|

Annual balancing is one of the most important things that you can do to preserve, protect and grow your nest egg. (It’s also important to have your nest egg properly diversified, and to know what is safe in a world where bonds are illiquid and negative-yielding.) 2020 has been a clear example of that. Stocks dropped 35% between February and March. If you were trading on emotions, you were tempted to sell. Technology has been on fire since March, which has everyone wanting to join the party. Successful investing means that you don’t chase returns over the cliff, or sell at the bottom so you can sleep again. Annual Rebalancing is a Buy Low, Sell High Plan on Auto-Pilot for Your Nest Egg Rather, one to three times a year, simply draw a pie chart of what you have and compare that to a pie chart of what you should have. (We have a free web app where you can personalize your own sample nest egg pie chart.) The large slices prompt you to sell high, capture gains and make sure you have the right amount safe. The small slices prompt you to buy low. Keeping enough safe (and knowing what is safe) protects you from losses when stocks tank like they did in March of 2020, and as they did in the Great Recession and in the Dot Com Recession before that. 21st Century recessions are different than previous periods in that they end with “episodes of financial instability,” according to Federal Reserve Board Chairman Jerome Powell. At your rebalancing, it is a good idea to examine what’s hot and safe for the coming year. Every year that changes. You might also consider swapping out some of the funds in your slices, particularly if you’ve used replacement funds. (You might have swapped out value funds this year.) Below is a 6-point checklist to assist you with your annual rebalancing. It would be a good idea to do your rebalancing now. If you need help, consider getting an unbiased 2nd opinion from me. (Call or email our offices for pricing and information at 310-430-2397 or [email protected].) Many people have no idea what they own, and therefore aren’t really capable of putting their holdings into an easy-to-understand pie chart for comparison purposes. After a retreat, you’ll get better at this. There’s too much at stake in this recession. It’s important to know exactly what you own, how much at risk you are and for you to be the boss of your money. If a financial advisor loses your money, it is your loss, not theirs. As a heads up, I’ve been doing a lot of 2nd opinions over the past few years. Not even one of the portfolios that I’ve reviewed have been properly diversified. Most are far more at risk than the client realizes. Knowing what you own allows you to be the boss of your money. Email [email protected] or call 310-430-2397 to learn more. Rebalancing 6-Point Checklist

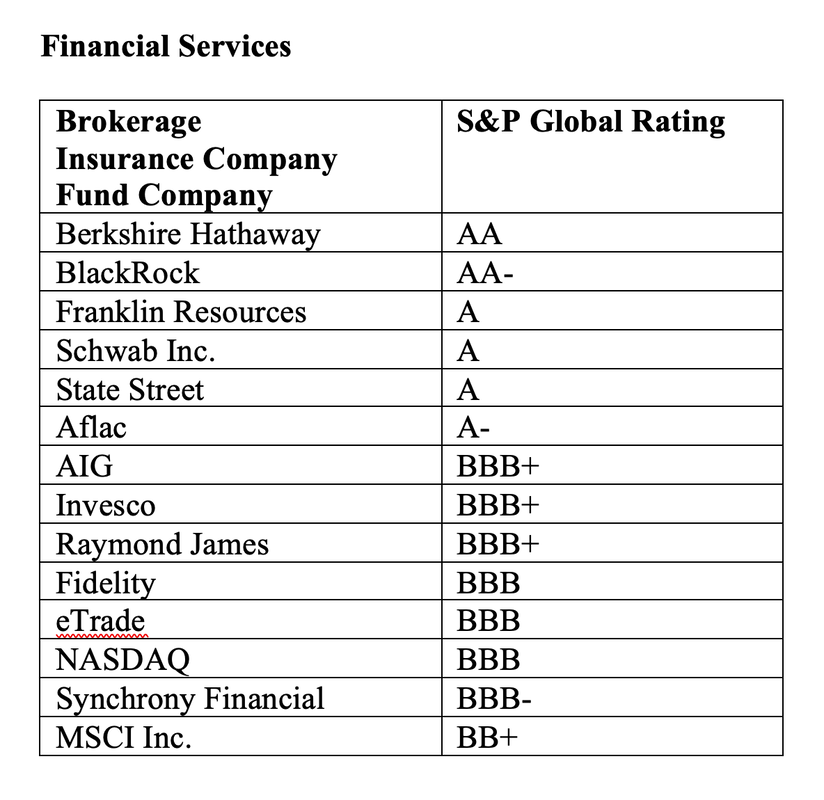

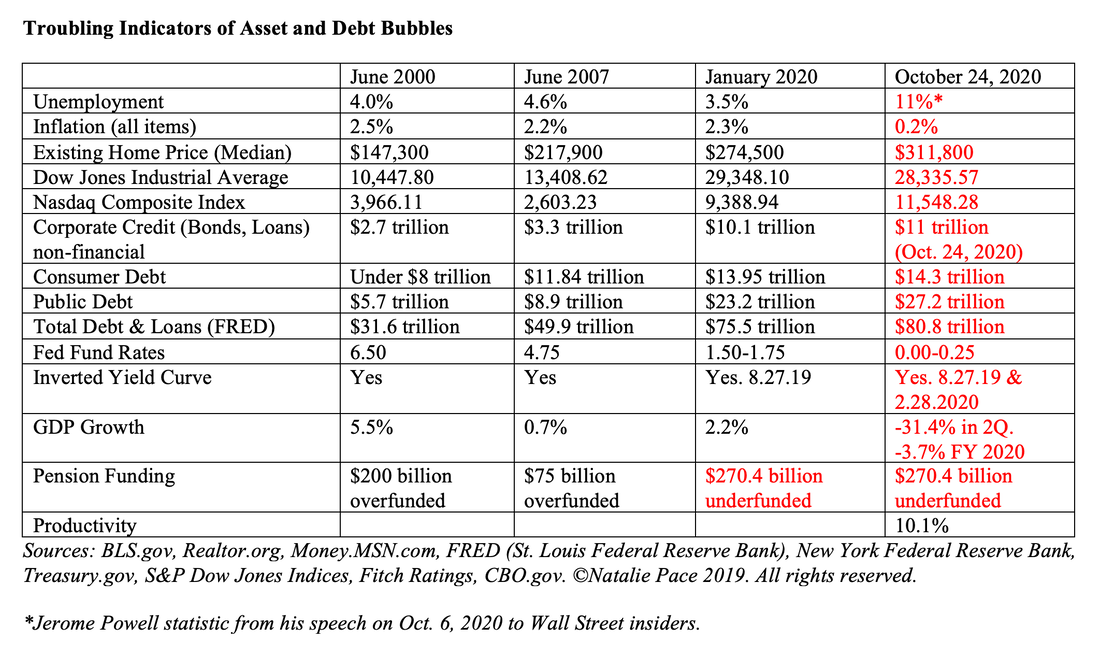

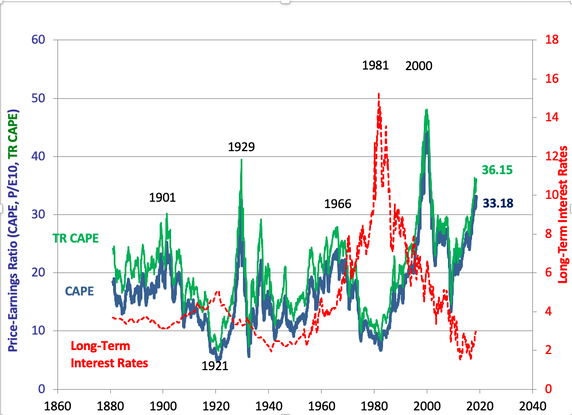

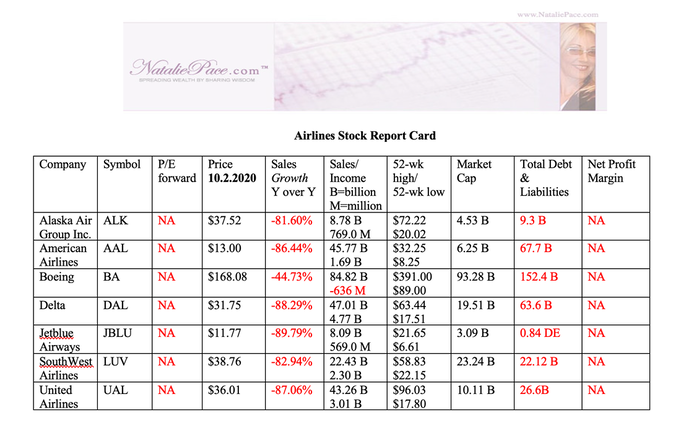

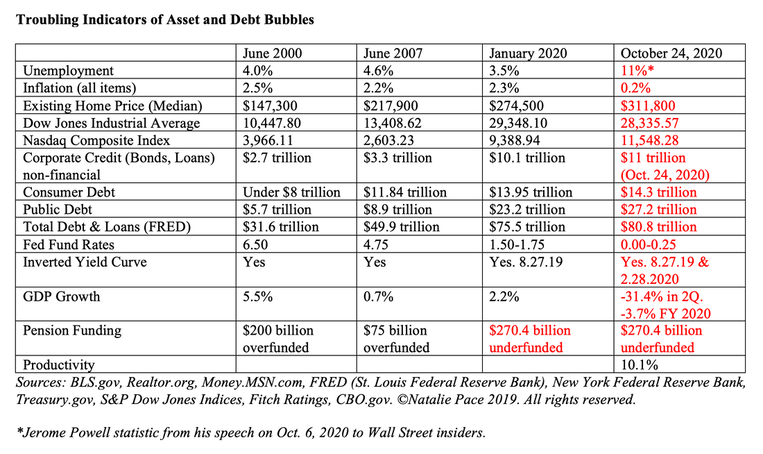

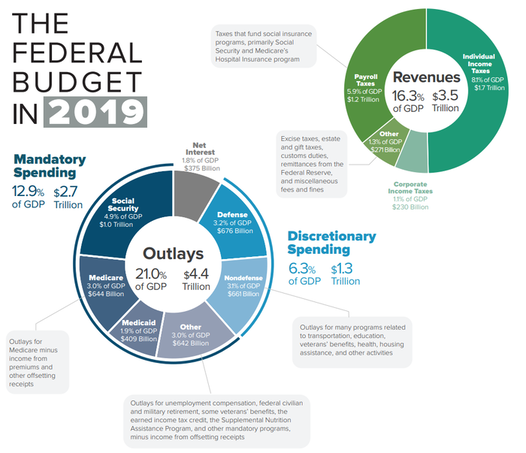

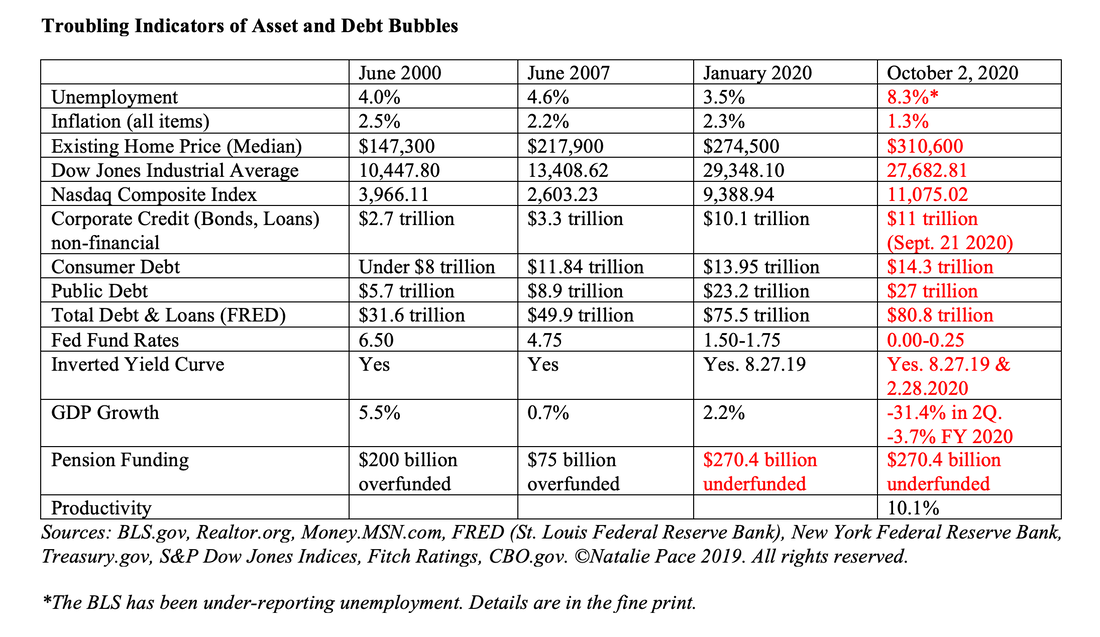

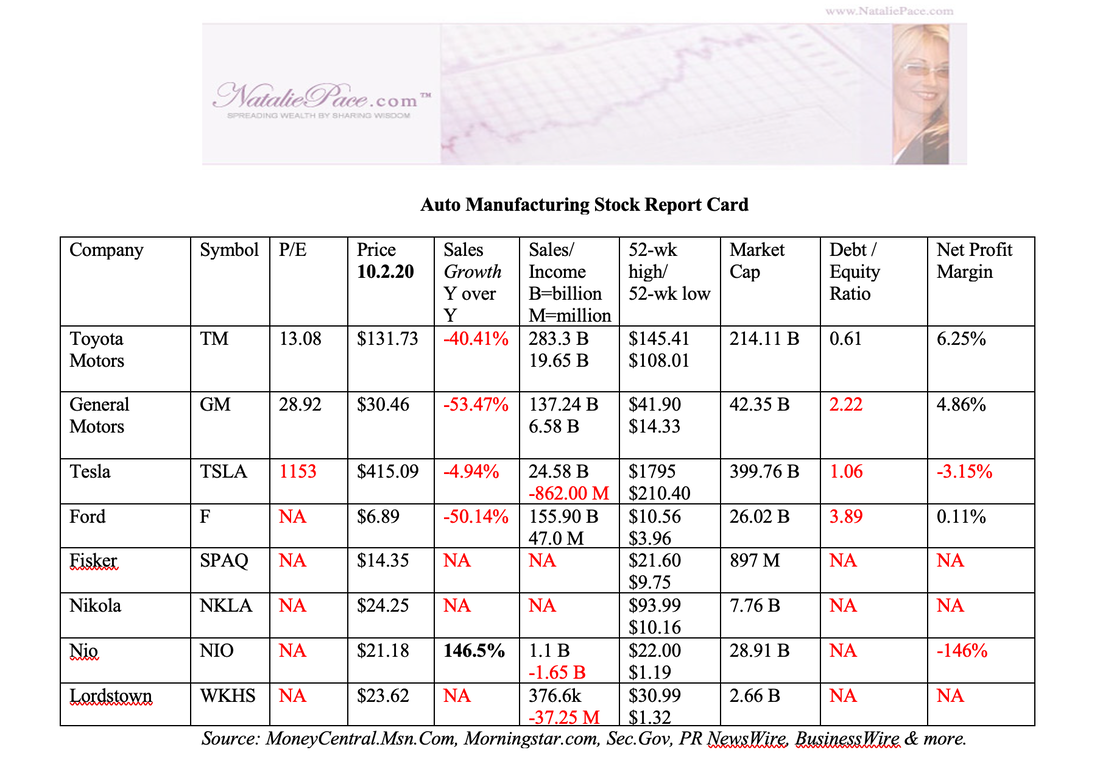

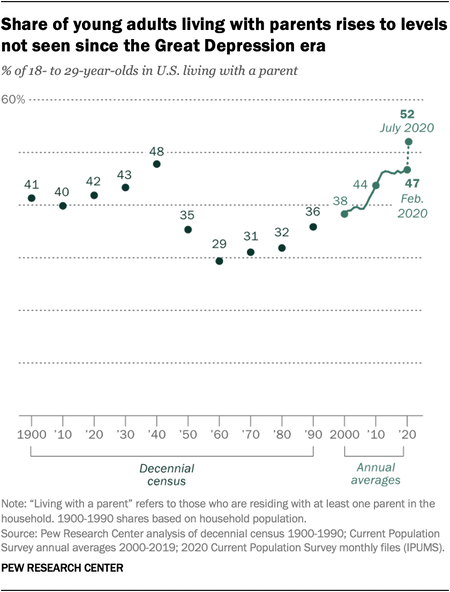

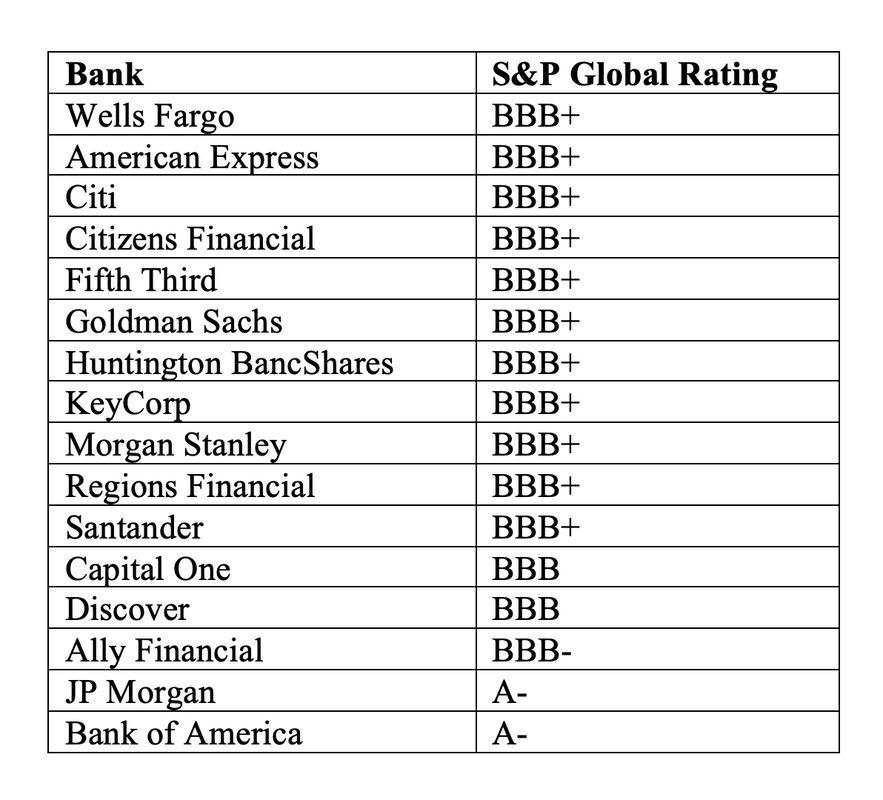

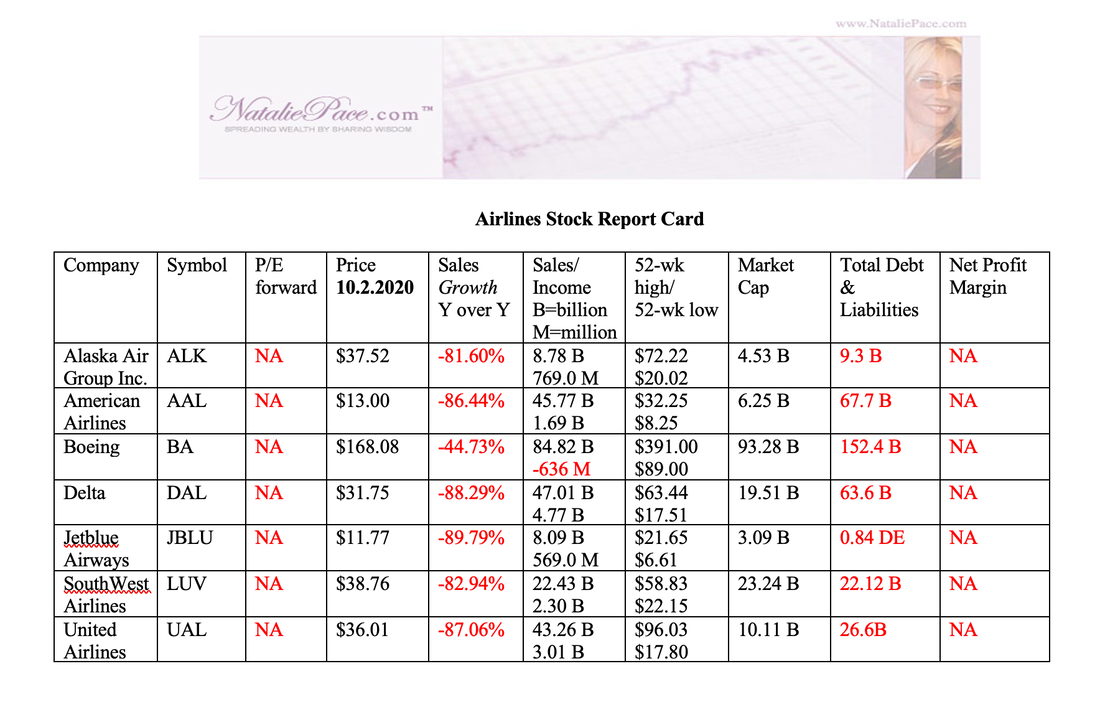

1. Mock Up What You Currently Have in Your Nest Egg Your nest egg consists of all of your liquid assets. Your home and any other real estate or hard asset are a part of your wealth. However, these are not part of your nest egg (liquid assets). Use an Excel file to help you organize the funds you have into basic categories based upon size and style. If you’ve decided to invest in something that you think is hot, like gold, cryptocurrency or a fund of FANG*, then allocate those holdings to one of the hot slices. You should be able to see your holdings in a pie chart that looks similar to the sample. 2. Personalize a Sample Nest Egg Pie Chart Start with your age. As a general rule, you’ll keep a percentage equal to your age safe. As you get older, and closer to retirement, you can’t afford to lose half or more of your wealth in stocks when recessions hit. (That was the price of the last two recessions.) If we’re in the late stage of the business cycle or in a recession (as we are today), then consider overweighting safe (pretending that you are older than you are). If a 50-year old had overweighted 20% safe in October of 2007, she would have earned gains instead of losing more than half, like many people did. Once you’ve overweighted safe, simply divide the at-risk portion by 10 funds, with small, mid and large caps, both value and growth, and four hot slices. This plan is far more diversified than 18 pages of holdings, which typically amounts to a few giant slices of large cap growth and value, bonds and maybe some international holdings, with nothing hot and not nearly enough safe. Again, you may personalize your own sample pie chart using our free web app. 3. What’s Hot and What’s Safe Change Every Year FANG* has been hot for years. The technology-rich NASDAQ has gone up more than seven-fold since the Great Recession. Gold is up over 60% since 2011. Cannabis was the hottest thing in 2018, and is the lowest-priced today. Bitcoin was $20,000/coin in December of 2017. Bonds saved the day in the Great Recession and were top performers in the Dot Com Recession (if you avoided the telecom and Enron bonds). Between February and March, bonds and bond funds became illiquid. Investors who sold lost principal. *Facebook, Apple, Amazon, Netflix, Nvidia and Google. More than half of the S&P500 is at or near junk bond status, including a majority of U.S. banks and financial services companies. So, what’s hot and what’s safe for 2021? Technology and biotechnology should continue to be strong. This is already priced in, however. China, Vietnam and Indonesia are predicted to have the strongest recovery from COVID. Gold remains a leader, with silver yet to shine (but typically runs in line with gold). I discuss this at greater length in the 4th edition of The ABCs of Money, which has been updated to include vital information on the current pandemic and recession. The ebook is free through Halloween. Today you have to be as careful on the safe side as you are on the at-risk side. As I have already said, bonds are illiquid and negative-yielding. Money market funds are subject to redemption gates and liquidity fees. Bond funds, even mid-term Treasury bill funds, can lose value. Annuities that are tied to the stock market can lose value. Insurance companies are over-leveraged and often get into trouble in recessions. (Many, including AIG, were bailed out in the Great Recession.) Insurance products are not FDIC-insured. It’s very important to educate yourself on how to win in an over-leveraged world where most assets are in a bubble: stocks, bonds and real estate. That’s why I updated The ABCs of Money. There’s an entire section on What’s Safe in the book. 4. Your Action Plan Is Obvious Once You Are Properly Diversified. When you compare your sample pie chart to your holdings pie chart, your action plan becomes obvious. The slices that are larger than they should be get sold high. You capture your gains, while leaving the appropriate amount at risk. The slices that are smaller than they should be get beefed up. You buy more at a lower price – unless you think that you could substitute a better fund for that slice. This is how annual rebalancing is a buy low, sell high plan on auto-pilot. 5. Should You Consider a Replacement Fund? Novice investors are often tempted to replace funds that have underperformed. However, past performance is not a good measure of future performance. We’re underweighting value funds because they are full of companies that have the slowest revenue growth, are vulnerable to recessions and have a dangerous amount of debt. If you were basing this decision on performance, you might think, “Well, the markets have recovered somewhat, maybe I’ll keep these.” Value funds typically offer dividends. However, many companies have been forced to suspend or cut their dividends. With regard to hots, hot funds have the best performance by far. However, they also have a great deal of volatility. I discuss the issues with gold, cryptocurrency, technology and more in the 4th edition of The ABCs of Money (which was updated in September and published last week). 6. Stick to Your Knitting This is an age-old adage in investing. If you have a time-proven plan (our time-proven, 21st Century easy-as-a-pie-chart nest egg strategy), then you stick to it. Disregard the noise you hear in the media. If you wait for the headlines, you’ll be too late. When the headlines finally say we’re in an Apocalypse, that’s often the bottom, when you’d do better to buy low. (Many people sell low at this moment.) Misinformation in the Financial Media In 1999, you would have heard a lot of media experts explain that we were in a New Economy where Dot Coms could be cash negative for more than five years. In 2007, you were drowned in ads offering no down, Liar’s Loans and easy access to your home equity ATM machine (even though that would send over 10 million homes to auction in the coming years). Jon Stewart skewered Jim Cramer for recommending Bear Stearns days before it imploded in 2008 and was bailed out by JP Morgan, losing more than 90% of its value. Today, you’re hearing how great our economy is doing, despite the facts that:

So now, when the markets are back to all-time highs is a great time to rebalance your nest egg (your 401K, IRA, Health Savings Account, etc.). The 3rd quarter 2020 GDP report was very good news, as expected. However, expectations for the news were already priced in, which is why we’ve seen the Dow Jones Industrial Average fall more than 2000 points since mid-October. Additional Tips About What’s Hot and What’s Safe FYI: The tips below are from a blog that was published in May of 2019 – well before we saw the bond liquidity crisis. We’ve been warning that bonds are negative-yielding and at risk of loss of principal for years now. Financial wisdom is the cure for mainstream media misinformation.

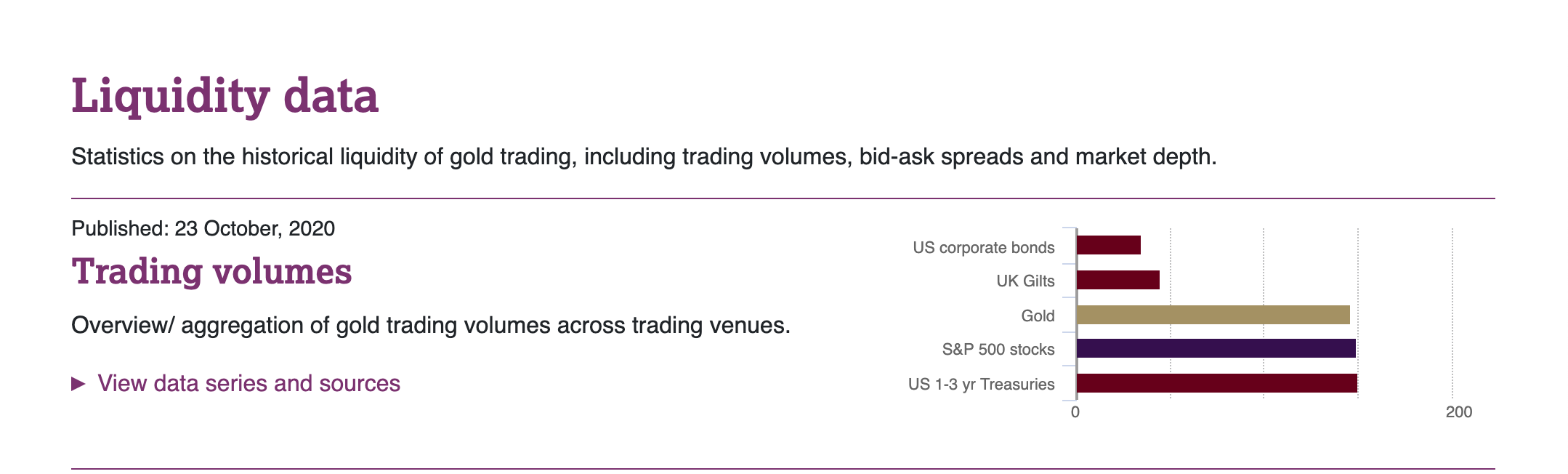

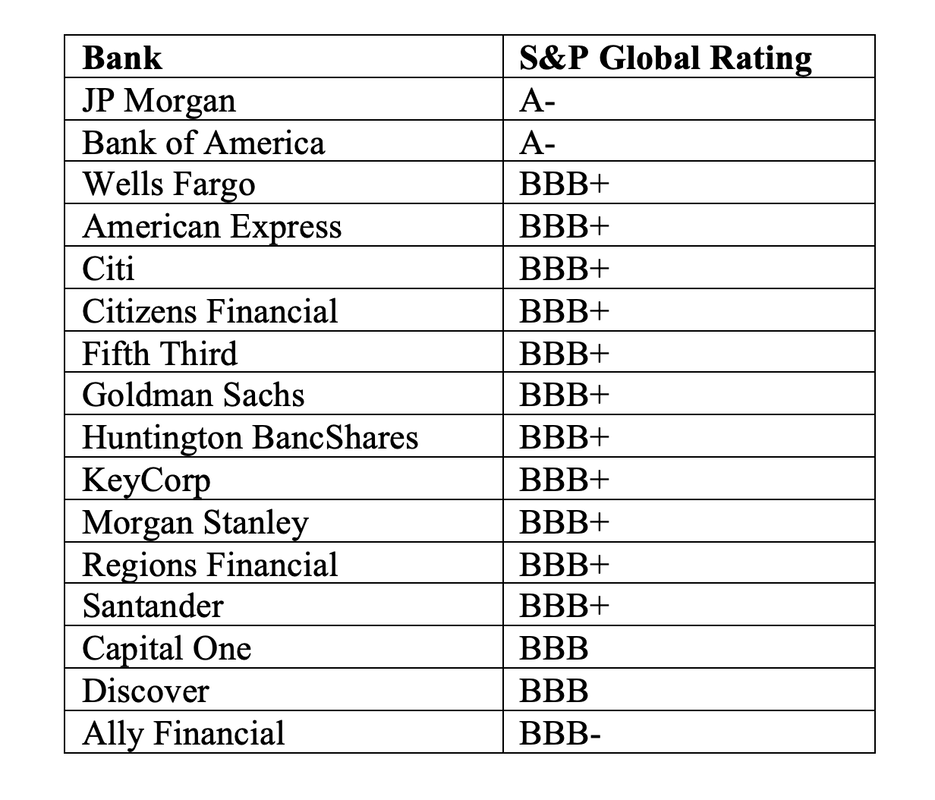

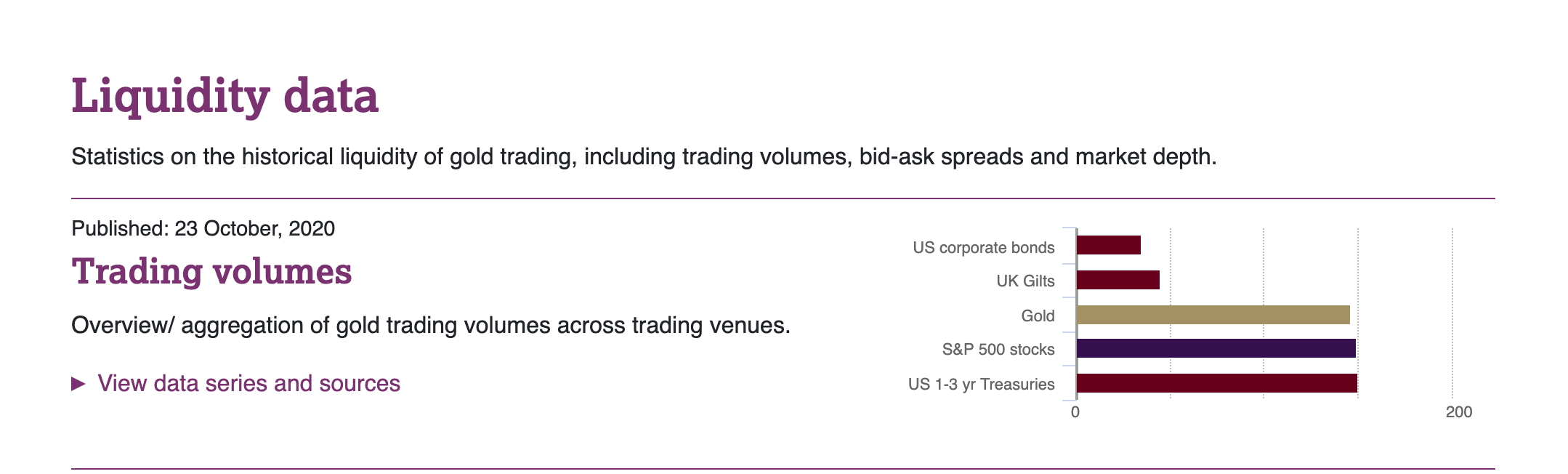

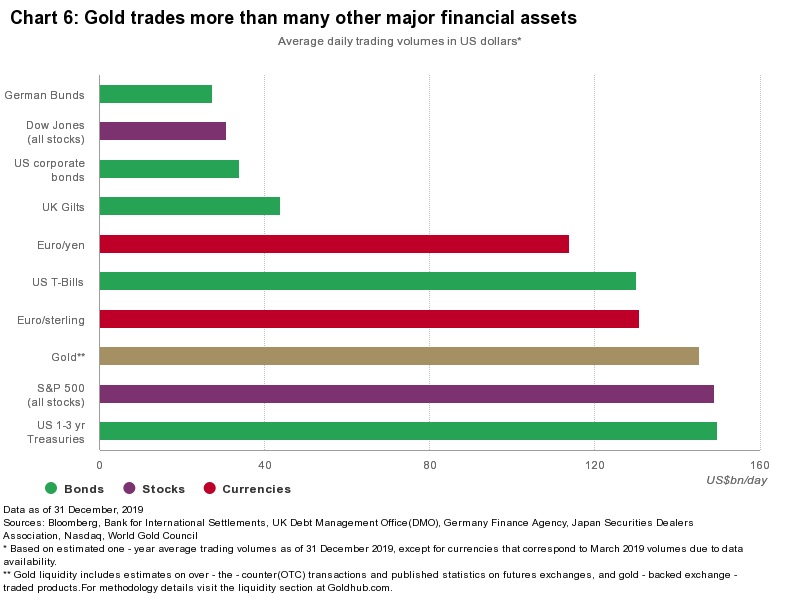

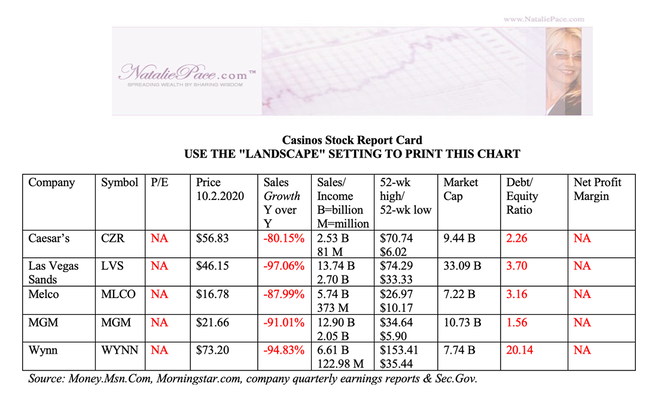

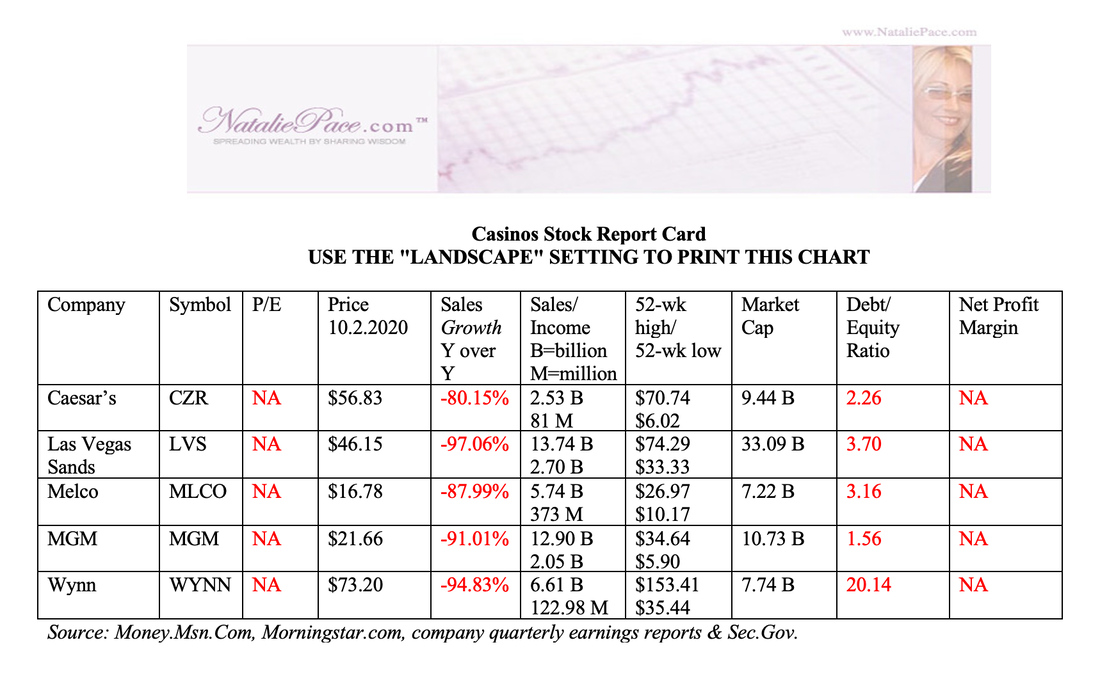

Buy & Hope is a 20th Century strategy that has lost more than half in each of the last two 21st Century recessions. Fortunately, a time-proven 21st Century strategy is easy-as-a-pie-chart. You can read about this system in my bestselling books. You can learn and implement the system by attending an Investor Educational Retreat. If you’re worried about what you own, then consider getting an unbiased 2nd opinion, which includes a step-by-step action plan for diversification, performance and safety. Call 310-430-2397 or email [email protected] to learn more now. Register for the Jan. 16-18, 2021 New Year, New You Retreat by Halloween to receive the lowest price and a free 50-minute private prosperity coaching session (value $300). Learn more in the retreat flyer. (Click to access). Other Blogs of Interest 5 Red Flags of a Financial Implosion Will Regeneron Be Approved Before the Election? Tesla Will Have an Outstanding Earnings Report Should You Wait Until After the Election to Fix Your Wealth Plan? The October Surprise Is Your Bank a Junk Bond Do Stocks Fare Better Under Democrats or Republicans? Put Your Money Where Your Heart Is. Crystal Ball for the Remainder of 2020 (Including the Election). Microcap Gaming Company Doubles 2Q 2020 Revenue. Apple & Tesla Stock Splits. Schwab's Chief Fixed Income Strategist on What's Safe. China's Tesla (Nio). 2Q Sales Soar. Why Are You Still Renting? (Errr. There is More Than This to Consider!) MedMen's Turnaround Plan Attracts A-List Board Members. Wealth Myths That Keep You Poor. Prosperity Truths That Make You Rich. Protecting Your Wealth and Home in a Recession. Technology and Silver are Golden. The Economy Contracts 32.9% in the 2nd Quarter of 2020. Real Estate: Feeling Equity Rich? Make Sure That Feeling Isn't Fleeting. Airline Revenue Plunges 86%. 10 Questions for College Success Bank Earnings Season. Crimes. Cronyism. Speculation. Real Estate Solutions for a Post-Pandemic World. Copper and Chile Update. Gold Soars. Some Gold Funds Tank. Will the Facebook Ad Boycott De-FANG Stocks? Why Did My Cannabis Stock Go Down? Which Countries Are Hot in a Global Pandemic? Is Your Financial Advisor Good at Navigating Stormy Seas? $10 Avocados, Lies, Damn Lies, Statistics & Wall Street Secrets. It's Never a Crash. Work From Home and Intergenerational Housing. Biotech Races for a Coronavirus Cure. Are You Worried About Money? May is a Good Time for Rebalancing. Is FDIC-Insured Cash at Risk of a Bank Bail-in Plan? Why Did my Bonds Lose Money? Cannabis Update. Recession Proof Your Life. Free Videocon Monday, May 10, 2020. The Recession will be Announced on July 30, 2020. Apple Reports Terrible Earnings. We Are in a Recession. Unemployment, Rising Stocks. What's Going On? 8 Money Myths, Money Pits, Scams and Conspiracy Theories. 21st Century Solutions for Protecting Your Home, Nest Egg & Job. Wall Street Insiders are Selling Like There is No Tomorrow. Why Are My Bonds Losing Money? Tomorrow is Going to be Another Tough Day. Price Matters. Stock Prices are Still Too High. Should You Ride Things Out? 7 Recession Indicators Corona Virus Update. The Bank Bail-in Plan on Your Dime. NASDAQ is Up 6X. CoronaVirus: Which Companies and Countries Will be Most Impacted. Is Tesla Worth GM and Ford Combined. Artificial Intelligence is on Fire. Is it Time to Buy S'More? Take the Retirement Challenge. 2020 Investor IQ Test. Answers to the 2020 Investor IQ Test. The Cannabis Capital Crunch and Stock Meltdown. Does Your Commute Pollute More Than Planes? Are Health Care Costs Killing Your Budget? 2020 Crystal Ball. The Benefits of Living Green. Featuring H.R.H. The Prince of Wales' Twin Eco Communities. What Love, Time and Charity Have to do with our Commonwealth. Interview with MacArthur Genius Award Winner Kevin Murphy. Unicorns Yesterday. Fairy Tales Today. IPO Losses Top $100 Billion. Price Matters. Will There be a Santa Rally? It's Up to Apple. Harness Your Emotions for Successful Investing. What the Ford Downgrade Means for Main Street. The Dow Dropped Over 1000 Points Do We Talk Ourselves into Recessions? Interview with Nobel Prize Winning Economist Robert J. Shiller. Ford is Downgraded to Junk. Gold Mining ETFs Have Doubled. The Gold Bull Market Has Begun. The We Work IPO. The Highs and Hangovers of Investing in Cannabis. Recession Proof Your Life. What's Your Exit Strategy? It's Time To Do Your Annual Rebalancing. Are You Suffering From Buy High, Sell Low Mentality? Financial Engineering is Not Real Growth. The Zoom IPO. Uber vs. Lyft. Which IPO Will Drive Returns? Boeing Cuts 737 Production by 20%. The Lyft IPO Hits Wall Street. Should you tak Cannabis Doubles. Did you miss the party? 12 Investing Mistakes The High Cost of Free Advice. 2018 Was the Worst December Since the Great Depression. Russia Dumps Treasuries and Buys Gold OPEC and Russia Cut Oil Production. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable. However, NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors.  About Natalie Pace Natalie Wynne Pace is an Advocate for Sustainability, Financial Literacy & Women's Empowerment. She has been ranked as a No. 1 stock picker, above over 835 A-list pundits, by an independent tracking agency (TipsTraders). The ABCs of Money remained at or near the #1 Investing Basics e-book on Amazon for over 3 years (in its vertical), with over 120,000 downloads and a mean 5-star ranking. The 4th edition of The ABCs of Money was released on October 17, 2020. Natalie Pace's easy as a pie chart nest egg strategies earned gains in the last two recessions and have outperformed the bull markets in between. That is why her Investor Educational Retreats, books and private coaching are enthusiastically recommended by Nobel Prize winning economist Gary S. Becker, TD AMERITRADE chairman Joe Moglia, Kay Koplovitz and many Main Street investors who have transformed their lives using her Thrive Budget and investing strategies. Click to view a video testimonial from Nilo Bolden. My conversations with Wall Street are very different than those with Main Street. On Main Street, I hear a lot of people parroting sales pitches. Some might say, “I sold my bonds low in March! If I waited until today, I would have made hundreds of thousands of dollars.” (Not true.) Others say that stocks have gone “up and up and up!” (True of some, not true of a lot of others.) Both of these statements are misinformed, as you can see in the charts and information below. And these sentiments are not those held by Wall Street insiders. Bonds are Illiquid and Negative Yielding As you can see in the charts below, bonds are highly illiquid, even today. If you were trying to sell bonds today, you would have as much trouble as you had in March. Nobody wants to gamble 30 or 40 years on a bond that is paying them a measly 3-5% yield – when odds are so high that more debt will have to be issued at a higher rate (making the current bond completely illiquid) or debt will have to be restructured (making the bond a big loser). What’s just as important to note is that they were just as illiquid in December of 2019 – before the pandemic. So, what does Wall Street have to say about bonds? In my interview with the Chief Fixed Income Strategist of Charles Schwab Inc. Kathy Jones, she said: You could see depreciation in [treasuries] between the time you invest and the time they mature. One thing to do is to shorten the maturity or the duration. The longer the term, the more the risk of rates rising and seeing a price decline. With short term, you still have that safety and liquidity, but you’re not taking interest rate risk. Short-term T-bills are very liquid, as you can see in the chart above. You can read my blog Q&A with Kathy Jones at NataliePace.com/blog. You can watch my full interview with her on my YouTube.com/NataliePace channel. Your safe side shouldn’t be at risk of capital loss. In our retreats, we spend one full day on what’s safe. Bonds aren’t. Getting safe is a two-step process. The first step is to keep your money, so that you have the ability to buy low when asset values correct. The second step is to look for safe, income-producing hard assets that you purchase for a good price. You’ll have to consider what will be a steady, reliable income in a post-pandemic world. Things have changed dramatically for the foreseeable future. Of course, both of these steps require financial literacy and education (not what the broker-salesman sells you). Call 310-430-2397 to learn more. Stocks Are Hotter Than Ever: Errr… More Overpriced Than Ever Technology and biotechnology stocks are indeed hot, hot, hot. The old-school companies that are slow or negative growth and are heavily in debt are not hot at all. The markets have come back a little, but many of those companies are still way down. The ones that are up are propped up with bail-outs, and are at risk of financial fall-out. They can’t borrow from Peter to pay Paul forever, and they are getting to the point of no return (debt restructuring in a bankruptcy proceeding) to continue operating. The airline, travel, hospitality, retail, casino, oil, municipality and commercial real estate industries are all vulnerable right now. FANG companies (Facebook, Amazon, Apple, Netflix, Nvidia and Google) have been leading the U.S. economy for years now and have pushed the NASDAQ Composite Index to highs above what we saw in February of 2020 (pre-pandemic). However, the stocks are priced at astronomical levels. That is why Netflix stock is down 12% since reporting earnings on Oct. 20, 2020. Revenue growth was 23% and the net income of $790 million was higher than it had been in years – all great signs. However, investors are forward-looking. So, predictions of just 20% revenue growth in the 4th quarter, with net income that could be 22% lower sequentially, alongside an 82 price-earnings ratio, inspired traders to take profits. As Nobel Prize winning economist Robert Shiller has been warning since 2018, stock prices are alarmingly high. Shiller wrote, “The only time in history going back to 1881 when [stock prices] have been higher are, A: 1929 and B: 2000. We are at a high level, and its concerning. People should be cautious now.” The average price-earnings ratio is 16-17. Growth companies typically take a higher PE. However, Zoom’s PE is 740. Google’s is 35, with negative revenue growth in the most recent quarter. Nvidia’s is 98. Should Amazon be worth $1.6 trillion, when its sales and income are only $280.5 billion and $11.59 billion, respectively? Also, when stocks tanked -35% in March 2020, technology stocks sank, too. It’s difficult for even a great company to remain buoyant when economic storms roil the markets. The Biggest Bailout Index is Illiquid Daily we hear reports about the ups and downs of the Dow Jones Industrial Average, with media and politicians boasting about stock gains, as if that is a broad measure of how the economy is doing. We’re currently in a bull market in the midst of an unprecedented recession. So, how are stocks so high? Basically, the Federal Reserve purchased over 1,000 bonds and 17 bond funds to keep many of the most highly leveraged companies from going under. The Treasury Department, with Congressional permission, handed out payroll support to industries like the airlines. Today, the airlines are begging for more bailout money, so that they don’t have to “right-size” their operations. Demand in the travel industry is off by 85%-90%. Revenue has tanked similarly in many industries, including casinos, car rentals, commercial real estate and more. Auto sales are off by half in Ford and GM. As you can see in the chart below, the Dow Jones Industrial Average is almost as illiquid as bonds are. The DJIA is composed of 30 companies, all of which took a bailout from the Federal Reserve (except the banks, which are receiving other kinds of support). Many Dow components are slow or negative growth with very high debt. A lot of these companies were borrowing at cheap rates, while allowing their credit rating to fall to the lowest rung of investment grade. Over half of the S&P500 is at or near junk bond status, including a lot of the U.S. banks. What were they using that borrowed money for? Most used it to buy back their own stock and pay dividends, which benefit the executives, board and investors. In the worst examples, like Boeing, the company was neglecting to fund their pensions and OPEBs and underinvesting in product design, while making the rich insiders richer. Real Estate Prices are Higher Than Ever… Because of a Moratorium There is currently a moratorium on evictions and foreclosures. As a result of that house of cards and the successful sales of motivated commission-based real estate and mortgage brokers, home sales were up 21% year over year in September of 2020. The median existing-home price soared to an all-time high of $311,800 (source: the National Association of Realtors). Meanwhile, there are clear indicators of major financial distress in the housing market. According to the Mortgage Bankers Association research, in the 3rd quarter of 2020: