|

From Black Friday through Cyber Monday, our team here at NataliePace.com is offering freebies, $2 stocking stuffers and much more. Look below St. Nick for all of our special offers. Call 310-430-2397 or email Heather @ NataliePace.com to learn more.  Freebies: If you love sustainability, then you and your loved ones can enjoy two free mini ebooks, featuring the wisdom of green visionaries such as: The Dalai Lama, Elon Musk, HRH The Prince of Wales, The Earth Day Network, Deepak Chopra, Global Green and more. Simply go to EarthGratitude.org to download the Clean Earth, Clean Living and Future Earth ebooks, which you are welcome to print out and share freely. (The PDF version makes a great free holiday gift for a greenie!) Receive 30% off and a free 50-minute private, prosperity coaching session with No. 1 stock picker Natalie Pace (value $300), when you register with a friend for the Valentine's Retreat in the beautiful beach town of Santa Monica, California now through Cyber Monday. (Each of you enjoy 30% off and receive a complimentary coaching session.) The Natalie Pace Investor Educational Retreats are the gift of a lifetime. The retreat pays for itself in just a few short months in budget savings alone (according to many attendees)! Call 310-430-2397 to learn more. Only 5 seats remain available at this intimate, life-transformational, budgeting, investing, debt reduction, teen & money empowerment retreat! If you prefer to get a second opinion on your current budget and investing plan and private coaching, you can select the 12-session package of coaching and receive 60% off! Cal 310-430-2397 for pricing and details, to get your questions answered and to order your retreat and coaching at these amazing discounts. $2 Stocking Stuffers

Check out the beautiful Gratitude Heart Mantra Stones, handcrafted by Evelyn Ballin, which were designed to accompany the 21-day Walk to Wealth program outlined in Natalie Pace's 5-star book, The Gratitude Game. Purchase a bag of 21 stones for just $39, and you have 21 stocking stuffers that will be treasured by your loved ones (for less than $2/each). Colors range from royal purple, to earth and ruby red (heart). Order now to ensure delivery before the holiday. My Dear Friends and Family, Through the years, we have been connecting on special holidays, sharing laughter, love, wisdom and inspiring thoughts. This Thanksgiving, as I honor and celebrate a beautiful young woman who transitioned to spirit before her time, and give thanks for the blessing she was to those who knew and loved her, I am reminded of just how precious each celebration that we have is. I am extremely grateful for the loving people who have hugged me in person or in prayer during this heartbreaking time. My own thoughts, prayers and wishes are with the parents of beautiful Ella Hughes. There are two Go Fund Me campaigns that are active right now that are very close and personal to me. One is honoring someone I hold dear who was taken from her family a few days ago. Money won’t ease the pain of the loss. But it is helping this family to honor their daughter Ella Hughes with dignity. If you feel compelled to donate, please do and thank you. Prayers are welcome, too. If you click on the picture, it will take you to the campaign. You can also see these campaigns on my Facebook and Twitter pages. My son Davis Lau has created a campaign to help an African father of limited means to create a special family memory by attending his daughter’s graduation in Canada. You can help to create this memory for Jean and Jeanne Bosco, of the Democratic Republic of Congo, and you can also receive something great in the bargain. Davis Lau is a very gifted artist. He is offering a print of the portrait he created of Jean Bosco, and a commemorative t-shirt, with your donation of $40. Any amount is appreciated and will help. If you cannot donate money, then please consider sharing this campaign on Facebook to help others to be a part of Jean and Jeanne’s joy. I am very grateful to you on this Thanksgiving. From the depths of my broken heart, I know that each of you are special to me in ways small and large and perhaps even unknown. I am in gratitude to you for your love, your support, your laughter and for caring about my life’s work, in all of the ways, large and small, that you have touched me over the years. May your meals, treats, games and laughter today fill your heart and spirit with the joy that only close loved ones can bring.

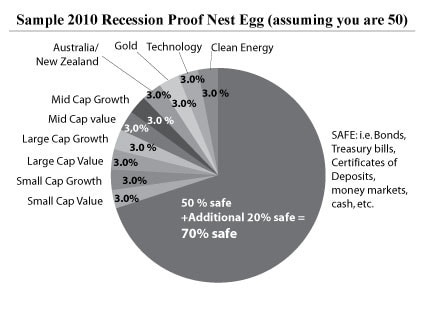

Warren Buffett has $100 Billion in cash on the sidelines. GE has lost more than $120 billion in market cap this year, and just slashed their dividend by half. The headlines are touting Wall Street gains and all-time highs, seducing Main Street investors to want to jump into the pool party. However, the smart money is not buying it. Hear Warren Buffett explain why on Bloomberg, and why bonds are even less attractive than stocks. Essentially, stocks are overpriced and bonds are far worse, which is why Buffett is keeping so much in cash, when he would prefer to invest at least $80 billion of the $100 billion he has sitting on the sidelines. As Warren Buffett noted in his Bloomberg interview of yesterday, “If you put $100,000 in a 10-year [Treasury] bond, you’re paying 45 times earnings.” On Nov. 14, 2017, Buffett reduced his holdings in IBM by another 1/3, down to 37 million shares, with a market value of about $5.4 billion. He also sold shares in Wells Fargo, Charter Communications and Wabco Holdings (a car parts company, based in Brussels). What Happened to General Electric? GE’s share price has lost 43% in 2017. The dividend was slashed by half on Nov. 13, 2017, to 12 cents a share per quarter (from 24 cents). (Since 1940, the only other time that GE cut its dividend was in 2009, during the Great Recession.) Investors recently learned that GE has been using all of its profits to buy back its own stock and pay a high dividend for years, essentially propping up its own share price. The reason that dividends are riskier than most investors realize is that when the company cuts the dividend, you don’t get advance warning. You lose the dividend income and a great deal of your principal in one fatal shot. Of course, at that disappointing moment, investors are tempted to cut their losses – selling low, the opposite of the age old Wall Street adage Buy low, Sell High. GE is not the only company using buybacks and dividends to make the company attractive to investors. According to Howard Silverblatt, the senior index analyst for S&P Dow Indices, dividends set a record in the 3rd quarter of this year, at $105.4 billion, $12.31 per share, and are expected to beat that record again in the 4th quarter. Dividends shower investors with love, keeping them complacent and distracted from understanding the health of the investment. Corporate buybacks inflate the earnings per share, even if the earnings are weak, and make the stock price look cheaper. Financial engineering of this nature has fueled the 8-year bull market. GE is the first company (outside of the retail industry) to show vulnerability. However, it is unlikely to be the last. Is Verizon Next? As I pointed out in my book, The ABCs of Money, which was published in 2012, the higher the dividend the higher the risk. Verizon is paying the highest dividend yield on Wall Street. So, what’s at stake? Verizon’s annual dividend payout for 2017 will be almost $12 billion. Last year’s annual income was $13.13 billion. Essentially, Verizon is doing what General Electric is getting criticized for doing – using all of the company profits to pay dividends. While Verizon is rewarding investors, the company is shafting its staff and borrowing from Peter to pay Paul. Verizon is $18.3 billion underfunded on its Other Post Employment Benefits and $6.4 billion underfunded on its pensions (source: S&P Dow Indices 2016 Report on Corporate Pensions). AT&T is the most underfunded on OPEBs and pensions ($33.7 billion) in the S&P500, with Verizon on the second position. Verizon’s long-term debt and liabilities are $226 billion, with a debt to equity ratio of 4.3. Some investors, perhaps without even knowing about it, just loaned Verizon $1.5 billion, which doesn’t have to be paid back for 30 years, and only pays 4.95% (less than the common stock dividend, which doesn’t require any time commitment). The problem with that is that with all of the debt, promises and liabilities that Verizon has, it is very possible that the company will need to restructure sometime over the next 30 years. 4.95% interest is a very low return for taking on the risk of a bond that is only one grade above junk (at BBB+). I warned about AT&T, GE and Verizon in December of 2015 – two years ago. Bankers have been willing to loan cheap money (5%) to these heavily indebted companies. The companies themselves have rewarded investors with dividends and buybacks – pushing their stocks to all time highs. Investors were happy and complacent. Workers complaints didn’t make the headlines. Telecom employees were likely more worried about losing their job, and joining the burgeoning ranks of underemployed, who are trying to make ends meet with multiple jobs, than they were about losing their benefits. Though stocks are high and Warren Buffett has a lot of cash on the sidelines, the right answer isn’t jumping all in or all out. Market timing doesn’t work because it is impossible to time the exact high and low. You’ll be early getting out and late jumping back in. My pie chart system is time-proven, easy and less time and money than most people spend. Now is definitely the time to do a wisdom-based analysis of what you have in your retirement plans because the last two times that the U.S. economy went 8 years without a correction, most people lost more than half of their nest egg. Just asking your HR person or the broker-salesman will not necessarily get you safe before the next downturn. There is an inherent conflict of interest in the financial services industry, which means that you must be the boss of your money, know exactly what you own, and make sure that you are safe and diversified. Are you over-invested in risky, dividend-paying stocks? Have you been put into expensive, low-yielding, long-term bonds that could lose money or become illiquid? You can read and implement the strategies in my three bestselling books. (Get links on the home page at NataliePace.com). You can call my office (at 310-430-2397) and schedule a second opinion of your current budgeting and investing plan. If you’d like to learn the ABCs of Money that we all should have received in high school now, before the next downturn, register for my Valentine’s Retreat in the beautiful beach town of Santa Monica, California. Only 5 seats remain available. You get the best price when you register with a friend by December 15, 2017. Call 310-430-2397 to learn more now. Important Disclaimers Please note: NataliePace.com does not act or operate like a broker. We report on financial news, and are one of the most trusted independently owned and operated financial news corporations in North America. This article is intended to educate and inform individual investors, and, thus, to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned in this article are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies.Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable however NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors.  FAANG. Facebook, Amazon, Apple, Netflix and Google. The companies are hot, and their stock is on fire. Since March of 2009 (the bottom of the market), FAANG stocks have lead the NASDAQ Composite Index to double the Dow Jones Industrial Average in returns. FYI: Technology was so hot in the wake of the Recession, that I listed it as a hot slice on my nest egg pie charts. Australia, gold and technology all more than doubled. (Even clean energy had a great run in 2010.) The question now is: “Will you will be toasty with holiday returns, or burned by buying high?” All of the FAANG companies have impressive sales growth year over year. This compares to many of the Dow Jones Industrial Average components have flat or lower sales. Facebook, Netflix and Amazon all boast sales growth of 30-47% year over year. Google is close with 23.7% growth, and Apple is still posting 12% growth (after a down year). By comparison, BUMPP stocks (Boeing, United Technologies, Merck, Pfizer and Procter and Gamble) sales are by and large flat year over year. Net profit margins lean toward FAANG, as well. While Boeing, United Technologies and Merck range between 7-9% net profit, Facebook’s profit margin is 41.69%. Apple and Google are in the 20% range, while Amazon eeks out 1.19% and Netflix profits at 4.04%. If we skip over the Pacific pond to China, Alibaba’s revenue growth is an eye-popping 61%! The sales growth range of the Chinese ABCWW stocks is 28.70-72.50% (Alibaba, Baidu, CTrip, Wuba & Weibo)! The profit margins are just as impressive with Baidu, Alibaba and Weibo at 23%, 27% and 31%, respectively. Clearly technology is hot, China is hotter, and old school pharma and defense are a bit blasé. But here is where we need to apply the price test. By every measure, FAANG stocks are high (as are BUMP and ABCWW). How high? Earlier this year, Robert Shiller, Nobel Prize winning economist and Yale professor of economics, wrote, “The only time in history going back to 1881 when [price earnings ratios] have been higher are, A: 1929 and B: 2000. We are at a high level, and its concerning. People should be cautious now.” Amazon's price-to-earnings ratio is 286. Netflix is 192. Facebook and Google are both 34. If you think about it for a moment, should a company like Amazon, with $2 billion in net income, be worth over half a trillion dollars? By comparison, Wal-Mart makes $13.64 billion, and has half the market value as Amazon. Google has $20 billion in net income, with a Wall Street valuation of $720 billion. The age old adage is: “Buy, low sell high,” not “Buy high, sell higher.” Anytime we buy high, we risk getting burned, whether it is stocks, real estate, classic cars, gold or Bitcoin. At the same time, if you try market timing, and jump all in or all out, then you are more likely to lose than to win. There is a lot of manipulation going on, so it is very difficult to predict the exact point of correction. (The current bull run is fueled largely by companies borrowing money very cheaply and buying back their own stock. While this makes the markets go higher, buybacks and running prices into the astrosphere don’t make for a healthy economy – great products do.) Most people who try market timing jump out at the bottom, selling low, and jump in at the top, buying high – the exact opposite of what you know, on paper, to do. This is because they are using emotions, not a sound, time-proven strategy. That’s why my time-proven, trademarked, easy-as-a-pie-chart nest egg strategies work so well. Instead of market timing, you just underweight or overweight based upon market conditions. You’re never all in or all out, but you keep enough safe to limit your losses in corrections, and enough at risk to ensure that you’re benefiting from bull runs. (Those people, like Nilo Bolden, who used this system earned gains in the Great Recession and have outperformed the bull market in between.) Annual rebalancing is also key, which turns out to be a great system for buying low and selling high… If you'd like to try the free web app for my pie charts, go to NataliePace.com. The link is on the home page. The pie charts will make more sense if you know my system, which is outlined in my 3 bestselling books (links are available on the home page at NataliePace.com) and in my 3-day, life-transforming, investor educational retreats. So, can the stock market keep going up up up? History tells us, “No.” Headlines and politicians tell us, “Yes.” I did a little homework and discovered that the first admission that we were in a deep, horrible downturn during the Great Recession occurred in October of 2008 – when the stock market had already lost over 8000 points. In other works, if you wait for the headlines and politicians, you’re going to be too late to protect yourself. Having more FAANG and Chinese ABCWW in your nest egg, getting diversified, and keeping enough safe, while underweighting BUMPP is a good idea. However, it is just as important to know how much to keep safe, and what safe is in a Debt World. At the Investor educational Retreats, you learn how to identify hot trends, how to avoid the loser funds, lean into the hotter industries and add sizzling slices for top-notch performance. And once you do that, it’s time to look at the biggest piece of the pie for anyone over 40 – the safe side. There again are some very hot prospects. We’ve even identified thousands of dollars that the average family can save with smarter energy, budgeting and investing choices, with some of the safest hard assets there are available today. Since there is too much paper floating around in the developed world (with massive debt), getting safe requires getting creative. If you simply choose what the broker-salesman offers (more paper, like bonds, private equity REITs, etc., annuities and life insurance), it is very likely that you are vulnerable to more capital loss than you are aware, and not getting properly paid for the risk. If you’re interested in learning this easy system from me, join me at the Valentine’s Retreat in the beautiful beach town of Santa Monica, California. Click to read testimonials and discover the 15+ things you’ll learn. Only 5 seats remain available. Get the best price when you register with a friend by Dec. 15, 2017. Will The Santa Rally Extend All the Way Through to the Spring Rally? On Oct. 27, 2017, the Bureau of Economic Analysis reported GDP growth that frankly shocked the experts. The New York Feds were predicting 1.6% GDP growth. The advance report came in at 3.0%. That was essentially a green light for the Santa Rally. (The report will be revised again on Nov. 29th and Dec. 21st, 2017, at which point it could come in higher or lower, based on more complete data.) Are There Any Red (Warning) or Yellow (Caution) Lights on the Santa Rally? There are definitely red and yellow lights on the economy. One has a deadline smack in the middle, on Dec. 9, 2017 (the Debt Ceiling crisis re-emerges). However, if an economy crashes in the woods and no one reports on it, then it doesn’t really happen until it makes headlines. (That’s really been the story of the past three years, when financial engineering has fueled the rise in real estate and equity assets.) The Cliff Notes on when headlines will start appearing is probably not until January or February of 2018. Below are the reasons why. Retail Bankruptcies: The Canary in the Coal Mine There have been 19 high-profile retail bankruptcies this year already, with Toys R Us being the most recent. This is a hint that the heavily indebted American consumer, which accounts for 70% of GDP growth, is overburdened. In fact, U.S. consumer debt is back to an all-time high, at $12.84 trillion. There is only so long that consumers can borrow at credit card usury interest rates to buy things before the credit defaults start happening again. In fact, credit card defaults have climbed for the 3rd straight quarter – something that hasn’t happened since 2009. Retail bankruptcies also hit banks and bond investors very hard. Before the Great Recession, the mortgage bank bankruptcies of early 2007 were the omens of harsh times to come. They were background noise, just as the retail bankruptcies are today, while stocks continued to rise. The politicians stuck to the sound byte that the mortgage bank bankruptcies were limited in scope and wouldn’t affect the larger economy. The retail bankruptcies aren’t even included in the current political debate, and when they are, they are pushed under the carpet with the phrase, “The Amazon Effect.” There is an outdated brick-and-mortar issue. However there is also a dramatic drop-off in spending on retail, particularly by Millennials, who prefer experiences and adventures over things. Once the retail bankruptcy fallout starts spreading into the earnings of mall REITs and banks that could start making headlines in the months ahead. The Debt Ceiling Will Be Hit (Again) on Dec. 8, 2017 The current U.S. public debt is $20.5 trillion. The current total U.S. debt and loans are $66.7 trillion. These numbers have become so astronomical that it is almost beyond comprehension. However, the easiest way to understand them is to know that the Federal Reserve decided to print money and keep interest rates low, which always creates bubbles. Consumers aren’t benefiting from the low interest rates, unless you’re purchasing a home at an all-time high (something that will come back to bite you big time when prices correct). Companies and countries are benefiting from low interest rates, in that the cost of borrowing is almost free, until credit risk becomes more apparent, at which time interest rates will jump and the problems that have been kicked down the road become exponentially more expensive. That is the specter that is looming behind the ongoing Debt Ceiling crisis. The two credit agencies that still maintain the U.S. with a AAA rating, namely Fitch Ratings and Moody’s Investor Services, have both indicated that the U.S. debt level is inconsistent with the AAA rating. In August, both agencies warned that if the U.S. didn’t raise the Debt Ceiling in time, they would review and possibly downgrade the U.S. credit. The last minute 3-month extension deal that the White House struck with the Democrats postponed the reviews. However, on September 11, 2017, Moody’s warned, “Even if the three-month suspension is approved by lawmakers, the risk of an economically disruptive stalemate over the debt ceiling in early 2018 remains.” Neither agency has a review of the U.S. rating on calendar at this time. However, both will be forced to address the issue when they believe that the U.S. is running dangerously close to the point of not being able to fund our bills. That is predicted to occur in February of 2018. (If Treasury Secretary Mnuchin has borrowed enough to get us through to April, when tax receipts pour in, the next Debt Ceiling crisus this could be postponed to late summer or early fall.) Where are the Bubbles? Real estate and stock prices are back to all-time highs – so high in fact that two top economists have issued warnings. “The American Dream of home ownership remains elusive, as the third quarter figure shows little change in the overall rate. The reason is simple. There is just not enough supply of homes to fully satisfy the desire to own. The lack of inventory has pushed up home prices by 48% from the low point in 2011, while wage growth over the same period has been only 15%,” Lawrence Yun, the chief economist of the National Association of Realtors, in a statement on October 31, 2017. “The only time in history going back to 1881 when [stock market prices] have been higher are, A: 1929 and B: 2000. We are at a high level, and its concerning. People should be cautious now.” Robert Shiller, Nobel Prize winning economist and Yale professor of economics Bitcoin and crypto-currency have had astronomical gains this year, with traders and novices pouring in, in droves. Is the Economy Really Growing & Healthy? So, what about the 3% GDP report? The 4th quarter GDP report estimates are coming in even higher – at 3.2-4.6%! The advance 4th quarter GDP report comes in at the end of January. If the projected numbers hold true, then the wind should be at the back of the stock market through the Spring Rally (assuming there is no Debt Ceiling crisis). The big issues between now and then are thes issue of the debt ceiling, and any credit implications that might have and the impact of the hurricanes. For example, if imports rise, then the GDP reports will be revised downward. (This morning’s International Trade Report reflected a rise in imports.) What is Hot? What is Hot? Right now, everything, except gold and clean energy, are hot, hot, hot! The problem is that they might be too hot to touch without getting severely burned. If you are in the money, then it could definitely pay to wait until early January to do your annual rebalancing. If the Debt Ceiling crisis will be pushed out beyond April and the GDP reports remain strong, then you should be good through the end of April before Wall Street shows any sign of a correction. There are a lot of ifs in those sentences. I will keep you posted as developments occur. If you’re tempted to jump into stocks or crypto-currency at current prices, do a forensic analysis to make sure that you are not buying at the top. (The adage is buy low, sell high; not buy high, hoping to sell higher.) So, the economic correction deck is stacked and ready to tip. However, the likelihood that it tips before the end of the year is now low… mostly because none of the above issues are in the political or mainstream media dialog. Other Blogs of Interest. Financial Engineering. How Corporate Buybacks are Keeping Stocks Artificially High. What’s Hot? If you want to get safe, hot, protect your assets and save thousands each year with smarter energy, budgeting and investing choices, then join me for my Valentine's Retreat in the beautiful beach town of Santa Monica, California. Register by Sunday, Nov. 5, 2017, and receive the lowest price and a complimentary private, prosperity coaching session valued at $300! This is a boardroom retreat, taught hands-on for 3 full days by me. Call 310-430-2397 to learn more now! |

AuthorNatalie Pace is the co-creator of the Earth Gratitude Project and the author of The Power of 8 Billion: It's Up to Us, The ABCs of Money, The ABCs of Money for College, The Gratitude Game and Put Your Money Where Your Heart Is. She is a repeat guest & speaker on national news shows and stages. She has been ranked the No. 1 stock picker, above over 830 A-list pundits, by an independent tracking agency, and has been saving homes and nest eggs since 1999. Archives

July 2024

Categories |

RSS Feed

RSS Feed