|

Fix the Roof While the Sun is Shining. The 10 Events That Will Drive (or Tank) the Economy in 2019. John F. Kennedy Jr. famously said, “The time to fix the roof is while the sun is shining.” As we enter the 11th year of this recovery, it is definitely time to do a full assessment of our roof, testing where the vulnerabilities lie and fixing them now. Most Americans are going to need an outside opinion for this. Why? Would you hire the roof contractor who let the storm flood your home last time? If you lost more than 30% in the Great Recession and you haven’t made any changes to your plan, then now is the time to get an unbiased, second opinion. And here’s why. There are at least 10 areas of economic vulnerability – many which are not in the headlines yet – that make 2019 a rather precarious year for stocks and bonds. The 10 Events That Will Drive (or Tank) the Economy in 2019.

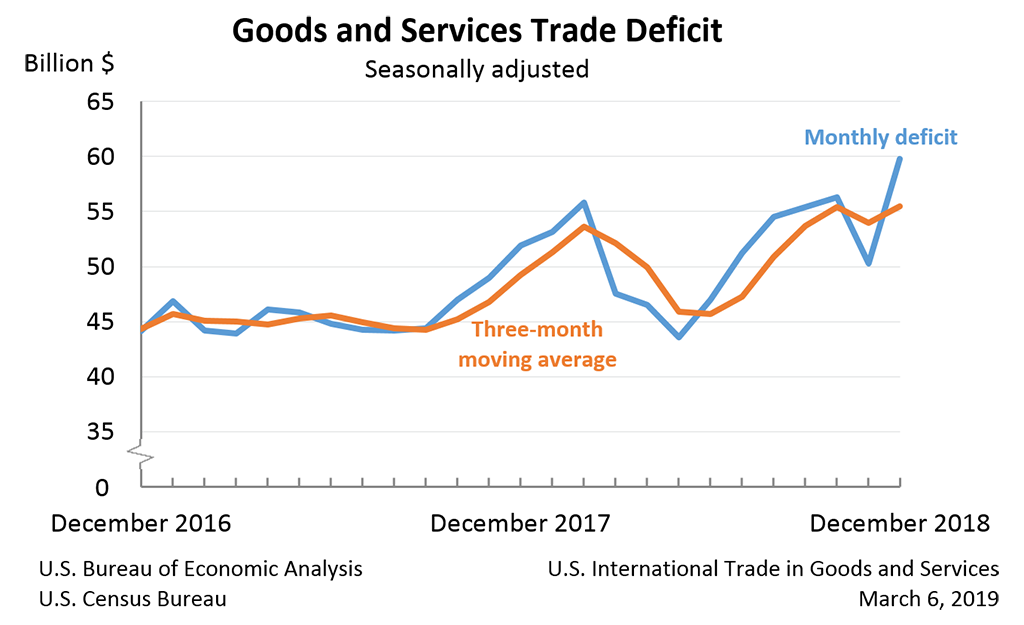

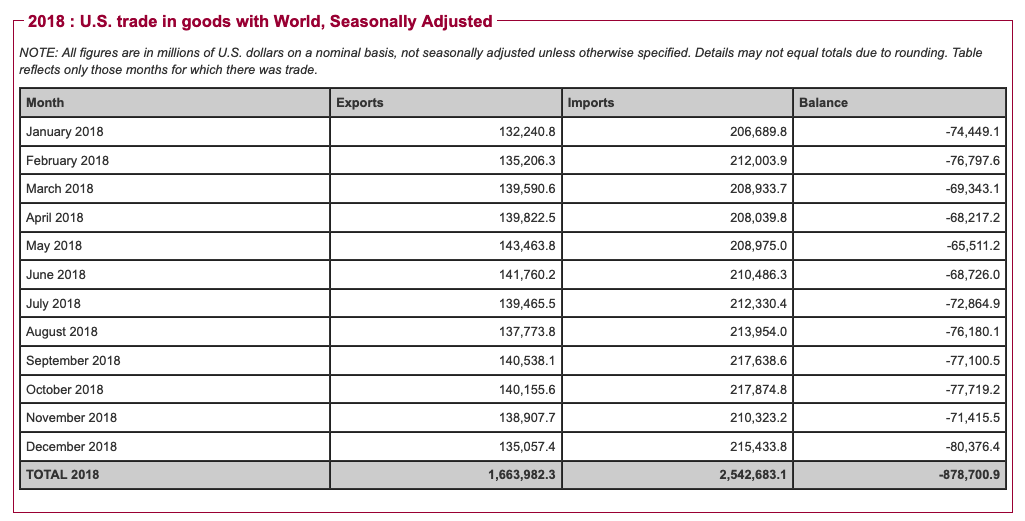

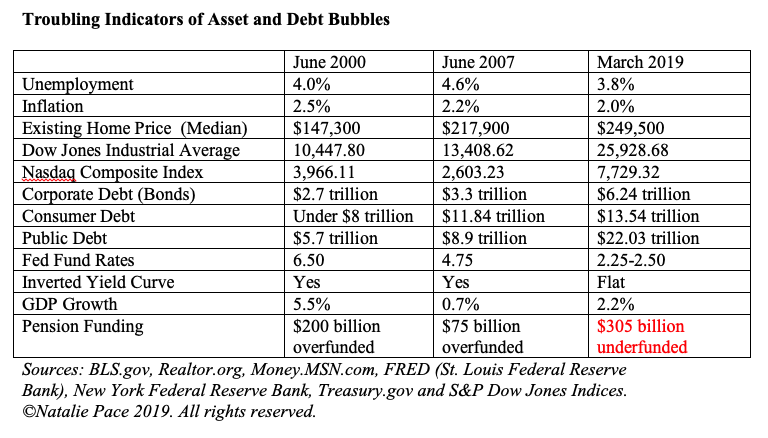

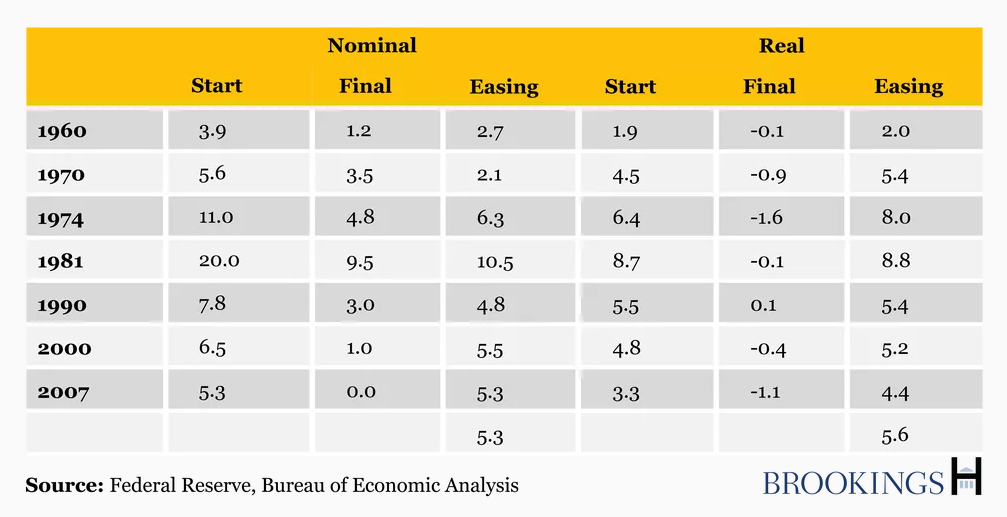

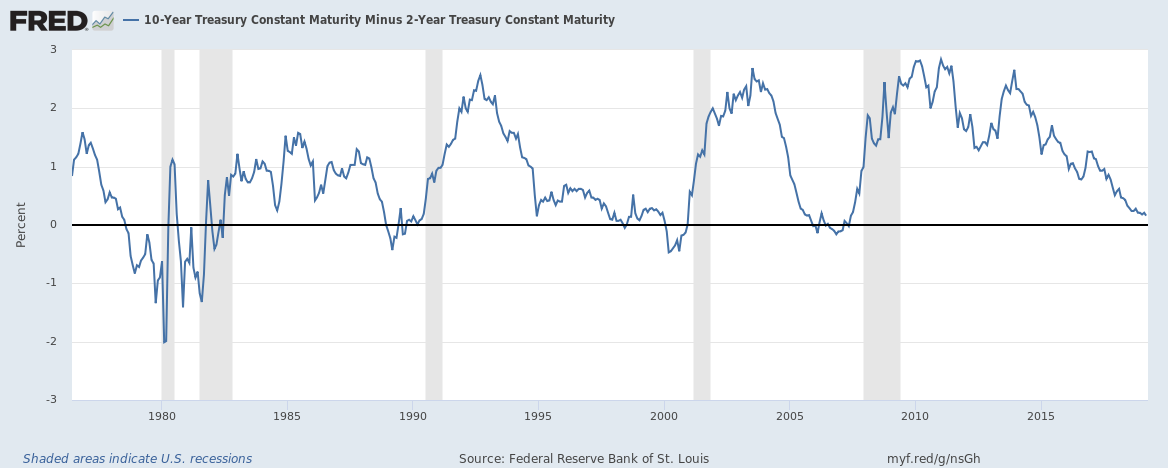

And here are the facts on each point. The 10 Events That Will Drive (or Tank) the Economy in 2019. 1. Stagnant GDP Growth. GDP growth in 2018 was 2.9%. 2019 GDP growth is predicted to slide down to 2.1%, with the 1st quarter 2019 GDP growth to fall somewhere between 1.4-2.3% (potentially under 4Q 2018’s disappointing 2.2% growth). The 1Q 2019 GDP growth report will be released on April 26, 2019. Investors aren’t fond of low GDP numbers. 2. The Debt Ceiling Was Hit on March 1, 2019. The debt limit was hit (again) on March 1, 2019. Most Americans aren’t aware of this, and it was under-reported in the mainstream media. Trying to locate a copy of the letter that Treasury Secretary Mnuchin send to Nancy Pelosi is next to impossible. (Click on Mnuchin to access.) The U.S. public debt is now at $22 trillion. Add in consumer debt, corporate debt and loans and municipal and state debt, and that number skyrockets to over $72 trillion. The U.S. must raise the debt ceiling before it runs out of money to pay its bills, which is predicted to be around September 30, 2019, give or take a few weeks (source: CBO.gov). If the debt limit is not raised before that X date, the U.S. risks a credit downgrade. Wonder who owns all of this debt? You do! Click to read my blog outlining the foreign and domestic holders of the U.S. debt. FYI: Russia sold off almost all of their U.S. treasuries in April of 2018 and has been stockpiling gold. 3. Will the U.S. Keep AAA Rating with Fitch Ratings? During the last Debt Ceiling crisis in 2017, Fitch Ratings warned, “If the debt limit is not raised in a timely manner prior to the so-called “x date” Fitch would review the US sovereign rating, with potentially negative implications.” This possibility was reiterated by Charles Seville, a senior director at Fitch, in January of 2019, during the government shutdown. Both Fitch and Moody’s expect the Debt Ceiling to be raised before the Treasury runs out of money, which is predicted to be sometime in August. (Last time, the White House made a deal with the Democrats, against their own party, to raise the Debt Limit.) In that event, the Debt Limit won’t generate a downgrade, but is a reminder of the unsustainable path of debt that the U.S. is currently teetering on. If X date is hit without a deal, both agencies will likely review the U.S. AAA credit. Fitch is more likely to downgrade than Moody’s. 4. Putin/bin Salman Oil Partnership. There is a very high correlation between oil prices and recessions. So, the lower prices of gasoline and other petroleum products over the last few years have been helpful to economic growth by giving consumers a little room in their budget for other spending. However, on December 7, 2018, Putin and Saudi Arabia Prince Mohammed bin Salman (the one accused of killing journalist Jamal Khashoggi) agreed to cut oil production. This is intended to increase the price of oil. If it works, this will be a drag on the economy. 5. China/U.S./EU Trade War & Tariffs. Tariffs hurt economies. Currently, the U.S. government is imposing tariffs on China and has threatened to impose them on Canada and Europe. The auto manufacturing and solar industries have suffered a dramatic increase in the cost of their parts. Farmers have suffered. And the U.S. trade deficit has skyrocketed to heights never seen before. 6. Interest Rates. Low interest rates create bubbles. Check out the Asset Bubble Chart below. Low interest rates will also create a massive problem for the Federal Reserve during the next recession. As former Secretary of the Treasury Lawrence H. Summers explains it, “Interest rates are reduced by 5 percentage points to combat recessions” Therefore, in the next recession, we risk “policy impotence” because there just isn’t enough room to lower rates enough to goose growth. Summers doubts that quantitative easing alone can do the trick. 7. Flat or Inverted Yield Curve. An inverted yield curve is 100% associated with recessions for the last half a century. Part of the reason for that, as Liz Ann Sonders, the chief investment strategist for Charles Schwab explains, is that having the short-term rate (the rate at which banks borrow) and the long-term rate (the rate at which banks can lend) be inverted means that banks lose money. So, financials are out of favor at this time, too, from an earnings perspective. However, the banks are buying back their own stock at records not seen since pre-Great Recession. According to Howard Silverblatt, the senior index analyst at S&P Dow Jones Indices, Wells Fargo spent $29.153 billion on buybacks and dividends in 2018, which is $8.46 billion more than the company earned (at $20.69 billion). 8. Escalating Public Debt (and debt of every nature really). See above for the details on the $72+ trillion in total debt and loans in the U.S. As Alan Greenspan said in an interview on CNBC on April 12, 2019, “The CBO is putting out huge forecasts of the deficit and nobody seems to mind. They will mind when it gets monetized [as inflation].” 9. Housing Market Slowing (source: The National Association of Realtors) Home sales are down in 2019, with the most recent report from February 2019 home sales slowing 1.8% over last February 2018. The main issue is unaffordability. Sales prices are at an all-time high, with the median existing home price for all-types of homes at $249,500, up 3.6% from a year ago. (Refer to the above Asset Bubble Chart.) 10. Policy Impotence in the 11th year of the Bull Market. Despite ample evidence that 5% Fed Fund rate is the basis needed before a recession, and growing evidence that inflation above 2% would actually be healthier for the economy, the Administration keeps Tweeting for lower interest rates. In the short run, that might make the economy look stronger than it is (something that all politicians like to brag about, regardless of which side of the aisle they sit), by promoting more asset bubbles. Additionally, we see 1% GDP growth for every 10% increase in stock prices (according to Alan Greenspan in his April 12, 2019 interview). In the long run, lowering interest rates prematurely would be a devastating move, causing policy impotence to help make the “landing” of a correction/recession “softer.” In the 11th year of a bull market, during a global economic slowdown, this risk becomes increasingly pronounced. Learning how much you have at risk, and how safe and diversified you currently are, from a qualified, independent, unbiased source, could protect you from another financial catastrophe, such as occurred in 2008 and 2000. As you can see from the 10 points above, the economy in 2019 is far more precarious than it was in 2000 or 2008. Real estate prices are higher, stock prices are higher, bonds are in a bubble, the trade deficit is higher and debt is absolutely astronomical. Wisdom and time-proven strategies are the cure. The economic landscape can change rapidly. Time proven systems will be your ally. Join me at my Colorado Investor Edu Retreat, where we’ll examine how to protect your assets, learn what's safe in a world where stocks and bonds are in a bubble and invest profitably in high growth opportunities (like cannabis). Call 310-430-2397 or email info @ NataliePace.com to learn more about the retreat, or to request an unbiased second opinion on your current budgeting and investing plan! Other Blogs of Interest Uber vs. Lyft. Which IPO Will Drive Returns? Boeing Cuts 737 Production by 20%. Tesla Delivery Data Disappoints. Stock Tanks. Why Did Wells Fargo's CEO Get the Boot? Earth Gratitude This Earth Day. Real Estate is Back to an All-Time High. Is the Spring Rally Over? The Lyft IPO Hits Wall Street. Should you take a ride? Cannabis Doubles. Did you miss the party? 12 Investing Mistakes Drowning in Debt? Get Solutions. What Hot in 2019? The Debt Ceiling Was Hit (Again) on March 1, 2019. How Bad Will the GDP Report Be? 2019 Investor IQ Test The State of the Union CBD Oil for Sale. The High Cost of Free Advice. Apple's Real Problem in China: Huawei. 2019 Crystal Ball. 2018 is the Worst December Ever. Will the Feds Raise Interest Rates? Should They? Learn what you're not being told in the MSM. Why FANG, Banks and Your Value Funds Are in Trouble. When the Santa Rally is a Loser, the Next Year is a Bigger Loser. Russia Dumps Treasuries and Buys Gold OPEC and Russia Cut Oil Production. Trade Deficit Hits an All-Time High. Wall Street Plunges 800 Points. How to Protect Yourself. Rebalance and Get Safe in December. Here's Why. The Best Investment Decision I Ever Made. What's Safe for Your Cash? FDIC? SIPC? Money Markets? Under the Mattress? The Real Reason Stocks Fell 602 Points on Veterans Day 2018. Will Ford Bonds Be Downgraded to Junk? 6 Risky Investments. 12 Red Flags. 1 Easy Way to Know Whom to Trust With Your Money. Whom Can You Trust? Trust Results. October Wipes Out 2018 Gains. Will There Be a Santa Rally in 2018? The Dow Dropped 832 Points. What Happened? Bonds are In Trouble. Learn 5 Ways to Protect Yourself. Interest Rates Projected to Double by 2020. 5 Warning Signs of a Recession. How a Strong GDP Report Can Go Wrong. Should I Invest in Ford and General Electric? Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable however NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors. 16/5/2019 08:09:58 am

Dear MichelJoy, I'll send you over information by email. If you don't receive it or if you wish to speak to me further about this, please call 310-430-2397 or email [email protected]. Heather, o/b/o Natalie Pace 30/11/2019 03:19:34 am

Roofing companies provide a variety of services and products to fulfill the needs of their customers. 20/2/2020 12:40:01 am

If you want to repair cracks and leakage of roof, always hire professional and certified roofers because they repair all cracks properly and charge genuine fees. 21/4/2020 01:15:59 am

Roofing is an important aspect to be considered while constructing a commercial outlet or any other establishment. 29/4/2020 10:13:58 pm

The roof protects the house from rain, thunderstorm, and strong and harsh rays of the sun, snow, and hailstorm on a daily basis. 20/6/2020 01:33:25 am

To locate a roofing contractor to contact you can ask friends and family for referrals or do a Google search as there are many great roofing directory sites that will provide a short list of roofers in your area. 9/12/2020 09:19:55 pm

Experience is always one of the first and most important things you should be considering with roofers. 9/12/2020 11:31:34 pm

One of the most common mistakes that people tend to make is by choosing to tackle the roofing services either by themselves or by choosing to hire some average roofing contractor. 24/8/2021 02:04:51 pm

Point line contracting is one the leading companies who provides the best roofing services in Brooklyn. So if you Comments are closed.

|

AuthorNatalie Pace is the co-creator of the Earth Gratitude Project and the author of The Power of 8 Billion: It's Up to Us, The ABCs of Money, The ABCs of Money for College, The Gratitude Game and Put Your Money Where Your Heart Is. She is a repeat guest & speaker on national news shows and stages. She has been ranked the No. 1 stock picker, above over 830 A-list pundits, by an independent tracking agency, and has been saving homes and nest eggs since 1999. Archives

July 2024

Categories |

RSS Feed

RSS Feed