|

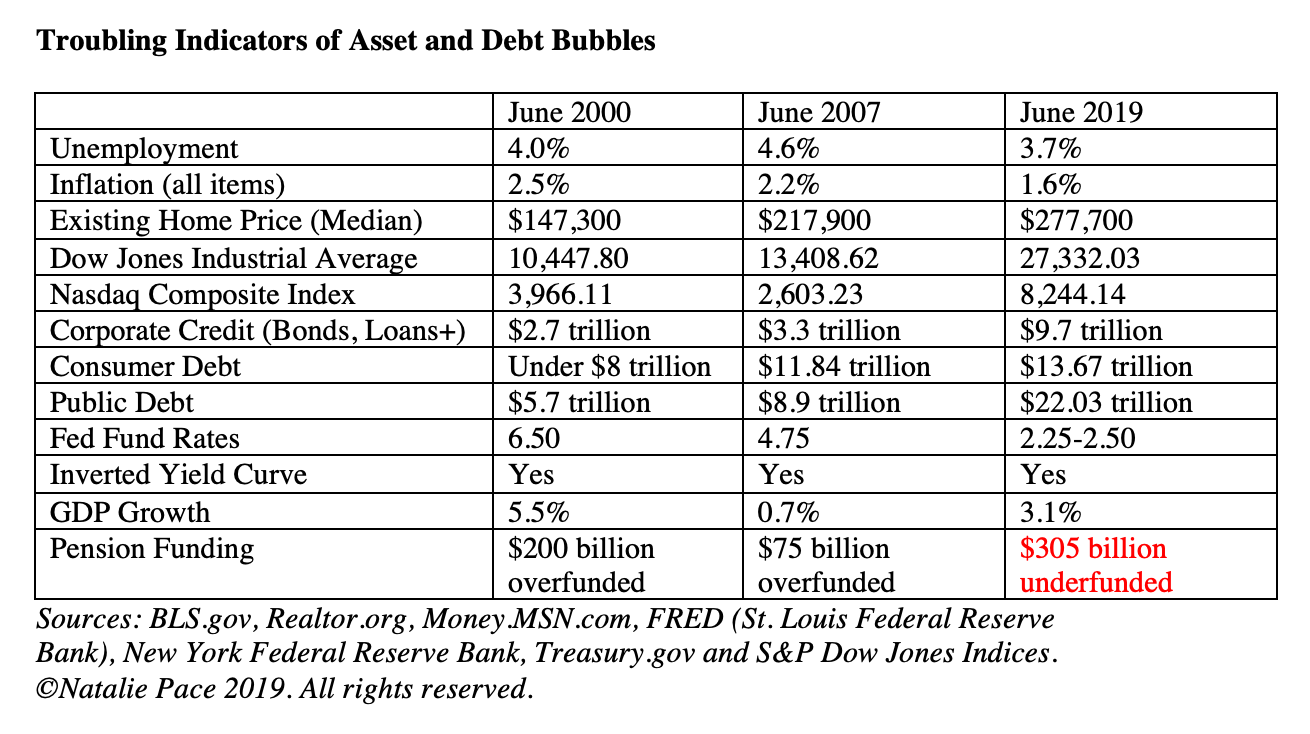

An interview with Nobel Prize winning economist Robert Shiller, who is the author of the new book Narrative Economics and the iconic book Irrational Exuberance. Shiller discusses how the stories we tell one another drive the economies of the world – sometimes into bubbles, sometimes into tearing down walls (like the Berlin Wall in 1989), and other times into depressions. On September 25, 2019, Professor Shiller and I spoke about his new book, Narrative Economics, and what some of the stories that are currently in circulation say about where the economy is headed. Is a recession, or a continued rally, on the horizon? Below is a transcript of our conversation. Natalie Pace: How can the study of stories help the economic profession to better forecast events, and perhaps even mitigate their severity? Professor Robert J. Shiller: The economics profession has had some success in forecasting economic events. But there has been a tendency to miss some of the most important factors, which are changes in the way people are thinking, that they get from each other through a kind-of contagion. The problem is that human conversation hasn’t in the past been largely recorded and available for searching. It’s getting a lot better. We can start to see what people are thinking, and how it’s changing. This will bring a revolution in economics. NP: As you noted in Narrative Economics, the frugality consciousness after the Great Depression may have contributed to the very rough decade that folks experienced in that era. Is there any mindset that is going on now that you believe we should be observing and discussing more? RJS: There are some that are obvious: Donald J. Trump and other populists like him, in other countries. Everyone is talking about it. I can’t add to it in any significant way, other than to say that it has really dominated our talk. It comes up with such regularity, and it’s polarizing. There are other narratives that are not thought of as narratives. One of them is the artificial intelligence narrative – stories about particular inventors and machines that will replace human intellect. That’s one that is lying in wait to affect our confidence. It’s definitely there, but I can’t claim that it has reduced our GDP yet. NP: I just saw an ad for Super Store where one of the employees screams that robots are coming to take our jobs. Does this fear act like a deer in the headlights for our psyche, stopping our confidence in our ability to earn income, which puts the brakes on our purchases, which knocks down GDP? RJS: That’s how it happened in the past. In the Great Depression, there was a lot of talk of robots replacing jobs. It’s not part of our conventional history of the Great Depression. The word robot was invented in 1920. In the Great Depression, when people saw unemployment going up, they blamed it on robots. They didn’t have robots that walked around and talked, but they had plenty of machines. It could happen again because artificial intelligence is such a stunning development, with things like driverless cars and pilotless ships. Artificial intelligence looks like it’s going to have an impact on our jobs. NP: In the wake of the Great Recession, did credit return more quickly to the consumer than it did in the Great Depression? How much of the recovery that we’ve seen was just access to money? Many of our banks and insurance companies wouldn’t even be in existence if we hadn’t bailed them out. Obama famously told bankers that he was all that stood between them and the pitchforks. RJS: Our credit markets have developed a lot since the Great Depression, and they are regulated better. In the early years of the Great Depression, there was no Securities and Exchange Commission. There was no Financial Stability Board. There was no Consumer Financial Protection Bureau. We learned, and things are better. We still are vulnerable to a consumption pullback, even though interest rates are low. People can afford to consume more because the cost of borrowing to do that is lower. Right now, consumption demand is holding up in the U.S. That could change though. NP: Credit card debt and consumer debt is higher than it has ever been. Businesses can still borrow at very low rates. However, I hear from small business owners who borrow on their credit cards to float their commerce. Those rates are exorbitant – usury rates. RJS: You don’t hear that word usury so much these days. There have been variations in people’s willingness to borrow. It’s not just due to the interest rate. It’s because of a story of prudent living – a narrative again. NP: Corporate buybacks have really driven this bull market. Main Street has been rather skeptical, up until 2016. What are your thoughts on the stories being told today about stocks? RJS: One thing that is happening is that there is a shading of the worry about crash. The lowest ebb for safety in the market was right at 2009. Although the market had gone down 50% in real terms, people thought it would go down even further. They were talking about 1929 in exorbitant levels. Now that narrative is fading. However, we still call that recession the Great Recession, which is a play on the words Great Depression, so it’s still on our minds. The recovery that we’ve seen since then is partly due to just forgetting about the stories that we heard about people losing their houses and suffering under unemployment. They are not fresh in our memory anymore. It may be that more than any new narrative. It’s also the Donald Trump narrative, which provides a script for a new way of living – more ostentatious. You may feel more embarrassed about being poor. Trump talks about losers. He’s very harsh in his judgment of some people. That affects our thinking. We have to keep up with the Joneses. They used to say that in the Depression, but they said it pejoratively. NP: The shift toward nationalism that began with the new Administration is not just in the U.S. There are a lot of countries grappling with this. You noted that this mindset was viral before World War II. RJS: I’m worried about the polarization in our societies and the rise of primitive nationalism. Part of my theory is about stories going viral. But it is also about stories that are forgotten. One of the powerful narratives that is being forgotten is World War II. That was such a nightmare. For a long time afterwards, people were much kinder to one another and supportive. That’s fading. We’re slipping back into our tribal past, and it’s worrisome. NP: What are the impacts historically of trade wars? Are tariffs an effective tool to stoke economies, or is it the exact opposite? RJS: Ever since Adam Smith, who wrote The Wealth of Nations in 1776, economists have a visceral negative reaction to tariffs. They think it is just protecting less competent businesses. It happens because of bribery of one sort or another. A lot of people during the Great Depression believed that the Trade War, created by the Smoot-Hawley Tariff Act in 1930, was the cause of the depression. It didn’t work. The economy just sank into the worst depression ever experienced by 1933. It’s an old narrative that is recovering today, and it may have an even worse impact on our economy. NP: Part of the trade war sloganeering to the populace is to protect jobs and bring manufacturing back. RJS: We do have a problem of rising inequality. A couple of our Democratic candidates seem to be addressing it. However, it may be a better election strategy to focus on immigrants as a threat to our jobs. However, this is potentially damaging to the economy. NP: So, the Great Depression experienced a toxic cocktail of frugality, nationalism and tariffs? Were there other contributing factors that we need to be looking at today as well. RJS: One important factor in the Great Depression was that people were thinking more about confidence and the confidence of others. It was a general trend early in the 20th century that people were reading more about psychology. They thought depression referred to a mental state, but it also occurred in the economy. Now we have these confidence numbers talked about all the time. We have the stock market reported every day, as if that was a measure of confidence in the economy. Actually, it is a measure of confidence in something more narrow than the whole economy. However, we’re accustomed to thinking of that as a barometer of our national psyche. NP: The White House has been very vocal about zero interest rates. The Federal Reserve had 3 dissents in the last meeting, when they lowered interest rates. There is a very wide-ranging view of what the policy should be. The market is expecting another cut in December. What are the problems with pervasively low and zero interest rates? RJS: It’s a complicated decision. That’s why there is dissent at the Federal Open Market Committee. Part of the reason that it is ambiguous is that it involves human psychology and human narratives. The idea of cutting interest rates all the way to zero as a dramatic stimulus measure… I’m more than a little uncomfortable with that because it’s like your doctor giving you a strong anti-depressant for your mental condition. You think, “I must be really mentally ill if he gave me that.” It harms your psyche. It reminds them of the famous narrative of the Lost Decade in Japan, which is really decades, after they cut interest rates to zero. It didn’t work for Japan either. NP: Are you concerned about asset bubbles and financial instability? More than 50% of the corporate bonds are just a hair above speculative, and Ford was just downgraded to junk by Moody’s. RJS: Yes, I am concerned because there is a debt/liquidity cycle and a leverage cycle. We’re seeing corporate balance sheets being leveraged. I don’t like to use the words leading indicators loosely, but it has been a sign of approaching recession. There is also a question of how big and how strong. We will have a recession eventually. I don’t know if it will be in 2020. But if memories of the 2008-2009 financial crisis come back, that could harm confidence. NP: You’re saying that just the narrative itself could actually create a deeper recession than needs to be… RJS: That’s the idea that I’m promoting in my book Narrative Economics, that stories are causal elements. Narratives are like diseases, like influenza. Influenza lies relatively tame until suddenly there is a big epidemic. Or maybe it’s not so big. It depends upon mutations in the influenza virus and maybe something like weather conditions. The same thing is true with narratives. The artificial intelligence narrative doesn’t seem to be scaring people, but it’s there. It could come back into a big scare. NP: You point out that stories can evolve just like viruses. In the Dot Com Recession, the artificial intelligence narrative was not a scare, but something that everyone wanted to profit from. RJS: That’s right. And then the Dot Com thing came to an end right around the time that Barron’s published an article called “Burning Up,” which documented how many of those Dot Com companies were close to insolvency. It became a sudden narrative that: “This is it.” [The Dot Com Recession] also came after the New Millennium. We heard all of these expansive stories about the future, and here we are in 2000, and it’s looking kind of iffy. Maybe we were suffering a hangover after our New Millennium party. NP: What do you think about the Sharing Economy and Micro Mobility, which are hallmarks of Millennials and Gen Z. Is this a new modesty craze that might spark frugality? RJS: The bike craze happened before. During the Great Depression, a lot of stores set up bike racks because there was a big switch to riding a bike. Right now, this isn’t associated with poverty, but it could become associated with that. Bikes are relatively cheap. NP: Interesting. Cheap bikes and e-scooters, which are getting popular out of necessity, can play into the Donald Trump “I’m winning” narrative, without being seen as frugality… RJS: The problem with narratives is that they are so subtle. You can’t just focus on a word. Ultimately it reflects humanity, and the deep complexity of our minds and our emotions. So, the idea is that some kind of new narrative just gets started. It goes like wildfire. It can stimulate demand, and it can contract demand. It’s not something that we can view at this point from a purely mathematical viewpoint. We have to look at the content of the story, and what is it that makes it so contagious. NP: Let’s talk about the rescue last week of the overnight repo market, which popped from 2 to 10% interest. RJS: Monetary experts view that as a glitch that will be handled by the Federal Reserve. The 10% interest rate was momentary. It disappeared quickly. It could get magnified. The question is, “How is the story received by the public?” For example, in October 19, 1987, we had the biggest stock market one-day drop ever. It was over 22% in the Dow in one day. There was talk of the Great Depression then, but it just didn’t register. There was no recession after that. People thought it was just some technical glitch. At another time, the story could take another dimension. It’s really hard to predict. NP: Ronald Reagan was very good at slogans. Do you think there was some slogan that he pulled out that people just bought into? RJS: I’m thinking it was a Reagan joke. He was great at jokes. The Reagan jokes were generally about the Soviet Union, and they were very effective. NP: OK. Let’s hear one. RJS: A man just bought a new car in the Soviet Union. The salesman is drawing up the final papers and he says, “Funny thing. I see that your car will be delivered on today’s date exactly ten years from now.” The buyer says, “Morning or afternoon?” The salesman responds, “It’s ten years from now. How can you care whether it is morning or afternoon?” The buyer says, “Well, the plumber is coming by in the morning.” NP: Apparently those jokes were so effective they could tear down walls. RJS: Those big changes in the Soviet Union were narrative induced. When I visited Moscow in 1989, I was struck at how people would talk against the government. I thought this was not allowed. Of course, you didn’t see this in the newspapers. I had a tour guide, an official tour guide, who showed me around the Kremlin. She said, “I think civil war is coming to Russia.” That was 1989, before the Internet and with no newspapers reporting on this. NP: But there might have been some sort of economic recession that preceded that mind shift? RJS: Yes. We went into a department store and they had nothing there. There were long lines. I asked someone what he was standing in line for and he said, “Soap.” Things weren’t working right. They sensed hypocrisy. They wanted a change. NP: There’s an ancient Chinese saying that the Emporer stays in power as long as the economy is good. When an economy tanks, there is a divine authority and a change in leadership. RJS: I hadn’t heard that. NP: I remember it from a Chinese culture survey course at USC. RJS: See, we remember the jokes and the narratives easily… NP: The housing market appears strong. The unaffordability index is starting to look problematic. Do you see potential problems or warning signs here? RJS: We have our own S&P CoreLogic Case-Shiller Home Price Indices. With our latest data, prices seem to still be going up, nationwide, in most places. However, it’s going up at a much lower rate. It used to be in double digits, shortly after the bottom of the market, in 2012. On the national index, it’s about 3% now, which is much lower. That is a sign of weakness. This market is different than the stock market. It has much more momentum to it. If we are losing momentum, it could have a drop-off like we saw in 2006, before the financial crisis. Home prices are a lot higher than they were in 2012. You could easily imagine that we could see a drop. I’d hate to suggest that it will be anything as dramatic as what we saw 10 years ago. That was unusual. That was the most dramatic drop in real home prices that we’ve ever experienced. NP: There are far fewer liar’s loans and extreme overleverage, like there was before the Great Recession. RJS: We have regulation that discourages overleverage. Also, people are more careful now. There is still a fear of debt, oppressive debt. It’s an old narrative that goes way back to Thomas Jefferson – even before. NP: Where does the CAPE ratio currently stand? What are the risks and indications of where stock prices are today? RJS: The CAPE ratio is between 28 and 29, or there about. That is high by historical standards. The historical average is about 17. But it’s not as high as it has ever been. We had a price earnings ratio of 46 in the beginning of 2000. That is more than 50% higher than it is now. So, we could keep going up and not break any records. But it is a concern. I think the expected return on the stock market isn’t as good now. NP: However, Main Street investors also have to be careful on the “safe” side, since there is so much leverage in the bond market… RJS: If you’re thinking of pulling out of the stock market and going into the bond market, you’ve got a problem. The bond market has very low yields. So, it’s not clear what to do. Be careful about over-investing in the U.S. market. Consider investing in stock markets around the world to diversify. There’s no reason to panic right now that I see. We’ll find out. NP: Do you have any last thoughts on the economy today? RJS: The economics profession is changing with the times, and particularly with the availability of data. We have digitized texts with all sorts of human exchange, talk and conversation. It will take decades for the economics profession to sort this out. With modern computers, which will be an essential element of the research, we should be able to classify and organize our thinking about narratives. Narratives repeat themselves in history, but you have to have them up to date. There are so many narratives that it is hard to summarize the effect of all of them. I think we’ll get there. NP: But there are some pervasive, over-riding themes to our stories, right? RJS: That’s right and they can come back. There are enough people who remember [the old stories] that they provide a background from which to take off again. And the stories may have a human-interest component that is very strong. Any narrative around some people making a lot of money fast tends to be contagious. That’s why we have bubbles. There are also narratives that have a different emotion attached to them, not so much glory and making a lot of money, but it can also be anger at other people and the willingness to boycott something – some nation or some product. NP: All of that played into cryptocurrency. RJS: That’s right. It was an anarchist sentiment. The anarchist narrative goes back to the early 19th century. Hatred of government, in the sense that if government didn’t exist, we’d be fine. One of the reasons that cryptocurrencies have been so popular is that they seem to suggest a route toward a cutting off of government influence, that we cosmopolitans can run our business quite well, thank you. We don’t need the government regulating us. On top of that, we had this nice mystery story about Satoshi Nakamoto who is the supposed inventor of Bitcoin. Nobody can find him. Nobody knows who he was. Maybe it was some committee that wrote the code. That actually adds to the narrative. People like mystery stories. Whenever someone comes forth claiming to be Satoshi Nakamoto, it’s like Anastasia or Delphine. When someone can’t be found and imposters keep coming up, that’s a great story. NP: You’re not seeing doom and gloom on the horizon here. You say there might not even be a recession in 2020… RJS: Right. There’s also a question of how bad a recession it will be when it does come. A lot of recessions have been mild. Let’s hope for the best. Click to listen to my full interview with Professor Robert Shiller on BlogTalkRadio.com/NataliePace. Watch Professor Shiller talking about Narrative Economics in the video below. About Robert Shiller

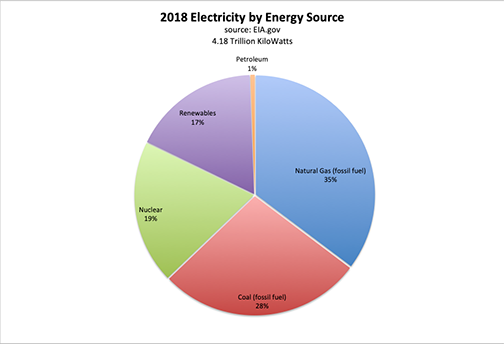

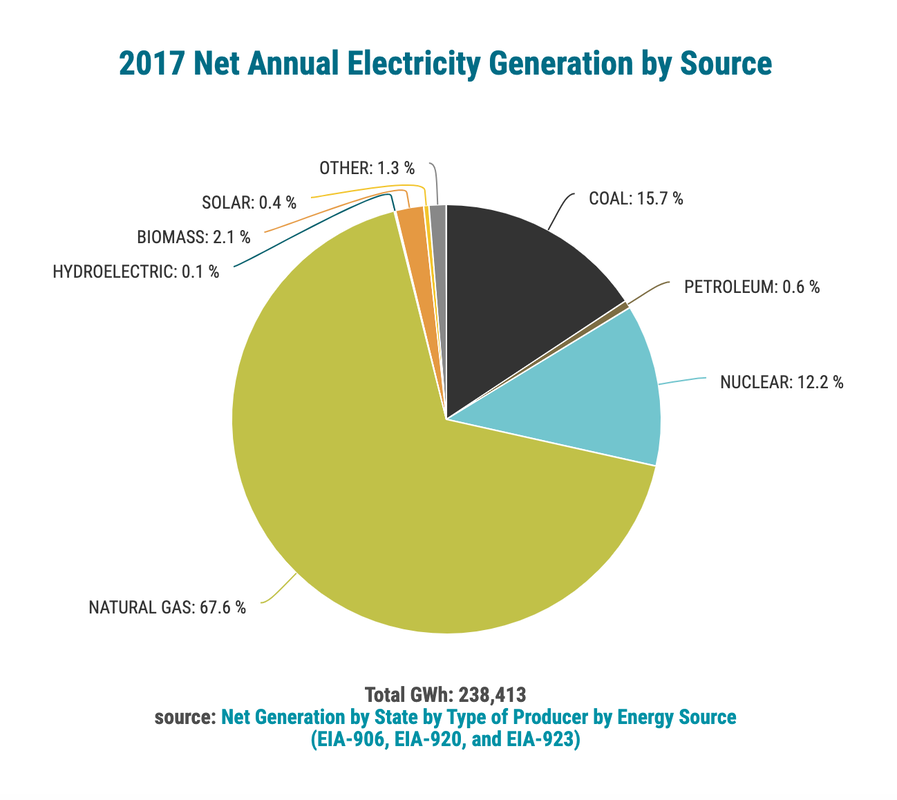

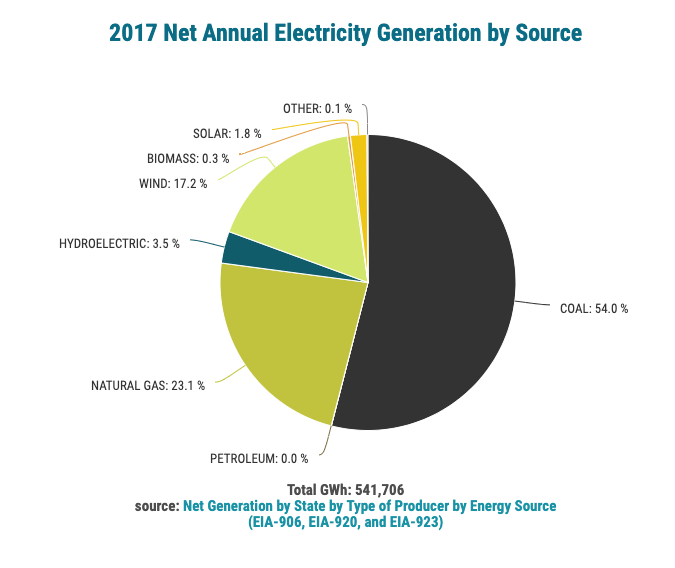

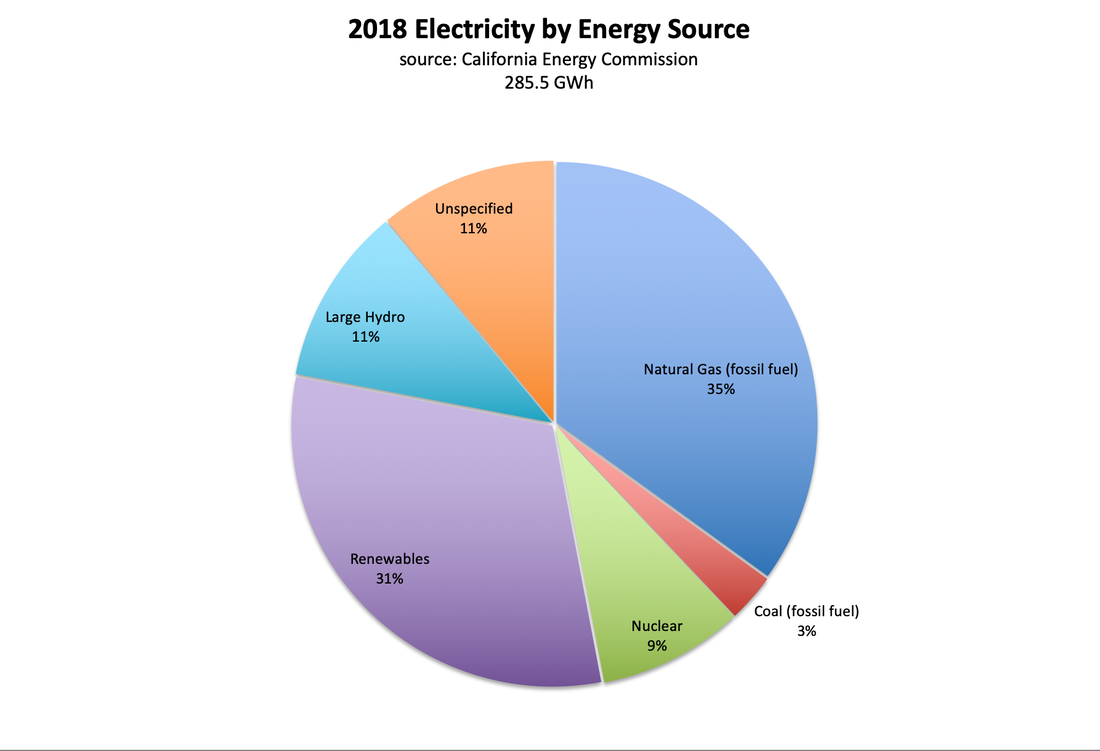

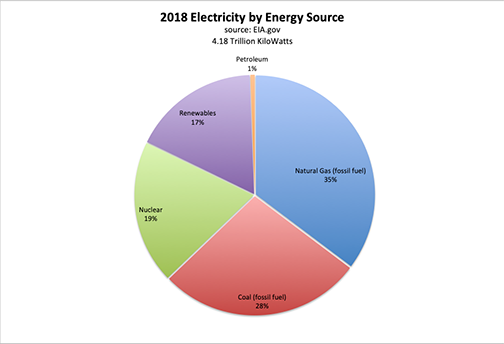

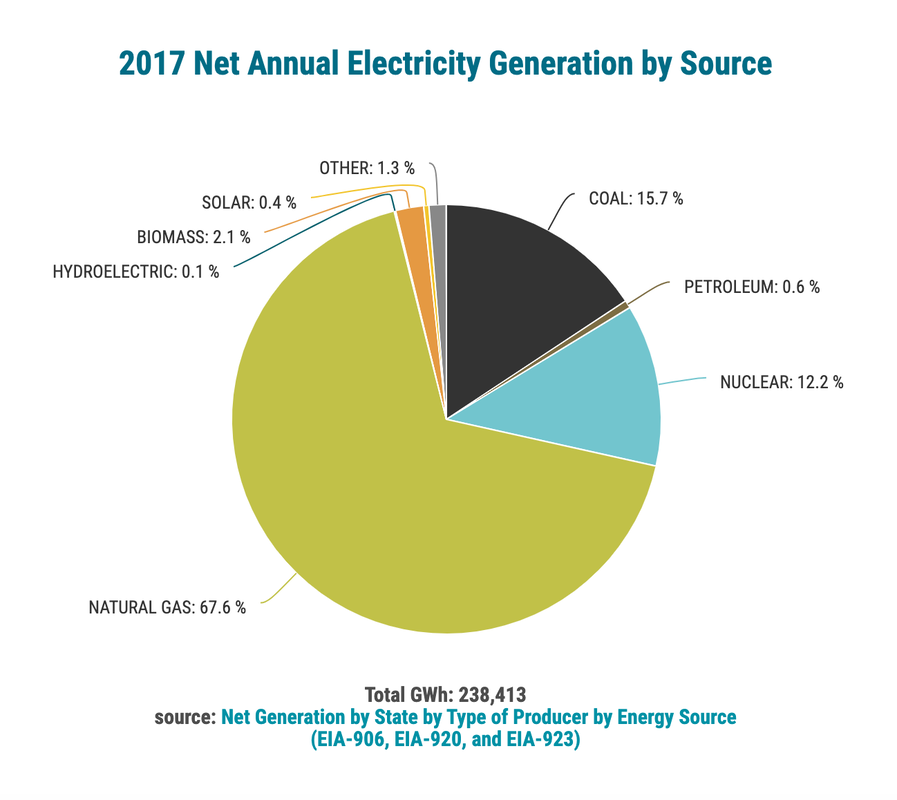

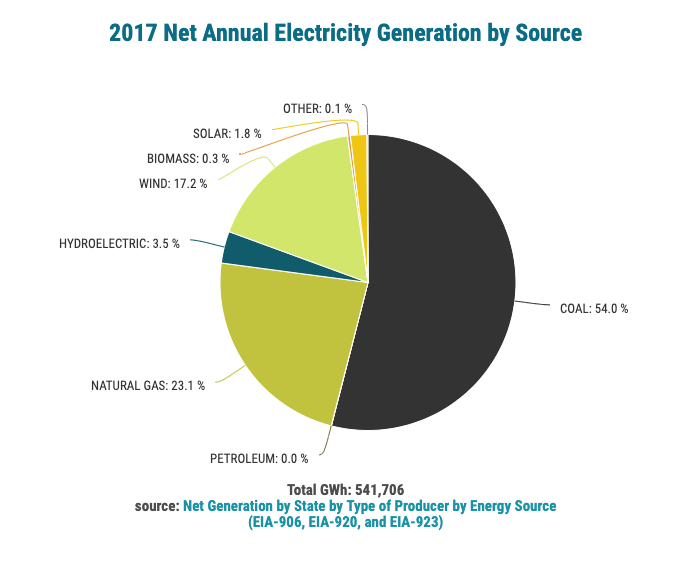

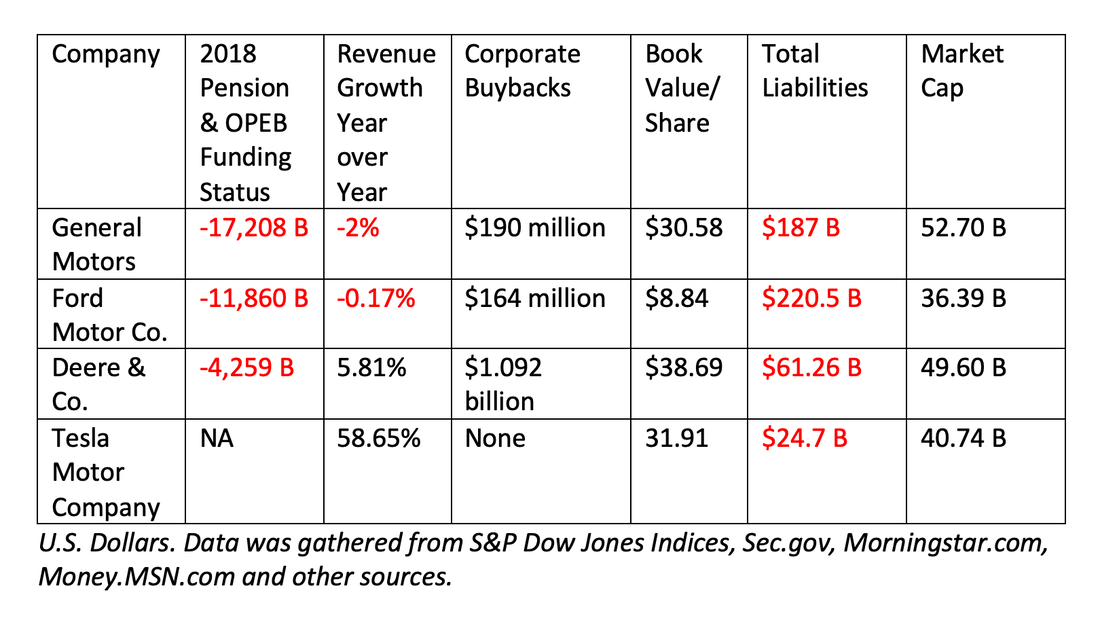

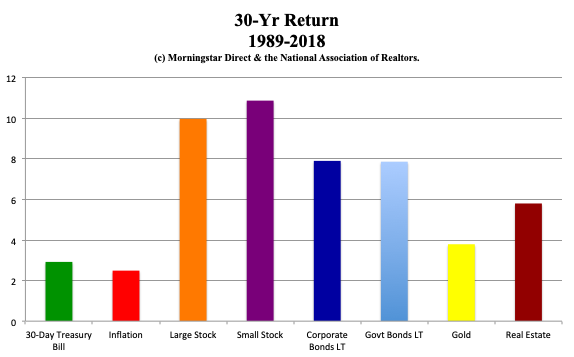

Professor Robert Shiller is one of the leading economists of today. His work on inefficient markets earned him a Nobel Prize in economics in 2013. He is the author of many bestselling books, and is a frequent guest on television and at major economic conferences worldwide. Professor Shiller is the Sterling Professor of Economics at Yale University. Is Greta Thunberg funded by a clean energy cartel that is underpinned by greed rather than altruism? On September 23, 2019, I posted a link to Greta Thunberg‘s five-minute diatribe at the United Nations. I was immediately hit with conspiracy theories about her. How did she get to New York? Who is funding her? Is Greta Thunberg the highest paid activist (or perhaps even actress) in the world, with links to George Soros? Who are the winners and losers of a worldwide clean energy policy? Where does the money trail lead? Let’s Examine the Affect that Clean Energy Policy Has On… 1. Consumers and citizens 2. Government subsidies 3. Fossil fuel companies: oil, coal and natural gas 4. Nuclear energy 5. Utilities 6. Automobile manufacturers 7. Politicians 8. 16-year old Greta Thunberg And here are details on each. 1. Consumers and citizens win big-time when they embrace cleaner solutions. Gasoline costs and utility costs are thousands of dollars annually. By kicking the gas guzzler to the curb and opting for an electric car, you’ll cut your gasoline costs in half – more if prices at the pump jump. If you change your commute altogether and take public transportation or ride a bike, then you’ve got thousands in savings annually that you can spend on things you enjoy more than paying bills – like vacations. Who doesn’t like more money? The same holds true with your electric bill. Most Americans spend hundreds per month and thousands per year keeping the lights on at home, along with all of the other appliances (this can be in the millions for businesses). With smarter energy choices, those costs can be cut in half. If you live in a sunny state and install solar, the payback can be as low as four years, with annual savings in the thousands that amount to a 25% yield or higher. No bond in today’s world comes close to that Return on Investment. Even if you don’t install solar, simply adopting passive house standards (insulation, passive solar), switching to LED lighting, installing an on/off switch on your water heater, using big appliances less and during off-peak hours, and turning the air conditioning off when you aren’t home can slash your electric bill in half or more. Many electrical engineers and astute handymen have electric bills of under $50/month with smarter choices. The 30% solar tax credits are still in effect through the end of 2019. Go to EnergyStar.gov and IRS.gov to learn more. 2. Government subsidies. The U.S. government subsidized the energy industry with $15 billion in 2016 (the most recent reports available). This is less than half of the subsidies and support spent in 2010 ($38 billion). Of that, $7 billion (45%) was spent on renewable energy (source: The U.S. Energy Information Administration at EIA.gov.) So, when anyone screams that clean energy is receiving all of the subsidies, this is simply untrue. More than half of the money (55%) is flowing elsewhere. 3. Fossil Fuel Companies: oil, coal and natural gas. According to ExxonMobil’s own website, the company has been actively involved in climate science for four decades. Their web page on climate change says clearly, “We believe that climate change risks warrant action.” So, why does it take four decades to act? This is a classic case of actions speaking louder than words. It’s not easy to replace your own cash cow business model. There is a planetary addiction to fossil fuels that is a multi trillion-dollar industry. This highlights the need for individuals to take ownership of their own lifestyles and habits, and start putting their own money where their picket signs are. (Greta Thunberg did just that when she took a zero-carbon sailboat to the United States from Sweden to speak at the United Nations, rather than a gasoline-powered airplane.) As long as consumers demand gasoline, oil companies will explore and drill to profit from that demand. The U.S. electrical grid is still 62% powered by fossil fuels. Some states, like Florida and Colorado are much higher than that, with 83% and 77% fossil fuel generation, respectively. Clean energy to the grid is definitely on the rise, but the increase has been rather glacial nationally (and pretty much non-existent in states where oil and natural gas are a primary industry, like Florida and Colorado). California is adopting renewable power much faster than the national average. California has 38% of its electrical generation sourced from fossil fuels, with 42% from renewables and hydro. If you want to check up on your state go to SpotforCleanEnergy.org. 4. There are currently 21 nuclear power plants that are in the decommissioning process in the U.S., according to NRC.gov. Part of the problem is that solar and wind have gotten so inexpensive that they are more affordable than nuclear (and new natural gas projects). Also, as we saw in Japan at the Fukushima power plant, when things go wrong with nuclear, it bankrupts the company that owns the asset. The formerly flourishing Japanese sea towns are now ghost towns. Fukushima reminds us that nuclear energy is not clean energy, once you factor in active rods that have to be stored in a toxic dump forever, and the price of a nuclear meltdown. Whenever we see reports that wind turbine blades cannot be recycled, or solar panel manufacturing has pollutants, we have to also match this up against the toxic cost of nuclear meltdown, the respiratory and other illnesses that are caused by air pollution and oil spills, the damage to habitat and wildlife… All of this should also remind us that energy efficiency must be a top priority for everyone, whether it’s in your home, or the office building that you work in, or the hotel that you sleep in when you travel out of town. Video conferencing should be an option considered far more often for business meetings in place of air travel. Take the stairs, rather than the elevator. Turn off the lights and air conditioning in hotel rooms. Open the curtains and use sunlight instead of electric light as much as possible. There is so much we can change just be being more mindful of coal miners, fracking and nuclear meltdowns whenever we turn on a light switch. Even with all of the decommissioning, nuclear power is still almost 19% of the grid. 5. Utilities have had to rethink their business model and investments. Encouraging energy efficiency means that utilities reap less revenue per person – a losing proposition for profits. So how do they keep their shareholders happy and continue to pay those high dividends? There are utilities that are still very much entrenched in the old ways of doing things, and others that are investing in the clean energy of tomorrow. Many utility companies now make it easy for consumers to choose clean energy with a simple check on one of their utility bills. So, it’s worth it to read the fine print and check the box. 6. Automobile Manufacturers. In 2004, the Toyota Prius won Motor Trend’s Car of the Year. U.S. gasoline prices were on the rise from $1/gallon in 2002, to over $3/gallon by October of 2005 and an all-time high of $4.70/gallon in July of 2008, due to the cost of fighting two wars. (Add a dollar per gallon in California.) Toyota soared to become the #1 auto manufacturer in the world, and has a current market valuation of $194 billion, compared to General Motor’s $52.50 billion. Ford just had its bonds downgraded to junk by Moody’s. It’s clear to see that fuel efficiency is a winning proposition in the auto industry, and has cost the laggards tens of billions in market share, sales and profits. Electric cars are the new game in town. In July of 2018, the Tesla 3 became the bestselling car in the U.S. by revenue. In August 2019, the Tesla 3 was the #1 bestselling car in Norway, #3 bestselling in the United Kingdom and The Netherlands, and #7 in Switzerland. Last week Mary Barra, the CEO of GM, told Bloomberg News that General Motors will sell a million electric vehicles a year, and is committed to winning, not just competing in, the electric and autonomous markets. “Once you start to believe in the science of global warming and look at the regulatory environment around the world, it becomes pretty clear that to win in the future, you’ve got to win [with electric and driverless vehicles],” she said. “This is… the future of transportation.” GM has a substantial investment in Lyft. Ford Motor Company purchased an e-scooter company, Spin, in 2018 for $100 million. So, the Big Auto manufacturers are also aware of, and investing in, the trend toward ride-share and micro mobility. 7. Politicians. 57% of Americans believe that climate change is a major threat to the well-being of the U.S. This average is composed of 84% of Democrats and 27% of Republicans. However, we are not as far apart on this topic as the above data would indicate, and we all lose when politicians try to divide us. When you remove the politically charged words “climate change,” you find a lot more consensus. Take this real-world example. A conservative person follows me on Twitter. My account is used for business, not for politics. However, as I mentioned above, I posted a link to Greta Thunberg’s UN speech. Here’s how the dialog went. Conservative: How did she get to NYC? NP: Greta Thunberg took a zero-carbon sailboat from Sweden to the United Nations in New York City. Conservative: Who is funding her? NP: Whatever she might be "funded" or "compensated" would be a rounding error equivalent of the multi trillion-dollar fossil fuel industry, utilities, nuclear & other businesses that profit from attacking a teenager, rather than letting the substance & truth of her words be the focal point. Conservative: What I mean is, where does the money trail lead? NP: I’ll look into it. Conservative: Are you getting into politics now? NP: Sustainability is not political. Most Americans are concerned about air and water pollution. 2 out of 10 Republicans think climate change is a top priority. 97% of climate scientists are ringing the alarms about fossil fuels and the damage they do to the atmosphere and ecosystem. Conservative: I’m concerned about air, water and pollution! Watching and listening to Greta only made me think “crazy”! I am very open to level discussions and listening to common sense dialogue, but there is so much more about this coming across as Hollywood drama! It’s important for each of us to remember that on social media today we are all siloed. If you get the chance to share information across borders of belief, act as civil as if that person were standing in front of you, having a two-way conversation. You might be very surprised just how many areas of concern you have in common. By listening, we can also discover problems in pockets of society that are on the losing side of a clean energy policy, which really must be addressed if we are going to act fast, together. 8. So… Is Greta Thunberg funded by a clean energy cartel that is under pinned by greed rather than altruism? Nope. The photos of Greta Thunberg with George Soros are doctored, and the photo of her on the cover of People With Money is also fake (source: Snopes). According to the team at Snopes, “Like other young people who have come forward to take on causes that immediately affect their lives, she has been subjected to a barrage of bullying, trolling, and conspiracy theories by adult media personalities.” Thunberg did just win the alternative Nobel Prize, the 2019 Right Livelihood Award, and has been nominated for a Nobel Peace Prize. (Announcements are made the first week of October). The Right Livelihood Award announcement came a few days after Thunberg’s emotional chastisement of world leaders on the United Nations stage, on September 23, 2019. Her winnings amount to about $103,000. How did it all begin for Greta? Thunberg started weekly school protests outside Swedish Parliament a year ago, which snowballed into a worldwide movement. The Bottom Line The scientific data is clear. Climate scientists are in unanimous agreement, at 97%, that climate change is caused by mankind and that we are getting very close to the tipping point where there will be nothing we can do about it. “Climate-warming trends over the past century are extremely likely due to human activities,” according to NASA’s Climate Consensus page. Together We Win. Divided We All Lose. It’s heartbreaking to see unemployment in states like West Virginia, where the coal industry has suffered so greatly. However, the solution is not to continue to destroy our planet with the burning of fossil fuels and to have short-sighted vision. The truth is we are all losers if we are not able to drink healthy water, breathe clean air and live in planetary balance. As Deepak Chopra said so eloquently in the Earth Gratitude e-book Future Earth, “Earth sustains us every moment of our life… She nourishes our existence… Let us work to keep her sustainable, so we may in turn be nourished and sustained.” Making smart energy choices will put a lot of money in your own budget now, and give us a shot at preserving this beautiful blue ball that we call home for our grandchildren. Sounds like a win-win to me. If you're interested on how to save thousands annually in your budget with smarter big-ticket energy choices, and how to invest in a clean energy economy, join me at one of my upcoming Investor Educational Retreats. You have 3 to choose from below. Arizona is my most affordable retreat. Students register for 1/2 off! Anyone who registers for the Florida or England Retreat by September 30, 2019 receives the lowest price and a complimentary private prosperity coaching session (value $300). Call 310-430-2397 or email [email protected] to learn more now. Other Blogs of Interest Make the Climate Strike Personal. Ford is Downgraded to Junk. From Buried Alive in Bill to Buying Your Own Island. The Manufacturing Recession. An Interview with Liz Ann Sonders. Gold Mining ETFs Have Doubled. The Gold Bull Market Has Begun. The We Work IPO. The Highs and Hangovers of Investing in Cannabis. Recession Proof Your Life. China Takes a Bite Out of Apple Sales. Will the Dow Hit 30,000? A Check Up on the Economy Red Flags in the Boeing 2Q 2019 Earnings Report The Weakening Economy. Think Capture Gains, Not Stop Losses. Buy and Hold Works. Right? Wall Street Secrets Your Broker Isn't Telling You. Unaffordability: The Unspoken Housing Crisis in America. Are You Being Pressured to Buy a Home or Stocks? What's Your Exit Strategy? Will the Feds Lower Interest Rates on June 19, 2019? Should You Buy Tesla at a 2 1/2 Year Low? It's Time To Do Your Annual Rebalancing. Cannabis Crashes. Should You Get High Again? Are You Suffering From Buy High, Sell Low Mentality? Financial Engineering is Not Real Growth The Zoom IPO. 10 Rally Killers. Fix the Roof While the Sun is Shining. Uber vs. Lyft. Which IPO Will Drive Returns? Boeing Cuts 737 Production by 20%. Tesla Delivery Data Disappoints. Stock Tanks. Why Did Wells Fargo's CEO Get the Boot? Earth Gratitude This Earth Day. Real Estate is Back to an All-Time High. Is the Spring Rally Over? The Lyft IPO Hits Wall Street. Should you take a ride? Cannabis Doubles. Did you miss the party? 12 Investing Mistakes Drowning in Debt? Get Solutions. What's Hot in 2019? The Debt Ceiling Was Hit (Again) on March 1, 2019. How Bad Will the GDP Report Be? 2019 Investor IQ Test The State of the Union CBD Oil for Sale. The High Cost of Free Advice. Apple's Real Problem in China: Huawei. 2019 Crystal Ball. 2018 is the Worst December Ever. Will the Feds Raise Interest Rates? Should They? Learn what you're not being told in the MSM. Why FANG, Banks and Your Value Funds Are in Trouble. When the Santa Rally is a Loser, the Next Year is a Bigger Loser. Russia Dumps Treasuries and Buys Gold OPEC and Russia Cut Oil Production. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable however NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors. Tomorrow will be one of the most important days of our children’s lives, when our collective voices will be heard and powerful change will shift from the wind of our words to the substance of our actions. However, as we march to make our voices heard, there is a large piece of the solution that is personal. If we really want to stop polluting and destroying our planet, we have to be smarter consumers and investors of clean energy. We must commit to understanding which approaches work, and which proposals and ideas are driven more by greed than green. And we must slough off old habits that are harming the environment, and embrace bold, new, clean choices. As the Earth Day Network pointed out in a Tweet today, “Recycling won’t cure our reliance on plastics. We need to find alternatives and devote more time to the other Rs: Refuse. Reduce. Reuse.” Say No to Plastic and Single Use Everything There are quite a number of ways that each one of us can Just Say No to Plastic. There is no excuse for single use. Ever. So, greet the day prepared with your own coffee mug, your personal to go container and your canvas bag or backpack for all shopping. Have a travel pack that includes your canteen, silverware and a reusable metal straw. Reduce Your Carbon Footprint with Smarter Electricity Choices The grid in the U.S. (and most of the world) is still majority powered by fossil fuels. Florida’s power is 83% natural gas, coal and petroleum. Colorado’s grid is 77% powered by the same mix. So, every time we turn on a light switch, take an elevator, fire up the air conditioning, fuel up our gas guzzling vehicle, do a load of laundry or take a hot shower, imagine that coal miner, that fracking operation, or even that Gulf Oil Spill. That will remind us of where all of our conveniences really come from. It will add a deeper meaning to why we: * turn off lights when we leave a room, * putt an on/off switch on our hot water heater, so that we’re not heating water 24/7, * turn the air conditioning/heating off when we go to work, * take the stairs instead of the elevator, and * walk or bike to the local market, shop, café or park, instead of driving. There so much that each one of us can do to live more in harmony with Mother Nature, which will go a long way to cleaner air, healthier ecosystems, more robust wild and ocean life, cultivating more trees (the lungs of our planet), enjoying adventures and so much more. It’s time to look in the mirror, and understand the power of cleaning up our own life, even as we also demand solutions from our elected leaders. As individuals, can each one of us reduce our personal carbon footprint by 30% or more by the end of next year? We can indeed, with smarter choices. Below are a few more ways to easily and affordably break old habits and replace them with planet-friendly practices – with the added benefit that these smarter quotidian activities can add up to savings of thousands of dollars in your budget annually. (That’s a bucket list vacation every year!) If you go to EarthGratitude.org, you can download two free, picturesque ebooks with wisdom from the world’s leading experts, including HH The Dalai Lama, HRH The Prince of Wales, the Earth Day Network, Elon Musk, the NRDC, Global Green and many other sustainable organizations and VIPs. Whether you are interested in: * planting a garden at your child’s school, * greenlighting micro mobility on your city streets, * reducing food waste, * saying no to plastic, * saving elephants, rhinos and other endangered species, * greening the grid, * installing solar panels, or * driving an electric car, You will find very helpful tips from the experts in the Future Earth and Clean Living ebooks. A Climate Strike is a fantastic collective experience to wake us all up – not just the politicians and powers that be. We can be the sustainable change that we wish to see. Residential solar has been around for decades, still offers 30% tax credit (through 2019), and is cheaper than ever. Electric cars are the future of automobiles. Micro mobility, including bike share, e-scooters and pedestrian-friendly walkways, is transforming our cities and solving the Last Mile challenge between public transportation and your ultimate destination. What changes have you already made? What new trends are you willing to champion? Will you commit to reducing your own carbon footprint, at home, on the commute and at the office, by 30% by the end of next year? We’ve got this. I’d love to hear your success stories, including the surprising ways that helping Mother Nature afforded you treasures and unexpected delights. (If you start riding a bike to work, you’ll have the unexpected delight of a healthy, sexier body, at minimum.) “I'm starting with the man in the mirror I'm asking him to change his ways And no message could have been any clearer If you want to make the world a better place Take a look at yourself, and then make a change.” From “Man in the Mirror” by Glen Ballard and Seidah Garrett. Made popular by Michael Jackson. If you'd like to learn how to put your money where your heart is, and green your investments, join me at my next Investor Educational Retreat. Choose from 3 locations below. Call 310-430-2397 or email [email protected] to learn more. Click on the banner ad to discover the 15+ things you'll discover and master, and to read testimonials from VIPs and Main Street folks who have transformed their lies using our time-proven strategies. Other Blogs of Interest Ford is Downgraded to Junk. From Buried Alive in Bill to Buying Your Own Island. The Manufacturing Recession. An Interview with Liz Ann Sonders. Gold Mining ETFs Have Doubled. The Gold Bull Market Has Begun. The We Work IPO. The Highs and Hangovers of Investing in Cannabis. Recession Proof Your Life. China Takes a Bite Out of Apple Sales. Will the Dow Hit 30,000? A Check Up on the Economy Red Flags in the Boeing 2Q 2019 Earnings Report The Weakening Economy. Think Capture Gains, Not Stop Losses. Buy and Hold Works. Right? Wall Street Secrets Your Broker Isn't Telling You. Unaffordability: The Unspoken Housing Crisis in America. Are You Being Pressured to Buy a Home or Stocks? What's Your Exit Strategy? Will the Feds Lower Interest Rates on June 19, 2019? Should You Buy Tesla at a 2 1/2 Year Low? It's Time To Do Your Annual Rebalancing. Cannabis Crashes. Should You Get High Again? Are You Suffering From Buy High, Sell Low Mentality? Financial Engineering is Not Real Growth The Zoom IPO. 10 Rally Killers. Fix the Roof While the Sun is Shining. Uber vs. Lyft. Which IPO Will Drive Returns? Boeing Cuts 737 Production by 20%. Tesla Delivery Data Disappoints. Stock Tanks. Why Did Wells Fargo's CEO Get the Boot? Earth Gratitude This Earth Day. Real Estate is Back to an All-Time High. Is the Spring Rally Over? The Lyft IPO Hits Wall Street. Should you take a ride? Cannabis Doubles. Did you miss the party? 12 Investing Mistakes Drowning in Debt? Get Solutions. What's Hot in 2019? The Debt Ceiling Was Hit (Again) on March 1, 2019. How Bad Will the GDP Report Be? 2019 Investor IQ Test The State of the Union CBD Oil for Sale. The High Cost of Free Advice. Apple's Real Problem in China: Huawei. 2019 Crystal Ball. 2018 is the Worst December Ever. Will the Feds Raise Interest Rates? Should They? Learn what you're not being told in the MSM. Why FANG, Banks and Your Value Funds Are in Trouble. When the Santa Rally is a Loser, the Next Year is a Bigger Loser. Russia Dumps Treasuries and Buys Gold OPEC and Russia Cut Oil Production. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable however NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors. The Chinese solar company SPI Energy Co., headquartered in Hong Kong and with a Santa Clara, California location, saw its share price soar 67% on Sept. 18, 2019, on the news that it was launching a CBD and hemp business. Its partner is the Navajo Nation, according to the company’s press release. What’s interesting about this is that the share price lift-off comes at a time when popular publicly traded cannabis companies, like Canopy Growth, Tilray, Aphria, Cronos and more, are trading near their 52-week lows. So what resonated with investors about the SPI transaction? As the company started to increase in share price, the story went viral on SeekingAlpha and Yahoo Finance (and more media outlets) with headlines like, “Tiny Solar Stock is Leading NASDAQ with Legal Weed.” A microcap with only $27 million in value (red flag) can jump far and fast with those kinds of headlines. But is the substance of this company as good as the story? Should you tame your racing heart, which wants to jump in and join the party, while you read between the lines? Here’s where a simple Stock Report Card, 4 Questions and the 3-Ingredient Recipe for Cooking Up Profits are essential. If you’re just chasing headlines and price jumps, that’s a recipe for being on the wrong side of the trade – on the Buy High, Sell Low side. SPI affords a fantastic opportunity to see how the company shapes up with real world analysis. The 3-Ingredient Recipe For Cooking Up Profits. (Take each ingredient/step in order.)

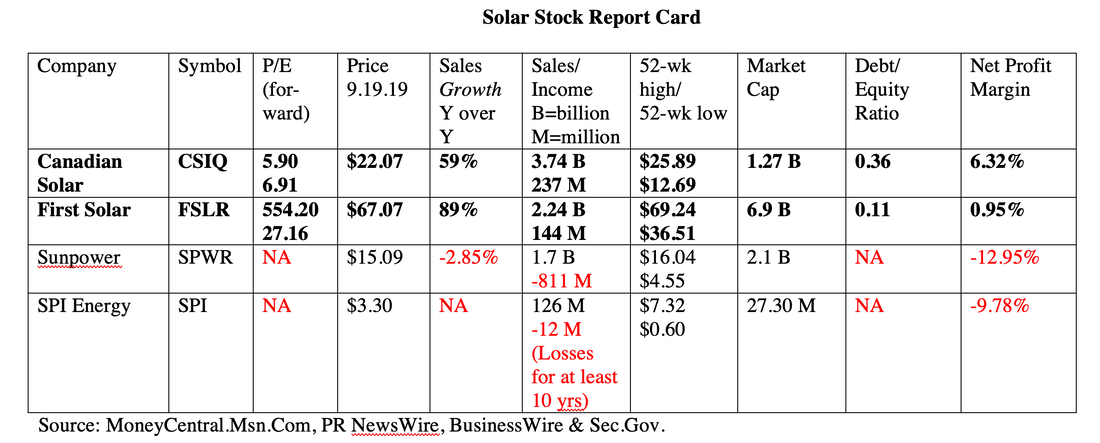

As you can see in the recipe above, price is not helpful in picking a leader. However, once you’ve picked your leader, the price, along with other valuation analysis, can help you to be on the right side of the trade. The Stock Report Card and the 4 Questions are key to picking the leader. In my 1st book Put Your Money Where Your Heart Is, which I wrote in 2006, I compared Google and General Motors as examples of how to use the Four Questions for Picking a Winner. Google (now Alphabet, Inc.) received an A, while GM received a D-. Google went on to become one of the most valuable companies in the world, with a current market capitalization of $855 billion (almost a trillion). General Motors declared bankruptcy in 2009. The company recently exited the sedan business, and is in the 4th day of a company-wide strike by the United Auto Workers Union. GM’s market capitalization is $55 billion, compared to Toyota’s $194 billion. As you can see from the Stock Report Card below, there is a lot of information which is difficult to obtain from SPI Energy. On the SEC Edgar platform, the last filing was in 2017. Morningstar is showing net losses for at least a decade for the company. Even when there is data, the Four Questions can be very revealing, particularly when a solar company is getting high (literally) on hemp (at least temporarily, in its share price). When there is no supporting earnings reports, then these questions are essential to ask. The Four Questions for Picking a Leader

And here is how SPI Energy (Smart Power Innovation) measures up. The Four Questions for Picking a Leader