|

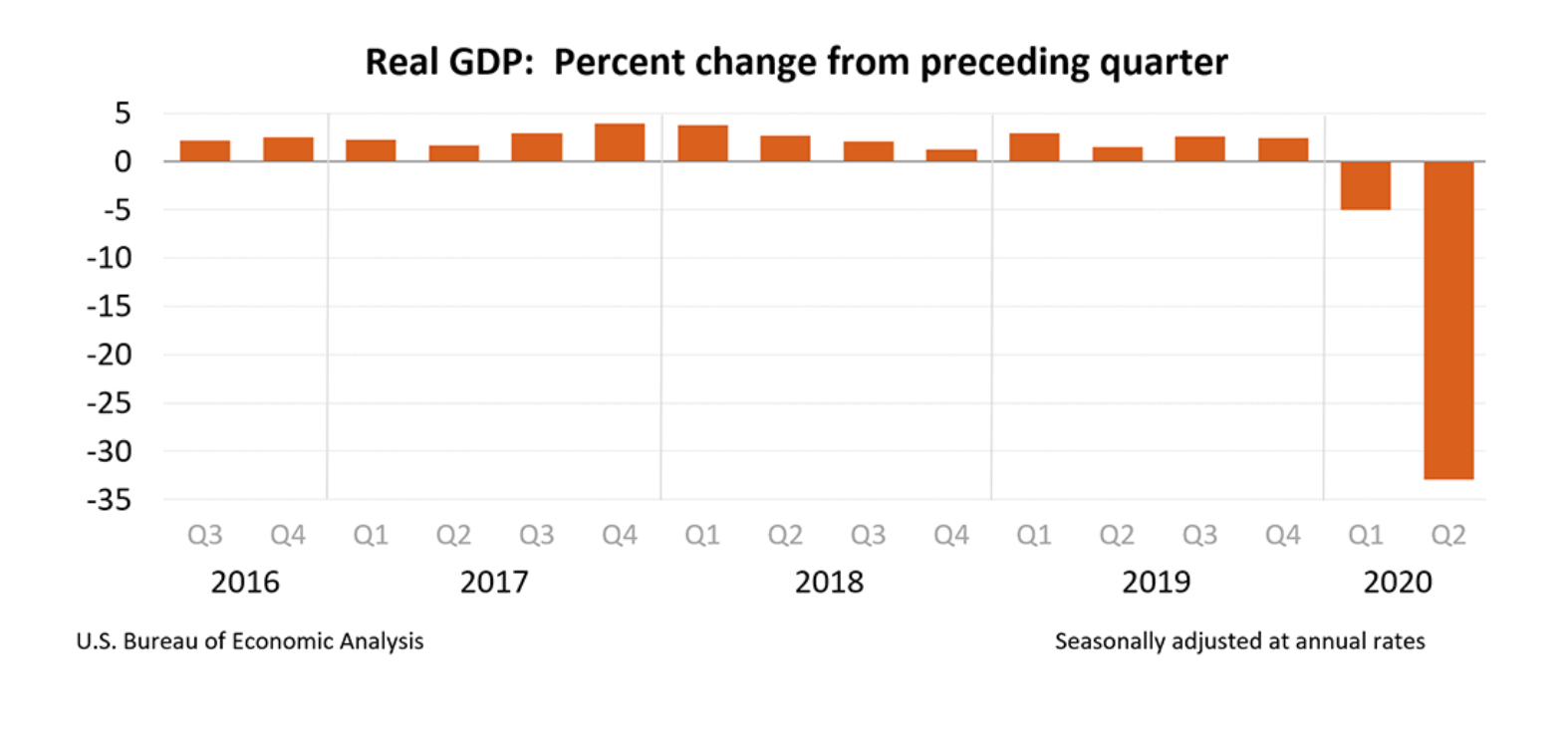

Includes 5 Tips on How to Protect Yourself from Continued Economic Fallout Due to the Pandemic. On July 30, 2020, the Bureau of Economic Analysis announced that the U.S. economy had contracted 32.9% in the 2nd quarter of 2020 (advance estimates). This was the worst quarter in recorded history (at least 70 years). It was widely expected, however the Dow Jones Industrial Average dropped 226 points (just under 1%). The tech-heavy NASDAQ Composite Index actually gained almost half a point. How does that happen? Are investors too complacent for their own good? Very Little Headline Coverage No televised media website had the -32.9% GDP contraction on the home page, not the left or right wing sites. The news didn’t even make the headline of the business sections of CNN.com or FoxNews.com. Instead attention was diverted to whether or not the White House should have tweeted about delaying the election. Interestingly, Fox News had two headline features of President Obama on the home page (giving the eulogy for John Lewis), with the caption “A Man of Pure Joy,” which is probably the best headline Obama ever enjoyed on the network. The President didn’t even mention the contraction of -32.9%, but instead unleashed a flurry of Tweets about delaying the election. Of course, his opponent Joe Biden, did mention the historic contraction, tweeting, “The last three months were the worst period for economic growth our nation has experienced in the 70 years since we started measuring it — a drop of nearly 33 percent.” Republican Whip Representative Steve Scalise was silent on the news. There was not a peep on the matter from Senate Majority Leader Mitch McConnell. Federal Reserve Board Chairman Jerome Powell (a Republican) did provide guidance in his press conference yesterday, saying “The path forward for the economy is uncertain. A full recovery is unlikely until people think it is safe to engage in a broad range of activities.” The V-Shaped Recovery? In the beginning, before the current surge of COVID-19 cases, there was a lot of talk about a V-shaped recovery. There is now debate about whether or not the recovery will be L-shaped or W-shaped. What’s important to remember about economics, which has a pretty terrible forecasting record, is, as Andrew Lo tells us, “Physics has three laws that explain 99% of the phenomena, and economics has 99 laws that explain 3% of the phenomena.” Temptation Abounds. Price Matters One thing we do know is that supply and demand are being monkeyed around with. The Federal Reserve Board has been buying up everything from Treasury bills, mortgage-backed securities, bonds, junk bonds, money market funds and even ETFs – keeping demand higher than it would otherwise be. This leads investors to believe that their retirement plans are in great shape, prompting many to adopt a Buy & Hope attitude. Newly minted day traders and younger retail investors are in love with tech stocks. However, recessions tend to educate the uninformed about the lofty prices they paid, and how that fairy tale ends like a Shakespearian tragedy. Stocks have lost more than half in the last 2 recessions. Stock prices are high, price-to-earnings ratios are high, while earnings are imploding. This typically results in a severe adjustment to price. The Hellish Future of Buying High In the real estate market, the shadow inventory is ignored while industry economists complain about a shortage in housing. There are 3.6 million homes underwater. Almost 8% of mortgage loans are in forbearance. Websites like RealtyTrac.com and Auction.com list a flurry of bank-owned homes, foreclosures, pre-foreclosures and auctions that are not on the MLS (multiple-listing service). Unsophisticated real estate buyers are being suckered in on the premise of historically low interest rates, and given all kinds of rationale to justify buying high. There are few worse mortal hells than buying real estate high and having the prices fall, leaving you with an underwater mortgage. Your credit score tanks and you’re locked into a purchase that you can’t extricate yourself from without a great deal of time, effort, expense and trouble. Real estate lost more than half in the Great Recession. Areas that didn’t implode were the ones that never saw the housing bubble pre-Great Recession. So, thinking that prices in your area never go down is likely to be an expensive assumption, particularly if prices are unaffordable in your area. (Read my blog on Equity-Rich Home Ownership to learn more.) How Soon Can the Economy Recover? Unemployment is very high, and has actually been kept lower than it would otherwise be with the Payroll Support Plan of the CARES Act. As just one example, there could be another 750,000 in the unemployment line from airlines alone. American Airlines warned that they have 20,000 more workers than they need for their fall schedule. Additionally, the world has changed. People are working from home, spending less time in their cars and have furloughed their vacations indefinitely. We have learned to bake banana bread and cook our own meals. Some of these changes might eventually come back (hopefully vacations and eating out). Others are likely to be more lasting. Square, Twitter, Facebook and Google have all announced that Work From Home is an option for many of their team. Add to that the amount of leverage (debt) in the S&P500 (over half at near or at junk bond status), and you have a toxic economic cocktail that is going to leave all of us hung over for quite a time. Real estate and stock prices are simply too high and unaffordable to withstand the forbearance, foreclosures, debt restructurings and bankruptcies on the horizon. Recessions typically take 18-24 months to bottom out. The timeline of the recovery doesn’t even begin until, as Powell noted, people start feeling safe. There may be a new normal that we all return to that includes less time in our cars and at the office. We may have an economic impact that further limits our ability to vacation (particularly if we’ve purchased a home at an all-time high or seen half of our retirement plan evanesce). Your Best Strategy Now Budget: In your budget, make sure that you can afford your life. You want to right-size your expenses and conserve your capital. Read The ABCs of Money, particularly the sections on budgeting and debt, to learn more. Home: If you own your own home, you need to make sure that you can afford it. You should also do an equity check. Learn more in my Equity-Rich Homeowners blog. If you can afford your home, you plan on staying there for another decade and you purchased it before 2013, then chances are refinancing now at a lower interest rate will save you a lot of money on the mortgage payments, which will help your budget. Nest Egg/Retirement/Passive Income: Stocks are very high-priced – way above what would be reasonable compared to their earnings. So, now is a good time to diversify and protect your retirement plan, and to know what you own and why in any liquid assets and brokerage account – even a managed plan. Do not assume that someone else is protecting you. You must be the boss of your money, know what you own and be confident that your plan is recession-proof. Fortunately, this is easy-as-a-pie-chart. You can read about this time-proven strategy in The ABCs of Money. You can call our office at 310-430-2397 to receive an unbiased 2nd opinion and potential action plan. You can join us for our October 3-5, 2020 Online Investor Educational Retreat where you can learn and implement these strategies. (It’s not a good idea to wait until October to know what you own and protect your wealth.) Do not drain your retirement account to support yesterday’s lifestyle if today and tomorrow are seeing less income. Don’t siphon your future to pay off your credit cards. Learn the ABCs of Money now so that you can design a plan that is sustainable in our new world. The sooner you adjust to the New Normal and protect your wealth, the better off your financial future will be. Learn the ABCs of Money that we all should have received in high school at our Oct. 3-5, 2020 Investor Educational Retreat. Click on the banner ad below for additional information on the Oct. 3-5, 2020 Online Financial Empowerment Retreat. Register by July 31, 2020 to receive the best price. "Many people, including educated men and women, often get into trouble when they neglect to follow simple and fundamental rules of the type provided [by Natalie]. This is why I recommend them with enthusiasm." Professor Gary S. Becker. Dr. Becker won the 1992 Nobel Prize in economics for his theories on human "College students need this information before they get their first credit card. Young adults need it before they buy their first home. Empty nesters can use the information to downsize to a sustainable lifestyle, before they get into trouble." Joe Moglia, Chairman, TD AMERITRADE. Other Blogs of Interest Real Estate: Feeling Equity Rich? Make Sure That Feeling Isn't Fleeting. Airline Revenue Plunges 86%. 10 Questions for College Success Bank Earnings Season. Crimes. Cronyism. Speculation. Real Estate Solutions for a Post-Pandemic World. Copper and Chile Update. Gold Soars. Some Gold Funds Tank. Will the Facebook Ad Boycott De-FANG Stocks? Why Did My Cannabis Stock Go Down? Which Countries Are Hot in a Global Pandemic? Is Your Financial Advisor Good at Navigating Stormy Seas? $10 Avocados, Lies, Damn Lies, Statistics & Wall Street Secrets. It's Never a Crash. Work From Home and Intergenerational Housing. Biotech Races for a Coronavirus Cure. Are You Worried About Money? May is a Good Time for Rebalancing. Is FDIC-Insured Cash at Risk of a Bank Bail-in Plan? Why Did my Bonds Lose Money? Cannabis Update. Recession Proof Your Life. Free Videocon Monday, May 10, 2020. The Recession will be Announced on July 30, 2020. Apple Reports Terrible Earnings. We Are in a Recession. Unemployment, Rising Stocks. What's Going On? 8 Money Myths, Money Pits, Scams and Conspiracy Theories. 21st Century Solutions for Protecting Your Home, Nest Egg & Job. Wall Street Insiders are Selling Like There is No Tomorrow. Why Are My Bonds Losing Money? Tomorrow is Going to be Another Tough Day. Price Matters. Stock Prices are Still Too High. Should You Ride Things Out? 7 Recession Indicators Corona Virus Update. The Bank Bail-in Plan on Your Dime. NASDAQ is Up 6X. CoronaVirus: Which Companies and Countries Will be Most Impacted. Is Tesla Worth GM and Ford Combined. Artificial Intelligence is on Fire. Is it Time to Buy S'More? Take the Retirement Challenge. 2020 Investor IQ Test. Answers to the 2020 Investor IQ Test. The Cannabis Capital Crunch and Stock Meltdown. Does Your Commute Pollute More Than Planes? Are Health Care Costs Killing Your Budget? 2020 Crystal Ball. The Benefits of Living Green. Featuring H.R.H. The Prince of Wales' Twin Eco Communities. What Love, Time and Charity Have to do with our Commonwealth. Interview with MacArthur Genius Award Winner Kevin Murphy. Unicorns Yesterday. Fairy Tales Today. IPO Losses Top $100 Billion. Price Matters. Will There be a Santa Rally? It's Up to Apple. Harness Your Emotions for Successful Investing. What the Ford Downgrade Means for Main Street. The Dow Dropped Over 1000 Points Do We Talk Ourselves into Recessions? Interview with Nobel Prize Winning Economist Robert J. Shiller. Ford is Downgraded to Junk. Gold Mining ETFs Have Doubled. The Gold Bull Market Has Begun. The We Work IPO. The Highs and Hangovers of Investing in Cannabis. Recession Proof Your Life. What's Your Exit Strategy? It's Time To Do Your Annual Rebalancing. Are You Suffering From Buy High, Sell Low Mentality? Financial Engineering is Not Real Growth. The Zoom IPO. Uber vs. Lyft. Which IPO Will Drive Returns? Boeing Cuts 737 Production by 20%. The Lyft IPO Hits Wall Street. Should you tak Cannabis Doubles. Did you miss the party? 12 Investing Mistakes The High Cost of Free Advice. 2018 Was the Worst December Since the Great Depression. Russia Dumps Treasuries and Buys Gold OPEC and Russia Cut Oil Production. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable. However, NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors.  About Natalie Pace Natalie Wynne Pace is an Advocate for Sustainability, Financial Literacy & Women's Empowerment. She has been ranked as a No. 1 stock picker, above over 835 A-list pundits, by an independent tracking agency (TipsTraders). The ABCs of Money remained at or near the #1 Investing Basics e-book on Amazon for over 3 years (in its vertical), with over 120,000 downloads and a mean 5-star ranking. The 3rd edition of The ABCs of Money was released in 2020. Natalie Pace's easy as a pie chart nest egg strategies earned gains in the last two recessions and have outperformed the bull markets in between. That is why her Investor Educational Retreats, books and private coaching are enthusiastically recommended by Nobel Prize winning economist Gary S. Becker, TD AMERITRADE chairman Joe Moglia, Kay Koplovitz and many Main Street investors who have transformed their lives using her Thrive Budget and investing strategies. Click to view a video testimonial from Nilo Bolden. Comments are closed.

|

AuthorNatalie Pace is the co-creator of the Earth Gratitude Project and the author of The Power of 8 Billion: It's Up to Us, The ABCs of Money, The ABCs of Money for College, The Gratitude Game and Put Your Money Where Your Heart Is. She is a repeat guest & speaker on national news shows and stages. She has been ranked the No. 1 stock picker, above over 830 A-list pundits, by an independent tracking agency, and has been saving homes and nest eggs since 1999. Archives

July 2024

Categories |

RSS Feed

RSS Feed