|

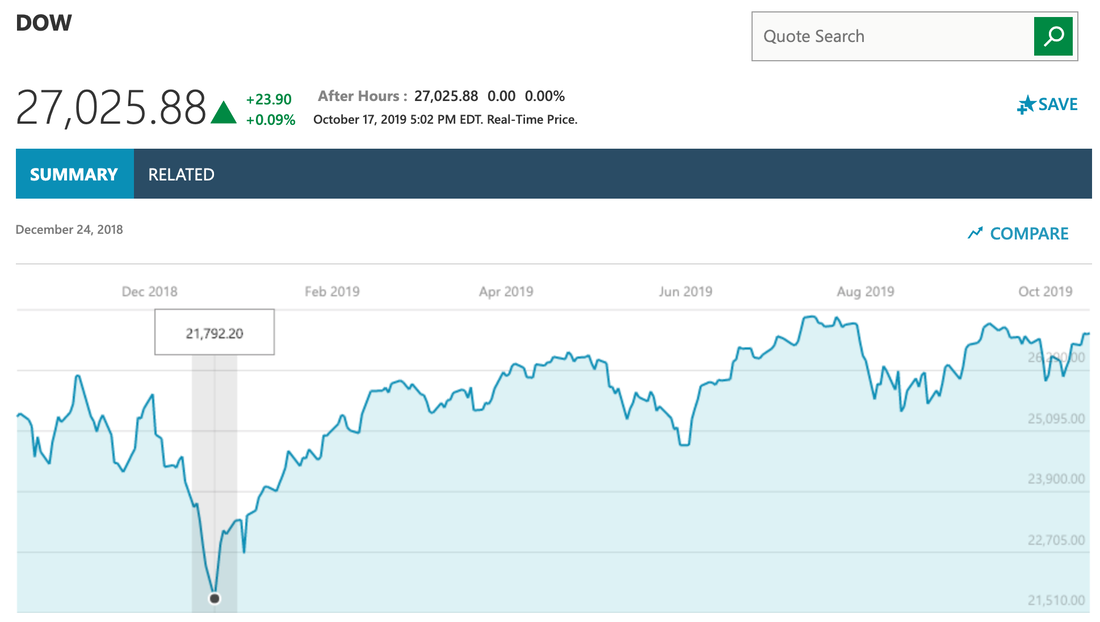

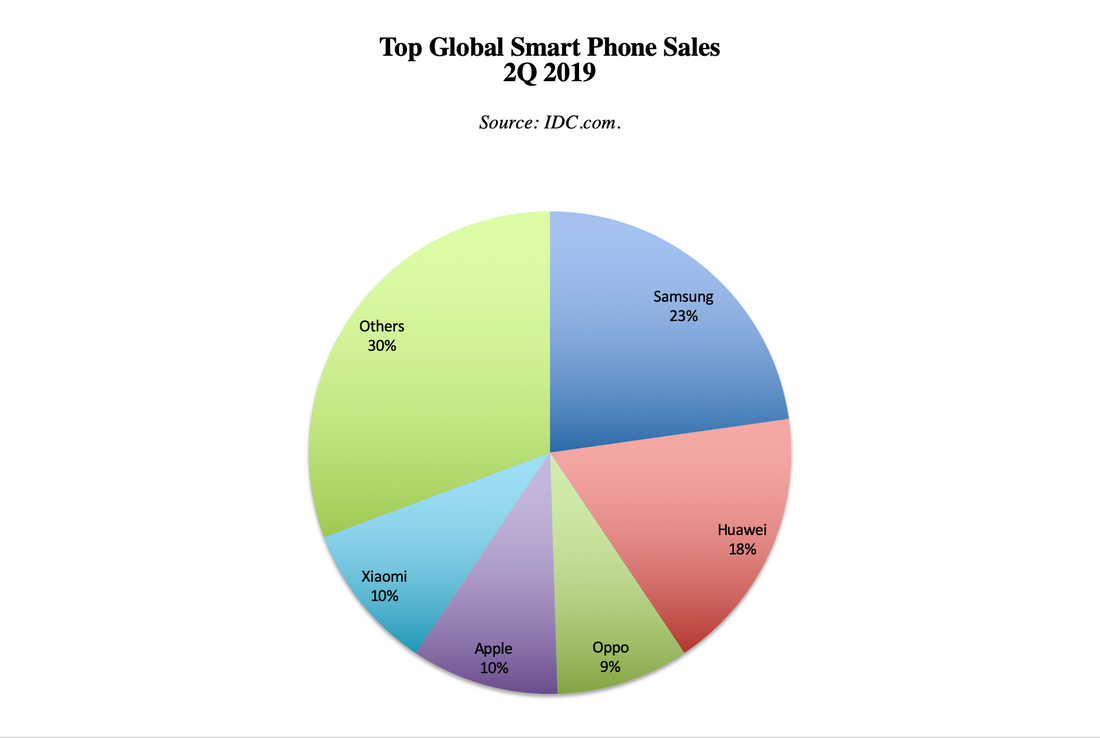

Apple has been the fuel of this bull market for years. Apple’s share repurchases are astonishing. The company bought back $74.2 billion of its own stock in 2018, compared to $34.4 billion in 2017. The closest buyback competitor in 2018 was Oracle, with $29.3 billion in share repurchases. Apple remains on track for another record buyback year, with almost $42 billion repurchased in the first half of 2019. However, rather mysteriously and without any explanation, Apple share repurchases dropped by half in the 4th quarter of 2018 (source: S&P Dow Jones Indices. In the first three quarters of 2018, Apple’s share repurchases averaged $21.4 billion per quarter. In the last quarter of 2018, buybacks abruptly stalled to a mere $10 billion. That was still higher than its peers. However, in a bull market driven by companies buying back their own stock, such a drastic policy shift can quickly impact into the broader market. December 2018 was the worst stocks have seen since the great depression. The S&P500 lost 6.4% in 2018, with losses of 12.31% in the last quarter. Last year’s Santa Rally was coal in the stocking. Most Main Street investors saw losses of 9% or more in their nest eggs, with losses on both the stocks and bonds side of their liquid assets. Performance of the Dow Jones Industrial Average Oct. 2018-Oct. 2019 The real question here is why did Apple stop repurchasing shares in December 2018, when they had plenty of cash on hand, and over $60 billion left in their buyback authorization? Was it simply a matter of price? In October of 2019, Apple stock was trading near its all-time high. Today, Apple’s stock price is even higher, at $241.83. Many companies have rules about pricing with regard to their buyback authorization. There can be other parameters, as well. (Apple hasn’t provided an explanation for the dramatic halt in share buybacks last December.) Another explanation for last year‘s cessation of share repurchases in December at Apple could be in anticipation of a very weak earnings report in January. Companies often have quiet periods before earnings, particularly if the news is not going to be good. We will know Apple’s forward outlook when they report earnings today, after the markets close. (I’ll update this in the comments section of this blog at that time.) In the 2nd quarter of 2019, Apple logged in as the #3 smart phone provider in the world, behind Samsung and Huawei (source: IDC.com). The 3rd quarter results will likely be released tomorrow. The Federal Reserve Fed Fund Rate Wonder why this year’s Santa Rally is more reliant upon Apple than the Federal Reserve’s Board decision? This is largely due to the Effective Lower Bound interest rate, which has already been hit. There comes a point when lower interest rates just can’t inject adrenalin into the late stage of the bull market’s life, even though Wall Street is practically demanding a rate cut today. As Nobel Prize winning economist Robert Shiller explains it, “It’s like your doctor giving you a strong anti-depressant for your mental condition. You think, ‘I must be really mentally ill if he gave me that.’” The economy grew at mere 1.9% in the 3rd quarter of 2019, according to the Bureau of Economic Analysis. Interest rates have been so low for so long that almost everything that can be leveraged responsibly has been. Below are a few examples.

Incidentally, even though interest rates have been falling again and home prices have still been rising, the number of mortgages that are severely underwater has grown this year. This has a lot to do with the recent trend of loan mods that have so many fees and unpaid interest tacked onto the new principle owed. I’ll be looking into this in the coming weeks. If you are a homeowner who is underwater on your home, it’s in your best interest to seek solutions outside of those being offered by the people you owe money to. Reach out to our office at 310-430-2397, or by email at [email protected], with any questions and/or if you are in this position. Bottom Line Apple had almost $100 billion left in its buyback facility as of June 29, 2019. The share price is back near its all-time high, at $241.83 today, vs. an all-time high of $249.75. (The 52-week low of $142/share occurred on January 4, 2019.) Apple is projecting flat to tepid revenue growth of $61-$64 billion, vs. $62.9 billion a year ago. Results will be announced today after the markets close. With Apple’s share price back to an all-time high, if Apple’s forward outlook is weak, we may be looking at the perfect storm that restrains the company from buying back its own stock in the coming months. That was devastating last year. The enlightened investor will take note of the trend, which runs counter to the normal Santa Rally trend, to protect their assets and remain on the right side of the trade. Other Blogs of Interest Will JP Morgan Implode on Fairy Tales and Unicorns. Harness Your Emotions for Successful Investing. What the Ford Downgrade Means for Main Street. The Dow Dropped Over 1000 Points Tesla's 3Q 2019 Deliveries Could Hit 100,000. Do We Talk Ourselves into Recessions? Interview with Nobel Prize Winning Economist Robert J. Shiller. The Winners and Loser of a Clean Energy Policy. Make the Climate Strike Personal. Ford is Downgraded to Junk. From Buried Alive in Bill to Buying Your Own Island. The Manufacturing Recession. An Interview with Liz Ann Sonders. Gold Mining ETFs Have Doubled. The Gold Bull Market Has Begun. The We Work IPO. The Highs and Hangovers of Investing in Cannabis. Recession Proof Your Life. China Takes a Bite Out of Apple Sales. Will the Dow Hit 30,000? A Check Up on the Economy Red Flags in the Boeing 2Q 2019 Earnings Report The Weakening Economy. Think Capture Gains, Not Stop Losses. Buy and Hold Works. Right? Wall Street Secrets Your Broker Isn't Telling You. Unaffordability: The Unspoken Housing Crisis in America. Are You Being Pressured to Buy a Home or Stocks? What's Your Exit Strategy? Will the Feds Lower Interest Rates on June 19, 2019? Should You Buy Tesla at a 2 1/2 Year Low? It's Time To Do Your Annual Rebalancing. Cannabis Crashes. Should You Get High Again? Are You Suffering From Buy High, Sell Low Mentality? Financial Engineering is Not Real Growth The Zoom IPO. 10 Rally Killers. Fix the Roof While the Sun is Shining. Uber vs. Lyft. Which IPO Will Drive Returns? Boeing Cuts 737 Production by 20%. Tesla Delivery Data Disappoints. Stock Tanks. Why Did Wells Fargo's CEO Get the Boot? Earth Gratitude This Earth Day. Real Estate is Back to an All-Time High. Is the Spring Rally Over? The Lyft IPO Hits Wall Street. Should you take a ride? Cannabis Doubles. Did you miss the party? 12 Investing Mistakes Drowning in Debt? Get Solutions. What's Hot in 2019? The Debt Ceiling Was Hit (Again) on March 1, 2019. How Bad Will the GDP Report Be? 2019 Investor IQ Test The State of the Union CBD Oil for Sale. The High Cost of Free Advice. Apple's Real Problem in China: Huawei. 2019 Crystal Ball. 2018 is the Worst December Ever. Will the Feds Raise Interest Rates? Should They? Learn what you're not being told in the MSM. Why FANG, Banks and Your Value Funds Are in Trouble. When the Santa Rally is a Loser, the Next Year is a Bigger Loser. Russia Dumps Treasuries and Buys Gold OPEC and Russia Cut Oil Production. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable however NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors. It has been a year rife with IPO losses, with the We Co. (WeWork) on the ropes, Uber losing $5.2 billion in the 2nd quarter of 2019 and Lyft shares down over 50% since its first day of trading. How much of that will impact the banks this earnings season? We’ll know by 7 am, when JP Morgan releases its 3rd quarter 2019 earnings report. Looking at bank fundamentals and analyst ratings (Buy buy buy!), one might be enticed to lean in for more financials exposure. The price to earnings ratios look fair, between 8 and 15. The profit margins range from 18% (Goldman Sachs and Morgan Stanley) to 31% (JP Morgan and Bank of America). Sales growth is holding steady, even though many of the banks have virtually stopped lending to homeowners, due to the low margins. As Jamie Dimon, the chairman & Chief Executive Officer of JPMorgan Chase & Co. explained in the company’s 2nd quarter 2019 earnings call, “It simply does not make sense to own home mortgages when you're constrained by standardized and you can't securitize.” However, past earnings are like looking in the rearview mirror. When driving for gains, it’s a better idea to polish up the crystal ball and look out on the horizon. The WeWork IPO Implosion Morgan Stanley should be clear of this one, having exited the fray when they were denied the lead on the IPO. However, sources, including The New York Times and the Financial Times, peg loss exposure in the hundreds of millions on both Goldman Sachs and JP Morgan. SoftBank reportedly has at least $11 billion in equity investments in the We Co. JP Morgan is believed to have loaned former CEO Adam Nauman hundreds of millions personally against his equity ownership in the company. When a company’s value gets written down to $10 billion from $47 billion, wiping out 79% of the assumptions every pre-IPO investor was banking on, that’s going to scar an earnings report. In fairness, we just don’t know the We Co.’s value at this time. However, investors balked at buying in for even a $15 billion valuation. And Fitch downgraded WeWork’s credit rating to CCC+ this month after the IPO was pulled, putting the company’s bonds firmly in junk-bond territory. According to The New York Times, there are two competing plans to take over the company, one from SoftBank and one from JP Morgan. Meanwhile the We Co. lays on the ropes in a cash-crunch coma. One of the fundamental toxins in the We Co. business plan is that the company signs on for long-term leases, while accepting short-term contracts with its customers. Another poison was not having a clear path to profitability, and being astonishingly steeped in nepotism and hubris, while short on business acumen. The We Co. lost $905 million in the first six months of this year. Since the IPO was pulled on September 30, 2019, the last day of the third quarter, the full financial accounting of the We Co. debacle is more likely to play out in the months ahead. It’s also possible that the company will want to rip the band-aid off and just put it behind them. However, that’s more likely to happen in the 4th quarter 2019 earnings than in tomorrow’s report. Another negative omen is that there have been other IPOs that sank in share price upon hitting the big boards this year, including Uber and Lyft. Any pre-IPO bank investments will have to be written down at some point, which may impact earnings. The Poor Performing IPO Class of 2019, combined with a flat yield curve and the overnight stress in the repo lending market are all signs that there is more going on behind the scenes in the financial industry than is being fully accounted for in the earnings reports and headlines. Will this quarter’s earnings reveal more weakness than investors are anticipating? Are financial storms on the horizon? Tomorrow will tell, as will the advance report of U.S. 3rd quarter GDP growth, which will be released on Oct. 30, 2019. 3rd Quarter 2019 GDP Growth With the full year 2019 GDP growth expected to be restrained to 2.2%, many economists are expecting a weak showing on Oct. 30, 2019. Banks have been the most aggressive buyers of their own stock. So, it’s not a great idea to bet against these juggernauts. JP Morgan repurchased $5 billion shares of its own stock in the 2nd quarter of 2019, with a total of $7.5 billion returned to shareholders in stock repurchases and dividends. However, it’s clear that institutional investors are sobering up and demanding profitability and reasonable valuations. The WeWork IPO and other financial hits will have to be accounted for. If not in the 3Q 2019 earnings season, then perhaps beginning as early as Christmas. Remember last Christmas was the worst December in stocks since the Depression. The S&P500 dropped 9.2%. That phenomenon was pegged to Apple pulling back on its astonishingly aggressive buyback pace. Apple cut its repurchases by half in the 4Q 2018, to $10 billion, from an average $21.4 billion in the three quarters preceding that. JP Morgan and Wells Fargo both increased their share buybacks in the last quarter of 2018. However, that wasn’t enough to save the day last December. The Late Stage of the Business Cycle This kind of race to monetize and capitalize cash-negative “unicorn” IPOs is a hallmark of the late stage of the business cycle. Inverted yield curves are 100% associated with recessions over the last half century. So, now is the time to stop looking back at how far this bull market has come, and start battening down the hatches to prepare for rougher seas to come. Learn how to save thousands annually in your budget with smarter big-ticket energy choices, and how to invest in your nest egg with a time-proven strategy that earns gains in recessions and outperforms the bull markets in between. Join me at one of my upcoming Investor Educational Retreats. You have 3 to choose from below. Arizona is my most affordable retreat. Students register for 1/2 off! Anyone who registers for the Florida or England Retreat by October 31, 2019 receives the lowest price. Call 310-430-2397 or email [email protected] to learn more now. Other Blogs of Interest

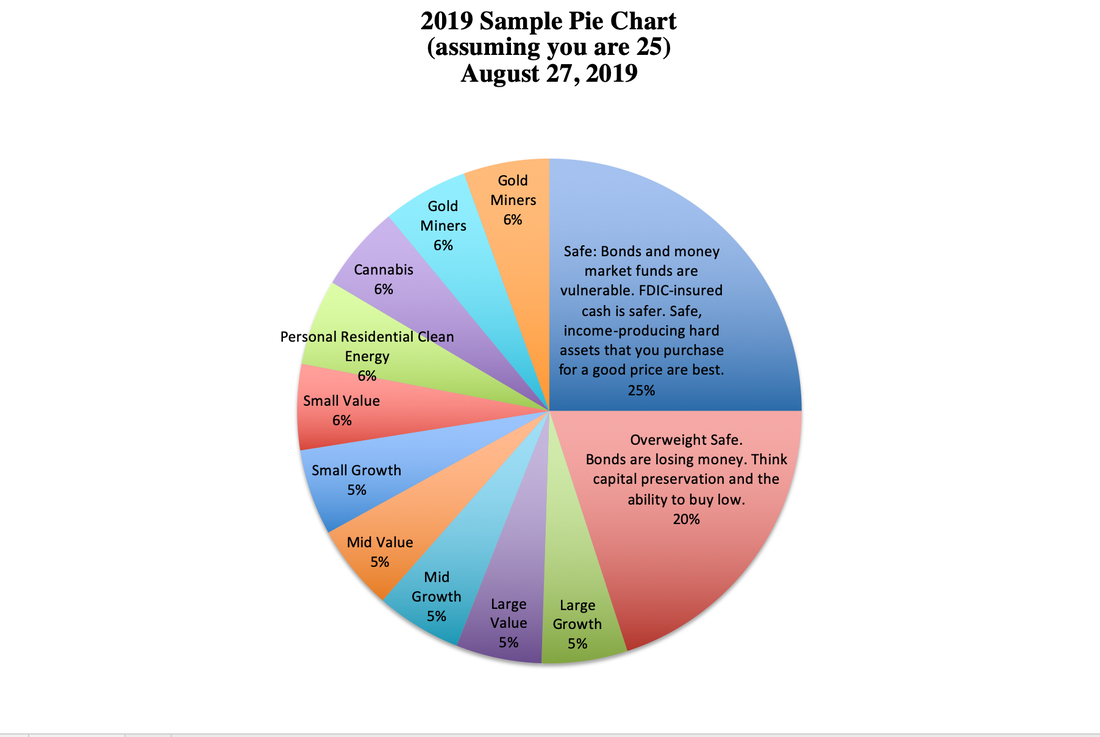

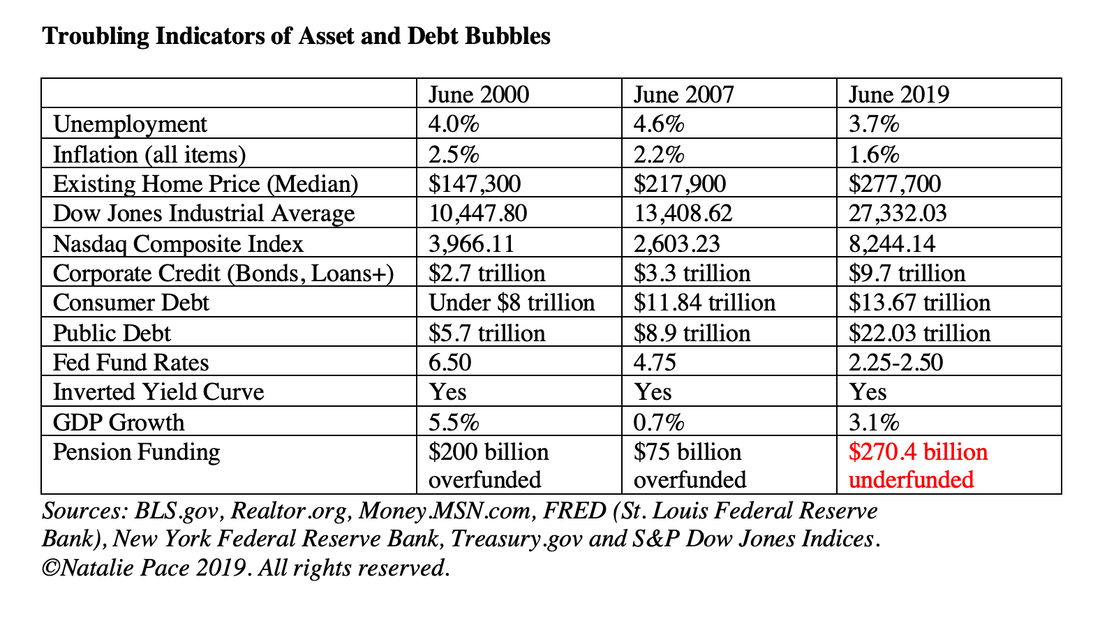

Harness Your Emotions for Successful Investing. What the Ford Downgrade Means for Main Street. The Dow Dropped Over 1000 Points Tesla's 3Q 2019 Deliveries Could Hit 100,000. Do We Talk Ourselves into Recessions? Interview with Nobel Prize Winning Economist Robert J. Shiller. The Winners and Loser of a Clean Energy Policy. Make the Climate Strike Personal. Ford is Downgraded to Junk. From Buried Alive in Bill to Buying Your Own Island. The Manufacturing Recession. An Interview with Liz Ann Sonders. Gold Mining ETFs Have Doubled. The Gold Bull Market Has Begun. The We Work IPO. The Highs and Hangovers of Investing in Cannabis. Recession Proof Your Life. China Takes a Bite Out of Apple Sales. Will the Dow Hit 30,000? A Check Up on the Economy Red Flags in the Boeing 2Q 2019 Earnings Report The Weakening Economy. Think Capture Gains, Not Stop Losses. Buy and Hold Works. Right? Wall Street Secrets Your Broker Isn't Telling You. Unaffordability: The Unspoken Housing Crisis in America. Are You Being Pressured to Buy a Home or Stocks? What's Your Exit Strategy? Will the Feds Lower Interest Rates on June 19, 2019? Should You Buy Tesla at a 2 1/2 Year Low? It's Time To Do Your Annual Rebalancing. Cannabis Crashes. Should You Get High Again? Are You Suffering From Buy High, Sell Low Mentality? Financial Engineering is Not Real Growth The Zoom IPO. 10 Rally Killers. Fix the Roof While the Sun is Shining. Uber vs. Lyft. Which IPO Will Drive Returns? Boeing Cuts 737 Production by 20%. Tesla Delivery Data Disappoints. Stock Tanks. Why Did Wells Fargo's CEO Get the Boot? Earth Gratitude This Earth Day. Real Estate is Back to an All-Time High. Is the Spring Rally Over? The Lyft IPO Hits Wall Street. Should you take a ride? Cannabis Doubles. Did you miss the party? 12 Investing Mistakes Drowning in Debt? Get Solutions. What's Hot in 2019? The Debt Ceiling Was Hit (Again) on March 1, 2019. How Bad Will the GDP Report Be? 2019 Investor IQ Test The State of the Union CBD Oil for Sale. The High Cost of Free Advice. Apple's Real Problem in China: Huawei. 2019 Crystal Ball. 2018 is the Worst December Ever. Will the Feds Raise Interest Rates? Should They? Learn what you're not being told in the MSM. Why FANG, Banks and Your Value Funds Are in Trouble. When the Santa Rally is a Loser, the Next Year is a Bigger Loser. Russia Dumps Treasuries and Buys Gold OPEC and Russia Cut Oil Production. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable however NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors. Discover why pie charts, not just account summary pages, are essential to successful investing. This strategy taps your emotions to work for you rather than against you. If you are looking at statements and adhering to a Buy and Hope plan, your feelings are jacked between euphoria, desperation and indigestion, and are very likely demanding that you do the wrong thing. Most investors have lost more than half of their nest egg in the last two market contractions. Our nest egg pie chart and annual rebalancing plan earned gains in the last two recessions and have outperformed the bull markets in between. So, in addition to this being an emotionally healthy plan, it’s also time-proven. Recently someone reached out to my office for some private coaching and a second opinion. Heather, my assistant, asked if they had mocked up their holdings into a pie chart. The response was, “No, I don’t need a pie chart. I’m just going to ask her what she thinks of my stocks.” This is the wrong approach for many reasons. And here’s why. Harnessing the power of your emotions When you look at summary pages, your emotions are going to be working against you, quite powerfully. The summary page will show gains and losses in your positions. The losses will be in red. The games will be in green. Most of us associate red with stop and green with go. If you use stop losses or sell when something loses value, then you are adopting a sell low plan. If you applaud your gains and hit the gas on the green light, rather than capturing your gains, then you might watch them skid into losses at the next red light. You are also more likely to buy high. Buying high and selling low is the exact opposite of what successful investors do. Our emotional response to losses is fear and loathing. Our emotional response to gains is jubilee. So, in addition to the rote response we have to red and green lights, we’ve now got adrenalin fueling us in the wrong direction. The Power of a Simple Pie Chart When we put our holdings into a pie chart everything changes. What was a liability becomes an asset. If you have a fund that has lost money, the pie chart slice will be thinner. If you have a fund that has massive gains, the pie chart slice will balloon in size. The visual prompts you to do what you’re supposed to do, which is to buy low and sell high. You have to buy more of the thin slice in order to be properly diversified. You’ll be capturing gains (selling high) in the funds that have rocketed up in share price, so that you will not be overleveraged in them. Annual rebalancing is a Buy Low and Sell High Plan on Auto Pilot for Your Nest Egg At my retreats, I teach that rebalancing your nest egg 1-3 times a year is an essential part of a successful strategy in today’s Debt World. Rebalancing is easy. Simply mock up what you have into a pie chart. Mock up what you should have into another pie chart. Then make what you have look like what you should have. Always take the time to freshen up your pie chart with current data before you consider what action you are going to take. The visual itself will be your guide. Get an Unbiased 2nd Opinion Some people have trouble mocking up what they have into a pie chart, and that is where my 2nd opinions can be helpful. Once you know how to do this, by observing how I did it, then your rebalancing will be easy and efficient. Sadly, you cannot rely upon your broker to do this for you. The pie charts supplied by most brokerages is not an accurate picture of what you own. The Pie Chart You Receive from your Brokerage Won’t Help You I’ve been doing 2nd opinions for over a year now. To date, I have not found one summary page with a pie chart on it that was an accurate representation of what the person really held. If you have pages and pages of holdings, and particularly if you have a lot of individual stocks, if the brokerage does supply a pie chart, they are likely just going to lump all of the stocks into “equity” and then put your bonds into “fixed income.” This is not helpful because you cannot see and capture your gains, as you can when you know clearly which funds are small, medium and large, and which are value and growth. Also, this type of plan is often just the same types of holdings over and over again, so you are not properly diversified, even if you have pages and pages of holdings. (In fact, this is a red flag that you’re getting killed in brokerage fees.) If you have less than a few hundred thousand dollars in your 401K, IRA or brokerage account, you may only own one or two funds. The pie charts supplied will try to show that the one or two funds you own are diversified by mocking up the various holdings within that fund. However, annual rebalancing doesn’t work when you have one or two “everything and the kitchen sink” funds because you can’t see and capture your gains. You have an amoeba type situation. You never know which areas of your plan are getting thinner or bigger (with losses and gains). Even if you did you would not be able to rebalance it because the fund manager has complete control over the holdings. You own one big glob of a fund that you basically have to just watch go up and down on the Wall Street rollercoaster that most investors have endured since 2000. Most Main Street investors are not properly diversified – not in their 401K, IRA or their managed account. Most of the plans that I’ve reviewed have no exposure to hot industries. Few people are aware of the risk that lies on the “safe” side of their portfolio this year. What is Hot and What is Safe Changes Every Year What’s hot and what is safe changes annually. So, when you’re doing your annual rebalancing, it’s important to consider both of these areas carefully, based upon data and information from a trustworthy source with an impeccable track record. Friends, family and your financial advisor qualify only if they have a Ph.D. in results for a minimum of 15 years. Many bloggers and writers don’t qualify at all. For instance, Chinese technology was the hottest thing going a few years ago. When FANG (Facebook, Apple, Netflix and Google) was scoring big-time, smart investors were also looking at BAT (Baidu, Alibaba and Tencent), where the gains were even more impressive. This year, with the trade war between China and the United States, Chinese stocks have suffered. If you had captured your gains in 2017, when these stocks doubled, then you’d be on the right side of this trade. You are expecting higher performance in the four hot slices of your nest egg. This is the place for experimenting, within reason, with the assets, industries and countries that you believe will outperform everyone else. As another example, gold mining ETFs have doubled over the past year. However, they are still down significantly from their all-time highs which were in 2012. Gold is a good hedge against a market downturn. If confidence in the economy and stocks weaken, that should be positive for gold. So, this year, even though those funds have doubled. you might want to take your profits and keep a slice or two in this area, rather than sell off the entire position. As I’ve mentioned many times, most people lost more than half of their assets in the last two recessions. This pie chart system far out performs the market, protects your assets (if you adopt this year’s safest strategy), limits any losses and offers a time-proven plan that ensures you can sleep at night. It costs less time and money than your current plan. The only real question is how are you going to learn The ABCs of Money that we all should have received in high school, so that you can be the boss of your money, instead of having to operate with blind faith? Learn how to save thousands annually in your budget with smarter big-ticket energy choices, and how to invest in your nest egg with a time-proven strategy that earns gains in recessions and outperforms the bull markets in between. Join me at one of my upcoming Investor Educational Retreats. You have 3 to choose from below. Arizona is my most affordable retreat. Students register for 1/2 off! Anyone who registers for the Florida or England Retreat by October 31, 2019 receives the lowest price. Call 310-430-2397 or email [email protected] to learn more now. Other Blogs of Interest What the Ford Downgrade Means for Main Street. The Dow Dropped Over 1000 Points Tesla's 3Q 2019 Deliveries Could Hit 100,000. Do We Talk Ourselves into Recessions? Interview with Nobel Prize Winning Economist Robert J. Shiller. The Winners and Loser of a Clean Energy Policy. Make the Climate Strike Personal. Ford is Downgraded to Junk. From Buried Alive in Bill to Buying Your Own Island. The Manufacturing Recession. An Interview with Liz Ann Sonders. Gold Mining ETFs Have Doubled. The Gold Bull Market Has Begun. The We Work IPO. The Highs and Hangovers of Investing in Cannabis. Recession Proof Your Life. China Takes a Bite Out of Apple Sales. Will the Dow Hit 30,000? A Check Up on the Economy Red Flags in the Boeing 2Q 2019 Earnings Report The Weakening Economy. Think Capture Gains, Not Stop Losses. Buy and Hold Works. Right? Wall Street Secrets Your Broker Isn't Telling You. Unaffordability: The Unspoken Housing Crisis in America. Are You Being Pressured to Buy a Home or Stocks? What's Your Exit Strategy? Will the Feds Lower Interest Rates on June 19, 2019? Should You Buy Tesla at a 2 1/2 Year Low? It's Time To Do Your Annual Rebalancing. Cannabis Crashes. Should You Get High Again? Are You Suffering From Buy High, Sell Low Mentality? Financial Engineering is Not Real Growth The Zoom IPO. 10 Rally Killers. Fix the Roof While the Sun is Shining. Uber vs. Lyft. Which IPO Will Drive Returns? Boeing Cuts 737 Production by 20%. Tesla Delivery Data Disappoints. Stock Tanks. Why Did Wells Fargo's CEO Get the Boot? Earth Gratitude This Earth Day. Real Estate is Back to an All-Time High. Is the Spring Rally Over? The Lyft IPO Hits Wall Street. Should you take a ride? Cannabis Doubles. Did you miss the party? 12 Investing Mistakes Drowning in Debt? Get Solutions. What's Hot in 2019? The Debt Ceiling Was Hit (Again) on March 1, 2019. How Bad Will the GDP Report Be? 2019 Investor IQ Test The State of the Union CBD Oil for Sale. The High Cost of Free Advice. Apple's Real Problem in China: Huawei. 2019 Crystal Ball. 2018 is the Worst December Ever. Will the Feds Raise Interest Rates? Should They? Learn what you're not being told in the MSM. Why FANG, Banks and Your Value Funds Are in Trouble. When the Santa Rally is a Loser, the Next Year is a Bigger Loser. Russia Dumps Treasuries and Buys Gold OPEC and Russia Cut Oil Production. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable however NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors.  What the Ford Downgrade Means. Main Street Investors Ask Natalie. Dear Natalie. These may be ignorant questions. Am I correct in thinking these bonds are issued as money raisers? I would have presumed that's what stocks were for. Also, is junk bond status something negative? I’m wondering what this means for the overall economy, and for me personally. Signed: Feeling a Bit Clueless Dear Getting Clued In: Never be embarrassed about asking these kinds of questions. Until we get The ABCs of Money and life math taught in high school and college, most of us are clueless. Stocks raise money by asking people to become a shareholder (i.e. owner). Bonds raise money by borrowing from banks. The banks then sell those bonds to regular folks as "safe" fixed income products that will pay a dividend and then repay the principal at the end of a certain period of time. When bonds are investment grade, then pensions and institutions purchase them. Main Street investors might opt for individual bonds or bond funds, thinking they are safe from a downturn in the stock market. Many Main Street investors hold bonds in their retirement, pensions, 401Ks, mutual funds, annuities, insurance products, etc. without really realizing it. The Ford downgrade is a symptom of a much more widespread problem. There is too much risk in the investment grade bonds for that asset to be considered safe. Over 50% of corporate bonds are at the lowest rung, just above junk status. So, they are just as vulnerable as Ford is to a downgrade. Borrowing from Peter to Pay Paul The economists contributing to the Financial Stability Report are also concerned about the leverage in corporate bonds and loans. In the May 2019 report, the Feds wrote, “Borrowing by businesses is historically high relative to gross domestic product (GDP), with the most rapid increases in debt concentrated among the riskiest firms amid signs of deteriorating credit standards.” In my August 2019 interview with Liz Ann Sonders, the Chief Investment Strategist at Charles Schwab Inc., she warned that “This highly indebted, weak component of the corporate sphere will mark the end of this cycle in some way.” Corporate Bonds Lost Money in 2018 Last year, corporate bonds lost money in tandem with stocks. Finally, interest rates are starting out too low for the bond market to be of much help in the next stock market correction. Bonds, particularly corporate and muni bonds with credit risk, could lose value in the next downturn (and always lose value in a downgrade), meaning that investors will lose principal on the “safe” side of their nest egg, in addition to the “at risk” side. Being downgraded to “junk” bond status is negative. It means that the bond has been downgraded to speculative and is a higher risk. The ultimate risk is that the company may have to restructure their debt, meaning that bondholders will not receive all of their money back, and will also lose the income they were expecting. After Greek bonds were cut to junk status, MF Global went bankrupt (in 2011). Junk status also means that the next time Ford needs to borrow more money, the company will have to pay a higher interest rate. So, it cuts into Ford’s profits. Many pension funds, bond funds and institutions limit the amount of speculative junk bonds that they hold, in their bylaws. So, junk bonds can become illiquid, which means that investors won’t be able to sell them to someone else. Many Ford bonds are 30-year bonds. That’s a long time to bet that Ford, which has over $220 billion in liabilities, including debt, pensions and other post-employment benefits, will not have to use bankruptcy to restructure. General Motors and Chrysler declared Chapter 11 in 2009. No one will be interested in taking a junk bond off of your hands, unless you take a large haircut on your investment – if you can get anyone to buy it at all. Stock Investors and Bond Investors Lose When a Company is Downgraded The bottom line is that when a company is downgraded, investors lose money on the stock and the bond side of the equation. Since 50% of corporate bonds are at the lowest rung, just above junk bond status, this is one of the riskiest areas of the market to be in. If you have high-yielding dividend stocks or bonds, then you are taking on a lot of risk for a very small return (under 5%). GE and Ford are the poster children of what happens to companies that keep borrowing from Main Street to buy back their own stock, while taking on unsustainable debt and short-changing their pension plans. (GE just froze the pension plans of over 20,000 employees this week.) However, they are not the only companies that have bought into this practice. In fact, corporate buybacks have been the fuel of the current bull market. My warnings on GE and Ford began years ago. Click on the blue highlights to see a few of those blogs. Learn Life Math Now If you don't invest the time and money to get financially literate, then you are vulnerable to the leverage in the world during the late stage of this business cycle... The upside is that if you do become financially literate, you can stop making everyone else rich at your own expense, start living a richer life, provide far better for your own future, protect your assets and even save thousands of dollars annually in your budget with smarter big-ticket choices. Wisdom is the cure. The time is now! Call 310-430-2397 to learn The ABCs of Money that we all should have received in high school. I also offer an unbiased 2nd opinion on your current investing plan. Call or email for pricing and information. Learn how to save thousands annually in your budget with smarter big-ticket energy choices, and how to invest in your nest egg with a time-proven strategy that earns gains in recessions and outperforms the bull markets in between. Join me at one of my upcoming Investor Educational Retreats. You have 3 to choose from below. Arizona is my most affordable retreat. Students register for 1/2 off! Anyone who registers for the Florida or England Retreat by October 31, 2019 receives the lowest price. Call 310-430-2397 or email [email protected] to learn more now. Other Blogs of Interest The Dow Dropped Over 1000 Points Tesla's 3Q 2019 Deliveries Could Hit 100,000. Do We Talk Ourselves into Recessions? Interview with Nobel Prize Winning Economist Robert J. Shiller. The Winners and Loser of a Clean Energy Policy. Make the Climate Strike Personal. Ford is Downgraded to Junk. From Buried Alive in Bill to Buying Your Own Island. The Manufacturing Recession. An Interview with Liz Ann Sonders. Gold Mining ETFs Have Doubled. The Gold Bull Market Has Begun. The We Work IPO. The Highs and Hangovers of Investing in Cannabis. Recession Proof Your Life. China Takes a Bite Out of Apple Sales. Will the Dow Hit 30,000? A Check Up on the Economy Red Flags in the Boeing 2Q 2019 Earnings Report The Weakening Economy. Think Capture Gains, Not Stop Losses. Buy and Hold Works. Right? Wall Street Secrets Your Broker Isn't Telling You. Unaffordability: The Unspoken Housing Crisis in America. Are You Being Pressured to Buy a Home or Stocks? What's Your Exit Strategy? Will the Feds Lower Interest Rates on June 19, 2019? Should You Buy Tesla at a 2 1/2 Year Low? It's Time To Do Your Annual Rebalancing. Cannabis Crashes. Should You Get High Again? Are You Suffering From Buy High, Sell Low Mentality? Financial Engineering is Not Real Growth The Zoom IPO. 10 Rally Killers. Fix the Roof While the Sun is Shining. Uber vs. Lyft. Which IPO Will Drive Returns? Boeing Cuts 737 Production by 20%. Tesla Delivery Data Disappoints. Stock Tanks. Why Did Wells Fargo's CEO Get the Boot? Earth Gratitude This Earth Day. Real Estate is Back to an All-Time High. Is the Spring Rally Over? The Lyft IPO Hits Wall Street. Should you take a ride? Cannabis Doubles. Did you miss the party? 12 Investing Mistakes Drowning in Debt? Get Solutions. What's Hot in 2019? The Debt Ceiling Was Hit (Again) on March 1, 2019. How Bad Will the GDP Report Be? 2019 Investor IQ Test The State of the Union CBD Oil for Sale. The High Cost of Free Advice. Apple's Real Problem in China: Huawei. 2019 Crystal Ball. 2018 is the Worst December Ever. Will the Feds Raise Interest Rates? Should They? Learn what you're not being told in the MSM. Why FANG, Banks and Your Value Funds Are in Trouble. When the Santa Rally is a Loser, the Next Year is a Bigger Loser. Russia Dumps Treasuries and Buys Gold OPEC and Russia Cut Oil Production. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable however NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors. Since September 13, 2019, when the Dow Jones Industrial Average was at 27,219, the Dow has plunged over 1500 points. Today’s low was 25,743.46, but settled back in to close at 26,201. Is this weakness due to the impeachment investigation? Are there underlying fundamentals that point to a correction? Will there be a Santa Rally in 2019? 12 Market Indicators. Examined.

12. Christmas Eve 2018 low of 21,712.53. December 2018 = worst performer for stocks since Great Depression. 2018 was a loser for stocks and corporate bonds. It’s a reminder that if you wait for the headlines that stocks are in trouble, it’s too late to protect yourself. What’s Your Best Plan?

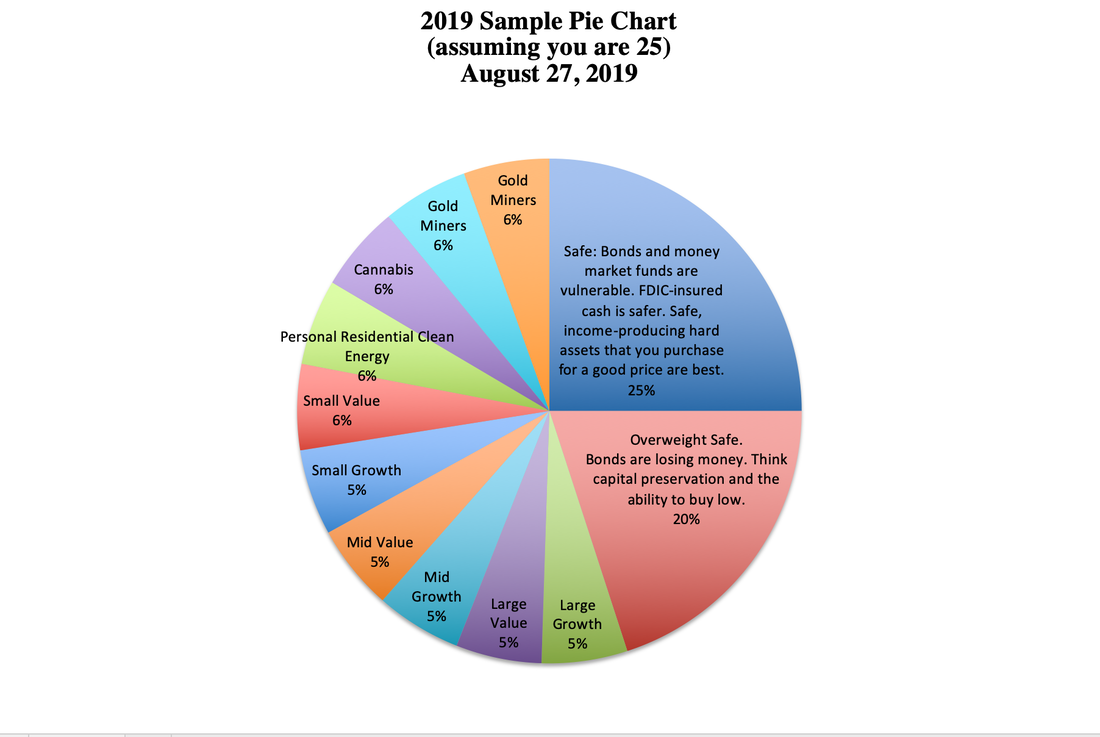

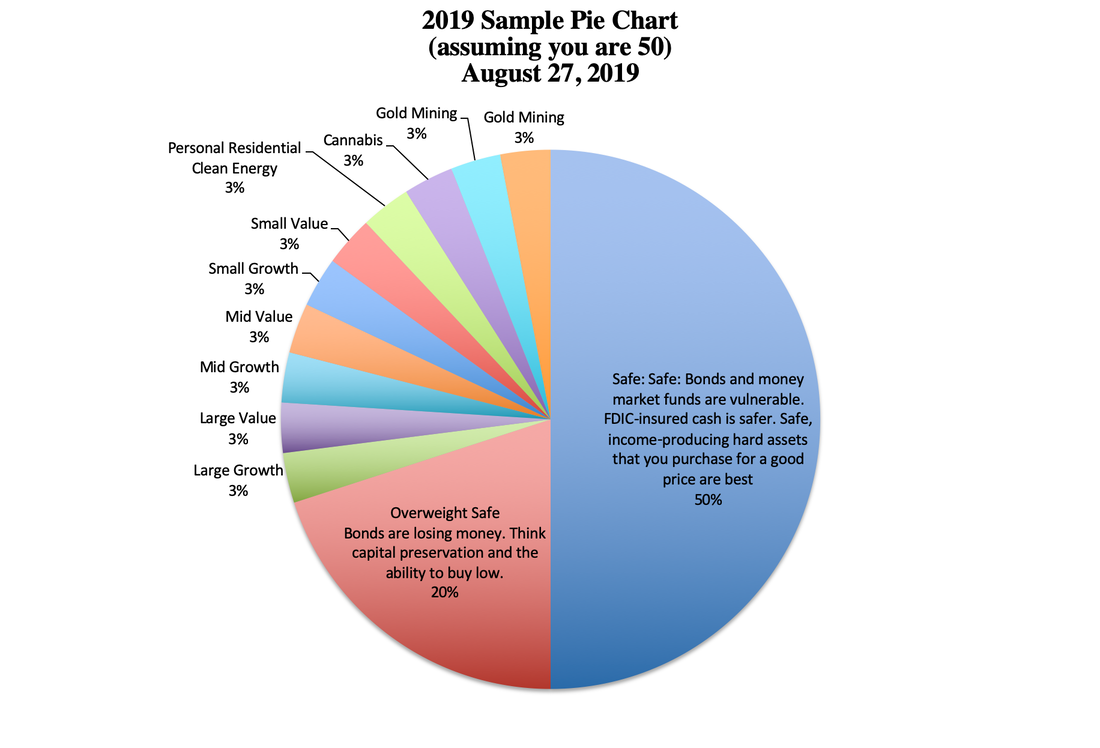

Here are sample Nest Egg Pie Charts. They will make more sense after you attend a retreat, receive a 2nd opinion or assiduously read, comprehend and apply the strategies in my 3 bestselling books. If you are going to trade, then you must apply an additional quantitative measure to your buy low/sell high analysis, after you have incorporated the 3-Ingredient Recipe for Cooking Up Profits, the Stock Report Card and the 4 Questions (all of which are outlined in my 1st book, Put Your Money Where Your Heart Is). Basically, in many industries (but not all), you are buying high, hoping to sell higher. That is why I’m discouraging trading, and encouraging that you stick to your knitting. Additional Quantitative Measure for the Late Stage of the Business Cycle.

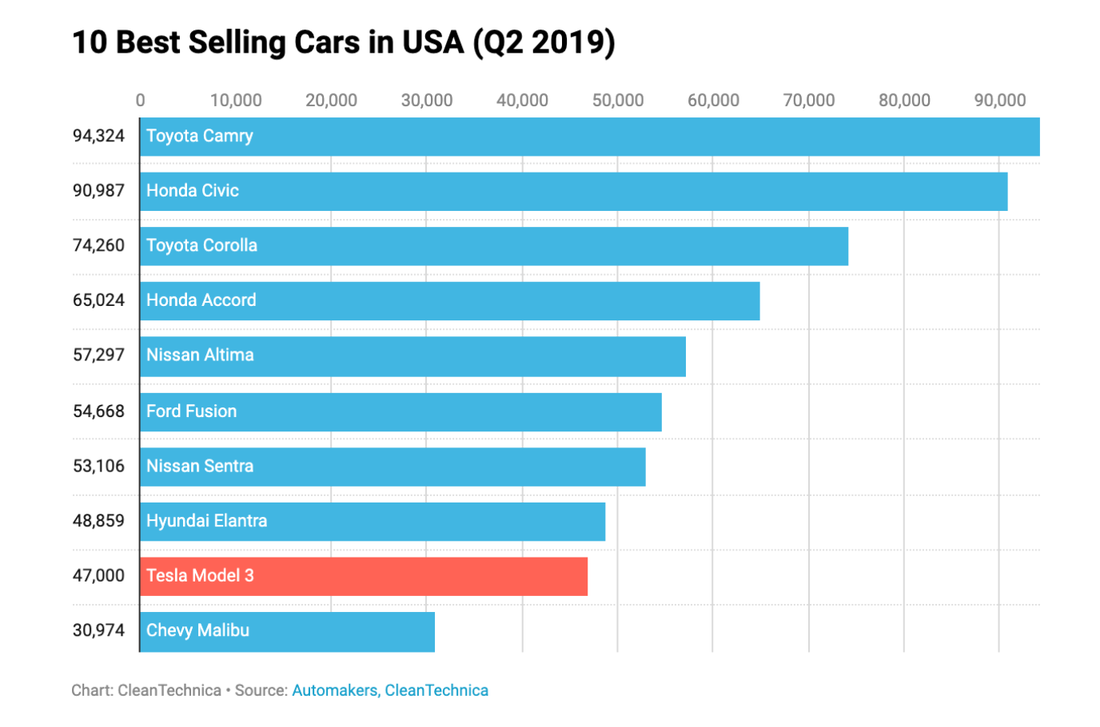

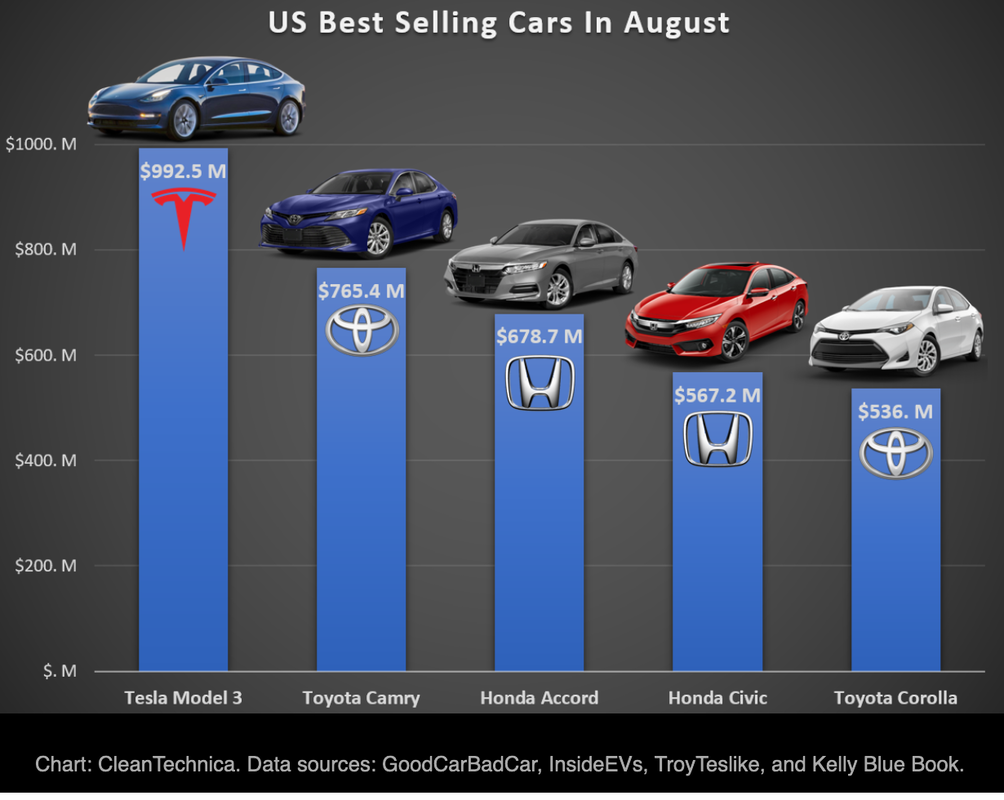

Additional Information on Unicorn IPOs, Gold, Cannabis, Tesla and More I continue to report on hot industries and companies (and toxic ones, too) in my blog. To stay plugged in, simply visit NataliePace.com regularly and scroll through my Twitter feed, which is posted on the home page. You can also go to the end of any recent blog, where you will find an index of past articles. Simply click on the blue highlights of the company or industry that you are most interested in. If you’re interested in any of the experts, companies and industries I’ve mentioned in this blog, click on the blue highlights to check out recent reports. Surgical robotics, artificial intelligence, cryptocurrency, a potential FitBit acquisition, GoPro and clean energy are on my radar. I will be featuring blogs on them soon. Stay tuned. Email or call if you have a hot tip that you’d like for our team to research. Bottom Line There are times when the wind is at your back, and others when the wind is in your face. Today, almost all of the leading indicators point to economic storms on the horizon. It’s time to fix the roof while the sun is still shining. If you’d like to listen back to my free monthly teleconference, where I include additional information not found in this blog, go to BlogTalkRadio.com/NataliePace. I’ll host my next free monthly teleconference in November. If you're interested on how to save thousands annually in your budget with smarter big-ticket energy choices, and how to invest in your nest egg with a time-proven strategy that earns gains in recessions and outperforms the bull markets in between, then join me at one of my upcoming Investor Educational Retreats. You have 3 to choose from below. Arizona is my most affordable retreat. Students register for 1/2 off! Anyone who registers for the Florida or England Retreat by October 31, 2019 receives the lowest price. Call 310-430-2397 or email [email protected] to learn more now. Other Blogs of Interest Tesla's 3Q 2019 Deliveries Could Hit 100,000. Do We Talk Ourselves into Recessions? Interview with Nobel Prize Winning Economist Robert J. Shiller. The Winners and Loser of a Clean Energy Policy. Make the Climate Strike Personal. Ford is Downgraded to Junk. From Buried Alive in Bill to Buying Your Own Island. The Manufacturing Recession. An Interview with Liz Ann Sonders. Gold Mining ETFs Have Doubled. The Gold Bull Market Has Begun. The We Work IPO. The Highs and Hangovers of Investing in Cannabis. Recession Proof Your Life. China Takes a Bite Out of Apple Sales. Will the Dow Hit 30,000? A Check Up on the Economy Red Flags in the Boeing 2Q 2019 Earnings Report The Weakening Economy. Think Capture Gains, Not Stop Losses. Buy and Hold Works. Right? Wall Street Secrets Your Broker Isn't Telling You. Unaffordability: The Unspoken Housing Crisis in America. Are You Being Pressured to Buy a Home or Stocks? What's Your Exit Strategy? Will the Feds Lower Interest Rates on June 19, 2019? Should You Buy Tesla at a 2 1/2 Year Low? It's Time To Do Your Annual Rebalancing. Cannabis Crashes. Should You Get High Again? Are You Suffering From Buy High, Sell Low Mentality? Financial Engineering is Not Real Growth The Zoom IPO. 10 Rally Killers. Fix the Roof While the Sun is Shining. Uber vs. Lyft. Which IPO Will Drive Returns? Boeing Cuts 737 Production by 20%. Tesla Delivery Data Disappoints. Stock Tanks. Why Did Wells Fargo's CEO Get the Boot? Earth Gratitude This Earth Day. Real Estate is Back to an All-Time High. Is the Spring Rally Over? The Lyft IPO Hits Wall Street. Should you take a ride? Cannabis Doubles. Did you miss the party? 12 Investing Mistakes Drowning in Debt? Get Solutions. What's Hot in 2019? The Debt Ceiling Was Hit (Again) on March 1, 2019. How Bad Will the GDP Report Be? 2019 Investor IQ Test The State of the Union CBD Oil for Sale. The High Cost of Free Advice. Apple's Real Problem in China: Huawei. 2019 Crystal Ball. 2018 is the Worst December Ever. Will the Feds Raise Interest Rates? Should They? Learn what you're not being told in the MSM. Why FANG, Banks and Your Value Funds Are in Trouble. When the Santa Rally is a Loser, the Next Year is a Bigger Loser. Russia Dumps Treasuries and Buys Gold OPEC and Russia Cut Oil Production. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable however NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors. This blog was updated at 4:55 p.m. PT on Oct. 1, 2019. The Tesla 3 was the #1 vehicle in the U.S. by revenue and the #5 by unit sales in August of 2018. In the 2nd quarter of 2019, it was the #9 bestseller by unit sells. The 2Q 2019 Tesla Vehicle Production and Deliveries report was outstanding. The one tomorrow should be even better. After Tesla reported on July 2, 2019 that the company had delivered 95,356 vehicles in the 2nd quarter of 2019, the share price popped from $224 to $265 over the next few weeks. Investor euphoria proved to be very short-lived, however. On July 24, 2019, when Tesla reported their 2nd quarter earnings, which included a net loss of $408 million, the previous share price gains were completely wiped out. This time around, Tesla stock is starting out slightly higher, at $243.43 (on a day when the Dow Jones Industrial Average has been down 324 points). If the stock rises to $265 again, that’s only a 9% gain. However, a leaked report from Elon Musk has investors believing that Tesla’s Delivery Report for 3Q 2019, which could be released as early as tomorrow, “has a shot” at being outstanding – above 100,000 vehicles for the first time in the company’s history. Having an outstanding delivery report right now, while Ford and General Motors are struggling, could attract investors who are looking for something to believe in. Ford bonds were just downgraded to junk by Moody’s. General Motors is entering the 3rd week of a company-wide strike. Tesla is aiming for cash positive in the 3rd quarter 2019 and believes the company can be self-funding now, after a $2.4 billion equity and convertible bond raise in the 2nd quarter that left the company with $5 billion cash and cash equivalents on hand. The company is expanding rapidly: building the Shanghai factory, a Model Y factory and an expansion of the Gigafactory. So, there will likely still be cash negative quarters going forward, particularly around product launches. This means Tesla stock could easily continue the rollercoaster ride, even though the general trend in worldwide sales is stellar. Tesla Sales are on Fire Worldwide Tesla was the #1 bestselling car in the U.S. by revenue, and was in the top 5 by unit sales in August of 2018. In the 2nd quarter of this year (2019), the unit sales had slipped, and the Tesla 3 was in the 9th position. The company is the #1 bestselling car in Norway, with 11,517 cars delivered in August. Tesla is the #1 bestselling car in The Netherlands, with 10,000-11,000 cars sold in September. The company soared to #3 bestseller in the United Kingdom. Tesla is enjoying a meteoric rise in every market where it delivers. (Sources: InsideEVs.com and CleanTechnica.com). Next Stop: China. Tesla is targeting production at their new Shanghai Factory by the end of this year. Analysts are a little wary of that target. However, Tesla sales are already exploding in popularity, with up to 6400 vehicles delivered in China in the 3rd quarter (source: JL Warren Capital). A new Chinese tax break for electric vehicles, amounting to about $14,000 U.S., should keep Tesla sales in high demand. If Musk is to be believed, the 3rd quarter 2019 earnings report shouldn’t crash into cash negative, unless there is a significant, unexpected event, which of course can always happen with factories, particularly ones that are getting up and running as fast as Tesla’s are. The earnings report should be released in the 3rd week of October, around October 24, 2019. The one bugaboo to investing in this strong company is you must factor in the marketplace itself. This is the late stage of the business cycle (i.e. at some point stocks will weaken). The Institute for Supply Management’s September Manufacturing ISM Report on Business was the weakest the U.S. has experienced in a decade (yup, since the Great Recession, June 2009). September was the second month of contraction -- marking the official start to the 2019 Manufacturing Recession. Investing in the Late Stage of the Business Cycle There are certain times when the wind is at your back in trading, and others when it’s in your face. For the last decade, stocks have made money. You didn’t have to be a great stock picker. You just had to be invested. When stocks weaken, however, even great stock pickers can be eaten alive. Most stocks will head south in a general downturn, just as they did in 2009. Apple iPhone was on fire in 2009, after a game-changing launch in 2006. The company had figured out how to charge a lot for a phone (over $600), and still give it away for free via the wireless carrier. And yet the stock still tanked after the Lehman Brothers, General Motors and Chrysler bankruptcies in 2008-2009. So, in 2019, even with an outstanding company like Tesla, which is leading one of the fastest growing industries in the world (electric vehicles), you still have to ask these three questions before investing. What can the company do? What can the industry do? What will the general market do? And if you do invest, and you find yourself on the right side of the trade, it’s a good idea to take your profits early and often. There have been multiple opportunities to trade Tesla “around the core” over the past few years. Full Disclosure: I’ve been actively trading Tesla for the past two years. Other Blogs of Interest Do We Talk Ourselves into Recessions? Interview with Nobel Prize Winning Economist Robert J. Shiller. The Winners and Loser of a Clean Energy Policy. Make the Climate Strike Personal. Ford is Downgraded to Junk. From Buried Alive in Bill to Buying Your Own Island. The Manufacturing Recession. An Interview with Liz Ann Sonders. Gold Mining ETFs Have Doubled. The Gold Bull Market Has Begun. The We Work IPO. The Highs and Hangovers of Investing in Cannabis. Recession Proof Your Life. China Takes a Bite Out of Apple Sales. Will the Dow Hit 30,000? A Check Up on the Economy Red Flags in the Boeing 2Q 2019 Earnings Report The Weakening Economy. Think Capture Gains, Not Stop Losses. Buy and Hold Works. Right? Wall Street Secrets Your Broker Isn't Telling You. Unaffordability: The Unspoken Housing Crisis in America. Are You Being Pressured to Buy a Home or Stocks? What's Your Exit Strategy? Will the Feds Lower Interest Rates on June 19, 2019? Should You Buy Tesla at a 2 1/2 Year Low? It's Time To Do Your Annual Rebalancing. Cannabis Crashes. Should You Get High Again? Are You Suffering From Buy High, Sell Low Mentality? Financial Engineering is Not Real Growth The Zoom IPO. 10 Rally Killers. Fix the Roof While the Sun is Shining. Uber vs. Lyft. Which IPO Will Drive Returns? Boeing Cuts 737 Production by 20%. Tesla Delivery Data Disappoints. Stock Tanks. Why Did Wells Fargo's CEO Get the Boot? Earth Gratitude This Earth Day. Real Estate is Back to an All-Time High. Is the Spring Rally Over? The Lyft IPO Hits Wall Street. Should you take a ride? Cannabis Doubles. Did you miss the party? 12 Investing Mistakes Drowning in Debt? Get Solutions. What's Hot in 2019? The Debt Ceiling Was Hit (Again) on March 1, 2019. How Bad Will the GDP Report Be? 2019 Investor IQ Test The State of the Union CBD Oil for Sale. The High Cost of Free Advice. Apple's Real Problem in China: Huawei. 2019 Crystal Ball. 2018 is the Worst December Ever. Will the Feds Raise Interest Rates? Should They? Learn what you're not being told in the MSM. Why FANG, Banks and Your Value Funds Are in Trouble. When the Santa Rally is a Loser, the Next Year is a Bigger Loser. Russia Dumps Treasuries and Buys Gold OPEC and Russia Cut Oil Production. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable however NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors. |

AuthorNatalie Pace is the co-creator of the Earth Gratitude Project and the author of The Power of 8 Billion: It's Up to Us, The ABCs of Money, The ABCs of Money for College, The Gratitude Game and Put Your Money Where Your Heart Is. She is a repeat guest & speaker on national news shows and stages. She has been ranked the No. 1 stock picker, above over 830 A-list pundits, by an independent tracking agency, and has been saving homes and nest eggs since 1999. Archives

July 2024

Categories |

RSS Feed

RSS Feed