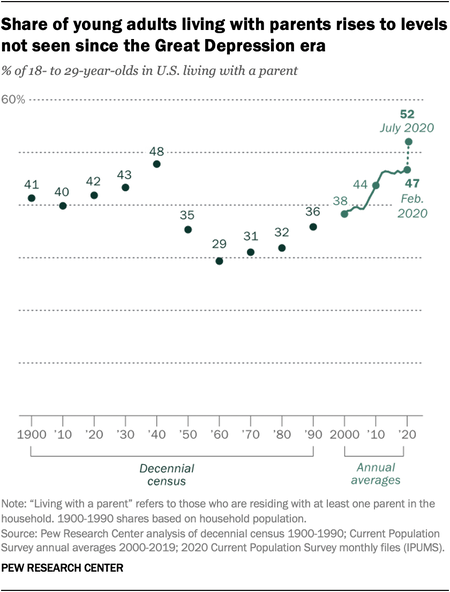

Sanctuary Sandwich Home. Multigenerational Housing Replaces the Nuclear Family. Interview with Lawrence Yun, the chief economist of the National Association of Realtors. During the pandemic, a great deal of folks welcomed their adult children back home. Some were college students taking classes online, instead of on campus. Others are post-grads who lost a job in hospitality or travel. Many were underemployed to begin with, trying to make a living off of gigs, like driving for Lyft. However, even before the pandemic, the trend toward intergenerational housing was already underway. Intergenerational housing is higher today than it was during the Great Depression (source: Pew Research)! 18% of Gen Z home buyers are purchasing larger homes to house their parents and future children (source: The National Association of Realtors). This may be partially motivated by the need to borrow money for the down payment, in addition to budgetary and pandemic concerns. How will homesharing affect home buying and the real estate market going forward?

On March 25, 2021, I spoke with Lawrence Yun, the chief economist of the National Association of Realtors, about these trends and more, including:

Natalie Pace: 18% of Gen Z are purchasing multigenerational homes, with a 12% increase overall. How is this affecting the real estate market? Lawrence Yun: The silver lining of the pandemic is that people want to have a larger size home, perhaps to turn one additional bedroom into an office space. As they were considering this, they said, “Well, why don’t we get an even larger home that could accommodate our elderly parents?” There is also the financing aspect, where the parents could help out. It’s a very interesting development. We don’t know yet whether this is a permanent trend, or just a temporary, cyclical situation. I have heard from people that they want their parents to be living in a single-family home, rather than a nursing home, in case of a future virus breakout. NP: Home prices are high. When more people are contributing to the budget, it’s easier to afford the mortgage. How does this affect other housing types? Does this shift in demand toward larger homes negatively impact the sales of 2-bedroom homes? LY: Right now, the demand is strong across all price points. We have seen a doubling in home sales for million-dollar plus homes. At the under $250,000 price point, sales are negative from last year. Is there a change in preference? [No.] There’s simply not enough inventory at the low end. NP: In the wake of the pandemic, we saw weakness in very expensive markets, like San Francisco and Manhattan. Is there still a trend out of the city and toward the suburbs? LY: The overall long-term trend is toward smaller towns in less expensive parts of the country. The work-from-home flexibility for office workers is a new phenomenon. People will be wondering why they are paying such high housing costs in San Francisco, when they could be elsewhere, even Sacramento, which is not too far from San Francisco. We have seen Sacramento take off in terms of sales and prices. Natalie Pace: Last year was one of the most challenging economies in history. Yet real estate prices went crazy. Lawrence Yun: Home sales increased 7% nationwide on a year-over-year basis [in 2020]. The prices are still running very strong. NP: Is it too hot? Will 2021 cool down? Or will the fundamentals – Millennial interest and lack of availability – push prices higher? LY: We have a record low of listings. The latest data is showing a 15% price appreciation from one year ago. The cause is very simple. We don’t have enough supply. If we can bring supply to the market, it will tame some of the price growth that we have been experiencing. NP: Do escalating prices and lack of inventory have anything to do with the moratoria on rental evictions and foreclosure forbearance? LY: Yes. There are roughly 2.6 million homeowners in the mortgage forbearance program. We are missing roughly 260,000 homes that could be on the market. As the mortgage forbearance period winds down, we could see more inventory. Also, many of the elderly population who wanted to move to a retirement home, or to Florida, do not want strangers visiting their home. Now, with the vaccine making progress, some of the elderly households will also list their homes. NP: Is September 30, 2021 the end of the forbearance period? LY: It’s possible that it could be extended if the economy doesn’t make strong progress. With the vaccination and potentially herd immunity in the 2nd half of the year, maybe people can move out of mortgage forbearance, and begin to do their normal residential movement from changes in life circumstances. NP: Are you seeing any red flags? We saw a boatload of red flags prior to the Great Recession. Are you seeing poor credit quality, Adjustable-Rate Mortgages, or overleveraged homeowners? Are homeowners speculating? Is unaffordability an issue? LY: The good news is that we don’t have the funny mortgages of 10 years ago – the subprime lending that overstretched people’s budget, or the adjustable-rate mortgages that reset to higher rates, which people couldn’t afford. Over 90% of people are taking out a 30-year, fixed-rate mortgage. The average credit scores are one of the best. I don’t see any trouble on the mortgage front, other than job loss. Persistent job losses could lead to some foreclosures. But the demand is so strong that any distressed property that comes onto the market will be easily picked up by ready buyers. NP: Are buyers getting out over their skis and spending too much on housing – overextending their budget? LY: Banks are not making loans that overstretch the budget. However, many of the younger generation are getting help from their family members – a down payment from Mom, Dad or the rich Uncle. People who are only reliant on their own resources are having a tough time getting into the market. NP: Could increasing mortgage rates impede future sales? What could push mortgage rates up, when the Fed Fund rate is predicted to stay very low for the next few years? LY: Mortgage rates are influenced by many factors, including inflationary expectations, how the 10-year bond yields are moving and the Treasury government bond borrowing rate. Mortgage rates have already jumped up in recent months. The absolute low was back in December/January, when it was averaging 2.7%. Now it is above 3%. It’s inching higher because stimulus is not free money. People are getting the $1400 stimulus check. There is possibly more spending for infrastructure later in the year. The larger budget deficit and higher national debt make bond investors nervous. So, mortgage rates are rising. Fortunately, the increases have been in the decimal points. But if the bond investors lose confidence, and mortgage rates rise to 4% before the year finishes, that will choke off demand for homebuying. NP: Let’s discuss what might spook bond investors. The U.S. has a negative outlook on our AAA credit rating from Fitch Ratings. Inflation could also play a role, right? LY: Inflation will be rising. In the early months of the pandemic, inflation went down to zero. Now inflation is picking up to 1.7%, partly due to rising health care costs. We’ve seen an increase in the price of automobiles. Apartment rental rates, which had sunk very low in the early months of the pandemic, are now beginning to climb out again. The younger generation, who went straight to the parents’ basement in the early stages of the pandemic, are now seeing job creation. They are itching to get out. Rental demand is picking up, so rents are rising. Inflation should cross over the 2% line before the year-end. NP: With about 1/3 of homebuyers being first-time home buyers, let’s give them some tips for successful home ownership. LY: Be very comfortable in what you are willing to spend. Don’t overstretch. There are multiple offers and sometimes the bid offers include an escalation clause. But if it overstretches your budget, just hold off and look for a better time later, or a different neighborhood that is further out from the city, where things are more affordable. See what the company policy will be regarding Work-From-Home after the pandemic. If there is greater flexibility, or maybe you can negotiate how many days you have to come into the office, then you have better options – more affordable options – to consider. Many of the younger generation are saddled with student debt. There is a psychological barrier of not wanting to carry too large of debt simultaneously in student debt and mortgage debt. There is also a financial barrier. If you have too much student loan debt it is harder to qualify for a mortgage. So, try to pay down existing debt, including student loan debt, as quickly as possible, so that you can be better prepared once you want to enter the market. NP: Let’s go macro for just a moment. Do you think the U.S. will be downgraded by Fitch Ratings? LY: The U.S. debt level is extremely high. However, so is the debt of other nations. So, people are still willing to invest in the U.S. dollar and U.S. treasuries, even though the debt situation is one of the worst in U.S. history. It is possible that we could be downgraded, but the downgrade will be across the board with other countries, as well. All countries have been using stimulus measures and running up deficits, to fight the coronavirus and the economic downturn. If there is positive news on the vaccine, and the economy can come back close to pre-pandemic levels maybe by the end of the year, then the debt levels could start to decline at that point. NP: The most recent projections from the Federal Reserve peg 2021 U.S. GDP growth expectations at 6.5%. Do you think we can get there? LY: That would be an outstanding figure. I have GDP pegged at 4% growth. We are in a very unusual time. Think of how fast the GDP collapsed last year, and how fast we are recovering. NP: What’s your advice for Main Street real estate buyers and sellers in 2021? LY: For the buyers, understand that it is a very competitive market out there. For the sellers, they have been in the driver’s seat in terms of what offers to accept. Don’t price your home too high, thinking that the market is hot. Once your home stays on the market too long, it gets a label that it is stale or that there is something wrong. Also understand that the market that has been hot will not be hot for very long. If you want to consider selling, now may be a good time because it should be easy to find buyers. NP: Is there still an opportunity to refinance and lock in that historically low fixed mortgage rate? LY: Most people have already done that. But there are still people who could benefit from that 3% mortgage rate. So, just look at what your monthly mortgage interest rates are saying. If it is 3.5% or higher, depending upon how long you wish to live in your existing residence, refinancing could really pay off. NP: I always say, “Align your mortgage pay-off date with your retirement date.” Is that counsel you would give as well? LY: That is very good advice. Once you retire, your retirement income is to enjoy life, after multiple years of dedicating your life to work. With real estate prices hitting all-time highs, and many cities unaffordable, Americans are finding innovative solutions, including multigenerational housing and moving out of expensive cities, particularly when they can work remotely from home. If you are saddled with a lot of student loan debt, the cost savings of multigenerational housing might make it easier to pay down debt, build up your down payment and get into your own home much more quickly than if you are attempting these things from a high-cost apartment. If Lawrence Yun is right in forecasting that a hot real estate market might cool down later this year, then waiting for a better opportunity could be the best way to ensure that you don’t have buyer’s remorse down the road. If you’d like to watch the entire video interview with Lawrence Yun, go to YouTube.com/NataliePace. Join us for our April 24-26, 2021 Financial Empowerment Retreat. (Click to learn more.) In 3 days, you'll receive a complete Money Makeover and transform your life forever! Bring your friends, family and teens for an unbelievably low group rate. Call 310-430-2397 or email [email protected] to learn more now.  Natalie Pace Financial Empowerment Retreat. April 24-26, 2021. Call 310-430-2397 or email [email protected] to learn more. Receive the best price when you register with friends and family. Other Blogs of Interest 10 Budget Leaks That Cost $10,000 or More Each Year. The Stimulus Check. Party Like It's 1999. Kushner's Times Square Building Plunges 80% in Value. Will There be a Spring Rally? Cannabis and the Road to Decriminalization in the U.S. Hot ETFs Return Up to 50% Since October. Investor IQ Test 2021. Investor IQ Test Answers Shoot the Moon Stock Picks 2021 Crystal Ball. Would You Pay $50 for a Cafe Latte? Is Your Tesla Stock Overpriced? Can Medmen Avoid Bankruptcy? Bitcoin is Back, Baby! Real Estate Prices are Going Up. And Down. Movie Theaters are in Trouble Airbnb Should Have a Spectacular IPO Today. Cannabis is Decriminalized. Stocks Triple. Airbnb's IPO. Should Hosts Invest? Gifts Under $5 and Free. Thanksgiving in a Pandemic. The Sustainability Silver Lining. Secretary Mnuchin Halts Bailouts Money Stress Killed My Friend Real Estate and Housing 2021. Challenges & Opportunities Real Estate in a Pandemic. Interview with Mike Fratantoni, the Chief Economist of the Mortgage Bankers Association. Bonds are Illiquid & Negative-Yielding. Annual Rebalancing is a Buy Low, Sell High Plan on Auto-Pilot. 5 Red Flags of a Financial Implosion Will Regeneron Be Approved Before the Election? Tesla Will Have an Outstanding Earnings Report Should You Wait Until After the Election to Fix Your Wealth Plan? The October Surprise Is Your Bank a Junk Bond Do Stocks Fare Better Under Democrats or Republicans? Put Your Money Where Your Heart Is. Crystal Ball for the Remainder of 2020 (Including the Election). Microcap Gaming Company Doubles 2Q 2020 Revenue. Apple & Tesla Stock Splits. Schwab's Chief Fixed Income Strategist on What's Safe. China's Tesla (Nio). 2Q Sales Soar. Why Are You Still Renting? (Errr. There is More Than This to Consider!) MedMen's Turnaround Plan Attracts A-List Board Members. Wealth Myths That Keep You Poor. Prosperity Truths That Make You Rich. Protecting Your Wealth and Home in a Recession. Technology and Silver are Golden. The Economy Contracts 32.9% in the 2nd Quarter of 2020. Real Estate: Feeling Equity Rich? Make Sure That Feeling Isn't Fleeting. Airline Revenue Plunges 86%. 10 Questions for College Success Bank Earnings Season. Crimes. Cronyism. Speculation. Real Estate Solutions for a Post-Pandemic World. Copper and Chile Update. Gold Soars. Some Gold Funds Tank. Will the Facebook Ad Boycott De-FANG Stocks? Why Did My Cannabis Stock Go Down? Which Countries Are Hot in a Global Pandemic? Is Your Financial Advisor Good at Navigating Stormy Seas? $10 Avocados, Lies, Damn Lies, Statistics & Wall Street Secrets. It's Never a Crash. Work From Home and Intergenerational Housing. Biotech Races for a Coronavirus Cure. Are You Worried About Money? May is a Good Time for Rebalancing. Is FDIC-Insured Cash at Risk of a Bank Bail-in Plan? Why Did my Bonds Lose Money? Cannabis Update. Recession Proof Your Life. Free Videocon Monday, May 10, 2020. The Recession will be Announced on July 30, 2020. Apple Reports Terrible Earnings. We Are in a Recession. Unemployment, Rising Stocks. What's Going On? 8 Money Myths, Money Pits, Scams and Conspiracy Theories. 21st Century Solutions for Protecting Your Home, Nest Egg & Job. Wall Street Insiders are Selling Like There is No Tomorrow. Why Are My Bonds Losing Money? Tomorrow is Going to be Another Tough Day. Price Matters. Stock Prices are Still Too High. Should You Ride Things Out? 7 Recession Indicators Corona Virus Update. The Bank Bail-in Plan on Your Dime. NASDAQ is Up 6X. CoronaVirus: Which Companies and Countries Will be Most Impacted. Is Tesla Worth GM and Ford Combined. Artificial Intelligence is on Fire. Is it Time to Buy S'More? Take the Retirement Challenge. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable. However, NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors.  About Natalie Pace Natalie Wynne Pace is an Advocate for Sustainability, Financial Literacy & Women's Empowerment. She has been ranked as a No. 1 stock picker, above over 835 A-list pundits, by an independent tracking agency (TipsTraders). The ABCs of Money remained at or near the #1 Investing Basics e-book on Amazon for over 3 years (in its vertical), with over 120,000 downloads and a mean 5-star ranking. The 4th edition of The ABCs of Money was released on October 17, 2020. Natalie Pace's easy as a pie chart nest egg strategies earned gains in the last two recessions and have outperformed the bull markets in between. That is why her Investor Educational Retreats, books and private coaching are enthusiastically recommended by Nobel Prize winning economist Gary S. Becker, TD AMERITRADE chairman Joe Moglia, Kay Koplovitz and many Main Street investors who have transformed their lives using her Thrive Budget and investing strategies. Click to view a video testimonial from Nilo Bolden. Comments are closed.

|

AuthorNatalie Pace is the co-creator of the Earth Gratitude Project and the author of The Power of 8 Billion: It's Up to Us, The ABCs of Money, The ABCs of Money for College, The Gratitude Game and Put Your Money Where Your Heart Is. She is a repeat guest & speaker on national news shows and stages. She has been ranked the No. 1 stock picker, above over 830 A-list pundits, by an independent tracking agency, and has been saving homes and nest eggs since 1999. Archives

July 2024

Categories |

RSS Feed

RSS Feed