|

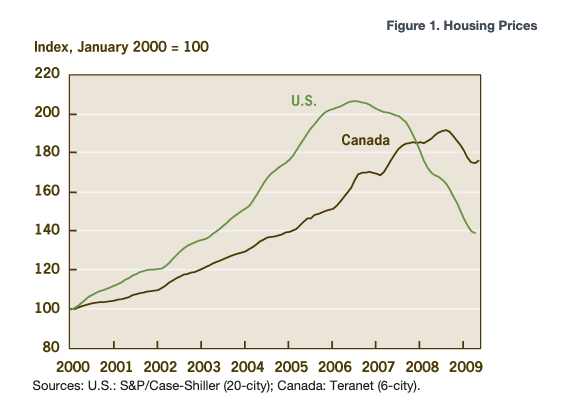

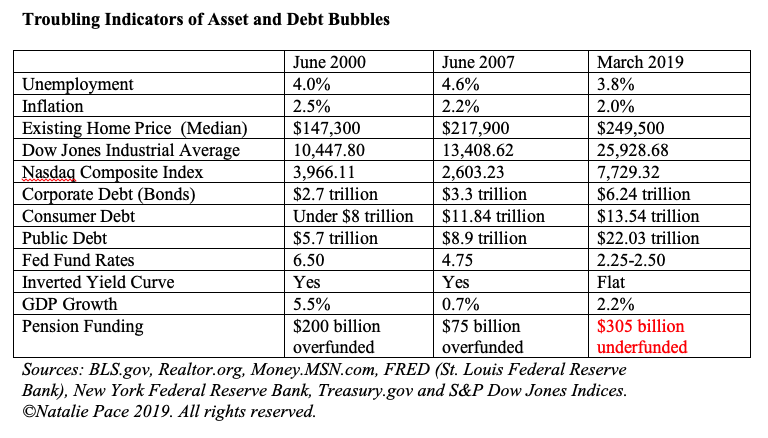

Buying real estate between 2005 and 2007 was a nightmare. Over 10 million homes were lost in the wake of the Great Recession. If you purchased a home in the years preceding 2008, or refinanced at or above the value of your home, the last decade was a living nightmare. Conversely, the low for real estate was in 2011. If you purchased a home then, you’re up at least by 53% (nationwide). Cities like Las Vegas, Denver, San Francisco and even Detroit have seen home values double or more. Seattle prices have skyrocketed by 76%. You’re riding high and living the Life of Riley! There is no denying that when you purchase an investment can be the most formidable foe, or your best ally. Dreams Do Come True! In February of 2011, a young entrepreneur in his mid-30s attended my Investor Educational Retreat. At that time, real estate was a bargain. He was earning a good, steady income, and had a young family. He lived in Las Vegas, where real estate prices had plummeted. AT could purchase a home and live in it for much less than he was spending on rent. Plus he could write off the mortgage interest to reduce his taxable income and save a boatload on taxes each year. AT was just starting out with his nest egg, and wanted tips to diversify it and get it going. He wasn’t even thinking of purchasing a home. However, I said that the lowest-hanging fruit for him was to purchase a home first, and then start building up the nest egg. He did. His home value doubled by 2017, at which time he sold, took his profits and made a dramatic move to British Columbia, where he built his own off-grid sustainable home, where he lives with his wife and young son. He has traded in the stress of commuting in Vegas for the challenges of living in the wilderness. However, having the funds to create his new life began by making an outstanding home purchase in 2011. The Canadian market tends to shadow the U.S., as you can see in the chart below. This has a lot to do with the fact that low interest rates create asset bubbles. (More on that to come.) Subprime Hell In May of 2005, I began screaming from the rooftops that real estate was in a bubble. One friend refused to be warned about the real estate bubble, however. Her “mentor” kept encouraging her to load up on properties in Las Vegas as late as even 2007. She pooh-poohed my warnings about bubbles with a rather supercilious hubris, as she put down payments on credit cards and relied upon no-interest loans where she didn’t have to show gainful employment or income. When her actions caught up with her in 2009, and she could no longer afford to float things on credit cards, she lost 5 properties, was buried in lawsuits and was financially and emotionally bankrupt. (We offered her husband and her a scholarship to a retreat to put them on the road to recovery.) Another example of subprime hell came in the form of a successful young woman, BB, who was at her wit’s end when she came to my Investor Educational Retreat in January of 2008. Her boyfriend’s friend had suckered her into buying a condo in Florida in 2007. This realtor “friend” promised to flip it within a few short months and give her back a quick and easy $20,000-$40,000. After months of paying high mortgage and Homeowner Association fees, while watching the value of her purchase plummet, she reached out to me in desperation for some private coaching. I found a legal colleague who was able to assist her in getting a deed in lieu (giving the keys back to the bank). When you make a grave investment mistake that is likely to decrease dramatically in value, the sooner you accept this and get out of it, the better off you’ll be. BB’s credit score recovered rather quickly (before most people even got out of their subprime hell). She also saved herself several years of hell and hundreds of thousands of dollars by getting out early. She’s now a proud homeowner and the mother of a young son (rather than the desperate servant of an underwater condo) and in a loving relationship (with a different life partner). Real Estate Education ala Trump University Most real estate seminars offer you very basic tips on how to secure a loan. They tout up the value of owning income-property (which is real) – without having a time-proven system on how to make sure your investment is a rewarding, dream-come-true “money while you sleep” experience, instead of a nightmare that can dog you for decades (which is always a potential reality with a big purchase like real estate). Trump University wasn’t the only ruse that suckered people into investing tens of thousands of dollars for inexperienced mentors offering unsound strategies. This space is still full of marketers who pose as good investors, with enticing language and exciting offers (even free seminars!), who whitewash over the Great Recession as if it never existed. If you take the bait, you’ll then be sold into expensive mentoring and software. However, that’s not the only cost of that free real estate seminar. If you buy high in real estate, you don’t just lose your investment. You could be on the hook for hundreds of thousands of dollars of lost equity, if the value of your property falls beneath the amount of your loan. You’ll be stuck with it, unable to sell it. And if you are able to short sell it, then you could be stuck with a very high tax bill on the “phantom income” of the difference between the sale price and your loan. The Most Important Key to a Great Real Estate Investment Again, one of the most important considerations for buying real estate is the price itself. Real estate prices are back to an all-time high. So, now is the time when most of these real estate mentors will be revealed as self-serving marketers rather than masters. It’s important you learn that lesson in the wings, rather than on your own dime. Low Interest Rates Create Asset Bubbles Low interest rates create asset bubbles. As you can see in the chart below, asset prices (stocks and real estate) are back to all-time highs. Debt is now astronomical. The statistics that politicians use to claim a strong economy, low unemployment and inflation, are not indicators of where the economy is headed. In fact, since 2000, asset bubbles have been the reliable harbingers of recessions. Real estate prices plummeted during the Great Recession, with many markets dropping to less than half their value at the high. It’s a warning worth heading today. With real estate prices back to an all-time high, what’s your best game plan? 1. Learn how to implement the 3-Ingredient Recipe for Cooking Up Profits for your real estate investment. Do your research and planning now, so that you’ll be ready to make a purchase when prices become more favorable. There are many events that create buying opportunities, including bubbles popping, deflation, unaffordability, the labor market slackening, natural disasters, terrorist events, the 4 D’s (death, depression, divorce and disaster) and more. The 3-Ingredient Recipe for Cooking Up Profits 1. Start With What You Know and Love. 2. Pick the Leader. 3. Buy Low; Sell High. 2. There is also more shadow inventory than most professionals are aware of. So, it will really pay to know the market you wish to buy into, and understanding how many people are hanging onto property they cannot afford by a thread. Any local market with a judicial foreclosure process is likely to have a lot more shadow inventory. Did you know that there are still more than five million U.S. homes that are severely underwater – owing at least 25% more than their value (source: AttomData.com)? 3. You will also do well with thinking bigger, and considering innovative solutions to pervasive problems, such as affordable housing, which is needed in most major cities in the developed world. Real estate prices are downright unaffordable in many major cities. As Lawrence Yun, the chief economist of the National Association of Realtors said in our recent conversation, “Unaffordability is making home sales plunge in California, even though the job market is great. Unless California can address the unaffordability of housing, you may see people leaving the area.” Any “guru” who tells you today is different than 2007 is not giving you the complete picture. (Take another look at the Asset Bubble chart above.) You can listen to my complete interview with Lawrence Yun on my BlogTalkRadio.com/NataliePace pod cast. Today, many asset bubbles are at an all-time high. You can’t afford to get bad advice. That is why I’m offering the Real Estate Master Class this April 26, 2019 in Denver, Colorado. Call 310-430-2397 or email info @ NataliePace.com to learn more and register now. Other Blogs of Interest Is the Spring Rally Over? The Lyft IPO Hits Wall Street. Should you take a ride? Cannabis Doubles. Did you miss the party? 12 Investing Mistakes Drowning in Debt? Get Solutions. What Hot in 2019? The Debt Ceiling Was Hit (Again) on March 1, 2019. How Bad Will the GDP Report Be? 2019 Investor IQ Test The State of the Union CBD Oil for Sale. The High Cost of Free Advice. Apple's Real Problem in China: Huawei. 2019 Crystal Ball. 2018 is the Worst December Ever. Will the Feds Raise Interest Rates? Should They? Learn what you're not being told in the MSM. Why FANG, Banks and Your Value Funds Are in Trouble. When the Santa Rally is a Loser, the Next Year is a Bigger Loser. Russia Dumps Treasuries and Buys Gold OPEC and Russia Cut Oil Production. Trade Deficit Hits an All-Time High. Wall Street Plunges 800 Points. How to Protect Yourself. Rebalance and Get Safe in December. Here's Why. The Best Investment Decision I Ever Made. What's Safe for Your Cash? FDIC? SIPC? Money Markets? Under the Mattress? The Real Reason Stocks Fell 602 Points on Veterans Day 2018. Will Ford Bonds Be Downgraded to Junk? 6 Risky Investments. 12 Red Flags. 1 Easy Way to Know Whom to Trust With Your Money. Whom Can You Trust? Trust Results. October Wipes Out 2018 Gains. Will There Be a Santa Rally in 2018? The Dow Dropped 832 Points. What Happened? Bonds are In Trouble. Learn 5 Ways to Protect Yourself. Interest Rates Projected to Double by 2020. 5 Warning Signs of a Recession. How a Strong GDP Report Can Go Wrong. Should I Invest in Ford and General Electric? Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable however NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors. 17/7/2019 08:48:02 am

You're quite welcome Homeia. It's our pleasure. You might find this more recent real estate blog very helpful as well. 18/7/2019 01:04:48 pm

Check out NataliePace.com for additional resources, Homeia. Whether you want to protect your home and nest egg, reduce debt, budget better or earn money while you sleep, wisdom is the cure. Our team has easy to understand, time-proven systems that work. Now is the time to fix the roof while the sun is still shining. You know that once real estate turns, everything gets rougher. So, planning ahead is key. 30/7/2019 12:20:44 am

Good post. I just stumbled upon your blog and wanted to say that I have really enjoyed reading your blog posts. Any way I'll be subscribing to your feed and I hope you post again soon. Big thanks for the useful info. 30/7/2019 06:31:17 am

It's our true pleasure to provide the news, information and education you need to thrive in this uniquely different time in the U.S. economy. If you want to be sure to receive all of our news, be sure to email us at [email protected] and we'll add you to our distribution list. 30/7/2019 06:32:32 am

Here's a link to our more recent blog on real estate. 15/9/2019 09:15:19 am

I like how you mention it is important to have good credit when trying to buy a new home. I’ve been thinking of moving, so I will need a real estate agent to help me with buying a new home. I will make sure to build up my credit before starting the buying process. 15/9/2019 09:52:12 am

And perhaps shop in the shadow inventory, or wait for the economy to weaken, so that you can purchase for a good price. It's a good idea to read the real estate section of The ABCs of Money and my 3-Ingredient Recipe for Cooking Up Profits, and to understand just how important the price is before making the biggest investment of your life! 22/9/2019 08:37:34 pm

These are so great!!! I realized the other day I had three mini butterfly cutters!!! How in the world did I end up with 3? I feel much better now that I realize at least one of them are really flip-flops!!! Thanks for another great post! 16/10/2019 12:10:35 pm

Hello, wow! Fantastic guide again, this is the second post that I am reading at this blog. Loved it. I’m not a rental investor lover but got some ideas while reading your this post. Now, sharing your blog with my lovely twitter community. 17/10/2019 05:27:42 am

These real estate agents want to play with people till they are satisfied with it. I do not know why they do that. If they really want something from their consumer, they should have just let them know about the fact rather than doing such thing. 18/12/2019 11:51:29 pm

Really nice post. I really enjoy a lot while reading your post. Comments are closed.

|

AuthorNatalie Pace is the co-creator of the Earth Gratitude Project and the author of The Power of 8 Billion: It's Up to Us, The ABCs of Money, The ABCs of Money for College, The Gratitude Game and Put Your Money Where Your Heart Is. She is a repeat guest & speaker on national news shows and stages. She has been ranked the No. 1 stock picker, above over 830 A-list pundits, by an independent tracking agency, and has been saving homes and nest eggs since 1999. Archives

July 2024

Categories |

RSS Feed

RSS Feed