|

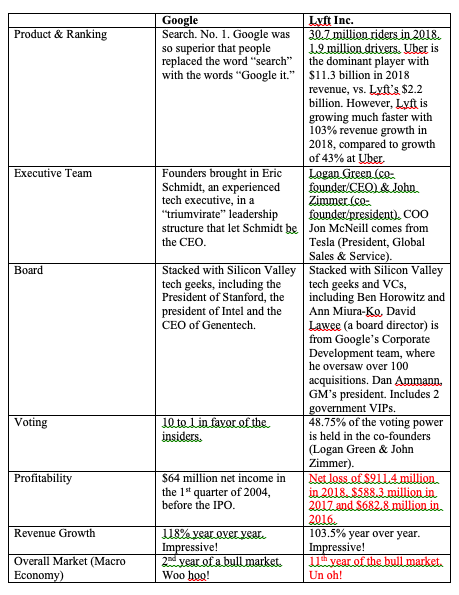

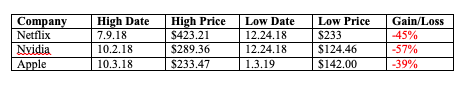

The long-anticipated Lyft IPO is ready to drive onto the NASDAQ stock exchange, (with the symbol LYFT). Should you catch a ride? To put the LYFT IPO into better perspective, I lined up some of the key metrics alongside another highly anticipated IPO of yesteryear, Google. Google went on to become an $826 billion company (now called Alphabet Inc.). Can Lyft support a market value of $18.5 billion? Should you invest once it hits the big boards, which is expected to be as early as next week? As you can see in the above chart, Lyft comes with an impressive line-up. Growth is astounding. The leadership is top-tier. Perhaps my favorite fact about Logan Green and John Zimmer is that their passion for the company was born in statistical data that there were too many single-occupant vehicles on the road. Lyft’s vision is to “improve people’s lives with the best transportation.” They were early in the e-scooter space, and are investing heavily in autonomous vehicles. The problems with the IPO relate solely to profitability and the macro economy. Lyft has been cash negative for three years now, with losses of almost a billion in 2018 ($911.4 million). We’ve gotten accustomed to companies losing a lot of money or carrying a very high price-to-earnings ratio. This is largely because it is very cheap for businesses to borrow money. Banks are willing to take on a lot of risk to keeping loaning companies money, so that they can rack up the fees for their own quarterly earnings. However, with an economy that is expected to slow down to 0.4-1.4% in the 1st quarter of 2019, pricey valuations can be very risky. When investors get skittish about valuation, even companies that are experiencing great growth and enormous market share can lose a lot of value very rapidly. It’s possible that the hype and potential of Lyft could lift the share price up next week when it begins trading. However, a tepid 1st quarter GDP report on April 26, 2019, which many fund managers are expecting now, could also make any lift short-term. The macro economy sobered up the valuations of other rock star companies like Netflix and Nvidia in December 2018, and it is very possible that it could do the same with Lyft in late April. Lyft is a great company that is disrupting old-school transportation. The trends, revenue growth and leadership team are all in the company’s favor. However, the macro economy winds are in the company’s face. As the landscape changes rapidly, time proven systems will be your ally. Join me at my Colorado Investor Edu Retreat, where we’ll examine how to invest profitably in Lyft, cannabis, and many more high growth opportunities in far greater detail. Call 310-430-2397 or email info @ NataliePace.com to learn more! Other Blogs of Interest Cannabis Doubles. Did you miss the party? 12 Investing Mistakes Drowning in Debt? Get Solutions. What Hot in 2019? The Debt Ceiling Was Hit (Again) on March 1, 2019. How Bad Will the GDP Report Be? 2019 Investor IQ Test The State of the Union CBD Oil for Sale. The High Cost of Free Advice. Apple's Real Problem in China: Huawei. 2019 Crystal Ball. 2018 is the Worst December Ever. Will the Feds Raise Interest Rates? Should They? Learn what you're not being told in the MSM. Why FANG, Banks and Your Value Funds Are in Trouble. When the Santa Rally is a Loser, the Next Year is a Bigger Loser. Russia Dumps Treasuries and Buys Gold OPEC and Russia Cut Oil Production. Trade Deficit Hits an All-Time High. Wall Street Plunges 800 Points. How to Protect Yourself. Rebalance and Get Safe in December. Here's Why. The Best Investment Decision I Ever Made. What's Safe for Your Cash? FDIC? SIPC? Money Markets? Under the Mattress? The Real Reason Stocks Fell 602 Points on Veterans Day 2018. Will Ford Bonds Be Downgraded to Junk? 6 Risky Investments. 12 Red Flags. 1 Easy Way to Know Whom to Trust With Your Money. Whom Can You Trust? Trust Results. October Wipes Out 2018 Gains. Will There Be a Santa Rally in 2018? The Dow Dropped 832 Points. What Happened? Bonds are In Trouble. Learn 5 Ways to Protect Yourself. Interest Rates Projected to Double by 2020. 5 Warning Signs of a Recession. How a Strong GDP Report Can Go Wrong. Should I Invest in Ford and General Electric? Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable however NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors. 21/3/2019 04:12:10 am

Since I didn't penetrate the world of stock market, and I don't have an extensive knowledge about that I am quite hesitant if there is something I can share or not. But if the arrival of Lyft IPO is ready to drive onto the NASDAQ stock exchange, then that may be a good news for them, especially for the people who work in stock market! I m always curious on how things work on their field. It's just that it's too complicated for me and I am afraid I might screw up in the middle of all processes. Comments are closed.

|

AuthorNatalie Pace is the co-creator of the Earth Gratitude Project and the author of The Power of 8 Billion: It's Up to Us, The ABCs of Money, The ABCs of Money for College, The Gratitude Game and Put Your Money Where Your Heart Is. She is a repeat guest & speaker on national news shows and stages. She has been ranked the No. 1 stock picker, above over 830 A-list pundits, by an independent tracking agency, and has been saving homes and nest eggs since 1999. Archives

July 2024

Categories |

RSS Feed

RSS Feed