|

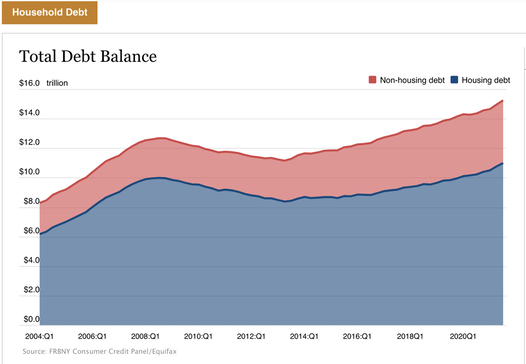

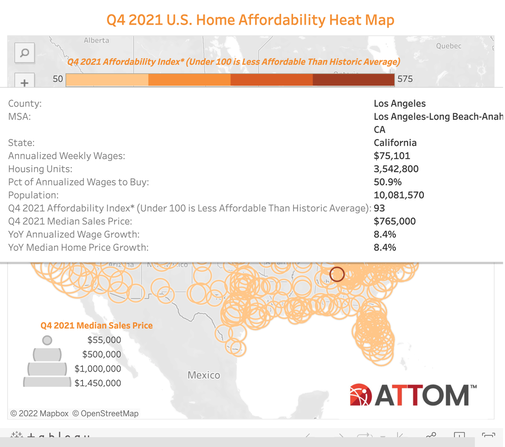

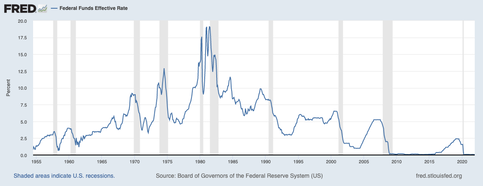

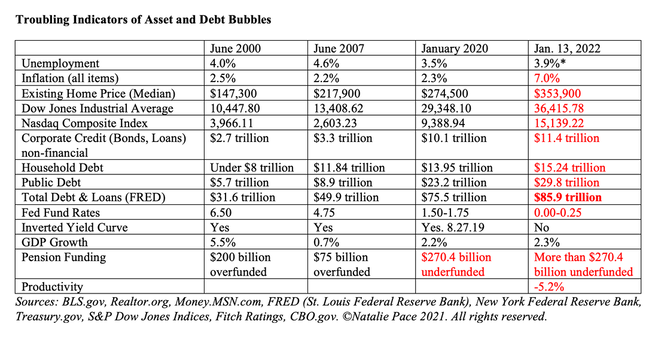

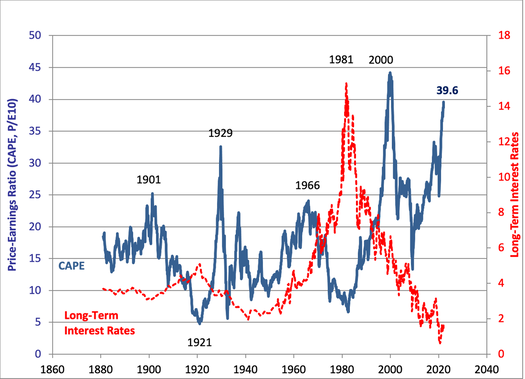

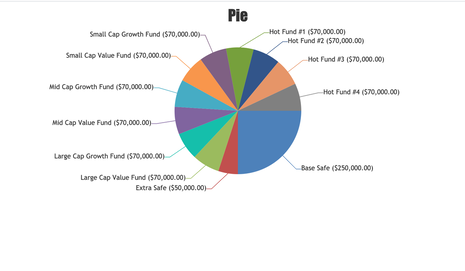

Let’s start with the good news. The median price of a single-family existing home was $353,900 in November 2021 (source: National Association of Realtors). (This is lower than it was in June, when prices hit an all-time high of $362,800.) Interest rates are at rock-bottom. Student loan payments were recently paused through May 1, 2022. Low interest rates, government support, Work From Home, and a flight to more affordable suburbs lit housing on fire in 2020 and 2021. What will 2022 bring? The U.S. Economy in 2022 2021 GDP growth should come in at 5% or may be slightly higher. The 4Q 2021 GDP growth could actually be 4.7% or higher, which is a great deal better than 3Q’s 2.3%. When this is reported by the Bureau of Economic Analysis on January 27, 2022, investors might get happy again. We certainly have seen a lot of volatility on Wall Street, with the NASDAQ Composite Index down 6% on the year, as of the Jan. 14, 2022 close. How will Main Street homeowners react to the news? Home sales could continue to remain strong – until student loans must be paid, lenders rein in their loan approvals and interest rates rise, in May/June of this year. We’ll get our first look at the 2022 economy at the end of April, when the 1Q 2022 GDP is reported. Predictions are that 2022 GDP growth will be around 4.0%. It’s important to remember that investors are forward thinking. Institutional money is aware that the Fed Fund Rate is expected to rise on June 15, 2022, and again on September 21, 2022. The Fed Fund Rate is projected to be close to 1% by the end of 2022, and at 1.75% by the end of 2023 – unless inflation forces the Federal Reserve to act more aggressively. So, while housing might remain strong until summer, publicly-traded homebuilders might find themselves out of favor a few months before. (If you haven’t locked in your personal mortgage fixed rate, now is a great time to do so.) Unaffordability is Another Headwind for Housing 77% of counties are registering in the unaffordable price range, according to Attomdata. With housing taking up 25.2% of wages for homebuyers, on average, lenders are likely to be a lot pickier about who is approved for a mortgage. It’s also important to note that consumer debt hit an all-time high of $15.24 trillion in the third quarter of 2021. Add inflation to the mix of rising interest rates, the end of government support, unaffordable housing and tighter bank policies, and we could be seeing a dramatically reduced pool of buyers for real estate. Homeowners I’m hearing first-time homebuyers talking about purchasing now to “lock in the low interest rates.” However, it’s even more important to understand what happens if you buy high, and the price of your home drops dramatically. When you have an underwater mortgage, your credit score plunges. You could be locked into a home that you can’t sell, with a lousy credit score, for up to a decade. The cycles in real estate are long. The high before the Great Recession was in 2006. The low occurred in 2011, and the recovery to 2006 prices didn’t happen until 2015. If you or someone you care about are thinking of buying a home at this time, it’s very important to go through the checklist that is outlined in the Real Estate section of the 5th edition of The ABCs of Money. It would also be a good idea to read the case studies that are listed there. One example illustrates a person who watched too many get-rich-quick ads and lost everything in 2008-2009, while another features a family that purchased low in 2011, doubled their money by 2017, and then used the proceeds to build an off-grid solar home. Homebuilder Stocks Homebuilders, such as Hovnanian, Toll Brothers, KB home and Beazer Homes are all below investment grade, with very high debt. That means that few of these companies pay dividends. Their share prices soared in 2021 because housing was on fire. Hovnanian stock was trading at $6.44 in April 2020. It closed on January 14, 2022, at $120/share. KB home was it $12/share on March 23, 2020, and is now at $49. If you purchase these stocks now, you’re buying at a 4-year high. Could the stocks go higher? Homebuilders traded much higher in 2005, during the last housing heyday. Most of these homebuilders have a very large backlog. However, they are also affected by a supply shortage in building materials. (Supply chain issues hit Beazer Homes revenue in the 3rd quarter of 2021.) Most homebuilders are reporting extremely low cancellation rates – another good sign. But it is important to remember that cancellation rates were as low as they are now back in 2006, at 15%, but jumped to 42% by the end of 2008. The Optimism (Delusion?) of Commercial Real Estate CEOs In the 3Q 2021 earnings call, Boston Properties CEO Owen D. Thomas predicted that “It's only a matter of time before employers more strongly encourage their teams to return to in-person work.” Meanwhile BXP‘s leading region is New York City, and it is only 52% occupied. San Francisco is a ghost town with only 18% occupancy. Subleases are elevated and are going for under the market rate. Technology CEOs are embracing Work From Home. And Citrix did a survey with Millennials and Gen Z that showed 90% do not want to return to the office full-time and half wish to work from home full-time. One of the biggest reasons why the two largest working demographics don’t want to return to the city and the skyscraper office is that cities are just too expensive to live in. It’s important to remember that long-term leases are keeping the revenues at these office buildings stable. If a company wants to break the lease, there are punitive fees to pay. WeWork is perhaps the biggest red flag in this industry. The company took on long-term leases and required only a short-term commitment before Work From Home became a trend. It is believed that a great deal of the subleases on the market in NYC are from WeWork. (Building owners aren’t disclosing which tenants are subleasing.) WeWork recently went public via a SPAC. The company has a CCC+ rating with a negative outlook, lost $844 million in the 3rd quarter and has lower revenue in 2021 than it did in 2020 (by -18.5%). Judging from the surveys conducted by Citrix, Work-From-Home is a structural shift that is not going to go away. The Great Resignation that is currently happening has shifted the power from employers to the employed. Companies are forced to raise salaries, increase benefits and make concessions (such as flexible schedules and WFH) to attract talent. Private Placement REITs Private placement rates are even more troublesome. Many of these companies are cash negative and have been for quite a while. They pay a high yield to investors and a very high commission to broker-salesmen. If you’re being sold into these products as a safe way to earn income, then you better read D&T’s story. They fell for that sales pitch, and lost 18% of their principal. One of the most important market aphorisms is this: the higher the dividend, the higher the risk. https://www.nataliepace.com/blog/they-trusted-him-now-he-doesnt-return-calls Malls Malls are reporting 90% occupancy. However, a walk through the mall yields different results, with far more than 10% of the storefronts papered over with advertising or just glaringly empty. How are malls are coming up with their numbers? It could have something to do with accrual accounting or leases, even though the actual store fronts are shuttered. However, when the story that you hear doesn’t add up to what you’re seeing, that’s a red flag. Some of the biggest mall REITs pay 3-4% yield. You’re not getting paid very much at 3-4%, particularly if your principal investment is at risk of evanescing. Rising Interest Rates and Recessions At his confirmation hearing, Federal Reserve Board Chairman Jerome Powell made it clear that interest rates must rise to cool off inflation. The Summary of Economic Projections revealed that most of the Federal Reserve Board Governors believe interest rates will be closer to 2% by the end of 2023. That’s a lot higher than it is now, at zero. The chart below reveals just how correlated recessions are with rising interest rates. (The gray lines indicate the recessions.) The Federal Reserve Board will try to negotiate a soft landing – to raise rates without triggering a plunge in asset prices. However, as was mentioned in the Financial Stability Report released in November of 2021, “Asset prices remain vulnerable to significant declines should investor risk sentiment deteriorate, progress on containing the virus disappoint, or the economic recovery stall.” 2022 isn’t expected to stall, but it is expected to slow down. “As the pandemic arrived our immediate challenge was to stave off a full scaled depression,” according to Jerome Powell. During the pandemic, stocks and real estate prices soared, while debt became absolutely astronomical. A depression was averted. However, it will take decades to pay off the trillions that have been borrowed. The combination of expensive assets and overleverage are two of the reasons why we see such outsized and swift corrections in 21st-century recessions. Below are stock charts from the last three recessions. As you can see, the S&P 500 dropped 38% in the 2020 pandemic. The Dow Jones Industrial Average sank 55% in the Great Recession. It took 6 years to climb back to the 2007 highs (by 2013). The NASDAQ Composite Index plunged 78% in the Dot Com Recession, and took 15 years to recover. Now would be a very good time to know what you own, and to begin underweighting real estate. It’s very important to understand what a properly diversified portfolio looks like, and not just rely upon somebody else to do this for you. If you had the nerve to lean into housing at the bottom in March 2020, then you have done quite well. Now is a great time to take your profits. If you’re interested in a 2nd opinion on your current plan, email [email protected] with 2nd opinion in the subject line to receive pricing and information. You can learn the ABCs of money that we all should have received in high school, including time proven 21st-century strategies, at our February 11-13, 2022 online Investor Educational Retreat. Call 310-430-2397 or email [email protected] to learn more now.  Join us for our New Year New You Financial Empowerment Retreat. Feb. 11-13, 2022. Email [email protected] to learn more. Register with a friend or family member to receive the best price. Click for testimonials & details. Other Blogs of Interest What Happened to Ark, Cloudflare, Bitcoin and the Meme Stocks? Omicron is Not the Only Problem From FAANNG to ZANA MAD MAAX Ted Lasso vs. Squid Game. Who Will Win the Streaming Wars? Starbucks. McDonald's. The Real Cost of Disposable Fast Food. The Plant-Based Protein Fire-Sale What's Safe in a Debt World? Inflation, Gasoline Prices & Recessions China: GDP Soars. Share Prices Sink. The Competition Heats Up for Tesla & Nio. How Green in Your Love for the Planet? S&P500 Hits a New High. GDP Should be 7% in 2021! Will Work-From-Home and EVs Destroy the Oil Industry? Insurance and Hedge Funds are at Risk and Over-Leveraged. Office Buildings are Still Ghost Towns. Money Market Funds, FDIC, SIPC: Are Any of Them Safe? My 24-Year-Old is Itching to Buy a Condo. Should I Help Him? The 12-Step Guide to Successful Investing. Gardeners Creating Sanctuary & Solutions in Food Deserts. 2021 Company of the Year Almost 5 Million Americans are Behind on Rent & Mortgage. Real Estate Hits All-Time High. Rebalancing Your Nest Egg IQ Test. Answers to the Rebalancing Your Nest Egg IQ Test. Videoconferencing in a Post-Pandemic World (featuring Zoom & Teladoc). Sanctuary Sandwich Home. Multigenerational Housing. Interview with Lawrence Yun, the chief economist of the National Association of Realtors. 10 Budget Leaks That Cost $10,000 or More Each Year. The Stimulus Check. Party Like It's 1999. Investor IQ Test 2021. Investor IQ Test Answers 2021 Crystal Ball. Would You Pay $50 for a Cafe Latte? Is Your Tesla Stock Overpriced? 10 Questions for College Success. Is FDIC-Insured Cash at Risk of a Bank Bail-in Plan? 8 Money Myths, Money Pits, Scams and Conspiracy Theories. Why Are My Bonds Losing Money? The Bank Bail-in Plan on Your Dime. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable. However, NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors.  About Natalie Pace Natalie Wynne Pace is an Advocate for Sustainability, Financial Literacy & Women's Empowerment. She has been ranked as a No. 1 stock picker, above over 835 A-list pundits, by an independent tracking agency (TipsTraders). The ABCs of Money remained at or near the #1 Investing Basics e-book on Amazon for over 3 years (in its vertical), with over 120,000 downloads and a mean 5-star ranking. The 5th edition of The ABCs of Money was released on September 17, 2021. Natalie Pace's easy as a pie chart nest egg strategies earned gains in the last two recessions and have outperformed the bull markets in between. That is why her Investor Educational Retreats, books and private coaching are enthusiastically recommended by Nobel Prize winning economist Gary S. Becker, TD AMERITRADE chairman Joe Moglia, Kay Koplovitz and many Main Street investors who have transformed their lives using her Thrive Budget and investing strategies. Click to view a video testimonial from Nilo Bolden. Comments are closed.

|

AuthorNatalie Pace is the co-creator of the Earth Gratitude Project and the author of The Power of 8 Billion: It's Up to Us, The ABCs of Money, The ABCs of Money for College, The Gratitude Game and Put Your Money Where Your Heart Is. She is a repeat guest & speaker on national news shows and stages. She has been ranked the No. 1 stock picker, above over 830 A-list pundits, by an independent tracking agency, and has been saving homes and nest eggs since 1999. Archives

July 2024

Categories |

RSS Feed

RSS Feed