|

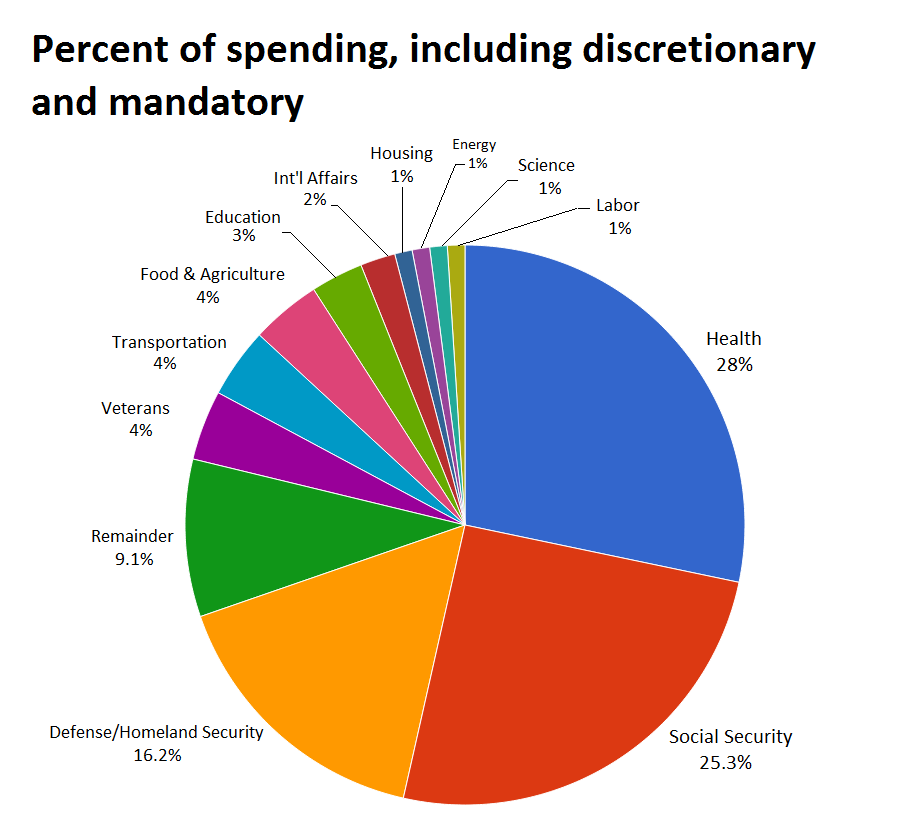

Ever wonder who is picking up the tab every time the U.S. borrows more money to pay its bills? How is it that we can magically raise the debt ceiling and, poof!, instantly more money appears? Who would loan money to a country that has doubled its public debt load over the past decade? (And did the same thing the decade prior to that.) Errr. For the most part, we do. If your 401K, IRA or savings account is invested in a Treasury bill mutual fund, ETF or money market account, you own part of the U.S. debt. The Treasury has also borrowed from “the trusts for Federal Social Security, Federal Employees, Hospital and Supplemental Medical Insurance (Medicare), Disability and Unemployment, and several other smaller trusts” (according to the World Fact Book). About 31% of the debt is owned by foreigners, with China and Japan holding about $1.1 trillion each, followed by a lot of European nations, a few Middle Eastern nations, Russia and others. Japan and China have actually reduced the amount of our debt that they hold over the last year. Saudi Arabia and Russia have both increased their holdings. Click to see the Major Foreign Holders of U.S. Treasury Securities. Get more information on how social security accounts for 28% of the public debt and is the fastest growing (cash-negative) burden on our economy, in my Social Security Blog. Is Debt Ever Good? Borrowing from Peter to pay Paul only has a happy ending when the borrowing is done to fund something that creates great value. When an excellent student borrows money to become a doctor, engineer, computer scientist, CFO (or another career with excellent earning potential), then the loan has a greater chance of being paid back. When a corporation borrows money to build factories to make products that the consumers of the world love, as Apple and Tesla have done, then the loans have a greater chance of being paid back. America has long been the world’s reserve currency, with a legacy of inventing the products that the world loves. That plays in our favor. What plays against us is that the money being borrowed today is largely funding war, health care and social security, which account for almost 70% of the annual federal budget (source: Politifact). While a country must defend itself and keep its citizens healthy and happy, we must also create the products, goods and services that the world needs and is hungry for to create a better tomorrow for the planet and all of us. In fact, the period of greatest expansion in U.S. history, under President Clinton, occurred during a relatively peaceful time for our nation. Our collective investments in the 1990s focused on developing the Internet and the smart phone, which put the U.S. at the forefront of innovation yet again. Anticipating the products of tomorrow is what kept America the strongest economy from the 1940s until 2000... A few years ago, China surpassed the U.S. in term of GDP purchasing power parity. As we slip into 3rd position on the global scale, behind China and The European Union, it's important to empower entrepreneurs, invest in Research & Development, educate our Millennials, get healthy, roll up our sleeves and work, and not just become a nation of war, borrowing and social security.

Should You Be Loaning the U.S. Money? There are certainly safer investments that you should be considering. (I do not recommend just “cashing out” now without a plan, or dumping everything into Bitcoin, gold or real estate). I spend one full day on “What is Safe?” at my Investor Educational Retreats. I also offer a second opinion on your current budgeting and investing strategy. You can read my books and blogs and listen in on my free teleconferences. (I answer questions in the second half of my monthly teleconferences.) Wisdom is the first step. Right action is also key. Quick fixes, lofty promises, free seminars and get-rich-quick schemes are more often scams and money pits. The solutions are not hard, but they do require accurate information and an effort on your part to learn and transform your own life. When someone says, "Let me do it for you," prepare to be oppressed. When someone says, "Let me teach you how," prepare to fly. Again, be very wary of anyone who says they can fix this for you, and all you have to do is to write a check and trust them. There are very few people who have the results track record to warrant your trust and blind faith. Most “fixes” are actually commission-based products, and most of the experts offering those fixes are salesmen, who are schooled in sales-speak, not economics. *This blog was updated on Oct. 10, 2017.

Richard Costa

10/10/2017 10:14:04 am

Keep up the correspondence and have a retreat in the Columbia, MD. area. 10/10/2017 09:47:39 pm

Hi Richard. Thanks for the comment. We'll consider a retreat in the MD area. However, it does take us awhile to work out the logistics. So, if you want to be sure to get safe and educated on all of this, I'd consider coming to our most affordable retreat this weekend in Arizona, or the Valentine's Retreat in Santa Monica, CA. I'm including links below to learn more. 17/5/2018 02:31:20 pm

The East Coast retreats are in Florida, Richard. We only have them once every year of so, and the June 9-11, 2018 retreat only has 2 seats still available! We'd love to have you join us. Comments are closed.

|

AuthorNatalie Pace is the co-creator of the Earth Gratitude Project and the author of The Power of 8 Billion: It's Up to Us, The ABCs of Money, The ABCs of Money for College, The Gratitude Game and Put Your Money Where Your Heart Is. She is a repeat guest & speaker on national news shows and stages. She has been ranked the No. 1 stock picker, above over 830 A-list pundits, by an independent tracking agency, and has been saving homes and nest eggs since 1999. Archives

July 2024

Categories |

RSS Feed

RSS Feed