|

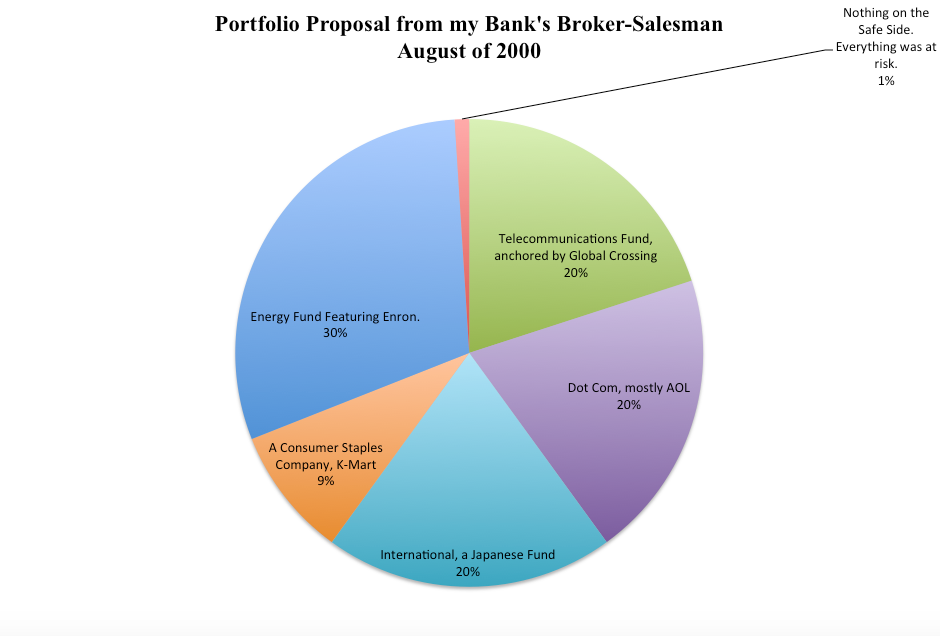

Recently someone asked me, “Natalie, what was the best investment decision you ever made?” I’ve certainly had a few that were rocket ships to the moon, like plunking down a buck a share for the first cloud-based computing company in August of 2001, and watching that investment almost triple in just a few short months. Yup, you read that right. I bought stock the month before 911, and enjoyed the best ROI* I’d ever known, up to that moment. However, the best investment decision was not buying Loudcloud on the cheap. It was the investment decision that I made right before that purchase. The Real Reason That People Don’t Buy Low The reason that most people don’t buy low is because they can’t. Their money is all tied up. Most of the time, when stocks are low, investors are shocked at how much money they’ve lost and are either hoping to recover from their losses, or are tempted to sell low so that they can sleep again at night. If you sold in 2009, then you know intimately how this feels. If you haven’t kept enough safe and diversified, then you would have to sell low in order to buy low. So, how was it that I had money to buy low in August of 2001, when the NASDAQ Composite Index had already lost 64% of its value? Because the best investment decision I ever made was to refuse to buy high. The Best Investment Decision I Ever Made In August of 2000, a banker noticed that I had some cash in a CD that was earning 4.5%. It was at a bank where everyone was incentivized to cross-sale you into other products. So, I was introduced to the bank’s investment advisor. He had a lot of letters behind his name, which he flashed around like a Ph.D., so I assumed that he was an expert. I didn’t know at the time that he was hired as a salesman, which is the primary qualification required to get a job as a broker-salesman. So, this financial advisor laid out his “safe and diversified plan” for me. He told me that he would have to make an exception for me to take me under management because normally he only takes people who buy in at a much higher level than I could. But he’d make that exception if I committed to depositing $450/month into the account, in addition to placing all of my money with him. He also told me that I’d be buying low because “stocks had pulled back about 25% from their highs.” Here’s what his plan looked like. Enron had just been named the Most Innovative Company in the U.S. by Fortune Magazine, for the 6th year in a row, he told me. “But the company is price-gouging!” I objected. “Grandmothers are dying in California,” I said. I would never invest in such an immoral company. He then went on to sing the praises of Global Crossing. As it happened, I worked for a telecom company that purchased wholesale long distance from a Global Crossing competitor. The contract was for 4 cents a minute. However, the company had been overbilling at over ten times that amount for months, and was dragging their feet in adjusting and crediting (even though they kept promising to). “Telecom is cooking the books,” I said. “I’m in the industry.” I objected to Dot Com for being cash negative for five years running. You can’t borrow from Peter to pay Paul forever, and five years seemed a few years too long. “It’s a New Economy!” the CFP piped up! Al Gore was running on a strong economy, boasting that the U.S. had 8 years of prosperity under his tenure while Vice President – something he vowed to continue. I was pretty sure that eight years was too long to go without a correction. And the country was far too divided. No matter who was elected, almost half of the population was going to be mad about it. Besides, my Dad was complaining that K-Mart never stocked anything he needed, so he’d begun just going to Wal-Mart. The broker-salesman told me how stupid I was to keep my money in a CD earning 4.5%, and lied, saying that was under inflation. (It wasn’t.) When our meeting began, he was all sweet talk and compliments. However, toward the end when he tired of my objections and comments and just wanted to close the deal, he got aggressive and brash, shoving the brokerage application toward me and indicating that it was time to pull out my checkbook. He was making an exception for me, after all. I pretended to have a meeting that I was late for, and vowed to learn more before I made any choice to invest. That process took me on a quite a journey over the next 12 months. In August of 2001, when I saw my favorite technology company drop from $12/share in the pre-IPO roadshow period to under $1/share, I was ready to make a significant bet (for me). That decision paid off in spades just a few months later. However, it would have never happened if I’d allowed the CFP to lose all of my money. K-Mart, Enron and Global Crossing all declared bankruptcy; AOL lost over 80% of its value. I can’t even imagine what would have happened to my son and I in that scenario. I’m pretty sure the CFP left the industry. He couldn’t have returned my money, and he wouldn’t have apologized for wrecking my life. I avoided that tragedy by asserting myself and not letting myself be taken in by his bullying. Successful investing requires a time-proven strategy and a lot of discipline. (It’s called “sticking to your knitting,” in the industry.) However, when you are just starting out, the most important move is to avoid being snared in a sales trap. You are the boss. It is your future at stake. That person across from you might be a salesman rather than a market genius. If you understand what a sound, diversified plan really looks like, then you’ll rack up gains, prevent losses and accumulate experience as you journey up the path to financial wisdom. If you don’t, you’re going to find blind faith, fear, stomach acid and euphoria guiding your investment decisions – which means that you’ll always be tempted to sell low and buy high. As a young single mom, I saved myself tens of thousands with the best investment decision. Since then, countless investors have saved millions. This year alone, when the markets are flat on the year, A&A have saved almost $60,000 by moving from a “managed” blind faith plan into a truly safe, diversified and hot strategy. At their age knowing that their future is safe from losses is invaluable to their emotional health, and critically important to their fiscal health. *Return on Investment. If you are interested in receiving an unbiased second opinion on your current investing strategy, email [email protected] or call 310-430-2397. You can learn the ABCs of Money that we all should have received in high school at one of my Investor Educational Retreats. Only 3 seats remain available at the Valentine’s Retreat in Santa Monica. Receive a complimentary private, prosperity coaching session (value $300) when you register for the Colorado Retreat by November 30, 2018. Other Blogs of Interest

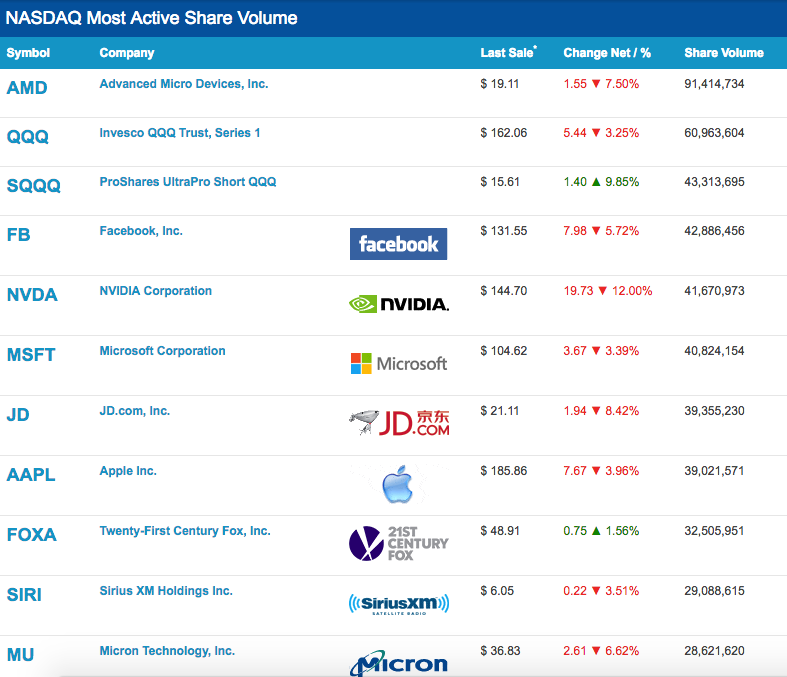

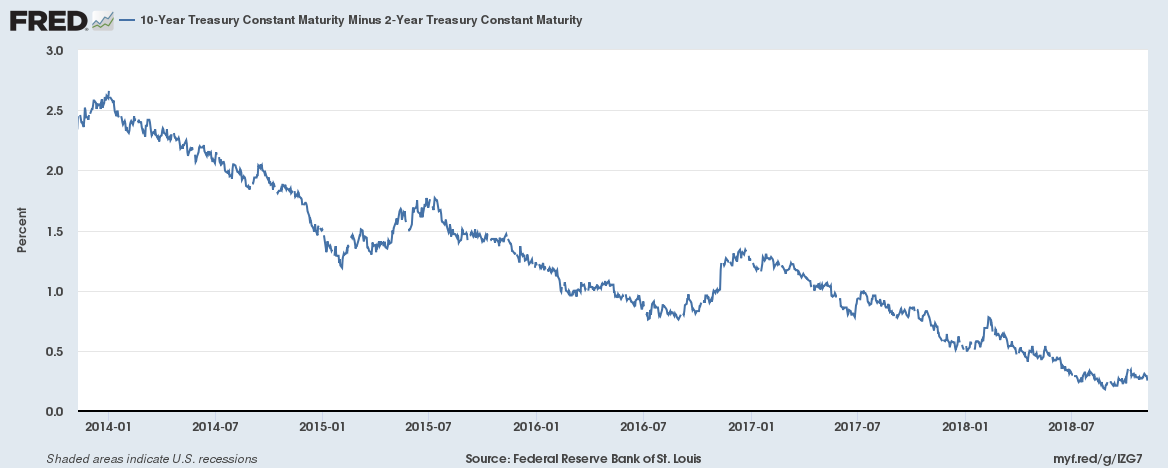

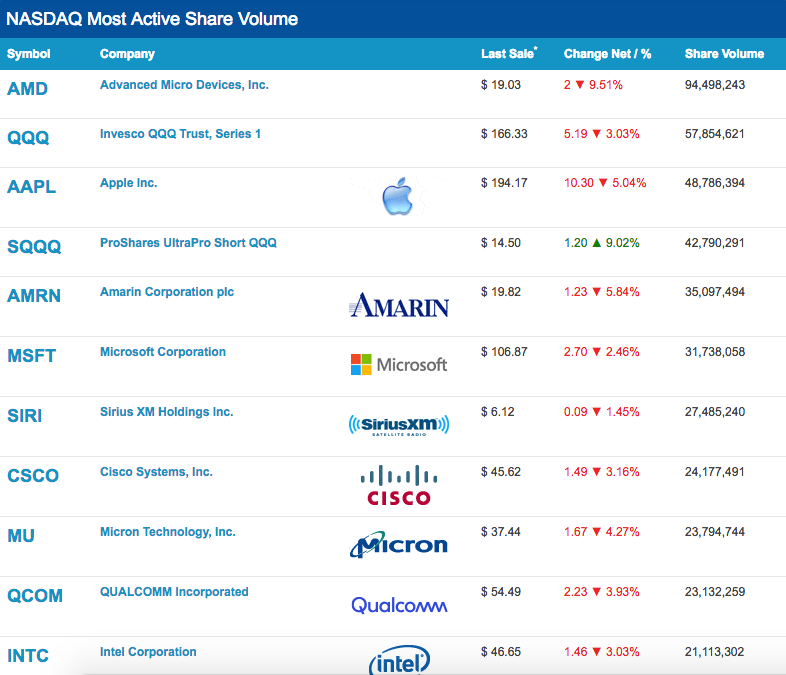

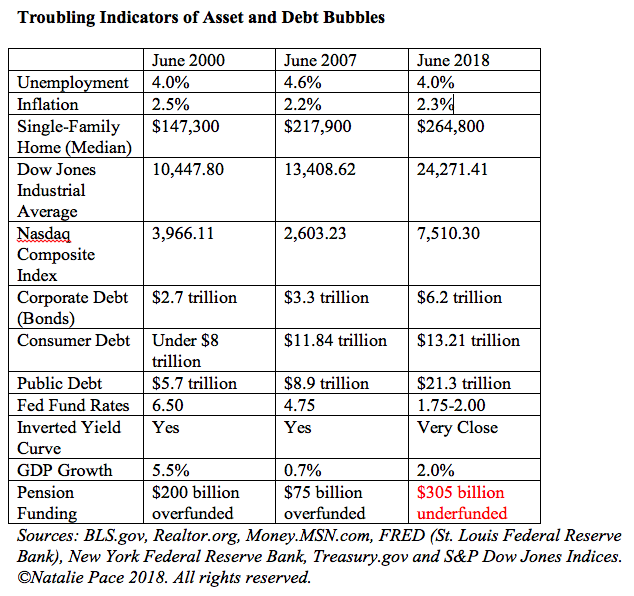

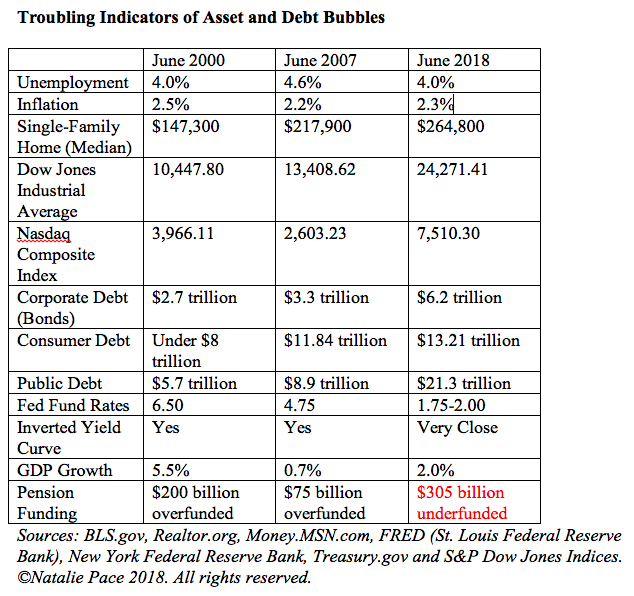

Thanksgiving 2018 Stocks Losses. Black Friday Sales. Get a 2nd Opinion on Your Current Investing Strategy. What's Safe for Your Cash? FDIC? SIPC? Money Markets? Under the Mattress? The Real Reason Stocks Fell 602 Points on Veterans Day 2018. Will Ford Bonds Be Downgraded to Junk? 6 Risky Investments. 12 Red Flags. 1 Easy Way to Know Whom to Trust With Your Money. Whom Can You Trust? Trust Results. October Wipes Out 2018 Gains. Will There Be a Santa Rally in 2018? The Dow Dropped 832 Points. What Happened? Bonds are In Trouble. Learn 5 Ways to Protect Yourself. Interest Rates Projected to Double by 2020. 5 Warning Signs of a Recession. How a Strong GDP Report Can Go Wrong. Should I Invest in Ford and General Electric? Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable however NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors. On November 19, 2018, the NASDAQ Composite Index dropped 3.03%. (The Dow Jones Industrial Average lost 1.6%.) Some of the Top 10 sell-off volume leaders were elite members of the coveted FANG*, where the most outstanding returns over the past few years have been. Today, Wall Street dropped again, this time losses were more concentrated in the Dow, with losses of over 2%. What’s going on, and, more importantly, what should you do about it? The simple truth is that stock prices were too high. The big money knows that, and VIP leaders, including former Federal Reserve chairman Alan Greenspan, billionaire Warren Buffett and Nobel Prize winning economist Robert Shiller, have been warning about bubbles for over a year. Here’s where buy low, sell high becomes an emotional game. For the last few years, many folks have wanted to jump into stocks, i.e. buying high, after hearing of the extraordinary gains investors have enjoyed since 2009. Meanwhile, the smart money is looking for every opportunity to sell high and capture gains. That’s why it is so important to use wisdom, information and time proven strategies, and minimize your reliance on headlines, articles, talk shows and salesmen. Below I’ve highlighted some of the data and information you need to be aware of, and below that tips to what is needed for you to get safe, diversified, protected and hot now, before a more severe correction. Here are 10 Key Elements to Wall Street’s Rise and Fall in 2018 1.Price. 2.Earnings. 3.Average P/E. 4.Financial Engineering. (Buybacks, Dividends.) 5.Quiet Periods. 6.Interest Rates. 7.Trading. 8.Deleveraging. 9.Rhetoric and MSM Language. 10.Bubbles. 11.Catastrophic Events. And here is more information on each point… 1. Price. Stock prices are at an all-time high. So are real estate, bonds and debt. The recent weakness doesn’t put things into buying territory, unless 2019 is going to be a gangbuster of a year in terms of earnings growth – something that is not predicted currently. 2. Earnings. Earnings were boosted in 2018 with the Tax Cut. While lower taxes should help companies with their profitability, the one-time boost to earnings growth in 2018 could be hard to match in 2019. The 4th quarter 2018 GDP growth is predicted to just 2.6%, much lower than the 3.5% in the 3rd quarter 2018. 2019 estimates are coming in between 2.4-2.7% (source: Federal Reserve Board). 3. Average P/E. The average P/E for stocks today is 22.19 (as of June 2018). The historical average (since 1936) is 17.18. That’s almost a third higher than normal. The FANG stocks were much pricier. In April of this year, Amazon’s P/E was 227. Netflix’s was 233. Google was 56. And Nvidia’s P/E was 44. These are very lofty prices, even given the outstanding sales growth of these companies, which was 38%, 33%, 24% and 34%, respectively. Today, even with the price pullback on these companies, the P/Es are still much higher than the average, with the exception of Apple with a P/E of 15.60. If earnings soften in 2019, this will increase the P/E, unless prices keep going down. 4. Financial Engineering. Many companies, particularly those with very high debt and pension obligations, have been borrowing money for almost free, and using it to buy back their own stock and to pay dividends. As of Nov. 16, 2018, corporate buybacks are setting an all-time record of almost $200 billion for the 3rd quarter 2018. Apple has been on the largest buyback spree.When a company buys back its own stock, it increases the earnings per share (by reducing the share count), which makes the P/E look lower (by increasing the EPS). All of this keeps investors interested. However, with interest rates rising, and debt rising, the cost of buybacks and dividends is getting to be too high. Too much debt puts a company at risk of a credit downgrade, and rising interest rates make borrowing more costly. Currently over 50% of the investment-grade companies in the U.S. are at the lowest rung before junk bond status. 5. Quiet Periods. Two weeks before a company releases its earnings, the buybacks are suspended. Quiet periods have been associated with the most massive downturns this year, largely because the current bull market has been fueled to a very large extent on corporate buybacks. 6. Interest Rates. The Federal Reserve Board has indicated that they would like to take interest rates to at least 3.4% by 2020. That is double from where rates started 2018. Rising interest rates have meant that bonds have lost value in 2018. Bond funds are losing money. Any company with high debt and high leverage is vulnerable to rising interest rates. 7. Trading. Any big move on Wall Street is subject to high speed due to the amount of high-frequency traders and options traders that are in the market. In the Dot Com Recession, it took NASDAQ 31 months to hit rock bottom, with losses of up to 78%. In the Great Recession, the colossal drop of 55% occurred over a 17-month period. Cryptocurrency has been in a rout for over a year since the high of $20,000 for Bitcoin, with losses of 77%. Is this the beginning of a more severe downturn in stocks, bonds and real estate that will play out in the coming year(s)? It’s better to be safe than sorry… A good plan will allow you to profit from rallies and will protect you from downturns. 8. Deleveraging. The Big Money knows that if they sell all at once, they will end up selling low. Selling a large amount high requires a careful strategy that includes optimizing your sales during market rebounds. That’s why Wall Street looks like a rollercoaster this year (and since 2000). 9. Rhetoric and MSM Language. You’ll hear a lot of pundits in the mainstream media say that stocks have hit “bear” territory. This implies to a lot of less-sophisticated investors that they can buy low now. Broker-salesmen use this kind of language to their advantage, enticing clients to buy into a plan that is not diversified, hot or properly designed for safety. Investor beware. 10. Bubbles. Low interest rates create asset bubbles. Today, we have bubbles in stocks, bonds, real estate and debt. Earlier this year, we had a bubble in cryptocurrency. 11. Catastrophic Events. The wildfires in California were heartbreaking and monumental. The cost of the fires could negatively impact GDP growth. It will also hurt the utilities sector, particularly PG&E and So Cal Edison, which were already struggling under high debt, slow earnings growth and massive liabilities before the fires. Both companies have already experienced a sell-off in stocks, losing more than half their value since the fires began. Recent legislation limits the liabilities of utilities in California. However, it won’t mitigate all of the financial costs of the fires that will have to be borne by these companies. Crystal Ball 2019 Essentially, there are 11 reasons why stocks, bonds and real estate prices are poised to soften in 2019. Which means it’s time for you to get your defensive game on, while keeping some targeted offensive action in play. Solutions The solution to the weakness on Wall Street isn’t to just sell everything. It is to:

You can’t just trust that your broker-salesman is doing this for you when all of the products that they have to sell you are trading near all time highs and are vulnerable to capital losses. It’s time to be the boss of your money and to understand clearly what your exposure is and what a healthy plan looks like. Wisdom is the cure. If you are interested in receiving an unbiased second opinion on your current investing strategy, email [email protected] or call 310-430-2397. You can learn the ABCs of Money that we all should have received in high school at one of my Investor Educational Retreats. Only 3 seats remain available at the Valentine’s Retreat in Santa Monica. Receive a complimentary private, prosperity coaching session (value $300) when you register for the Colorado Retreat by November 30, 2018. *Facebook, Apple, Amazon, Netflix, Nvidia, Google. *BAT is the Chinese equivalent: Baidu, Alibaba, TenCent Holdings Other Blogs of Interest Black Friday Sales. Get a 2nd Opinion on Your Current Investing Strategy. What's Safe for Your Cash? FDIC? SIPC? Money Markets? Under the Mattress? The Real Reason Stocks Fell 602 Points on Veterans Day 2018. Will Ford Bonds Be Downgraded to Junk? 6 Risky Investments. 12 Red Flags. 1 Easy Way to Know Whom to Trust With Your Money. Whom Can You Trust? Trust Results. October Wipes Out 2018 Gains. Will There Be a Santa Rally in 2018? The Dow Dropped 832 Points. What Happened? Bonds are In Trouble. Learn 5 Ways to Protect Yourself. Interest Rates Projected to Double by 2020. 5 Warning Signs of a Recession. How a Strong GDP Report Can Go Wrong. Should I Invest in Ford and General Electric? Interview with Liz Ann Sonders Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable however NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors. Have a wonderful Thanksgiving Day feast and celebration! I wish today that you are rich in love, family and laughter – all of the things that money can’t buy. Of course, once you wake up from your tryptophan coma, you’ll start thinking about holiday gift buying, and our team has a few sales and freebies for you. We’re starting the sale now, and we’ll keep it going through Monday, November 26, 2018. Our Free Gift to You New Year New You Gratitude Teleconference Series Value: $399 Cost: Free! Simply email [email protected] for your free gift or a card to send this gift to a friend. This January take the 21-day Gratitude Game challenge to a healthier, wealthier, more beautiful you. Complimentary Private Prosperity Coaching, value $300, when you register for the Colorado Financial Empowerment Retreat. Click to learn the 15+ things you’ll learn and master at the retreat, and to see testimonials. Learn The ABCs of Money that we all should have received in high school. Protect your assets. Earn money while you sleep, safely. Learn how to save thousands annually with smarter big ticket choices. Gifts Under $5 The ABCs of Money. 2nd Edition. Revised in 2018. "College students need this information before they get their first credit card. Young adults need it before they buy their first home. Empty nesters can use the information to downsize to a sustainable lifestyle, before they get into trouble." Joe Moglia, Chairman, TD AMERITRADE. Nilo Bolden used this information to save her nest egg before the Great Recession, and earned gains when most people lost more than half of their assets! Gift yourself, or stuff a stocking (or a Kindle) for someone you love. If you wish to combine the book with the free 21-day teleconference series, we'll send you a gift card to give to your loved one. ½ Off Coaching (When You Purchase a 12-pack). This is perfect for anyone who is interested in an unbiased second opinion of their current retirement strategy. Receive an easy-to-read and understand pie chart of what you do have, a sample Natalie Pace nest egg pie chart, and notes from Natalie Pace directly outlining the areas of strength and weakness in your current plan. Email Info @ NataliePace.com or call 310-430-2397 to learn more. FYI: There is very limited availability at the April 25-29, 2019 Denver, Colorado Retreat. Only 3 seats remain available at the February 16-18, 2019 Santa Monica Retreat. Offers expire on Monday, November 26, 2018. Other Blogs of Interest What's Safe for Your Cash? FDIC? SIPC? Money Markets? Under the Mattress? The Real Reason Stocks Fell 602 Points on Veterans Day 2018. Will Ford Bonds Be Downgraded to Junk? 6 Risky Investments. 12 Red Flags. 1 Easy Way to Know Whom to Trust With Your Money. Whom Can You Trust? Trust Results. October Wipes Out 2018 Gains. Will There Be a Santa Rally in 2018? The Dow Dropped 832 Points. What Happened? Bonds are In Trouble. Learn 5 Ways to Protect Yourself. Interest Rates Projected to Double by 2020. 5 Warning Signs of a Recession. How a Strong GDP Report Can Go Wrong. Should I Invest in Ford and General Electric? Interview with Liz Ann Sonders Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable however NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors. What’s Safer? FDIC, SIPC, Money Markets or Cash Under Your Mattress? Investors Ask Natalie.15/11/2018

Dear Natalie, I had a session with you, and you said to make sure my cash accounts were guaranteed by FDIC. I found out that several of my accounts are covered by SPIC (or is it PIDC?), which my broker said was better because it will cover up to $500,000 in cash and covers stock and bond losses up to $250,000. Seems like a better deal than FDIC. Would you agree? Signed, The Acronyms Are Confusing Dear Acronym Sleuth, We’d all love to put our accounts with a brokerage that covers stock losses! However, sadly, that’s a pretty big misrepresentation of what SIPC insurance covers. That is why it is so important to read the fine print, and not just trust what the broker-salesman tells you. Have you ever heard the joke, “What do you call the person who got Cs in medical school?” (Doctor.) Below is a general breakdown of what some brokerages offer, with more color on what the acronyms themselves mean. Consult the fine print of your personal brokerage agreement to know exactly what your brokerage does and does not offer. FDIC-insured. The Federal Deposit Insurance Corporation is an independent federal agency that insures cash held in FDIC-insured banks. Many brokerages and banks now offer a bank sweep program where you can actually be insured above the $250,000 maximum individual coverage. For instance, my brokerage offers FDIC coverage up to $500,000 for individuals and $1,000,000 for join accounts. SIPC-insured. The Securities Investor Protection Corporation is backed by a fund with assets of about $3.1 billion. The fund ensures against brokerage default (not stock losses). So, if you have the misfortune of investing with Bernie Madoff or MF Global, then SIPC would work with the bankruptcy trustee to restore as much of your principal as possible. FYI: Most of Madoff’s clients were invested for years, thinking they were earning 12% annualized and compounding. So, even though the trustees and SIPC boast of returning 75% of the principal lost in the Madoff Ponzi scheme, it is a much smaller amount than most investors believed they were owed. One important consideration is that when you own stock in a company or a fund, you still own that equity, even if a brokerage goes belly-up (unless, the fund is owned by the brokerage, as was the case in the MF Global insolvency). FYI: the SIPC cash coverage is limited to $250,000 (not $500,000). Money Market Funds. Money market funds are not guaranteed by the government or by any bank. It is possible to lose money in a money market fund. There can be hidden charges and expenses. Under certain circumstances, the money market fund can impose liquidity fees and redemption gates (in other words, charge you to access your money, or limit the amount you can redeem). Those are some of the reasons why FDIC-insured cash can be a better choice, particularly in the 10th year of a bull market. Money Under Your Mattress. There’s an old joke in my family that someone buried their cash during the Great Depression, and the chickens dug it up and ate it! Keeping cash on hand is very risky. Wolves and chickens abound. So, what is safe in a world where bonds are losing money and you have to be careful about the acronym you choose for your cash account? In today’s world of very high-leverage (i.e. a lot of debt), FDIC-insured cash is just the first step in a two or three step process to make sure that you protect your assets and are positioned to earn an income on your wealth in the years to come. Protecting your assets is so important today that I spend one full day on this topic at my Investor Educational Retreats. Call 310-430-2397 to learn more now. Don't be caught unaware. Don't be complacent. Don't rely upon others to do it for you. It's time to know what you own and be the boss of your money. If you are interested in receiving an unbiased second opinion on your current investing strategy, email [email protected] or call 310-430-2397. You can learn the ABCs of Money that we all should have received in high school at one of my Investor Educational Retreats. Only 3 seats remain available at the Valentine’s Retreat in Santa Monica. Receive a complimentary private, prosperity coaching session (value $300) when you register for the Colorado Retreat by November 30, 2018. Other Blogs of Interest The Real Reason Stocks Fell 602 Points on Veterans Day 2018. Will Ford Bonds Be Downgraded to Junk? 6 Risky Investments. 12 Red Flags. 1 Easy Way to Know Whom to Trust With Your Money. Whom Can You Trust? Trust Results. October Wipes Out 2018 Gains. Will There Be a Santa Rally in 2018? The Dow Dropped 832 Points. What Happened? Bonds are In Trouble. Learn 5 Ways to Protect Yourself. Interest Rates Projected to Double by 2020. 5 Warning Signs of a Recession. How a Strong GDP Report Can Go Wrong. Should I Invest in Ford and General Electric? Interview with Liz Ann Sonders Important Disclaimers

Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable however NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors. The Real Reason Stocks Fell 600 Points on Veteran’s Day. On Veteran’s Day, November 12, 2018, the Dow Jones Industrial gave up 602 points. Was it for political reasons? If not, why are investors skittish when unemployment is low and GDP growth rang in at 3.5% in the 3rd quarter? Are there other financial phantoms looming in the shadows? In order to answer how politics affect the markets, I looked at history. We’ve had two impeachment proceedings in the recent past, one with President Clinton (Democrat) and one with President Nixon (Republican). How did Wall Street react before, during and after each? Turns out that Wall Street enjoyed one of the strongest Santa Rallies of our generation during the Clinton Impeachment hearings. The Dow Jones Industrial Average soared 21% between September 1998 and February 12, 1999. The impeachment began October 8, 1998 and ended February 12, 1999, when President Clinton was acquitted by the Senate on both counts of impeachment. Of course, that wasn’t because investors were excited about the salacious tales of a White House intern and her lying boss. It was all about the money. The 3rd quarter GDP growth of 3.9% was officially released on November 24, 1998. However, the market is forward-looking, and the big money was expecting a solid number, after the rather tepid 2nd quarter growth of 1.6%. In 1973, GDP growth was 5.6%. Impeachment proceedings began on February 6, 1974 against Richard Nixon. Nixon resigned on August 9, 1974. The Dow Jones Industrial Average sank from 957 on Oct. 31, 1973 to 608 on September 30, 1974, for losses of 36.5%. However, Watergate wasn’t the cause of the Wall Street rout. It was the First Oil Shock. In October of 1973, the members of the Organization of Arab Petroleum Exporting Countries called for an oil embargo against the United States and other nations that supported Israel (including the UK and Canada). Global oil prices quadrupled, from $3/barrel to $12/barrel between October 1973 and March 1974. Oil was rationed. American consumers were asked to conserve gas and could only fill up their tanks on certain days. Unemployment jumped from 4.9% to 7.2%. 1974 was a recession year because oil prices squeezed our economy. The U.S. was very reliant on foreign oil in 1973, producing only 16.5% of global output. However, since 2009, the U.S. has been the world’s top natural gas producer, toppling Russia from the top spot. The U.S. became the No. 1 petroleum hydrocarbon producer in 2013, when it replaced Saudi Arabia (source: EIA.gov) So, why is there so much volatility in the stock market this year? Wall Street follows the economic indicators – the money. Though investors and business leaders care about policy (lower taxes, business-friendly rules), they are not invested in the individual who sits in the Oval Office. We don’t have an oil embargo to deal with, and the 2nd quarter GDP was actually quite good, at 3.5%. So, why did the market really drop? Here are 7 Real Concerns that Have Kept Stocks on a Rollercoaster This Year 1. Interest Rates. The Federal Reserve Board is predicted to raise interest rates again at their Dec. 18-19, 2018 meeting. Rising interest rates put pressure on housing, real estate and any corporation, individual or nation that has a lot of debt. Over half of the investment grade corporations in the U.S. are at the lowest rung, just one spot above junk bond status, according to Collin Martin, a fixed income strategist at the Schwab Center for Financial Research. The costs of servicing the U.S. debt is going up as well, adding to an already ballooning $21.7 trillion public debt. 2. The Yield Curve. “Every U.S. recession in the past 60 years was preceded by an inverted yield curve,” according to Michael D. Bauer and Thomas M. Mertens of the San Francisco Federal Reserve Bank. Every rate hike takes the data closer to an inversion. Learn more about yield curves in my blog, “5 Warning Signs of Recessions.” 3. Valuations (Bubbles) Alan Greenspan, Warren Buffett and Nobel Prize winning economist Robert Shiller have all been saying for over a year that stocks and bonds are in a bubble. Real estate prices are unaffordable in many U.S. cities to the denizens who live there. When prices outpace prospective buyers, they have to come down to attract an audience again. 4. Speculation. High frequency trading. Trading around the core. On Oct. 24, 2018, when the NASDAQ Composite Index dropped 4.4%, the second most active sell was the 3X NASDAQ bull fund. Yesterday, on November 12, 2018, the second most active sell was a NASDAQ index fund. The top-seller on both days was Advanced Micro Devices, a company that many traders have been using for fast profits due to the predictable volatility in the share price. This kind of speculation is called trading around the core. Apple was also one of the top trades on 11.12.18. Insider selling at Apple is in the hundreds of millions range. 5. Tariffs As Liz Ann Sonders, the Chief Investment Strategist at Charles Schwab, told me in an interview last month, “Trade Wars almost always raise inflation and lower growth.” Click to read more of Liz Ann’s wisdom in my blog on ThriveGlobal. 6. Tax Cuts Boosted Earnings in 2018, But Won't in 2019. In 2018, most corporations were able to boost earnings with the tax cut. However, it will be more difficult to keep that growth apace in 2019, when there isn’t another stimulus to goose earnings. 7. GDP Growth GDP growth was 3.5% in the 3rd quarter, however 4th quarter 2018 GDP growth is predicted to be back in the high 2% range. Crystal Ball 2019 We won’t get the 4th quarter GDP growth results until January 30, 2019. Between now and then, there will be a lot of headlines about the great 3.5% GDP growth, which will allow the big money and the speculators to profit on those who are led by headlines. In other words, rollercoaster volatility is expected to continue, with dramatic run-ups and pullbacks. There could be more dramatic selling in January and February 2019 for a few reasons. One is that corporations don’t buy back their own stock in the two-week period before they release earnings. This quiet period has been when the markets have experienced the most dramatic downturns and selling. Valuation remains a problem for the “smart” money. Finally, corporations buying back their own stock has fueled this entire bull market. As interest rates rise, it becomes more expensive for corporations to do that. Considering the cost of money (higher borrowing costs) with the inflated stock prices (buying high), you have a proposal on the table that reasonable board members can no longer support. Don't be caught unaware. Don't be complacent. Don't rely upon others to do it for you. It's time to know what you own and be the boss of your money. If you are interested in receiving an unbiased second opinion on your current investing strategy, email [email protected] or call 310-430-2397. You can learn the ABCs of Money that we all should have received in high school at one of my Investor Educational Retreats. Only 3 seats remain available at the Valentine’s Retreat in Santa Monica. Receive a complimentary private, prosperity coaching session (value $300) when you register for the Colorado Retreat by November 30, 2018. Other Blogs of Interest Will Ford Bonds Be Downgraded to Junk? 6 Risky Investments. 12 Red Flags. 1 Easy Way to Know Whom to Trust With Your Money. Whom Can You Trust? Trust Results. October Wipes Out 2018 Gains. Will There Be a Santa Rally in 2018? The Dow Dropped 832 Points. What Happened? Bonds are In Trouble. Learn 5 Ways to Protect Yourself. Interest Rates Projected to Double by 2020. 5 Warning Signs of a Recession. How a Strong GDP Report Can Go Wrong. Should I Invest in Ford and General Electric? Interview with Liz Ann Sonders Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable however NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors. With very high liabilities ($223 billion), tariffs and rising interest rates, Ford faces a tough road to keep out of junk bond territory. Moody’s downgraded Ford bonds to the lowest investment grade rung, with a negative outlook, on August 29, 2018. At the time the analysts wrote, “The ratings could be downgraded absent clear progress in pursuing the Fitness initiatives by early to mid-2019, with evidence that the company is on a strong trajectory for recovery.” As interest rates rise, bond investors have begun trading Ford like it is already in junk bond territory, according to a report from Bloomberg today. Ford is America’s bestselling brand for trucks, SUVs and vans. Since bonds are on the safe side of your nest egg, this is something that everyone should pay attention to. More than half of investment grade corporations are at the lowest rung above junk bond status. Many bond funds allow 20% or more junk bonds in their bond funds, making these products far riskier than most investors realize. Ford earnings are predicted to finish up 2018 21-30% lower than last year. Ford Motor Company has the highest debt to equity ratio in the U.S. auto manufacturing industry. (Yes, Ford’s debt and liabilities are eight times higher than Tesla’s.) Nov. 14, 2018 will be a big day for Ford, when they reveal their “operational efficiency improvements.” The presentation will include “complexity management, capital equipment reuse and yield management.” Ford stock investors should be aware that one of the ways Ford can avoid a downgrade is by cutting its dividend. The company promised in the 3rd quarter earnings call and in its fixed income presentation to keep the regular dividend “throughout the cycle” (whatever that means). Ford did not respond to my inquiry to define this phrase. More details on the regular and special Ford dividends should be revealed on Nov. 14, 2018. Ford Motor Company’s revenue was up 3.3% in the 3rd quarter of 2018; Tesla’s revenues more than doubled in the same period (from $2.98 billion a year to $6.8 billion). Learn more about what’s really happening at Ford and Tesla in my blogs from September 20, 2018. Investors Ask Natalie Pace: Should I Invest in Ford? The Tesla 3 is the Number 1 Selling Luxury Sedan In other news, yesterday Ford purchased the e-scooter company, Spin. Learn more here: Wall Street values Tesla ($60 billion) higher than GM ($50 billion) and Ford ($37 billion). All three U.S. carmakers combined don’t equal the value of Toyota Motors ($168 billion). Moody’s indicated on September 18, 2018 that the auto manufacturing industry should keep their current bond ratings into 2019. However, with gasoline prices up near $3.00/gallon (nationwide average), over $1.88/gallon in early 2016, and mounting “environmental policy pressures” (worldwide), consumer preferences are likely to shift, technological disruptions will continue and pressure will increase on profit margins and cash flow. This is the cocktail that weakened General Motors’ capital position ten years ago, when Toyota launched the Prius and consumers opted for fuel efficient vehicles. If Ford relies too much on gas guzzlers to fuel it through these challenges, that could be a losing bet. All Americans want a strong economy, jobs and a healthy auto manufacturing industry. As investors, however, it’s imperative to know the fiscal health of your holdings and to make sure that you are not over-exposed to industries and companies that are experiencing fiscal health challenges. Tariffs, higher costs for steel and rising interest rates are expected to negatively impact all carmakers in 2019. Other Blogs of Interest 6 Risky Investments. 12 Red Flags. 1 Easy Way to Know Whom to Trust With Your Money. Whom Can You Trust? Trust Results. October Wipes Out 2018 Gains. Will There Be a Santa Rally in 2018? The Dow Dropped 832 Points. What Happened? Bonds are In Trouble. Learn 5 Ways to Protect Yourself. Interest Rates Projected to Double by 2020. 5 Warning Signs of a Recession. How a Strong GDP Report Can Go Wrong. Should I Invest in Ford and General Electric? Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable however NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors. In today’s world, it’s easy to get caught up in trying to earn more to make ends meet. However, there are certain moments in time when protecting what you have, and learning how to stop making everyone else rich at your own expense, becomes the most important thing you can do for your future. That time is now. Cheap money has fueled bubbles in real estate, stocks and bonds. As interest rates rise, all of those over-leveraged and over-priced industries will become vulnerable to capital loss. You don’t want the lost capital to be on your dime. Yes, the GDP growth, low unemployment and low inflation are all good things. However, they are not indicators of corrections. All of these healthy signs were present in 2000 and 2008. Click to learn more about why asset bubbles are the top concerns in the New Millennium. Asset Bubbles and other Harbingers of a Recession are here, which means now is the time to make sure the roof and foundation of your money house are secure enough to withstand the financial storms on the horizon. As John F. Kennedy Jr. said, “The time to repair the roof is when the sun is shining.” Below are risky investments, red flags you need to be aware of, and one easy way to know whether or not you can trust someone who is offering you investing tips. 6 Risky Investments that are being Sold as Safe.

12 Red Flags that You’re Dealing with a Scam Artist or a Salesman.

Whom should you trust with your money? Trust results. Click to read my blog on that. And here is a little more information on each point. Learn 6 Risky Investments that are being Sold as Safe. In 2018 and beyond, the big issue is one of over-leverage and over-valuation. Low interest rates create bubbles, which is why we’ve seen real estate, stocks and bonds soar to the highest prices ever seen. As interest rates rise, all of these assets are under pressure. What’s more troublesome is that many are where you are placing your safe money, where you don’t want to worry about losing money. 1. Bonds. Particularly long-term bonds.Bonds lose value as interest rates rise. Many bond funds can have 20% or more in junk bonds. Over 50% of investment grade corporations are at the lowest rung, just one step above junk bond status. In the worst-case scenario, bonds can become illiquid or the corporation will declare bankruptcy. 2. High-Dividend Stocks.The higher the dividend, the higher the risk. High-dividend paying stocks are seducing investors with the “fixed income,” without properly advising them of the leverage risk. General Electric isn’t the only legacy corporation that is borrowing from Peter to pay Paul. When the dividend gets cut, the stock drops precipitously. GE’s dividend is now one of the lowest on Wall Street, and the stock has lost 72% of its value. 3. Private Placement Real Estate Investment Trusts (REITs).Private placement REITs lure salesmen in with high commissions. One retiree had all of her nest egg put into REITs without realizing that every one of the companies she invested in had been cash negative for years. She was told that she owns real estate, rather than the truth, which is she owns stock in high-risk cash negative companies. As interest rates rise, these companies will become a serious problem for their investors, who may have to try to get a portion of their return of part of their money in a bankruptcy court. 4. Annuities. Annuities are one of the few investments where you lose money the minute you purchase them. (They call it a surrender fee.) The largest annuity and insurance provider in the U.S. wouldn’t be in business if we hadn’t bailed it out in 2008. This company is back to being the largest. In 2017, it lost $6.08 billion. If an insurance corporation goes belly-up, your annuity and life insurance product is not FDIC-insured. If your annuity’s value is tied to the stock market performance, then you are vulnerable if the market corrects (which it does in recessions). 5. Money Market Funds. Money market funds are now subject to redemption gates and liquidity fees. If you want to ensure that you have access to your own money, without paying for it, then FDIC-insured cash accounts are a safer bet. 6. PensionsAnother little known Wall Street secret is that U.S. corporations are underfunded on their pensions and Other Post Employment Benefits by $453.6 billion (almost half a trillion). Multiemployer funds, government employees and others who have been promised pensions are likely linked to underfunded accounts as well – something that is more of a problem than most realize. According to W. Thomas Reeder, the director of the Pension Benefit Guaranty Corporation, “The [PBGC] Multiemployer Program faces very serious challenges and is likely to run out of money by the end of fiscal year 2025.” These funds are supposed to do better in bull markets, but that hasn’t happened this time. In fact, prior to the last two recessions, pensions were overfunded… 12 Red Flags that you’re Dealing with a Scam Artist or a Salesman. Learn more about all of these red flags in my blog on the Elon Musk cryptocurrency scams that made the rounds this year, and the penny pot stock scams that made the rounds in 2017. If something fishy turns up in your email box or on social media, let us know and we’ll look into it for you! Call 310-430-2397, email info @ NataliePace.com or ask your question on my Twitter or Facebook pages. 1 Easy Way to Know Whom to Trust! Whom should you trust with your money? Trust results. If you have a managed account, ask your financial advisor for a chart of the performance of your portfolio, including fees, compared to the NASDAQ Composite Index for a 10-year-period and for a 15-year-period. The first will let you know how well you’ve done in the bull market. The second will let you know how protected you are from the next stock market downturn. Most people are performing far below the NASDAQ because they are more invested in large cap value stocks than they are in hot, growth stocks. Additionally, when you add in the fees, your performance sinks even further. Click to learn more in my teleconference from Thursday November 8, 2018. If you are interested in receiving an unbiased second opinion on your current investing strategy, email [email protected] or call 310-430-2397. You can learn the ABCs of Money that we all should have received in high school at one of my Investor Educational Retreats. Only 3 seats remain available at the Valentine’s Retreat in Santa Monica. Receive a complimentary private, prosperity coaching session (value $300) when you register for the Colorado Retreat by November 30, 2018. Other Blogs of Interest Whom Can You Trust? Trust Results. October Wipes Out 2018 Gains. Will There Be a Santa Rally in 2018? The Dow Dropped 832 Points. What Happened? Bonds are In Trouble. Learn 5 Ways to Protect Yourself. Interest Rates Projected to Double by 2020. 5 Warning Signs of a Recession. How a Strong GDP Report Can Go Wrong. Should I Invest in Ford and General Electric? Important Disclaimers

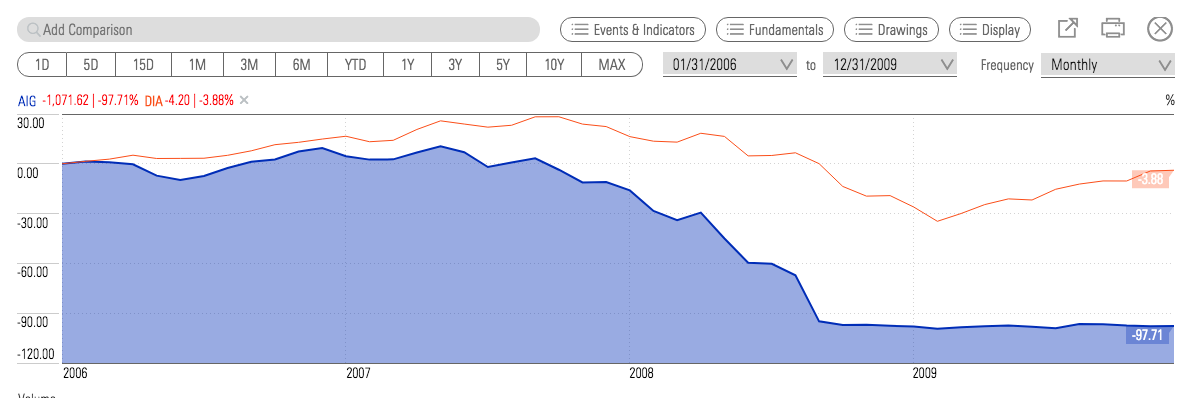

Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable however NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors. Dear Beefed, I can understand your frustration because there is a lot of noise out there and a lot of Madoff-types making promises of easy returns without any risk. There are also a lot of commission-based salesman passing themselves off as informed advisors. Trust Results You wouldn’t expect a failed musician to teach you music, so hold your financial team to the same test. The proof of whether or not they have a plan worth listening to and adopting is easily visible in the results test. Simply ask for a graph of the returns of the financial plan compared to the S&P500 for the past 10 years, and the past 15 years. The first chart shows you how well the plan did in the bull market. The 15-year chart will show you how the proposed investment strategy fared in the Great Recession. Most plans underperform the bull markets, due to fees, and drop precipitously during bear markets because they are not properly diversified. If the plan performed at or below the market, then you’re signing up to ride the Wall Street rollercoaster. Clearly, it’s not a good idea to lose more than half of your retirement every 8-10 years, and then just crawl back to even, only to be crushed again. If the strategy is an annuity or a high-yield REIT (Real Estate Investment Trust), then you can easily construct the chart yourself on Money.MSN.com (as long as the company is publicly traded). Since you are being asked to place your full faith in the company itself, without any backstop, it would be important to know how well that company fared in the last recession. If the business isn’t publicly traded then your risk level is much higher. AIG Compared to the Dow Jones Industrial Average January 2006-December 2009 What Worked in 2000 and 2008? Buy and Hold worked in the wake of World War II because the United States was in an expansionary period and our dollar had just become the world’s reserve currency. Performance of the Dow Jones Industrial Average Index 1940-2000 Since 2000, the U.S. (and most of the developed world) has been engaged in financial engineering to boost growth. Low interest rates create bubbles, which is why 2000 and 2008 losses were devastating, with investors losing up to 78% of their NASDAQ holdings in 2000-2002 and up to 55% of their Dow Jones Industrial Average positions in 2008. Bubbles are the reason that Wall Street has been a rollercoaster in the New Millennium. In 2000, it was the Dot Com Bubble. In 2008, it was the real estate bubble. What bubbles exist in 2018? An Easy Plan With a Ph.D. in Results There is a simple plan that worked great in both recessions – being properly diversified, with annual rebalancing. As for the results test, this easy-as-a-pie-chart nest egg strategy earned gains in the recessions and outperformed the bull markets in between. See Nilo Bolden’s testimonial for a real-world example of someone who trusted results before the Great Recession and is very happy that she did! In both 2000 and 2008, simply keeping a percentage equal to your age safe, and overweighting up to 20% safe due to the perilous market conditions, combined with the tried-and-true annual rebalancing, limited losses on the “at-risk” stock side and earned gains on the “fixed-income” bond side. That’s how Nilo and many others earned gains in the Great Recession – by having an age-appropriate, balanced and diversified plan. Bonds Earned Gains in 2008, When The DJIA Dropped by More Than Half Getting Safe in 2019 Getting safe now is trickier because bonds are vulnerable and losing money. As interest rates rise, as is predicted to happen over the next two years, bonds will continue to be under attack. Meanwhile, stocks are overleveraged, too, and are vulnerable to a correction. Diversification, annual rebalancing, avoiding the leverage, adding in hot industries and knowing what is safe in a world where bonds are losing money is important. That may sound complicated, but it is in fact easy as a pie chart (alongside a few other important details). Many, but not all, of the financial products that are readily available to you are overleveraged and overpriced today, meaning you are vulnerable to capital loss. Don’t let yourself succumb to disillusionment, befuddlement, blind faith or complacency. You have far too much at stake. Make it a priority to learn the ABCs of Money that we all should have received in high school. Be The Boss of Your Money Yes, you can be the boss of your money. No, it doesn’t mean that you have to take on another job, anymore than being the boss of your home means that you have to fix every little thing that needs to be repaired. There are certain times when protecting what you have is the most important financial move you can make. Now is that time. If blind faith cost you more than a third of your nest egg in 2008, then you have all the proof you need that your current plan needs a second opinion. Now. When you are disillusioned and befuddled, the right answer is to become informed and clear-headed. Wisdom and right action are always the best strategy, especially in tough times. Who can you trust to help you learn? Trust results. They will reveal who is the shaman and who is the snake-oil salesman. When someone says, "Let me do it for you," prepare to be oppressed. When someone says, "Let me teach you how," prepare to fly. I’ll be discussing 5 High-Risk Investments that are being sold as safe, and 5 Red Flags that you’re dealing with a salesman (rather than someone who is protecting you) in my November teleconference this Thursday (Nov. 8, 2018) at 9 am PT (noon ET). Call into: (347) 215-7305. Listen back 24/7 on demand at BlogTalkRadio.com/NataliePace. If you are interested in receiving an unbiased second opinion on your current investing strategy, email [email protected] or call 310-430-2397. You can learn the ABCs of Money that we all should have received in high school at one of my Investor Educational Retreats. Only 3 seats remain available at the Valentine’s Retreat in Santa Monica. Receive a complimentary private, prosperity coaching session (value $300) when you register for the Colorado Retreat by November 30, 2018. Other Blogs of Interest October Wipes Out 2018 Gains. Will There Be a Santa Rally in 2018? The Dow Dropped 832 Points. What Happened? Bonds are In Trouble. Learn 5 Ways to Protect Yourself. Interest Rates Projected to Double by 2020. 5 Warning Signs of a Recession. How a Strong GDP Report Can Go Wrong. Should I Invest in Ford and General Electric? Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable however NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors. |

AuthorNatalie Pace is the co-creator of the Earth Gratitude Project and the author of The Power of 8 Billion: It's Up to Us, The ABCs of Money, The ABCs of Money for College, The Gratitude Game and Put Your Money Where Your Heart Is. She is a repeat guest & speaker on national news shows and stages. She has been ranked the No. 1 stock picker, above over 830 A-list pundits, by an independent tracking agency, and has been saving homes and nest eggs since 1999. Archives

July 2024

Categories |

RSS Feed

RSS Feed