|

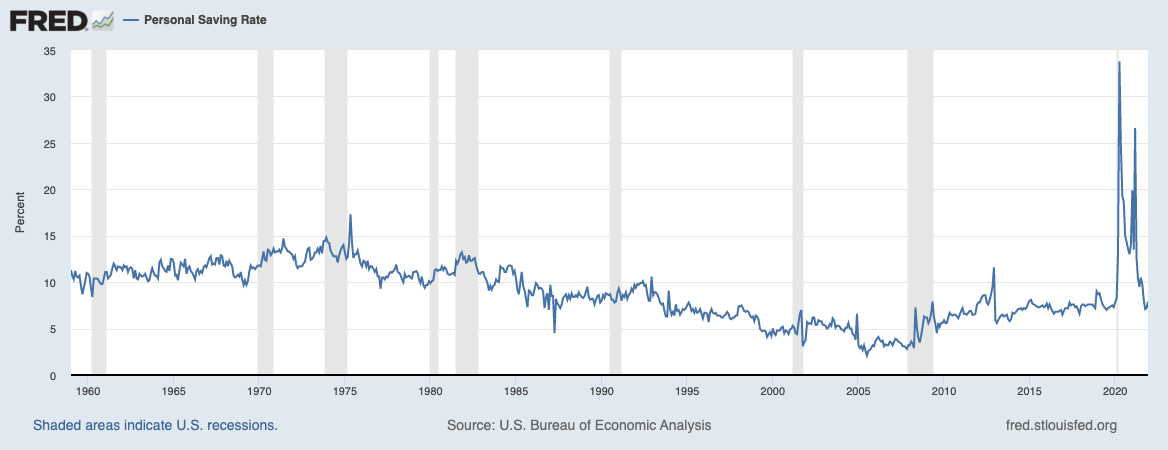

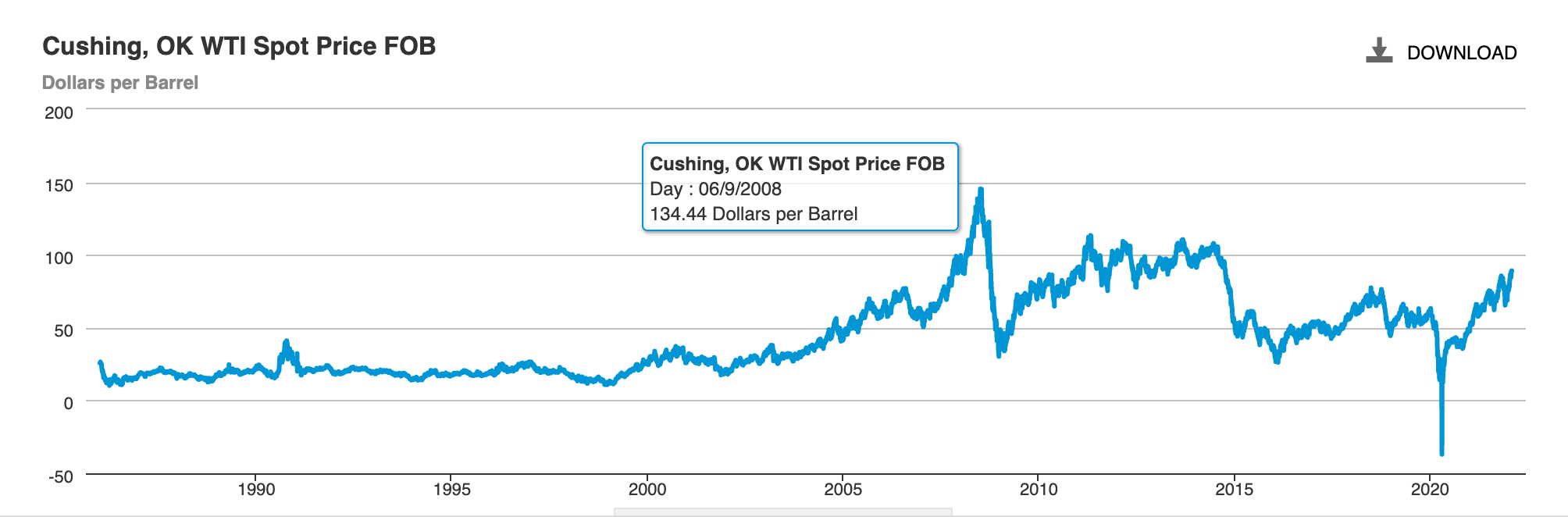

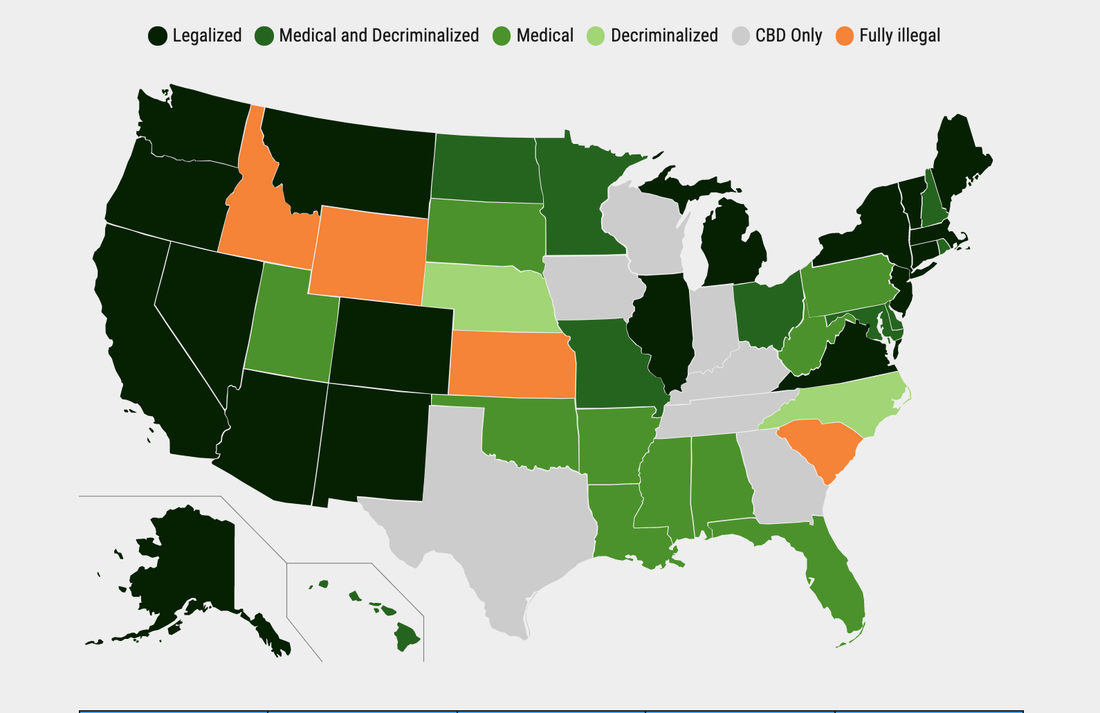

Easy money versus tight money. That’s probably the best way to think about 2022, as opposed to 2021. In 2021, there were a lot of stimulus checks and pauses on payments. If you rented, you couldn’t be evicted. If you owed student loan debt, you could pause it (through May 1, 2022). If you had a mortgage that was too much for the budget, you could even forego paying without risk of a foreclosure. This year, we’ll begin paying the borrowed money back – at a higher interest rate. Last year, consumers had high levels of savings. That’s been wiped out. We are starting to see red flags that consumption will wane, particularly with regard to real estate, cars, and large household goods. Since the consumer drives almost 70% of economic growth in the United States, that means 2022 economic growth is expected to slow from 2021's 5.7% GDP growth. The Federal Reserve Board is still predicting 4.0% GDP growth in the U.S., however. China’s GDP should be above 5.0%, and perhaps as high as 5.6%. World GDP growth is predicted to be 4.8% (source: IMF). That’s not Armageddon. However, if some of the risk factors become heightened, growth will be impacted. Oil High oil prices have a high correlation with recessions and stock market downturns. This has a lot to do with the drag that gasoline prices have on the family budget. Recessions are preceded by stock market downturns. Stocks 2022 is unlikely to produce the 27% rise that the S&P500 experienced in 2021. If you haven’t rebalanced recently, or worse, in a number of years, now is a very good time for you to know what you own, to be properly diversified and to rebalance and capture some gains. There are a few sections of the market that have been destroyed, and are trading for a better price than we’ve seen in years. There is room in a balanced plan for buying low and selling high – without making it an “all in or all out” proposition. What do you need to watch out for and be aware of? Zombie companies, many of which are in retail, travel and hospitality, are not making enough money to pay the interest on the debt they’ve borrowed. Meme stocks are highly volatile, even if the underlying business is sound. In your retirement plan, the pie charts can offer you protection and performance, whereas those target date retirement plans underperform the S&P500. If you want to trade stocks (and have the stomach for it), then you need to understand the basics and also what’s changed in the past two years. We spend one full day on evaluating stocks (winners and losers) at the Investor Educational Retreat. Small caps underperformed during the pandemic, while large companies (including zombies) had an easier time beefing up their treasury. Value funds may include more zombies than investors are aware of. So, as support is being pulled back, it’s important to find value in non-traditional ways and in other parts of the world, where equities are on sale. Real Estate The cure for high prices is high prices. A housing affordability crisis, combined with rising interest rates, has tanked consumer sentiment on their intentions to purchase homes, cars and large household goods. Most economists do not predict a House of Cards as terrible as The 2008 Great Recession crisis. However, there will be pressure on households, particularly once the student loans have to be paid again (5.1.2022). Rising interest rates will limit the amount of buyers who can qualify for a loan. With fewer buyers, anyone who wants to sell will be under pressure to lower prices as interest rates rise. Homeowners want to adhere to the age-old rules. Buy what you can afford. Purchase for a good price (not at an all-time high). Lock in your fixed rate now. Bonds There was simply no appetite for lenders to put much pressure on corporations and municipalities during the pandemic. However, rising interest rates are going to make existing bonds less valuable. There will be a sweet spot when bond yields pay you to take on the risk. However, in today’s world you’re still at risk of losing money on the fixed income side, and also of having your money tied up for too long. It’s very important that you look at the safe side of your bond portfolio and to know what you own. Keep the credit worthiness very high and the terms very short. Because so many bonds are at risk of poor credit quality, negative yields and illiquidity, I would be underweighting them. Getting safe should mean not having your principal at risk. Cryptocurrency Bitcoin is down 43% from its all-time high of $69,000, set on Nov. 9, 2021. Elon Musk recently announced that Dogecoin could be used for certain Tesla products. However, that didn’t even move the needle on Dogecoin – yet. Cryptocurrency is still a Wild West trading platform, one where Main Street tends to get crushed by the whales. If you use our nest egg pie chart slice system, you will be prompted to trim high and add low to your cryptocurrency holdings, which will help you to be more on the right side of the trade. One undercurrent that many traders are not factoring in is the massive carbon footprint of Bitcoin and Ethereum. If young traders begin factoring this in, it might make the alt coins more attractive. Gold Gold keeps trying to push through its all-time high of $2,089.20 that was set back in January 2021. What will make gold soar in 2022? If stocks fall and investors lose faith in the dollar, then there could definitely be a flight to gold. Remember, however, that the younger generation thinks of cryptocurrency as their hedge against a weak dollar. That sentiment has definitely muted the performance of gold and silver. If the dollar remains strong against other world currencies, and if stocks remain high, then you’ll probably see gold continue to trade in the range between $1700 and $2000 an ounce. If stocks see weakness in 2021 or 2022, due to valuation pressures, slower growth or as a result of the zombie corporations making headlines, that would be positive for gold, and even more positive for silver. Silver Silver is still trading very low from its all-time high. Silver’s all-time high was close to $50 an ounce, and it is currently in the $22/ounce range. Gold and silver typically run in parallel to one another. So, if you’re interested in gold, you might consider its shadow, silver, as the better bargain. Cannabis With regard to cannabis, there are certain companies that are operated by experienced executives, while others are struggling under newbie start-up CEOs. Anytime there is any hot new industry, you have to be worried about scams and phishing, particularly if it’s calling itself a club. Cannabis legislation has been on the back burner in the United States. However, there appears to be a growing appetite for legalization in Germany. In the past, when a major country legalizes cannabis, all cannabis stocks have a meteoric rise. They can also have a sonic boom-type fall. So, you have to be aware of how to play a “shoot the moon” stock. Cannabis stocks, even ones that are a cannabis lifestyle hybrid, soar and crash on decriminalization legislation. Currently, the cannabis equities are in a crash mode, and could be a very good buying opportunity. However, you have to have a trader’s mentality. This is not as easy as just setting a limit order. That is why we spend one full day on how to play hot stocks (and avoid the losers) at the Investor Educational Retreat. When Will U.S. Legalization Happen There is an appetite in the U.S. to decriminalize cannabis. The number of states moving to legalize pot has happened faster than anything I’ve seen in my lifetime. Senators Elizabeth Warren and Cory Booker have asked the Department of Justice to delist marijuana from controlled substances. Many Republicans are pro-pot, including the former Speaker of the House John Boehner, who was on the board of Acreage. So, what is the holdup? It’s partisan bickering. The Democrats can’t afford to advance cannabis decriminalization bills until after they address voting rights and the Build Back Better Biden proposal. The only way cannabis decriminalization gets advanced before the midterm election is if there is a political advantage at the voting booth. Meanwhile, we might continue to see states moving forward with their own legalization legislation. Healthcare, Utilities & REITs Schwab has healthcare on an outperform, with utilities on an underperform, due to valuation concerns. With investors looking for a higher yield, it’s possible that utilities will continue to do well, in my humble opinion. REITs, particularly commercial real estate, malls and hotel chains, could be vulnerable to rising interest rates. You have to know what you own, and understand that the higher the dividend, the higher the risk. With real estate prices at an all-time high, homebuilders have benefitted. However, we might be at the pinnacle of that trend. You can read about our time-proven 21st-century strategies in The ABCs of Money, or you can learn and implement this time-proven plan by attending our February 11-13, 2022 Financial Empowerment Retreat. A small investment of time and money could save your nest egg! These time-proven 21st Century strategies earned gains in the Dot Com and Great Recessions, and outperformed the bull markets in between. Call 310-430-2397 or email [email protected] to learn more now. You can also click on the banner ad below to get testimonials, to learn the 15 things you’ll learn at the retreat, and to get pricing and hours information. It’s going to be conducted online, so it feels like it’s you and I talking directly in your living room. It’s a great way to learn, and you have no travel or lodging expenses.  Join us for our New Year New You Financial Empowerment Retreat. Feb. 11-13, 2022. Email [email protected] to learn more. Register with a friend or family member to receive the best price. Click for testimonials & details. Other Blogs of Interest Interview with the Chief Investment Strategist of Charles Schwab & Co., Inc. Stocks Enter a Correction Investor IQ Test Investor IQ Test Answers Real Estate Risks. What Happened to Ark, Cloudflare, Bitcoin and the Meme Stocks? Omicron is Not the Only Problem From FAANNG to ZANA MAD MAAX Ted Lasso vs. Squid Game. Who Will Win the Streaming Wars? Starbucks. McDonald's. The Real Cost of Disposable Fast Food. The Plant-Based Protein Fire-Sale What's Safe in a Debt World? Inflation, Gasoline Prices & Recessions China: GDP Soars. Share Prices Sink. The Competition Heats Up for Tesla & Nio. How Green in Your Love for the Planet? S&P500 Hits a New High. GDP Should be 7% in 2021! Will Work-From-Home and EVs Destroy the Oil Industry? Insurance and Hedge Funds are at Risk and Over-Leveraged. Office Buildings are Still Ghost Towns. Money Market Funds, FDIC, SIPC: Are Any of Them Safe? My 24-Year-Old is Itching to Buy a Condo. Should I Help Him? The 12-Step Guide to Successful Investing. Gardeners Creating Sanctuary & Solutions in Food Deserts. 2021 Company of the Year Almost 5 Million Americans are Behind on Rent & Mortgage. Real Estate Hits All-Time High. Rebalancing Your Nest Egg IQ Test. Answers to the Rebalancing Your Nest Egg IQ Test. Videoconferencing in a Post-Pandemic World (featuring Zoom & Teladoc). Sanctuary Sandwich Home. Multigenerational Housing. Interview with Lawrence Yun, the chief economist of the National Association of Realtors. 10 Budget Leaks That Cost $10,000 or More Each Year. The Stimulus Check. Party Like It's 1999. Investor IQ Test 2021. Investor IQ Test Answers 2021 Crystal Ball. Would You Pay $50 for a Cafe Latte? Is Your Tesla Stock Overpriced? 10 Questions for College Success. Is FDIC-Insured Cash at Risk of a Bank Bail-in Plan? 8 Money Myths, Money Pits, Scams and Conspiracy Theories. Why Are My Bonds Losing Money? The Bank Bail-in Plan on Your Dime. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable. However, NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors.  About Natalie Pace Natalie Wynne Pace is an Advocate for Sustainability, Financial Literacy & Women's Empowerment. She has been ranked as a No. 1 stock picker, above over 835 A-list pundits, by an independent tracking agency (TipsTraders). The ABCs of Money remained at or near the #1 Investing Basics e-book on Amazon for over 3 years (in its vertical), with over 120,000 downloads and a mean 5-star ranking. The 5th edition of The ABCs of Money was released on September 17, 2021. Natalie Pace's easy as a pie chart nest egg strategies earned gains in the last two recessions and have outperformed the bull markets in between. That is why her Investor Educational Retreats, books and private coaching are enthusiastically recommended by Nobel Prize winning economist Gary S. Becker, TD AMERITRADE chairman Joe Moglia, Kay Koplovitz and many Main Street investors who have transformed their lives using her Thrive Budget and investing strategies. Click to view a video testimonial from Nilo Bolden. Comments are closed.

|

AuthorNatalie Pace is the co-creator of the Earth Gratitude Project and the author of The Power of 8 Billion: It's Up to Us, The ABCs of Money, The ABCs of Money for College, The Gratitude Game and Put Your Money Where Your Heart Is. She is a repeat guest & speaker on national news shows and stages. She has been ranked the No. 1 stock picker, above over 830 A-list pundits, by an independent tracking agency, and has been saving homes and nest eggs since 1999. Archives

July 2024

Categories |

RSS Feed

RSS Feed