|

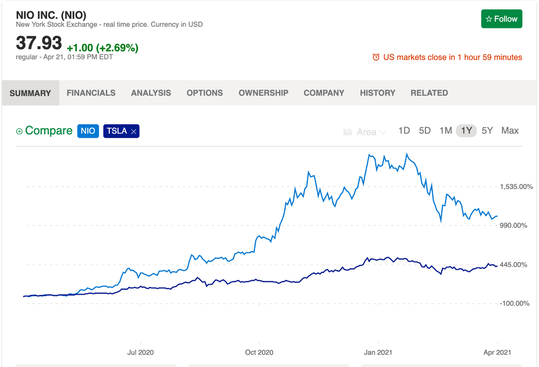

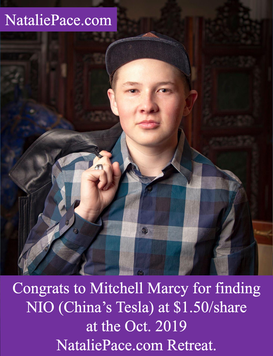

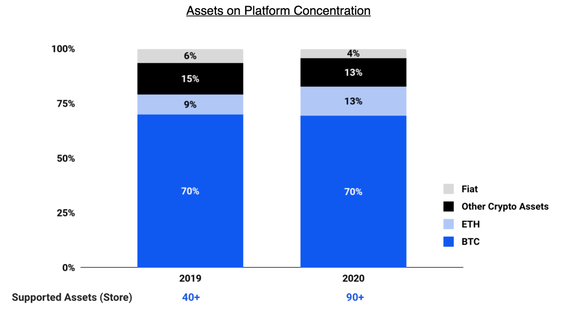

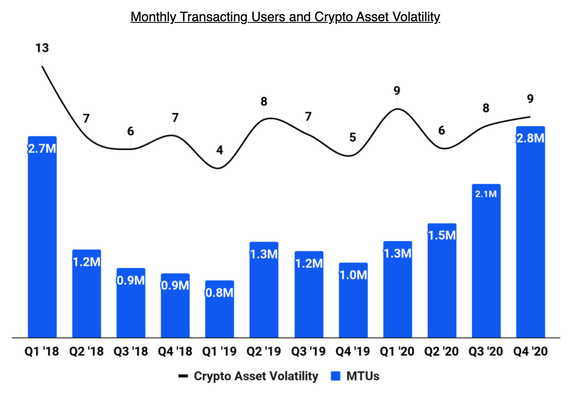

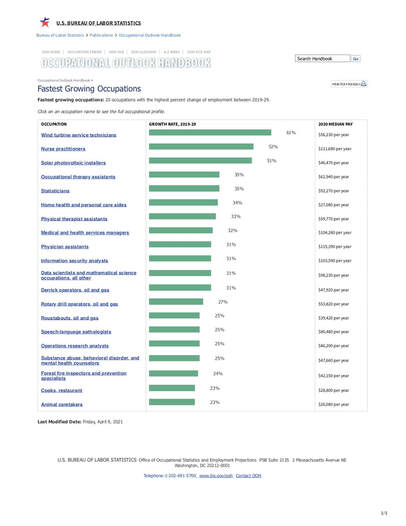

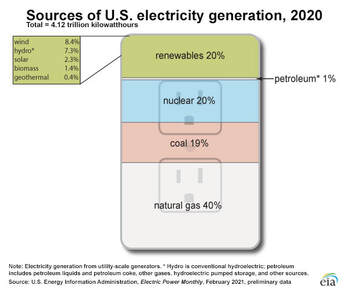

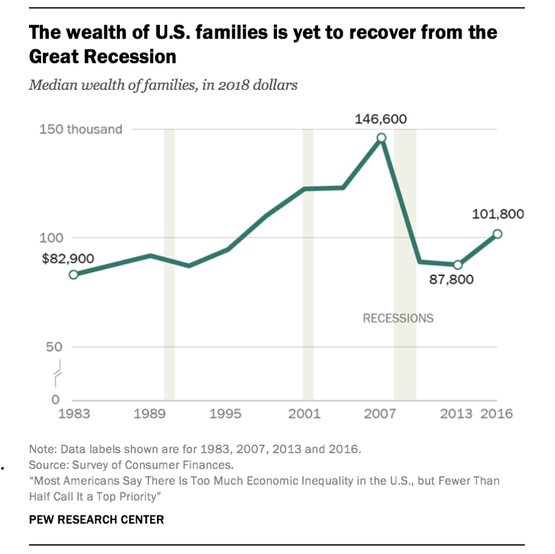

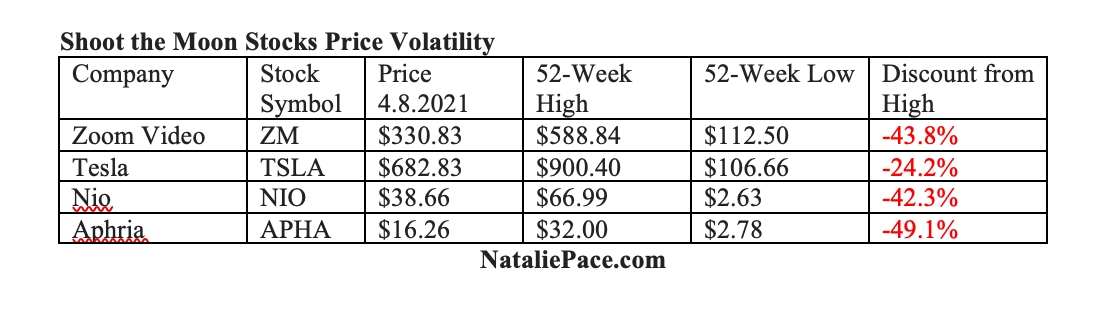

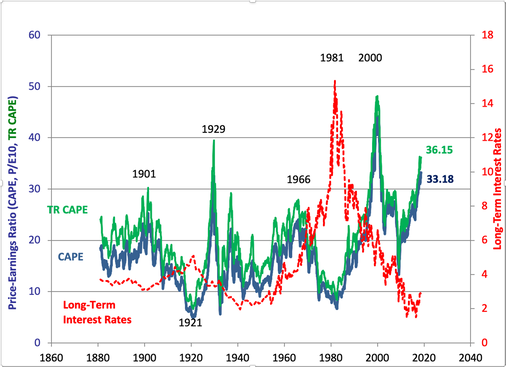

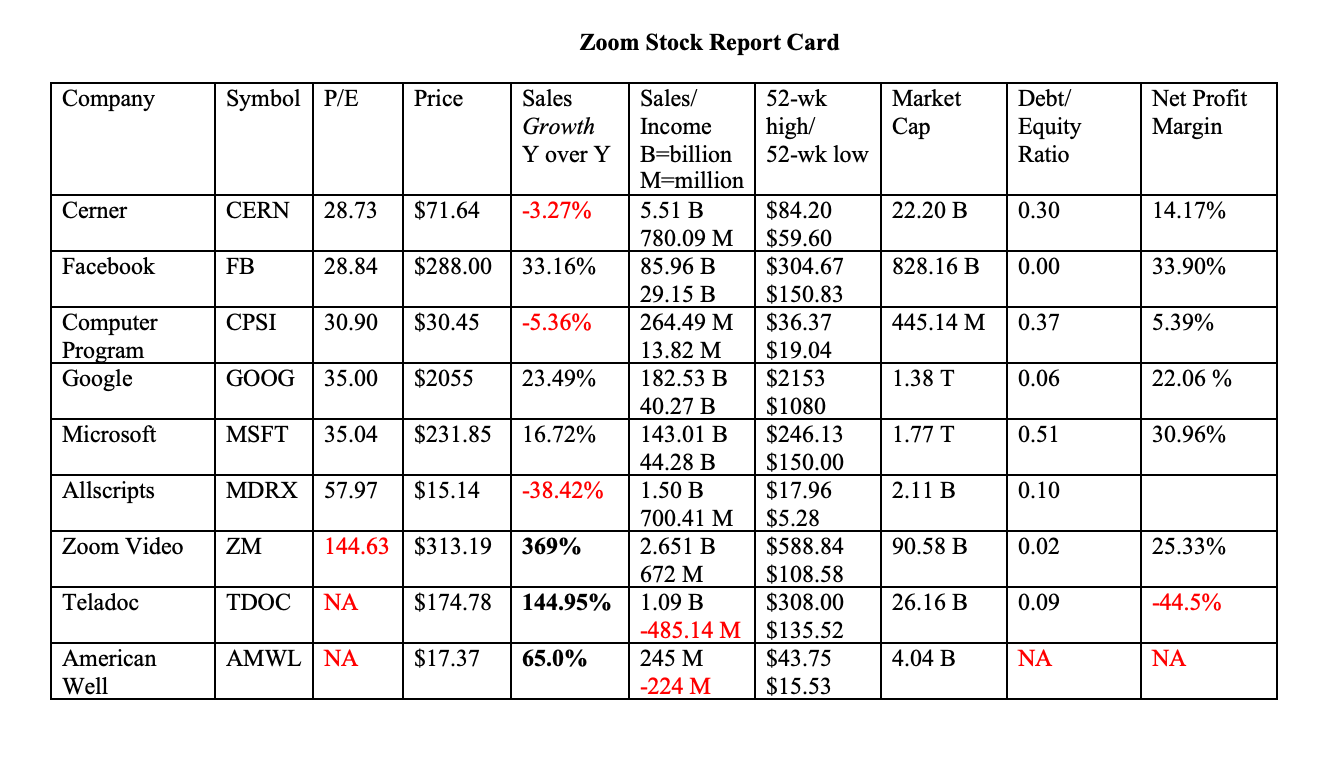

Tesla and Nio Will Report Spectacular Earnings Next Week. Will the semiconductor shortage ruin things going forward? Tesla reported another record-breaking production and delivery achievement earlier this month, with 185,000 deliveries and 180,000 vehicles produced. That is more than double the amount of cars delivered a year ago, with a 75% increase in production. Revenue could top $11 billion. If the net income is on par or higher than the 4th quarter of 2020, at $270 million, that will be a 17-fold increase for last year. Before you get too excited: that good news is already priced into the company shares. Keep reading. Is the Semiconductor Shortage an Issue for Tesla? While other auto manufacturers, including Ford, General Motors and Nio, were pausing production because they couldn’t get the semiconductors they needed, Tesla’s Elon Musk was tweeting thanks to their suppliers for keeping them in the parts. Does that mean that Tesla is well-stocked going forward and will not have any issues? In a letter to the Commerce Department on April 5, 2021, John Bozzella, the President and CEO of the Alliance for Automotive Innovation, wrote that the semiconductor manufacturers warn that the shortage could continue for an additional six months. Intel’s new CEO Pat Gelsinger warned that it could take up to two years to iron out all of the issues. Tesla benefits by being the largest U.S. auto manufacturer by far, with a market capitalization of $690 billion, compared to $45 billion at Ford, $125 billion at General Motors and $61 billion at Nio (China’s Tesla). With Tesla’s reputation for innovation, and success at putting electric vehicles and self-driving on the map, the company’s relationships with semiconductor manufacturers has legacy standing. Tesla could be first in line for semiconductors, ahead of the competition. The Evolution of the Auto Industry G.M. has promised to sell only zero-emissions vehicles by 2035, with a plan to be carbon neutral by 2040, and powered only by renewable energy by 2030. Mary Barra, GM’s CEO, sees a future of “zero crashes, zero emissions and zero congestion.” The auto industry has a large footprint in our economy, contributing up to $1.1 trillion and 5.5% to the U.S. GDP. So, no politician or business leader wants to see car sales or vehicle production drop dramatically. The semiconductor industry is seizing the opportunity and is ramping up quickly to address the shortage. However, setting up factories is not something that can be done quickly. While the bottleneck continues, rising costs can impact the profitability of auto manufacturers that are already heavily indebted. All of this makes it more difficult to justify the very lofty valuations that we are seeing in the auto manufacturers. Tesla’s market cap is $700 billion, while it is still netting less than $1 billion in income per year. That puts its price-earnings ratio at 1016. The average PE is 16-17. (Wouldn’t you love to have a company that makes less than a billion in net income, but is worth $700 billion?) All stocks in the U.S. are very pricey at this point, with an average PE (Professor Robert Shiller's CAPE) of 33. The 6.5% predicted 2021 GDP growth is built-in to the price. So, a market rally through the rest of the year is not necessarily a given, particularly since we still have a debt ceiling debate coming up in July, and a potential credit downgrade from Fitch Ratings this year. (Fitch Ratings has had the U.S. on a negative outlook for its AAA rating since July of 2020.) Check out my blog for additional information on the 2021 outlook. The Semiconductor Industry is Hot, Hot, Hot Nvidia, a leader in autonomous driving chips and other semiconductors, saw its revenue jump by 61% in the most recent quarter (year over year). Intel hopes to benefit from the surge in demand going forward, but saw flat sales in the last quarter. The entire semiconductor industry is in a boom cycle. Nio: China’s Tesla Tesla has been all the rage in the U.S. However, Nio’s revenue and share price growth is dwarfing that of Tesla. Nio’s 1Q 2021 vehicle deliveries report was meteoric. 1Q 2021 deliveries increased 408% to 19,500 vehicles, from 3,838 a year ago. That’s 550 vehicles shy of their first devliery announcement earlier this month, due to a 5-day factory shutdown caused by the semiconductor shortage. Nio is offering sleek, sexy EVs that are priced slightly lower than Tesla’s. The power and weight of the Chinese economy and the demand of the Chinese consumer could help Nio to be first in line for semiconductor distribution going forward. Nio is scheduled to report their 1Q 2021 earnings on April 29, 2021, after the U.S. market close. Incidentally, Nio was first discovered at our October 2019 Investor Educational Retreat by Mitchell Marcy, when the company share price was under $2.00. We featured the company in our blog a few months later, when the company was trading at about $13.00. Nio’s shares have soared as high as $67.00 and are currently trading at $38.00. Bottom Line Technology, artificial intelligence, clean energy, electric vehicles and other products of the 21st-Century are hot. However, the amazing growth that many of these industries are experiencing is already overpriced into the shares. So, you have to be very cautious about not purchasing shares at an all-time high, and equally diligent about profit-taking when valuations get too lofty. The easiest way to do all of this is through our pie chart nest egg strategies. We teach it at our Investor Education Retreats. The next one is this weekend. Call 310-430-2397 or email [email protected] to learn more and register now. Join us for our April 24-26, 2021 Financial Empowerment Retreat. (Click to learn more.) In 3 days, you'll learn how to pick great companies (like Zoom Video, Tesla, Aphria, Veritone and Nio), incorporate them into a well-diversified wealth plan, receive a complete Money Makeover and transform your life forever! Bring your friends, family and teens for an unbelievably low group rate. Call 310-430-2397 or email [email protected] to learn more now.  Natalie Pace Financial Empowerment Retreat. April 24-26, 2021. Call 310-430-2397 or email [email protected] to learn more. Receive the best price when you register with friends and family. Other Blogs of Interest The Coinbase IPO. Restore Our Earth on April 22nd (and Every Earth Day). Should You Sell in May and Go Away? Adding Shoot the Moon Performance to Your Nest Egg. Videoconferencing in a Post-Pandemic World (featuring Zoom & Teladoc). Sanctuary Sandwich Home. Multigenerational Housing. Interview with Lawrence Yun, the chief economist of the National Association of Realtors. 10 Budget Leaks That Cost $10,000 or More Each Year. The Stimulus Check. Party Like It's 1999. Kushner's Times Square Building Plunges 80% in Value. Will There be a Spring Rally? Cannabis and the Road to Decriminalization in the U.S. Hot ETFs Return Up to 50% Since October. Investor IQ Test 2021. Investor IQ Test Answers Shoot the Moon Stock Picks 2021 Crystal Ball. Would You Pay $50 for a Cafe Latte? Is Your Tesla Stock Overpriced? Can Medmen Avoid Bankruptcy? Bitcoin is Back, Baby! Real Estate Prices are Going Up. And Down. Movie Theaters are in Trouble Airbnb Should Have a Spectacular IPO Today. Cannabis is Decriminalized. Stocks Triple. Airbnb's IPO. Should Hosts Invest? Gifts Under $5 and Free. Thanksgiving in a Pandemic. The Sustainability Silver Lining. Secretary Mnuchin Halts Bailouts Money Stress Killed My Friend Real Estate and Housing 2021. Challenges & Opportunities Real Estate in a Pandemic. Interview with Mike Fratantoni, the Chief Economist of the Mortgage Bankers Association. Bonds are Illiquid & Negative-Yielding. Annual Rebalancing is a Buy Low, Sell High Plan on Auto-Pilot. 5 Red Flags of a Financial Implosion Will Regeneron Be Approved Before the Election? Tesla Will Have an Outstanding Earnings Report Should You Wait Until After the Election to Fix Your Wealth Plan? The October Surprise Is Your Bank a Junk Bond Do Stocks Fare Better Under Democrats or Republicans? Put Your Money Where Your Heart Is. Crystal Ball for the Remainder of 2020 (Including the Election). Microcap Gaming Company Doubles 2Q 2020 Revenue. Apple & Tesla Stock Splits. Schwab's Chief Fixed Income Strategist on What's Safe. China's Tesla (Nio). 2Q Sales Soar. Why Are You Still Renting? (Errr. There is More Than This to Consider!) MedMen's Turnaround Plan Attracts A-List Board Members. Wealth Myths That Keep You Poor. Prosperity Truths That Make You Rich. Protecting Your Wealth and Home in a Recession. Technology and Silver are Golden. The Economy Contracts 32.9% in the 2nd Quarter of 2020. Real Estate: Feeling Equity Rich? Make Sure That Feeling Isn't Fleeting. Airline Revenue Plunges 86%. 10 Questions for College Success Bank Earnings Season. Crimes. Cronyism. Speculation. Real Estate Solutions for a Post-Pandemic World. Copper and Chile Update. Gold Soars. Some Gold Funds Tank. Will the Facebook Ad Boycott De-FANG Stocks? Why Did My Cannabis Stock Go Down? Which Countries Are Hot in a Global Pandemic? Is Your Financial Advisor Good at Navigating Stormy Seas? $10 Avocados, Lies, Damn Lies, Statistics & Wall Street Secrets. It's Never a Crash. Work From Home and Intergenerational Housing. Biotech Races for a Coronavirus Cure. Are You Worried About Money? May is a Good Time for Rebalancing. Is FDIC-Insured Cash at Risk of a Bank Bail-in Plan? Why Did my Bonds Lose Money? Cannabis Update. Recession Proof Your Life. Free Videocon Monday, May 10, 2020. The Recession will be Announced on July 30, 2020. Apple Reports Terrible Earnings. We Are in a Recession. Unemployment, Rising Stocks. What's Going On? 8 Money Myths, Money Pits, Scams and Conspiracy Theories. 21st Century Solutions for Protecting Your Home, Nest Egg & Job. Wall Street Insiders are Selling Like There is No Tomorrow. Why Are My Bonds Losing Money? Tomorrow is Going to be Another Tough Day. Price Matters. Stock Prices are Still Too High. Should You Ride Things Out? 7 Recession Indicators Corona Virus Update. The Bank Bail-in Plan on Your Dime. NASDAQ is Up 6X. CoronaVirus: Which Companies and Countries Will be Most Impacted. Is Tesla Worth GM and Ford Combined. Artificial Intelligence is on Fire. Is it Time to Buy S'More? Take the Retirement Challenge. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable. However, NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors.  About Natalie Pace Natalie Wynne Pace is an Advocate for Sustainability, Financial Literacy & Women's Empowerment. She has been ranked as a No. 1 stock picker, above over 835 A-list pundits, by an independent tracking agency (TipsTraders). The ABCs of Money remained at or near the #1 Investing Basics e-book on Amazon for over 3 years (in its vertical), with over 120,000 downloads and a mean 5-star ranking. The 4th edition of The ABCs of Money was released on October 17, 2020. Natalie Pace's easy as a pie chart nest egg strategies earned gains in the last two recessions and have outperformed the bull markets in between. That is why her Investor Educational Retreats, books and private coaching are enthusiastically recommended by Nobel Prize winning economist Gary S. Becker, TD AMERITRADE chairman Joe Moglia, Kay Koplovitz and many Main Street investors who have transformed their lives using her Thrive Budget and investing strategies. Click to view a video testimonial from Nilo Bolden. The Coinbase IPO Isn’t an IPO. 6 Things You Need to Know About Coinbase’s 1st Day of Public Trading. The crypto IPO craze has begun! Only it’s not a coin or an IPO. Coinbase is the largest crypto trading platform in the U.S. It’s first day on the big boards will be a direct listing, not an IPO. If you’re interested in investing, below are a few things to keep in mind. One of the most important considerations is to use a limit order if you do decide to purchase Coinbase stock. The Coinbase Direct Listing (i.e. Not an IPO) Direct listings are liquidity events for insiders, not fundraising events for companies. There is no roadshow. It’s more affordable way to go public. Most importantly, early investors are able to turn paper profits into cash. (Yes, the crypto company’s investors will be receiving their gains in USD, not Bitcoin.) Meme Stocks Everybody is talking about the Coinbase IPO. Meme stocks have a reputation for shooting the moon, and then dropping like a rock. (Learn more in my Meme Stock blog.) There will be pressure from insider selling. At the same time, there is a fervor with all things crypto right now. Which side will win in the coming days? In the coming months? The long-term potential of a crypto trading platform is directly tied with investor interest in cryptocurrency. That love affair has waxed and waned over the years, and then exploded over the past few months. It’s sobering to remember that Bitcoin hit $20,000 in December of 2017, and then lost 80% of its value – dropping $3,400 within one year. Coinbase Revenue is Up 9-Fold in 1Q 2021! Coinbase enjoyed a 9-fold increase in revenue year over year in the 1st quarter of 2021. Nothing comes close to that growth in any other industry -- not even in Nio, the Chinese electric vehicle manufacturer that saw revenue more than double. The 1Q 2021 revenue of $1.8 billion is more than Coinbase enjoyed all year in 2020. Revenue in 2020 was just $1.14 billion. Coinbase is profitable – another plus – reportedly bringing in $730-$800 million in net income in the 1st quarter of 2021, more than double the $322.3 million net income of 2020. The company is on fire. Revenue and profits are up, largely because Bitcoin has shot the moon with a price of $63,700 yesterday. Bitcoin and Ethereum still account for most of Coinbase’s revenue. A crypto price correction would negatively impact Coinbase’s stellar growth. Another issue is that, like many stocks on Wall Street, Coinbase’s intergalactic growth is already priced into the stock. Should a company with the potential of $8 billion in revenue be worth over $65 billion? If cryptocurrencies continue soaring higher and higher in price, so will Coinbase’s revenue. In that scenario, Coinbase will not be overvalued at today’s price. Many Direct Listings Lose Value in the 1st Week The Coinbase reference price is $250.00. If Coinbase follows the trends of other recent direct listings, like Spotify, the price could weaken in the 1st week. On the other hand, with Bitcoin price accelerating yesterday to yet another all-time high (of almost $64,000), it’s likely that Coinbase’s share prices will explode today. As long as Bitcoin makes up a substantial piece of Coinbase’s revenue, the company’s earnings will have a strong correlation to Bitcoin’s price fluctuations. Everything is coming up fire-hot for now. But the asset does have a track record of blizzard cold spells, too. The Popularity of Cryptocurrency As you can see from the chart above, interest in Bitcoin has everything to do with the price of the coin. Past profit-taking has wiped out crypto investors. 2018 was a terrible year for cryptophiles. Those who held on are sitting pretty now. The question is: for how long? Bottom Line With all of the fever around this IPO, Coinbase should take a trip to the moon today when it hits the NASDAQ Stock Exchange. It might be difficult to jump on board before the ship takes off, however. Be sure to use limit, not market, orders today when you are purchasing your Coinbase shares. It’s unclear just how long the oxygen levels will remain high in cryptocurrency, and thus in Coinbase, before everything has to ground for a breath of reality and a bit of fresh air. It’s important to remember that, for now, cryptocurrency is a trader’s platform, a way to win and lose a great deal of cash (USD). The Coinbase insiders win today. Main Street investors should enjoy a great ride, too. The question for the future value of Coinbase is highly correlated with Bitcoin’s price. If you see volatility or weakness in Bitcoin in the months ahead, it will hit Coinbase’s revenue and share price. Join us for our April 24-26, 2021 Financial Empowerment Retreat. (Click to learn more.) In 3 days, you'll learn how to invest safely in crypto and how to pick great companies (like Zoom Video, Tesla, Aphria, Veritone and Nio). When you incorporate performance into a well-diversified wealth plan, you can benefit from Shoot the Moon stocks safely. You'll also receive a complete Money Makeover and transform your life forever. Bring your friends, family and teens for an unbelievably low group rate. Call 310-430-2397 or email [email protected] to learn more now.  Natalie Pace Financial Empowerment Retreat. April 24-26, 2021. Call 310-430-2397 or email [email protected] to learn more. Receive the best price when you register with friends and family. Other Blogs of Interest Restore Our Earth on April 22nd. Should You Sell in May and Go Away? Adding Shoot the Moon Performance to Your Nest Egg. Videoconferencing in a Post-Pandemic World (featuring Zoom & Teladoc). Sanctuary Sandwich Home. Multigenerational Housing. Interview with Lawrence Yun, the chief economist of the National Association of Realtors. 10 Budget Leaks That Cost $10,000 or More Each Year. The Stimulus Check. Party Like It's 1999. Kushner's Times Square Building Plunges 80% in Value. Will There be a Spring Rally? Cannabis and the Road to Decriminalization in the U.S. Hot ETFs Return Up to 50% Since October. Investor IQ Test 2021. Investor IQ Test Answers Shoot the Moon Stock Picks 2021 Crystal Ball. Would You Pay $50 for a Cafe Latte? Is Your Tesla Stock Overpriced? Can Medmen Avoid Bankruptcy? Bitcoin is Back, Baby! Real Estate Prices are Going Up. And Down. Movie Theaters are in Trouble Airbnb Should Have a Spectacular IPO Today. Cannabis is Decriminalized. Stocks Triple. Airbnb's IPO. Should Hosts Invest? Gifts Under $5 and Free. Thanksgiving in a Pandemic. The Sustainability Silver Lining. Secretary Mnuchin Halts Bailouts Money Stress Killed My Friend Real Estate and Housing 2021. Challenges & Opportunities Real Estate in a Pandemic. Interview with Mike Fratantoni, the Chief Economist of the Mortgage Bankers Association. Bonds are Illiquid & Negative-Yielding. Annual Rebalancing is a Buy Low, Sell High Plan on Auto-Pilot. 5 Red Flags of a Financial Implosion Will Regeneron Be Approved Before the Election? Tesla Will Have an Outstanding Earnings Report Should You Wait Until After the Election to Fix Your Wealth Plan? The October Surprise Is Your Bank a Junk Bond Do Stocks Fare Better Under Democrats or Republicans? Put Your Money Where Your Heart Is. Crystal Ball for the Remainder of 2020 (Including the Election). Microcap Gaming Company Doubles 2Q 2020 Revenue. Apple & Tesla Stock Splits. Schwab's Chief Fixed Income Strategist on What's Safe. China's Tesla (Nio). 2Q Sales Soar. Why Are You Still Renting? (Errr. There is More Than This to Consider!) MedMen's Turnaround Plan Attracts A-List Board Members. Wealth Myths That Keep You Poor. Prosperity Truths That Make You Rich. Protecting Your Wealth and Home in a Recession. Technology and Silver are Golden. The Economy Contracts 32.9% in the 2nd Quarter of 2020. Real Estate: Feeling Equity Rich? Make Sure That Feeling Isn't Fleeting. Airline Revenue Plunges 86%. 10 Questions for College Success Bank Earnings Season. Crimes. Cronyism. Speculation. Real Estate Solutions for a Post-Pandemic World. Copper and Chile Update. Gold Soars. Some Gold Funds Tank. Will the Facebook Ad Boycott De-FANG Stocks? Why Did My Cannabis Stock Go Down? Which Countries Are Hot in a Global Pandemic? Is Your Financial Advisor Good at Navigating Stormy Seas? $10 Avocados, Lies, Damn Lies, Statistics & Wall Street Secrets. It's Never a Crash. Work From Home and Intergenerational Housing. Biotech Races for a Coronavirus Cure. Are You Worried About Money? May is a Good Time for Rebalancing. Is FDIC-Insured Cash at Risk of a Bank Bail-in Plan? Why Did my Bonds Lose Money? Cannabis Update. Recession Proof Your Life. Free Videocon Monday, May 10, 2020. The Recession will be Announced on July 30, 2020. Apple Reports Terrible Earnings. We Are in a Recession. Unemployment, Rising Stocks. What's Going On? 8 Money Myths, Money Pits, Scams and Conspiracy Theories. 21st Century Solutions for Protecting Your Home, Nest Egg & Job. Wall Street Insiders are Selling Like There is No Tomorrow. Why Are My Bonds Losing Money? Tomorrow is Going to be Another Tough Day. Price Matters. Stock Prices are Still Too High. Should You Ride Things Out? 7 Recession Indicators Corona Virus Update. The Bank Bail-in Plan on Your Dime. NASDAQ is Up 6X. CoronaVirus: Which Companies and Countries Will be Most Impacted. Is Tesla Worth GM and Ford Combined. Artificial Intelligence is on Fire. Is it Time to Buy S'More? Take the Retirement Challenge. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable. However, NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors.  About Natalie Pace Natalie Wynne Pace is an Advocate for Sustainability, Financial Literacy & Women's Empowerment. She has been ranked as a No. 1 stock picker, above over 835 A-list pundits, by an independent tracking agency (TipsTraders). The ABCs of Money remained at or near the #1 Investing Basics e-book on Amazon for over 3 years (in its vertical), with over 120,000 downloads and a mean 5-star ranking. The 4th edition of The ABCs of Money was released on October 17, 2020. Natalie Pace's easy as a pie chart nest egg strategies earned gains in the last two recessions and have outperformed the bull markets in between. That is why her Investor Educational Retreats, books and private coaching are enthusiastically recommended by Nobel Prize winning economist Gary S. Becker, TD AMERITRADE chairman Joe Moglia, Kay Koplovitz and many Main Street investors who have transformed their lives using her Thrive Budget and investing strategies. Click to view a video testimonial from Nilo Bolden. Spring is here. The vaccine gives us hope that we can break free from our quarantine caves, and dance in the sunlight. Our lives have changed in many ways over the last year, changes that resulted in the largest drop of carbon emissions reductions of our lifetime, at 7% (source: The Carbon Project, University of East Anglia and University of Exeter). The skies in many American cities are bluer than ever. The question is: can we continue this trend and Restore Our Earth™ – this year’s theme of Earth Day? It all begins with knowing more about the challenges and issues we face, and how normal citizens can push progress in the right direction. Toward that end, I spoke with an expert on the matter, Kathleen Rogers, the President of EARTHDAY.ORG. EARTHDAY.ORG works with 75,000 partner organizations across the planet and has mobilized over a billion people in planet-positive projects since the first Earth Day on April 22, 1970 (51 years ago). Climate anxiety is real. One of the solutions to our personal distress is to cure the problem. Restoring the planet that nourishes and sustains us begins with greater awareness of the issues that have brought us to where we are. Learn more in my conversation with Kathleen Rogers. Natalie Pace: 2020 saw global carbon emissions reductions. How can we make sure these reductions are permanent, while at the same time getting the developing world on board? (China’s carbon emissions were only down 1.7%, while the developed world led with 11-13% reductions.) Kathleen Rogers: While there is a little bit of good news in terms of carbon emissions from industries like transportation and others, we still have countries like China and India going full hog on coal, and building new power plants. The U.S. remains the biggest polluter in the world. The reality is that we are making very little progress toward achieving the goals that were laid out in the Paris Agreement. The world needs to up their ambition on climate change. NP: Additionally, 2020 reductions were pandemic-induced. If we go back to our 2019 way of life, there will be an increase in emissions. So, as we develop a new normal for ourselves, what are the most important things individuals can do to Restore Our Earth™? (Get tips and resources at EARTHDAY.ORG.) KR: Every individual action that you take counts, whether you recycle, take public transportation, or reduce or eliminate meat and dairy. I’d also like to point out that the most important thing we can do is to constantly remind our elected officers – everyone from elected school boards, board of supervisors, city council, our members of congress, state legislators – that we care about this. Do this on a regular basis. Speaking out and speaking up about climate and environmental issues is critical. NP: 2/3rds of Americans believe the government should do more to reduce the impacts of climate change (source: Pew Research). How do we engage all Americans? KR: EARTHDAY.ORG’s target population is what we call Everybody Else, not the Green people, but those people who don’t have the time to listen, don’t want to get involved, have a small footprint, or have different political views. Invest in listening and talking to people who aren’t as engaged as you might be, or as committed or knowledgeable. Make friends. Find common ground. Especially in the current political atmosphere, there is nothing more valuable than finding common ground. NP: Students learn about sustainability and protecting the planet on Earth Day. Some pioneering schools like Ashley Primary School and Damers First School in England are weaving Harmony with nature into their curriculum (based upon H.R.H. The Prince of Wales’ book and principles). How can concerned U.S. parents and citizens get sustainability and conservation curriculum into our local schools? KR: Ask the principal of your school who you should write to. The failure to educate people on climate and environment literacy is a national liability. The jobs of today and tomorrow are dependent upon having a green educated workforce. At the community college level, people can get a two-year degree, and become wind turbine engineers, green builders or eco designers. Non-formal climate education could include a trip to the river to test water quality, to augment what the students are learning in biology or chemistry. NP: The Top 10 Fastest Growing Jobs in the U.S. include wind turbine engineers and solar panel installers (source: BLS.gov). NP: Let’s talk a little more about non-formal curriculum. We’re seeing parents and teachers coming together, using PTA and Booster club funds alongside government grants, to reduce the water and electrical usage of their buildings, and point some of those funds toward outdoor learning gardens. KR: That’s really important. The other thing I’d recommend is to find a community to partner with that is not as wealthy, that doesn’t have the opportunities. We have such a tragic division in our country. Some schools have no heating or air conditioning, bad indoor air quality and cement for a yard. To the extent that we are able, it’s great for kids to learn how to communicate with other kids, whether it is urban versus country or suburban. Whatever you’re doing, try to duplicate it and pay it forward. NP: Let’s discuss EARTHDAY.ORG’s Canopy Project. I read a statistic that EARTHDAY.ORG has planted tens of millions of trees. How have you achieved that? KR: Vegetation gives us the oxygen we breathe. We cannot solve climate change by planting trees, but we can push it way off down the field, if we do. There are huge initiatives worldwide that we’re participating in, hoping to plant close to a trillion trees. How and where we plant them has to be based on science and community. In India, for example, we’re planting fruit trees. Common land is converted to fruit orchards. This is important for water quality because [India] has terrible problems with runoff, pesticides and pollutants. Half the fruit goes to market, and half of the fruit stays in the community. They are protecting their own trees as if they are their children because they mean something to them economically. We check in with the community to make sure that they are with us and will protect what we’ve planted. There are other reasons behind areas we choose, such as biodiversity or water quality. We have a project in Mexico that is heavily focused along the edges of rivers. Pesticides, chemicals and run-off clog the river and kill the fish. We’re doing low-level tree planting in a biosphere preserve, which is already protected. There are really interesting projects where people are shooting seedlings into the ground from an airplane or catapults to promote rapid reforestation. There are good faith efforts to bring back our forests, for the oxygen, for the water quality, for biodiversity and for our health. NP: Which companies are protecting the forests? How can we support them with our consumer and investing dollars? KR: Without naming names, some companies are committed to staying away from old-growth forests. Others are ruthlessly denuding the planet. They give us our toilet paper, books and everything else. If you’re a consumer, it’s difficult to dig deep. There is no ranking on toilet paper to indicate whether it comes from an old-growth forest or not – at least not in most stores, The Rain Forest Alliance certifies timber. Now you can find certified or recycled toilet paper and paper towels, and recycled paper for printers. NP: Let’s discuss pesticides, and how we can better protect bees. KR: We can’t live without pollinators. A giant percentage of our food is a result of pollination. Whether you are talking about a bee or a butterfly, or any other species that is involved in pollinating, we have to be aware of the benefits. The problems are a combination of agribusiness, where they move bee colonies around, and pesticides. Pollinators are not a single food species. They like variety, just like we do. On the chemical side, lots of countries are banning various chemicals that they know weakens the population. We haven’t gotten a grip on this at all in the United States. We have to be active and committed to understanding where our food comes from, and in speaking up about these pesticides and chemicals when the opportunity comes up in your community. We have to take that extra step and understand that without bees, without pollinators, we’re not going to survive. ( Editorial Note: Take EARTHDAY.ORG's Pollinator Pledge. NP: Is there value in choosing organic and making sure that you are not spraying chemicals in your own garden or in your school’s garden, in addition to advocating a ban on chemicals that harm bees and butterflies? KR: Absolutely. We should not be using any chemicals on our lawns. We shouldn’t be using heavy-duty fertilizers either. The love affair that we have with perfect lawns and gardens needs to be over because it is hurting our children and wildlife. The science is clear on how deadly these chemicals are to a baby’s brain development and to our pets. Look for organic fertilizers. NP: Let’s talk about greening the grid. On a nationwide basis, the U.S. electrical grid is still about 60% fossil fuels. California now has 41% of its grid powered with renewables. My home town, Santa Monica, California, is 100% powered by renewable energy. This shows what can happen when people make clean energy a priority. How can we mobilize people in states like Florida, which is over 80% fossil fuels, or Colorado, which is about 70%? KR: The only way to ensure that you are powering your home with renewables is if you live in a place that is powered by solar, wind, biomass or another renewable. That’s hard to find. Davis, California, has remarkable clean energy requirements. Of course, they have a lot of sun, and they have backup. We need to end subsidies for fossil fuels. They do not need it. Why burn something that is filthy, dirty and makes us sick, and leaves a giant, permanent hole? It’s time to switch off. I’m looking forward to the next couple of years to see innovation, not just in where we get our energy, but also in how the national grid is restructured. Energy can be decentralized. I’m hoping that, by opening up the green economy and getting lots of kids engaged, we can solve the energy issues from the community, all the way up to the national and the global. NP: How should we celebrate Earth Day, on April 22nd, this year? KR: Earth Day will just be at the mark when life starts to go back to normal. People are signing up for clean-ups, tree planting, community gardens and more. We have so much pent-up energy! We’re seeing everybody, right, left, center and all over the world. People want to get the heck out of our house and do something. I think we’ll have a huge turnout this year. There are some exciting innovations that are happening, some necessary regulations that need to happen, and many commitments that each one of us can make to protect our planet. Visit EARTHDAY.ORG to join their Earth Day Live digital livestream event on April 22, 2021, and to learn how you can participate in a billion acts of green year-round. April has been on fire so far, with stocks hitting new highs in the Dow Jones Industrial Average, and technology stocks recovering some of their February weakness. Wall Street says, “Sell in May and go away.” Your broker probably tells you, “Buy and hold.” Which is right? Should you be doing a little bit of both? What does that look like? What do you need to do to make sure you pocket some of those gains before you go away on vacation this year (at long last)? See the tips below to batten down the hatches before your friends yell, “Bon Voyage!” Join me this Thursday at 5 pm PT for a free videoconference to discuss the tips in greater detail. (See below for login instructions.) 7 Tips to Secure Your Wealth Before Your Summer Vacation 1. Rebalance in May 2. Diversify 3. Know What You Own 4. Keep a Percentage Equal to Your Age Safe 5. Know What’s Safe 6. Consider Overweighting Safe 7. Feeling Equity-Rich? Overleveraged? Underwater? And here are the margaritas, palapas and thongs of the experience. 1. Rebalance in May Market timing doesn’t work. Buy & Hold is a last-century plan that hasn’t worked in the 21st Century. (If you’re using bull markets to regain losses, which is what has happened since 2000, you’re worth less today that you were in 1995.) Rebalancing is a time-proven, 21st Century, buy low, sell high strategy on auto-pilot. Learn more in my Rebalancing and Shoot the Moon Performance blogs, and at our April 24-26, 2021 Financial Empowerment Retreat. Email [email protected] or call 310-430-2397 for additional information. 2. Diversify Do you think you’re diversified because you have someone managing your money who tells you that you are? Do you have pages and pages of holdings which surely diversify you (you hope)? Most plans, yes even managed 18-page plans, are not diversified at all. Most people are heavily invested in large caps and bonds, and are very light on mid caps, small caps and hot countries and industries. If you have one fund that is supposed to do everything for you, you are not diversified at all. Getting a 2nd opinion to know exactly what you own is a better plan than blind faith. A&A discovered how empowering it is to actually know what you own. Natalie researched and reviewed each stock and fund. She then explained to us in plain English how we were positioned in the market and how high our risk exposure was. Stocks and investing are no longer rocket science. We are finally able to take control of our money. We give thanks just about every day that we met Natalie. I feel like I live on a different planet. Natalie added sanity and peace to my life. I am forever grateful. 3. Know What You Own It’s your money that gets lost if the plan is poorly designed, not the broker-salesman’s. You’re the boss of your money. However, it’s impossible to take command if you don’t know what you own, or what a healthy strategy looks like. The antidote to blind faith is learning the ABCs of Money that we all should have received in high school. Call 310-430-2397 for pricing and information on my unbiased 2nd opinion and our next Investor Educational Retreat. 4. Keep a Percentage Equal to Your Age Safe A standard rule of thumb in investing is to always keep a percentage equal to your age safe. 5. Know What’s Safe In today’s world, where bonds are illiquid and vulnerable to loss of principal, it’s also important to know what’s safe. Is your cash FDIC-insured? Do your bond funds have junk bonds and more risk than you might realize? Is the fund company itself risky? Is your cash at risk of redemption gates and liquidity fees? Click on the blue highlights to access blogs that are vitally important to your fiscal health. 6. Consider Overweighting Safe 2021 is projected to be a recovery year (if COVID-19 is conquered by the vaccine). The U.S. economy is projected to grow at 6.5%, while China might soar with 8.4% growth. So, why should you consider overweighting safe? Because recovery is already priced into the current asset prices. If anything challenging happens, and lots of things can in a Debt World that is highly leveraged, then both stocks and real estate prices could take a hit. 2020 saw stocks soar during the worst recession of our lifetimes. Normally, stocks sink in recessions and recover slowly, step by step with the rest of the economy. Real estate doesn’t do well during episodes of elevated unemployment – unless you have a moratorium on rental evictions and foreclosures. Extraordinary tools were used to prop up the economy, which have to be removed. When will that happen and will stocks and real estate fall? We’ve already seen astonishing drops in commercial real estate this year. Learn more in my Spring Rally and Times Square Building blog. 7. Feeling Equity-Rich? Overleveraged? Underwater? Whether you are feeling equity rich or are sick of renting and want to buy, it pays to understand that what soars can sink (and vice versa). Buying real estate high is one of the most devastating things you can do in life. It can weigh like a ton of bricks on you, your budget and your family for a decade. Even if you are sitting pretty now, read the Feeling Equity Rich blog – and definitely read it if you are thinking of buying real estate this year. If you are overleveraged in your budget or underwater on your home, then now is the time to get solutions that the bank and debt collectors are not going to share with you. If you’re spending more than 28% of your income on housing, you need a brave and bold budgeting plan that gives you room for other important expenses in your life. Otherwise, you’re likely putting some basic needs on credit cards. Learn more in my blog, “10 Budget Leaks That Can Cost You $10,000 or More Each Year.” Give yourself the peace of mind that comes with knowing your wealth and future are properly protected and diversified. It’s not a case of selling in May and going away. It is a case of adopting a time-proven 21st-Century strategy that you rebalance regularly (once a quarter), using the 7 tips I’ve outlined above. Join me for my teleconference Thursday, April 15, 2021 at 5 PM PT for our free Firesides at 5 monthly video conference. Invite your friends, too. If you would like to receive the logon instructions, email [email protected] with VIDEOCON in the subject line. (If you’re already on the list, you’ll receive the instructions automatically.) Join us for our April 24-26, 2021 Financial Empowerment Retreat. (Click to learn more.) In 3 days, you'll learn how to pick great companies (like Zoom Video, Tesla, Aphria, Veritone and Nio), incorporate them into a well-diversified wealth plan, receive a complete Money Makeover and transform your life forever! Bring your friends, family and teens for an unbelievably low group rate. Call 310-430-2397 or email [email protected] to learn more now.  Natalie Pace Financial Empowerment Retreat. April 24-26, 2021. Call 310-430-2397 or email [email protected] to learn more. Receive the best price when you register with friends and family. Other Blogs of Interest Adding Shoot the Moon Performance to Your Nest Egg. Videoconferencing in a Post-Pandemic World (featuring Zoom & Teladoc). Sanctuary Sandwich Home. Multigenerational Housing. Interview with Lawrence Yun, the chief economist of the National Association of Realtors. 10 Budget Leaks That Cost $10,000 or More Each Year. The Stimulus Check. Party Like It's 1999. Kushner's Times Square Building Plunges 80% in Value. Will There be a Spring Rally? Cannabis and the Road to Decriminalization in the U.S. Hot ETFs Return Up to 50% Since October. Investor IQ Test 2021. Investor IQ Test Answers Shoot the Moon Stock Picks 2021 Crystal Ball. Would You Pay $50 for a Cafe Latte? Is Your Tesla Stock Overpriced? Can Medmen Avoid Bankruptcy? Bitcoin is Back, Baby! Real Estate Prices are Going Up. And Down. Movie Theaters are in Trouble Airbnb Should Have a Spectacular IPO Today. Cannabis is Decriminalized. Stocks Triple. Airbnb's IPO. Should Hosts Invest? Gifts Under $5 and Free. Thanksgiving in a Pandemic. The Sustainability Silver Lining. Secretary Mnuchin Halts Bailouts Money Stress Killed My Friend Real Estate and Housing 2021. Challenges & Opportunities Real Estate in a Pandemic. Interview with Mike Fratantoni, the Chief Economist of the Mortgage Bankers Association. Bonds are Illiquid & Negative-Yielding. Annual Rebalancing is a Buy Low, Sell High Plan on Auto-Pilot. 5 Red Flags of a Financial Implosion Will Regeneron Be Approved Before the Election? Tesla Will Have an Outstanding Earnings Report Should You Wait Until After the Election to Fix Your Wealth Plan? The October Surprise Is Your Bank a Junk Bond Do Stocks Fare Better Under Democrats or Republicans? Put Your Money Where Your Heart Is. Crystal Ball for the Remainder of 2020 (Including the Election). Microcap Gaming Company Doubles 2Q 2020 Revenue. Apple & Tesla Stock Splits. Schwab's Chief Fixed Income Strategist on What's Safe. China's Tesla (Nio). 2Q Sales Soar. Why Are You Still Renting? (Errr. There is More Than This to Consider!) MedMen's Turnaround Plan Attracts A-List Board Members. Wealth Myths That Keep You Poor. Prosperity Truths That Make You Rich. Protecting Your Wealth and Home in a Recession. Technology and Silver are Golden. The Economy Contracts 32.9% in the 2nd Quarter of 2020. Real Estate: Feeling Equity Rich? Make Sure That Feeling Isn't Fleeting. Airline Revenue Plunges 86%. 10 Questions for College Success Bank Earnings Season. Crimes. Cronyism. Speculation. Real Estate Solutions for a Post-Pandemic World. Copper and Chile Update. Gold Soars. Some Gold Funds Tank. Will the Facebook Ad Boycott De-FANG Stocks? Why Did My Cannabis Stock Go Down? Which Countries Are Hot in a Global Pandemic? Is Your Financial Advisor Good at Navigating Stormy Seas? $10 Avocados, Lies, Damn Lies, Statistics & Wall Street Secrets. It's Never a Crash. Work From Home and Intergenerational Housing. Biotech Races for a Coronavirus Cure. Are You Worried About Money? May is a Good Time for Rebalancing. Is FDIC-Insured Cash at Risk of a Bank Bail-in Plan? Why Did my Bonds Lose Money? Cannabis Update. Recession Proof Your Life. Free Videocon Monday, May 10, 2020. The Recession will be Announced on July 30, 2020. Apple Reports Terrible Earnings. We Are in a Recession. Unemployment, Rising Stocks. What's Going On? 8 Money Myths, Money Pits, Scams and Conspiracy Theories. 21st Century Solutions for Protecting Your Home, Nest Egg & Job. Wall Street Insiders are Selling Like There is No Tomorrow. Why Are My Bonds Losing Money? Tomorrow is Going to be Another Tough Day. Price Matters. Stock Prices are Still Too High. Should You Ride Things Out? 7 Recession Indicators Corona Virus Update. The Bank Bail-in Plan on Your Dime. NASDAQ is Up 6X. CoronaVirus: Which Companies and Countries Will be Most Impacted. Is Tesla Worth GM and Ford Combined. Artificial Intelligence is on Fire. Is it Time to Buy S'More? Take the Retirement Challenge. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable. However, NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors.  About Natalie Pace Natalie Wynne Pace is an Advocate for Sustainability, Financial Literacy & Women's Empowerment. She has been ranked as a No. 1 stock picker, above over 835 A-list pundits, by an independent tracking agency (TipsTraders). The ABCs of Money remained at or near the #1 Investing Basics e-book on Amazon for over 3 years (in its vertical), with over 120,000 downloads and a mean 5-star ranking. The 4th edition of The ABCs of Money was released on October 17, 2020. Natalie Pace's easy as a pie chart nest egg strategies earned gains in the last two recessions and have outperformed the bull markets in between. That is why her Investor Educational Retreats, books and private coaching are enthusiastically recommended by Nobel Prize winning economist Gary S. Becker, TD AMERITRADE chairman Joe Moglia, Kay Koplovitz and many Main Street investors who have transformed their lives using her Thrive Budget and investing strategies. Click to view a video testimonial from Nilo Bolden.  Heart Angel Rocket Launch is a photo taken by SpaceX in Oct. of 2018. Heart Angel Rocket Launch is a photo taken by SpaceX in Oct. of 2018. Includes 5 Key Success Strategies to put you on the right side of the trade The recent pullback in many of the hottest stocks on Wall Street is a reminder of two things. If you missed investing in Shoot the Moon stock pics you might be afforded a 2nd chance to invest, particularly if you employ a careful strategy of dollar-cost averaging (not Buy & Hope). The other is the importance of regular rebalancing to capture gains. Here are some examples of Shoot the Moon stock pics that we’ve identified over the last couple of years. All of the companies listed below are trading at a lower price now than they were in mid-February 2021. FYI: Each of these hot companies were identified at or before their 52-week lows, which are dramatically lower than today’s price. As you can see in the chart above, Zoom Video soared to a high of $589 on October 19, 2020. At today’s share price was $331, the stock is trading at a 44% discount. Aphria's share price rocketed up to $32/share on February 9, 2021, and is now half that price. This illustrates the importance of all of the key strategies outlined above: