|

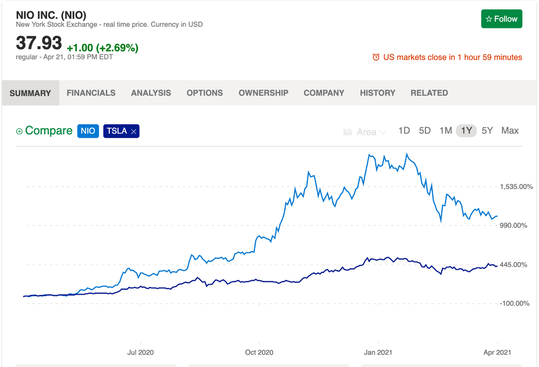

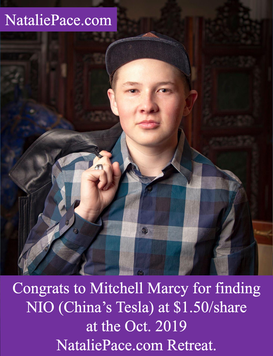

Tesla and Nio Will Report Spectacular Earnings Next Week. Will the semiconductor shortage ruin things going forward? Tesla reported another record-breaking production and delivery achievement earlier this month, with 185,000 deliveries and 180,000 vehicles produced. That is more than double the amount of cars delivered a year ago, with a 75% increase in production. Revenue could top $11 billion. If the net income is on par or higher than the 4th quarter of 2020, at $270 million, that will be a 17-fold increase for last year. Before you get too excited: that good news is already priced into the company shares. Keep reading. Is the Semiconductor Shortage an Issue for Tesla? While other auto manufacturers, including Ford, General Motors and Nio, were pausing production because they couldn’t get the semiconductors they needed, Tesla’s Elon Musk was tweeting thanks to their suppliers for keeping them in the parts. Does that mean that Tesla is well-stocked going forward and will not have any issues? In a letter to the Commerce Department on April 5, 2021, John Bozzella, the President and CEO of the Alliance for Automotive Innovation, wrote that the semiconductor manufacturers warn that the shortage could continue for an additional six months. Intel’s new CEO Pat Gelsinger warned that it could take up to two years to iron out all of the issues. Tesla benefits by being the largest U.S. auto manufacturer by far, with a market capitalization of $690 billion, compared to $45 billion at Ford, $125 billion at General Motors and $61 billion at Nio (China’s Tesla). With Tesla’s reputation for innovation, and success at putting electric vehicles and self-driving on the map, the company’s relationships with semiconductor manufacturers has legacy standing. Tesla could be first in line for semiconductors, ahead of the competition. The Evolution of the Auto Industry G.M. has promised to sell only zero-emissions vehicles by 2035, with a plan to be carbon neutral by 2040, and powered only by renewable energy by 2030. Mary Barra, GM’s CEO, sees a future of “zero crashes, zero emissions and zero congestion.” The auto industry has a large footprint in our economy, contributing up to $1.1 trillion and 5.5% to the U.S. GDP. So, no politician or business leader wants to see car sales or vehicle production drop dramatically. The semiconductor industry is seizing the opportunity and is ramping up quickly to address the shortage. However, setting up factories is not something that can be done quickly. While the bottleneck continues, rising costs can impact the profitability of auto manufacturers that are already heavily indebted. All of this makes it more difficult to justify the very lofty valuations that we are seeing in the auto manufacturers. Tesla’s market cap is $700 billion, while it is still netting less than $1 billion in income per year. That puts its price-earnings ratio at 1016. The average PE is 16-17. (Wouldn’t you love to have a company that makes less than a billion in net income, but is worth $700 billion?) All stocks in the U.S. are very pricey at this point, with an average PE (Professor Robert Shiller's CAPE) of 33. The 6.5% predicted 2021 GDP growth is built-in to the price. So, a market rally through the rest of the year is not necessarily a given, particularly since we still have a debt ceiling debate coming up in July, and a potential credit downgrade from Fitch Ratings this year. (Fitch Ratings has had the U.S. on a negative outlook for its AAA rating since July of 2020.) Check out my blog for additional information on the 2021 outlook. The Semiconductor Industry is Hot, Hot, Hot Nvidia, a leader in autonomous driving chips and other semiconductors, saw its revenue jump by 61% in the most recent quarter (year over year). Intel hopes to benefit from the surge in demand going forward, but saw flat sales in the last quarter. The entire semiconductor industry is in a boom cycle. Nio: China’s Tesla Tesla has been all the rage in the U.S. However, Nio’s revenue and share price growth is dwarfing that of Tesla. Nio’s 1Q 2021 vehicle deliveries report was meteoric. 1Q 2021 deliveries increased 408% to 19,500 vehicles, from 3,838 a year ago. That’s 550 vehicles shy of their first devliery announcement earlier this month, due to a 5-day factory shutdown caused by the semiconductor shortage. Nio is offering sleek, sexy EVs that are priced slightly lower than Tesla’s. The power and weight of the Chinese economy and the demand of the Chinese consumer could help Nio to be first in line for semiconductor distribution going forward. Nio is scheduled to report their 1Q 2021 earnings on April 29, 2021, after the U.S. market close. Incidentally, Nio was first discovered at our October 2019 Investor Educational Retreat by Mitchell Marcy, when the company share price was under $2.00. We featured the company in our blog a few months later, when the company was trading at about $13.00. Nio’s shares have soared as high as $67.00 and are currently trading at $38.00. Bottom Line Technology, artificial intelligence, clean energy, electric vehicles and other products of the 21st-Century are hot. However, the amazing growth that many of these industries are experiencing is already overpriced into the shares. So, you have to be very cautious about not purchasing shares at an all-time high, and equally diligent about profit-taking when valuations get too lofty. The easiest way to do all of this is through our pie chart nest egg strategies. We teach it at our Investor Education Retreats. The next one is this weekend. Call 310-430-2397 or email [email protected] to learn more and register now. Join us for our April 24-26, 2021 Financial Empowerment Retreat. (Click to learn more.) In 3 days, you'll learn how to pick great companies (like Zoom Video, Tesla, Aphria, Veritone and Nio), incorporate them into a well-diversified wealth plan, receive a complete Money Makeover and transform your life forever! Bring your friends, family and teens for an unbelievably low group rate. Call 310-430-2397 or email [email protected] to learn more now.  Natalie Pace Financial Empowerment Retreat. April 24-26, 2021. Call 310-430-2397 or email [email protected] to learn more. Receive the best price when you register with friends and family. Other Blogs of Interest The Coinbase IPO. Restore Our Earth on April 22nd (and Every Earth Day). Should You Sell in May and Go Away? Adding Shoot the Moon Performance to Your Nest Egg. Videoconferencing in a Post-Pandemic World (featuring Zoom & Teladoc). Sanctuary Sandwich Home. Multigenerational Housing. Interview with Lawrence Yun, the chief economist of the National Association of Realtors. 10 Budget Leaks That Cost $10,000 or More Each Year. The Stimulus Check. Party Like It's 1999. Kushner's Times Square Building Plunges 80% in Value. Will There be a Spring Rally? Cannabis and the Road to Decriminalization in the U.S. Hot ETFs Return Up to 50% Since October. Investor IQ Test 2021. Investor IQ Test Answers Shoot the Moon Stock Picks 2021 Crystal Ball. Would You Pay $50 for a Cafe Latte? Is Your Tesla Stock Overpriced? Can Medmen Avoid Bankruptcy? Bitcoin is Back, Baby! Real Estate Prices are Going Up. And Down. Movie Theaters are in Trouble Airbnb Should Have a Spectacular IPO Today. Cannabis is Decriminalized. Stocks Triple. Airbnb's IPO. Should Hosts Invest? Gifts Under $5 and Free. Thanksgiving in a Pandemic. The Sustainability Silver Lining. Secretary Mnuchin Halts Bailouts Money Stress Killed My Friend Real Estate and Housing 2021. Challenges & Opportunities Real Estate in a Pandemic. Interview with Mike Fratantoni, the Chief Economist of the Mortgage Bankers Association. Bonds are Illiquid & Negative-Yielding. Annual Rebalancing is a Buy Low, Sell High Plan on Auto-Pilot. 5 Red Flags of a Financial Implosion Will Regeneron Be Approved Before the Election? Tesla Will Have an Outstanding Earnings Report Should You Wait Until After the Election to Fix Your Wealth Plan? The October Surprise Is Your Bank a Junk Bond Do Stocks Fare Better Under Democrats or Republicans? Put Your Money Where Your Heart Is. Crystal Ball for the Remainder of 2020 (Including the Election). Microcap Gaming Company Doubles 2Q 2020 Revenue. Apple & Tesla Stock Splits. Schwab's Chief Fixed Income Strategist on What's Safe. China's Tesla (Nio). 2Q Sales Soar. Why Are You Still Renting? (Errr. There is More Than This to Consider!) MedMen's Turnaround Plan Attracts A-List Board Members. Wealth Myths That Keep You Poor. Prosperity Truths That Make You Rich. Protecting Your Wealth and Home in a Recession. Technology and Silver are Golden. The Economy Contracts 32.9% in the 2nd Quarter of 2020. Real Estate: Feeling Equity Rich? Make Sure That Feeling Isn't Fleeting. Airline Revenue Plunges 86%. 10 Questions for College Success Bank Earnings Season. Crimes. Cronyism. Speculation. Real Estate Solutions for a Post-Pandemic World. Copper and Chile Update. Gold Soars. Some Gold Funds Tank. Will the Facebook Ad Boycott De-FANG Stocks? Why Did My Cannabis Stock Go Down? Which Countries Are Hot in a Global Pandemic? Is Your Financial Advisor Good at Navigating Stormy Seas? $10 Avocados, Lies, Damn Lies, Statistics & Wall Street Secrets. It's Never a Crash. Work From Home and Intergenerational Housing. Biotech Races for a Coronavirus Cure. Are You Worried About Money? May is a Good Time for Rebalancing. Is FDIC-Insured Cash at Risk of a Bank Bail-in Plan? Why Did my Bonds Lose Money? Cannabis Update. Recession Proof Your Life. Free Videocon Monday, May 10, 2020. The Recession will be Announced on July 30, 2020. Apple Reports Terrible Earnings. We Are in a Recession. Unemployment, Rising Stocks. What's Going On? 8 Money Myths, Money Pits, Scams and Conspiracy Theories. 21st Century Solutions for Protecting Your Home, Nest Egg & Job. Wall Street Insiders are Selling Like There is No Tomorrow. Why Are My Bonds Losing Money? Tomorrow is Going to be Another Tough Day. Price Matters. Stock Prices are Still Too High. Should You Ride Things Out? 7 Recession Indicators Corona Virus Update. The Bank Bail-in Plan on Your Dime. NASDAQ is Up 6X. CoronaVirus: Which Companies and Countries Will be Most Impacted. Is Tesla Worth GM and Ford Combined. Artificial Intelligence is on Fire. Is it Time to Buy S'More? Take the Retirement Challenge. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable. However, NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors.  About Natalie Pace Natalie Wynne Pace is an Advocate for Sustainability, Financial Literacy & Women's Empowerment. She has been ranked as a No. 1 stock picker, above over 835 A-list pundits, by an independent tracking agency (TipsTraders). The ABCs of Money remained at or near the #1 Investing Basics e-book on Amazon for over 3 years (in its vertical), with over 120,000 downloads and a mean 5-star ranking. The 4th edition of The ABCs of Money was released on October 17, 2020. Natalie Pace's easy as a pie chart nest egg strategies earned gains in the last two recessions and have outperformed the bull markets in between. That is why her Investor Educational Retreats, books and private coaching are enthusiastically recommended by Nobel Prize winning economist Gary S. Becker, TD AMERITRADE chairman Joe Moglia, Kay Koplovitz and many Main Street investors who have transformed their lives using her Thrive Budget and investing strategies. Click to view a video testimonial from Nilo Bolden. Comments are closed.

|

AuthorNatalie Pace is the co-creator of the Earth Gratitude Project and the author of The Power of 8 Billion: It's Up to Us, The ABCs of Money, The ABCs of Money for College, The Gratitude Game and Put Your Money Where Your Heart Is. She is a repeat guest & speaker on national news shows and stages. She has been ranked the No. 1 stock picker, above over 830 A-list pundits, by an independent tracking agency, and has been saving homes and nest eggs since 1999. Archives

July 2024

Categories |

RSS Feed

RSS Feed