|

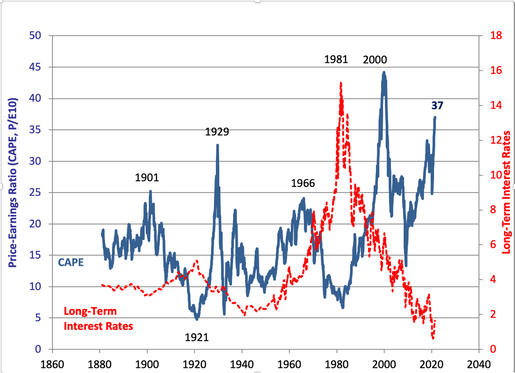

The S&P 500 hit another high today of 4302. Yesterday was a high for the NASDAQ Composite Index, with intraday trading soaring to 14,536. 2021 is predicted to be a gangbuster year for the U.S. economy, with GDP growth of up to 7.0%, according to the Federal Reserve Board. Only China’s 8.4% predicted GDP growth is higher. 7.0% growth is a level that the U.S. hasn’t seen in decades. So, does that mean that stocks will continue to hit all-time highs? There are a few hurdles along the way. However, since April 2021, when the amazing GDP predictions were first unveiled, we've removed the overweight safe from our sample pie charts. (That doesn't prevent you from overweighting safe, if you are worried about the hurdles outlined below.) Fitch Ratings Has the U.S. AAA Credit Rating on a Negative Outlook The Debt Ceiling Suspension Ends July 31, 2021 Stocks and Real Estate Are Very Expensive Not All Industries Are Created Equal We Live in a Debt World Student Loans, Rent and Mortgages Are Not Being Paid And here is a little more color on each point. Fitch Ratings Has the U.S. AAA Credit Rating on a Negative Outlook This is of concern. When the U.S. credit was downgraded to AA+ by Standard & Poor’s, on August 5, 2011, gold and silver soared to all-time highs. Stocks stumbled (but recovered). Will Fitch downgrade the U.S.? The rating agency does not have the USA listed on its 2021 sovereign ratings calendar. Yesterday, Fitch issued a press release stating that negative outlooks were not likely to be downgraded as much in 2021 as they were in 2020. So, there’s less risk of a downgrade this year, unless we have a crisis around the Debt Ceiling at the end of July, or the pandemic rages again. The Debt Ceiling Suspension Ends July 31, 2021 Treasury Secretary Janet Yellen has urged Congress to raise or suspend the Debt Ceiling immediately. Traditionally when the Debt Ceiling is not raised in a timely manner, the Treasury Secretary can use extraordinary measures to pay bills until Congress comes back from their summer break. Yellen has warned Congress that this strategy would be a disaster this year. She can’t assure them that the Treasury Department can scrape by. Funds might run out in August, if the Debt Ceiling is not raised. Under the Trump Administration’s Debt Ceiling crisis in 2017, Treasury Secretary Steven Mnuchin complained that he had to run the U.S. like a piggy bank. There is no real question as to whether or not raising the Debt Ceiling should be done. Without borrowing, the U.S. would default on paying the bills that we have promised to pay. That would result in a downgrade from Fitch, and likely Moody’s, as well. It would also mean that we would have to borrow money at a much higher interest-rate, which would toss the amazing projections of 7.0% GDP growth into the trash. At the same time, we need a plan to start reducing our debt and deficits. The current debt levels are understandable, given the pandemic, but unsustainable. (Debt was a problem before the pandemic. The 45th Administration promised to put the U.S. spending on a sustainable path, but added over a trillion a year between 2017 and 2020.) Stocks and Real Estate Are Very Expensive The recovery is already priced in. The only two times when stock prices have been higher than they are today was before the Dot Com Recession in 2000, and before the Great Depression in 1929. Real estate prices are booming. This is largely because there has been a shift toward larger homes for multi-generational housing. More expensive homes are skewing the average prices upward, even though not all homeowners are enjoying the equity gains that are revealed in the percentages. One must be very cautious and strategic about stock and real estate purchases, even though it’s very tempting to just jump in and join the party. Having a well-balanced, diversified plan for your retirement and brokerage accounts is essential. Now is the time to know exactly what you own. With regard to housing, even if you are equity-rich, it’s a good idea to review our 8-Point Real Estate Checklist. If you’re interested in cryptocurrency or cannabis, click to learn more about these industries in my blog. Not All Industries Are Created Equal As I indicated in my oil blog of this week, some industries are suffering from very high debt, very slim profit margins and negative revenue growth. The wild swings in oil prices wiped out a large number of oil and gas companies in 2020. Those that didn’t restructure their debt are still pretty beleaguered by the volatility. The commercial real estate industry, particularly retail and office buildings, are going through a structural shift that could create financial instability in our banking system. In the May 6, 2021 Financial Stability Report, the Federal Reserve Board noted that low transaction volumes may be masking declines in commercial property values. They also warned that delinquency rates on commercial mortgage-backed securities are elevated. A review of one’s portfolio should include an understanding of how exposed you are to the riskier industries. Many of these pay a high dividend (relatively speaking) in order to keep investors interested. However, if your principal is at risk of significant losses, a small dividend is hardly worth the risk. We Live in a Debt World There is so much borrowing in the corporate sector, that over half of the S&P 500 is at or near junk-bond status. In March of 2020, the Feds bought up over 1200 individual bonds and took sizable positions in many junk-bond ETFs in order to prevent a meltdown in the marketplace. There weren’t any buyers and the market had become illiquid. On June 2, 2021, the Federal Reserve Board notified everyone that they are going to begin selling their holdings. The distress in the bond industry is a reminder that, sadly, the safe side of your portfolio is carrying far greater risk than many people realize. Bonds are not safe in today’s Debt World. There a risk of illiquidity and negative yield in the bond portfolio. There is also a risk of redemption gates and liquidity fees in money market funds. Again, it is essential to know what you own now. Fix the roof while the sun is still shining. You do not want to wait until the economic storms arrive to discover that your financial house has major leaks. If it leaked in March 2020, that’s a sign that you need to do some repairs now. Student Loans, Rent and Mortgages Are Not Being Paid Almost five million renters and homeowners didn’t make their payments in March 2021 (source: MBA.org). 41.4% of student loans weren’t paid, as well. Consumer debt is at an all-time high. Unemployment rates remain elevated. Bottom Line You want to be invested the year that the US economy grows 7%. However, many people already have too much at risk in equities, with the safe side of the portfolio carrying greater risk than is prudent, as well. The higher the dividend, the higher the risk. Know what you want and why. Fix the roof while the sun is still shining. Join us for our Oct. 9-11, 2021 Financial Empowerment Retreat. (Click to learn more.) In 3 days, you'll learn how to evaluate your funds, including dividend and value funds, what's safe in a Debt World, how to make a smart investment in real estate, pick hot funds and companies (like crypto, cannabis and our 2021 Company of the Year), and how to incorporate hard assets and safe havens into a well-diversified wealth plan. You'll discover how to protect your wealth and save thousands annually in your budget with smarter big-ticket choices. The retreat is a complete Money Makeover that will transform your life forever. Bring your friends, family and teens for an unbelievably low group rate. Call 310-430-2397 or email [email protected] to learn more now. Register with your friends and family to receive the lowest price.  Natalie Pace Financial Empowerment Retreat. Oct. 9-11, 2021. Call 310-430-2397 or email [email protected] to learn more. Families and friends registering together receive the best price. Click for testimonials & details. Other Blogs of Interest 2021 Financial Freedom Sweepstakes Will Work-From-Home and EVs Destroy the Oil Industry? Insurance and Hedge Funds are at Risk and Over-Leveraged. Office Buildings are Still Ghost Towns. Money Market Funds, FDIC, SIPC: Are Any of Them Safe? My 24-Year-Old is Itching to Buy a Condo. Should I Help Him? Will Cannabis be Decriminalized This Summer? The 12-Step Guide to Successful Investing. Gardeners Creating Sanctuary & Solutions in Food Deserts. 2021 Company of the Year Almost 5 Million Americans are Behind on Rent & Mortgage. Real Estate Hits All-Time High. Beyond Meat, Oatly & The Very Good Food Co. Is Cryptocurrency the New Gold? Rebalancing Your Nest Egg IQ Test. Answers to the Rebalancing Your Nest Egg IQ Test. Tesla & Nio Will Report Spectacular Earnings. The Coinbase IPO. Restore Our Earth on April 22nd (and Every Earth Day). Should You Sell in May and Go Away? Adding Shoot the Moon Performance to Your Nest Egg. Videoconferencing in a Post-Pandemic World (featuring Zoom & Teladoc). Sanctuary Sandwich Home. Multigenerational Housing. Interview with Lawrence Yun, the chief economist of the National Association of Realtors. 10 Budget Leaks That Cost $10,000 or More Each Year. The Stimulus Check. Party Like It's 1999. Kushner's Times Square Building Plunges 80% in Value. Will There be a Spring Rally? Cannabis and the Road to Decriminalization in the U.S. Hot ETFs Return Up to 50% Since October. Investor IQ Test 2021. Investor IQ Test Answers Shoot the Moon Stock Picks 2021 Crystal Ball. Would You Pay $50 for a Cafe Latte? Is Your Tesla Stock Overpriced? Can Medmen Avoid Bankruptcy? Bitcoin is Back, Baby! Real Estate Prices are Going Up. And Down. Cannabis is Decriminalized. Stocks Triple. Thanksgiving in a Pandemic. The Sustainability Silver Lining. Money Stress Killed My Friend Real Estate and Housing 2021. Challenges & Opportunities Real Estate in a Pandemic. Interview with Mike Fratantoni, the Chief Economist of the Mortgage Bankers Association. Bonds are Illiquid & Negative-Yielding. Annual Rebalancing is a Buy Low, Sell High Plan on Auto-Pilot. Is Your Bank a Junk Bond Put Your Money Where Your Heart Is. Schwab's Chief Fixed Income Strategist on What's Safe. China's Tesla (Nio). 2Q Sales Soar. Why Are You Still Renting? (Errr. There is More Than This to Consider!) Wealth Myths That Keep You Poor. Prosperity Truths That Make You Rich. Technology and Silver are Golden. Real Estate: Feeling Equity Rich? Make Sure That Feeling Isn't Fleeting. Airline Revenue Plunges 86%. 10 Questions for College Success. Is FDIC-Insured Cash at Risk of a Bank Bail-in Plan? 8 Money Myths, Money Pits, Scams and Conspiracy Theories. Why Are My Bonds Losing Money? The Bank Bail-in Plan on Your Dime. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable. However, NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors.  About Natalie Pace Natalie Wynne Pace is an Advocate for Sustainability, Financial Literacy & Women's Empowerment. She has been ranked as a No. 1 stock picker, above over 835 A-list pundits, by an independent tracking agency (TipsTraders). The ABCs of Money remained at or near the #1 Investing Basics e-book on Amazon for over 3 years (in its vertical), with over 120,000 downloads and a mean 5-star ranking. The 4th edition of The ABCs of Money was released on October 17, 2020. Natalie Pace's easy as a pie chart nest egg strategies earned gains in the last two recessions and have outperformed the bull markets in between. That is why her Investor Educational Retreats, books and private coaching are enthusiastically recommended by Nobel Prize winning economist Gary S. Becker, TD AMERITRADE chairman Joe Moglia, Kay Koplovitz and many Main Street investors who have transformed their lives using her Thrive Budget and investing strategies. Click to view a video testimonial from Nilo Bolden. Comments are closed.

|

AuthorNatalie Pace is the co-creator of the Earth Gratitude Project and the author of The Power of 8 Billion: It's Up to Us, The ABCs of Money, The ABCs of Money for College, The Gratitude Game and Put Your Money Where Your Heart Is. She is a repeat guest & speaker on national news shows and stages. She has been ranked the No. 1 stock picker, above over 830 A-list pundits, by an independent tracking agency, and has been saving homes and nest eggs since 1999. Archives

July 2024

Categories |

RSS Feed

RSS Feed