|

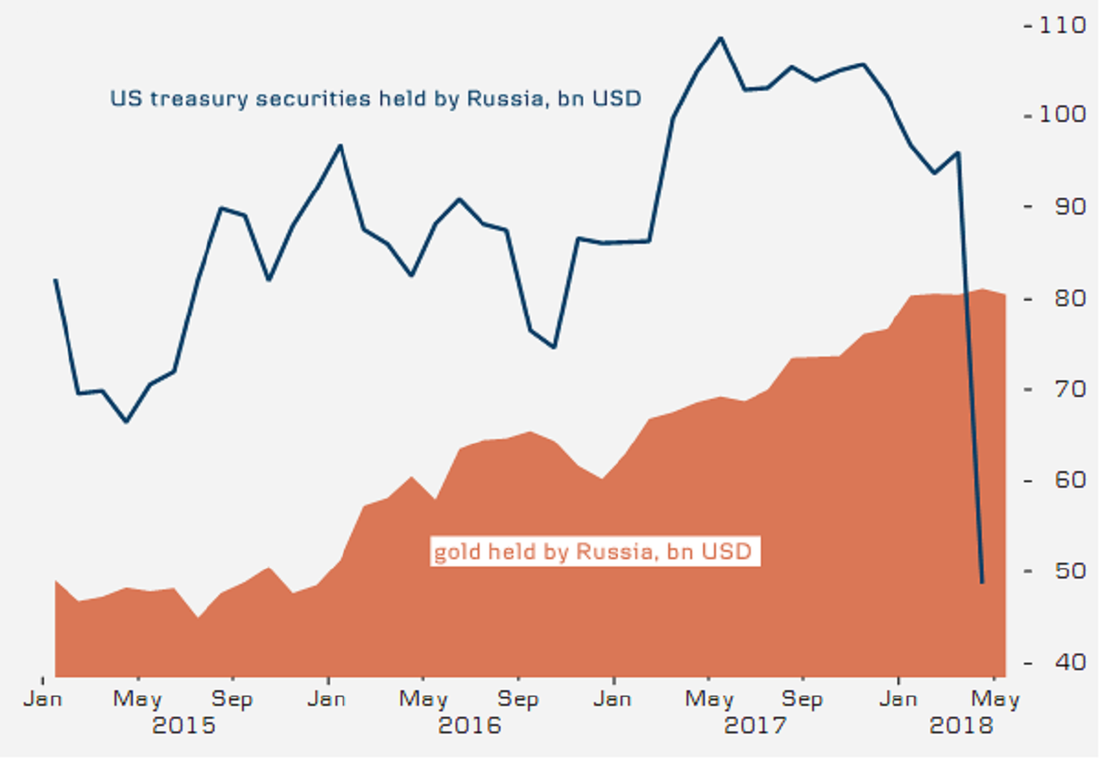

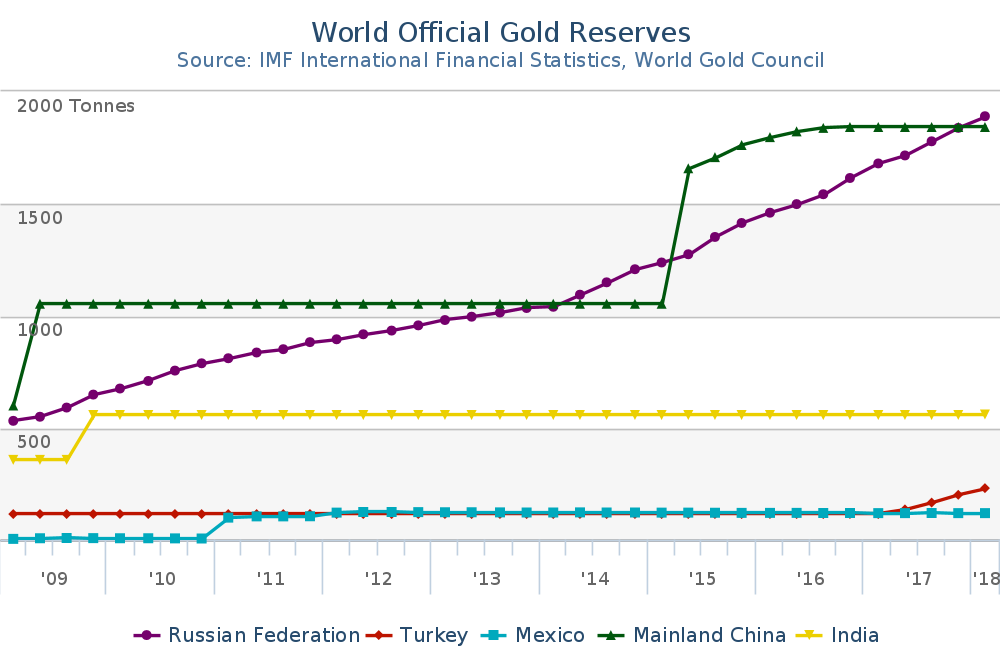

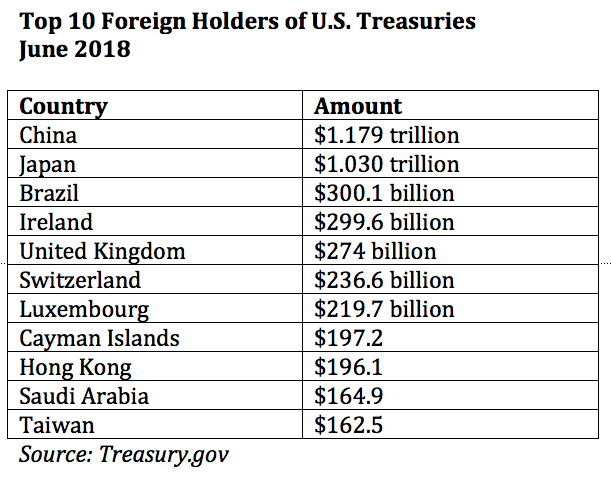

In February of 2013, Russia was one of the top holders of U.S. treasury securities, with $165 billion invested. China was number one at $1.252 trillion. As of June 2018, China is still the top foreign holder of U.S. treasuries with $1.179 trillion. However, Russia has dumped virtually everything, with only $15 billion in U.S. Treasuries remaining. At the same time, both China and Russia have been on a gold buying spree for the last decade. As you can see from the chart below, both countries have almost tripled their gold reserves since 2009. (If you are interested in reading more about gold and the top holders in the world, read my updated 2nd Edition of The ABCs of Money, which was just released this month.) According to the Q2 2018 Report from the World Gold Council (Gold.org), “Russia’s voracious appetite for gold is strategic – amidst geopolitical tensions it looks to diversify away from the US dollar.” On May 8, 2018, Russian President Vladamir Putin said that he wants to break away from the dollar to establish “economic sovereignty.” Selling Russia’s U.S. T-bills is only part of that strategy. Putin wants to take the oil trade off of the dollar standard as well. “The whole world sees the dollar monopoly is not reliable; it is dangerous for many, not only for us,” according to Putin. (Click to see a video with subtitles.) China is very interested in trading oil with Russia (and others) in yuan instead of U.S. dollars, as well. Reuters reported on March 29, 2018, that China is launching a Pilot Program to pay for oil in yuan. China is the world’s largest oil importer (and 2nd largest consumer behind the U.S.). China imports most of their oil from Russia, Angola and Saudi Arabia. The pilot program with Russia, Iran and Angola could launch anytime now. To make the trade more attractive, China is offering to convert their currency into gold on demand. As the trade war heats up with China, there is also concern about what China will do with their U.S. Treasury holdings. The Grand Total of the foreign T-Bill holdings as of June 2018 was $6.212 trillion. The total U.S. public debt is currently $21.4 trillion. So, who holds the majority of the debt? Actually, it is us (U.S.). If you check your retirement account, you probably hold Treasury bills there. Additionally, $5.7 trillion has been borrowed from the “intragovernmental holdings” such as the Social Security trust, Medicare, Federal Employees, Disability, Unemployment and others. So should you be following Russia’s lead and trading in your T-bills for gold? I will examine that in greater detail an upcoming blog. However, for the past year, we’ve had two slices of gold in our hot funds diversification, and have emphasized having a 2-step process for the safe side of your nest egg. Step 1 is to hold your “safe” money in FDIC-insured cash, and then to consider what safe, income-producing hard assets that you might purchase for a good price. (There are a few to consider right now!) In a world where major world powers are dumping U.S. treasuries, and there is far too much U.S. debt floating around, hard assets should hold their value better than paper assets. Since we hold the majority of our own debt (71%), government policy and political rhetoric can keep the value of T-bills stable – even while Russia dumps the U.S. like a bad date. However, if China dumps T-bills, too, that could make headlines. Bonds, including T-bills, remain vulnerable to capital loss and illiquidity, which takes them out of the safe category. If you want to be sure that you keep your nest egg intact and protect your assets, then it is definitely time to replace blind faith and hope with time-proven systems and real data. You have to be the boss of your money in a world where stocks and bonds are both in a bubble and vulnerable to capital loss. Call 310-430-2397 or email Heather @ NataliePace.com to learn more about our time-proven systems that earn gains in recessions and outperform the bull markets in between. Other Articles of Interest

Pensions in Peril. Unaffordability: The Unspoken Housing Crisis in America How a Strong GDP Report Could Go Bad. 5 Harbingers of Recessions. And how you can protect yourself. Cut Your Health Care Costs in Half. Interest Rates Keep Rising. Should you lock in a fixed? Social Security and Medicare Warn of Depletion. If you'd like a second opinion on your current budgeting and investing strategy, call 310-430-2397. Attend Natalie Pace's next life transformational Investor Education Retreat to protect what you have, earn money while you sleep and save thousands annually with smarter big-ticket choices. Watch how fast your life transforms when wisdom and time-proven strategies are the foundation of your fiscal health! Call 310-430-2397 or email Heather @ NataliePace.com to learn more now. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable however NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors. Comments are closed.

|

AuthorNatalie Pace is the co-creator of the Earth Gratitude Project and the author of The Power of 8 Billion: It's Up to Us, The ABCs of Money, The ABCs of Money for College, The Gratitude Game and Put Your Money Where Your Heart Is. She is a repeat guest & speaker on national news shows and stages. She has been ranked the No. 1 stock picker, above over 830 A-list pundits, by an independent tracking agency, and has been saving homes and nest eggs since 1999. Archives

July 2024

Categories |

RSS Feed

RSS Feed