|

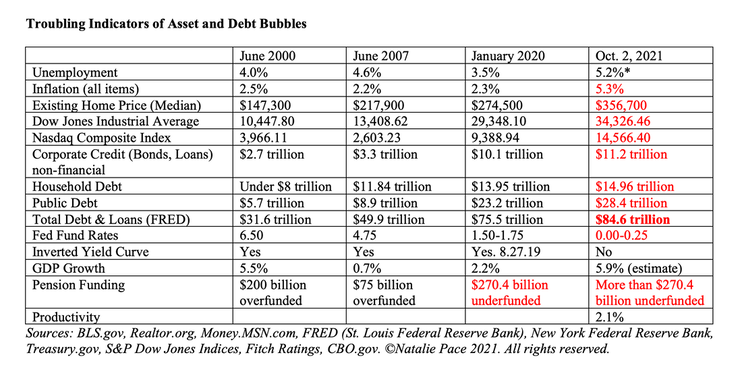

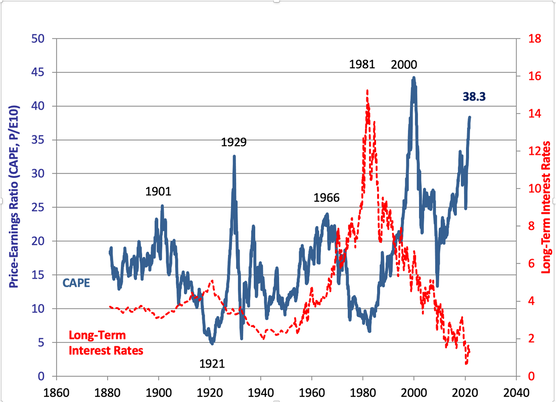

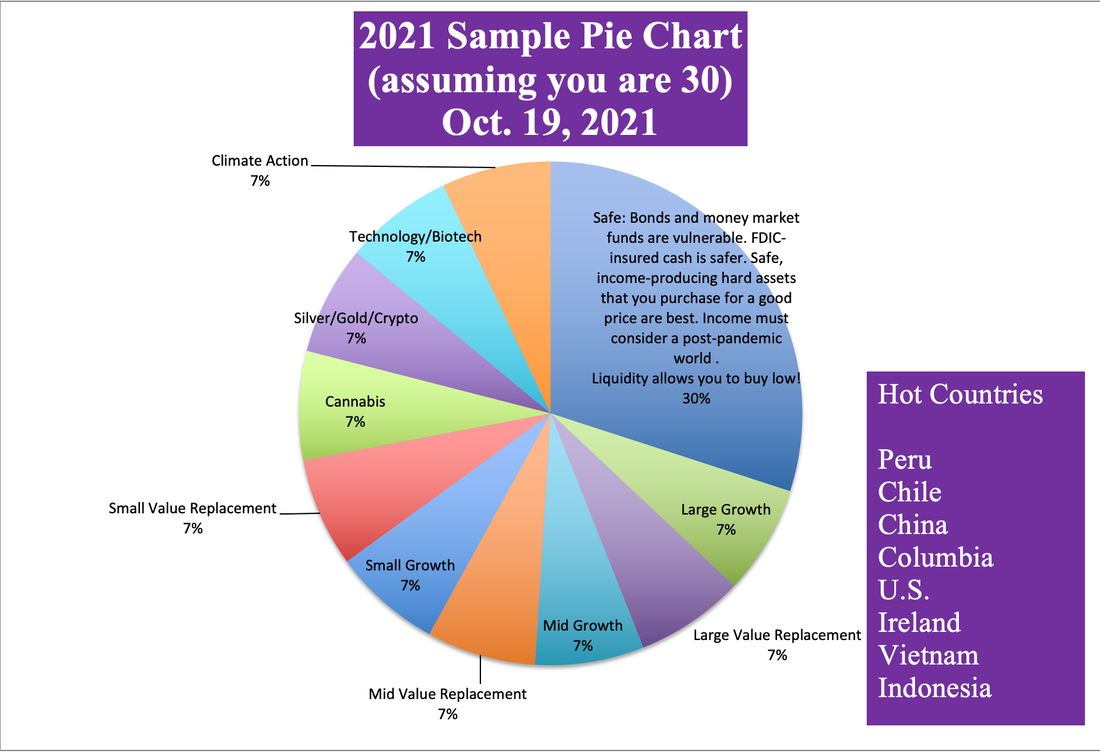

What’s Safe in a Debt World? Includes 11 Essential Tips How many times have you seen or heard recently that Bitcoin or gold/silver will be the only thing worth anything when the dollar becomes worthless and the Federal Reserve Board is abolished? It’s easy to understand how alluring this sentiment is, or why Squid Game is the top show on Netflix. (Saturday Night Live’s skit on October 15, 2021, did a good job of synopsizing the show.) We live in a Debt World. For reference, check out the chart below, which shows a laundry list of economic indicators, including debt, from today and before the pandemic, the Great Recession and the Dot Com Recession. Below is another chart that should have you concerned. While debt levels are unprecedented and eyepopping, so are asset prices in stocks and real estate. In fact, the only time that stock prices have been higher was before the Dot Com Recession (when the NASDAQ Composite Index sank 78% between March 2000 and October of 2002). The Great Depression (yes, 1929) is now the 3rd most leveraged time for stocks in recorded U.S. history. Take a Historical Perspective What was safe during the Great Depression (or even the Great Recession)? Real estate? Owning a business? Owning stocks? Owning bonds? Would Bitcoin have saved the day at either time? Is a better currency the answer, or do the solutions lie elsewhere? According to the Federal Reserve Board’s Financial Stability Report from May of 2021, “Should risk appetite decline from elevated levels, a broad range of asset prices could be vulnerable to large and sudden declines, which can lead to broader stress to the financial system.” In plain English, now is the time to make sure that you are protected from the financial storms that could appear anytime on the horizon. (If you wait for them to arrive, it’s too late to prepare.) 11 Tips on Getting Safe in a Debt World 1. Bonds are a Big Part of the Problem 2. Market Timing Doesn’t Work 3. Don’t Fight the Fed 4. Proper Diversification 5. What’s Hot 6. Diversifying by Country 7. Liquidity Affords Us the Opportunity to Buy Low 8. Value is Getting Trounced by Growth 9. Dividends Don’t Pay When Your Principal Plunges 10. Safe, Income-Producing Hard Assets that You Purchase for a Good Price 11. Think Bigger and Get Creative 1. Bonds are a Big Part of the Problem Bonds are illiquid and negative-yielding. Those conditions become heightened when interest rates rise, whether it is due to interest rate risk or credit risk. Both scenarios are troublesome today. The Fed Fund rate is targeted to begin its ascent in 2022 and rise to 1.8% (from zero today) by 2024. Meanwhile, over half of the S&P500 companies are at or near junk bond status. Never reach for yield. Know what you own. Heed the advice of Roy Rogers, who once said, “I’m more concerned with the return of my money than the return on my money.” Don’t rely on an asset that is losing money to protect your wealth. 2. Market Timing Doesn’t Work The worst economic crisis of our lives became the shortest recession in history. The world’s economists have learned many lessons from the Great Depression, which they applied during the pandemic. Their theories were aided by a debt suspension, which meant they had a blank check on available funds. That’s one of the underreported points of contention in Congress. The Democrats want a suspension of the Debt Ceiling (as has been the case for decades). The Republicans want the Democrats to take ownership of an actual number (in the trillions) that they are willing to add to the public debt. Editor’s Note: Public debt increased $7.8 trillion under the Trump Administration. Before the pandemic, the public debt under the 45th President was increasing at a faster rate than it did in the Obama Administration. In 2009, the U.S. was using Keynesian economic tools to ameliorate a banking and insurance crisis that had brought many of the developed world’s economies and businesses to the brink of financial destruction. By 2016, the increased debt was due to tax cuts that were not paid for by economic growth. Trying to outthink the policymakers is hazardous to our fiscal health. A better plan is to be properly diversified and to rebalance regularly. A simple, time-proven, 21st Century, easy-as-a-pie-chart strategy is outlined in my book, The ABCs of Money (5th edition). 3. Don’t Fight the Fed In the Pandemic Recession, we learned a few things. If you wait for the headlines, you’re too late. The informed money had already sold off about 38% by March 23, 2021, which turned out to be the market bottom. That was the time that Main Street was ready to plunge into the Wall Street exodus that had been led for a month by the whales. When the Feds bought up distressed bonds and ETFs, the Treasury gave money to anything that moved and many Americans no longer had to pay rent or keep up with their student loan debt, all of the sudden buying stocks and homes became the life hack du jour. 4. Proper Diversification Being properly diversified, underweighting areas of distress, regular rebalancing and understanding what’s safe in a debt world position us best in today’s overleveraged existence. So, what is proper diversification?

5. What’s Hot? The pandemic taught us that we can’t live without technology, communications, bleach and toilet paper. Biotechnology does quite well in a global pandemic. Copper prices are at an all-time high, which has pushed 2021 GDP growth expectations to 10 and 11 for Peru and Chile, respectively. Cannabis decriminalization bills are on tap in the House and Senate, and could take centerstage after the Budget and Debt Ceiling are resolved. (Perhaps this will be a Christmas present?) 6. Diversifying by Country One of the ways that you can get diversified in value is to look at foreign countries. For example, some of the countries that have the strongest growth in the world have a much more attractive price point today than U.S. equities, which are very expensive (like buying avocados for three or four times the normal price). I make my case for country diversification in the updated fifth edition of The ABCs of Money. Some of the highest growth countries in the world today include Chile, Peru, China and Colombia. Chinese equities were trading near their 52-week low in mid-October. The iShares ETFs for the other countries mentioned are trading near their 15-year lows. 7. Liquidity Affords Us the Opportunity to Buy Low The reason that most people don’t buy low is because they can’t buy low. When we lose more than half of our wealth, we are in a position to have to recover losses during the bull market. Preserving our capital means that we can shop when things go on sale. So, what is safe and liquid today? FDIC-insured cash. If you’re going to own bonds or Treasuries, keep the terms short and the creditworthiness high. Keeping your money is the 1st step of a 2-step safe strategy for today’s Debt World. (Keep reading.) 8. Value is Getting Trounced by Growth The technology and biotechnology-rich NASDAQ Composite Index (growth) has almost tripled the returns of the Dow Jones industrial average (value) over the last three years. There are reasons for that – having a lot to deal with too much debt, slow growth, financial engineering and expensive share prices. 9. Dividends Don’t Pay When Your Principal Plunges The higher the dividend, the higher the risk. It’s not worth it to take on an underperforming company that gives you a small dividend, commonly under 2%, if you’re at risk of losing your principal. When you subtract the fees, the promised yield becomes even more anemic. High-yield private placement REITs put your principal at risk and may charge you higher fees and commissions than you realize. They are typically very illiquid. They pay very high commissions to brokers, which is why you might be sold them if you tell your broker-salesman that you are concerned and want to get safe. Read D&T’s real-world warning, which is based on their personal experience. 10. Safe, Income-Producing Hard Assets that You Purchase for a Good Price Hard assets should hold their value better than paper assets in our Debt World – providing you don’t buy high, aren’t overleveraged or can truly (and easily) afford what you purchased. The mantra, and 2nd step in a Get Safe Plan, is to look for safe, income-producing hard assets that you purchase for a good price, considering a post-pandemic world. That’s difficult for two reasons. Real estate prices are at all-time highs and are unaffordable in many markets. Interest rates are rising, making it more difficult to finance. And it’s getting harder to be a landlord. According to the Mortgage Bankers Association, “Missed rental payments now total $41.7 billion, missed mortgage payments total $76.5 billion, and missed student loan payments total $155 billion” as of the 2nd quarter of 2021. With less travel, due to the pandemic and to many conferences being hosted online, AirBNB hosts may find far fewer guests. 11. Think Bigger and Get Creative Money is a means (not the end) to help us provide better for our families and to live a richer life. When we consider all of the things that are important to us, and become more holistic about our ability to change our own circumstances, then (and only then) do things change. Those loved ones we care about and the world at large benefit. When we expand our vision and embrace the power of our consumption and investing choices, our wealth and reach have a broader, positive affect. As just a few examples, intergenerational housing is on the rise and is actually higher today than it was in the Great Depression. This helps to keep the money in the family, and stops making the landlord rich. Rooftop solar is a great way to reduce your personal electric bill, while also cleaning up the grid. That leaves thousands of dollars annually in your budget for things you’d like more than paying electric bills. Oil companies are in business because we visit the pump regularly. How can you become part of the solution? Put Your Money Where Your Heart Is was written in 2006. It is imperative today. These are things we will discuss at the retreat this weekend, and also in the videoconference on October 28, 2021. Bottom Line There are solutions to protecting your wealth in a Debt World. These are so important (and so faintly highlighted in the mainstream media) that I spend one full day on this subject at our Investor Education Retreats. The age-old aphorisms and warnings should be billboards for investors today. Anytime someone tells you they have a safe investment that is earning above 1.5% that is a red flag (and a prevarication). Join me this weekend for our Investor Educational Retreat. We outline all of the strategies mentioned above and much more in three days of life-transformational, interactive, hands-on training. Email [email protected] or call 310-430-2397 to learn more now. If you’d like to join me live for our free videoconference on Oct. 28, 2021, email [email protected] with VIDEOCON in the subject line.  Natalie Pace Financial Empowerment Retreat. Oct. 23-25, 2021. Call 310-430-2397 or email [email protected] to learn more. Families and friends registering together receive the best price. Click for testimonials & details. Other Blogs of Interest Inflation, Gasoline Prices & Recessions Will There Be a Santa Rally? The Dangerous Debt Ceiling Game The Robinhood IPO. Will the Crypto Crash Hit Tesla, Square & Coinbase? China: GDP Soars. Share Prices Sink. The Competition Heats Up for Tesla & Nio. How Green in Your Love for the Planet? S&P500 Hits a New High. GDP Should be 7% in 2021! 2021 Financial Freedom Sweepstakes Will Work-From-Home and EVs Destroy the Oil Industry? Insurance and Hedge Funds are at Risk and Over-Leveraged. Office Buildings are Still Ghost Towns. Money Market Funds, FDIC, SIPC: Are Any of Them Safe? My 24-Year-Old is Itching to Buy a Condo. Should I Help Him? Will Cannabis be Decriminalized This Summer? The 12-Step Guide to Successful Investing. Gardeners Creating Sanctuary & Solutions in Food Deserts. 2021 Company of the Year Almost 5 Million Americans are Behind on Rent & Mortgage. Real Estate Hits All-Time High. Beyond Meat, Oatly & The Very Good Food Co. Is Cryptocurrency the New Gold? Rebalancing Your Nest Egg IQ Test. Answers to the Rebalancing Your Nest Egg IQ Test. Tesla & Nio Will Report Spectacular Earnings. The Coinbase IPO. Restore Our Earth on April 22nd (and Every Earth Day). Should You Sell in May and Go Away? Adding Shoot the Moon Performance to Your Nest Egg. Videoconferencing in a Post-Pandemic World (featuring Zoom & Teladoc). Sanctuary Sandwich Home. Multigenerational Housing. Interview with Lawrence Yun, the chief economist of the National Association of Realtors. 10 Budget Leaks That Cost $10,000 or More Each Year. The Stimulus Check. Party Like It's 1999. Kushner's Times Square Building Plunges 80% in Value. Will There be a Spring Rally? Cannabis and the Road to Decriminalization in the U.S. Hot ETFs Return Up to 50% Since October. Investor IQ Test 2021. Investor IQ Test Answers Shoot the Moon Stock Picks 2021 Crystal Ball. Would You Pay $50 for a Cafe Latte? Is Your Tesla Stock Overpriced? Can Medmen Avoid Bankruptcy? Bitcoin is Back, Baby! Real Estate Prices are Going Up. And Down. Cannabis is Decriminalized. Stocks Triple. Thanksgiving in a Pandemic. The Sustainability Silver Lining. Money Stress Killed My Friend Real Estate and Housing 2021. Challenges & Opportunities Real Estate in a Pandemic. Interview with Mike Fratantoni, the Chief Economist of the Mortgage Bankers Association. Bonds are Illiquid & Negative-Yielding. Annual Rebalancing is a Buy Low, Sell High Plan on Auto-Pilot. Is Your Bank a Junk Bond Put Your Money Where Your Heart Is. Schwab's Chief Fixed Income Strategist on What's Safe. China's Tesla (Nio). 2Q Sales Soar. Why Are You Still Renting? (Errr. There is More Than This to Consider!) Wealth Myths That Keep You Poor. Prosperity Truths That Make You Rich. Technology and Silver are Golden. Real Estate: Feeling Equity Rich? Make Sure That Feeling Isn't Fleeting. Airline Revenue Plunges 86%. 10 Questions for College Success. Is FDIC-Insured Cash at Risk of a Bank Bail-in Plan? 8 Money Myths, Money Pits, Scams and Conspiracy Theories. Why Are My Bonds Losing Money? The Bank Bail-in Plan on Your Dime. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable. However, NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors.  About Natalie Pace Natalie Wynne Pace is an Advocate for Sustainability, Financial Literacy & Women's Empowerment. She has been ranked as a No. 1 stock picker, above over 835 A-list pundits, by an independent tracking agency (TipsTraders). The ABCs of Money remained at or near the #1 Investing Basics e-book on Amazon for over 3 years (in its vertical), with over 120,000 downloads and a mean 5-star ranking. The 5th edition of The ABCs of Money was released on September 17, 2021. Natalie Pace's easy as a pie chart nest egg strategies earned gains in the last two recessions and have outperformed the bull markets in between. That is why her Investor Educational Retreats, books and private coaching are enthusiastically recommended by Nobel Prize winning economist Gary S. Becker, TD AMERITRADE chairman Joe Moglia, Kay Koplovitz and many Main Street investors who have transformed their lives using her Thrive Budget and investing strategies. Click to view a video testimonial from Nilo Bolden. Comments are closed.

|

AuthorNatalie Pace is the co-creator of the Earth Gratitude Project and the author of The Power of 8 Billion: It's Up to Us, The ABCs of Money, The ABCs of Money for College, The Gratitude Game and Put Your Money Where Your Heart Is. She is a repeat guest & speaker on national news shows and stages. She has been ranked the No. 1 stock picker, above over 830 A-list pundits, by an independent tracking agency, and has been saving homes and nest eggs since 1999. Archives

July 2024

Categories |

RSS Feed

RSS Feed