|

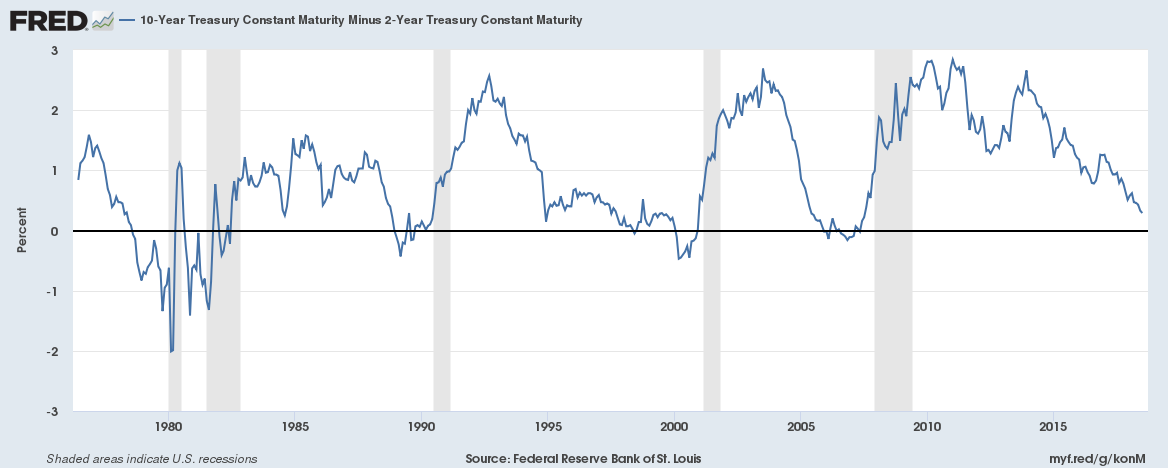

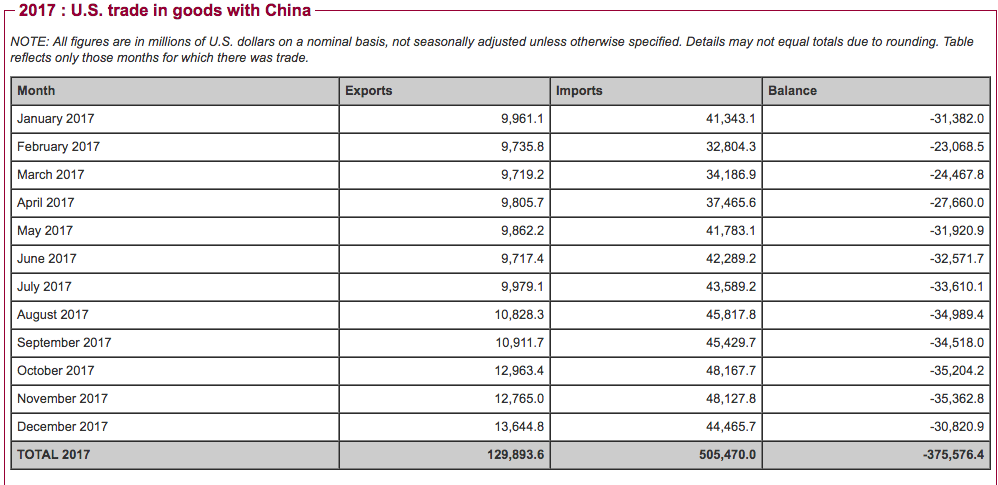

While the politicians tout low unemployment (4.0%) and economic growth (2.0%), there are troubling occurrences that are not making headlines, which many economists and Federal Reserve governors are concerned might dive the U.S. into a recession. Economic forecasting is a tricky business. However, some of the warning signs below are batting 1000 on predicting recessions. This late in the bull market, it will pay to know what’s really going on that is not being discussed on prime time and make sure that you’re protected – before the next downturn. If you wait for the headlines that the economy is in trouble, it will be too late to protect yourself. 5 Harbingers of Recessions. 1. Inverted Yield Curve. 2. Tariff Wars. 3. Warning Language in the Federal Reserve Minutes. 4. Bubbles. 5. Business Cycles. And here is additional information on each red flag. 1. Inverted Yield Curve. “Every U.S. recession in the past 60 years was preceded by an inverted yield curve,” according to Michael D. Bauer and Thomas M. Mertens of the San Francisco Federal Reserve Bank. Right now, the yield curve is flat, just a hair’s breath above the danger zone. With each Fed Fund rate hike, it becomes more likely that the yield curve will invert. So, keep an ear to the ground during the FOMC meetings for yield curve news. The next FOMC press releases are scheduled for August 1, September 26, November 8 and December 19, 2018. There are at least two more Fed Fund rate hikes expected in 2018. 2. Tariff Wars. In the world of economics, tariffs are as welcome as viruses are to doctors. They are unhealthy for the economy in general, and can lead to a lack of confidence in business planning and expenditures that can stall out growth and slam economies into recessions. While the trade imbalance is in need of being addressed, there are few data-driven experts who think that tariffs are the answer. The most infamous tariff war was the Smoot-Hawley Tariff Act of 1930, which many experts believe deepened the severity and extended the length of the Great Depression. 3. Warning Language in the Federal Reserve Minutes. The Federal Reserve under Chairman Ben Bernanke mentioned nothing of the inverted yield curve in the 2007 minutes, though this monumental event was surely discussed. Concerns over real estate, credit markets and subprime loans prompted the Feds to lower the Fed Fund rate. However, the official word was that the economy would slow in 2008, but still be growing. Thus, most Americans were blindsided by the severity of the Great Recession crisis. Under Chairman Jerome Powell, the June 13, 2018 meeting discussion included concern that the flattened yield curve might invert and spark a recession, or that “financial imbalances” might lead to a “significant economic downturn.” Powell is still staying close to his calming sound bytes in the press conferences. However, under Powell’s aegis, the FOMC minutes are far more transparent than his two predecessors allowed. 4. Bubbles. Warren Buffet has said that stocks and bonds are overpriced. Alan Greenspan went on Bloomberg TV and said that stocks and bonds are in a bubble. Robert Shiller continues to warn that stock prices are unsustainably high. Every troubling economic indicator that preceded the Great Recession is higher now. Housing prices, stock prices, bond prices, consumer debt and public debt are all far higher than they were in 2007 before stocks lost more than half of their value and 15 million homes were sent to auction, foreclosed on or received a loan modification. Low interest rates create bubbles, which is why the Federal Reserve Board is committed to increasing the Fed Fund rate to 3.4% by 2020. 5. Business Cycles. This is the 10th year of the current bull market. Recessions occur on average every 5.5 years. In the last two recessions, most people lost more than half of their retirement. Between 2000 and 2002, the NASDAQ Composite Index lost 78% of its value. Between 2007 and 2009, the Dow Jones Industrial Average lost 55% of its value. Buy and Hold doesn’t work on the Wall Street Rollercoaster of today. My easy-as-a-pie-chart nest egg strategies earned gains in both of the last two recessions, outperformed the bull markets in between and are less time and money than most people spend. What you can do about it. How you can protect yourself before the next market correction. Market corrections and recessions happen. Regularly. (There were two recessions under President George W. Bush.) You can profit from a growing economy, while protecting yourself from a downturn, easily, with the strategies listed directly below. Your 10-Step Recession-Proof Plan

If you don’t fully understand how to do the 10-point list above, then your next move should be education. It’s time to learn the ABCs of Money that we all should have received in high school. Wisdom is the cure. Come to my Investor Educational Retreat (links below), or, at minimum, read my 3 books, with time-proven strategies that earn gains in recessions and outperform the bull markets in between. Call 310-430-2397 to learn more! Comments are closed.

|

AuthorNatalie Pace is the co-creator of the Earth Gratitude Project and the author of The Power of 8 Billion: It's Up to Us, The ABCs of Money, The ABCs of Money for College, The Gratitude Game and Put Your Money Where Your Heart Is. She is a repeat guest & speaker on national news shows and stages. She has been ranked the No. 1 stock picker, above over 830 A-list pundits, by an independent tracking agency, and has been saving homes and nest eggs since 1999. Archives

July 2024

Categories |

RSS Feed

RSS Feed