lyft IPO Hits Wall Street. Should you take a ride? Cannabis Doubles. Did you miss the party? 12 Investing Mistakes Drowning in Debt? Get Solutions. CBD Oil for Sale. The High Cost of Free Advice. Apple's Real Problem in China: Huawei. 2018 is the Worst December Since the Great Depression. Will the Feds Raise Interest Rates? Should They? Learn what you're not being told in the MSM. Why FANG, Banks and Your Value Funds Are in Trouble. Russia Dumps Treasuries and Buys Gold OPEC and Russia Cut Oil Production. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable. However, NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors. |

AuthorNatalie Pace is the co-creator of the Earth Gratitude Project and the author of The Power of 8 Billion: It's Up to Us, The ABCs of Money, The ABCs of Money for College, The Gratitude Game and Put Your Money Where Your Heart Is. She is a repeat guest & speaker on national news shows and stages. She has been ranked the No. 1 stock picker, above over 830 A-list pundits, by an independent tracking agency, and has been saving homes and nest eggs since 1999. Archives

July 2024

Categories |

RSS Feed

RSS Feed