|

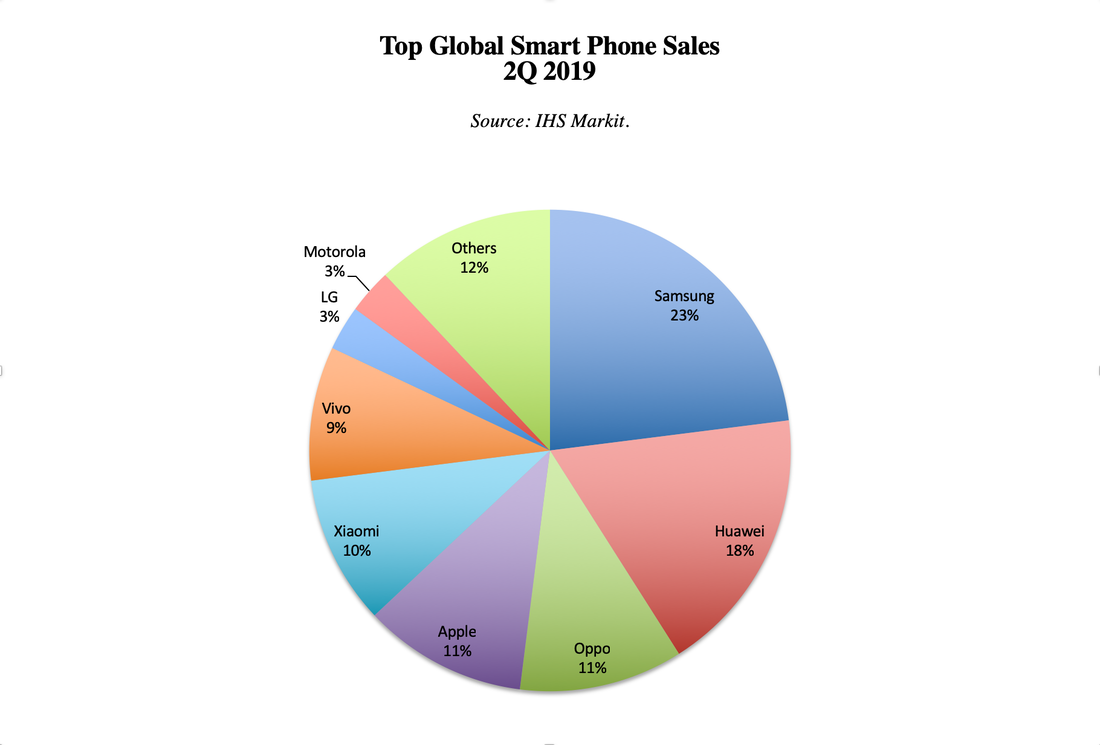

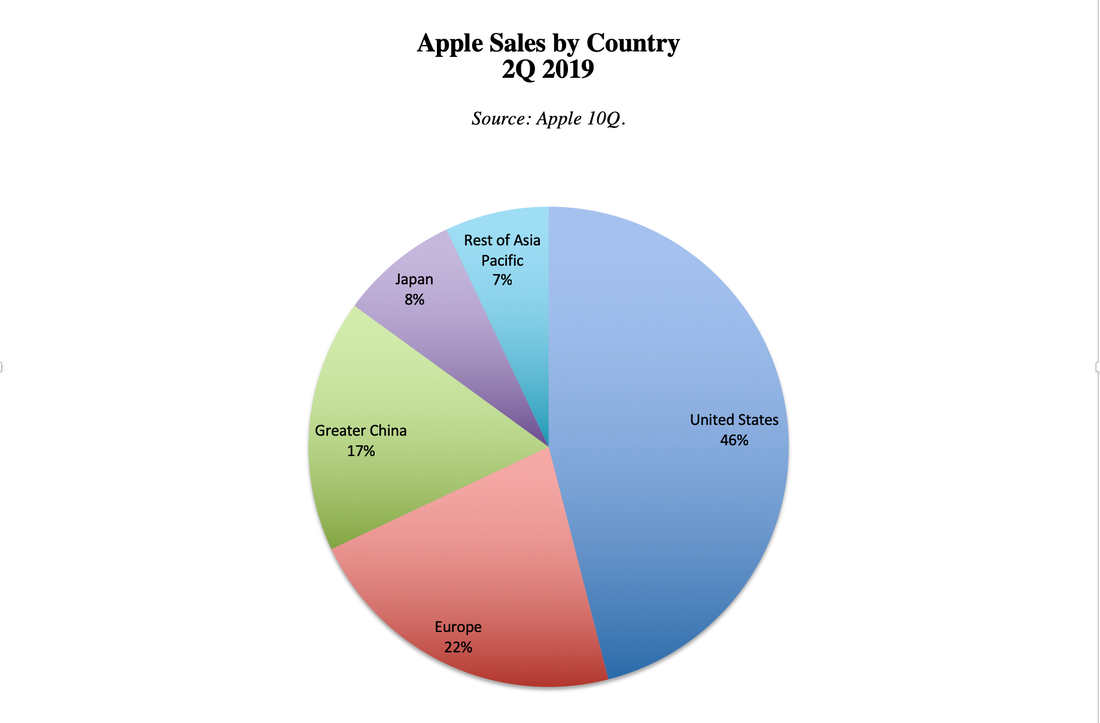

In the 2nd quarter of 2019, Apple sank to the 4th position in global smartphone sales, behind Samsung (75.1 million shipments), Huawei (58.7 million) and Oppo (36.2 million). Apple’s sales/shipments were 35.3 million for the quarter (source: IHS Markit). According to Jusy Hong, IHS Markit’s research and analysis director, “Huawei was able to replace falling international shipments with increased sales in China. However, the full effects of the ban likely will be felt by Huawei’s international business in the third quarter of this year.” Actually, Huawei’s sales are strong in both China and Europe – costing Apple market share in both regions. (The ban is in the U.S., Australia and Japan.) According to Apple’s 2Q 2019 earnings report, net Apple sales in Greater China and Europe fell in the 2nd quarter year over year, by -4% and -2%, respectively. Sales in the Americas were also down 1%, while the rest of Asia Pacific and Japan increased 13% and 5.6%, respectively. Apple is projecting flat revenue growth of $61-$64 billion for the next quarter (its fiscal 4th quarter). What is perhaps just as relevant as slipping to 4th in smartphone sales is that Apple’s diluted earnings per share actually dropped 7%, despite a massive buyback attack from Apple of $17 billion in share repurchases. Apple has the largest corporate share buyback plan in the U.S. by far, having repurchased $74.2 billion in shares in 2018 and $41 billion already in the first half of this year. The current buyback program authorizes up to $75 billion in share repurchases. The company has $94 billion in cash and marketable securities, and $135 billion in total current assets. So, is Apple’s new strategy to wage war on Huawei through the White House, while repurchasing its own shares to keep investor interest piqued? Or will there be a new exciting product launch on the horizon? In the 3rd quarter 2019 earnings press release Apple CEO Tim Cook promised, “The balance of calendar 2019 will be an exciting period, with major launches on all of our platforms, new services and several new products.” However, since Steve Jobs transitioned, the business strategy has been built more on political warfare and financial engineering than innovation. Apple’s Chief Design Officer Sir Jonathan Ive, the creative technological mind behind the Mac and the iPhone, left the company to launch his own on June 27, 2019. However, Apple will remain one of the new company’s primary clients, according to both Jony Ives and Tim Cook. With 17% of Apple’s revenue coming from Greater China and 22% coming from Europe, Apple can’t afford to continue to lose market share in these countries. The tariffs and trade wars exacerbate the problem in these regions, while the Huawei ban should help Apple sales in Japan, the U.S. and Australia. A weaker yuan and stronger dollar mean that Apple’s already pricey products become unaffordable in China and Europe – even more so when compared to the prices of Huawei and Oppo. A general anti-White House sentiment in China doesn’t help. Tariffs and trade wars, and the fallout of this strategy, are problems that the White House can’t blame on the Federal Reserve. Apple can afford to keep its share price afloat with share repurchases this year. However, declining sales will send a message to Wall Street that could taint investor appetite, particularly if Apple misses its revenue target in the fiscal 4th quarter of this year. That report won’t be released until the first week of November… If you'd like to learn time-proven strategies that earned gains in the last two recessions and have outperformed the bull markets in between, join me at my Wild West Investor Educational Retreat this Oct. 19-21, 2019. Click on the flyer link below for additional information, including the 15+ things you'll learn and VIP testimonials. Register for the Florida Feb. 8-10, 2020 Retreat by Sept. 30, 2019 to receive the best price and a complimentary private prosperity coaching session (value $300). Call 310-430-2397 or email [email protected] to learn more now. I'm also offering an unbiased 2nd opinion on your current retirement plan. If you're worried that you have too much Apple in your portfolio, or would like to be sure that you are safe and properly diversified, then call 310.430.2397 or email [email protected] for pricing and information. Other Blogs of Interest Will the Dow Hit 30,000? A Check Up on the Economy Red Flags in the Boeing 2Q 2019 Earnings Report The Weakening Economy. Think Capture Gains, Not Stop Losses. Buy and Hold Works. Right? Wall Street Secrets Your Broker Isn't Telling You. Unaffordability: The Unspoken Housing Crisis in America. Are You Being Pressured to Buy a Home or Stocks? What's Your Exit Strategy? Will the Feds Lower Interest Rates on June 19, 2019? Should You Buy Tesla at a 2 1/2 Year Low? It's Time To Do Your Annual Rebalancing. Cannabis Crashes. Should You Get High Again? Are You Suffering From Buy High, Sell Low Mentality? Financial Engineering is Not Real Growth The Zoom IPO. 10 Rally Killers. Fix the Roof While the Sun is Shining. Uber vs. Lyft. Which IPO Will Drive Returns? Boeing Cuts 737 Production by 20%. Tesla Delivery Data Disappoints. Stock Tanks. Why Did Wells Fargo's CEO Get the Boot? Earth Gratitude This Earth Day. Real Estate is Back to an All-Time High. Is the Spring Rally Over? The Lyft IPO Hits Wall Street. Should you take a ride? Cannabis Doubles. Did you miss the party? 12 Investing Mistakes Drowning in Debt? Get Solutions. What's Hot in 2019? The Debt Ceiling Was Hit (Again) on March 1, 2019. How Bad Will the GDP Report Be? 2019 Investor IQ Test The State of the Union CBD Oil for Sale. The High Cost of Free Advice. Apple's Real Problem in China: Huawei. 2019 Crystal Ball. 2018 is the Worst December Ever. Will the Feds Raise Interest Rates? Should They? Learn what you're not being told in the MSM. Why FANG, Banks and Your Value Funds Are in Trouble. When the Santa Rally is a Loser, the Next Year is a Bigger Loser. Russia Dumps Treasuries and Buys Gold OPEC and Russia Cut Oil Production. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable however NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors.

tom

16/10/2019 12:03:20 am

l would like advice 16/10/2019 12:14:50 pm

Dear Tom, Please feel free to call our office at 310-430-2397. You can also email info @ NataliePace.com. You can access other blogs at https://www.nataliepace.com/blog. You can get links to Natalie Pace's bestselling books and life transformational retreats at https://www.nataliepace.com. 16/10/2019 07:38:54 am

This is quite a remarkable message, it sounds quite interesting, huh, I don't know what will happen next. 7/11/2019 09:49:59 am

I wonder why Apple sitll doesn't have store in Vietnam while the sale in VN is always higher than other countries? The Apple's sale can be higher than in Singapore or Thailand as Vietnamese is willing to pay for newest model from Apple 26/6/2021 02:31:19 am

Thank you so much for sharing such an intresting blog with us. Visit OGEN Infosystem for creative website designing, Mobile App Development, SEO, Digital Marketing, & PPC Services at an affordable price. 1/9/2021 05:42:48 am

Excellent article! Your post is essential today. Thanks for sharing, by the way. 29/9/2022 11:00:39 pm

Comments are closed.

|

AuthorNatalie Pace is the co-creator of the Earth Gratitude Project and the author of The Power of 8 Billion: It's Up to Us, The ABCs of Money, The ABCs of Money for College, The Gratitude Game and Put Your Money Where Your Heart Is. She is a repeat guest & speaker on national news shows and stages. She has been ranked the No. 1 stock picker, above over 830 A-list pundits, by an independent tracking agency, and has been saving homes and nest eggs since 1999. Archives

July 2024

Categories |

RSS Feed

RSS Feed