|

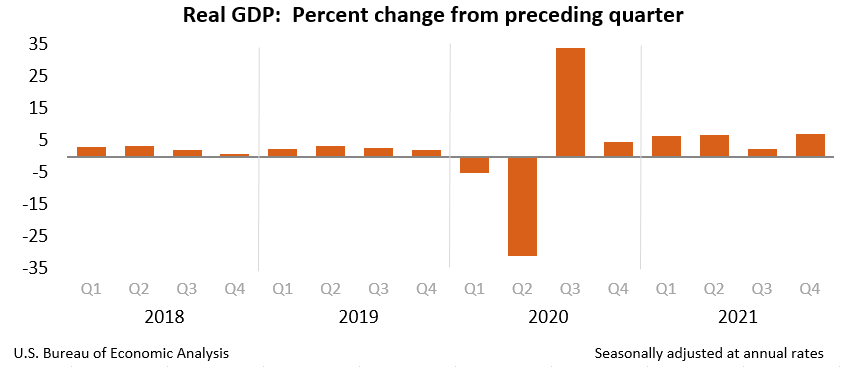

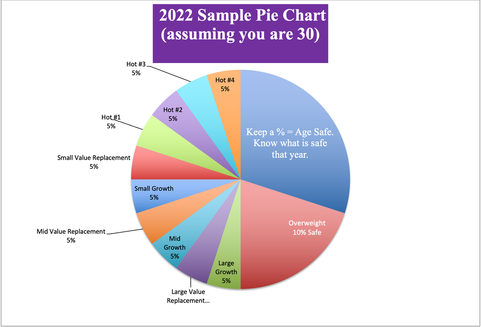

The 1Q 2022 GDP report will be released tomorrow morning at 8:30 am ET. Last year’s 1Q was an outstanding 6.3%. This year is predicted to be a barely-breathing 0.4% (source: GDPNow). If the number is negative, Thursday could be a blood bath on Wall Street. The low expectations are one of the biggest reasons why the S&P500 is already down -12% year to date. There are at least 6 other concerns that are also weighing on wealth. If you haven’t already read my blog “Recession Risks in 6 Charts,” click to access. Have You Lost More Than 6%? Here’s an important equation to factor in. The S&P500 is down -12%. However, if you’re 50 and you have a properly protected and diversified plan, then you should only be down about -4%. If you are over 30 and your losses are more than -6% total, then that is a giant red flag that your wealth plan is not properly protected and diversified. As you can see in the sample pie chart below, we began overweighting 20% safe in January of 2022, and actively encouraged everyone to rebalance (take profits) at the end of December 2021. The all-time high of the S&P500 was on January 4, 2022. I first announced the overweighting in my December 1, 201 blog. (It’s a good idea to follow my Twitter feed, which is conveniently located on the home page at NataliePace.com, to ensure that you don’t miss important emails of this nature.) If you haven’t already subscribed to my YouTube.com/NataliePace channel, you might be missing out on my free videoconferenes and webinars. 2021 was a gangbuster year of 5.7% GDP growth – largely as a robust recovery from the pandemic recession. 2022 faces inflation, rising interest rates, war, leverage, elevated equity prices, churn and an inverted yield curve. The forecast is for 2.8% GDP growth in 2022. Losses Yesterday Tesla is down 30% from its 52-week high. The company lost -12% (about $121/share) yesterday, and has clawed back about 3% of the losses today. AMD is down 48% year to date. The company dropped 6% yesterday. Both Tesla and AMD are still experiencing impressive revenue growth at 80% and 50% respectively. (AMD is projecting 45% revenue growth in the 1st quarter. Earnings will be released on May 3, 2022 after the markets close.) So, what gives? Expensive stock prices. Even with the share price pullbacks, Tesla’s P/E is 118 and AMD’s is 33. The historic average of P/Es is about 17. Yes, growth companies can take a higher P/E. However, as we’ve been highlighting, stock prices entered the nethersphere in 2021. Why did Google Drop Yesterday? Alphabet (Google) announced earnings yesterday. The company is still growing revenue, with $68 billion being 23% higher than the same quarter in 2021. However, net income dropped -8.3%, to $16.436 billion. There’s nothing disastrous about this – if the P/E weren’t 22, and if there weren’t so many headwinds impacting the outlook for the 2nd quarter, including foreign exchange rates (a stronger dollar), the war in Ukraine, a suspension of activities in Russia and a “tough comp” compared to a robust 2Q in 2021. Alphabet shares were down 6% yesterday, including after-hours trading (after the earnings report and call took place). Microsoft was a bright spot. After dropping 3.74% before the earnings report, investors raced back in for 4.51% gains in after-hours trading. Microsoft saw an increase in revenue of 18% to $49.4 billion in the last quarter. GAAP net income also increased to $16.7 billion (up 8%). The company is projecting a solid next quarter, even with the challenges of mark-to-market adjustments for their equity investments (potential losses), a rise in COVID cases in China (production and supply disruptions, particularly for OEM, Surface, and Xbox consoles), FX headwinds and a 1% impact on suspension of new business in Russia. Microsoft’s P/E is also inflated at 30. However, the company’s share repurchases continue to be robust, with $23.9 billion invested in buybacks over the past nine months ($8.8 billion in the most recent quarter). Email [email protected] if you’d like a Big Tech Stock Report Card. It’s Easy to Make Money in a Bull Market Recessions tell us who has been swimming naked, as Warren Buffett is fond of saying. Do you have your swimming suit on? Are you properly protected and diversified? Now is the time to know what you own and to be the boss of your money. Today’s rally might bring a little hope to Buy & Hope investors. However, it’s better to have wisdom and time-proven strategies underpinning your wealth plan, rather than rely upon blind faith that someone else is protecting you – particularly when the longest bull market in history is trending in the opposite direction. If you'd like to learn 21st Century time-proven investing strategies to protect your wealth from a No. 1 stock picker, join us for our June 10-12, 2022 retreat. Email [email protected] or call 310-430-2397 to learn more and to register. Click on the banner ad below to discover the 18+ strategies you'll learn and master.  Join us for our Financial Freedom Retreat. June 10-12, 2022. Email [email protected] to learn more. Register by April 30, 2022 to receive the best price. Click for testimonials & details.  Natalie Wynne Pace is an Advocate for Sustainability, Financial Literacy & Women's Empowerment. Natalie is the bestselling author of The Power of 8 Billion: It's Up to Us and is the co-creator of the Earth Gratitude Project. She has been ranked as a No. 1 stock picker, above over 835 A-list pundits, by an independent tracking agency (TipsTraders). Her book The ABCs of Money remained at or near the #1 Investing Basics e-book on Amazon for over 3 years (in its vertical), with over 120,000 downloads and a mean 5-star ranking. The 5th edition of The ABCs of Money was released on September 17, 2021. Natalie Pace's easy as a pie chart nest egg strategies earned gains in the last two recessions and have outperformed the bull markets in between. That is why her Investor Educational Retreats, books and private coaching are enthusiastically recommended by Nobel Prize winning economist Gary S. Becker, TD AMERITRADE chairman Joe Moglia, Kay Koplovitz and many Main Street investors who have transformed their lives using her Thrive Budget and investing strategies. Click to view a video testimonial from Nilo Bolden. Other Blogs of Interest The Dow Dropped 2000 Points. Is Plant-Based Protein Dying? Should You Sell in April? The U.S. House Decriminalizes Cannabis Again. Chinese Electric Vehicle Market Share Hits 20%. The Risk of Recession in 6 Charts. High Gas Prices How Will Russian Boycotts Effect U.S. Multinational Companies? Oil and Gas Trends During Wartime Russia Invades Ukraine. How Have Stocks Responded in Past Wars? Zombie Companies. Rescue, Rehab or Liquidate? Spotify: Music to my Ears. Cannabis Crashes. 2022 Crystal Ball in Stocks, Real Estate, Crypto, Cannabis, Gold, Silver & More. Interview with the Chief Investment Strategist of Charles Schwab & Co., Inc. Stocks Enter a Correction Investor IQ Test Investor IQ Test Answers Real Estate Risks. What Happened to Ark, Cloudflare, Bitcoin and the Meme Stocks? Omicron is Not the Only Problem From FAANNG to ZANA MAD MAAX Ted Lasso vs. Squid Game. Who Will Win the Streaming Wars? Starbucks. McDonald's. The Real Cost of Disposable Fast Food. The Plant-Based Protein Fire-Sale What's Safe in a Debt World? Inflation, Gasoline Prices & Recessions China: GDP Soars. Share Prices Sink. The Competition Heats Up for Tesla & Nio. How Green in Your Love for the Planet? S&P500 Hits a New High. GDP Should be 7% in 2021! Will Work-From-Home and EVs Destroy the Oil Industry? Insurance and Hedge Funds are at Risk and Over-Leveraged. Office Buildings are Still Ghost Towns. Money Market Funds, FDIC, SIPC: Are Any of Them Safe? My 24-Year-Old is Itching to Buy a Condo. Should I Help Him? The 12-Step Guide to Successful Investing. Gardeners Creating Sanctuary & Solutions in Food Deserts. 2021 Company of the Year Almost 5 Million Americans are Behind on Rent & Mortgage. Real Estate Hits All-Time High. Rebalancing Your Nest Egg IQ Test. Answers to the Rebalancing Your Nest Egg IQ Test. Videoconferencing in a Post-Pandemic World (featuring Zoom & Teladoc). Sanctuary Sandwich Home. Multigenerational Housing. Interview with Lawrence Yun, the chief economist of the National Association of Realtors. 10 Budget Leaks That Cost $10,000 or More Each Year. The Stimulus Check. Party Like It's 1999. Would You Pay $50 for a Cafe Latte? Is Your Tesla Stock Overpriced? 10 Questions for College Success. Is FDIC-Insured Cash at Risk of a Bank Bail-in Plan? 8 Money Myths, Money Pits, Scams and Conspiracy Theories. Why Are My Bonds Losing Money? The Bank Bail-in Plan on Your Dime. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable. However, NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors. The Dow Jones Industrial Average has dropped almost 2000 points since Thursday. The S&P500 is down 12.1% on the year. Are There More Losses to Come? Based on the last three recessions and the current economic trends, yes, there could be more pain to come. The S&P500 dropped about 38% in one month in 2020. The Dow Jones Industrial Average dropped 55% in the Great Recession. The NASDAQ Composite Index plunged up to 78% in the Dot Com Recession. Source: MSN.com. (c) Microsoft. Are We in a Recession? Not yet. However, experts, including Goldman Sachs, have put the possibility of a recession in the next two years at 35-40%. Should We Just Buy and Hold? That worked pretty well in the pandemic. However, that was an anomaly. The U.S. had a debt ceiling suspension which allowed the Treasury Department to print up $5 trillion and give away free money to a lot of people, and pad corporate coffers with cash. On September 30, 2019, U.S. public debt was $22.7 trillion. By September 30, 2021, the public debt had soared to $28.4 trillion. As of April 25, 2022, public debt was at $30.4 trillion, with a cap of $31.4 trillion. That limits the ability of the Treasury to send out “Stimmy” checks to keep stocks and bonds artificially buoyant. Borrowing rates were historically low during the pandemic. With interest rates rising, high debt levels, elevated asset prices, inflation, war, expensive gasoline and an inverted yield curve, there are many signals that a recession is on its way. Recessions are usually preceded by stock market downturns. You can check out my blog “Risks of a Recession in 6 Charts” for additional data and information. Buy and Hold investors had to wait 15 years for the NASDAQ to crawl back to even. During the Great Recession the wait time while your wealth was underwater was almost 6 years. Riding that kind of Wall Street roller coaster, and using the bull market to crawl back to even, can be disastrous. It tanks your credit score, drains your liquidity and could cost you your home. How Can You Protect Yourself? Below are just a few important things to take action on now, with regard to your nest egg (your liquid assets).

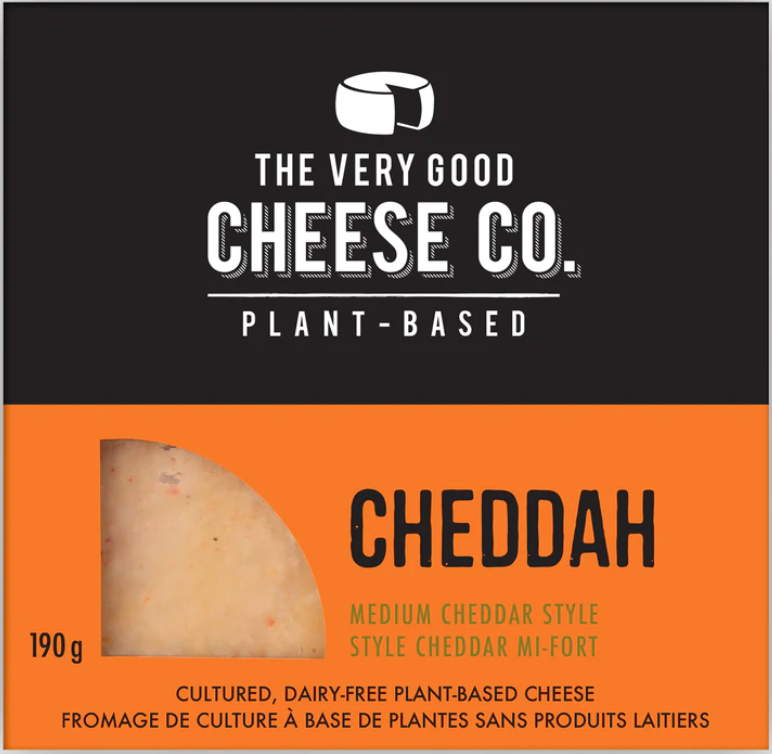

If you aren’t sure how to ensure that a Wealth Protection Plan is in place, then consider some of the tools below to help. How Can You Be the Boss of Your Money?

If You Wait for the Headlines, It Will Be Too Late It’s tempting to wait and see. However, if you wait for the headlines that the economy is in a recession, or to learn that the stock market has plunged by 50% or more, it’s too late to protect your wealth. You’ll then be in a position of having to hope and pray that you make up losses. So, now is the time to get educated, get protected, be the boss of your money and adopt time-proven, 21st Century strategies. (Again, Buy & Hope worked well in the last century, but has been a disaster in 21st Century recessions.) Now is the time to know what you own and why. If you'd like to learn 21st Century time-proven investing strategies to protect your wealth, or how to pick stocks from a No. 1 stock picker, join us for our June 10-12, 2022 retreat. Email [email protected] or call 310-430-2397 to learn more and to register. Click on the banner ad below to discover the 18+ strategies you'll learn and master.  Join us for our Financial Freedom Retreat. June 10-12, 2022. Email [email protected] to learn more. Register by April 30, 2022 to receive the best price. Click for testimonials & details.  Natalie Wynne Pace is an Advocate for Sustainability, Financial Literacy & Women's Empowerment. Natalie is the bestselling author of The Power of 8 Billion: It's Up to Us and is the co-creator of the Earth Gratitude Project. She has been ranked as a No. 1 stock picker, above over 835 A-list pundits, by an independent tracking agency (TipsTraders). Her book The ABCs of Money remained at or near the #1 Investing Basics e-book on Amazon for over 3 years (in its vertical), with over 120,000 downloads and a mean 5-star ranking. The 5th edition of The ABCs of Money was released on September 17, 2021. Natalie Pace's easy as a pie chart nest egg strategies earned gains in the last two recessions and have outperformed the bull markets in between. That is why her Investor Educational Retreats, books and private coaching are enthusiastically recommended by Nobel Prize winning economist Gary S. Becker, TD AMERITRADE chairman Joe Moglia, Kay Koplovitz and many Main Street investors who have transformed their lives using her Thrive Budget and investing strategies. Click to view a video testimonial from Nilo Bolden. Other Blogs of Interest Is Plant-Based Protein Dying? Should You Sell in April? The U.S. House Decriminalizes Cannabis Again. Chinese Electric Vehicle Market Share Hits 20%. The Risk of Recession in 6 Charts. High Gas Prices How Will Russian Boycotts Effect U.S. Multinational Companies? Oil and Gas Trends During Wartime Russia Invades Ukraine. How Have Stocks Responded in Past Wars? Zombie Companies. Rescue, Rehab or Liquidate? Spotify: Music to my Ears. Cannabis Crashes. 2022 Crystal Ball in Stocks, Real Estate, Crypto, Cannabis, Gold, Silver & More. Interview with the Chief Investment Strategist of Charles Schwab & Co., Inc. Stocks Enter a Correction Investor IQ Test Investor IQ Test Answers Real Estate Risks. What Happened to Ark, Cloudflare, Bitcoin and the Meme Stocks? Omicron is Not the Only Problem From FAANNG to ZANA MAD MAAX Ted Lasso vs. Squid Game. Who Will Win the Streaming Wars? Starbucks. McDonald's. The Real Cost of Disposable Fast Food. The Plant-Based Protein Fire-Sale What's Safe in a Debt World? Inflation, Gasoline Prices & Recessions China: GDP Soars. Share Prices Sink. The Competition Heats Up for Tesla & Nio. How Green in Your Love for the Planet? S&P500 Hits a New High. GDP Should be 7% in 2021! Will Work-From-Home and EVs Destroy the Oil Industry? Insurance and Hedge Funds are at Risk and Over-Leveraged. Office Buildings are Still Ghost Towns. Money Market Funds, FDIC, SIPC: Are Any of Them Safe? My 24-Year-Old is Itching to Buy a Condo. Should I Help Him? The 12-Step Guide to Successful Investing. Gardeners Creating Sanctuary & Solutions in Food Deserts. 2021 Company of the Year Almost 5 Million Americans are Behind on Rent & Mortgage. Real Estate Hits All-Time High. Rebalancing Your Nest Egg IQ Test. Answers to the Rebalancing Your Nest Egg IQ Test. Videoconferencing in a Post-Pandemic World (featuring Zoom & Teladoc). Sanctuary Sandwich Home. Multigenerational Housing. Interview with Lawrence Yun, the chief economist of the National Association of Realtors. 10 Budget Leaks That Cost $10,000 or More Each Year. The Stimulus Check. Party Like It's 1999. Would You Pay $50 for a Cafe Latte? Is Your Tesla Stock Overpriced? 10 Questions for College Success. Is FDIC-Insured Cash at Risk of a Bank Bail-in Plan? 8 Money Myths, Money Pits, Scams and Conspiracy Theories. Why Are My Bonds Losing Money? The Bank Bail-in Plan on Your Dime. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable. However, NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors. According to ResearchandMarkets.com, the plant-based protein market was $13.18 billion in 2021. It is expected to grow to $14.58 billion in 2022 (+10.8%) and reach $21.29 billion in 2026 (9.9% CAGR). Of course, if Meatless Monday takes hold in the hinterlands, things could escalate even faster. There is an environmental push for this to occur. So, if the future for plant-based protein is so bright, why are investors so disenchanted? Beyond Meat (symbol: BYND), the Very Good Food Company (symbol: VGFC) and Oatly (symbol: OTLY) are trading near all-time lows. Former meme stock darling the Very Good Food Company hit a low of 34 cents this week, after canning their CEO and Chief Product and Research Officer. These kind of routs leave a bad taste in your mouth. However, do delicious returns lie ahead? Churn It’s important to realize that part of the issue is churn – wild Wall Street rides that were quite common last year. Even before Russia invaded Ukraine, we were seeing unprecedented levels of volatility. As Liz Ann Sonders, the Chief Investment Strategist of Charles Schwab, revealed in our conversation in January of this year, “More than 90% of the NASDAQ’s members had at least a 10% correction at some point in 2021. The average maximum drawdown last year was -43% across all 3648 stocks. As of the first few weeks of 2022, 45% of NASDAQ stocks were down at least -50% from their 52-week highs.” You can watch my entire conversation with her on YouTube.com/NataliePace. What is going on? Money is very hot and fast. Everybody is trying to get rich quick. Meme stocks shoot the moon posting astronomical gains, and then just as suddenly crash down to Earth again. We’ve seen it happen with the cannabis stocks. We’ve seen it happen with GameStop and AMC. And we certainly are seeing it happen with the young plant-based protein companies. Beyond Meat Why is Beyond Meat trading near an all-time low? During the pandemic, Beyond Meat benefited from a shortage of animal-based protein products and stockpiling fever. However, last year, retail sales slumped by -19.5% in the U.S., with year-over-year revenue down -1.2%. Some of this had to do with less interest in plant-based products, as well as robust competition in the space. Beyond Meat’s president and CEO Ethan Brown believes there are “sporadic yet promising signs of a resumption of growth in U.S. retail.” Beyond Meat retained the title of the No. 1 brand in the category of refrigerated plant-based meats. While retail was weak, foodservice was up 35-36% both nationally and internationally. Beyond Meat has Beyond™ The Original Orange Chicken™ at Panda Express, Beyond Meat Nuggets at all A&W Canada stores nationwide and Beyond Fried Chicken® at KFC locations throughout the US. McDonald’s McPlant partnership with Beyond Meat is being tested in San Francisco and Dallas. In the coming weeks, we’ll learn more about Beyond Meat’s PLANeT partnership and products with Pepsico. On April 6, 2022, Beyond Meat announced that they are now offering burgers and meatballs in Rite Aid stores. I did a spot check when I was passing through Davis, California, and the products were in the store there. The question is, “How popular will these products be?” Beyond Chicken Tenders are expanding their retail footprint into 8000 new U.S. stores, including Albertson’s, CVS, Sprouts and Whole Foods. Beyond Chicken Tenders were awarded a FABI Best New Product Innovation Award in 2021. The company is still in expansion-mode, with losses of -$182.1 million in 2021. There is plenty of room on the runway, with $733.3 million cash on hand and $1.1 billion in debt. Two former Tyson executives were hired in December of 2021 with the goal of streamlining costs and operations. The company will continue to face cashflow headwinds in the first quarter of 2022 with transportation costs and high productions costs, particularly for newer product offerings. The 1Q 2022 earnings report should be released mid-May. The Very Good Food Company The Very Good Food Company is definitely having growing pangs. The fourth-quarter revenue grew 70% year-over-year. However, the founder CEO Mitchell Scott and Chief Research and Development Officer James Davison got the boot on April 4, 2022. The company hasn’t provided much color on the termination. However, it likely has to do with the fact that these founders left the Very Good Food Company with only 3 to 5 months of run-time on their cash, while taking out personal loans. You always want to stockpile the treasury before you get that close to flying in the trees, and you definitely shouldn’t be depleting it by using it as your own parachute. The new Executive Committee hasn’t provided a lot of details on how they’ll improve the cash-flow situation. However, both debt and equity are on the table. They also believe that organic growth will get them back into compliance with the NASDAQ requirement of having their share price over $1.00, which must be done by July 10, 2022 (unless the period is extended). While VGFC is out of favor with investors, their year-over-year sales growth and rave reviews of their flagship restaurant in Victoria, BC, show that customers are still fans. Mmm Meatballs were nominated for a NEXTY Award in the Best New Frozen Product category, but lost to the Plant-Based Seafood Co. In the April 14, 2022 VGFC earnings call, in response to a question as to why the Very Good Food Company had not yet landed a “major grocery deal,” Kevin Callaghan (VP, Sales, North America) reported that he’s excited to announce some new partnerships in retail very soon. VGFC is currently available at Erewhon and 1,651 other stores in North America. According to Callaghan, U.S. retail is a focus for the company in 2022. With annual sales of $12.3 million, which increased 164% in 2021, the current price to sales ratio is just 3.8 for The Very Good Food Company, compared to 5.88 for Beyond Meat. If the popularity of their products continues to work in their favor, then bargain hunting investors could be rewarded. However, it’s certainly high risk. The Very Good Food Company must raise capital or they’ll run into very serious problems, which could impede their progress into U.S. retail. The 1Q 2022 earnings report should be released at the end of May. Bottom Line Plant-based protein just wasn’t as popular in 2021 as it was in the pandemic, when animal protein products experienced COVID-related production bottlenecks. The vertical is still predicted to be one of the bright spots going forward, however. Competition is certainly heating up, with even the old-school food companies like Kellogg, Conagra and Tyson Foods offering their own versions of plant-protein products. However, sometimes when a company’s share price has been hammered, and good news shows up, there can be a delightful resurgence in the share price. If you have an appetite for risk, the leading plant-based protein companies, like Beyond Meat, Oatly and The Very Good Food Company might be on your menu, even though the general market place is tightening up for all the reasons outlined in my 6 Red Flags of a Recession blog. Full disclosure. I own shares in Beyond Meat and The Very Good Food Company. If you'd like to learn 21st Century time-proven investing strategies to protect your wealth, or how to pick stocks from a No. 1 stock picker, join us for our June 10-12, 2022 retreat. Email [email protected] or call 310-430-2397 to learn more and to register. Click on the banner ad below to discover the 18+ strategies you'll learn and master.  Join us for our Financial Freedom Retreat. June 10-12, 2022. Email [email protected] to learn more. Register by April 30, 2022 to receive the best price. Click for testimonials & details.  Natalie Wynne Pace is an Advocate for Sustainability, Financial Literacy & Women's Empowerment. Natalie is the bestselling author of The Power of 8 Billion: It's Up to Us and is the co-creator of the Earth Gratitude Project. She has been ranked as a No. 1 stock picker, above over 835 A-list pundits, by an independent tracking agency (TipsTraders). Her book The ABCs of Money remained at or near the #1 Investing Basics e-book on Amazon for over 3 years (in its vertical), with over 120,000 downloads and a mean 5-star ranking. The 5th edition of The ABCs of Money was released on September 17, 2021. Natalie Pace's easy as a pie chart nest egg strategies earned gains in the last two recessions and have outperformed the bull markets in between. That is why her Investor Educational Retreats, books and private coaching are enthusiastically recommended by Nobel Prize winning economist Gary S. Becker, TD AMERITRADE chairman Joe Moglia, Kay Koplovitz and many Main Street investors who have transformed their lives using her Thrive Budget and investing strategies. Click to view a video testimonial from Nilo Bolden. Other Blogs of Interest

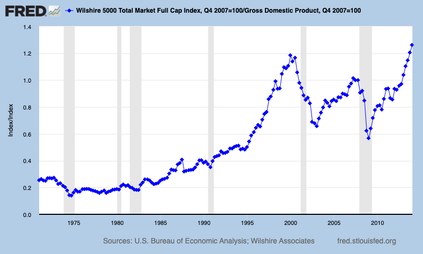

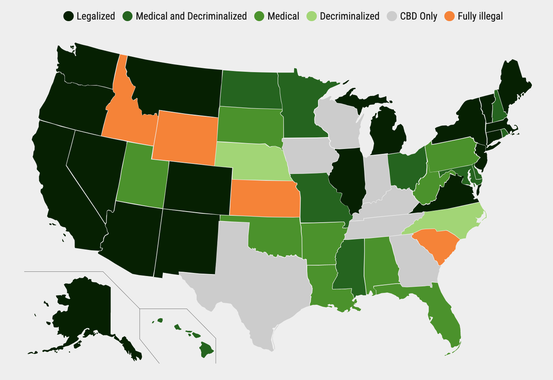

Should You Sell in April? The U.S. House Decriminalizes Cannabis Again. Chinese Electric Vehicle Market Share Hits 20%. The Risk of Recession in 6 Charts. High Gas Prices How Will Russian Boycotts Effect U.S. Multinational Companies? Oil and Gas Trends During Wartime Russia Invades Ukraine. How Have Stocks Responded in Past Wars? Zombie Companies. Rescue, Rehab or Liquidate? Spotify: Music to my Ears. Cannabis Crashes. 2022 Crystal Ball in Stocks, Real Estate, Crypto, Cannabis, Gold, Silver & More. Interview with the Chief Investment Strategist of Charles Schwab & Co., Inc. Stocks Enter a Correction Investor IQ Test Investor IQ Test Answers Real Estate Risks. What Happened to Ark, Cloudflare, Bitcoin and the Meme Stocks? Omicron is Not the Only Problem From FAANNG to ZANA MAD MAAX Ted Lasso vs. Squid Game. Who Will Win the Streaming Wars? Starbucks. McDonald's. The Real Cost of Disposable Fast Food. The Plant-Based Protein Fire-Sale What's Safe in a Debt World? Inflation, Gasoline Prices & Recessions China: GDP Soars. Share Prices Sink. The Competition Heats Up for Tesla & Nio. How Green in Your Love for the Planet? S&P500 Hits a New High. GDP Should be 7% in 2021! Will Work-From-Home and EVs Destroy the Oil Industry? Insurance and Hedge Funds are at Risk and Over-Leveraged. Office Buildings are Still Ghost Towns. Money Market Funds, FDIC, SIPC: Are Any of Them Safe? My 24-Year-Old is Itching to Buy a Condo. Should I Help Him? The 12-Step Guide to Successful Investing. Gardeners Creating Sanctuary & Solutions in Food Deserts. 2021 Company of the Year Almost 5 Million Americans are Behind on Rent & Mortgage. Real Estate Hits All-Time High. Rebalancing Your Nest Egg IQ Test. Answers to the Rebalancing Your Nest Egg IQ Test. Videoconferencing in a Post-Pandemic World (featuring Zoom & Teladoc). Sanctuary Sandwich Home. Multigenerational Housing. Interview with Lawrence Yun, the chief economist of the National Association of Realtors. 10 Budget Leaks That Cost $10,000 or More Each Year. The Stimulus Check. Party Like It's 1999. Would You Pay $50 for a Cafe Latte? Is Your Tesla Stock Overpriced? 10 Questions for College Success. Is FDIC-Insured Cash at Risk of a Bank Bail-in Plan? 8 Money Myths, Money Pits, Scams and Conspiracy Theories. Why Are My Bonds Losing Money? The Bank Bail-in Plan on Your Dime. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable. However, NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors. Win a Seat at the Retreat Everyone is a winner in our 2022 The Power of 8 Billion: It’s Up to Us Sweepstakes. (See the full list of prizes below.) The Grand prize is a complimentary seat at an Online Financial Empowerment Retreat, valued at $895. Simply email [email protected] with the subject line Power of 8 Billion Sweepstakes! You will be automatically entered to win. If you’d like to up your odds, then write a review of Natalie Pace’s new book, The Power of 8 Billion: It’s Up to Us. Send us a link to your review on Amazon, and we’ll enter you 10 more times in the Sweepstakes. The Kindle version is available for just $2.99. The print edition can be purchased for $11.99. Your review of The Power of 8 Billion: It’s Up to Us is important to us, and even more important for anyone who is interested in climate action. The more you share and review, the greater the chance that this important information gets into the hands of those who can help to heal our planet in time. Act now. Entries must be received by April 22, 2022 (Earth Day). Winners will be notified on or before June 15, 2022. List of Prizes Retreat Seat (value up to $895). ½ off Retreat Seat (value $447.50). 2nd opinion on your current budgeting and investing plan (value up to $1495) Three 50-minute private prosperity coaching sessions (value $900). 50-minute private prosperity coaching session (value $300). Autographed print edition of The Power of 8 Billion: It's Up to Us (priceless) Everyone is a Winner Every person who enters the sweepstakes can choose to receive: 1. A complimentary 21-day Gratitude Game audio program: 21 days to a healthier, wealthier, more beautiful you, and/or 2. A 21-Day Sustainability Videoconference series, where you can learn how to save thousands of dollars annually with smarter big-ticket choices. Thank You! Your presence in our community, with a dedication to financial literacy and sustainability, means the world to us. We work hard to keep you informed and empowered, and you help us to spread the word of this important information. Thank you so much for your review of The Power of 8 Billion: It’s Up to Us! We need your help in getting at least 50 reviews up by Earth Day, and in spreading the word about this important book. You can read the editorial and reader reviews on the Amazon book page. I’ve highlighted just a few below. In the pages of The Power of 8 Billion, Natalie Pace empowers the readers to realize how each one of us can, through deliberate small or big actions, affect the course of the survival of our beautiful Earth. With reverence, gratitude, renewed prayers and conscious actions, we can reverse the crisis we are in. This book will ignite your spark that you can make a difference. Agapi Stassinopoulos, Author of Speaking with Spirit: 52 prayers to guide, uplift and inspire you. Natalie Pace brings a message of utmost importance: that we can only solve today's environmental problems with an attitude of gratitude. A sincere sense of appreciation for what we have is the only path forward to reclaim the beauty of our natural world – not more anger, disappointment or blame. Natalie outlines so many small, practical ways for any individual to act for nature and not against, and references practical, living examples of those who walk, not just talk, the path. My journey started 5 years ago when I bought an acreage in Canada and built an off-grid house, with encouragement from Natalie herself. I am continually inspired by her relentless mission to assail the world with love and gratitude." Alvin Tam, Filmmaker and Off-Grid Adventurer What a phenomenal book. I couldn't put it down, and wanted to keep reading until the end. I read it in one afternoon/evening! The Power of 8 Billion: It's Up to Us is inspiring, engaging and informative. There are so many fantastic ideas in this book that schools can implement. Teachers can use the challenges and facts to teach young people to reduce their carbon emissions, and even achieve carbon zero by 2030. Edd Moore, award-winning environmentalist, eco-coordinator and Level 3 teacher at Damers First School in Poundbury, England This is an amazing book and, in a profound and literal sense, quite empowering. Natalie Pace draws from examples from around the world, of cities, schools, organizations, and especially people who are taking action to move our ways of life in positive directions. Powered by gratitude and the understanding that our small planet – each person – can make a difference, the book is both a manual for action and a reminder that despair and powerlessness are not options, given the stakes we face to preserve the beauty and diversity of all life on Earth. No action is too small; and the great news is that these changes are win-win solutions. They improve the quality of life of each individual, while also contributing to the paradigm shift humanity as a whole needs to make to create the future we want. Mark Nelson, Ph.D., Chairman, Institute of Ecotechnics and a biospherian crew member in Biosphere 2’s first two-year closure experiment. Mark is the author of The Wastewater Gardener: Preserving the Planet One Flush at a Time, Pushing Our Limits: Insights from Biosphere 2, and Life Under Glass: Crucial Lessons in Planetary Stewardship from 2 years in Biosphere 2. Grounded in gratitude, driven by facts, powered by hope. The Power of 8 Billion, by prolific writer, thought leader, advocate and insightful teacher Natalie Pace, offers a solution-based pathway forward into a future of personal and planetary sustainability. This must-read is written by someone who literally walks the path of personal accountability, sustainability, curiosity, and a daily investigation into economic systems, ideals, and ways of living that put health and wellness first. Felicia Tomasko, Editorial Director at Bliss Network and Editor in Chief at LA YOGA Magazine, Faculty Lecturer, Loyola Marymount University Center for Religion and Spirituality. Planet Earth is our home. We have not been respectful. We have not been grateful. We take our beautiful, abundant planet for granted and abuse her. If planet Earth were a human being, most of us, including me, would be jailed for criminal abuse. Natalie Pace brings an acute awareness of the importance of showing gratitude to our planet in this wonderful book. Natalie offers dozens of concrete examples of how we can improve our behavior. It all starts with gratitude and respect. Reading this book and sharing the book widely can be your first step on the amazing journey that awaits us all to become the children and stewards of the Earth we were meant to be. William Gladstone, bestselling author and literary agent As a young person who is passionate about all things eco, I enjoyed reading The Power of 8 Billion: It’s Up to Us because it made me reflect on the power that people can have when we all work together towards a common goal. I really liked Natalie’s suggestions, as they made me think more about what I can do. The book also helps others who want to start their own eco-journey and make the planet a better place to live. Isla Lester, Aged 10, award-winning eco-champion, Jane Goodall’s Roots and Shoots School of the Year 2019, Young Volunteer Award and Green Blue Peter Badge (among others) Progress doesn’t come from focusing on the environmental issues or problems – it comes from awareness that leads to solutions. In The Power of 8 Billion: It's Up to Us, Natalie Pace tells us why gratitude is more important than hope today. We need to act and commit to create a better world for our future generations. Let’s get inspired from the stories, people and organizations that are healing the environment. Sainath & Sai Sahana Manikandan, award-winning student activists, Abu Dhabi Having known Natalie for nearly two decades, there are three things she is obsessively passionate about: the need to protect our environment, the power of gratitude, and helping others achieve and maintain abundance. In this book she breakdowns what is happening, and why and how we can be proactive to shift the tides of change to what we want, instead of what we fear. Brianna Brown Keen, actress, producer, author of Manifesting Your Mission Guidebook, Founder/CEO of the nonprofit The New Hollywood The book The Power of 8 Billion: It’s Up to Us is so important!!! At a time when politicians seem to come up with nothing else but promises, it provides sound information about climate change and clear descriptions how we as citizens can help to address the problem. It provides not only the facts, but also describes how individuals can reduce carbon emissions and climate change. Since both the challenges and solutions are described in an engaging and jargon-free language, it is ideal as a textbook for use in schools, in further education colleges and at universities. Carlo Leifert, Organic farmer and Adjunct Professor, SCU Plant Science, Southern Cross University, Australia. The Retreat Sweepstakes entry period expires April 22, 2022. Anyone who has emailed us on or before April 22, 2022 with The Power of 8 Billion Sweepstakes in the subject line will be entered in the drawing. Winners will be chosen and notified on or before June 15, 2022. There is no cash value for the prizes.  Join us for our Financial Freedom Retreat. June 10-12, 2022. Email [email protected] to learn more. Register by April 30, 2022 to receive the best price. Click for testimonials & details.  About Natalie Pace Natalie Wynne Pace is an Advocate for Sustainability, Financial Literacy & Women's Empowerment. Natalie is the bestselling author of The Power of 8 Billion: It's Up to Us and is the co-creator of the Earth Gratitude Project. She has been ranked as a No. 1 stock picker, above over 835 A-list pundits, by an independent tracking agency (TipsTraders). Her book The ABCs of Money remained at or near the #1 Investing Basics e-book on Amazon for over 3 years (in its vertical), with over 120,000 downloads and a mean 5-star ranking. The 5th edition of The ABCs of Money was released on September 17, 2021. Natalie Pace's easy as a pie chart nest egg strategies earned gains in the last two recessions and have outperformed the bull markets in between. That is why her Investor Educational Retreats, books and private coaching are enthusiastically recommended by Nobel Prize winning economist Gary S. Becker, TD AMERITRADE chairman Joe Moglia, Kay Koplovitz and many Main Street investors who have transformed their lives using her Thrive Budget and investing strategies. Click to view a video testimonial from Nilo Bolden. Other Blogs of Interest Should You Sell in April? The U.S. House Decriminalizes Cannabis Again. Chinese Electric Vehicle Market Share Hits 20%. The Risk of Recession in 6 Charts. High Gas Prices How Will Russian Boycotts Effect U.S. Multinational Companies? Oil and Gas Trends During Wartime Russia Invades Ukraine. How Have Stocks Responded in Past Wars? Zombie Companies. Rescue, Rehab or Liquidate? Spotify: Music to my Ears. Cannabis Crashes. 2022 Crystal Ball in Stocks, Real Estate, Crypto, Cannabis, Gold, Silver & More. Interview with the Chief Investment Strategist of Charles Schwab & Co., Inc. Stocks Enter a Correction Investor IQ Test Investor IQ Test Answers Real Estate Risks. What Happened to Ark, Cloudflare, Bitcoin and the Meme Stocks? Omicron is Not the Only Problem From FAANNG to ZANA MAD MAAX Ted Lasso vs. Squid Game. Who Will Win the Streaming Wars? Starbucks. McDonald's. The Real Cost of Disposable Fast Food. The Plant-Based Protein Fire-Sale What's Safe in a Debt World? Inflation, Gasoline Prices & Recessions China: GDP Soars. Share Prices Sink. The Competition Heats Up for Tesla & Nio. How Green in Your Love for the Planet? S&P500 Hits a New High. GDP Should be 7% in 2021! Will Work-From-Home and EVs Destroy the Oil Industry? Insurance and Hedge Funds are at Risk and Over-Leveraged. Office Buildings are Still Ghost Towns. Money Market Funds, FDIC, SIPC: Are Any of Them Safe? My 24-Year-Old is Itching to Buy a Condo. Should I Help Him? The 12-Step Guide to Successful Investing. Gardeners Creating Sanctuary & Solutions in Food Deserts. 2021 Company of the Year Almost 5 Million Americans are Behind on Rent & Mortgage. Real Estate Hits All-Time High. Rebalancing Your Nest Egg IQ Test. Answers to the Rebalancing Your Nest Egg IQ Test. Videoconferencing in a Post-Pandemic World (featuring Zoom & Teladoc). Sanctuary Sandwich Home. Multigenerational Housing. Interview with Lawrence Yun, the chief economist of the National Association of Realtors. 10 Budget Leaks That Cost $10,000 or More Each Year. The Stimulus Check. Party Like It's 1999. Would You Pay $50 for a Cafe Latte? Is Your Tesla Stock Overpriced? 10 Questions for College Success. Is FDIC-Insured Cash at Risk of a Bank Bail-in Plan? 8 Money Myths, Money Pits, Scams and Conspiracy Theories. Why Are My Bonds Losing Money? The Bank Bail-in Plan on Your Dime. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable. However, NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors. The Wall Street adage is “Sell in May and go away.” However, does it apply during times of war, rising inflation, tightening monetary policy and elevated asset prices? Or should you be doing your rebalancing session now? Last week, I outlined the risk of a recession in 6 charts. (Click to access that blog.) The S&P500 has recovered some of its losses on the year, but is still down -6.9% from the high of 4818.62, set on January 4, 2022. March bloomed with 5.2% returns and April is often sunny on Wall Street. However, stocks have been sliding so far this month. Additionally, there is a 1Q 2022 GDP report waiting in the wings that could overshadow any Spring glee that investors might muster up. According to the Minutes of the Federal Reserve Board’s FOMC meeting March 15-16, 2022, “The first quarter [GDP] pace was slower than the rapid gain posted in the fourth quarter of 2021.” The 4th quarter of 2021 posted GDP growth of 6.9%, with full-year growth of 5.7% in 2021 (source: BEA.gov). That’s the fastest the economy has grown since 1984. You might think, “Well, slower than 6.9% might still be pretty good.” However, according to the FOMC’s Summary of Economic Projections, the 2022 GDP growth is projected to be just 2.8%. GDPNow, offered by the Federal Reserve Bank of Atlanta, warns that the 1st quarter of 2022 might have slowed to just 1.1% GDP growth. Asset valuations are still far too high for that slow of growth. U.S. Prices Are Too High for Slow Growth As you can see from the well-known Buffet Indicator chart (above), equity prices are higher than they have ever been. History teaches us that when valuations get this lofty, the correction can be steep and severe. As one example, the most recent all-time high was February 2020 – right before the 2020 Pandemic Recession. Between February 19 and March 23, 2020, the S&P 500 sank -38%. That was the fastest that a bull market had become a bear. In the Dot Com Recession, which was another period of lofty equity valuations, the NASDAQ Composite Index bottomed out with up to -78% losses. History books can tell you what happened in the Great Depression. Growth is Growth The US is a pretty resilient economy because we are so well-diversified and have so many leading industries that we’ve invested in over the years, including technology, biotechnology, electric vehicles, clean energy products, and many other devices and services that the rest of the world really likes. It didn’t hurt that we printed up a lot of money and passed it out everywhere, and paused payments on student loans, rent and mortgages during and after the pandemic. Most of the support has seen its sunset. The pause on federal student loans was recently extended through August 31, 2022. There are other countries in the world that also make things that all of us like. China is the world’s factory. Indonesia is the leading producer of nickel, which is used in batteries for electric vehicles, computers and other things. Copper prices are at an all-time high and that benefits Chile (the number one producer in the world) and Peru (#2). Many of these other countries are expected to have much higher GDP growth in the US. Be sure to check out my videoconference on Hot Countries from April 2, 2022. The other upside to these countries is that their equity prices are not as lofty as the U.S. The Safe Side is Vulnerable I still hear a lot of people saying, “I have to invest in something on the safe side. I have to get some sort of income. Otherwise, I’m losing money, due to inflation.“ I think a more apt attitude toward the safe side of your money is one proposed by Will Rogers, who said, “I’m more concerned with the return of my money than the return on my money.” Why is that quote so appropriate today? Over half of the S&P 500 is at or near junk bond status. Bonds are illiquid and negative yielding. In order to get any income at all, you have to take on risk. With rising interest rates, the patient investor could get a good yield on a creditworthy, short or medium term bond, if they just take their foot off the gas and wait for interest rates to rise. Having money available to buy into bonds when interest rates are higher could be a lot more valuable and yield more than getting locked into a long-term high-risk low interest-rate investment at this time. Yes, We Had a Recession in 2020 I hear a lot of people saying they’ve been waiting for the correction, and it just never came. However, we had a recession in 2020. It was the shortest in history. Just prior to the recession, we had the swiftest about-turn from bull to bear in history. Money moves very fast these days. The Treasury Department cannot just print up trillions to save the day every time we hit troubled times. In fact, we are now in a monetary tightening trend – the opposite of free, easy money. I encourage everyone to read our Warning Signs of a Recession blog to get caught up on why you want to be properly diversified, keep at least a percentage equal to your age safe and consider overweighting another 10 to 20% safe, based upon market conditions. It’s also very important to know what safe looks like in a Debt World, where bonds are losing money. You can learn and implement these time-proven, 21st Century strategies by attending our June 10-12, 2022 Online Financial Freedom Retreat. Email [email protected] to learn more. Bottom Line 2021 was an outstanding recovery year, after the pandemic threw the economy into a recession with -3.5% GDP growth in 2020. 2021 started the first quarter off with a bang of 6.4% GDP growth. This year’s predictions are for 2.8% full-year GDP growth, with the first quarter’s growth potentially coming at just 1.1%. April could get stronger simply because it’s a traditionally strong month, Spring is happening and people get a little more optimistic about things. People also receive their tax return. We’ve seen stimulus checks increase share prices, and tax returns could as well. However, on April 28th at 8:30 am ET when the 1Q 2022 GDP growth report is issued, the Jubilee could end very quickly. The best strategy will not be market timing, or trying to jump all in or all out. Buy & Hope is a last century strategy that has been quite a disaster in the 21st Century. If you'd like to personalize your own sample Pie Chart, email [email protected]. If you'd like to learn 21st Century time-proven investing strategies to protect your wealth, or how to pick stocks from a No. 1 stock picker, join us for our June 10-12, 2022 retreat. Email [email protected] or call 310-430-2397 to learn more and to register. Click on the banner ad below to discover the 18+ strategies you'll learn and master.  Join us for our Financial Freedom Retreat. June 10-12, 2022. Email [email protected] to learn more. Register by April 30, 2022 to receive the best price. Click for testimonials & details.  About Natalie Pace Natalie Wynne Pace is an Advocate for Sustainability, Financial Literacy & Women's Empowerment. Natalie is the bestselling author of The Power of 8 Billion: It's Up to Us and is the co-creator of the Earth Gratitude Project. She has been ranked as a No. 1 stock picker, above over 835 A-list pundits, by an independent tracking agency (TipsTraders). Her book The ABCs of Money remained at or near the #1 Investing Basics e-book on Amazon for over 3 years (in its vertical), with over 120,000 downloads and a mean 5-star ranking. The 5th edition of The ABCs of Money was released on September 17, 2021. Natalie Pace's easy as a pie chart nest egg strategies earned gains in the last two recessions and have outperformed the bull markets in between. That is why her Investor Educational Retreats, books and private coaching are enthusiastically recommended by Nobel Prize winning economist Gary S. Becker, TD AMERITRADE chairman Joe Moglia, Kay Koplovitz and many Main Street investors who have transformed their lives using her Thrive Budget and investing strategies. Click to view a video testimonial from Nilo Bolden.Other Blogs of Interest Other Blogs of Interest The U.S. House Decriminalizes Cannabis Again. Chinese Electric Vehicle Market Share Hits 20%. The Risk of Recession in 6 Charts. High Gas Prices How Will Russian Boycotts Effect U.S. Multinational Companies? Oil and Gas Trends During Wartime Russia Invades Ukraine. How Have Stocks Responded in Past Wars? Zombie Companies. Rescue, Rehab or Liquidate? Spotify: Music to my Ears. Cannabis Crashes. 2022 Crystal Ball in Stocks, Real Estate, Crypto, Cannabis, Gold, Silver & More. Interview with the Chief Investment Strategist of Charles Schwab & Co., Inc. Stocks Enter a Correction Investor IQ Test Investor IQ Test Answers Real Estate Risks. What Happened to Ark, Cloudflare, Bitcoin and the Meme Stocks? Omicron is Not the Only Problem From FAANNG to ZANA MAD MAAX Ted Lasso vs. Squid Game. Who Will Win the Streaming Wars? Starbucks. McDonald's. The Real Cost of Disposable Fast Food. The Plant-Based Protein Fire-Sale What's Safe in a Debt World? Inflation, Gasoline Prices & Recessions China: GDP Soars. Share Prices Sink. The Competition Heats Up for Tesla & Nio. How Green in Your Love for the Planet? S&P500 Hits a New High. GDP Should be 7% in 2021! Will Work-From-Home and EVs Destroy the Oil Industry? Insurance and Hedge Funds are at Risk and Over-Leveraged. Office Buildings are Still Ghost Towns. Money Market Funds, FDIC, SIPC: Are Any of Them Safe? My 24-Year-Old is Itching to Buy a Condo. Should I Help Him? The 12-Step Guide to Successful Investing. Gardeners Creating Sanctuary & Solutions in Food Deserts. 2021 Company of the Year Almost 5 Million Americans are Behind on Rent & Mortgage. Real Estate Hits All-Time High. Rebalancing Your Nest Egg IQ Test. Answers to the Rebalancing Your Nest Egg IQ Test. Videoconferencing in a Post-Pandemic World (featuring Zoom & Teladoc). Sanctuary Sandwich Home. Multigenerational Housing. Interview with Lawrence Yun, the chief economist of the National Association of Realtors. 10 Budget Leaks That Cost $10,000 or More Each Year. The Stimulus Check. Party Like It's 1999. Would You Pay $50 for a Cafe Latte? Is Your Tesla Stock Overpriced? 10 Questions for College Success. Is FDIC-Insured Cash at Risk of a Bank Bail-in Plan? 8 Money Myths, Money Pits, Scams and Conspiracy Theories. Why Are My Bonds Losing Money? The Bank Bail-in Plan on Your Dime. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable. However, NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors. On April 1, 2022, H.R.3617 The Marijuana Opportunity Reinvestment and Expungement Act (the MORE Act), passed the U.S. House of Representatives. On April 4, 2022, the U.S. Senate referred the bill to its Committee on Finance, which is chaired by Ron Wyden (D: OR). Senator Wyden is one of the sponsors of another piece of cannabis legislation, alongside Senators Cory Booker and Chuck Schumer. Below are a few important things to note about whether or not a cannabis decriminalization bill is likely to pass the Senate, and why criminal justice experts believe it is so important to pass now. Will the U.S. become the Next Nation to Decriminalize Cannabis? Is the bill likely to pass the Senate? The MORE Act passed the House largely on partisan lines. Three Republicans voted yes, and two Democrats voted no. Most political pundits believe that the act is destined to fail in the Senate. There it would require all of the Democrats voting “Aye,” plus at least 10 Republicans, for a total of 60 votes. Without that support, it is likely to fall under a filibuster. Senate Majority Leader Chuck Schumer plans to introduce legislation that he, Cory Booker and Ron Wyden drafted “very soon.” They are currently seeking comments from senators on their draft legislation. Cannabis legislation is likely to be hotly debated over the next few weeks, as Senate Majority Leader Schumer seeks to prioritize cannabis legalization. 40% of U.S. Drug Arrests in 2018 According to the Pew Research Center, 40% of the U.S. drug arrests in 2018 were marijuana-related, mostly for possession. This is down from 52% of all drug arrests in 2010, largely due to the number of states that have decriminalized cannabis. The ACLU notes that “despite roughly equal usage rates, blacks are 3.73 times more likely than whites to be arrested for marijuana.” Americans Favor Legalization of Marijuana According to a Gallup Poll conducted in November of 2021, 68% of U.S. adults support legalizing marijuana. That’s way up from only slightly more than half in favor of legalization from a 2013 survey, and about 1/3 from 2001. Which Companies Win if the U.S. Legalizes Marijuana? Tilray is in an excellent position, not only with its many popular brands like Sweetwater Brewing, but also with its stake in MedMen, a retailer with a big footprint in California. There are a few other brands that could do well, including HEXO (through their Molson Coors JV brand Truss CBD USA). Check out my recent blog on cannabis for additional information. It’s worth repeating that decriminalization has many hurdles in The U.S. Senate that might trip up the legislation. Meanwhile, Luxembourg is set to become the first European country to legalize weed. (The Netherlands has a “liberal” policy.) Germany has also promised to make recreational marijuana legal. Analysts believe the political process for legalization in Germany is at least a year out. Bottom Line Cannabis decriminalization is split on party lines in the U.S., which makes it vulnerable to a filibuster. Legislation would need to pass with 60 votes, rather than just a simple majority. Senate Majority Leader Chuck Schumer and Senators Booker and Wyden have made cannabis decriminalization a priority, and are trying to secure the votes for their bill. Americans are behind them. However, with 50 G.O.P. Senators (half of the Senate), there will need to be bipartisan support – something that has kept pot legalization a pipe dream in the land of the free and the home of the brave. Full Disclosure: I own shares in a few cannabis companies, including Tilray and HEXO. If you'd like to learn 21st Century time-proven investing strategies to protect your wealth, or how to pick stocks from a No. 1 stock picker, join us for our June 10-12, 2022 retreat. Email [email protected] or call 310-430-2397 to learn more and to register. Click on the banner ad below to discover the 18+ strategies you'll learn and master.  Join us for our Financial Freedom Retreat. June 10-12, 2022. Email [email protected] to learn more. Register by April 30, 2022 to receive the best price. Click for testimonials & details.  About Natalie Pace Natalie Wynne Pace is an Advocate for Sustainability, Financial Literacy & Women's Empowerment. Natalie is the bestselling author of The Power of 8 Billion: It's Up to Us and is the co-creator of the Earth Gratitude Project. She has been ranked as a No. 1 stock picker, above over 835 A-list pundits, by an independent tracking agency (TipsTraders). Her book The ABCs of Money remained at or near the #1 Investing Basics e-book on Amazon for over 3 years (in its vertical), with over 120,000 downloads and a mean 5-star ranking. The 5th edition of The ABCs of Money was released on September 17, 2021. Natalie Pace's easy as a pie chart nest egg strategies earned gains in the last two recessions and have outperformed the bull markets in between. That is why her Investor Educational Retreats, books and private coaching are enthusiastically recommended by Nobel Prize winning economist Gary S. Becker, TD AMERITRADE chairman Joe Moglia, Kay Koplovitz and many Main Street investors who have transformed their lives using her Thrive Budget and investing strategies. Click to view a video testimonial from Nilo Bolden.Other Blogs of Interest Other Blogs of Interest Chinese Electric Vehicle Market Share Hits 20%. The Risk of Recession in 6 Charts. High Gas Prices How Will Russian Boycotts Effect U.S. Multinational Companies? Oil and Gas Trends During Wartime Russia Invades Ukraine. How Have Stocks Responded in Past Wars? Zombie Companies. Rescue, Rehab or Liquidate? Spotify: Music to my Ears. Cannabis Crashes. 2022 Crystal Ball in Stocks, Real Estate, Crypto, Cannabis, Gold, Silver & More. Interview with the Chief Investment Strategist of Charles Schwab & Co., Inc. Stocks Enter a Correction Investor IQ Test Investor IQ Test Answers Real Estate Risks. What Happened to Ark, Cloudflare, Bitcoin and the Meme Stocks? Omicron is Not the Only Problem From FAANNG to ZANA MAD MAAX Ted Lasso vs. Squid Game. Who Will Win the Streaming Wars? Starbucks. McDonald's. The Real Cost of Disposable Fast Food. The Plant-Based Protein Fire-Sale What's Safe in a Debt World? Inflation, Gasoline Prices & Recessions China: GDP Soars. Share Prices Sink. The Competition Heats Up for Tesla & Nio. How Green in Your Love for the Planet? S&P500 Hits a New High. GDP Should be 7% in 2021! Will Work-From-Home and EVs Destroy the Oil Industry? Insurance and Hedge Funds are at Risk and Over-Leveraged. Office Buildings are Still Ghost Towns. Money Market Funds, FDIC, SIPC: Are Any of Them Safe? My 24-Year-Old is Itching to Buy a Condo. Should I Help Him? The 12-Step Guide to Successful Investing. Gardeners Creating Sanctuary & Solutions in Food Deserts. 2021 Company of the Year Almost 5 Million Americans are Behind on Rent & Mortgage. Real Estate Hits All-Time High. Rebalancing Your Nest Egg IQ Test. Answers to the Rebalancing Your Nest Egg IQ Test. Videoconferencing in a Post-Pandemic World (featuring Zoom & Teladoc). Sanctuary Sandwich Home. Multigenerational Housing. Interview with Lawrence Yun, the chief economist of the National Association of Realtors. 10 Budget Leaks That Cost $10,000 or More Each Year. The Stimulus Check. Party Like It's 1999. Would You Pay $50 for a Cafe Latte? Is Your Tesla Stock Overpriced? 10 Questions for College Success. Is FDIC-Insured Cash at Risk of a Bank Bail-in Plan? 8 Money Myths, Money Pits, Scams and Conspiracy Theories. Why Are My Bonds Losing Money? The Bank Bail-in Plan on Your Dime. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable. However, NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors. |

AuthorNatalie Pace is the co-creator of the Earth Gratitude Project and the author of The Power of 8 Billion: It's Up to Us, The ABCs of Money, The ABCs of Money for College, The Gratitude Game and Put Your Money Where Your Heart Is. She is a repeat guest & speaker on national news shows and stages. She has been ranked the No. 1 stock picker, above over 830 A-list pundits, by an independent tracking agency, and has been saving homes and nest eggs since 1999. Archives

July 2024

Categories |

RSS Feed

RSS Feed