|

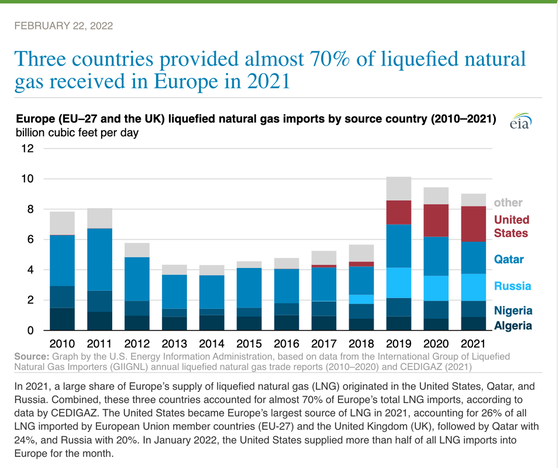

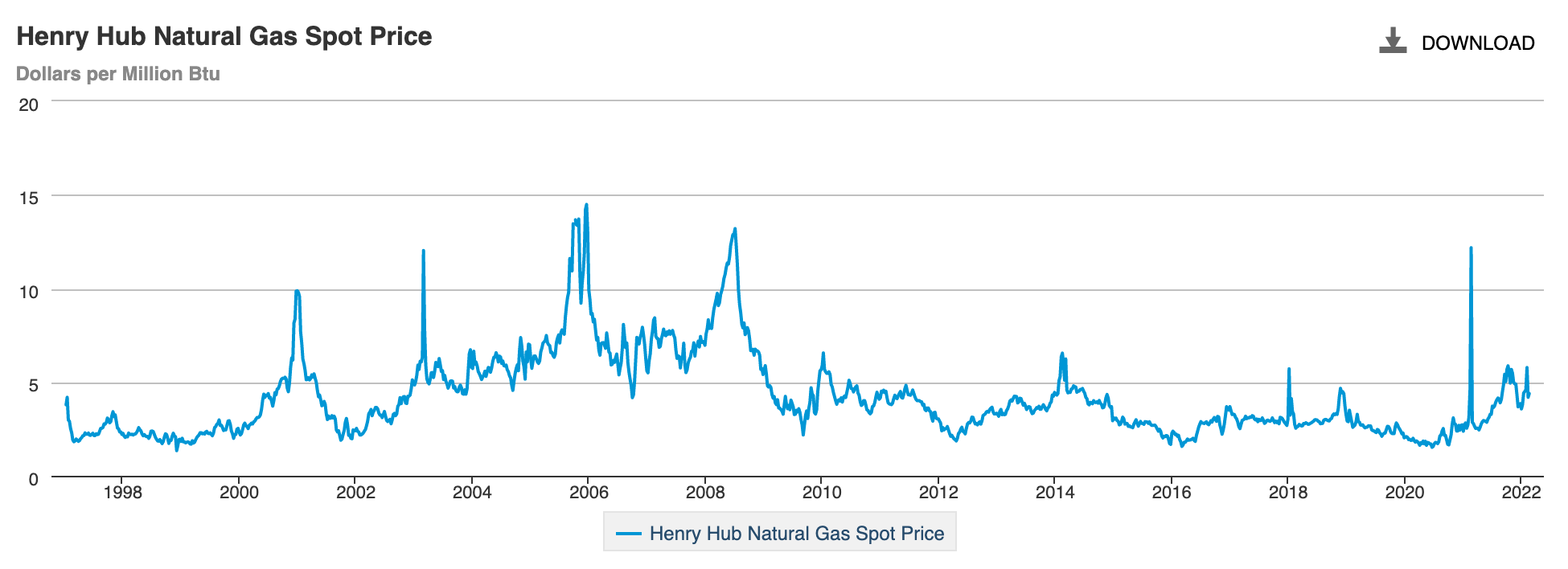

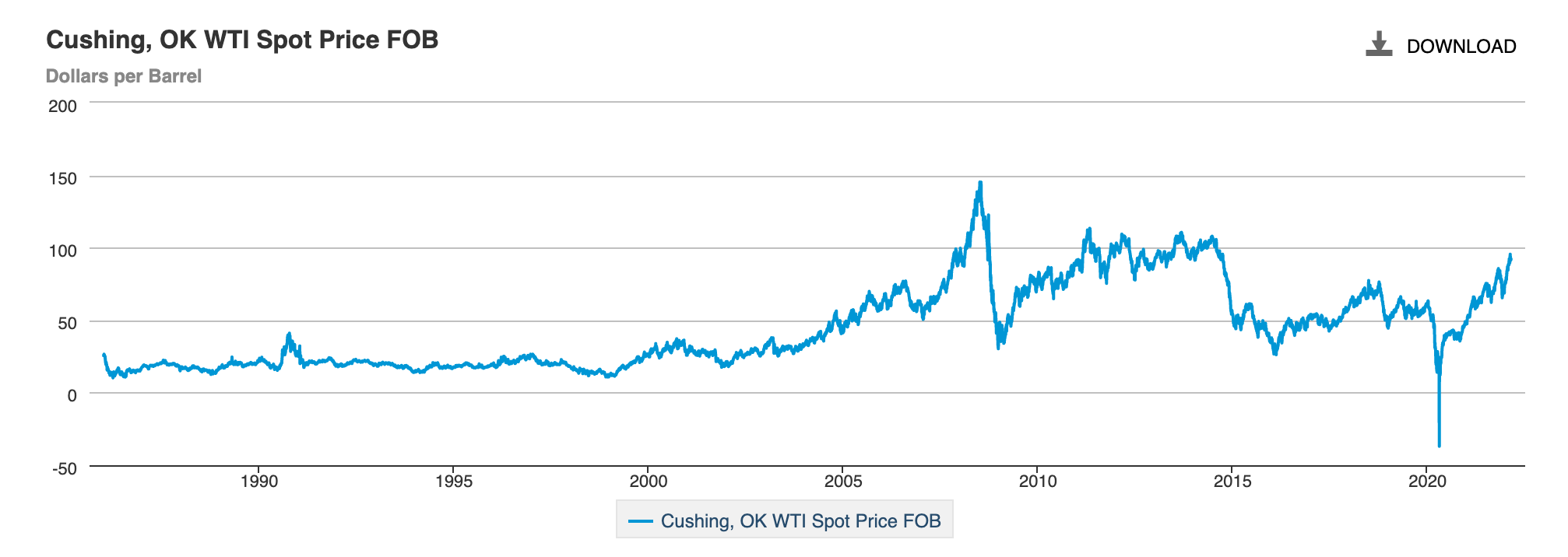

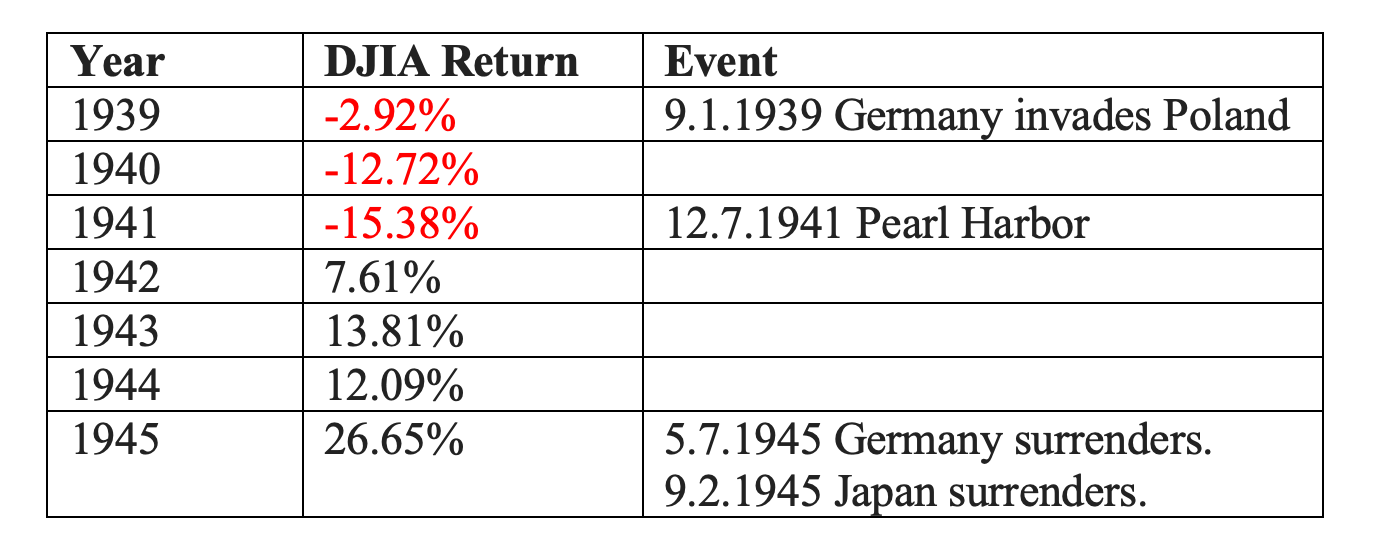

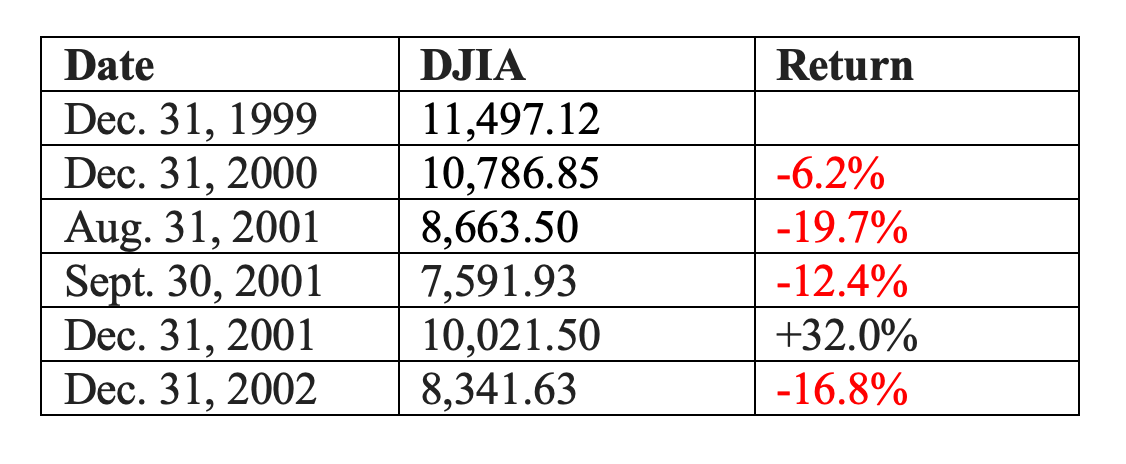

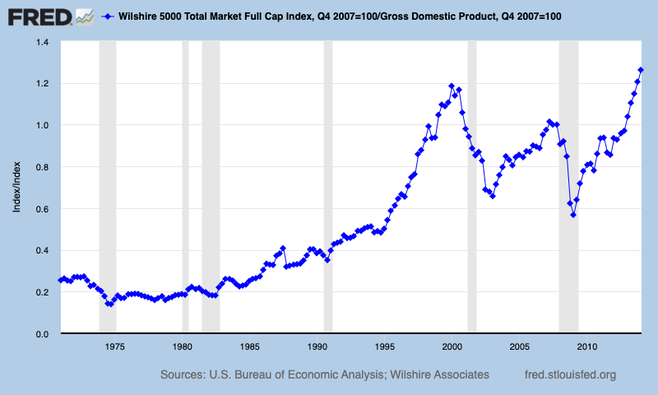

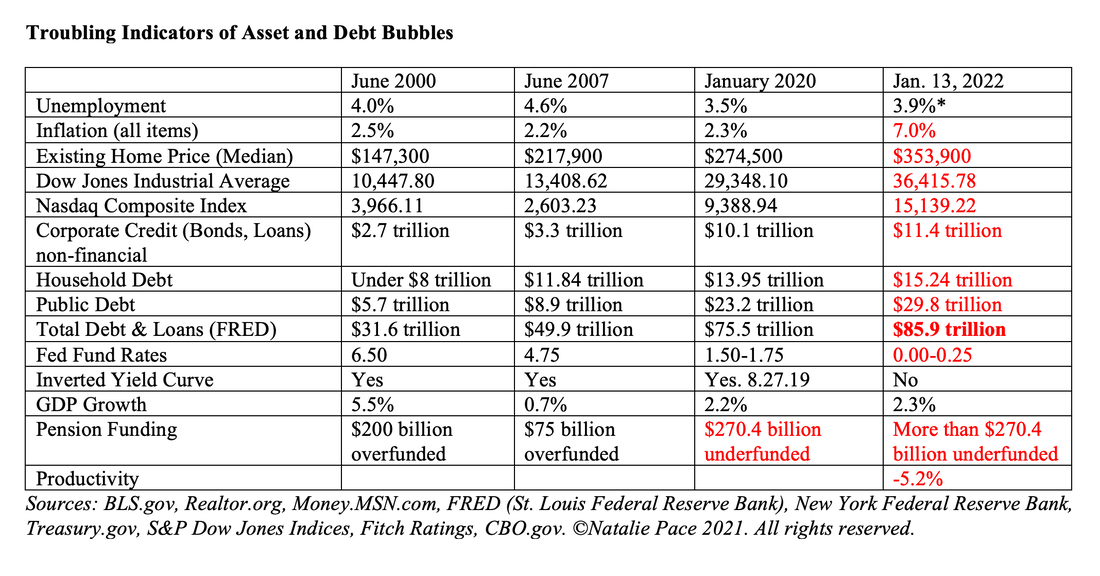

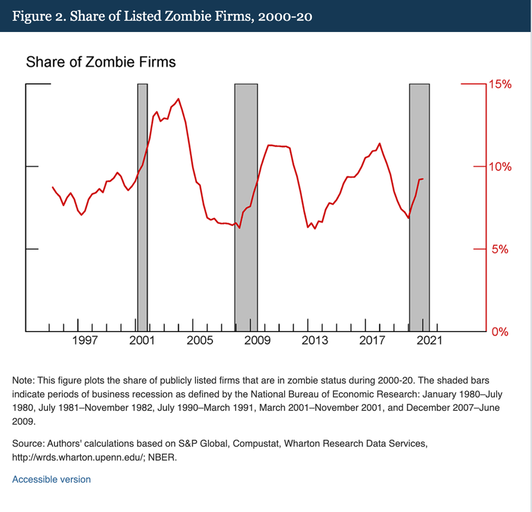

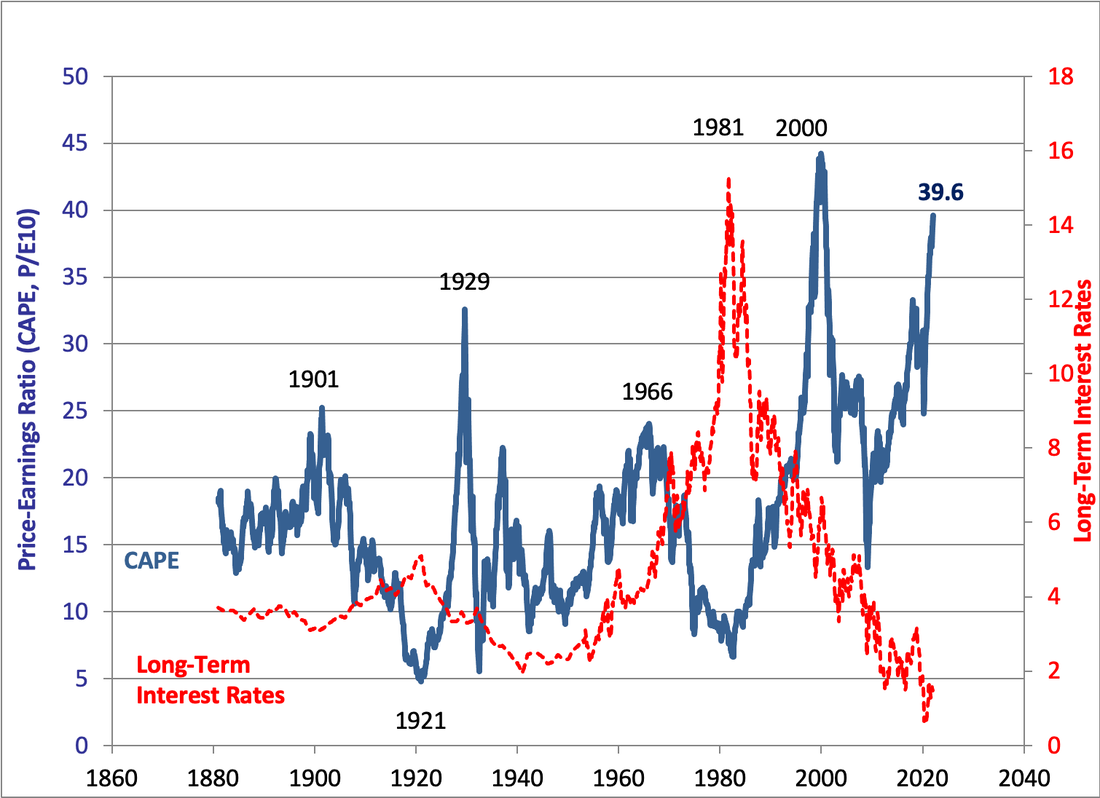

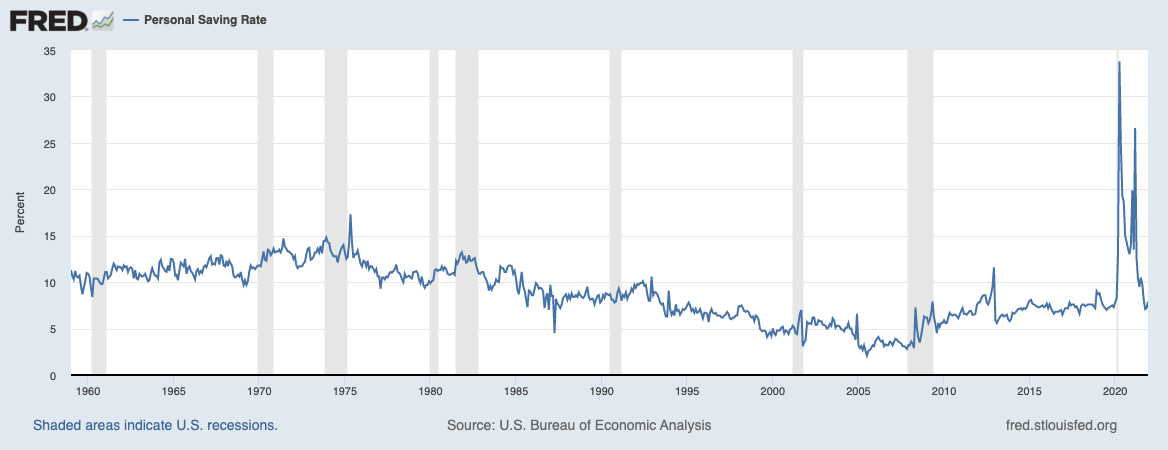

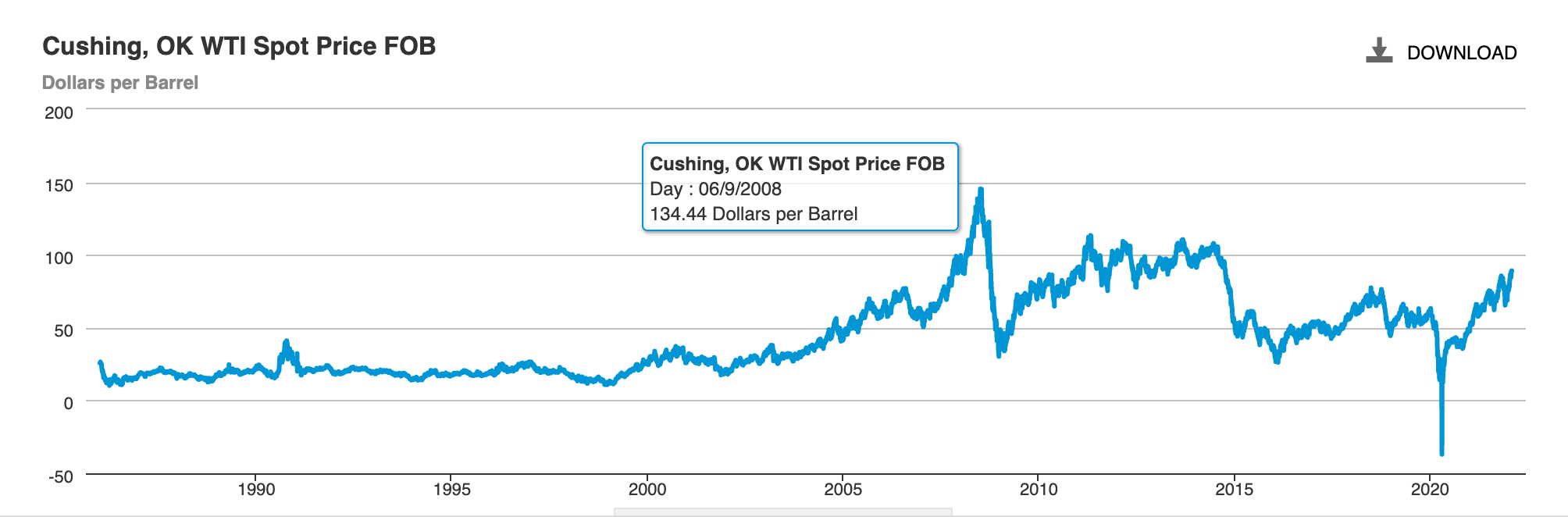

Corporate Boycotts of Putin’s War With a Special Analysis of Oil & Gas Trends Sports Clubs Were the First to Act The German football club FC Schalke 04 removed Gazprom (a Russian natural gas company) from their jerseys on February 25, 2022, the day after Putin’s invasion of Ukraine. The Poland, Czech Republic and Swedish soccer clubs announced that they will not participate in World Cup qualifiers scheduled to take place in Russia in March. Despite the rather cryptic tweet by Gazprom on February 19, 2022 (above) and social media pressure, it doesn’t appear that JP Morgan has taken any steps to limit their banking and capital funding relationships with Gazprom. However, BP became one of the first multi-national corporation to censure Putin’s invasion of Ukraine. Today, two BP representatives, Bob Dudley and Bernard Looney, resigned from the board of the Russian oil company Rosneft effective immediately. BP vows to “exit” its 19.75% stake in the company and take a “material non-cash charge” in the first quarter of 2022. That report is expected in May. S&P Global Ratings cut Russia’s sovereign rating to junk on Saturday, writing that the international sanctions imposed on Russia could have “significant direct and second-round effects on economic and foreign trade activity, domestic resident confidence, and financial stability,” which could weigh on growth. The Conference Board expected Russia’s GDP growth to be a rather tepid 2.0% in 2022 before the conflict, compared to 5.1% in China, 4.4% in the United Kingdom, 4.0% in Europe and 3.7% in the United States. Will Europe Boycott Russian Natural Gas? Over the last 5 years, Russia has supplied around 40% of European natural gas. Some countries are more exposed than others. Italy is the most exposed, since 50% of its electricity comes from natural gas and 95% of that amount is imported. This is why none of the sanctions (so far) include what would hurt Russia the most – a boycott of oil and gas. Will Russia retaliate against NATO nations’ sanctions and withhold oil and gas from Europe – cutting off its most important source of income? That’s equally difficult to imagine, as Russia needs riches to fund its military aggression. So, investing in natural gas expecting it to spike in price isn’t a guarantee. In the event of a severance in the natural gas relationship between supplier (Russia) and customer (Europe), the U.S., Qatar and Nigeria might benefit, as you can see in the chart below. Will Natural Gas Prices Soar? The peaks and valleys of natural gas prices reflect both supply and demand side shocks. In December 2000, natural gas prices soared to $8.90 per mmBtu, almost quadrupling from the start of the year, when gas prices were at $2.36. It was an abnormally cold winter, and there was an increase in demand for natural gas for heating (source: GAO.gov). This occurred at a time when supplies by both utilities and marketers were unusually low. With increased demand and higher prices, gas companies increased production. By the end of October 2001, prices were back down to $2.46 mmBtu. In October of 2005, gas prices soared again, spiking from $6.35 in October 2004 to $13.42. This time, it was an unexpected drop in supply that was the culprit. Hurricanes Rita and Katrina disrupted production and delivery from the Gulf of Mexico. By September 2006, prices were back down to the $4.90 mmBtu range. And those are where prices are again today, after a knife-like slice just before the Russian invasion of Ukraine. As of February 23, 2022, natural gas prices are $4.59. If prices spike, it’s important to remember that they can also plunge. In anticipation of the U.S. Invasion of Iraq (March of 2003), natural gas prices doubled to $12.03 at the end of February 2003, and then plunged back to $5 by the end of March, only a month later. Supply Side Disruptions If the report from Gazprom is accurate, then Europe and the Ukraine have dangerously low gas inventories. The EIA.gov reports that the U.S. storage is on the low end, based upon 5-year averages, at just 1782 Bcf. Without sanctions, boycotts or withholding, prices could remain fairly stable. However, whether it is a decision made by a government or multiple Ukrainian pipelines destroyed by Russian missiles, there could easily be a supply-side disruption that factors into already low storage. (Ukraine lies between Russia and Europe so destroying the pipelines that funnel Russian gas into that region would be counterproductive.) Any severe supply side disruption would cause gas prices to soar in the near-term (2-12 months). In the past, high prices prompt an increase in production, which floods the market with supply, bringing prices back down again. The higher the price, the more swift and severe the decline. Demand The only good news is that February is the last winter month in Europe. Demand for heating could abate in the coming weeks. However, if summer is as hot as it was last year, then demand for natural gas to power air conditioners will be high. Prices of Natural Gas and Oil As we’ve seen in the chart above, natural gas price summits tend to be rather short-lived. On the other hand, oil prices can stay elevated during prolonged periods of conflict. War requires a lot more gasoline than peace does. ESG Considerations Many people are not aware that just 20 fossil fuel companies are responsible for over 1/3 of CO2 emissions since 1965 (source: ClimateAccountability.org). BP is 3rd on that list, behind Chevron (#1) and ExxonMobil (#2). If we care about the environment and are committed to climate action, then it’s essential to make sure that we are not profiting from polluters, particularly in our 401k, mutual funds or managed brokerage account. It’s also critical to decrease our oil addiction. These companies are simply supplying the fuel that we power our cars and lives with. I’ll be outlining easy ways we can power green and reduce our carbon footprint in my new book The Power of 8 Billion, which will be released in the coming month. Email [email protected] with The Power of 8 Billion in the subject line to be notified if its release. Bottom Line Be careful betting on natural gas at this time. While supply side constraints could push gas prices up quickly, the fall can be just as fast. Oil prices, on the other hand, could remain elevated in 2022, as a flight to the suburbs increases gasoline consumption. The trend for electric vehicles is positive for natural gas and negative for oil companies in 2025 and beyond. Many electric grids around the world are still powered 60% or more by fossil fuels (mostly natural gas), so this isn’t as clean of an alternative as many drivers might think. In 2020, EV sales were 3 million – about 4.1% of total car sales (source: IEA.og). If you’d like an Oil or Gas Stock Report Card, just email [email protected]. If you’d like to divest your portfolio of oil and gas investments, you can learn how at our Investor Empowerment Retreats. The next one is March 18-20, 2022. Early Bird pricing ends on Feb. 28, 2022 (Monday). Our easy-as-a-pie-chart investing, with regular rebalancing, earned gains in the Dot Com and the Great Recessions and has outperformed the bull markets in between. So, if you are a Buy & Hope investor, it’s important to read between the lines of rhetoric, understand the true trends, and consider adopting a strategy that works in a 21st Century world marked by overvalued equities, unprecedented leverage and deep downturns. If you’d like to see the charts of past war-time shocks to the stock market, lined up with the average P/E of the day, just email [email protected]. You can watch my videoconference on the Ukrainian Crisis, which features 5 things every Buy & Hold investor must do now and 3 essential strategies for Pie Chart Investors, at YouTube.com/NataliePace. (If you don't know the difference, you'll learn in the free videoconference.)  Join us for our St. Patrick's Weekend Financial Empowerment Retreat. March 18-20, 2022. Email [email protected] to learn more. Register by Monday, February 28, 2022, to receive the best price. Click for testimonials & details. Other Blogs of Interest Russia Invades Ukraine. How Have Stocks Responded in Past Wars? Zombie Companies. Rescue, Rehab or Liquidate? Spotify: Music to my Ears. Cannabis Crashes. 2022 Crystal Ball in Stocks, Real Estate, Crypto, Cannabis, Gold, Silver & More. Interview with the Chief Investment Strategist of Charles Schwab & Co., Inc. Stocks Enter a Correction Investor IQ Test Investor IQ Test Answers Real Estate Risks. What Happened to Ark, Cloudflare, Bitcoin and the Meme Stocks? Omicron is Not the Only Problem From FAANNG to ZANA MAD MAAX Ted Lasso vs. Squid Game. Who Will Win the Streaming Wars? Starbucks. McDonald's. The Real Cost of Disposable Fast Food. The Plant-Based Protein Fire-Sale What's Safe in a Debt World? Inflation, Gasoline Prices & Recessions China: GDP Soars. Share Prices Sink. The Competition Heats Up for Tesla & Nio. How Green in Your Love for the Planet? S&P500 Hits a New High. GDP Should be 7% in 2021! Will Work-From-Home and EVs Destroy the Oil Industry? Insurance and Hedge Funds are at Risk and Over-Leveraged. Office Buildings are Still Ghost Towns. Money Market Funds, FDIC, SIPC: Are Any of Them Safe? My 24-Year-Old is Itching to Buy a Condo. Should I Help Him? The 12-Step Guide to Successful Investing. Gardeners Creating Sanctuary & Solutions in Food Deserts. 2021 Company of the Year Almost 5 Million Americans are Behind on Rent & Mortgage. Real Estate Hits All-Time High. Rebalancing Your Nest Egg IQ Test. Answers to the Rebalancing Your Nest Egg IQ Test. Videoconferencing in a Post-Pandemic World (featuring Zoom & Teladoc). Sanctuary Sandwich Home. Multigenerational Housing. Interview with Lawrence Yun, the chief economist of the National Association of Realtors. 10 Budget Leaks That Cost $10,000 or More Each Year. The Stimulus Check. Party Like It's 1999. Would You Pay $50 for a Cafe Latte? Is Your Tesla Stock Overpriced? 10 Questions for College Success. Is FDIC-Insured Cash at Risk of a Bank Bail-in Plan? 8 Money Myths, Money Pits, Scams and Conspiracy Theories. Why Are My Bonds Losing Money? The Bank Bail-in Plan on Your Dime. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable. However, NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors.  About Natalie Pace Natalie Wynne Pace is an Advocate for Sustainability, Financial Literacy & Women's Empowerment. She has been ranked as a No. 1 stock picker, above over 835 A-list pundits, by an independent tracking agency (TipsTraders). The ABCs of Money remained at or near the #1 Investing Basics e-book on Amazon for over 3 years (in its vertical), with over 120,000 downloads and a mean 5-star ranking. The 5th edition of The ABCs of Money was released on September 17, 2021. Natalie Pace's easy as a pie chart nest egg strategies earned gains in the last two recessions and have outperformed the bull markets in between. That is why her Investor Educational Retreats, books and private coaching are enthusiastically recommended by Nobel Prize winning economist Gary S. Becker, TD AMERITRADE chairman Joe Moglia, Kay Koplovitz and many Main Street investors who have transformed their lives using her Thrive Budget and investing strategies. Click to view a video testimonial from Nilo Bolden. Putin made good on his threats and invaded Ukraine last night. The Dow Jones Industrial Average started the day down over -800 points. After the U.S. announced sanctions, the markets recovered. The Dow rose 92 points (0.28%). The NASDAQ Composite Index posted a gain of 3.35% (436 points). However, the market, similar to wars, is not something that is won in a day, but over time. The conflict isn’t going to disappear. So, what’s your best strategy? How did stocks behave in past periods of bloodshed and conflict? Attacks, particularly those that are unexpected, are definitely a market driver, especially in the near-term. Usually there is a drop. (Today there was an unexpected rally; we’ll see how long that lasts.) The stock market was closed for four trading days in an attempt to calm investors after 9/11, and there was still a sell-off on September 17, 2001, when the market opened. (That’s not all there was to the story. Keep reading.) Over the past 24 hours, I’ve seen a flurry of pundits blogging and blabbing about wartime market statistics. Some of the numbers quoted are simply wrong. Others have been shaved to support whatever message they wish to convey. (I’m going to let you see the data for yourself below.) A lot of media and broker-salesmen are going to be pointing to overall market gains in attempt to calm roiled nerves into accepting their premise that you should just Buy & Hold. However, is that really the best strategy today? As one example, Fortune just published an article writing that “from 1939 until the end of the war in late 1945, the Dow saw increases of 50%, more than 7% per year.” The cumulative gains between the beginning of 1939 and the end of 1945 were actually only 36%, for annualized gains of 5.14% (source: FRED). (Not sure where the Fortune writer is getting his data.) To get to that sum, however, you have to overlook pretty steep losses between 1939 and 1941. The simple statement that there were gains over the period doesn’t reflect what people experienced at the time, as the chart below indicates. If you lose a third of your wealth over a 3-year period, you might lose your home. Your credit score plunges, which increases your cost of borrowing. You might have to take on debt to make ends meet. You can’t buy low at the bottom. You don’t have any money. In fact, when the bull market finally comes, you are hoping and praying that you’ll make up losses, rather than enjoying the gains. As I averred above, the stock market plunge of the Dot Com Recession and the terrorist attack on 9/11 are often misrepresented. Between December 31, 1999 and August 31, 2001, the Dow Jones Industrial Average dropped from 11,497.12 to 8,663.50, for losses of -24.6%. The correction was already quite steep before 9/11. After a bounce up to 10,021.50 at the end of 2001, the DJIA slid again in 2002, ending the year at 8,341.63 – just -3.7% lower than the low in August of 2001 (before the terrorist attacks on the Twin Towers). The losses of the NASDAQ Composite Index between the highs of March 9, 2000 (5,046.86) and Oct. 10, 2002 (1,150), were even more severe, at -77.2%. Why did the stock market correction happen before 9/11? Was there another factor at play? Can it help us to understand where we are today? In 2000, stock prices were very bubblicious. If we refer to the Buffett Indicator, which measures the total value of all publicly traded stocks against GDP, Dot Com stocks were the most expensive in history, outside of one other time – today. Stocks were very pricey in 2007, too, a time of real estate and stock investor euphoria that ushered in the Great Recession. There are a few key differences between the Dot Com Recession, the Great Recession and today, which were all periods of elevated asset prices. Before the Dot Com and Great Recessions, there was room for the Federal Reserve Board to cut interest rates to spark borrowing and economic growth to try and lift us out of the market troughs. Today, interest rates are at rock-bottom, and have to rise to combat inflation. The Federal Reserve Board will try to negotiate a “soft landing,” to raise rates without sparking a recession. However, elevated asset prices and the invasion of Ukraine present complications that could make that difficult. Market returns are typically lower when the tightening cycle begins, and can be negative if interest rates rise too rapidly. In short, 2022 was unlikely to experience anything close to 2021’s 27% market rally in the U.S. before Russia invaded Ukraine. Debt was high before the Great Recession. Today it is astronomical. Debt and leverage were already elevated before the pandemic, and then shot into the Nethersphere when trillions were printed up to help states, cities, consumers and businesses survive the lockdowns. Now, while GDP growth is still strong enough, is when we want to start reducing the debt load. The Federal Reserve unloaded all of the bonds they had purchased in early 2020 by 2021, and announced that they will start reducing their Treasury and asset-backed security holdings this year. The Beltway has had difficulty agreeing on how to balance the budget and put the U.S. on a more fiscally responsible path. Another way of looking at today’s world, while also factoring in the harsh and heartbreaking backdrop of the Ukraine Crisis, is that the 21st Century has been marked by asset bubbles that present a different type of economy than existed in the last century. Most wartime events get folded into an average annualized gain over XYZ period, but are actually a rollercoaster, often with a severe two years or more of losses close to the inception of the war or attack. The elevated stock prices of the Dot Com Era ushered in sharper declines than were experienced during Pearl Harbor, World War II and even the Vietnam War. That’s one of the reasons why Buy & Hope worked better in the 20th Century and has been a Wall Street rollercoaster in the 21st. During wartime and periods of elevated stock prices, Modern Portfolio Theory with regular rebalancing works better than Buy & Hold. Our easy-as-a-pie-chart investing, with regular rebalancing, earned gains in the Dot Com and the Great Recessions and has outperformed the bull markets in between. So, if you are a Buy & Hope investor, it’s important to read between the lines of rhetoric, understand the true trends, and consider adopting a strategy that works in a 21st Century world marked by overvalued equities, unprecedented leverage and deep downturns. If you’d like to see the charts of past war-time shocks to the stock market, lined up with the average P/E of the day, just email [email protected]. You can watch my videoconference on the Ukrainian Crisis, which features 5 things every Buy & Hold investor must do now and 3 essential strategies for Pie Chart Investors, at YouTube.com/NataliePace. (If you don't know the difference, you'll learn in the free videoconference.)  Join us for our St. Patrick's Weekend Financial Empowerment Retreat. March 18-20, 2022. Email [email protected] to learn more. Register by Monday, February 28, 2022, to receive the best price. Click for testimonials & details. Other Blogs of Interest Zombie Companies. Rescue, Rehab or Liquidate? Spotify: Music to my Ears. Cannabis Crashes. 2022 Crystal Ball in Stocks, Real Estate, Crypto, Cannabis, Gold, Silver & More. Interview with the Chief Investment Strategist of Charles Schwab & Co., Inc. Stocks Enter a Correction Investor IQ Test Investor IQ Test Answers Real Estate Risks. What Happened to Ark, Cloudflare, Bitcoin and the Meme Stocks? Omicron is Not the Only Problem From FAANNG to ZANA MAD MAAX Ted Lasso vs. Squid Game. Who Will Win the Streaming Wars? Starbucks. McDonald's. The Real Cost of Disposable Fast Food. The Plant-Based Protein Fire-Sale What's Safe in a Debt World? Inflation, Gasoline Prices & Recessions China: GDP Soars. Share Prices Sink. The Competition Heats Up for Tesla & Nio. How Green in Your Love for the Planet? S&P500 Hits a New High. GDP Should be 7% in 2021! Will Work-From-Home and EVs Destroy the Oil Industry? Insurance and Hedge Funds are at Risk and Over-Leveraged. Office Buildings are Still Ghost Towns. Money Market Funds, FDIC, SIPC: Are Any of Them Safe? My 24-Year-Old is Itching to Buy a Condo. Should I Help Him? The 12-Step Guide to Successful Investing. Gardeners Creating Sanctuary & Solutions in Food Deserts. 2021 Company of the Year Almost 5 Million Americans are Behind on Rent & Mortgage. Real Estate Hits All-Time High. Rebalancing Your Nest Egg IQ Test. Answers to the Rebalancing Your Nest Egg IQ Test. Videoconferencing in a Post-Pandemic World (featuring Zoom & Teladoc). Sanctuary Sandwich Home. Multigenerational Housing. Interview with Lawrence Yun, the chief economist of the National Association of Realtors. 10 Budget Leaks That Cost $10,000 or More Each Year. The Stimulus Check. Party Like It's 1999. Would You Pay $50 for a Cafe Latte? Is Your Tesla Stock Overpriced? 10 Questions for College Success. Is FDIC-Insured Cash at Risk of a Bank Bail-in Plan? 8 Money Myths, Money Pits, Scams and Conspiracy Theories. Why Are My Bonds Losing Money? The Bank Bail-in Plan on Your Dime. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable. However, NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors.  About Natalie Pace Natalie Wynne Pace is an Advocate for Sustainability, Financial Literacy & Women's Empowerment. She has been ranked as a No. 1 stock picker, above over 835 A-list pundits, by an independent tracking agency (TipsTraders). The ABCs of Money remained at or near the #1 Investing Basics e-book on Amazon for over 3 years (in its vertical), with over 120,000 downloads and a mean 5-star ranking. The 5th edition of The ABCs of Money was released on September 17, 2021. Natalie Pace's easy as a pie chart nest egg strategies earned gains in the last two recessions and have outperformed the bull markets in between. That is why her Investor Educational Retreats, books and private coaching are enthusiastically recommended by Nobel Prize winning economist Gary S. Becker, TD AMERITRADE chairman Joe Moglia, Kay Koplovitz and many Main Street investors who have transformed their lives using her Thrive Budget and investing strategies. Click to view a video testimonial from Nilo Bolden. It’s not all that surprising that after a pandemic forced us all to stop traveling and having vacations, there are a few companies in travel and hospitality that are in trouble. This is exacerbated even more by the amount of debt in the world today (which was already heightened before the pandemic). Rising interest rates make it more expensive and difficult to borrow money, particularly for the most troubled firms. What is a zombie company? It is a company that is so heavily indebted and so weakened by revenue losses that they are having difficulty making even the interest payments on their debt service. The Federal Reserve describes such firms as “highly leveraged and unprofitable.” In a July 30, 2021 report, it was noted that zombie firms were concentrated in retail and manufacturing. The pandemic severely damaged the travel and hospitality sectors. Many of the companies are in junk bond status, with revenue that is far below 2019 levels. The question on the minds of policymakers is whether or not travel, work, and lifestyle have suffered structural shifts that will force some of these firms to rightsize and/or restructure operations based upon lower expectations of revenue. Work from home, Zoom conferences and even climate action have impacted travel choices. Will that remain the case as the world moves out of a pandemic mindset and into living with the risks of COVID as an endemic virus? The IMF pointed out recently that governments are going to have to decide which firms to support, which to restructure and which will have to liquidate. In an IMF blog on Feb. 23, 2022, Ceyla Pazarbasioglu and Rhoda Weeks-Brown wrote: Shoring up these systems is critical as there are shortcomings in many important areas at present and countries may need to tackle many cases at once. There is not much time to prepare… Governments were right to support firms financially through the worst of the pandemic. They recognized the initial large premium on speed over precision and provided rapid support without distinguishing between enterprises that could be saved and those that should not. Now policymakers should calibrate financial support and direct it efficiently to companies that are in need. They should also be prepared to restructure or liquidate badly scarred firms. How Do You Know Which Companies are Zombie Firms? If you have a 401K, an IRA or any kind of investment portfolio, now is the time to know what you own. As you can see in the chart below, zombie firms become more common and problematic during recessions. Stock market downturns precede recessions. Zombie firm implosions increase uncertainty and investor anxiety, and accelerate selling. If you look at a chart of the downturns in 2000 and 2008, each major slide was associated with a bankruptcy, bailout or restructuring. 5 Factors for Identifying The Most Vulnerable Companies

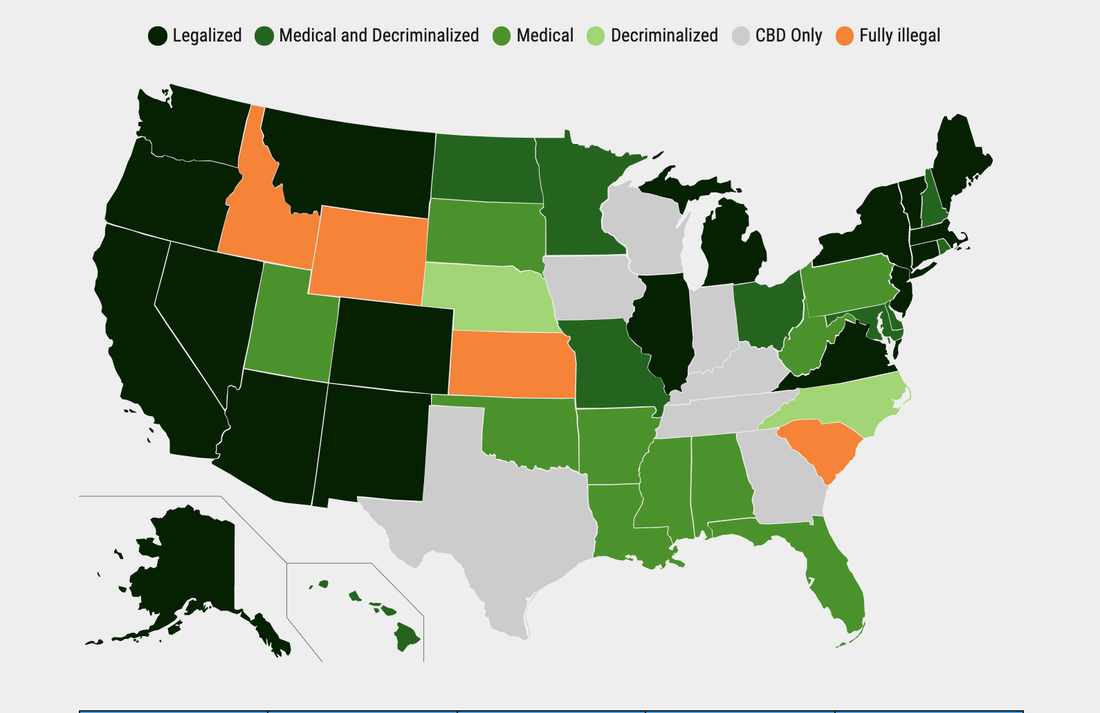

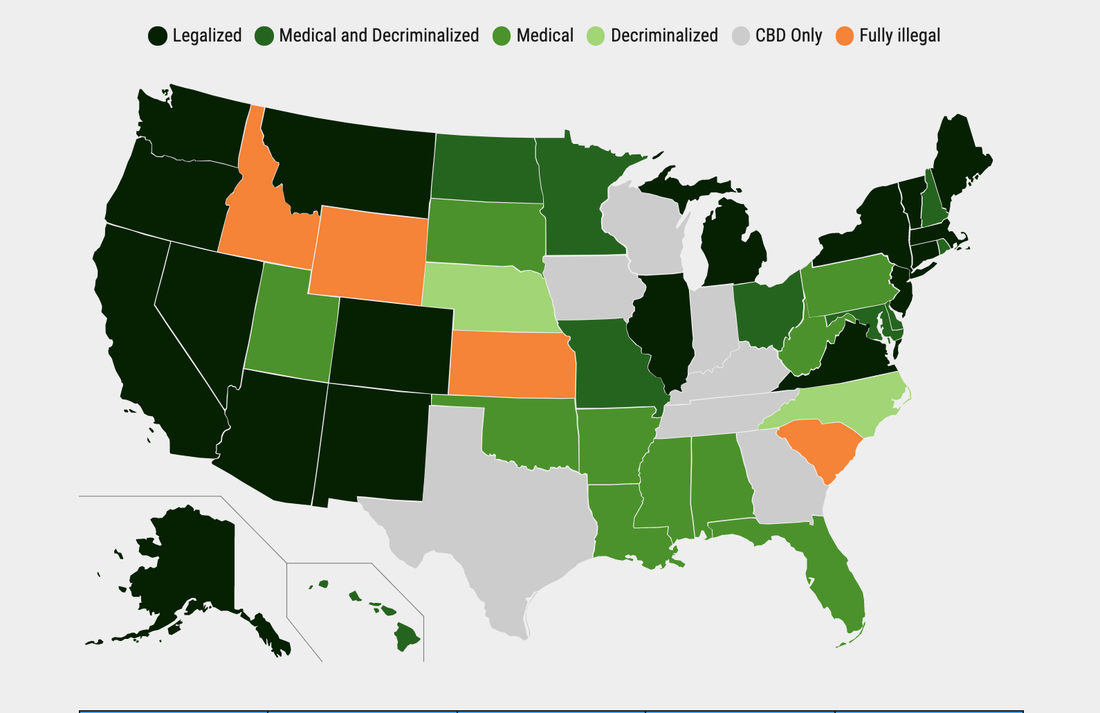

And here is more color on each point. 5 Factors for Identifying The Most Vulnerable Companies 1. The Higher the Dividend, the Higher the Risk If any company is offering you an interest rate above 3%, you are taking on risk to earn a very small yield. This is heightened with higher interest rates, particularly when they are coupled with longer terms. If you own bonds, bond funds or a private placement investment, it’s time to know what you own. Shorter terms and high creditworthiness are essential as we cycle out of free and easy money and into more expensive, tighter policies. 2. Revenue is Substantially Lower Today Than in 2019 Airlines, casinos, hotels and even cruise ships are showing outstanding year-over-year revenue growth. However, when you compare today’s sales and net losses with 2019, it becomes clear that extreme rightsizing is going to be needed to survive, unless there is a massive increase in travel and sales. The Retail Apocalypse continues to weigh down the economy, particularly as the Work-from-Home trend limits the need for business attire. 3. Highly Leveraged and Unprofitable The 2020 and 2021 losses in the airlines, cruise lines, commercial real estate and casinos were enough to wipe-out most of the companies had there not been government support. The airlines, cruise lines and casinos are all rated as speculative (junk bonds). If you’d like to see the Stock Report Cards of key companies in these industries, just email [email protected] with Zombie Stock Report Cards in the subject line. 4. The Firm is Unable to Make Key Interest Payments The rating agencies offer details on which companies are coming up on key payments, and even their ability to meet these. You can also check the company’s cash on hand in their earnings reports. The interesting thing about some beleaguered, low-rated firms is that some still use funds to repurchase their own stock. MGM Resorts repurchased $1.75 billion shares in 2021. This is just one of the reasons why you don’t use a rising stock price as your due diligence analysis of the fiscal health of a firm. 5. Larger Firms are More Likely to Be Rescued Than Smaller Companies During and after the Great Recession, 489 banks failed. FDIC-insured depositors simply found a new company name on their bank statements. However, investors were keenly aware of the losses that their stock and bond investments suffered from holdings in Lehman Bros., Countrywide, Washington Mutual, Merrill Lynch, Bear Stearns and the many smaller, community banks that failed (and were absorbed by larger firms). Despite the sins of Boeing, many of which were outlined in the new Netflix documentary Downfall, the company is more likely to be rescued than the airlines, which have experienced a cycle of restructuring in all of the 21st Century recessions. Boeing is a Dow Jones Industrial Average component, just as AIG was prior to its bailout in 2008. Bottom Line Zombie firms could begin to usher in stock market weakness. The typical market correction can be stretched over a period of 18 months or longer, with the market dropping and then stabilizing at a new low each time a large company fails. The top of the market in the Dot Com Recession was March 2000, with Dot Com stocks bottoming out with losses of -78% by October of 2002. The Great Recession started from a high in October of 2007, and was down -55% by March of 2009. Because market dives tend to be a series of unfortunate events over an extended period rather than an instant crash, your best strategy is not jumping all in or all out. Rather, make sure that you are safe, protected, hot and diversified, and that you know what is safe in a world where fixed income assets, like bonds, can lose money and are high-risk, negative-yielding and potentially illiquid. We’re overweighting 10-20% safe in our sample pie charts for 2022. Wisdom is the cure. It’s time to step off the Buy & Hope Wall Street rollercoaster and into time-proven, 21st Century systems. They are easy as a pie chart.  Join us for our St. Patrick's Weekend Financial Empowerment Retreat. March 18-20, 2022. Email [email protected] to learn more. Register by Monday, February 28, 2022, to receive the best price. Click for testimonials & details. Other Blogs of Interest Spotify: Music to my Ears. Cannabis Crashes. 2022 Crystal Ball in Stocks, Real Estate, Crypto, Cannabis, Gold, Silver & More. Interview with the Chief Investment Strategist of Charles Schwab & Co., Inc. Stocks Enter a Correction Investor IQ Test Investor IQ Test Answers Real Estate Risks. What Happened to Ark, Cloudflare, Bitcoin and the Meme Stocks? Omicron is Not the Only Problem From FAANNG to ZANA MAD MAAX Ted Lasso vs. Squid Game. Who Will Win the Streaming Wars? Starbucks. McDonald's. The Real Cost of Disposable Fast Food. The Plant-Based Protein Fire-Sale What's Safe in a Debt World? Inflation, Gasoline Prices & Recessions China: GDP Soars. Share Prices Sink. The Competition Heats Up for Tesla & Nio. How Green in Your Love for the Planet? S&P500 Hits a New High. GDP Should be 7% in 2021! Will Work-From-Home and EVs Destroy the Oil Industry? Insurance and Hedge Funds are at Risk and Over-Leveraged. Office Buildings are Still Ghost Towns. Money Market Funds, FDIC, SIPC: Are Any of Them Safe? My 24-Year-Old is Itching to Buy a Condo. Should I Help Him? The 12-Step Guide to Successful Investing. Gardeners Creating Sanctuary & Solutions in Food Deserts. 2021 Company of the Year Almost 5 Million Americans are Behind on Rent & Mortgage. Real Estate Hits All-Time High. Rebalancing Your Nest Egg IQ Test. Answers to the Rebalancing Your Nest Egg IQ Test. Videoconferencing in a Post-Pandemic World (featuring Zoom & Teladoc). Sanctuary Sandwich Home. Multigenerational Housing. Interview with Lawrence Yun, the chief economist of the National Association of Realtors. 10 Budget Leaks That Cost $10,000 or More Each Year. The Stimulus Check. Party Like It's 1999. Would You Pay $50 for a Cafe Latte? Is Your Tesla Stock Overpriced? 10 Questions for College Success. Is FDIC-Insured Cash at Risk of a Bank Bail-in Plan? 8 Money Myths, Money Pits, Scams and Conspiracy Theories. Why Are My Bonds Losing Money? The Bank Bail-in Plan on Your Dime. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable. However, NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors.  About Natalie Pace Natalie Wynne Pace is an Advocate for Sustainability, Financial Literacy & Women's Empowerment. She has been ranked as a No. 1 stock picker, above over 835 A-list pundits, by an independent tracking agency (TipsTraders). The ABCs of Money remained at or near the #1 Investing Basics e-book on Amazon for over 3 years (in its vertical), with over 120,000 downloads and a mean 5-star ranking. The 5th edition of The ABCs of Money was released on September 17, 2021. Natalie Pace's easy as a pie chart nest egg strategies earned gains in the last two recessions and have outperformed the bull markets in between. That is why her Investor Educational Retreats, books and private coaching are enthusiastically recommended by Nobel Prize winning economist Gary S. Becker, TD AMERITRADE chairman Joe Moglia, Kay Koplovitz and many Main Street investors who have transformed their lives using her Thrive Budget and investing strategies. Click to view a video testimonial from Nilo Bolden. A couple of decades ago, executives (including Steve Jobs) had a vision that music would be in the cloud, and you could access your favorite artists on demand from anywhere at any time. Today, Spotify, Apple Music and others are prolific. Spotify claims that people in 184 countries and territories have access to 82 million tracks. Saturday Night Live even folded the company into a sketch this year. Many of us heard about Spotify recently when there was a backlash against the company for removing Neil Young music, when the artist protested Joe Rogan’s podcast on Spotify. Harry and Meghan’s Archewell Audio also has a podcast on Spotify. Scandal The Joe Rogan/Neil Young scandal hasn’t cost Spotify as much as you might think. The company traded at $175/share on Jan. 26, 2022 (the day it removed Neil Young’s music at “his request”). Today, shares are trading for $163.74. That’s down a little. However, the current price is down significantly from the high of $387.44 set on Feb. 19, 2021. What happened over the past year? Churn Churn happened. In short, Spotify’s price was quite lofty. Big money movers decided to lock in profits. Shares dropped. All of this happened before the Rogan scandal. Churn isn’t something unique to Spotify. As Liz Ann Sonders, the Chief Investment Strategist of Charles Schwab & Co. Inc., revealed in our interview last month: More than 90% of the NASDAQ’s members had at least a 10% correction at some point in 2021. As of the first few weeks of 2022, 45% of NASDAQ stocks were down at least 50% from their 52-week highs. When I asked the Senior Index Analyst of S&P Dow Jones Indices who was selling, he emailed me that it appeared to be institutional. There is a lot of hot money out there, seeking quick profits. That creates volatility. In a world where equity prices are very expensive in general, it pays to know when your favorite stock has soared to the nether sphere. The hot, institutional money certainly is aware of it. If you are trading and you don’t know valuation strategies, now is the time to get savvy. If you haven’t read my 2022 Crystal Ball blog yet, click to access. You can learn about how to evaluate hot stocks on your own at our March 18-20, 2022 Financial Empowerment Retreat. Click to access that flyer or email [email protected] to learn more. Value Spotify is still cash negative, with a net loss of 34 million euros in 2021. Smaller companies have to worry about borrowing costs in a rising interest rate environment. Spotify has 2.86 billion euros in cash and cash equivalents, and is increasing its cash accumulation quarter over quarter, despite the loss on paper. Since there are no earnings, we have to use another method of valuation than price-earnings ratio. The price-sales ratio for Spotify is down to 2.94, compared to an industry standard of 7.05 and Apple’s 7.71. Spotify is currently valued at $31.47 billion, compared to the high of over $51 billion in March of 2021. And, of course, buyers today are paying less than half for shares, compared to February of 2021. Growth Spotify leads the industry in growth, with revenue growth of 24% in the most recent quarter. (How many of your friends subscribe to Spotify versus Apple Music, Sirius or UMG?) The company’s forward outlook is projecting flat growth in the 1st quarter of 2022. (This projection was issued after the Joe Rogan scandal, so it should be factoring that in.) Share Repurchases Spotify has a share repurchase program in place to the tune of $1 billion, of which about $101 million has been used. Bottom Line Spotify’s current price is music to my ears. Of course, a war in Ukraine or a Taper Tantrum by investors could stop all the music on Wall Street. In precarious times during an overpriced market, it’s important to be properly diversified and safe, in addition to being hot. If you'd like to see our Music Stock Report Card, email [email protected].  Join us for our New Year New You Financial Empowerment Retreat. March 18-20, 2022. Email [email protected] to learn more. Register by Sunday, Feb. 20, 2022 to receive the best price and a complimentary private prosperity coaching session (value $300). Click for testimonials & details. Other Blogs of Interest Cannabis Crashes. 2022 Crystal Ball in Stocks, Real Estate, Crypto, Cannabis, Gold, Silver & More. Interview with the Chief Investment Strategist of Charles Schwab & Co., Inc. Stocks Enter a Correction Investor IQ Test Investor IQ Test Answers Real Estate Risks. What Happened to Ark, Cloudflare, Bitcoin and the Meme Stocks? Omicron is Not the Only Problem From FAANNG to ZANA MAD MAAX Ted Lasso vs. Squid Game. Who Will Win the Streaming Wars? Starbucks. McDonald's. The Real Cost of Disposable Fast Food. The Plant-Based Protein Fire-Sale What's Safe in a Debt World? Inflation, Gasoline Prices & Recessions China: GDP Soars. Share Prices Sink. The Competition Heats Up for Tesla & Nio. How Green in Your Love for the Planet? S&P500 Hits a New High. GDP Should be 7% in 2021! Will Work-From-Home and EVs Destroy the Oil Industry? Insurance and Hedge Funds are at Risk and Over-Leveraged. Office Buildings are Still Ghost Towns. Money Market Funds, FDIC, SIPC: Are Any of Them Safe? My 24-Year-Old is Itching to Buy a Condo. Should I Help Him? The 12-Step Guide to Successful Investing. Gardeners Creating Sanctuary & Solutions in Food Deserts. 2021 Company of the Year Almost 5 Million Americans are Behind on Rent & Mortgage. Real Estate Hits All-Time High. Rebalancing Your Nest Egg IQ Test. Answers to the Rebalancing Your Nest Egg IQ Test. Videoconferencing in a Post-Pandemic World (featuring Zoom & Teladoc). Sanctuary Sandwich Home. Multigenerational Housing. Interview with Lawrence Yun, the chief economist of the National Association of Realtors. 10 Budget Leaks That Cost $10,000 or More Each Year. The Stimulus Check. Party Like It's 1999. Would You Pay $50 for a Cafe Latte? Is Your Tesla Stock Overpriced? 10 Questions for College Success. Is FDIC-Insured Cash at Risk of a Bank Bail-in Plan? 8 Money Myths, Money Pits, Scams and Conspiracy Theories. Why Are My Bonds Losing Money? The Bank Bail-in Plan on Your Dime. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable. However, NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors.  About Natalie Pace Natalie Wynne Pace is an Advocate for Sustainability, Financial Literacy & Women's Empowerment. She has been ranked as a No. 1 stock picker, above over 835 A-list pundits, by an independent tracking agency (TipsTraders). The ABCs of Money remained at or near the #1 Investing Basics e-book on Amazon for over 3 years (in its vertical), with over 120,000 downloads and a mean 5-star ranking. The 5th edition of The ABCs of Money was released on September 17, 2021. Natalie Pace's easy as a pie chart nest egg strategies earned gains in the last two recessions and have outperformed the bull markets in between. That is why her Investor Educational Retreats, books and private coaching are enthusiastically recommended by Nobel Prize winning economist Gary S. Becker, TD AMERITRADE chairman Joe Moglia, Kay Koplovitz and many Main Street investors who have transformed their lives using her Thrive Budget and investing strategies. Click to view a video testimonial from Nilo Bolden. Cannabis may have gone out of favor with investors, but it is still very popular with its customers. So, why are so many of publicly-traded cannabis companies trading very close to all-time lows? Will the cannabis industry come back, or will investor exodus and cash bleed carry some of the companies into the crypt? The Meme Stock Phenomenon Tilray soared as high as $67 and is now at $6.72/share. HEXO was at $11 and is now 69 cents. Canopy Growth rose to $59. It’s now under $9/share. Cannabis has been a boom and bust investor rollercoaster since weed legalization in Canada in October of 2018. In 2021, many cannabis stocks were meme stocks, adding an extra layer of volatility. Which, if any, of the cannabis companies are a good investment in this price range? Is there a fundamental problem with the industry? As you can see in the chart above, some investors are calling for a $420 price for Tilray. You might think that’s a little outlandish until you consider that those same optimists took GameStop from $5/share to over $350/share. If you’re interested in that kind of Shoot the Moon ride, it’s important to babysit your payload. You’ll need to monitor the news and price swings, and have a rapid-fire profit-taking strategy. It’s a good idea to load up your cannabis stock symbols onto your favorite smart phone stock app. Once a company shoots the moon, it might stay there for just a few hours, only to drop precipitously near the market close that same day. Decriminalization One of the triggers for cannabis climbs tends to be when a major country legalizes. Cannabis shot the moon in September 2018, the month before Canada decriminalized. Tilray soared from $8 to $67 after the House of Representatives voted to decriminalize cannabis in the MORE Act on Dec. 4, 2020. The legislation never got a vote in the Senate. After both events, cannabis stocks dropped back precipitously. Why Has Cannabis Legislation Stalled in the United States? We all had hopes that the USA would make weed completely legal in 2020 or 2021. Those hopes seem to be stuck behind a stalled out Build Back Better plan and bickering over banking, criminal justice reform and recreational use. According to John Hudak, a senior fellow at the Brookings Institute, a supermajority of Americans supports full-scale cannabis reform. However, Congressional bills that include social equity and racial justice in a more comprehensive overhaul of the U.S. cannabis policy are threatened with a Senate filibuster. In the meantime, it looks like Germany might be the next major country to legalize. Even Texas Governor Greg Abbott has become dovish about reform. Stay tuned. $72 Billion Cannabis Market by 2028 Illegal weed takes a bite out of the corporate cannabis Mecca. Nonetheless, the legal market is predicted to grow from $13.5 billion in 2021 to $70.6 billion in 2028 (source GrandviewResearch). Tilray has a goal of hitting $4 billion in revenue by the end of fiscal 2024. That would be about a six-fold increase from their current sales. Tilray is in active acquisition mode with an experienced C-Suite and Board of Directors, so that is not an outlandish goal. Which Cannabis Companies are in Trouble? Most cannabis companies are losing money and trying to expand and innovate to keep up with demand. Cash burn is a serious concern. It can be difficult to separate the winners from the losers because cannabis companies have to be based out of Canada, rather than the U.S., in order to have a bank account. (Yes, that’s how ridiculous the U.S. laws are.) There are legitimate cannabis companies that are trading off the boards in the U.S., with others that are not true contenders. Penny stocks are like a 1000-piece puzzle, where you must turn over 10 times the amount of information you would normally review when evaluating a company. Don’t invest blindly. There could be a shakeout in the industry this year. Some companies may fold. Others might get bought on the cheap, or lag the competition. Canopy Growth has struggled for years -- leading the industry with losses. The fiscal 2021 net loss was $1.7 billion, with $1.3 billion lost the prior year. Canopy Growth's former founder CEO was canned in July of 2019, and replaced by Constellation Brands CFO David Klein. In November of 2021, there was another executive exodus, with the CFO and Chief Product Officer leaving the company. Meanwhile, the Green Organic Dutchman appointed Olivier Dufourmantelle as the president of U.S. Operations. (Dufourmantelle is the former COO of Canopy Growth.) John Bell, who was the chair of the board of Canopy Growth between 2014 and 2020, is now the chair of HEXO's board.) Canopy Growth, Aurora Cannabis and Charlotte’s Web are all cannabis companies that are losing revenue on a year-over-year basis. HEXO’s revenue increased 70% year over year, while The Green Organic Dutchman saw its sales soar by 142%. Email [email protected] with "Cannabis Stock Report Card" in the subject line if you'd like to receive our Cannabis Stock Report Card. The Power of Innovation (and Acquisition) The company that innovates the hottest product tends to be the one that will become 10 times as valuable very quickly. Tilray is betting on a 420 branded craft brewery to be able to take them into the CBD market. HEXO partnered with Molson Coors to create a CBD sparkling beverage brand that is getting five-star reviews. Canopy Growth has bet big on a sports drink called Bio Steel. The Green Organic Dutchman’s product angle is organic farming. Which Cannabis Companies are Ripe for Buying? Most cannabis companies are trading at a multi-year low price. However, that doesn’t mean that all of them are ripe to buy. You might wish to create your own cannabis fund with the companies that you believe are poised for that great product breakthrough, who are also run by executives that can take the company through the end zone. I’ll discuss my favorites and why in an upcoming videoconference. Email [email protected] with VIDEOCON in the subject line to join us live (or receive a link to watch it back). Innovative Properties continues to show impressive revenue growth, but is quite overvalued, with a P/E of 44. Who is Running the Show and Who is On the Team? Tilray is led by Irwin Simon, the former CEO and chairman of Hain/Celestial. Tilray’s team includes the former co-CEO of Whole Foods. The Green Organic Dutchman is surprisingly strong for a microcap, and is clearly on the move, as exhibited by its sales growth and talent acquisition. This penny stock is looking to compete. HEXO’s CEO was ousted on Nov. 19, 2021 and replaced by the Chief Innovation Officer of Molson Coors who had overseen the Truss CBD Beverage launch. HEXO has a new “Path Forward” that will be more conscious about capital preservation. Should You Purchase a Cannabis Fund? The funds that are readily available are offered by lesser-known financial services providers. With the amount of debt and leverage in the world, I would be cautious about investing in a cannabis fund from a company without knowing how well it was capitalized. Smaller fund companies almost folded in March of 2020. The ETFMG Alternative Harvest Fund (symbol: MJ) dropped 77% from its 2019 high to its March 2020 low. The Cambria Cannabis Fund (symbol: TOKE) sank by 66%. Building your own fund will require you babysitting the companies and understanding how to trade meme stocks. If the stocks shoot the moon, the trouble should be worth it. What Can the Company Do? What Can the Industry Do? What Will the Market Do? In the late stage of the business cycle, whenever you are purchasing individual stocks it’s important to also consider what the macro environment is going to do. It’s very difficult for even a strong fish to swim upstream against a crashing tide. While no one is predicting a Wall Street rout in 2022, few are anticipating a roaring bull. (Click to read my 2022 Crystal Ball blog and to watch Schwab’s Chief Investment Strategist’s two cents on equities for the year.) We’ve already determined that the cannabis industry itself should experience tremendous growth, and that there is a strong and swift global shift toward pot legalization. So, the hottest cannabis companies should be experiencing potential tailwinds from the industry itself. There has been a dearth of good news in the headlines. However, when that changes, such as if Germany or Texas legalizes, ready your engines for the rocket ship ride. The low prices of today could put investors on the right side of the trade as the world moves toward decriminalizing cannabis on a more massive scale. We discuss how to add cannabis to your wealth plan without betting the farm, and how to evaluate stocks using our time-proven system, for one full day at our Investor Educational Retreats. You can learn and implement a time-proven, 21st Century investment plan by attending our February 11-13, 2022 Financial Empowerment Retreat. A small investment of time and money could save your nest egg! These time-proven 21st Century strategies earned gains in the Dot Com and Great Recessions, and outperformed the bull markets in between. Call 310-430-2397 or email [email protected] to learn more now. You can also click on the banner ad below to get testimonials, to learn the 15 things you’ll learn at the retreat, and to get pricing and hours information. It’s going to be conducted online, so it feels like it’s you and I talking directly in your living room. It’s a great way to learn, and you have no travel or lodging expenses.  Join us for our New Year New You Financial Empowerment Retreat. Feb. 11-13, 2022. Email [email protected] to learn more. Register with a friend or family member to receive the best price. Click for testimonials & details. Other Blogs of Interest 2022 Crystal Ball in Stocks, Real Estate, Crypto, Cannabis, Gold, Silver & More. Interview with the Chief Investment Strategist of Charles Schwab & Co., Inc. Stocks Enter a Correction Investor IQ Test Investor IQ Test Answers Real Estate Risks. What Happened to Ark, Cloudflare, Bitcoin and the Meme Stocks? Omicron is Not the Only Problem From FAANNG to ZANA MAD MAAX Ted Lasso vs. Squid Game. Who Will Win the Streaming Wars? Starbucks. McDonald's. The Real Cost of Disposable Fast Food. The Plant-Based Protein Fire-Sale What's Safe in a Debt World? Inflation, Gasoline Prices & Recessions China: GDP Soars. Share Prices Sink. The Competition Heats Up for Tesla & Nio. How Green in Your Love for the Planet? S&P500 Hits a New High. GDP Should be 7% in 2021! Will Work-From-Home and EVs Destroy the Oil Industry? Insurance and Hedge Funds are at Risk and Over-Leveraged. Office Buildings are Still Ghost Towns. Money Market Funds, FDIC, SIPC: Are Any of Them Safe? My 24-Year-Old is Itching to Buy a Condo. Should I Help Him? The 12-Step Guide to Successful Investing. Gardeners Creating Sanctuary & Solutions in Food Deserts. 2021 Company of the Year Almost 5 Million Americans are Behind on Rent & Mortgage. Real Estate Hits All-Time High. Rebalancing Your Nest Egg IQ Test. Answers to the Rebalancing Your Nest Egg IQ Test. Videoconferencing in a Post-Pandemic World (featuring Zoom & Teladoc). Sanctuary Sandwich Home. Multigenerational Housing. Interview with Lawrence Yun, the chief economist of the National Association of Realtors. 10 Budget Leaks That Cost $10,000 or More Each Year. The Stimulus Check. Party Like It's 1999. Investor IQ Test 2021. Investor IQ Test Answers 2021 Crystal Ball. Would You Pay $50 for a Cafe Latte? Is Your Tesla Stock Overpriced? 10 Questions for College Success. Is FDIC-Insured Cash at Risk of a Bank Bail-in Plan? 8 Money Myths, Money Pits, Scams and Conspiracy Theories. Why Are My Bonds Losing Money? The Bank Bail-in Plan on Your Dime. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable. However, NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors.  About Natalie Pace Natalie Wynne Pace is an Advocate for Sustainability, Financial Literacy & Women's Empowerment. She has been ranked as a No. 1 stock picker, above over 835 A-list pundits, by an independent tracking agency (TipsTraders). The ABCs of Money remained at or near the #1 Investing Basics e-book on Amazon for over 3 years (in its vertical), with over 120,000 downloads and a mean 5-star ranking. The 5th edition of The ABCs of Money was released on September 17, 2021. Natalie Pace's easy as a pie chart nest egg strategies earned gains in the last two recessions and have outperformed the bull markets in between. That is why her Investor Educational Retreats, books and private coaching are enthusiastically recommended by Nobel Prize winning economist Gary S. Becker, TD AMERITRADE chairman Joe Moglia, Kay Koplovitz and many Main Street investors who have transformed their lives using her Thrive Budget and investing strategies. Click to view a video testimonial from Nilo Bolden. Easy money versus tight money. That’s probably the best way to think about 2022, as opposed to 2021. In 2021, there were a lot of stimulus checks and pauses on payments. If you rented, you couldn’t be evicted. If you owed student loan debt, you could pause it (through May 1, 2022). If you had a mortgage that was too much for the budget, you could even forego paying without risk of a foreclosure. This year, we’ll begin paying the borrowed money back – at a higher interest rate. Last year, consumers had high levels of savings. That’s been wiped out. We are starting to see red flags that consumption will wane, particularly with regard to real estate, cars, and large household goods. Since the consumer drives almost 70% of economic growth in the United States, that means 2022 economic growth is expected to slow from 2021's 5.7% GDP growth. The Federal Reserve Board is still predicting 4.0% GDP growth in the U.S., however. China’s GDP should be above 5.0%, and perhaps as high as 5.6%. World GDP growth is predicted to be 4.8% (source: IMF). That’s not Armageddon. However, if some of the risk factors become heightened, growth will be impacted. Oil High oil prices have a high correlation with recessions and stock market downturns. This has a lot to do with the drag that gasoline prices have on the family budget. Recessions are preceded by stock market downturns. Stocks 2022 is unlikely to produce the 27% rise that the S&P500 experienced in 2021. If you haven’t rebalanced recently, or worse, in a number of years, now is a very good time for you to know what you own, to be properly diversified and to rebalance and capture some gains. There are a few sections of the market that have been destroyed, and are trading for a better price than we’ve seen in years. There is room in a balanced plan for buying low and selling high – without making it an “all in or all out” proposition. What do you need to watch out for and be aware of? Zombie companies, many of which are in retail, travel and hospitality, are not making enough money to pay the interest on the debt they’ve borrowed. Meme stocks are highly volatile, even if the underlying business is sound. In your retirement plan, the pie charts can offer you protection and performance, whereas those target date retirement plans underperform the S&P500. If you want to trade stocks (and have the stomach for it), then you need to understand the basics and also what’s changed in the past two years. We spend one full day on evaluating stocks (winners and losers) at the Investor Educational Retreat. Small caps underperformed during the pandemic, while large companies (including zombies) had an easier time beefing up their treasury. Value funds may include more zombies than investors are aware of. So, as support is being pulled back, it’s important to find value in non-traditional ways and in other parts of the world, where equities are on sale. Real Estate The cure for high prices is high prices. A housing affordability crisis, combined with rising interest rates, has tanked consumer sentiment on their intentions to purchase homes, cars and large household goods. Most economists do not predict a House of Cards as terrible as The 2008 Great Recession crisis. However, there will be pressure on households, particularly once the student loans have to be paid again (5.1.2022). Rising interest rates will limit the amount of buyers who can qualify for a loan. With fewer buyers, anyone who wants to sell will be under pressure to lower prices as interest rates rise. Homeowners want to adhere to the age-old rules. Buy what you can afford. Purchase for a good price (not at an all-time high). Lock in your fixed rate now. Bonds There was simply no appetite for lenders to put much pressure on corporations and municipalities during the pandemic. However, rising interest rates are going to make existing bonds less valuable. There will be a sweet spot when bond yields pay you to take on the risk. However, in today’s world you’re still at risk of losing money on the fixed income side, and also of having your money tied up for too long. It’s very important that you look at the safe side of your bond portfolio and to know what you own. Keep the credit worthiness very high and the terms very short. Because so many bonds are at risk of poor credit quality, negative yields and illiquidity, I would be underweighting them. Getting safe should mean not having your principal at risk. Cryptocurrency Bitcoin is down 43% from its all-time high of $69,000, set on Nov. 9, 2021. Elon Musk recently announced that Dogecoin could be used for certain Tesla products. However, that didn’t even move the needle on Dogecoin – yet. Cryptocurrency is still a Wild West trading platform, one where Main Street tends to get crushed by the whales. If you use our nest egg pie chart slice system, you will be prompted to trim high and add low to your cryptocurrency holdings, which will help you to be more on the right side of the trade. One undercurrent that many traders are not factoring in is the massive carbon footprint of Bitcoin and Ethereum. If young traders begin factoring this in, it might make the alt coins more attractive. Gold Gold keeps trying to push through its all-time high of $2,089.20 that was set back in January 2021. What will make gold soar in 2022? If stocks fall and investors lose faith in the dollar, then there could definitely be a flight to gold. Remember, however, that the younger generation thinks of cryptocurrency as their hedge against a weak dollar. That sentiment has definitely muted the performance of gold and silver. If the dollar remains strong against other world currencies, and if stocks remain high, then you’ll probably see gold continue to trade in the range between $1700 and $2000 an ounce. If stocks see weakness in 2021 or 2022, due to valuation pressures, slower growth or as a result of the zombie corporations making headlines, that would be positive for gold, and even more positive for silver. Silver Silver is still trading very low from its all-time high. Silver’s all-time high was close to $50 an ounce, and it is currently in the $22/ounce range. Gold and silver typically run in parallel to one another. So, if you’re interested in gold, you might consider its shadow, silver, as the better bargain. Cannabis With regard to cannabis, there are certain companies that are operated by experienced executives, while others are struggling under newbie start-up CEOs. Anytime there is any hot new industry, you have to be worried about scams and phishing, particularly if it’s calling itself a club. Cannabis legislation has been on the back burner in the United States. However, there appears to be a growing appetite for legalization in Germany. In the past, when a major country legalizes cannabis, all cannabis stocks have a meteoric rise. They can also have a sonic boom-type fall. So, you have to be aware of how to play a “shoot the moon” stock. Cannabis stocks, even ones that are a cannabis lifestyle hybrid, soar and crash on decriminalization legislation. Currently, the cannabis equities are in a crash mode, and could be a very good buying opportunity. However, you have to have a trader’s mentality. This is not as easy as just setting a limit order. That is why we spend one full day on how to play hot stocks (and avoid the losers) at the Investor Educational Retreat. When Will U.S. Legalization Happen There is an appetite in the U.S. to decriminalize cannabis. The number of states moving to legalize pot has happened faster than anything I’ve seen in my lifetime. Senators Elizabeth Warren and Cory Booker have asked the Department of Justice to delist marijuana from controlled substances. Many Republicans are pro-pot, including the former Speaker of the House John Boehner, who was on the board of Acreage. So, what is the holdup? It’s partisan bickering. The Democrats can’t afford to advance cannabis decriminalization bills until after they address voting rights and the Build Back Better Biden proposal. The only way cannabis decriminalization gets advanced before the midterm election is if there is a political advantage at the voting booth. Meanwhile, we might continue to see states moving forward with their own legalization legislation. Healthcare, Utilities & REITs Schwab has healthcare on an outperform, with utilities on an underperform, due to valuation concerns. With investors looking for a higher yield, it’s possible that utilities will continue to do well, in my humble opinion. REITs, particularly commercial real estate, malls and hotel chains, could be vulnerable to rising interest rates. You have to know what you own, and understand that the higher the dividend, the higher the risk. With real estate prices at an all-time high, homebuilders have benefitted. However, we might be at the pinnacle of that trend. You can read about our time-proven 21st-century strategies in The ABCs of Money, or you can learn and implement this time-proven plan by attending our February 11-13, 2022 Financial Empowerment Retreat. A small investment of time and money could save your nest egg! These time-proven 21st Century strategies earned gains in the Dot Com and Great Recessions, and outperformed the bull markets in between. Call 310-430-2397 or email [email protected] to learn more now. You can also click on the banner ad below to get testimonials, to learn the 15 things you’ll learn at the retreat, and to get pricing and hours information. It’s going to be conducted online, so it feels like it’s you and I talking directly in your living room. It’s a great way to learn, and you have no travel or lodging expenses.  Join us for our New Year New You Financial Empowerment Retreat. Feb. 11-13, 2022. Email [email protected] to learn more. Register with a friend or family member to receive the best price. Click for testimonials & details. Other Blogs of Interest Interview with the Chief Investment Strategist of Charles Schwab & Co., Inc. Stocks Enter a Correction Investor IQ Test Investor IQ Test Answers Real Estate Risks. What Happened to Ark, Cloudflare, Bitcoin and the Meme Stocks? Omicron is Not the Only Problem From FAANNG to ZANA MAD MAAX Ted Lasso vs. Squid Game. Who Will Win the Streaming Wars? Starbucks. McDonald's. The Real Cost of Disposable Fast Food. The Plant-Based Protein Fire-Sale What's Safe in a Debt World? Inflation, Gasoline Prices & Recessions China: GDP Soars. Share Prices Sink. The Competition Heats Up for Tesla & Nio. How Green in Your Love for the Planet? S&P500 Hits a New High. GDP Should be 7% in 2021! Will Work-From-Home and EVs Destroy the Oil Industry? Insurance and Hedge Funds are at Risk and Over-Leveraged. Office Buildings are Still Ghost Towns. Money Market Funds, FDIC, SIPC: Are Any of Them Safe? My 24-Year-Old is Itching to Buy a Condo. Should I Help Him? The 12-Step Guide to Successful Investing. Gardeners Creating Sanctuary & Solutions in Food Deserts. 2021 Company of the Year Almost 5 Million Americans are Behind on Rent & Mortgage. Real Estate Hits All-Time High. Rebalancing Your Nest Egg IQ Test. Answers to the Rebalancing Your Nest Egg IQ Test. Videoconferencing in a Post-Pandemic World (featuring Zoom & Teladoc). Sanctuary Sandwich Home. Multigenerational Housing. Interview with Lawrence Yun, the chief economist of the National Association of Realtors. 10 Budget Leaks That Cost $10,000 or More Each Year. The Stimulus Check. Party Like It's 1999. Investor IQ Test 2021. Investor IQ Test Answers 2021 Crystal Ball. Would You Pay $50 for a Cafe Latte? Is Your Tesla Stock Overpriced? 10 Questions for College Success. Is FDIC-Insured Cash at Risk of a Bank Bail-in Plan? 8 Money Myths, Money Pits, Scams and Conspiracy Theories. Why Are My Bonds Losing Money? The Bank Bail-in Plan on Your Dime. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable. However, NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors.  About Natalie Pace Natalie Wynne Pace is an Advocate for Sustainability, Financial Literacy & Women's Empowerment. She has been ranked as a No. 1 stock picker, above over 835 A-list pundits, by an independent tracking agency (TipsTraders). The ABCs of Money remained at or near the #1 Investing Basics e-book on Amazon for over 3 years (in its vertical), with over 120,000 downloads and a mean 5-star ranking. The 5th edition of The ABCs of Money was released on September 17, 2021. Natalie Pace's easy as a pie chart nest egg strategies earned gains in the last two recessions and have outperformed the bull markets in between. That is why her Investor Educational Retreats, books and private coaching are enthusiastically recommended by Nobel Prize winning economist Gary S. Becker, TD AMERITRADE chairman Joe Moglia, Kay Koplovitz and many Main Street investors who have transformed their lives using her Thrive Budget and investing strategies. Click to view a video testimonial from Nilo Bolden. |

AuthorNatalie Pace is the co-creator of the Earth Gratitude Project and the author of The Power of 8 Billion: It's Up to Us, The ABCs of Money, The ABCs of Money for College, The Gratitude Game and Put Your Money Where Your Heart Is. She is a repeat guest & speaker on national news shows and stages. She has been ranked the No. 1 stock picker, above over 830 A-list pundits, by an independent tracking agency, and has been saving homes and nest eggs since 1999. Archives

July 2024

Categories |

RSS Feed

RSS Feed