|

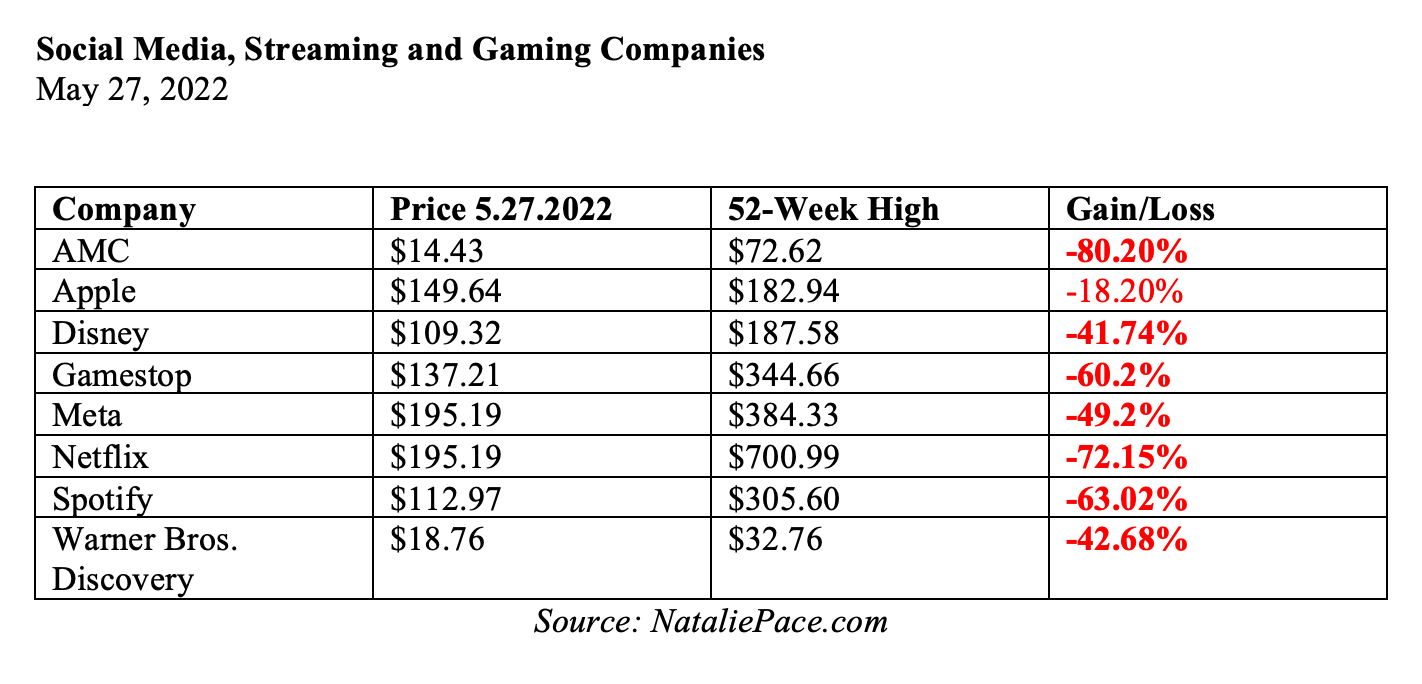

Streaming Wars End in a Share Price Bloodbath. Netflix. Spotify. Warner Bros. Discovery. Meta. Are Shares Finally in Buying Range? S&P500 has dropped -13.7% since the high of 4,818.62 on January 4, 2022. The NASDAQ Composite Index is in Bear Market Territory, with losses of -25.17%. However, the plunge in streaming and social media shares are staggering. Social Media, Streaming and Gaming Companies May 27, 2022 Why is Netflix One of the Worst Performers? On April 19, 2022, Netflix announced that instead of adding 2.5 million new subscribers (as they projected on January 20, 2022), the company had lost about 200,000 in the first quarter of 2022. The company stopped streaming in Russia on March 7, 2022. (Russia invaded Ukraine on Feb. 24, 2022.) Without losing Russia, the company would have gained 500,000 subscribers – still two million under the forecast. It was the first time growth contracted for Netflix in over a decade. The company went on to warn that they could lose another 2 million of their 221.6 million subscribers in 2Q 2022. That would still represent year-over-year growth. However, having two quarters of sequential decline was too much for investors to swallow. Netflix had already been beaten up in January, when the share price plunged to $360/share from a high of $700 in November of 2021. After the 1Q 2022 earnings release revealed the massive miss on April 19, 2022, spooked investors raced back to the Sell button. By May 11, 2022, the share price had tanked to $160/share. Why is Netflix losing subscribers? According to Reed Hastings, the co-CEO of Netflix, the competition has heated up, accounting sharing is rampant and the Russian invasion is affecting all of Eastern Europe. Additionally, COVID quarantines had made 2020 the golden year for streaming services. At the November 2021 highs, Netflix’s price-earnings ratio was a very lofty 70. While shares are down 72%, the valuation is more in line with a slower growth company – at a price-earnings ratio of 18. The Competition is Hot CODA won the Best Picture Oscar for Apple in 2022. Hulu is the place for reality streaming (Disney). Disney is a century-old brand with some of the most beloved films of all time, including the Star Wars and Pixar brands. The Batman just launched on HBO (Warner Bros. Discovery), where Harry Potter fans hang out. So, what will Netflix’s next hit be? Will their focus on international content creators pay off? Squid Game (from Korea) was one of the biggest shows in television history with over 1.6 billion hours viewed. The series contributed to an outstanding 4th quarter in 2021 for Netflix. However, the 2nd season isn’t expected to drop until the end of 2023, or later. In December 2022, Guillermo Del Toro will release his stop-motion film Pinocchio on Netflix. The film’s all-star cast includes Cate Blanchett, Ewan McGregor, Tilda Swinton and Christoph Waltz. Netflix will tease the film on June 15th at the Annecy International Animation Film Festival in France. The Crown is set to return to Netflix in November. It may go head to head with Apple’s Ted Lasso, which is predicted to air around the same time. Higher Prices, More ARM and/or Advertising? Many households, including family and friends in different households, share accounts to have the best of all streaming worlds. While all of the streaming providers are keenly aware that content is king, each is trying to squeeze more ARM (average revenue per member) without breaking it. Netflix has been testing various ways to get more revenue from shared accounts. CEO Reed Hastings made it clear that Netflix is also looking at a lower-priced subscription with ads, similar to what Hulu and other streaming services already have. Affordable Self-Soothing in an Inflationary World Incidentally, Netflix shares did quite well in the Great Recession. The share price actually increased from $2.96/share in October of 2007 (the top before the recession) to $6.18/share by March 2009 (the bottom before the recovery). It’s important to remember that not all self-soothing and social media are created equal. Some are paid for by streaming subscribers, while others get their cash from advertising dollars – an industry that implodes in recessions. Advertising budgets are typically the first to go when revenue dries up. All of Meta’s (Facebook, Instagram, WhatsApp) revenue comes from advertising, while none of Netflix’s does (yet). Are We in a Recession? During the Pandemic Recession (yes, there was one), people were quarantined and given free money. Streaming services had a golden moment. This time around, money is being siphoned out of the system, and Main Street is burning through savings trying to stay afloat. Federal Reserve Board Chairman Jerome Powell has made it clear that he and his board governors have made “price stability” (inflation) a supreme priority and that getting back to 2% inflation will “include some pain.” In his interview with Kai Ryssdal on May 12, 2022, Powell changed the definition of a soft landing from what it typically is – averting recession – to “keeping the labor market strong.” We won’t know if the economy is in a recession until July 28, 2022, when the 2Q 2022 GDP growth numbers are released. 1Q 2022 contracted -1.5%. Streaming Yes. Advertising No. The 2nd and 3rd quarters are the seasonally weak quarters for Netflix and streaming in general because people are off on vacation with better things to do than sit in front of their screens. So, there could still be more pain in the markets and in this industry, particularly if the 2Q 2022 GDP is negative. However, if I were thinking about buying into weakness in the industry in the early fall (presumably before the Santa Rally), I’d lean toward platforms with strong subscriber revenue, that are not overly reliant on advertising. Is the Price Right? A rising tide lifts all ships; a crashing wave drowns them. There may be more market weakness over the summer, which could fall as harshly on this beaten-up sector as the others. Netflix is on my Stock Shopping List, anticipating that late September might bring an even more attractive buying price. Bottom Line A 2022 recession will be very different from the 2020 Pandemic Recession for streaming services. This time, Disney Plus, Peacock, HBO, Paramount and Apple are all competing with Netflix for subscribers, and gasoline, housing and food are competing with streaming in the family budget. Free cash is not showing up magically in everyone’s bank account. And the recession that could be closer than everyone thinks is unlikely to be the shortest in history, like the Pandemic Recession was. Netflix is a staple of the streaming diet. But investors and consumers are fickle. Expect both to become more interested once Netflix releases its next blockbuster – particularly if that happens in the fall, after a potentially hellish summer. If you’re interested in a copy of my Netflix Stock Report Card, simply email [email protected] with Netflix Stock Report Card in the subject line. If you're interested in learning stock and 21st Century time-proven investing strategies for protecting your wealth from a No. 1 stock picker, join us for our June 10-12, 2022 Financial Freedom Retreat. Email [email protected] or call 310-430-2397 to learn more and to register. Click on the banner ad below to discover the 18+ strategies you'll learn and master.  Join us for our Financial Freedom Retreat. June 10-12, 2022. Email [email protected] to learn more. Register with friends and family to receive the best price. Click for testimonials & details.  Natalie Wynne Pace is an Advocate for Sustainability, Financial Literacy & Women's Empowerment. Natalie is the bestselling author of The Power of 8 Billion: It's Up to Us and is the co-creator of the Earth Gratitude Project. She has been ranked as a No. 1 stock picker, above over 835 A-list pundits, by an independent tracking agency (TipsTraders). Her book The ABCs of Money remained at or near the #1 Investing Basics e-book on Amazon for over 3 years (in its vertical), with over 120,000 downloads and a mean 5-star ranking. The 5th edition of The ABCs of Money was released on September 17, 2021. Natalie Pace's easy as a pie chart nest egg strategies earned gains in the last two recessions and have outperformed the bull markets in between. That is why her Investor Educational Retreats, books and private coaching are enthusiastically recommended by Nobel Prize winning economist Gary S. Becker, TD AMERITRADE chairman Joe Moglia, Kay Koplovitz and many Main Street investors who have transformed their lives using her Thrive Budget and investing strategies. Click to view a video testimonial from Nilo Bolden. Check out Natalie Pace's Podcast on Spotify. Watch videoconferences and webinars on Youtube. Other Blogs of Interest Elon Musk Sells $23 Billon in Tesla Stock and Receives $23 Billion in Options. Are You Gambling With Your Future? ESG Investing: Missing the E. Moderna & Biotech Trade at 2-Year Lows. Bitcoin Crashes. Crypto, Bold and Stocks All Crash. The Economy Contracted -1.4% in 1Q 2022. The Dow Dropped 2000 Points. Is Plant-Based Protein Dying? Should You Sell in April? The U.S. House Decriminalizes Cannabis Again. Chinese Electric Vehicle Market Share Hits 20%. The Risk of Recession in 6 Charts. High Gas Prices How Will Russian Boycotts Effect U.S. Multinational Companies? Oil and Gas Trends During Wartime Russia Invades Ukraine. How Have Stocks Responded in Past Wars? Zombie Companies. Rescue, Rehab or Liquidate? Spotify: Music to my Ears. Cannabis Crashes. 2022 Crystal Ball in Stocks, Real Estate, Crypto, Cannabis, Gold, Silver & More. Interview with the Chief Investment Strategist of Charles Schwab & Co., Inc. Stocks Enter a Correction Investor IQ Test Investor IQ Test Answers Real Estate Risks. What Happened to Ark, Cloudflare, Bitcoin and the Meme Stocks? Omicron is Not the Only Problem From FAANNG to ZANA MAD MAAX Ted Lasso vs. Squid Game. Who Will Win the Streaming Wars? Starbucks. McDonald's. The Real Cost of Disposable Fast Food. The Plant-Based Protein Fire-Sale What's Safe in a Debt World? Inflation, Gasoline Prices & Recessions China: GDP Soars. Share Prices Sink. The Competition Heats Up for Tesla & Nio. How Green in Your Love for the Planet? S&P500 Hits a New High. GDP Should be 7% in 2021! Will Work-From-Home and EVs Destroy the Oil Industry? Insurance and Hedge Funds are at Risk and Over-Leveraged. Office Buildings are Still Ghost Towns. Money Market Funds, FDIC, SIPC: Are Any of Them Safe? My 24-Year-Old is Itching to Buy a Condo. Should I Help Him? The 12-Step Guide to Successful Investing. Gardeners Creating Sanctuary & Solutions in Food Deserts. 2021 Company of the Year Almost 5 Million Americans are Behind on Rent & Mortgage. Real Estate Hits All-Time High. Rebalancing Your Nest Egg IQ Test. Answers to the Rebalancing Your Nest Egg IQ Test. Videoconferencing in a Post-Pandemic World (featuring Zoom & Teladoc). Sanctuary Sandwich Home. Multigenerational Housing. Interview with Lawrence Yun, the chief economist of the National Association of Realtors. 10 Budget Leaks That Cost $10,000 or More Each Year. The Stimulus Check. Party Like It's 1999. Would You Pay $50 for a Cafe Latte? Is Your Tesla Stock Overpriced? 10 Questions for College Success. Is FDIC-Insured Cash at Risk of a Bank Bail-in Plan? 8 Money Myths, Money Pits, Scams and Conspiracy Theories. Why Are My Bonds Losing Money? The Bank Bail-in Plan on Your Dime. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable. However, NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors. A lot of ink has been given to Tesla’s share price plunge and how Musk’s net worth has lost about 1/3 since the peak price of $1,243.49/share on Nov. 4, 2021. Of course, the Twitter acquisition is also making headlines. Less attention has been focused on the robust, consensus insider selling at Tesla. Elon is the top seller by far. However, he is joined by his brother Kimbal, Tesla’s CFO Zachary Kirkhorn, Robyn Denholm (the chairman of the board) and others. Starting on Nov. 8, 2021 (at the high), Musk began selling. Between November 2021 and April 28, 2022 (when Tesla was at $877/share), Musk cashed in over $23 billion out of Tesla. Additionally, Musk received a CEO bonus compensation package for operational milestones and for keeping the market value above $650 billion, which are worth about $23 billion in stock options that will be vested over the next 5 years (source: Reuters). Will He or Won’t He Buy Twitter? Should you be selling, too, or is Musk simply selling a small portion of his net worth to buy Twitter and diversify his portfolio? With Tesla stock down 43% on the year and the year-over-year revenue growth running at a hot 80.54%, it’s easy to think that holding on will be a winning strategy. However, when evaluating which way prices are headed, it’s important to consider a few valuation tools, as well as where the general marketplace might go. While a rising tide lifts all ships, a crashing wave can destroy them. Valuation Concerns With a market capitalization of $730.72 billion, Tesla is now worth more than Ford ($52.72 billion), GM ($54.74 billion) and Toyota ($263 billion) combined. If Tesla achieves 50% growth in vehicle production in 2022 (a claim Elon Musk made in the 1Q 2022 earnings call), then the annual revenue in 2022 could be above $80 billion. Net income could top $13 billion or more, unless supply chain bottlenecks and commodity prices continue to bite into profitability. That would put Tesla’s income above GM ($9.84 billion in 2021), but beneath Ford ($17.94 billion in 2021). There’s no doubt that electric vehicles are the future of the auto industry. According to the Alliance for Automotive Innovation, EV sales increased 11% in the 4th quarter of 2021 (compared to Q3), while sales of gas-powered vehicles contracted by -1.3% over the same period. EVs currently make up only 4.4% of the total U.S. fleet, so there’s plenty of room to grow. However, with a price-earnings ratio of 89 (while the average P/E is around 17), Tesla is still expensive – even with the pullback. When Musk’s profit taking instincts kicked in back in November of 2021, the P/E was an eyepopping 415. Tesla’s Deliverables Austin and Germany Gigafactories are producing now. However, with the COVID shutdowns in Shanghai, Tesla is projecting that 2Q 2022 deliverables will only be on par with 1Q or “slightly lower.” That will still represent year-over-year growth of more than 50%, assuming Tesla’s guidance becomes reality. Auto Stock Report Card How are the lockdown in China, supply chain disruptions and high commodity prices affecting the Chinese EV makes? XPeng and Li Auto led the pack with 1Q 2022 revenue growth of 153% and 168% year over year, respectively. Nio is still growing, but has seen revenue growth trim back to 49%, with about 28.5% growth expected for the 1st quarter of 2022 (based upon deliveries). Nio will report 1Q 2022 results on June 9, 2022 before the markets open. Despite some of the best revenue growth in the industry, the Chinese EV makers have seen their share prices plunge. Most are trading at a 3-year low not seen since the bottom of the Pandemic Recession. Since these newer companies are still cash-negative, a more helpful valuation tool is a price-to-sales ratio. Here again, Tesla shows up as quite elevated, with a 13 P/S ratio, compared to an average 4-6 in Nio, XPeng and Li Auto. Supply Chain Disruption, Commodity Prices and Inflation Supply chain, COVID and commodity prices are affecting the entire auto industry. Xpeng’s 1Q 2022 deliveries were 17% lower than 4Q 2021. 2Q 2022 deliveries could be lower than 1Q if May and June are not significantly stronger than April’s deliveries of 9002 vehicles. If Xpeng’s 2Q deliveries are in the range of 27,006, that is still year-over-year growth of 55.22% -- impressive, but much slower than 1Q’s 153% growth. Tesla is in a slightly better position to stay strong despite the COVID shutdowns in China, as it has factories in the U.S. and Germany, too. The company certainly is enjoying popularity. Tesla’s autos are all on backlog in the U.S., with the Model Y not delivering until 2023 (source: Electrek). However, high commodity prices could impact Tesla’s profitability. If Bitcoin remains where it is ($29,000 range) through the end of June, Tesla will have to write down its investment in crypto. Recession? There are many signs (and many analyst warnings) that a recession could hit the U.S. over the next year, not the least of which was that the 1st quarter of 2022 contracted -1.5%. (2 consecutive quarterly contractions are considered a recession.) New car sales slump in recessions. While no one has a crystal ball, it’s important to remember that General Motors and Chrysler both declared bankruptcy in 2009 – after years of losses in sales and profitability during the Great Recession. In the 1st quarter of 2022, the consumer appetite for vehicles was strong, despite the contraction. The legacy automakers are far more vulnerable in recessions due to the amount of debt and Other Post-Employment Benefits (OPEBs) that ae carried on their balance sheets. Ford Motor Company is a junk bond, and is the only company on the Auto Stock Report Card that saw revenue decrease year-over-year in the 1st quarter (by -4.84%). If you’d like a copy of the Auto Stock Report Card, just email [email protected] with Auto Stock Report Card in the subject line. Bottom Line High gas prices and environmental concerns are fueling a shift from gas-powered to electric vehicles. Ford and GM were already at a disadvantage from debt and OPEBs before the exodus to EV began. While Ford and GM are transitioning, they still ring up 95% of their sales from gasoline-powered products. Companies like Tesla and the Chinese EV makers are seeing stellar sales growth – even with the headwinds caused by COVID, supply chain bottlenecks, high commodity prices and inflation. If you'd like to learn 21st Century time-proven investing strategies for protecting your wealth from a No. 1 stock picker, join us for our June 10-12, 2022 Financial Freedom Retreat. Email [email protected] or call 310-430-2397 to learn more and to register. Click on the banner ad below to discover the 18+ strategies you'll learn and master.  Join us for our Financial Freedom Retreat. June 10-12, 2022. Email [email protected] to learn more. Register with friends and family to receive the best price. Click for testimonials & details.  Natalie Wynne Pace is an Advocate for Sustainability, Financial Literacy & Women's Empowerment. Natalie is the bestselling author of The Power of 8 Billion: It's Up to Us and is the co-creator of the Earth Gratitude Project. She has been ranked as a No. 1 stock picker, above over 835 A-list pundits, by an independent tracking agency (TipsTraders). Her book The ABCs of Money remained at or near the #1 Investing Basics e-book on Amazon for over 3 years (in its vertical), with over 120,000 downloads and a mean 5-star ranking. The 5th edition of The ABCs of Money was released on September 17, 2021. Natalie Pace's easy as a pie chart nest egg strategies earned gains in the last two recessions and have outperformed the bull markets in between. That is why her Investor Educational Retreats, books and private coaching are enthusiastically recommended by Nobel Prize winning economist Gary S. Becker, TD AMERITRADE chairman Joe Moglia, Kay Koplovitz and many Main Street investors who have transformed their lives using her Thrive Budget and investing strategies. Click to view a video testimonial from Nilo Bolden. Check out Natalie Pace's Podcast on Spotify. Watch videoconferences and webinars on Youtube. Other Blogs of Interest Are You Gambling With Your Future? ESG Investing: Missing the E. Moderna & Biotech Trade at 2-Year Lows. Bitcoin Crashes. Crypto, Bold and Stocks All Crash. The Economy Contracted -1.4% in 1Q 2022. The Dow Dropped 2000 Points. Is Plant-Based Protein Dying? Should You Sell in April? The U.S. House Decriminalizes Cannabis Again. Chinese Electric Vehicle Market Share Hits 20%. The Risk of Recession in 6 Charts. High Gas Prices How Will Russian Boycotts Effect U.S. Multinational Companies? Oil and Gas Trends During Wartime Russia Invades Ukraine. How Have Stocks Responded in Past Wars? Zombie Companies. Rescue, Rehab or Liquidate? Spotify: Music to my Ears. Cannabis Crashes. 2022 Crystal Ball in Stocks, Real Estate, Crypto, Cannabis, Gold, Silver & More. Interview with the Chief Investment Strategist of Charles Schwab & Co., Inc. Stocks Enter a Correction Investor IQ Test Investor IQ Test Answers Real Estate Risks. What Happened to Ark, Cloudflare, Bitcoin and the Meme Stocks? Omicron is Not the Only Problem From FAANNG to ZANA MAD MAAX Ted Lasso vs. Squid Game. Who Will Win the Streaming Wars? Starbucks. McDonald's. The Real Cost of Disposable Fast Food. The Plant-Based Protein Fire-Sale What's Safe in a Debt World? Inflation, Gasoline Prices & Recessions China: GDP Soars. Share Prices Sink. The Competition Heats Up for Tesla & Nio. How Green in Your Love for the Planet? S&P500 Hits a New High. GDP Should be 7% in 2021! Will Work-From-Home and EVs Destroy the Oil Industry? Insurance and Hedge Funds are at Risk and Over-Leveraged. Office Buildings are Still Ghost Towns. Money Market Funds, FDIC, SIPC: Are Any of Them Safe? My 24-Year-Old is Itching to Buy a Condo. Should I Help Him? The 12-Step Guide to Successful Investing. Gardeners Creating Sanctuary & Solutions in Food Deserts. 2021 Company of the Year Almost 5 Million Americans are Behind on Rent & Mortgage. Real Estate Hits All-Time High. Rebalancing Your Nest Egg IQ Test. Answers to the Rebalancing Your Nest Egg IQ Test. Videoconferencing in a Post-Pandemic World (featuring Zoom & Teladoc). Sanctuary Sandwich Home. Multigenerational Housing. Interview with Lawrence Yun, the chief economist of the National Association of Realtors. 10 Budget Leaks That Cost $10,000 or More Each Year. The Stimulus Check. Party Like It's 1999. Would You Pay $50 for a Cafe Latte? Is Your Tesla Stock Overpriced? 10 Questions for College Success. Is FDIC-Insured Cash at Risk of a Bank Bail-in Plan? 8 Money Myths, Money Pits, Scams and Conspiracy Theories. Why Are My Bonds Losing Money? The Bank Bail-in Plan on Your Dime. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable. However, NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors. I am writing in earnest about something so important that I need you to stop whatever you are doing and read this blog now. I know you have heard phrases like this bantered about by other people. However, you never hear something like this from me, unless I’m dead serious and there is something that demands your attention now. Yes, we’re all getting ready for summer vacation and holidays, wrapping up the school year and looking forward to some freedom and fun. However, a little attention now will make the summer go far more smoothly, and help our vacations to truly be the R&R we desire, deserve and need. Are we already in a recession? What can you do to protect yourself now before things get worse? Remember that I called the Great Recession in December of 2007, and offered solutions that earned gains, when most of Main Street lost more than half of their wealth. An email similar to this one was sent on Dec. 23, 2007. That was before the Dow Jones Industrial Average dropped by half. I was the least popular person at Christmas parties in 1999, when I warned of the Dot Com Crash, while everyone was bragging about their gains (only to lose up to 78% in the Dot Com Recession). I want to stress that avoiding these kinds of losses is easy-as-a-pie-chart. The devastating losses that so many people suffered during the Dot Com and the Great Recessions are even more heartbreaking because they are preventable with a few quite simple strategies. Having time-proven 21st century solutions was what earned me the honor of having Nobel-Prize winning economist Gary S. Becker, one of the most esteemed economists of all time, write the Preface to my book Put Your Money Where Your Heart Is. As Becker wrote, “Many people, including educated men and women, often get into trouble when they neglect to follow simple and fundamental rules of the type provided [by Natalie]. This is why I recommend them with enthusiasm.” This system is specifically designed to be easy, efficacious and time-efficient, so that you can set it up, rebalance it once or twice a year, and protect and grow your wealth without stress and drama. Take Our Wealth Challenge Add up everything you have in your retirement accounts, savings, brokerage accounts, etc. Once you get the total, divide it by half. Then ask yourself, "Am I really willing to risk losing half of my wealth? Should I have blind faith that someone else is protecting my future? Or is now the time to be the boss of my money and know exactly what I own and why, and what a time-proven plan looks like?" (That plan is easy-as-a-pie-chart.) Even if you’re feeling equity rich or that you have a "conservative" allocation in your portfolio, you might be at risk of devastating losses with the added horror of being invested in illiquid assets where you cannot access your money. If you have already lost money (most people have) or do not have a clue what holdings you have in your retirement plan, and you have even $10,000 invested, you need to move heaven and earth to be at my retreat this June 10-12, 2022. Here is why. At the retreat, we will look at the danger zones that you need to avoid NOW before inflation (and 5 other risk factors) start to bring down the stock market. You will carefully restructure your nest egg, so that you are protected against a downturn and are positioned to earn gains in the companies of tomorrow. You will learn sound, higher performing, less risky alternative investments that could bring you thousands of dollars annually right now that are lying right under your nose. You’ll gain an understanding of the best hedging investments and how to be on the right side of the volatility in crypto, gold and other safe havens. Your current investment strategy has very likely already lost a chunk of dough. This could be a hellish summer with more losses on the horizon. We will know whether or not we’re already in a recession on July 28, 2022. (The smart money will know as early as mid-June.) This will be the subject of my June webinar on June 2, 2022. You can listen to it on my Spotify podcast, or watch it free of charge on my YouTube.com/NataliePace channel. So, if you delay taking action now, whether it is attending the June 10-12, 2022 Retreat or getting an unbiased 2nd opinion personally and confidentially, you are putting your wealth and future at risk. If you wait for the headlines that the economy is in a recession, it’s always too late to protect yourself. Stocks drop before the recession is announced. A better strategy could protect your wealth from losses, and position you for gains, while offering the peace of mind that ensures your vacation will be a golden memory for you and your loved ones. (If you’re constantly checking the news and worrying about your losses, quite the opposite experience is going to occur.) And again, learning and implementing a time-proven, 21st Century wealth plan is not expensive, difficult to learn, or time-consuming. That’s the beauty of something that is well-designed. We have put together a 3-day wisdom immersion experience that is extremely unique, powerful and results-certain. On Day 1, we are going to protect our nest egg. On Day 2, we’ll discover the hottest areas of opportunity and why some of the most well-known brands are at the greatest risk for losses. Day 3 is all about, “What’s safe in a Debt World?” If you don’t know the answer to that question, your conservative plan could (again) be at risk of devastating losses with the added horror of being invested in illiquid assets where you cannot access your money. The safe side of your wealth plan is not supposed to lose money. Meanwhile, many people are being sold into long-term, high-risk, low-yielding investments as a “protection” against inflation, putting their principal and liquidity at risk, while also losing buying power. The investor loses in that scenario, while the broker-salesman makes a high commission. By the time you leave our retreat on the third day, you will no longer be the same person. (Please take a moment to read the testimonials below). Even if you have been following my blogs and books to a T, the immersion process of getting course-corrected by me personally will teach you how to think how I think, so that you can have the same level of success in your life. I cannot promise that you will make a billion dollars, but I can tell you that if you invest with the foundation and strategies we teach you, it is much easier to amass wealth and to live a richer life. Financial freedom over the coming years will only be possible by adopting a plan that preserves your wealth today, and allows you to earn gains, while having an easy-to-follow plan that is capable of auto-navigating a tough and treacherous economic environment. Without that plan, the coming years could be simply heartbreaking. I’d far rather assist you in protecting yourself now than in rebuilding your life after the crash. (Most people wait until they hit rock-bottom to fix things. Please be smarter than that.) The three days of June 10-12, 2022 will absolutely be the most enriching, the most important and the most valuable three days of your investment life. Speaking of which, we are not charging the $5,000 or $10,000 that most investment training programs ask. We are not even charging half of that. We are creating a value-priced, priceless retreat where I can work deeply, intimately and personally with our most motivated, serious and ambitious retreat attendees. Click for pricing and information. If this resonates with you, register now by emailing [email protected] with Retreat in the subject line. Click for times, pricing, the 15+ tools you’ll master and for testimonials. Our team is holding a limited amount of space, and you will be attending from the comfort of your living room or office, without any add-on travel and accommodations expenses. Mark your calendar right now and clear it for the dates June 10-12, 2022 from 11-7 pm ET (8-4 pm PT). If you go into your summer of 2022 without this information, understanding and strategic guidance, you are at risk of a pretty hellish summer. There is no downside to you attending our June retreat, outside of the modest registration fee. Learning the life math and time-proven 21st Century systems that we all should have received in high school will transform your relationship with money and investing forever. “An investment in knowledge pays the best interest,” Benjamin Franklin. Additional Testimonials “I did not know a THING about investing but Natalie Pace made it so easy that I was literally jumping for joy after the first day. I learned so much so fast. Before Natalie’s retreat, I never imagined investing could be so safe, easy and profitable, and that I would love it so much.” CC in Canada “We asked Natalie Pace for a second opinion on our investment portfolio. She researched and reviewed each stock and fund. She then explained to us in plain English how we were positioned in the market, and how high our risk exposure was. Her knowledge was so profound that we decided to take her retreat. My husband was still quite skeptical, but 20 minutes into the retreat he turned to me and said "Thank you." Stocks and investing are no longer rocket science. We are finally able to take control of our money. We give thanks just about every day that we met Natalie. I feel like I live on a different planet. I am forever grateful.” AC & AM “Through Natalie Pace and her strategies, I have built up a nest egg from zero (having gone through bankruptcy 9 years ago due to over leveraging myself in real estate at too high of prices just before the crash) to 44K in less than 2 years through investments. I appreciate her discussion about the path to wisdom. The first retreat was emotional and overwhelming. Now it makes so much more sense that I have even started learning about and doing my first options trades!” SS “Ten minutes into the first day I was already much smarter about investing than I ever thought I would be in my life and I knew I was in exactly the right place at this retreat. I am amazed at how EASY and FUN it is to make my money work for me and those I love. I think this kind of information should be compulsory in schools. I wish I'd learned it earlier in life. I would recommend this retreat for everyone.” CM “I am saving $20,000 annually on health insurance with Natalie’s Health Savings Account tips.” RM “I reduced my electric bill from $800/month to less than $30/month, using Natalie’s Stop Making the Billionaire Corporations Rich at Your Own Expense Plan.” MR No matter how dark and scary the forest gets, if you follow the light, you will reach the promised land. If you'd like to learn 21st Century time-proven investing strategies for protecting your wealth (from a No. 1 stock picker), join us for our June 10-12, 2022 Financial Freedom Retreat. Email [email protected] or call 310-430-2397 to learn more and to register. Click on the banner ad below to discover the 18+ strategies you'll learn and master.  Join us for our Financial Freedom Retreat. June 10-12, 2022. Email [email protected] to learn more. Register with friends and family to receive the best price. Click for testimonials & details.  Natalie Wynne Pace is an Advocate for Sustainability, Financial Literacy & Women's Empowerment. Natalie is the bestselling author of The Power of 8 Billion: It's Up to Us and is the co-creator of the Earth Gratitude Project. She has been ranked as a No. 1 stock picker, above over 835 A-list pundits, by an independent tracking agency (TipsTraders). Her book The ABCs of Money remained at or near the #1 Investing Basics e-book on Amazon for over 3 years (in its vertical), with over 120,000 downloads and a mean 5-star ranking. The 5th edition of The ABCs of Money was released on September 17, 2021. Natalie Pace's easy as a pie chart nest egg strategies earned gains in the last two recessions and have outperformed the bull markets in between. That is why her Investor Educational Retreats, books and private coaching are enthusiastically recommended by Nobel Prize winning economist Gary S. Becker, TD AMERITRADE chairman Joe Moglia, Kay Koplovitz and many Main Street investors who have transformed their lives using her Thrive Budget and investing strategies. Click to view a video testimonial from Nilo Bolden. Check out Natalie Pace's Podcast on Spotify. Watch videoconferences and webinars on Youtube. Other Blogs of Interest ESG Investing: Missing the E. Moderna & Biotech Trade at 2-Year Lows. Bitcoin Crashes. Crypto, Bold and Stocks All Crash. The Economy Contracted -1.4% in 1Q 2022. The Dow Dropped 2000 Points. Is Plant-Based Protein Dying? Should You Sell in April? The U.S. House Decriminalizes Cannabis Again. Chinese Electric Vehicle Market Share Hits 20%. The Risk of Recession in 6 Charts. High Gas Prices How Will Russian Boycotts Effect U.S. Multinational Companies? Oil and Gas Trends During Wartime Russia Invades Ukraine. How Have Stocks Responded in Past Wars? Zombie Companies. Rescue, Rehab or Liquidate? Spotify: Music to my Ears. Cannabis Crashes. 2022 Crystal Ball in Stocks, Real Estate, Crypto, Cannabis, Gold, Silver & More. Interview with the Chief Investment Strategist of Charles Schwab & Co., Inc. Stocks Enter a Correction Investor IQ Test Investor IQ Test Answers Real Estate Risks. What Happened to Ark, Cloudflare, Bitcoin and the Meme Stocks? Omicron is Not the Only Problem From FAANNG to ZANA MAD MAAX Ted Lasso vs. Squid Game. Who Will Win the Streaming Wars? Starbucks. McDonald's. The Real Cost of Disposable Fast Food. The Plant-Based Protein Fire-Sale What's Safe in a Debt World? Inflation, Gasoline Prices & Recessions China: GDP Soars. Share Prices Sink. The Competition Heats Up for Tesla & Nio. How Green in Your Love for the Planet? S&P500 Hits a New High. GDP Should be 7% in 2021! Will Work-From-Home and EVs Destroy the Oil Industry? Insurance and Hedge Funds are at Risk and Over-Leveraged. Office Buildings are Still Ghost Towns. Money Market Funds, FDIC, SIPC: Are Any of Them Safe? My 24-Year-Old is Itching to Buy a Condo. Should I Help Him? The 12-Step Guide to Successful Investing. Gardeners Creating Sanctuary & Solutions in Food Deserts. 2021 Company of the Year Almost 5 Million Americans are Behind on Rent & Mortgage. Real Estate Hits All-Time High. Rebalancing Your Nest Egg IQ Test. Answers to the Rebalancing Your Nest Egg IQ Test. Videoconferencing in a Post-Pandemic World (featuring Zoom & Teladoc). Sanctuary Sandwich Home. Multigenerational Housing. Interview with Lawrence Yun, the chief economist of the National Association of Realtors. 10 Budget Leaks That Cost $10,000 or More Each Year. The Stimulus Check. Party Like It's 1999. Would You Pay $50 for a Cafe Latte? Is Your Tesla Stock Overpriced? 10 Questions for College Success. Is FDIC-Insured Cash at Risk of a Bank Bail-in Plan? 8 Money Myths, Money Pits, Scams and Conspiracy Theories. Why Are My Bonds Losing Money? The Bank Bail-in Plan on Your Dime. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable. However, NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors. Tesla very famously was booted out of the S&P Global’s E.S.G. Index on May 17, 2022. S&P Global explained their decision in a blog, writing, “While Tesla may be playing its part in taking fuel-powered cars off the road, it has fallen behind its peers when examined through a wider ESG lens.” Elon Musk responded with a series of Tweets calling the index a “scam,” and noting that Exxon Mobil was in the index. He also shared the above Tweet mentioning that there are 6 oil companies in the index. (There are actually at least 15 oil and gas companies in the index.) Is oil the only dirty little secret of E.S.G. investing? Would Mother Nature be including the companies that S&P Global has chosen for their ESG index? What about those self-proclaimed “socially conscious” funds? ESG is the hot new way of investing. The acronym wraps environmental, social and governance factors into one blanket, offering climate-action and socially-conscious investors a feel-good idea for growing their wealth. However, a look into the actual holdings of these funds reveals that the “E” is missing. Fossil Fuels Just 20 of the world’s largest fossil fuel companies are responsible for over 1/3 of the CO2 in the atmosphere. Over half of each barrel of oil is used to make plastic, polyester, asphalt, rubber and other petrochemical products. The S&P Global’s E.S.G. Index includes 15 oil companies and 15 plastics, petrochemicals, and single-use waste-generating companies. If we add in the gasoline-powered automobile companies, airlines and cruise ships (heavy CO2 footprint) and the plastics and petrochemical companies, the number of problematic CO2 companies on the ESG list jumps to at least 30 – about 10% of the list. Add in the environmental impact of biotechnology and mining, which are both hard on our home planet, and the percentage jumps to 20%. The self-described socially conscious fund companies always include banks (which fund oil and other environmentally-toxic businesses), consumer products (many of which promote single-use plastic or paper waste) and even some traditional (gas-guzzling) automotive companies. Plastic and Forest-Clearing Less than 10% of plastic was recycled in the U.S. Forests are being cleared for toilet paper and single-use paper waste. The NRDC publishes a Report Card assigning high marks to companies that are using recycled paper for their products, compared to companies that are clearing old-growth forests, which their customers are flushing down toilets. Single-Use Many companies in the ESG and socially conscious funds have a single-use, waste problem. Since recycling isn’t happening, it’s important to focus on the first 5 of the 6 Rs of sustainability – Rethink, Refuse, Reduce, Repair, Reuse. That means that all of us need to pack our water canteen, canvas bags/backpack and reusable coffee mugs on our errand runs (ideally locally, on a bike). Petrochemicals, Dead Zones and Health Hazards The Dead Zone in the Gulf of Mexico results from toxic agricultural run-off from industrial farms along the Mississippi River. There is a Cancer Alley in Louisiana, due to the amount of oil and petrochemical refineries in the region. Long-term pesticide exposure increases the risk of diabetes, according to studies by the NIH. Bottom Line The truth about ESG and socially conscious investing is that many of these funds are missing the environmental filter that their clients are relying upon. Whether or not they live up to the SG is for a separate analysis. Mother Nature would be canning at least 30 companies that are included in the S&P Global ESG Fund (probably double that amount), if she were creating an environmentally-conscious fund. Don’t be misled by the fancy title, which is a clear case of false advertising. If you care about the environment and you don’t have time to dig into all of the holdings of the funds, E.S.G. investing is just too CO2 for clean hands. If you’re interested in healing our planet, take our challenge to reduce your personal CO2 footprint by 30% this year. Learn more in The Power of 8 Billion: It’s Up to Us. If you'd like to learn how to green your investments, while also adopting 21st Century time-proven investing strategies for protecting your wealth (from a No. 1 stock picker), join us for our June 10-12, 2022 Financial Freedom Retreat. Email [email protected] or call 310-430-2397 to learn more and to register. Click on the banner ad below to discover the 18+ strategies you'll learn and master.  Join us for our Financial Freedom Retreat. June 10-12, 2022. Email [email protected] to learn more. Register with friends and family to receive the best price. Click for testimonials & details.  Natalie Pace learning organic farming tips from David Wilson, the Home Farm manager of H.R.H. The Prince of Wales. Natalie Pace learning organic farming tips from David Wilson, the Home Farm manager of H.R.H. The Prince of Wales. Natalie Wynne Pace is an Advocate for Sustainability, Financial Literacy & Women's Empowerment. Natalie is the bestselling author of The Power of 8 Billion: It's Up to Us and is the co-creator of the Earth Gratitude Project. She has been ranked as a No. 1 stock picker, above over 835 A-list pundits, by an independent tracking agency (TipsTraders). Her book The ABCs of Money remained at or near the #1 Investing Basics e-book on Amazon for over 3 years (in its vertical), with over 120,000 downloads and a mean 5-star ranking. The 5th edition of The ABCs of Money was released on September 17, 2021. Natalie Pace's easy as a pie chart nest egg strategies earned gains in the last two recessions and have outperformed the bull markets in between. That is why her Investor Educational Retreats, books and private coaching are enthusiastically recommended by Nobel Prize winning economist Gary S. Becker, TD AMERITRADE chairman Joe Moglia, Kay Koplovitz and many Main Street investors who have transformed their lives using her Thrive Budget and investing strategies. Click to view a video testimonial from Nilo Bolden. Check out Natalie Pace's Podcast on Spotify. Watch videoconferences and webinars on Youtube. Other Blogs of Interest Moderna & Biotech Trade at 2-Year Lows. Bitcoin Crashes. Crypto, Bold and Stocks All Crash. The Economy Contracted -1.4% in 1Q 2022. The Dow Dropped 2000 Points. Is Plant-Based Protein Dying? Should You Sell in April? The U.S. House Decriminalizes Cannabis Again. Chinese Electric Vehicle Market Share Hits 20%. The Risk of Recession in 6 Charts. High Gas Prices How Will Russian Boycotts Effect U.S. Multinational Companies? Oil and Gas Trends During Wartime Russia Invades Ukraine. How Have Stocks Responded in Past Wars? Zombie Companies. Rescue, Rehab or Liquidate? Spotify: Music to my Ears. Cannabis Crashes. 2022 Crystal Ball in Stocks, Real Estate, Crypto, Cannabis, Gold, Silver & More. Interview with the Chief Investment Strategist of Charles Schwab & Co., Inc. Stocks Enter a Correction Investor IQ Test Investor IQ Test Answers Real Estate Risks. What Happened to Ark, Cloudflare, Bitcoin and the Meme Stocks? Omicron is Not the Only Problem From FAANNG to ZANA MAD MAAX Ted Lasso vs. Squid Game. Who Will Win the Streaming Wars? Starbucks. McDonald's. The Real Cost of Disposable Fast Food. The Plant-Based Protein Fire-Sale What's Safe in a Debt World? Inflation, Gasoline Prices & Recessions China: GDP Soars. Share Prices Sink. The Competition Heats Up for Tesla & Nio. How Green in Your Love for the Planet? S&P500 Hits a New High. GDP Should be 7% in 2021! Will Work-From-Home and EVs Destroy the Oil Industry? Insurance and Hedge Funds are at Risk and Over-Leveraged. Office Buildings are Still Ghost Towns. Money Market Funds, FDIC, SIPC: Are Any of Them Safe? My 24-Year-Old is Itching to Buy a Condo. Should I Help Him? The 12-Step Guide to Successful Investing. Gardeners Creating Sanctuary & Solutions in Food Deserts. 2021 Company of the Year Almost 5 Million Americans are Behind on Rent & Mortgage. Real Estate Hits All-Time High. Rebalancing Your Nest Egg IQ Test. Answers to the Rebalancing Your Nest Egg IQ Test. Videoconferencing in a Post-Pandemic World (featuring Zoom & Teladoc). Sanctuary Sandwich Home. Multigenerational Housing. Interview with Lawrence Yun, the chief economist of the National Association of Realtors. 10 Budget Leaks That Cost $10,000 or More Each Year. The Stimulus Check. Party Like It's 1999. Would You Pay $50 for a Cafe Latte? Is Your Tesla Stock Overpriced? 10 Questions for College Success. Is FDIC-Insured Cash at Risk of a Bank Bail-in Plan? 8 Money Myths, Money Pits, Scams and Conspiracy Theories. Why Are My Bonds Losing Money? The Bank Bail-in Plan on Your Dime. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable. However, NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors. Moderna & Biotech Trade Near 2-Year Lows. Is the industry diseased, or has Fast Money just gone crazy with profit taking? Let’s start with an analysis of Moderna. The company made headlines on Wednesday when it was revealed that the new CEO Jorge Gomez was canned after just one day of work (but would still receive $700,000 for a full year’s worth of salary). Gomez forfeits his signing bonus and bonus eligibility, according to CNBC. Moderna says they had no prior knowledge of an internal investigation into accounting problems at Gomez’s former employer Dentsply Sirona. Dentsply was unable to file its quarterly report with the SEC on time. The notice of the late filing was filed on May 9, 2022, the first day of work for Gomez at Moderna. Is the CFO Embarrassment a Problem? Whenever a company sacks the CFO, it raises a red flag. What happened to the due diligence? Why was the former CFO leaving in the first place? As it turns out, David Meline, the former CFO, had actually come out of retirement in order to help Moderna scale up their COVID vaccine quickly. He joined Moderna in June of 2020, after his consultation period at Amgen ended. (He had retired from Amgen effective Dec. 31, 2019.) So, it’s completely understandable that after getting Moderna off to the races, Meline was ready to retire for a second time. When the issue with the newly hired CFO came up, Meline stepped up and committed to staying on until a replacement is found. (He had already committed to a period of transition as a consultant.) It appears that Gomez might have been a former friend of Meline from General Motors back in the day. At any rate, the departure doesn’t appear to be a red flag or a lack of due diligence on the part of Moderna. In fact, it appears that they were fortunate to learn of the news when they did. The histrionic headlines on this should fade soon. So, now let’s look at Moderna’s business, including: Revenue & Sales Growth M&A & Cash on Hand The NIH Patent Claim Revenue & Sales Growth Moderna’s revenue more than tripled in the 1Q of 2022, from $1.9 billion to $6.1 billion. Advance Purchase Agreements for 2022 total approximately $21 billion. This represents an increase of 13.7% over 2021, if that turns out to be the total revenue. So, the annual growth expectation is much more muted than the 1st quarter was. When you factor in the 1st quarter revenue, you are left with $14.9 billion for the remaining three quarters – or just under $5 billion per quarter. Further, 2Q is the seasonally weak quarter, which takes the expectation down to the $4.5 billion range (per the earnings call). That would be flat year over year. With a P/E of just 3.83, the expectations for a weaker 2Q are already factored in. If the news is better than expected that might be great for investors (unless macro market weakness drags this company down with the crash). The bulk of vaccine sales is expected in the second half of the year. The pandemic is transitioning into an endemic. The expectation is that people will be interested in vaccinating and boosting in October in anticipation of the winter seasonal surge in sicknesses. The summer season (2Q 2022) is when most people have already gotten their booster for the summer holiday. Moderna has a footprint around the world – in Asia, Europe, Australia, Africa and Latin America. They also have a healthy pipeline of therapies for oncology, HIV, Epstein-Barr and other diseases, and a booster targeting Omicron in a Phase 2 Study. M&A & Cash on Hand Moderna has $19.3 billion in cash, cash equivalents and investments. That kind of cash puts the company in a great seat for mergers and acquisitions, especially as weakness continues in the biotech space. This industry has been sacked by sellers and some very attractive, compatible biotech companies might be far more affordable today than they were just a few months ago. According to the earnings call, Moderna has “never been so busy” looking at partnerships and M&A. The company repurchased $623 million of their stock in the 1st quarter of 2022, and have a $3 billion buyback authorization from the board. This could help keep their share price more buoyant if there is continued weakness in the larger marketplace. NIH Patent Claim Last October 2021, it was reported that the NIH wanted to stick its hand in Moderna’s patent claims on the mRNA sequence of their vaccine. On December 17, 2021, Moderna issued a statement that they were working with the NIH to resolve the matter. (Click to read their statement.) There haven’t been any details released on how that was resolved. However, Moderna disclosed in the 1Q 2022 earnings call that they are paying “third-party royalties.” The net income for the quarter was $3.7 billion. Is Now a Good Time to Add a Biotech Fund to Your Wealth Plan? Biotech funds like Ishares (symbol IBB) are trading near their three-year lows. Many profitable companies have historically low price-earnings ratios. Biotechnology is the only industry that Liz Ann Sonders, the chief investment strategist of Charles Schwab, has an overweight on. Visit YouTube.com/NataliePace to watch my entire interview with her from Jan. 30, 2022. If you’d like to receive my Biotech Stock Report Card, simply email [email protected]. Macro Problems A rising tide lifts all ships. A sinking tide can ground them. The first quarter of 2022 saw a contraction of -1.4%. If the second quarter has a contraction, we are in a recession. How likely is it that we’ll have a recession this year (or next year)? Analysts peg the likelihood at about 35%. Click to listen to my podcast, watch my webinar or read my blog on the “Warning Signs of a Recession.” What happens in a recession? Asset prices can plunge. We’ve already seen a -16.5% correction in the S&P500 from its high of 4818.62, set on January 4,2022. In the Great Recession, the Dow Jones Industrial Average plunged -55%. During the Dot Com Recession, the NASDAQ Composite Index bottomed out with -78% losses and took 15 years to recover. In other words, now is the time to make sure that your wealth plan is properly protected and diversified, and that you know what is safe in a Debt World where bonds have interest rate, credit, duration, principal loss and liquidity risks. Real estate prices are also a concern. The National Association of Realtors has warned that home sales are expected to contract by 10% in 2022. As interest rates rise, fewer people qualify for a mortgage or can afford the payments. Home prices in the U.S. are at all-time highs. In the most recent Financial Stability Report, the authors wrote, that home prices had “stretched valuations,” and that “a negative shock to house prices might hurt homeowners.” Buying high in real estate and having the value fall beneath your mortgage is hard on your wealth, your wallet, your relationships and your credit score. It can take a decade or longer to recover. I’ll be discussing this in my free webinar this week. If you’d like to join us live, simply email [email protected] with VIDEOCON in the subject line. I’ve noticed that Jerome Powell‘s most recent definition of a soft landing has changed. A soft landing is typically referred to as raising interest rates without triggering a recession. Powell now defines it as “Getting back to 2% inflation, while keeping the labor market strong.” When asked by Marketplace’s Kai Ryssdal to describe his priority in 5 words or less, Powell said, “Get inflation back under control” (not avoid a recession). Could the U.S. already be in recession? This is something I’m going to be addressing in my podcast and webinar this Thursday at 5 PM Pacific. If you’re on our list you will receive the logon instructions automatically. If you’d like to join the webinar simply email [email protected] with VIDEOCON in the subject line. Bottom Line Moderna has a global reach, APAs of about $21 billion and a solid pipeline. The company, along with many biotech stocks, has been beaten up by investors, and might be oversold. If you think biotech is still hot, consider adding a slice of the industry to your nest egg. Measure this against a backdrop of economic contraction in the 1st quarter and a potential recession on the horizon (if it’s not already here). Remember that a healthy wealth plan doesn’t try to market time or jump all in or all out. It’s a carefully designed (but easy!) system of proper diversification and regular (but not obsessive) rebalancing. If you'd like to learn 21st Century time-proven investing strategies for protecting your wealth from a No. 1 stock picker, join us for our June 10-12, 2022 retreat. Email [email protected] or call 310-430-2397 to learn more and to register. Click on the banner ad below to discover the 18+ strategies you'll learn and master.  Join us for our Financial Freedom Retreat. June 10-12, 2022. Email [email protected] to learn more. Register with friends and family to receive the best price. Click for testimonials & details.  Natalie Wynne Pace is an Advocate for Sustainability, Financial Literacy & Women's Empowerment. Natalie is the bestselling author of The Power of 8 Billion: It's Up to Us and is the co-creator of the Earth Gratitude Project. She has been ranked as a No. 1 stock picker, above over 835 A-list pundits, by an independent tracking agency (TipsTraders). Her book The ABCs of Money remained at or near the #1 Investing Basics e-book on Amazon for over 3 years (in its vertical), with over 120,000 downloads and a mean 5-star ranking. The 5th edition of The ABCs of Money was released on September 17, 2021. Natalie Pace's easy as a pie chart nest egg strategies earned gains in the last two recessions and have outperformed the bull markets in between. That is why her Investor Educational Retreats, books and private coaching are enthusiastically recommended by Nobel Prize winning economist Gary S. Becker, TD AMERITRADE chairman Joe Moglia, Kay Koplovitz and many Main Street investors who have transformed their lives using her Thrive Budget and investing strategies. Click to view a video testimonial from Nilo Bolden. Check out my Podcast on Spotify. Watch videoconferences and webinars on Youtube. Other Blogs of Interest Bitcoin Crashes. Crypto, Bold and Stocks All Crash. The Economy Contracted -1.4% in 1Q 2022. The Dow Dropped 2000 Points. Is Plant-Based Protein Dying? Should You Sell in April? The U.S. House Decriminalizes Cannabis Again. Chinese Electric Vehicle Market Share Hits 20%. The Risk of Recession in 6 Charts. High Gas Prices How Will Russian Boycotts Effect U.S. Multinational Companies? Oil and Gas Trends During Wartime Russia Invades Ukraine. How Have Stocks Responded in Past Wars? Zombie Companies. Rescue, Rehab or Liquidate? Spotify: Music to my Ears. Cannabis Crashes. 2022 Crystal Ball in Stocks, Real Estate, Crypto, Cannabis, Gold, Silver & More. Interview with the Chief Investment Strategist of Charles Schwab & Co., Inc. Stocks Enter a Correction Investor IQ Test Investor IQ Test Answers Real Estate Risks. What Happened to Ark, Cloudflare, Bitcoin and the Meme Stocks? Omicron is Not the Only Problem From FAANNG to ZANA MAD MAAX Ted Lasso vs. Squid Game. Who Will Win the Streaming Wars? Starbucks. McDonald's. The Real Cost of Disposable Fast Food. The Plant-Based Protein Fire-Sale What's Safe in a Debt World? Inflation, Gasoline Prices & Recessions China: GDP Soars. Share Prices Sink. The Competition Heats Up for Tesla & Nio. How Green in Your Love for the Planet? S&P500 Hits a New High. GDP Should be 7% in 2021! Will Work-From-Home and EVs Destroy the Oil Industry? Insurance and Hedge Funds are at Risk and Over-Leveraged. Office Buildings are Still Ghost Towns. Money Market Funds, FDIC, SIPC: Are Any of Them Safe? My 24-Year-Old is Itching to Buy a Condo. Should I Help Him? The 12-Step Guide to Successful Investing. Gardeners Creating Sanctuary & Solutions in Food Deserts. 2021 Company of the Year Almost 5 Million Americans are Behind on Rent & Mortgage. Real Estate Hits All-Time High. Rebalancing Your Nest Egg IQ Test. Answers to the Rebalancing Your Nest Egg IQ Test. Videoconferencing in a Post-Pandemic World (featuring Zoom & Teladoc). Sanctuary Sandwich Home. Multigenerational Housing. Interview with Lawrence Yun, the chief economist of the National Association of Realtors. 10 Budget Leaks That Cost $10,000 or More Each Year. The Stimulus Check. Party Like It's 1999. Would You Pay $50 for a Cafe Latte? Is Your Tesla Stock Overpriced? 10 Questions for College Success. Is FDIC-Insured Cash at Risk of a Bank Bail-in Plan? 8 Money Myths, Money Pits, Scams and Conspiracy Theories. Why Are My Bonds Losing Money? The Bank Bail-in Plan on Your Dime. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable. However, NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors. Bitcoin Crashes. Answers to 6 Common Crypto Questions. If you were getting your altcoin tips from a young trader on Tiktok or Youtube, you probably loved listening/watching in November and are now ready to unsubscribe. A spot check on a few of the Youtube gurus reveals that at Bitcoin’s high, views were in the hundreds of thousands. The same self-proclaimed prophets are now seeing about a quarter or less of that traffic. Is crypto flawed? Are these gurus inexperienced? Do charts work? I’ll answer these questions and more below. 420K Bitcoin in 60 Days! Worst Crash in Crypto History! SUPER BULLISH PREDICTION! LUNA COULD HIT $200+ IN 30 DAYS! Guess which headline was popping up everywhere around November 9, 2021, when Bitcoin hit $69,000/coin, and which one is circulating today. Bitcoin sank to a one-year low today of $28,122.44 (May 12, 2022). The Luna prediction was made last November. In all fairness, Terra (LUNA) did go up after the prediction to a high of $119.18. However, today it is virtually worthless. Not all coins are what they are hyped up to be. Coin clubs can be even riskier. Some are outright scams. Good marketers lure you in with headlines like those above. However, hype-monster marketers are not necessarily great analysts. Remember to always grade your guru before you listen to their advice. (This is true of your financial planner/broker-salesman, too. Be sure to check out my webinar and podcast “Is Your Conservative Plan Safe?” and the chapter in Put Your Money Where Your Heart Is entitled “Brokers are Salesmen.”) Will Prices Keep Plunging? We’ve seen a few crypto crashes over the years. In December of 2017, Bitcoin hit $20,000 in mid-December of 2017, and then crashed to $11,000 on January 19, 2018. That was the beginning of a plunge that sank to the $3,000-range by the end of 2018. This wiped out many crypto millionaires. This kind of devastation is not just hard on a wallet. There were suicides. Bitcoin had a reasonable recovery in 2019, but never came close to $20,000 and stayed mostly in the $7,000-$10,000 range. However, in the pandemic, the price plunged again to under $5,000. While the waves of Bitcoin can run independent from stocks, we’ve seen that stock market corrections can drag down safe havens. The recovery of Bitcoin, gold and silver can be more robust and speedier than stocks after a crash. However, in the early stages, everything tends to fall. That’s why having a capture gains strategy is key with this volatile investment. You can’t do that when you are drinking the Kool-Aid that cryptocurrency will be the only thing of value when the dollar collapses. What does a “capture gains” strategy look like? Keep reading. Does the Crypto Crash Mean Crypto is Doomed? No. However, it does reveal a fundamental aspect of all cryptocurrency. It’s a trader’s delight, not a currency (at this time). If you’ve got Diamond Hands and are HODLing (Holding On for Dear Life), the whales are going to eat your lunch. The average hold time of most crypto is less than 4 months. (You can easily see these statistics on Coinbase.) Statistics show that the beginning of crypto crashes are sparked from hedge fund and large investors selling. As the fallout becomes unbearable, Main Street investors might be forced to sell low just to pay their housing costs. Volatility favors sophisticated traders, not Diamond Hands (Buy & Hold investors). That’s not to say that isn’t a place for crypto in the monetary system. NFTs are gaining in popularity and most are paid for in Bitcoin, Ethereum or altcoins. (There is not a lot of crypto purchasing outside of this sphere at this time.) However, you can’t have a currency that loses half or more of its value every year or two. That’s not a currency. It’s a casino, which means you should limit your betting to something you can afford to lose. Is Crypto a Good Safe Haven Investment? As I mentioned, in the beginning of a correction/recession, even safe haven investments are vulnerable to losses. There does come a point, however, when the bad news on the status quo makes alternative investments look like Nirvana. Things can pick up steam fast when people feel like they are in an Apocalypse. However, the volatility of cryptocurrencies and the exceptionally weak returns of gold over the past decade are reminders that these safe haven investments work best as a slice of our strategy – not the entire plan. Using our pie chart system will also help you to capture gains at the high and buy back in at the low (without day-trading). You can learn this system by reading The ABCs of Money (5th edition), or you can learn and implement this system now by attending our June 10-12, 2022 Retreat. Email [email protected] to learn more. Is Crypto an Energy Hog (Like Elon Musk Warned)? Yes. According to the University of Cambridge’s Cambridge Centre for Alternative Finance, Bitcoin’s annual network power demand is 147 Twh. That is more electricity than the countries of Sweden, Norway or Ukraine burn. Some Altcoins are designed to be faster and greener, in order to compete with VISA and Mastercard, and to meet the social demands of climate action. The altcoins are in a crash, too. However, in a future that is getting ever more concerned about energy efficiency and reducing CO2 emissions, the altcoins have a potential to become a meme hot topic, once the recovery starts generating some steam. Here are some of the altcoins with interesting stories: Cardano (ADA), Solana (SOL), and Polygon (MATIC). You can access their descriptions and white papers on Coinbase.com. Can a Main Street Investor Surf the Waves of Crypto Successfully? A well-designed investment plan allows you the freedom of investing in a few hot industries, like cryptocurrency – within reason. The 21st Century has proven itself to be volatile over and over again. So, it’s important to have a time-proven plan that you rebalance regularly (at least once a year) that also prompts you to capture gains and buy into weakness. The pie chart plan does just that. Again, you can read about it in The ABCs of Money. You can learn and implement it at our next Financial Empowerment Retreat. You can also consider getting an unbiased second opinion from me – particularly if you were too aggressive about your belief in crypto and/or purchased near the top. This easy, time-proven plan is the life math that we all should have received in high school. The sooner you learn and implement it, the faster your life transforms. Should You Transfer Your Retirement Plan Into an LLC IRA That Invests in Crypto? IRAs have tax advantages. Betting your entire IRA on an investment that has a history of shooting the moon and then sinking into the sea is not worth the tax advantage. If you have enough in your nest egg that a couple of slices can be put into an LLC IRA that allows you to invest in crypto, then you might have the best of both worlds. If your slices are still a bit small, then it’s a better idea to build your wealth on a traditional, reliable platform like Coinbase. When you pay taxes, it’s only on the capital gains. If you’ve held the position for longer than a year, it could be taxed at 15% or less (for most people). Bottom Line Cryptocurrency is better thought of as a hot slice of a well-designed system, not the entire wealth plan. Regular rebalancing is key to being on the right side of the trade and to successfully riding the waves of volatility. This is still a highly speculative play. Capturing gains and buying low is not day-trading. Ideally, you’ll have 2-3 times a year on the calendar to consider your positions, while also having a strategy to deploy if the volatility lands in between those dates. If you’re invested in crypto, you’re going to hear when it soars and crashes. It makes headlines. The trick is being on the right side of those headlines, rather than being crushed by them. Proper diversification with regular rebalancing is your bunker. If you'd like to learn 21st Century time-proven investing strategies to protect your wealth from a No. 1 stock picker, join us for our June 10-12, 2022 retreat. Email [email protected] or call 310-430-2397 to learn more and to register. Click on the banner ad below to discover the 18+ strategies you'll learn and master.  Join us for our Financial Freedom Retreat. June 10-12, 2022. Email [email protected] to learn more. Register with friends and family to receive the best price. Click for testimonials & details.  Natalie Wynne Pace is an Advocate for Sustainability, Financial Literacy & Women's Empowerment. Natalie is the bestselling author of The Power of 8 Billion: It's Up to Us and is the co-creator of the Earth Gratitude Project. She has been ranked as a No. 1 stock picker, above over 835 A-list pundits, by an independent tracking agency (TipsTraders). Her book The ABCs of Money remained at or near the #1 Investing Basics e-book on Amazon for over 3 years (in its vertical), with over 120,000 downloads and a mean 5-star ranking. The 5th edition of The ABCs of Money was released on September 17, 2021. Natalie Pace's easy as a pie chart nest egg strategies earned gains in the last two recessions and have outperformed the bull markets in between. That is why her Investor Educational Retreats, books and private coaching are enthusiastically recommended by Nobel Prize winning economist Gary S. Becker, TD AMERITRADE chairman Joe Moglia, Kay Koplovitz and many Main Street investors who have transformed their lives using her Thrive Budget and investing strategies. Click to view a video testimonial from Nilo Bolden. Check out my Podcast on Spotify.