|

With 17.9 million people (11.2%) unemployed and over 30 million taking unemployment benefits of some kind or another (source: BLS.gov), there are a lot of Americans who have less income this year than just a few months ago in February. (You have to read the fine print to get the accurate numbers.) If it isn’t us personally (thankfully), then it is someone we know. Perhaps the most important things when life shifts so dramatically and so fast is to avoid the common mistakes and embrace fiscal best practices. It is also key to band together, and look at the challenge, where possible, as a family challenge. The more that we can help one another in our familial groups, the better off we’ll all be. Common Mistakes

Smart Strategies

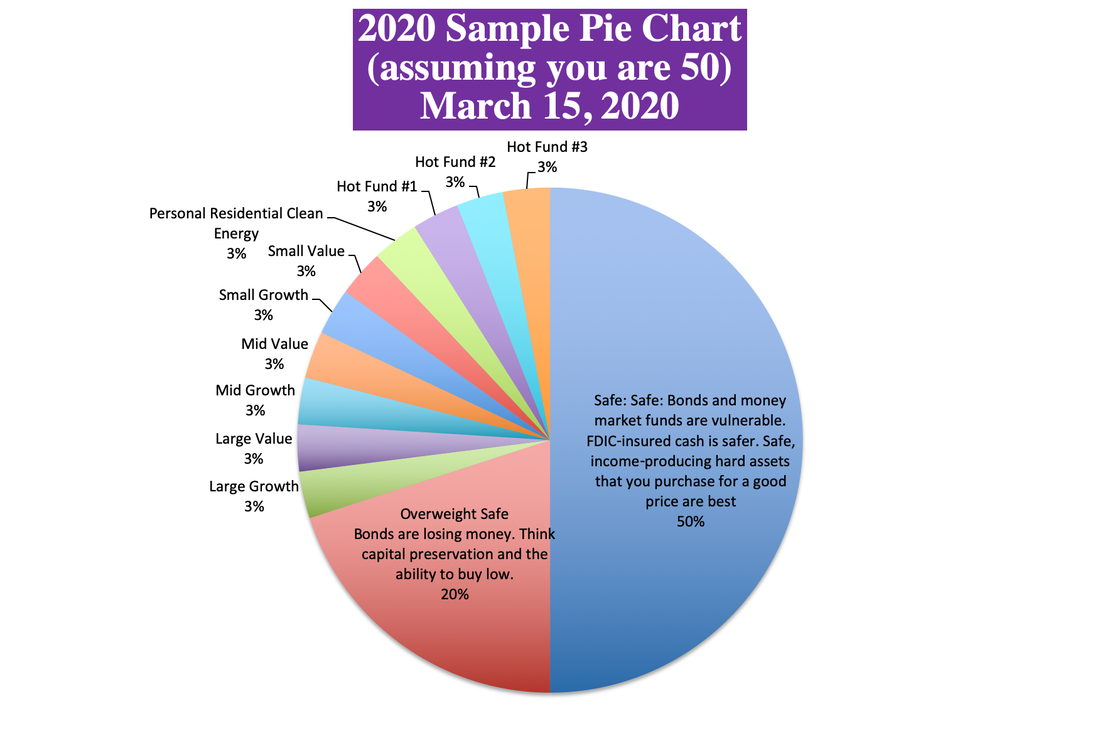

It’s important to remember that there is no panacea for an unprecedented recession. Just like a healthy diet consists of various types of food, vitamins, minerals and supplements, a healthy fiscal plan will be diversified – while also specialized for your particular age and specifications. Below is a sample pie chart. You can personalize your own pie chart using my free web apps. Go to https://www.NataliePace.com/ or click on the badge below to access. Are Hot Stocks Safe? Technology is up seven-fold since the Great Recession and has gained 57% since March. However, FANG stocks also dropped 25-40% between the highs of February 19, 2020, and the lows of March 23, 2020. Being properly diversified, overweighting tech and having a rebalancing plan helps you to stay on the right side of the trade. (This is something I teach at my Investor Educational Retreats. It’s easy-as-a-pie-chart.) So, rather than invest all you’ve got in technology, make sure that your growth funds are rich in technology, and maybe have an extra slice or two of tech in your hots. Learn more in my Technology blog. During your rebalancing, if the industry has been on a tear, you will trim back, selling high. If stocks have tanked and your slices are now slivers, then you’ll buy more low. This pie chart strategy is a way to earn gains in bull markets, while protecting yourself in bear markets. Since we’re having a rally in a recession, it’s important to incorporate both strategies. Don’t assume that what has come up will never go back down. What About Safe Havens Like Gold? Going all-in on gold, silver or cryptocurrency can be a problem, too. Learn more in my Gold Blog. When they are hot, nothing can touch them. However, when these commodities crash, they stay low for a very long time. When the U.S. was downgraded to AA+ by Standard & Poor’s, gold soared to its all-time high. That was in 2011. It took nine years to return to that high, squishing the assets of a lot of gold bugs for almost a decade. Just as in technology, if you think it’s hot, have an extra slice or two of the industry. Cryptocurrency is still a trader’s platform, not a currency, as you can see in the volatile chart below. Bitcoin has never come close to the December 2017 high of $20,000. Also, due to priority trading of certain individuals, you might have a massive line in front of you when you want to sell high. No individual trader I know was able to sell their Bitcoin at $20,000/coin. If you want to use crypto as a hedge against a stock rout or weak dollar, then consider a hot slice or two in your diversified pie chart, not betting the whole farm. Traditionally Safe Assets Like Bonds and Money Market Funds are Vulnerable Many bonds are highly leveraged. Bond funds lost money in late February and early March, and have experienced periods of illiquidity. Many investment grade bond funds allow 20% or more of junk bonds, mortgage-backed securities and other riskier fixed income assets in them. Junk bond funds had to be bailed out by the Federal Reserve on March 15, 2020. Keep the terms short and the creditworthiness very high on any bonds that you have. Learn more in my bond blog. FDIC-insured cash is safer than SPIC or money market funds. Money market funds are now the bank's bail-in plan. So it’s important to double-check your savings, retirement plans and brokerage accounts to see where your cash is being stored. Money market funds have redemption gates and liquidity fees. Learn more in my blogs. Click on the blue-highlighted words to access. However, getting safe is a two-step process. First you want to keep your money (in FDIC-insured cash or short-term Treasury bills). So, remember that liquidity affords you the opportunity to buy low, when everyone else is in a cash crunch. The second step is to look for safe, income-producing hard assets that you buy for a bargain. Hard assets will hold their value better in a world where there is just too much paper floating around. Hard Assets Safe, income producing hard assets that you purchase for a good price, with a clear vision on what can produce income in a post-pandemic world, is the safest way to preserve the value of your capital, while producing an income. The problem is that real estate is at an all-time high. With high unemployment, you also have to be concerned that your renter may not be able to pay. There is a moratorium on evictions in many cities and states currently. That may be why more families are turning to intergenerational housing to keep the money in the family and reduce expenses. Learn more in my real estate blog. Clean Energy Solar is the low-hanging fruit on a safe, income-producing hard asset that you purchase for a good price, particularly if you live in a sunny state. The panels themselves are available at historically low prices, and there is still a 24% tax credit available. If you reduce your electric bill from $300/month to $35/month, then your annual savings is over $3,000. That means your solar might be paid off in a few years, and from there on out offers you the equivalent of 15% or higher yield on your purchase. Learn more in my solar blog. This only makes sense if you plan on staying in your home for a few decades. Other Important Considerations Right-Size Your Budget If you’ve lost your job or reduced your work hours, then it’s important to right-size your budget before things get out of hand. This may require bold choices. However, if you address the big-ticket items first – housing, transportation, medical insurance – then you might find creative solutions that help you to make ends meet, even with a reduced income. Learn more in the Budgeting section of The ABCs of Money. Personalize your own budget with my free web app. Learn ways to reduce your medical insurance costs in my Health Savings Account blog. Don’t Drain Your Retirement Accounts Do not siphon off your retirement account to fill the holes in an unsustainable budget, or to pay down debt. That’s sinking your own life boat. You wouldn’t chop up your life boat and use it as firewood to warm you up for the day. So, don’t do that to stay temporarily in a situation that you can no longer afford. There are likely to be solutions that you haven’t put on the table yet. Learn more in the Debt and Budgeting section of The ABCs of Money. Evaluate Your Home Equity and Mortgage Whether you are equity-rich, treading water or underwater on your home mortgage, now is the time to evaluate your housing plan. If you’ve owned your home for 12 years or more, or went through the Great Recession as a homeowner, then put yourself back in that memory. How did it feel to be underwater on your mortgage? How did that impact your life? Do you need to take steps now to ensure that never happens again? If you purchased your home in the last few years and are feeling rich in equity, how would you feel if that all evanesced? Would your mortgage be underwater if prices trimmed back to where they were in 2011? Can you afford your home or is it eating up 28% or more of your budget? Is this where you want to live for the next 7-10 years? Read my Equity-Rich blog to develop your own recession-proof home ownership plan. Learn more about How to Keep Your Money Safe in a Pandemic and Recession in my What is Safe? Videoconference. Check out my interview with Kathy A. Jones, the Chief Fixed Income Strategist of Charles Schwab, where we discussed bond strategies. Click to access. We are still fairly early in the recession. The markets have had a nice recovery off of their March 2020 lows. That affords you a 2nd chance to protect your home and wealth before more economic storms hit. If you wait for the headlines that the economy is in trouble, it will be too late to protect yourself. Other Articles of Interest Recession Proof Your Life 21st Century Solutions for a Post-Crisis World Learn the ABCs of Money that we all should have received in high school at our Oct. 3-5, 2020 Investor Educational Retreat. Click on the banner ad below for additional information on the Oct. 3-5, 2020 Online Financial Empowerment Retreat. Families receive a discount for attending together. Call 310-430-2397 or email [email protected] for to get rates. "Many people, including educated men and women, often get into trouble when they neglect to follow simple and fundamental rules of the type provided [by Natalie]. This is why I recommend them with enthusiasm." Professor Gary S. Becker. Dr. Becker won the 1992 Nobel Prize in economics for his theories on human "College students need this information before they get their first credit card. Young adults need it before they buy their first home. Empty nesters can use the information to downsize to a sustainable lifestyle, before they get into trouble." Joe Moglia, Chairman, TD AMERITRADE. Other Blogs of Interest Technology and Silver are Golden. The Economy Contracts 32.9% in the 2nd Quarter of 2020. Real Estate: Feeling Equity Rich? Make Sure That Feeling Isn't Fleeting. Airline Revenue Plunges 86%. 10 Questions for College Success Bank Earnings Season. Crimes. Cronyism. Speculation. Real Estate Solutions for a Post-Pandemic World. Copper and Chile Update. Gold Soars. Some Gold Funds Tank. Will the Facebook Ad Boycott De-FANG Stocks? Why Did My Cannabis Stock Go Down? Which Countries Are Hot in a Global Pandemic? Is Your Financial Advisor Good at Navigating Stormy Seas? $10 Avocados, Lies, Damn Lies, Statistics & Wall Street Secrets. It's Never a Crash. Work From Home and Intergenerational Housing. Biotech Races for a Coronavirus Cure. Are You Worried About Money? May is a Good Time for Rebalancing. Is FDIC-Insured Cash at Risk of a Bank Bail-in Plan? Why Did my Bonds Lose Money? Cannabis Update. Recession Proof Your Life. Free Videocon Monday, May 10, 2020. The Recession will be Announced on July 30, 2020. Apple Reports Terrible Earnings. We Are in a Recession. Unemployment, Rising Stocks. What's Going On? 8 Money Myths, Money Pits, Scams and Conspiracy Theories. 21st Century Solutions for Protecting Your Home, Nest Egg & Job. Wall Street Insiders are Selling Like There is No Tomorrow. Why Are My Bonds Losing Money? Tomorrow is Going to be Another Tough Day. Price Matters. Stock Prices are Still Too High. Should You Ride Things Out? 7 Recession Indicators Corona Virus Update. The Bank Bail-in Plan on Your Dime. NASDAQ is Up 6X. CoronaVirus: Which Companies and Countries Will be Most Impacted. Is Tesla Worth GM and Ford Combined. Artificial Intelligence is on Fire. Is it Time to Buy S'More? Take the Retirement Challenge. 2020 Investor IQ Test. Answers to the 2020 Investor IQ Test. The Cannabis Capital Crunch and Stock Meltdown. Does Your Commute Pollute More Than Planes? Are Health Care Costs Killing Your Budget? 2020 Crystal Ball. The Benefits of Living Green. Featuring H.R.H. The Prince of Wales' Twin Eco Communities. What Love, Time and Charity Have to do with our Commonwealth. Interview with MacArthur Genius Award Winner Kevin Murphy. Unicorns Yesterday. Fairy Tales Today. IPO Losses Top $100 Billion. Price Matters. Will There be a Santa Rally? It's Up to Apple. Harness Your Emotions for Successful Investing. What the Ford Downgrade Means for Main Street. The Dow Dropped Over 1000 Points Do We Talk Ourselves into Recessions? Interview with Nobel Prize Winning Economist Robert J. Shiller. Ford is Downgraded to Junk. Gold Mining ETFs Have Doubled. The Gold Bull Market Has Begun. The We Work IPO. The Highs and Hangovers of Investing in Cannabis. Recession Proof Your Life. What's Your Exit Strategy? It's Time To Do Your Annual Rebalancing. Are You Suffering From Buy High, Sell Low Mentality? Financial Engineering is Not Real Growth. The Zoom IPO. Uber vs. Lyft. Which IPO Will Drive Returns? Boeing Cuts 737 Production by 20%. The Lyft IPO Hits Wall Street. Should you tak Cannabis Doubles. Did you miss the party? 12 Investing Mistakes The High Cost of Free Advice. 2018 Was the Worst December Since the Great Depression. Russia Dumps Treasuries and Buys Gold OPEC and Russia Cut Oil Production. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable. However, NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors.

Comments are closed.

|

AuthorNatalie Pace is the co-creator of the Earth Gratitude Project and the author of The Power of 8 Billion: It's Up to Us, The ABCs of Money, The ABCs of Money for College, The Gratitude Game and Put Your Money Where Your Heart Is. She is a repeat guest & speaker on national news shows and stages. She has been ranked the No. 1 stock picker, above over 830 A-list pundits, by an independent tracking agency, and has been saving homes and nest eggs since 1999. Archives

July 2024

Categories |

RSS Feed

RSS Feed