|

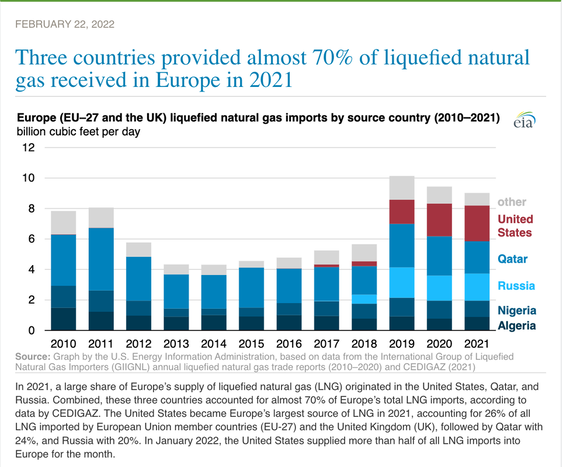

On February 24, 2022, Russia invaded Ukraine. Since then, some corporations, like BP, have moved fast to denounce the aggression and to divest themselves of Russian investments. Apple, Ikea, American Express, Mastercard, VISA, TJ Max, Nike and more announced they will suspend their businesses in Russia. The list grows each day. National Grid and Unison Energy in the United Kingdom are refusing to unload Russian liquified natural gas (LNG) when it arrives in dock. Airbnb.org acted swiftly to assist housing refugees from Ukraine. On March 5, 2022, Russia blocked Facebook in the country. (Myanmar did the same thing to silence dissent during their coup in 2021.) YouTube is reportedly still available in Russia, even though the platform has blocked access to Russian state-controlled media. On the other hand, JP Morgan Chase, Morgan Stanley and many of the more than 3000 multinationals with business in the land of the aggressors have been radio silent about their exposure to Russian businesses and customers. Boycotts of McDonald’s, Pepsi and Estee Lauder, who do business in Russia, are making headlines because so far these companies appear to be continuing operations as usual. On Friday, Shell purchased “heavily discounted” oil from Russia, promising to donate the profits to humanitarian aid in Ukraine. There aren’t any sanctions on Russian oil and gas, so the purchase was legal, though not without ample criticism. Oil and Gas are Still Flowing In an interview with Bloomberg TV on February 28, 2022, Jamie Dimon, the CEO of J.P. Morgan, acknowledged that banks are working with government officials to implement sanctions, but warned that there were workarounds for SWIFT and that there could be unintended consequences for sanctions. One of those potentially damaging consequences is the need for Russian oil and gas in Europe and Ukraine. About 1/3 of Russia’s economy is linked to oil and gas, and their top customers are Europe and Ukraine. While the Nord Stream 2 pipeline has been scuttled, Russian gas flows through three other pipelines, through the Ukraine to Europe. Infrastructure damage to these pipelines would disrupt the gas market, and prices could spike. Of course, that would be Russia shooting itself in one of the few revenue streams available, which is likely why those pipelines are being spared from the shelling. J.P. Morgan and other banks appear to be assisting in the work-around for the Russian oil and gas industry. J.P. Morgan’s research team issued an update on the industry on March 4, 2022, writing, “The west has taken careful steps to ensure that current SWIFT (Society for Worldwide Interbank Financial Telecommunication) and Russian bank sanctions do not prove to be an obstacle for Russian natural gas exports to Europe.” Bank reports are difficult enough to parse, much less understand how much of their revenue flows in from any particular country or client. However, there are reports that J.P. Morgan is the main U.S. banker for Gazprom – Russia’s largest publicly traded gas company by revenue. J.P. Morgan is also Rosneft’s bank, a Russian oil company. Oil Prices are Surging Even with help from banks and an exclusion of oil and gas from the sanctions, oil prices are already at $115/barrel. Prices could surge to $120/barrel if the Ukrainian conflict continues and the sanctions widen to include an outright ban on Russian oil products, unless Iranian oil is infused into the market. The all-time high for OK WTI crude hit $142.52/barrel on July 4, 2008. Incidentally, the U.S. imports about 600-800 kbd (thousand barrels per day) of Russian oil, according to the J.P. Morgan report, mainly consisting of fuel oil feedstocks and some crude. (Plastic is made from oil feedstocks.) Will the Russian Boycott Damage the Earnings of NATO Companies? So, how much damage can a Russian boycott create for multinational companies? Is that why McDonald’s, J.P. Morgan and others have not issued a press release outlining their position? Gazprom was the largest publicly listed gas company in the world in 2019. However, its share price began sinking on February 16, 2022, and tanked after the invasion. It’s now worth about 15% of what it was valued at in January of 2022. BP announced it would take a “material non-cash charge” for divesting itself of its Rosneft ownership. However, the move will also hit BP’s revenue. In 2021, Rosneft was responsible for an RC (replacement cost) profit of $2.4 billion. McDonald’s reported their 2021 full-year earnings on February 2, 2022. In that report, the company noted that 53% of their revenue comes from the “international operated marketplace,” driven largely by the U.K., France and Russia. Yes, you read that right: more than half. The New York Times is reporting that Russia makes up 9% of the company’s total revenues. If McDonald’s announces a suspension of operations, savvy investors are going to be worried about the next earnings report. Since McDonald’s is a Dow Jones Industrial Average component (one of just 30 companies), that would affect the index, which is broadly considered as a gauge of the “stock market.” The Cost of War First and foremost, our hearts and prayers go out to the Ukrainian people who have had their country invaded, and are suffering unimaginable harm from the killing, bombs, infrastructure disruption, lack of food, cold temperatures and loss of life and home. May there be peace, no more bloodshed, accountability and rebuilding. As I indicated in my blog on the Russian Invasion on February 24, 2022, war is expensive and costly – far beyond the horrific loss of life, the devastating destruction of homes and land and the hostile tensions. The worldwide ramifications ripple far beyond the hotspot. We live in a very interconnected global economy. Russia and Ukraine will be hit the hardest economically, but the damage will not be limited to those nations. The invasion of Ukraine is compounded by the already fragile economic condition that the pandemic left the world in. The ever-alarming reports of the catastrophic effects and costs of climate change continue. In plain words, the situation isn’t good for investors. There can be a substantial loss of personal wealth that can take a decade to recover, if ever. Email our office at [email protected] if you’d like a Bank or Fast Food Stock Report Card, or if you are having any difficulty accessing our report on the Russian invasion. Call 310-430-2397 or email [email protected] if you’re interested in a time-proven, 21st Century wealth protection plan that is easy-as-a-pie-chart. Yes, this works for retirement plans, too. We’ll be teaching this plan at the March 18-20, 2022 online Investor Educational Retreat.  Join us for our St. Patrick's Weekend Financial Empowerment Retreat. March 18-20, 2022. Email [email protected] to learn more. Register with friends and family to receive the best price. Click for testimonials & details. Other Blogs of Interest Oil and Gas Trends During Wartime Russia Invades Ukraine. How Have Stocks Responded in Past Wars? Zombie Companies. Rescue, Rehab or Liquidate? Spotify: Music to my Ears. Cannabis Crashes. 2022 Crystal Ball in Stocks, Real Estate, Crypto, Cannabis, Gold, Silver & More. Interview with the Chief Investment Strategist of Charles Schwab & Co., Inc. Stocks Enter a Correction Investor IQ Test Investor IQ Test Answers Real Estate Risks. What Happened to Ark, Cloudflare, Bitcoin and the Meme Stocks? Omicron is Not the Only Problem From FAANNG to ZANA MAD MAAX Ted Lasso vs. Squid Game. Who Will Win the Streaming Wars? Starbucks. McDonald's. The Real Cost of Disposable Fast Food. The Plant-Based Protein Fire-Sale What's Safe in a Debt World? Inflation, Gasoline Prices & Recessions China: GDP Soars. Share Prices Sink. The Competition Heats Up for Tesla & Nio. How Green in Your Love for the Planet? S&P500 Hits a New High. GDP Should be 7% in 2021! Will Work-From-Home and EVs Destroy the Oil Industry? Insurance and Hedge Funds are at Risk and Over-Leveraged. Office Buildings are Still Ghost Towns. Money Market Funds, FDIC, SIPC: Are Any of Them Safe? My 24-Year-Old is Itching to Buy a Condo. Should I Help Him? The 12-Step Guide to Successful Investing. Gardeners Creating Sanctuary & Solutions in Food Deserts. 2021 Company of the Year Almost 5 Million Americans are Behind on Rent & Mortgage. Real Estate Hits All-Time High. Rebalancing Your Nest Egg IQ Test. Answers to the Rebalancing Your Nest Egg IQ Test. Videoconferencing in a Post-Pandemic World (featuring Zoom & Teladoc). Sanctuary Sandwich Home. Multigenerational Housing. Interview with Lawrence Yun, the chief economist of the National Association of Realtors. 10 Budget Leaks That Cost $10,000 or More Each Year. The Stimulus Check. Party Like It's 1999. Would You Pay $50 for a Cafe Latte? Is Your Tesla Stock Overpriced? 10 Questions for College Success. Is FDIC-Insured Cash at Risk of a Bank Bail-in Plan? 8 Money Myths, Money Pits, Scams and Conspiracy Theories. Why Are My Bonds Losing Money? The Bank Bail-in Plan on Your Dime. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable. However, NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors.  About Natalie Pace Natalie Wynne Pace is an Advocate for Sustainability, Financial Literacy & Women's Empowerment. She has been ranked as a No. 1 stock picker, above over 835 A-list pundits, by an independent tracking agency (TipsTraders). The ABCs of Money remained at or near the #1 Investing Basics e-book on Amazon for over 3 years (in its vertical), with over 120,000 downloads and a mean 5-star ranking. The 5th edition of The ABCs of Money was released on September 17, 2021. Natalie Pace's easy as a pie chart nest egg strategies earned gains in the last two recessions and have outperformed the bull markets in between. That is why her Investor Educational Retreats, books and private coaching are enthusiastically recommended by Nobel Prize winning economist Gary S. Becker, TD AMERITRADE chairman Joe Moglia, Kay Koplovitz and many Main Street investors who have transformed their lives using her Thrive Budget and investing strategies. Click to view a video testimonial from Nilo Bolden. Comments are closed.

|

AuthorNatalie Pace is the co-creator of the Earth Gratitude Project and the author of The Power of 8 Billion: It's Up to Us, The ABCs of Money, The ABCs of Money for College, The Gratitude Game and Put Your Money Where Your Heart Is. She is a repeat guest & speaker on national news shows and stages. She has been ranked the No. 1 stock picker, above over 830 A-list pundits, by an independent tracking agency, and has been saving homes and nest eggs since 1999. Archives

July 2024

Categories |

RSS Feed

RSS Feed