|

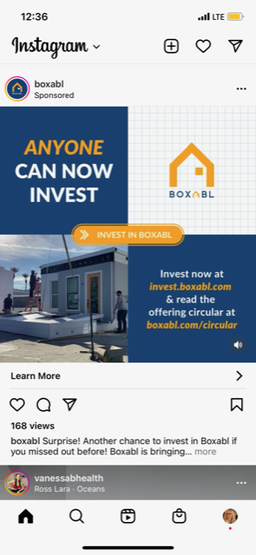

No, Elon Doesn’t Live in a Boxabl. Investors Ask Natalie. While I was on holiday/sustainability research in England last week, a new acquaintance asked me about investing in Boxabl. She was very excited about the opportunity based upon Elon Musk living in a Boxabl casita. She told me that the U.S. government had purchased hundreds of them. I’ve been a fan of prefab housing for quite a while. I was so impressed with the first platinum LEED rated home in the US, which was a prefab Living Home (now Plant Prefab), that I used to offer tours of it. It was the first I’d heard of Boxabl, so I decided to do a little digging. The first thing I turned up was this Elon Musk tweet. No, Elon doesn’t live in a Boxabl, although he does have a prototype (which he might have been given). Elon lives in a competitor’s tiny home, which he claims he purchased for less money than the Boxabl costs. If you look in the fine print of the posts by Boxabl, you’ll see a disclaimer, “Elon Musk is not affiliated with Boxabl and has not endorsed the Boxabl securities offering.” However, it’s easy to get excited about a YOLO* investment, when you see 5 posts of Elon and one of Kanye West on Boxabl’s Instagram. (Who reads the fine print?) Boxabl Gets an A in Marketing Boxable has done a number of things right, mostly in its marketing. Getting Elon Musk to accept a prototype is quite an achievement. The idea behind the design is cool, until you stop to consider just how small 375 square feet is, and just how expensive shipping costs of $10/mile from Vegas can be. As one Reddit user wrote, “I’m clueless on everything that would go into this, but I have lived in a 375 square foot apartment, and I must say it sucks ass.” (The factory-made LivingHome was about 2400 square feet – a real beauty.) There are no posted reviews (or pictures) from anyone who actually lives in a Boxabl casita because the company hasn’t received regulatory approval to sell to the general public yet (according to an email sent to me by Boxabl on Sept. 20, 2022). Millennials are starting families. The real estate trend has been toward the purchase of larger homes and multigenerational housing. Although in theory a small dwelling should be more affordable, there is still the problem of the high cost of land. Cheap, tiny homes have been around for decades and haven’t really taken off. Should We Invest? While the hype is intoxicating, there are lots of red flags about investing in this company. It’s important to remember that even a good company with a popular product doesn’t always pay off for investors. Beyond Meat investors loved the company at $200 a share. It’s not as popular today at $16. Sometimes, big companies (like D.R. Horton) bet on unicorns that never get out of the gate (like WeWork). Great companies always start with a popular product (something that is still unproven at Boxabl), and a team that can deliver, while making a profit. So What Are the Red Flags? One of the biggest red flags is that I have sent multiple emails asking for a profit and loss statement, and I still haven’t received it. Investors are buying in without knowing how much money goes into the founders’ bank accounts versus operations, how much cash has already been burned through, and with no say or oversight in the matter. 100% of the voting is held by Paolo Tiramani (74%) and Galiano Tiramani (26%). Additionally, Galiano has a history of serial startups – the last being a cryptocurrency exchange that ended in March of 2019 (red flag). The Focus is on Investing, Much More Than Orders On the home page, there’s a large tab to click and invest. After my search for Boxabl began, I started seeing ads everywhere luring me to invest. Crowdfunding & Private Equity Crowdfunding and private equity often fly under the SEC radar, so investors must do 10 times the due diligence. The marketing pitch deck makes no mention of a pathway to profitability. Homebuilding is a low margin business, so it’s important to understand how Boxabl is going to compete and stay in business. More Red Flags In addition to the troubled entrepreneurial track record and lack of financials and business plan, which would be reason enough to avoid investing, note the following concerns.

Bottom Line Boxabl is excelling at the hype game. Whether the company can build, deliver and make money by selling affordable, tiny homes is not clear yet. Beyond that, whenever you have a family business bringing in beaucoup investment dollars with no oversight or accountability, that often turns out very badly for the undiscerning wallet holders, and very well, in the near term, for the people who can put their hand in the cash kitty without anyone slapping it away. *You only live once. If you're interested in learning 21st Century time-proven investing strategies for protecting your wealth and managing the bear market from a No. 1 stock picker, join us for our Oct. 8-10, 2022 Financial Freedom Retreat. Email [email protected] to learn more and to register. Click on the banner ad below to discover the 18+ strategies you'll learn and master, to get pricing information and to read testimonials Get the best price when you register with friends and family. Register now to access your free 4-part Protect Your Wealth Now webinar that will get you started immediately.  Join us for our Financial Freedom Retreat. Oct. 8-10, 2022. Email [email protected] to learn more. Register with friends and family to receive the best price and a free 4-part webinar (which you can access to protect your wealth now). Click for testimonials & details.  Natalie Wynne Pace is an Advocate for Sustainability, FinancialLiteracy & Women's Empowerment. Natalie is the bestselling author of The Power of 8 Billion: It's Up to Us and is the co-creator of the Earth Gratitude Project. She has been ranked as a No. 1 stock picker, above over 835 A-list pundits, by an independent tracking agency (TipsTraders). Her book The ABCs of Money remained at or near the #1 Investing Basics e-book on Amazon for over 3 years (in its vertical), with over 120,000 downloads and a mean 5-star ranking. The 5th edition of The ABCs of Money was released on September 17, 2021. Natalie Pace's easy as a pie chart nest egg strategies earned gains in the last two recessions and have outperformed the bull markets in between. That is why her Investor Educational Retreats, books and private coaching are enthusiastically recommended by Nobel Prize winning economist Gary S. Becker, TD AMERITRADE chairman Joe Moglia, Kay Koplovitz and many Main Street investors who have transformed their lives using her Thrive Budget and investing strategies. Click to view a video testimonial from Nilo Bolden. Check out Natalie Pace's Apple Podcast. Watch videoconferences and webinars on Youtube. Other Blogs of Interest IRAs Offer More Freedom and Protection Than 401ks. Will There Be a Santa Rally 2022? What's Safe in a Debt World? Not Bonds. Will Your Favorite Chinese Company be Delisted? 75% of New Homeowners Have Buyer's Remorse Clean Energy Gets a Green Light from Congress. Fix Money Issues. Improve Your Relationships. 24% of House Sales Cancelled in the 2nd Quarter. 3 Things to Do Before July 28th. Recession Risks Rise + a Fairly Safe High-Yield Bond DAQO Doubles. Solar Shines. Which Company is Next in Line? Tesla Sales Disappoint. Asian EV Competition Heats Up. 10 Wealth Strategies of the Rich Copper Prices Plunge Colombia and Indonesia: Should You Invest? 10 Misleading Broker/Salesman Pitches. Why are Banks and Dividend Stocks Losing Money? Beyond Meat: Rare or Burnt? Netflix Streaming Wars End in a Bloodbath. Elon Musk Sells $23 Billon in Tesla Stock and Receives $23 Billion in Options. Are You Gambling With Your Future? ESG Investing: Missing the E. Moderna & Biotech Trade at 2-Year Lows. Bitcoin Crashes. Crypto, Bold and Stocks All Crash. The Economy Contracted -1.4% in 1Q 2022. The Dow Dropped 2000 Points. Is Plant-Based Protein Dying? Should You Sell in April? The U.S. House Decriminalizes Cannabis Again. Chinese Electric Vehicle Market Share Hits 20%. The Risk of Recession in 6 Charts. High Gas Prices How Will Russian Boycotts Effect U.S. Multinational Companies? Oil and Gas Trends During Wartime Russia Invades Ukraine. How Have Stocks Responded in Past Wars? Zombie Companies. Rescue, Rehab or Liquidate? Spotify: Music to my Ears. Cannabis Crashes. 2022 Crystal Ball in Stocks, Real Estate, Crypto, Cannabis, Gold, Silver & More. Interview with the Chief Investment Strategist of Charles Schwab & Co., Inc. Stocks Enter a Correction Investor IQ Test Investor IQ Test Answers Real Estate Risks. What Happened to Ark, Cloudflare, Bitcoin and the Meme Stocks? Omicron is Not the Only Problem From FAANNG to ZANA MAD MAAX Ted Lasso vs. Squid Game. Who Will Win the Streaming Wars? Starbucks. McDonald's. The Real Cost of Disposable Fast Food. The Plant-Based Protein Fire-Sale What's Safe in a Debt World? Inflation, Gasoline Prices & Recessions China: GDP Soars. Share Prices Sink. The Competition Heats Up for Tesla & Nio. How Green in Your Love for the Planet? S&P500 Hits a New High. GDP Should be 7% in 2021! Will Work-From-Home and EVs Destroy the Oil Industry? Insurance and Hedge Funds are at Risk and Over-Leveraged. Office Buildings are Still Ghost Towns. Money Market Funds, FDIC, SIPC: Are Any of Them Safe? My 24-Year-Old is Itching to Buy a Condo. Should I Help Him? The 12-Step Guide to Successful Investing. Gardeners Creating Sanctuary & Solutions in Food Deserts. 2021 Company of the Year Almost 5 Million Americans are Behind on Rent & Mortgage. Real Estate Hits All-Time High. Rebalancing Your Nest Egg IQ Test. Answers to the Rebalancing Your Nest Egg IQ Test. Videoconferencing in a Post-Pandemic World (featuring Zoom & Teladoc). Sanctuary Sandwich Home. Multigenerational Housing. Interview with Lawrence Yun, the chief economist of the National Association of Realtors. 10 Budget Leaks That Cost $10,000 or More Each Year. The Stimulus Check. Party Like It's 1999. Would You Pay $50 for a Cafe Latte? Is Your Tesla Stock Overpriced? 10 Questions for College Success. Is FDIC-Insured Cash at Risk of a Bank Bail-in Plan? 8 Money Myths, Money Pits, Scams and Conspiracy Theories. Why Are My Bonds Losing Money? The Bank Bail-in Plan on Your Dime. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable. However, NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors. IRAs Offer More Safety and Freedom Than 401ks. Should you roll over now, even if you’re still working? I recently had a coaching session with someone who had just retired. Prior to retirement, she had attempted to get the majority of her money safe in what seemed like the best option – a so-called “Capital Preservation” fund. However, when we looked at the performance of the fund, it was losing money on par with the S&P500. Since the safe side is where you are supposed to keep your money (not lose it), the plan was not doing what it advertised or what it should be doing. I’ll explain why that is below. However, there are plenty of questions to answer about 401ks, IRAs, HSAs and whether or not you can (or should) roll over. Invest 10% of Your Income into Tax-Protected Retirement Accounts (Not Just Your 401k) Your wealth plan could ideally be a combination of accounts. The sooner you start with this, the better. Consider contributing up to your employer’s match into the 401k (free money). If you’re healthy, don’t spend an arm and a leg on health insurance. Open a Health Savings Account, with a high deductible health insurance plan. Americans can save thousands annually (or more), while also developing your best long-term health care plan. Also, consider maxing out your Roth IRA contribution each year. The IRA could be where you invest in hot industries, companies or countries that are not offered in your 401k. IRAs typically offer thousands of investment choices. Learn more about how Health Savings Accounts can save you thousands annually, and how proper diversification and regular rebalancing earns gains in recessions at our Investor Educational Retreats. The next one is Oct. 8-10, 2022. Capital Preservation Plans are Losing Money Capital Preservation and bond funds are losing money because there is an inverse relationship between bonds and interest rates. Normally when the economy weakens, the Federal Reserve Board cuts interest rates to boost economic growth. That makes existing bonds (that are paying a higher premium) more valuable. Unfortunately, in the current cycle, the Federal Reserve Board is rapidly increasing interest rates – something that reduces the value of existing bonds. That means that most bonds and bond funds are losing value. Credit risk is also a problem. The yields are too low to compensate for the risk or the losses that bond investors are bearing. Currently, over half of the S&P500 is at or near junk bond status. You can learn more about why bonds, bond funds, annuities and money market funds are all vulnerable to capital losses in my blog, “What’s Safe in a Debt World.” (Click to access.) So, how can you protect your 401k from losses? IRAs Have Better Safety Measures Some brokerages offer FDIC-insured cash. While you might not be earning much, capital preservation is important on the safe side of your portfolio. IRAs Have Greater Freedom Diversification and Target Industries Most 401ks have very limited options. You might only have a few large caps, growth, value, international and bond funds to choose from. Getting access to industries that might perform better during a weak economy is almost impossible. Getting safe is also an issue, as I’ve already mentioned. IRAs might have a universe of industries, countries, individual stocks and size/style options, along with better strategies for capital preservation (depending upon the brokerage you choose). Three IRA Tips 1. I like to put my hot industries and stocks in my Roth IRA. According to ProPublica, Peter Thiel has over $5 billion in his Roth IRA. That’s the power of compounding without paying capital gains, with the added benefit of not having to pay income tax when the money is withdrawn. 2. You should be able to keep contributing to your 401k even if you are doing annual rollovers from your 401k into a Roth IRA. 3. Pages and pages of holdings is often not as diversified as our simple, 10-fund pie-chart strategy. It’s important to know what you own, and how well-diversified you truly are, rather than having blind faith that hundreds of holdings are protecting and diversifying you. I’ve done a lot of 2nd opinions on these types of plans. Most consist of large caps with bonds, are missing hot industries and proper protection, and are vulnerable to losing half or more in recessions. Rollover Rules You may be able to do a rollover even if you’re still working. Some employers make this very easy, offering a “self-directed” option. The clickable link might be so small that you’ve overlooked it in the past. If your 401k doesn’t offer a self-directed option, then ask your Human Resources executive if you can take an “in-service” distribution. You must make sure that you get the rollover done in a 60-day period in order to qualify for a tax-free distribution. It might take some convincing to get this done. (If you are 59 ½ or older, persistence could pay off.) Be sure to follow the IRS rules about rolling over your 401K into a self-directed IRA. If you don’t have a self-directed option and your employer is refusing an in-service distribution, then consider taking a personal loan from your 401k. You’ll need to pay it back within 5 years in order to avoid the distribution penalty, or to use it to buy a home. However, if a loan allows you greater freedom in keeping your money safe, it might be worth crossing the t’s and dotting the i’s to do it. Choosing the Right Brokerage You’ll need to select a brokerage and open up your Roth IRA for the 401k rollover. In general, it’s easier to start the process at the place where you want your money to end up, rather than start with your employer. The person who is getting your money is likely to be a lot more helpful than the person who is losing it. Below are a few things to consider when selecting the brokerage that is right for you.

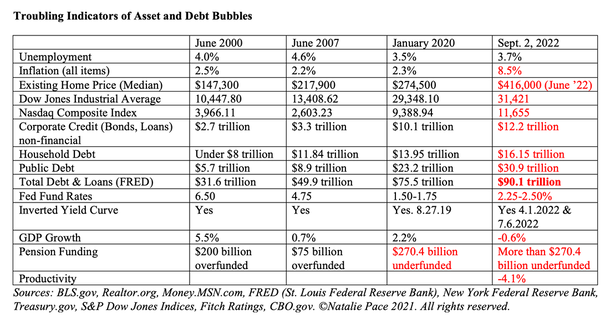

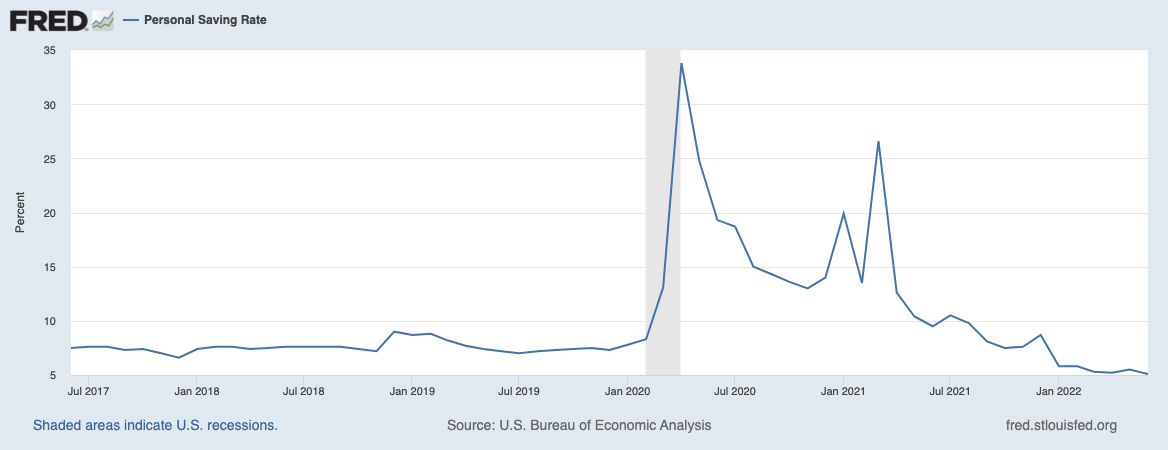

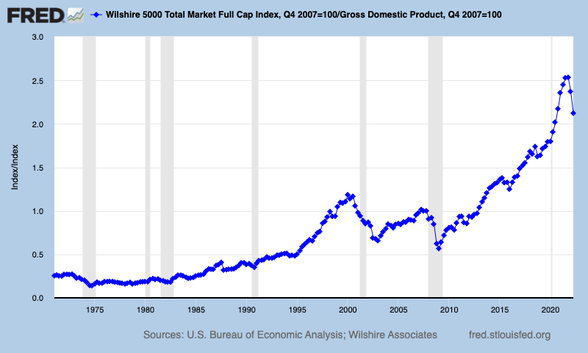

So What is Safe in a Debt World? Currently, 2-year Treasury Bills are paying a higher premium than 10-year bills, at about 3.5%! There’s a 9.62% Treasury I Savings Bond. However, there are also some safe, income-producing hard assets that you can purchase for a great price that most people should be considering now. Learn more in the What’s Safe section of The ABCs of Money 5th edition and at our Financial Empowerment Retreat (online Oct. 8-10, 2022). We spend one full day at the retreat offering strategies for safety. Bottom Line It’s difficult to get properly protected and diversified in a 401k. Consider setting up an HSA and Roth IRA, in addition to your 401K to have greater freedom and control over your money. Also think about rolling over your 401k into a tax-protected IRA (or taking that personal loan from it) that offers FDIC-insured cash on the safe side, and a universe of options for your at-risk allocations. No matter what kind of accounts that you have, it’s essential to set-up a diversified plan that is properly protected. Our books outline that time-proven, 21st Century strategy, while our retreats ensure that you learn and implement the plan. Buy & Hold is a last-century strategy that has been a disaster in the 21st Century (stagflation). Over the extended secular bull market, it’s been easy to earn gains. That is unlikely to be the case in the years to come. It’s easy to win in a bull market and easy to lose (a lot) in a recession. If you’re interested in an unbiased 2nd opinion of how well protected and diversified your plan is, email [email protected] with 2nd opinion in the subject line for pricing and information. If you're interested in learning 21st Century time-proven investing strategies for protecting your wealth and managing the bear market from a No. 1 stock picker, join us for our Oct. 8-10, 2022 Financial Freedom Retreat. Email [email protected] to learn more and to register. Click on the banner ad below to discover the 18+ strategies you'll learn and master, to get pricing information and to read testimonials Get the best price when you register with friends and family. Register now to access your free 4-part Protect Your Wealth Now webinar that will get you started immediately.  Join us for our Financial Freedom Retreat. Oct. 8-10, 2022. Email [email protected] to learn more. Register with friends and family to receive the best price and a free 4-part webinar (which you can access to protect your wealth now). Click for testimonials & details.  Natalie Wynne Pace is an Advocate for Sustainability, FinancialLiteracy & Women's Empowerment. Natalie is the bestselling author of The Power of 8 Billion: It's Up to Us and is the co-creator of the Earth Gratitude Project. She has been ranked as a No. 1 stock picker, above over 835 A-list pundits, by an independent tracking agency (TipsTraders). Her book The ABCs of Money remained at or near the #1 Investing Basics e-book on Amazon for over 3 years (in its vertical), with over 120,000 downloads and a mean 5-star ranking. The 5th edition of The ABCs of Money was released on September 17, 2021. Natalie Pace's easy as a pie chart nest egg strategies earned gains in the last two recessions and have outperformed the bull markets in between. That is why her Investor Educational Retreats, books and private coaching are enthusiastically recommended by Nobel Prize winning economist Gary S. Becker, TD AMERITRADE chairman Joe Moglia, Kay Koplovitz and many Main Street investors who have transformed their lives using her Thrive Budget and investing strategies. Click to view a video testimonial from Nilo Bolden. Check out Natalie Pace's Apple Podcast. Watch videoconferences and webinars on Youtube. Other Blogs of Interest Will There Be a Santa Rally 2022? What's Safe in a Debt World? Not Bonds. Will Your Favorite Chinese Company be Delisted? 75% of New Homeowners Have Buyer's Remorse Clean Energy Gets a Green Light from Congress. Fix Money Issues. Improve Your Relationships. 24% of House Sales Cancelled in the 2nd Quarter. 3 Things to Do Before July 28th. Recession Risks Rise + a Fairly Safe High-Yield Bond DAQO Doubles. Solar Shines. Which Company is Next in Line? Tesla Sales Disappoint. Asian EV Competition Heats Up. 10 Wealth Strategies of the Rich Copper Prices Plunge Colombia and Indonesia: Should You Invest? 10 Misleading Broker/Salesman Pitches. Why are Banks and Dividend Stocks Losing Money? Beyond Meat: Rare or Burnt? Netflix Streaming Wars End in a Bloodbath. Elon Musk Sells $23 Billon in Tesla Stock and Receives $23 Billion in Options. Are You Gambling With Your Future? ESG Investing: Missing the E. Moderna & Biotech Trade at 2-Year Lows. Bitcoin Crashes. Crypto, Bold and Stocks All Crash. The Economy Contracted -1.4% in 1Q 2022. The Dow Dropped 2000 Points. Is Plant-Based Protein Dying? Should You Sell in April? The U.S. House Decriminalizes Cannabis Again. Chinese Electric Vehicle Market Share Hits 20%. The Risk of Recession in 6 Charts. High Gas Prices How Will Russian Boycotts Effect U.S. Multinational Companies? Oil and Gas Trends During Wartime Russia Invades Ukraine. How Have Stocks Responded in Past Wars? Zombie Companies. Rescue, Rehab or Liquidate? Spotify: Music to my Ears. Cannabis Crashes. 2022 Crystal Ball in Stocks, Real Estate, Crypto, Cannabis, Gold, Silver & More. Interview with the Chief Investment Strategist of Charles Schwab & Co., Inc. Stocks Enter a Correction Investor IQ Test Investor IQ Test Answers Real Estate Risks. What Happened to Ark, Cloudflare, Bitcoin and the Meme Stocks? Omicron is Not the Only Problem From FAANNG to ZANA MAD MAAX Ted Lasso vs. Squid Game. Who Will Win the Streaming Wars? Starbucks. McDonald's. The Real Cost of Disposable Fast Food. The Plant-Based Protein Fire-Sale What's Safe in a Debt World? Inflation, Gasoline Prices & Recessions China: GDP Soars. Share Prices Sink. The Competition Heats Up for Tesla & Nio. How Green in Your Love for the Planet? S&P500 Hits a New High. GDP Should be 7% in 2021! Will Work-From-Home and EVs Destroy the Oil Industry? Insurance and Hedge Funds are at Risk and Over-Leveraged. Office Buildings are Still Ghost Towns. Money Market Funds, FDIC, SIPC: Are Any of Them Safe? My 24-Year-Old is Itching to Buy a Condo. Should I Help Him? The 12-Step Guide to Successful Investing. Gardeners Creating Sanctuary & Solutions in Food Deserts. 2021 Company of the Year Almost 5 Million Americans are Behind on Rent & Mortgage. Real Estate Hits All-Time High. Rebalancing Your Nest Egg IQ Test. Answers to the Rebalancing Your Nest Egg IQ Test. Videoconferencing in a Post-Pandemic World (featuring Zoom & Teladoc). Sanctuary Sandwich Home. Multigenerational Housing. Interview with Lawrence Yun, the chief economist of the National Association of Realtors. 10 Budget Leaks That Cost $10,000 or More Each Year. The Stimulus Check. Party Like It's 1999. Would You Pay $50 for a Cafe Latte? Is Your Tesla Stock Overpriced? 10 Questions for College Success. Is FDIC-Insured Cash at Risk of a Bank Bail-in Plan? 8 Money Myths, Money Pits, Scams and Conspiracy Theories. Why Are My Bonds Losing Money? The Bank Bail-in Plan on Your Dime. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable. However, NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors. Is There Any Hope for a Santa Rally 2022? Should you be looking for September Back to School Stock Sales or Bracing Yourself for a Long, Cold Winter? September is historically a down month on Wall Street. So, should you be stocking up on Back to School stock sales at the end of this month, in anticipation of a Santa Rally? Or do recession years act differently? Is this the beginning of a more severe downturn? Let’s take a look at the three past recessions of the 21st Century to see what history teaches us. Pandemic The pandemic was officially the shortest recession in history, with a peak on February 19, 2020 and the bottom on March 23, 2020. That was the result of the U.S. (and the world) printing up trillions of dollars and handing it out like candy to everyone with a pulse. This was intentional, as the alternative would have been a disaster unlike anything the world has seen since the Great Depression. As a result of that flush of money into the system, inflation, leverage, speculation and debt became elevated. Stocks and home prices soared. Rents went through the roof. The personal savings rate looked healthier than it had ever been with all of the PPP loans, handouts, student loan and mortgage pauses, and the prohibition on evictions and foreclosures. However, the personal savings rate disappeared just as rapidly as it soared, and has fallen to pre-pandemic lows. Stocks wobbled a little in September and October of 2020, with losses of -3.92% and -2.77%, respectively. However, the 2020 Santa Rally gave investors plenty of gifts in November and December, with gains of 10.75% & 3.71%. 2021 was one of the most spectacular years that the U.S. stock market has ever seen with annual gains of 26.6% in the S&P500®. The 2022 Inflation Recession (assuming one is named this year) won’t be the same as the 2020 Pandemic Recession. The Federal Reserve Board is tightening up the money supply and jacking up interest rates to fight inflation (taking money away from us). They are intentionally slowing the economy down. There are caps on the Debt Limit, so any requests to print up money and add to the public debt would have to be approved by Congress. The Feds have made it clear that we’re going to all have to endure some pain. They are ending the party, at least for now. The Great Recession (2008) The National Bureau of Economic Research (NBER) didn’t call the Great Recession until December 1, 2008, even though Wall Street share prices peaked in October of 2007 – a full year before the announcement. The Bureau is notoriously slow. That was just three months before the bottom (March 9, 2009)! So, investors didn’t receive any warning that the Santa Rally was called off in 2007 and 2008, but instead received a lot of false assurances that the failures of Countrywide, Washington Mutual, Bear Stearns, Lehman Bros, etc., were not endemic to the financial system. November and December 2007 had losses of -4.40% and -0.86% in the S&P500. 2008 was far worse, however, with losses of -16.94% in October, -7.49% in November and only a whimper of a recovery of less than 1% in December. Between October of 2007 and March of 2009, the Dow Jones Industrial Average dropped 55%, to a low of 6547, with the majority of those losses occurring before the recession announcement. While the DJIA recovered within 6 years, one’s portfolio takes quite a bit longer to crawl back to even. A 10% return on a million dollars is $100,000, while a 10% return on $450,000 is only $45,000. You can do the math on how many years it will take to make up $550,000 in losses. (Incidentally, those investors, like Bill and Nilo Bolden, who used our easy-as-a-pie-chart nest egg strategy earned gains in the Great Recession, while their friends and colleagues lost more than half.) Dot Com Recession Between March of 2000 when the NASDAQ Composite Index soared to a high of over 5,000 and October of 2002 when it dropped to a low of 1114, the NASDAQ lost -78%. Most of the drop happened before 911. The NASDAQ had already plunged to 1805 (-64%) by the end of August 2001. However, the recession wasn’t proclaimed official until Nov. 26, 2001. (When you wait for the headlines that we’re in a recession, it’s too late to protect yourself.) There wasn’t a Santa Rally in 2000. Even though the recession hadn’t been named yet, there were a lot of cash-negative Dot Coms that were going belly-up, and there was a general consensus that many NASDAQ-listed companies were severely overvalued. Wall Street acted, while many Main Street investors waited for the official announcement. As you can see in the chart below, stocks were very overpriced in early 2000, and are even more speculative now. As one example, even with a pullback of 34%, Tesla’s price-earnings ratio is 98. Tesla’s market value is $860 billion on net income of just $5.5 billion. The U.S. also had a protracted period of stress with hanging chad voter ballot recounts that extended from the election day on November 7, 2000, until Dec. 12, 2000, when the Supreme Court declared that George W. Bush was the electoral winner of the Presidential election. (Al Gore won the popular vote.) 2000 saw losses of 8% in the S&P500 in the last quarter. After 911, everyone thought the U.S. markets would take a nosedive. However, there was a robust Santa Rally of 10%! It was a brief respite from an otherwise quite miserable 3-year period. October 2002 was the low point of that business cycle. Investors had taken such a bath (beginning in March of 2000) that many were disgusted with investing. (It’s common to want to sell low after enduring such losses for such an extended period of time; emotions are not a friend of the successful investor.) After a year of losses culminating in the S&P500 being down -32.68% by the end of September 2002, Wall Street attempted a Rally in October and November of 14%, only to see December slide again by -6%. The NASDAQ Composite Index finally rallied 55% in 2003. Google had one of the most successful IPOs of all-time in 2004. However, there were a lot of people who didn't have the liquidity or the stomach to participate in either. Bottom Line Santa Rallies are rare in recession years. Buy & Hope investors, or anyone who waits for headlines, often endure severe downturns that require hoping and praying to crawl back to even during the majority of the bull market. That’s not a successful strategy. Recessions are not just hard on your fiscal health. They can delay your retirement, elevate stress and impact your family and partnerships. This year, instead of thinking about Back to School Stock Sales, I’d be more concerned about investors getting coal in their holiday stockings. Now is a good time to get defensive and make sure that you have protected as much of your wealth as possible, in anticipation of continued weakness on Wall Street (and around the world). We are overweighting an additional 20% safe in our sample pie charts. Market timing doesn’t work, so it’s never advisable to jump all in or all out. It’s just as important to know what’s safe in a Debt World because bonds are losing money, annuities are not FDIC-insured and money market funds have redemption gates and liquidity fees. (Click to access that blog). If you would like to know what you own, and how you might be better protected, consider receiving an unbiased 2nd opinion. In that analysis, you’ll learn what is toxic in your plan, what is sound but perhaps overweighted, and what a better strategy looks like. Email [email protected] for pricing and information. You can also attend our Oct. 8-10, 2022 Financial Empowerment Retreat to learn and implement these strategies yourself. It’s important to be the boss of your money, rather than relying on blind faith that someone else is protecting your wealth and future. Most managed plans, especially Buy and Hope plans, ride the Wall Street rollercoaster and are at risk of losses of 50% or more in recessions. Register for the Oct. 8-10, 2022 Retreat now to receive a free 4-part webinar on how to protect your investments and budget immediately. (If you are a busy professional and you’d just like our step-by-step Wealth Protection plan, then the 2nd opinion is right for you.) Testimonials "Many people, including educated men and women, often get into trouble when they neglect to follow simple and fundamental rules of the type provided [by Natalie]. This is why I recommend them with enthusiasm." Professor Gary S. Becker. Dr. Becker won the 1992 Nobel Prize in economics for his theories on human "College students need this information before they get their first credit card. Young adults need it before they buy their first home. Empty nesters can use the information to downsize to a sustainable lifestyle, before they get into trouble." Joe Moglia, Chairman, TD AMERITRADE. If you're interested in learning 21st Century time-proven investing strategies for protecting your wealth and managing the bear market from a No. 1 stock picker, join us for our Oct. 8-10, 2022 Financial Freedom Retreat. Email [email protected] to learn more and to register. Click on the banner ad below to discover the 18+ strategies you'll learn and master, to get pricing information and to read testimonials Get the best price when you register with friends and family. Register now to access your free 4-part Protect Your Wealth Now webinar that will get you started immediately.  Join us for our Financial Freedom Retreat. Oct. 8-10, 2022. Email [email protected] to learn more. Register with friends and family to receive the best price and a free 4-part webinar (which you can access to protect your wealth now). Click for testimonials & details.  Natalie Wynne Pace is an Advocate for Sustainability, FinancialLiteracy & Women's Empowerment. Natalie is the bestselling author of The Power of 8 Billion: It's Up to Us and is the co-creator of the Earth Gratitude Project. She has been ranked as a No. 1 stock picker, above over 835 A-list pundits, by an independent tracking agency (TipsTraders). Her book The ABCs of Money remained at or near the #1 Investing Basics e-book on Amazon for over 3 years (in its vertical), with over 120,000 downloads and a mean 5-star ranking. The 5th edition of The ABCs of Money was released on September 17, 2021. Natalie Pace's easy as a pie chart nest egg strategies earned gains in the last two recessions and have outperformed the bull markets in between. That is why her Investor Educational Retreats, books and private coaching are enthusiastically recommended by Nobel Prize winning economist Gary S. Becker, TD AMERITRADE chairman Joe Moglia, Kay Koplovitz and many Main Street investors who have transformed their lives using her Thrive Budget and investing strategies. Click to view a video testimonial from Nilo Bolden. Check out Natalie Pace's Apple Podcast. Watch videoconferences and webinars on Youtube. Other Blogs of Interest What's Safe in a Debt World? Not Bonds. Will Your Favorite Chinese Company be Delisted? 75% of New Homeowners Have Buyer's Remorse Clean Energy Gets a Green Light from Congress. Fix Money Issues. Improve Your Relationships. 24% of House Sales Cancelled in the 2nd Quarter. 3 Things to Do Before July 28th. Recession Risks Rise + a Fairly Safe High-Yield Bond DAQO Doubles. Solar Shines. Which Company is Next in Line? Tesla Sales Disappoint. Asian EV Competition Heats Up. 10 Wealth Strategies of the Rich Copper Prices Plunge Colombia and Indonesia: Should You Invest? 10 Misleading Broker/Salesman Pitches. Why are Banks and Dividend Stocks Losing Money? Beyond Meat: Rare or Burnt? Netflix Streaming Wars End in a Bloodbath. Elon Musk Sells $23 Billon in Tesla Stock and Receives $23 Billion in Options. Are You Gambling With Your Future? ESG Investing: Missing the E. Moderna & Biotech Trade at 2-Year Lows. Bitcoin Crashes. Crypto, Bold and Stocks All Crash. The Economy Contracted -1.4% in 1Q 2022. The Dow Dropped 2000 Points. Is Plant-Based Protein Dying? Should You Sell in April? The U.S. House Decriminalizes Cannabis Again. Chinese Electric Vehicle Market Share Hits 20%. The Risk of Recession in 6 Charts. High Gas Prices How Will Russian Boycotts Effect U.S. Multinational Companies? Oil and Gas Trends During Wartime Russia Invades Ukraine. How Have Stocks Responded in Past Wars? Zombie Companies. Rescue, Rehab or Liquidate? Spotify: Music to my Ears. Cannabis Crashes. 2022 Crystal Ball in Stocks, Real Estate, Crypto, Cannabis, Gold, Silver & More. Interview with the Chief Investment Strategist of Charles Schwab & Co., Inc. Stocks Enter a Correction Investor IQ Test Investor IQ Test Answers Real Estate Risks. What Happened to Ark, Cloudflare, Bitcoin and the Meme Stocks? Omicron is Not the Only Problem From FAANNG to ZANA MAD MAAX Ted Lasso vs. Squid Game. Who Will Win the Streaming Wars? Starbucks. McDonald's. The Real Cost of Disposable Fast Food. The Plant-Based Protein Fire-Sale What's Safe in a Debt World? Inflation, Gasoline Prices & Recessions China: GDP Soars. Share Prices Sink. The Competition Heats Up for Tesla & Nio. How Green in Your Love for the Planet? S&P500 Hits a New High. GDP Should be 7% in 2021! Will Work-From-Home and EVs Destroy the Oil Industry? Insurance and Hedge Funds are at Risk and Over-Leveraged. Office Buildings are Still Ghost Towns. Money Market Funds, FDIC, SIPC: Are Any of Them Safe? My 24-Year-Old is Itching to Buy a Condo. Should I Help Him? The 12-Step Guide to Successful Investing. Gardeners Creating Sanctuary & Solutions in Food Deserts. 2021 Company of the Year Almost 5 Million Americans are Behind on Rent & Mortgage. Real Estate Hits All-Time High. Rebalancing Your Nest Egg IQ Test. Answers to the Rebalancing Your Nest Egg IQ Test. Videoconferencing in a Post-Pandemic World (featuring Zoom & Teladoc). Sanctuary Sandwich Home. Multigenerational Housing. Interview with Lawrence Yun, the chief economist of the National Association of Realtors. 10 Budget Leaks That Cost $10,000 or More Each Year. The Stimulus Check. Party Like It's 1999. Would You Pay $50 for a Cafe Latte? Is Your Tesla Stock Overpriced? 10 Questions for College Success. Is FDIC-Insured Cash at Risk of a Bank Bail-in Plan? 8 Money Myths, Money Pits, Scams and Conspiracy Theories. Why Are My Bonds Losing Money? The Bank Bail-in Plan on Your Dime. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable. However, NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors. |

AuthorNatalie Pace is the co-creator of the Earth Gratitude Project and the author of The Power of 8 Billion: It's Up to Us, The ABCs of Money, The ABCs of Money for College, The Gratitude Game and Put Your Money Where Your Heart Is. She is a repeat guest & speaker on national news shows and stages. She has been ranked the No. 1 stock picker, above over 830 A-list pundits, by an independent tracking agency, and has been saving homes and nest eggs since 1999. Archives

July 2024

Categories |

RSS Feed

RSS Feed