|

Answers to the 2020 Investor IQ Test. by Natalie Pace. Jan. 20, 2020 1. What is the most important question you should ask your Certified Financial Advisor before hiring him/her? "How much of my portfolio should I keep safe?" This question will help you to determine whether you are dealing with a trusted professional who is looking after your best interest, or a salesman who is looking to make a quick buck. The answer to this question, as we enter the 12th year of the current bull market, is, "A percentage equal to your age for sure. But this late in the business cycle, we might consider overweighting even more safe." One more important thing. Bonds are highly leveraged, subject to credit risk and vulnerable to capital loss. So, you need to understand what’s safe, rather than just relying upon bonds to keep you safe. Now is the time to clearly know exactly what you own and why. Consider getting an unbiased 2nd opinion. Call 310-430-2397 or email [email protected] for pricing and details. 2. What are 3 red flags that your financial plan is in peril?

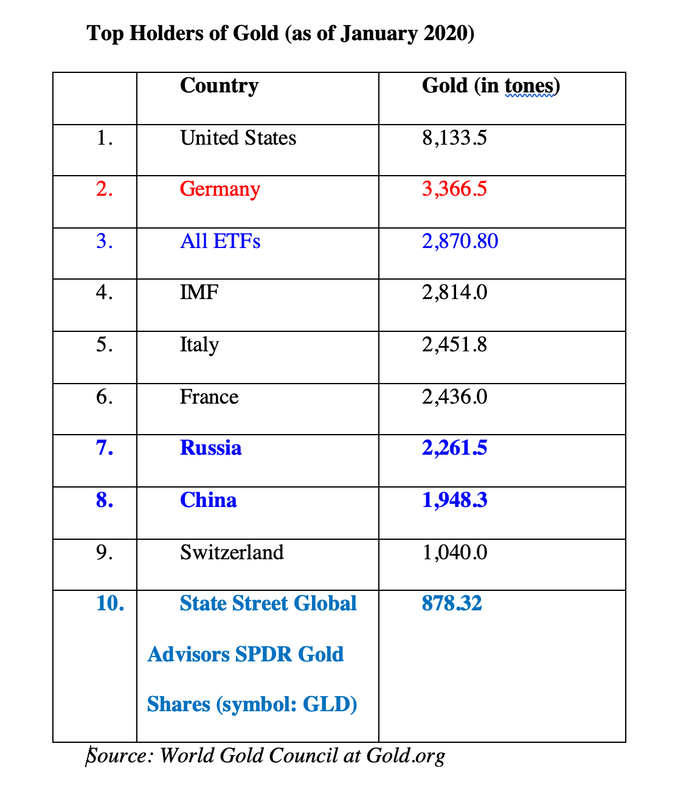

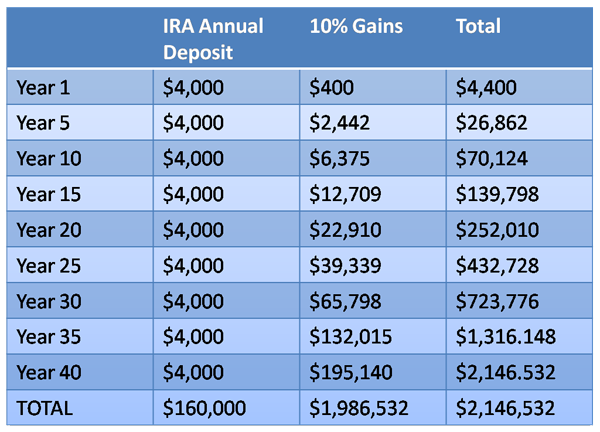

A percentage equal to your age. Consider overweighting more safe when the economy is stumbling or a bull market is going into its 12th year (as is the case in 2020). In today’s world, it is important to know what’s safe. Bonds lost money in 2018, and are riskier than most investors realize. Money market funds have redemption gates and liquidity fees. 4. What's safe? Hard assets will outperform paper assets in a world where there is too much paper money, financial inequality and broken promises floating around. So, the mantra is “safe, income-producing hard assets that you purchase for a good price.” It’s hard to buy real estate at a good price in 2020. You don’t want to be all in on hard assets because you also need liquidity and cash flow. That is why some of the best hard asset investments are those that reduce your monthly expenses (for life). I spend one full day on What’s Safe at the Investor Educational Retreats. Educate yourself now on the best income-producing hard assets that are right for you now, so that when prices are more attractive, you know what you want and have the means to move on it. Call 310-430-2397 to learn more. 5. What is the average return of stocks over the last 10 and 30 years? Large cap stocks earned 13.56% annualized over the last decade and 9.96% over the 30-year period. Small cap stocks performed at 12.4% and 11.2%, respectively. (Asset performance graphs, and more, are available to 2019 Retreat Attendees.) 6. What is the average return of gold over the last 10 and 30 years? Gold returned 2.69% annualized over the 10-year period and 4.37% over the last 30 years. While gold doesn’t look like much on paper, gold mining stocks doubled in 2016, and are currently on sale for 75% off. The all-time high of $1,895/ounce in gold occurred in September of 2011, the month after Standard and Poor’s downgraded the U.S. credit. 7. What is the average return of real estate over the last 10 and 30 years? Real estate prices are higher today than they were before the Great Recession – meaning real estate is largely unaffordable. According to AttomData, average income-earners are unable to purchase in their community in 74% of U.S. cities. During the Great Recession, about 10 million homes changed hands, and 3.2 million U.S. homes are still underwater. There is nothing worse than buying high in real estate! It can ruin your life for decades. Over the last decade, real estate has performed at 5.80% annualized. (The losses of the Great Recession are no longer included in this statistic.) Over a 30-year period, real estate increase 6.1% annualized. 8. What was the top performing investment in 2019? Bitcoin rose almost 14X in 2017. Cryptocurrency burned investors in 2018, with losses of up to 82%! However, after starting 2019 at $3700, Bitcoin ended the year at $7191, almost doubling, for gains of 94%. That’s the best performing investment, by far. 9. How long will it take for you to have a nest egg as big as your annual salary if you put 10% of your income into a tax-protected (and financial predator proof) individual retirement plan and invest in stocks and bonds*? 7 years. Based upon 10% average annualized returns of stocks and bonds over a 30-year period, which is about what those assets have done over the 30-year period, from 1990-2019. 10. How long will it take for your nest egg to earn more than you earn, if you put 10% of your income into a tax-protected (and financial predator proof) individual retirement plan and invest in stocks and bonds*? 25 years. Based upon 10% average annualized returns of stocks and bonds over a 30-year period, which is about what those assets did from 1990-2019. 11. What’s the best investment strategy in a slow-growth, high-debt world? Hard assets hold their value better than paper assets when there is too much paper floating around. Market timing doesn’t work. Pouring everything into real estate can be vulnerable, as you still need liquidity. It’s not a good idea to just put everything into cash and real estate. So, learn how to diversify properly (you don’t need 18-pages of holdings), avoid the Bailouts, add in hot industries, keep enough safe, overweight safe in volatile times and rebalance 1-3 times a year. Most, but not all, hard assets are overpriced right now, so it offers a good period of time to research and determine exactly what is right for you. There are some excellent hard assets that are worth considering, which is why I spend one full day on this topic at the Investor Education Retreats. Value capital preservation more than reaching for yield. It will allow you to buy low when things are on sale. 12. Which countries hold the most gold? The United States is the top holder of gold worldwide, by far, with 8,133.5 tons, followed by Germany, All ETFs, the International Monetary Fund, Italy, France, Russia and China. China and Russia have been on a gold buying spree since 2008. Reports are that they will start trading oil and other commodities using their own currency backed by gold, breaking free from the dollar. (Click to read my report on Russia and Gold.) There are multiple reports that the U.S. banks and brokerages have been selling their client’s gold assets (sometimes without permission) in a price fixing scandal, which has kept gold prices in the U.S. and Europe lower than the rest of the world. Deutsche Bank settled a lawsuit, and agreed on Dec. 2, 2016 to name names of other banks that were price-fixing gold. 13. Are annuities safe? Insurance products, including life insurance and annuities, aren't insured by the FDIC. If we had not bailed out AIG in 2007, more than 50 million annuity holders would have been in real trouble. Your annuity product is only as safe as the insurance company that is selling it to you. Recessions are hard on insurance companies, so we may see some troubled insurance companies in the next recession (as we did in the Great Recession). Insurance products are like being a renter. If you can’t pay, you get tossed out. Many people pay for life insurance their entire working life, and then can’t pay when they retire – when they are really most in need. If you put that money into your own tax protected account, you could save on taxes, compound your gains, and it would be there for you when you retire, even offering some income, in addition to the capital. 14. What were the top performing and the worst months for stocks over the past five years? July, November and February performed best over the 5-year period (in that order), on average. December, August & May were negative months. 2019 Retreat Attendees receive charts of the top-performing months and election year trends. If you’re interested in learning more about our 3-day, life transformational investor educational retreats, call 310-430-2397 or email info @ NataliePace.com. 15. What was the top performing 2-month period for stocks over the past twenty years? March & April – the Spring Rally – performed the best over the 20-year period, but saw only a 2% rise in the 5-year trend. December 2018 was the worst performing December in history, killing the historical returns of the Santa Rally. Understanding seasonal trends can help you with your annual rebalancing in your nest egg, and with your selling strategy for your trading. I spend one full day on what’s hot, teaching you how to identify the best investments of the year, in my Investor Educational Retreats. 16. What was the worst investment in 2019, NASDAQ, gold, the Dow Jones Industrial Average, bonds, cannabis or real estate? Cannabis was the worst investment in 2019 – with many companies losing half or more of their value. Canopy Growth dropped to a low of $13.81, from heights of $50/share in 2019. Learn more about Cannabis in my January 2019 blog and teleconference. 17. Which year is expected to perform better, 2019 or 2020, based upon historical returns of election years? 2020 is an election year. Traditionally, election years are strong performers. However, the 10 and 20-year returns are wiped out due to the Great Recession (losses of 55%) and the Dot Com Recession (losses of up to 78% in the NASDAQ). 2000, an election year, was the beginning of the Dot Com Recession. 2008, an election year, ushered in the devastating Great Recession. The post-election year (2021) is looking strong over the 10-year period, but is typically one of the weaker years. 18. How many companies are in the Dow Jones Industrial Average? 30 companies. Many are household brands. And many are carrying far more debt than the value of the company. Leverage has begun to concern economists. Over 50% of the corporate bonds are at the lowest rung, just above junk bond status. If you don’t understand how much debt corporations are holding, it’s time to learn The ABCs of Money that we all should have received in high school. General Electric isn’t the only blue chip that is likely to slash its dividend and lose market value. Ford Motor Company isn’t the only name brand about to be downgraded to junk bond status. Click to access the names of the 30 companies. The Dow Jones Industrial Average was launched in 1896. 19. How many Dow Jones Industrial Average companies were bailed out or went bankrupt in the Great Recession? Most don't realize that 20% of the companies of the Dow (6 companies: AIG, American Express, Bank of America, Citi, JP Morgan and General Motors) were bailed out or went bankrupt in the Great Recession. Others, like General Electric and Ford, received support. New Chips, like Apple, Google, Amazon, Facebook and Netflix, are far safer, and higher performing, than Blue Chips, both in terms of growth, but also in terms of the fiscal health of their balance sheets. Learn more about how to add in performance and avoid the bailouts in your funds and retirement account at the Investor Educational Retreat and in The ABCs of Money. Since the Great Recession, the NASDAQ Composite Index has offered far superior returns than the Dow Jones Industrial Average, even factoring in dividends. In fact, the higher the dividend, the higher the risk. 20. How much did investors lose during the Great Recession? The Dow Jones Industrial Average lost 55% in the Great Recession. Yes, the markets have come back. But it is important to realice that Buy & Hope has lost more than half in both of the last two recessions. You can’t afford to lose more than half every 8-10 years, crawl back to even, only to lose more than half again. It’s time to step off of the Wall Street Rollercoaster and into time-proven, easy systems that work. Buy & Hope is a last century plan that hasn’t worked in the New Millennium and will not work going forward. Returns of the Dow Jones Industrial Average Oct. 2007 – March 2009 21. How much did investors lose during the Dot Com Recession? Investors lost up to 78% in the Dot Com Recession, when the Nasdaq Composite Index dropped to a low of 1,114. Returns of the Nasdaq Composite Index March 2000 – October 2002 22. Does Buy & Hope work? If not, what does? Buy & Hope has been losing more than half in each recession since 2000. Due to the amount of debt and leverage, and the slow rate of growth, Buy and Hold will not work going forward (until those problems are dealt with and cycled through). Our easy-as-a-pie-chart nest egg strategies earned gains in the last two recessions and have outperformed the bull markets in between. Working off of the pie charts, instead of the brokerage statement, allows you to take the emotions out of the plan, and rely, instead, upon a time-proven system. Email [email protected] or call 310-430-2397, if you’d like a customized, sample pie chart. Annual rebalancing is also a key component of this plan. Annual rebalancing is a buy low, sell high system on auto-pilot for your nest egg – prompting you to do what you should be doing each year. 23. Why is it that so many investors are unable to Buy Low and Sell High? Buy low, sell high is a mantra that everyone knows. So, why do so few investors do it? There are a few reasons…

1. Start with what you know and love 2. Pick the Leader 3. Buy low; sell high (easy to say; hard to do) This recipe, along with my Stock Report Card, Four Questions, market strategies and data drilling are how I earned the ranking of number one stock picker. The recipe is easy. Learning how to use these tools requires practice. You must begin by locating and analyzing data, which is actually less time and far more informative than reading articles, which have a fraction of the information and might be written by a novice. Come to my next Stock Master Class on February 7, 2020, the day before the Florida beachfront Investor Educational Retreat to learn firsthand (from me) how easy and effective this strategy is, and why it has worked through bull and bear markets for more two decades now, while most strategies have bankrupted investors. Call 310-430-2397 or email [email protected] to learn more. 25. What are the Four Questions for Picking Winning Stocks? The Four Questions for Picking Winning Stocks. 1. What’s the product? 2. Who’s the customer? 3. Can the company continue to make a superior product going forward and get it to their customer at the best price before the competition? 4. Who’s the CEO and can s/he motivate the employees to make the best product faster, better and cheaper than the competition? As you can see, three out of four questions can be answered by being a good customer of the company. The 3rd question will benefit from you completing a Stock Report Card, and understanding how to use the data. So, the more you know about a company (ingredient #1 of the recipe for Cooking Up Profits), the easier it is to pick the leader. In Put Your Money Where Your Heart Is, I used these questions and tools to compare two companies. Google scored an A (in 2006, when it had only been publicly traded for 2 years). The Wall Street darling Blue Chip, which I gave a D- to, went on to declare bankruptcy (General Motors). FYI: Using the Stock Report Card and 4 Questions, I identified both of these trends years before these major events occurred. The book was written in 2006, three years before GM went bankrupt. In fact, I applauded Google on national television before its IPO, when most pundits pooh-poohed it. This is the power of asking the right questions, rather than just listening to the mainstream media. Join me at an upcoming Financial Empowerment and Investor Educational Retreats. Call 310-430-2397 or email [email protected] to learn now. Yesterday our team was told yet another story about someone who lost it all by trusting in the "free" advice of a financial advisor. Learn the truth about commissions & conflicts of interest & how to get a 2nd opinion now in the guest blog “They Trusted Him. Now He Doesn’t Return Phone Calls.” Know what you own. Protect your future now! Data Sources: (c) 2020 Morningstar Direct and The National Association of Realtors. All rights reserved. Used with permission. The information contained herein: (1) is proprietary; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete, or timely. Neither Morningstar, the National Association of Realtors, Natalie Pace, nor any content providers are responsible for any damages or losses arising from any use of this information. Past performance is no guarantee of future results. Other Blogs of Interest Win a Seat at a Retreat The Cannabis Capital Crunch and Stock Meltdown. Does Your Commute Pollute More Than Planes? Are Health Care Costs Killing Your Budget? 2020 Crystal Ball. The Benefits of Living Green. Featuring H.R.H. The Prince of Wales' Twin Eco Communities. What Love, Time and Charity Have to do with our Commonwealth. Interview with MacArthur Genius Award Winner Kevin Murphy. Unicorns Yesterday. Fairy Tales Today. IPO Losses Top $100 Billion. Counting Blessings on Thanksgiving. Real Estate Prices Decline. Hong Kong Slides into a Recession. China Slows. They Trusted Him. Now He Doesn't Return Phone Calls. Beyond Meat's Shares Dive 67% in 2 Months. Price Matters. Will There be a Santa Rally? It's Up to Apple. Will JP Morgan Implode on Fairy Tales and Unicorns. Harness Your Emotions for Successful Investing. What the Ford Downgrade Means for Main Street. The Dow Dropped Over 1000 Points Tesla's 3Q 2019 Deliveries Could Hit 100,000. Do We Talk Ourselves into Recessions? Interview with Nobel Prize Winning Economist Robert J. Shiller. The Winners and Loser of a Clean Energy Policy. Make the Climate Strike Personal. Ford is Downgraded to Junk. From Buried Alive in Bill to Buying Your Own Island. The Manufacturing Recession. An Interview with Liz Ann Sonders. Gold Mining ETFs Have Doubled. The Gold Bull Market Has Begun. The We Work IPO. The Highs and Hangovers of Investing in Cannabis. Recession Proof Your Life. China Takes a Bite Out of Apple Sales. Will the Dow Hit 30,000? A Check Up on the Economy Red Flags in the Boeing 2Q 2019 Earnings Report The Weakening Economy. Think Capture Gains, Not Stop Losses. Buy and Hold Works. Right? Wall Street Secrets Your Broker Isn't Telling You. Unaffordability: The Unspoken Housing Crisis in America. Are You Being Pressured to Buy a Home or Stocks? What's Your Exit Strategy? Will the Feds Lower Interest Rates on June 19, 2019? Should You Buy Tesla at a 2 1/2 Year Low? It's Time To Do Your Annual Rebalancing. Cannabis Crashes. Should You Get High Again? Are You Suffering From Buy High, Sell Low Mentality? Financial Engineering is Not Real Growth The Zoom IPO. 10 Rally Killers. Fix the Roof While the Sun is Shining. Uber vs. Lyft. Which IPO Will Drive Returns? Boeing Cuts 737 Production by 20%. Tesla Delivery Data Disappoints. Stock Tanks. Why Did Wells Fargo's CEO Get the Boot? Earth Gratitude This Earth Day. Real Estate is Back to an All-Time High. Is the Spring Rally Over? The Lyft IPO Hits Wall Street. Should you take a ride? Cannabis Doubles. Did you miss the party? 12 Investing Mistakes Drowning in Debt? Get Solutions. What's Hot in 2019? The Debt Ceiling Was Hit (Again) on March 1, 2019. How Bad Will the GDP Report Be? 2019 Investor IQ Test The State of the Union CBD Oil for Sale. The High Cost of Free Advice. Apple's Real Problem in China: Huawei. 2019 Crystal Ball. 2018 is the Worst December Ever. Will the Feds Raise Interest Rates? Should They? Learn what you're not being told in the MSM. Why FANG, Banks and Your Value Funds Are in Trouble. When the Santa Rally is a Loser, the Next Year is a Bigger Loser. Russia Dumps Treasuries and Buys Gold OPEC and Russia Cut Oil Production. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable however NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors. Comments are closed.

|

AuthorNatalie Pace is the co-creator of the Earth Gratitude Project and the author of The Power of 8 Billion: It's Up to Us, The ABCs of Money, The ABCs of Money for College, The Gratitude Game and Put Your Money Where Your Heart Is. She is a repeat guest & speaker on national news shows and stages. She has been ranked the No. 1 stock picker, above over 830 A-list pundits, by an independent tracking agency, and has been saving homes and nest eggs since 1999. Archives

July 2024

Categories |

RSS Feed

RSS Feed