|

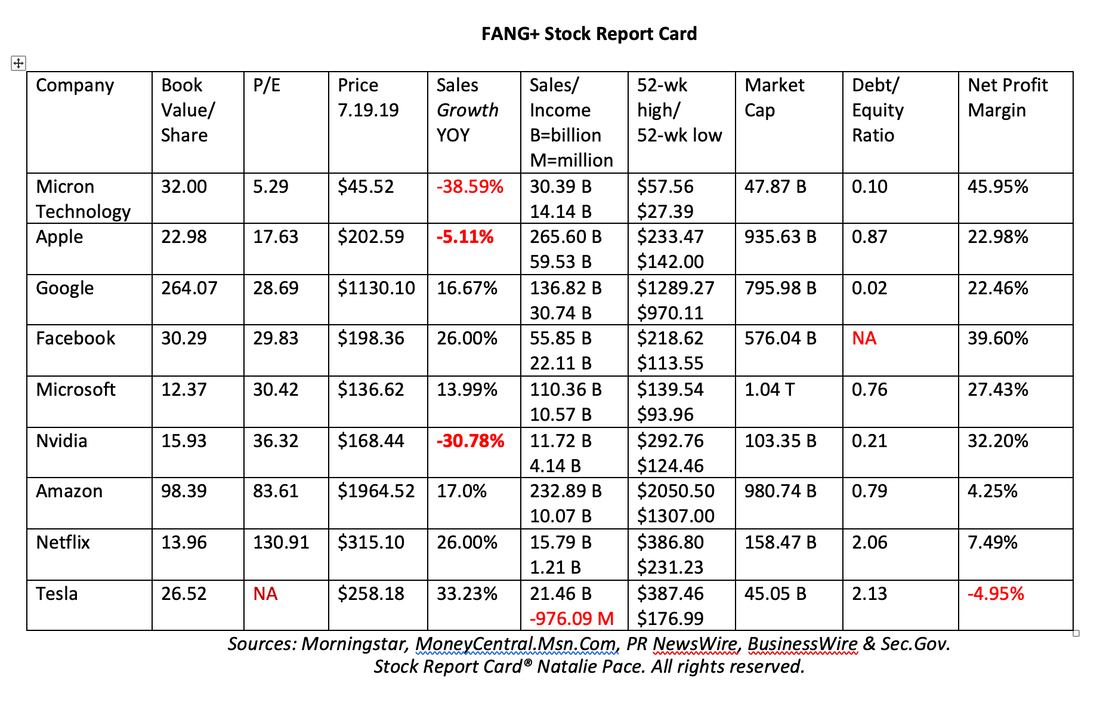

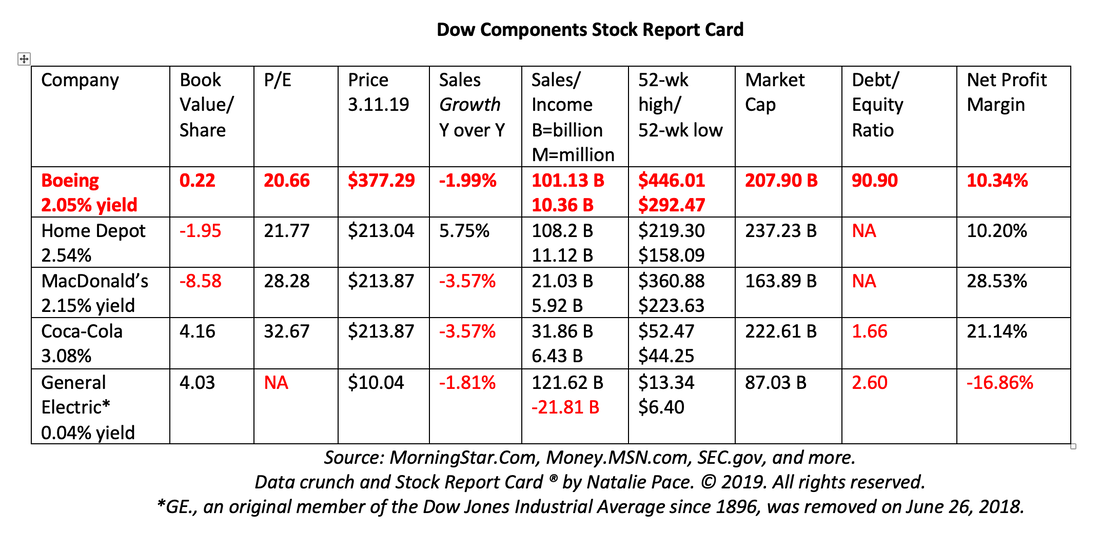

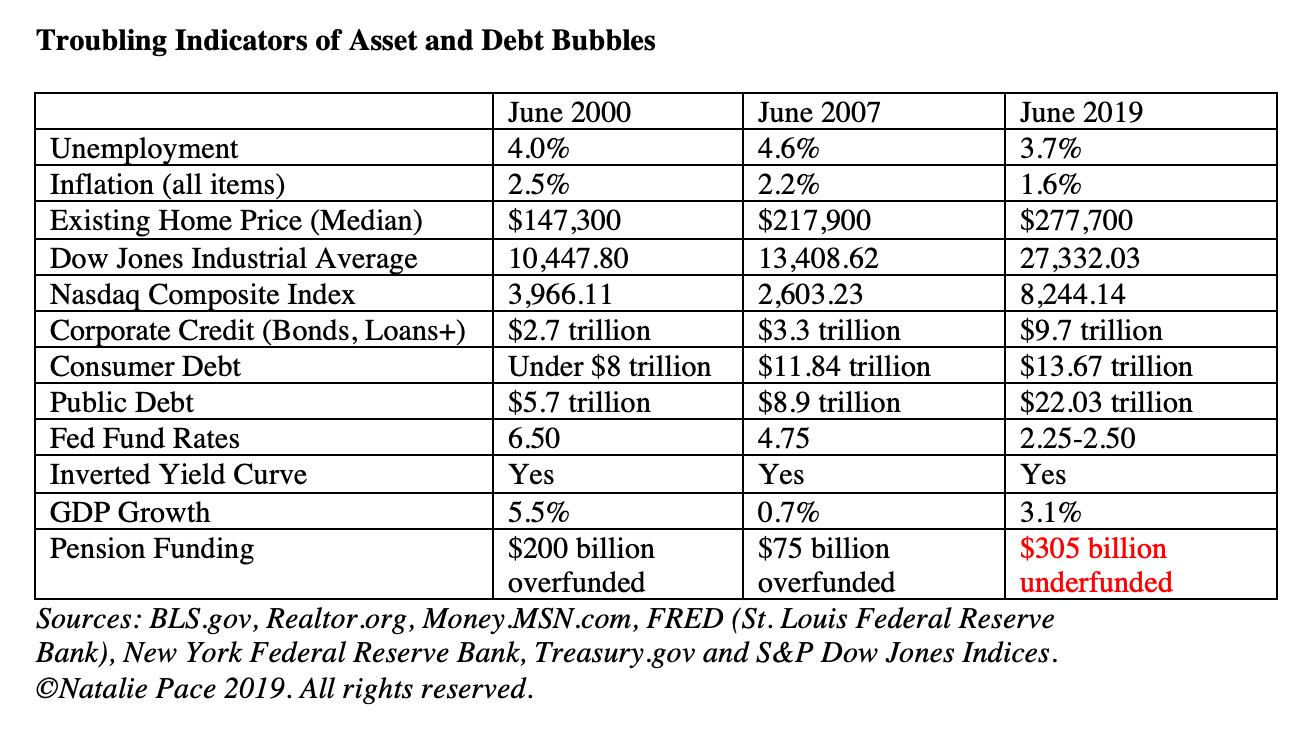

So, the markets are rallying because the economy is weakening… Hmmm… What might we be missing here? Tune into my free July 2019 Teleconference for additional information. (Click to access.) The economy is weakening by more than a few economic indicators, which has prompted Wall Street to believe there will be an interest rate cut on July 31, 2019 from the Federal Reserve Board. The cut excites everyone because low interest rates mean you can borrow money very cheaply. Err. That is if you are a corporation or you have an outstanding credit score. Main Street folks are borrowing on credit cards and paying 28% interest. Many banks have even stopped making mortgages because of the inverted yield curve. (The secondary market, like Quicken Loans, are lending like crazy.) How does a weaker economy translate into higher stock prices? Is that a good thing, or is it a short-term high with long-term consequences? What should you do? Buy? Sell? Hold? Below we’ll discuss: 1. Signs of a Weakening Economy 2. The 2Q 2019 GDP Report 3. The Shocking 36% Drop in Foreign Investment in U.S. Real Estate 4. The U.S. Budget Deficit and Skyrocketing Public Debt 5. The Federal Reserve Board Meeting on July 30-31, 2019 6. Financial Stability and Asset Bubbles 7. What You Should Do. And here is additional information on each subject. 1. Signs of a Weakening Economy The 2Q 2019 Corporate Earnings Decline (happening now). The benefits of last year’s tax cut are last year’s news, and now corporations must return to selling more product (or buying back their own stock) to increase their earnings per share. So, which companies are hot, and which are using financial engineering? Wall Street continues to be a tale of two cities. The newer growth companies, like FANG, are reporting strong (real) sales growth, but are overpriced. As you can see in the Stock Report Card below, valuations are lofty. You can also see that stocks that miss the growth boat are punished pretty heavily. Micron is down 26% from its 2018 high. Nvidia is down 40%. Apple repurchased $28 billion in buybacks to keep its stock price up. And this is at a time when the general market is back near its all-time high. The old-school blue chips have high debt, slow or negative growth, and are also overpriced. As you can see from the Stock Report Card above, many of the Dow Jones Industrial Average components have a negative book value, meaning that their debts are far above their assets. I’ve included General Electric because even though GE’s implosion was in 2017, few have learned the lesson. (GE was a Dow component since the beginning of the index through June 26, 2018.) GE was borrowing cheap money, repurchasing its own stock and paying dividends, instead of fixing its systemic issues – something that other Blue Chips, including Boeing, are doing. That burned through a lot of cash, but kept the share price high for years – until the banks put too many conditions on the borrowing, and the company had to slash its dividend first by half, and then to almost nothing. The GE share price dropped by 50% overnight and is still down almost 70% off of its 2017 high of $31.60. Buybacks are set to hit another all-time high in 2019. Last century’s name brands don’t appear to be as over-priced as the hot 21st century disrupters because buybacks are at an all-time high. Corporate buybacks take earnings per share higher (by reducing the share count), which then takes the price to earnings ratio lower. Apple tops with the list of corporate buybacks in the 1st quarter of 2019 with $23.8 billion shares repurchased, with Microsoft in the top 10 as well, with $4.8 billion in buybacks. Boeing is another top repurchaser of its own stock, along with Pfizer, Cisco, JP Morgan, Wells Fargo, UnitedHealth and Walgreen’s (and others). Meanwhile, the Retail Apocalypse continues, with J.C. Penney seeking help from restructuring experts (i.e. bankruptcy). The company’s stock (symbol: JCP) dropped under a dollar today, making Penney’s a penny stock. More Earnings Boeing announces 2Q 2019 earnings on July 24, 2019 at 10:30 ET, about an hour after the markets open. On July 18, 2019, after the markets closed, Boeing announced a $4.9 billion charge ($8.74 per share) + increased costs of $1.7 billion. In other words, the 2Q 2019 earnings report should be ugly. This is something that investors should have seen coming. Learn more in my Boeing blog from 4.8.19. (Click to access.) So, why did Boeing stock go up on July 19th, after the warning? The company is likely using buybacks to keep the stock afloat. Boeing repurchased $2.6 billion of its own stock in the 1st quarter of 2019. Netflix saw sales growth of 26% this quarter and is projecting year over year revenue growth of 31.3% in the next week. That’s pretty amazing. However, the subscriber count came in lower than projections, so the stock went down. With Netflix it is largely a case of being overpriced. The company is outstanding. But the price to earnings ratio is 131. Tesla’s 2Q 2019 earnings report on July 24, 2019 after the markets close should be stellar. In the 2nd quarter Tesla delivered 95,200 vehicles, compared to just 63,000 in Q1. That is an increase of 51%. This could make for a record earnings quarter. Tesla’s share price has already rallied 43% from its June 3rd 2019 low (when I published a blog predicting this stellar quarter). The only thing standing in the way of additional gains is the 2nd Quarter 2019 GDP report, which will be released on July 26, 2019 at 8:30 am ET. 2. The 2Q 2019 GDP Report (advance) will be released at 8:30 am ET on July 26, 2019. Just how weak will it be? Estimates are at 1.5-2.1%. Significantly lower than the 1st quarter. Full year 2019 GDP is predicted to slow to just 2.1%, compared to 2.9% in 2018. By comparison, China’s GDP this year should be 6.2%. 3. Foreign Purchases of U.S. Existing Homes Sank by an astonishing 36% over the last 12 months. What happened? It’s largely a story of unaffordability – something I wrote about in a blog earlier this month. In the U.S., 74% of people cannot afford to buy a home in their city. According to Lawrence Yun, the National Association of Realtors chief economist, “A confluence of many factors – slower economic growth abroad, tighter capital controls in China, a stronger U.S. dollar and a low inventory of homes for sale – contributed to the pullback of foreign buyers. However, the magnitude of the decline is quite striking, implying less confidence in owning a property in the U.S.” (That’s his way of saying that home prices are too high, and the international community isn’t taking the bait anymore.) What does this mean for U.S. buyers and sellers? Certainly, it's important to remember that one of the most important considerations for successful real estate investing and home ownership is the price itself. If you’re thinking of buying, the price is too high, and unaffordable, in most U.S. markets. If you’re thinking of selling, your buying pool just got significantly smaller. If your home isn’t snatched up right away, your price may be too lofty. 4. U.S. Budget and $22 Trillion Public Debt. The U.S. is currently using extraordinary means to pay bills. Congress needs to raise the Debt Ceiling before we run out of money now. There is talk that the House will vote on a deal on July 26, 2019, so that the Senate can pass it before the August break. According to Paul Ashworth of Capital Economics, a research group, “The Federal government ran a deficit of $215bn in August last year which, if repeated this year, would leave it with zero cash going into September.” Chairman of the Federal Reserve Board Jerome Powell believes, as do most economists, analysts and rating agencies, that the Debt Ceiling will be raised before we run out of money. In Powell’s testimony before the House of Representatives on July 10, 2019, Powell said, “I assume that the Debt Ceiling will be raised in a timely fashion. Any other outcome is unthinkable. I wouldn’t be able to capture the range of negative outcomes.” At the same hearing, Jerome Powell also expressed grave concern about the budget deficit and ballooning public debt, of $22 trillion and counting. (This will increase again once the Debt Ceiling is raised.) Powell said, “The U.S. budget is on an unsustainable path. We’ll wind up spending more on interest than on educating our grandchildren. Our generation should be paying for it rather than passing the bills onto the next generation.” 5. Will the Feds Cut Rates on July 31, 2019? There are a slight majority of Federal Reserve Board Governors who are concerned about financial stability and asset bubbles, who have been reticent to cut rates too soon. (See my analytical blog for details on which board governors lean this way.) However, the rate cut might happen for many reasons. The housing report was astonishing low. The GDP growth is predicted to be much weaker than 1Q. Earnings are slowing. And Wall Street is expecting a rate cut. The Feds don’t want another sell-off like December of 2018 (the worst December since the Great Depression). A 10% rise in stocks = 1% rise in GDP, according to Alan Greenspan. So, that might be what the Feds (and certainly the White House) want. The Real Question is whether a rate cut will send the market higher or not. It could this summer because volume is low and novices are playing. However, once the professionals return in September, it could be a different story. Wall Street pros know that the cut was due to worries about the economy. They know that there is a slowdown in sales, too much leverage and that the prices are too high. Leverage might even be too high to support continued borrowing to repurchase shares. Just as happened with GE, when a firm is over-leveraged and needs more dough, the banks will add conditions that prevent them from repurchasing stock or paying dividends. So, fall isn't looking good for stocks this year. 6. Financial Stability and Asset Bubbles. Low interest rates create bubbles. Today’s bubbles are more troubling than they were before the Great Recession or the Dot Com Recession. See the Asset Bubble chart directly below. The media, and politicians, are encouraging investors to grade the economy on low unemployment, low inflation and high stock prices. However, bubbles pop. 74% of Americans cannot afford to purchase a home in their home town. Over 50% of the corporations that are investment grade are at the lowest rung, just above junk bond status. Additionally, according to Robert Shiller, a Nobel Prize winning economist and Yale’s professor of economics, “The only time in history going back to 1881 when [CAPE] has been higher are, A: 1929 and B: 2000.We are at a high level, and its concerning. People should be cautious now.” Learn more in my blogs, “Wall Street Secrets Your Broker Isn’t Sharing With You,” “Financial Engineering is Not Real Growth,” and “The Gold Rally Has Begun.” 7. What Should You Do? Buy? Sell? Hold? You should:

This may sound complicated, but it is easy-as-a-pie-chart, once you learn the ABCs of Money that we all should have received in high school. Getting safe now should be your number one priority. Don’t rely on your financial advisor to do this for you, in a world where almost everything that a financial services company can sell you is highly leveraged and overpriced. Listen back to my free July teleconference on BlogTalkRadio.com/NataliePace, where you can get additional information on each topic. You can also hear my answer to a caller’s question, “Is gold a good place to get safe now?” Our team opens up the line for questions in the second part of the call (usually about 20-25 minutes into the call). Now is the time to fix the roof while the sun is shining (while the markets are at an all-time high). If you'd like to learn time-proven strategies that earned gains in the last two recessions and have outperformed the bull markets in between, join me at my Wild West Investor Educational Retreat this Oct. 19-21, 2019. Click on the flyer link below for additional information, including the 15+ things you'll learn and VIP testimonials. Call 310-430-2397 to learn more. Register by July 31, 2019 to receive the best price. I'm also offering an unbiased 2nd opinion on your current retirement plan. Call 310.430.2397 or email [email protected] for pricing and information. Other Blogs of Interest Think Capture Gains, Not Stop Losses. Buy and Hold Works. Right? Wall Street Secrets Your Broker Isn't Telling You. Unaffordability: The Unspoken Housing Crisis in America. Are You Being Pressured to Buy a Home or Stocks? What's Your Exit Strategy? Will the Feds Lower Interest Rates on June 19, 2019? Should You Buy Tesla at a 2 1/2 Year Low? It's Time To Do Your Annual Rebalancing. Cannabis Crashes. Should You Get High Again? Are You Suffering From Buy High, Sell Low Mentality? Financial Engineering is Not Real Growth The Zoom IPO. 10 Rally Killers. Fix the Roof While the Sun is Shining. Uber vs. Lyft. Which IPO Will Drive Returns? Boeing Cuts 737 Production by 20%. Tesla Delivery Data Disappoints. Stock Tanks. Why Did Wells Fargo's CEO Get the Boot? Earth Gratitude This Earth Day. Real Estate is Back to an All-Time High. Is the Spring Rally Over? The Lyft IPO Hits Wall Street. Should you take a ride? Cannabis Doubles. Did you miss the party? 12 Investing Mistakes Drowning in Debt? Get Solutions. What's Hot in 2019? The Debt Ceiling Was Hit (Again) on March 1, 2019. How Bad Will the GDP Report Be? 2019 Investor IQ Test The State of the Union CBD Oil for Sale. The High Cost of Free Advice. Apple's Real Problem in China: Huawei. 2019 Crystal Ball. 2018 is the Worst December Ever. Will the Feds Raise Interest Rates? Should They? Learn what you're not being told in the MSM. Why FANG, Banks and Your Value Funds Are in Trouble. When the Santa Rally is a Loser, the Next Year is a Bigger Loser. Russia Dumps Treasuries and Buys Gold OPEC and Russia Cut Oil Production. Trade Deficit Hits an All-Time High. Wall Street Plunges 800 Points. How to Protect Yourself. Rebalance and Get Safe in December. Here's Why. The Best Investment Decision I Ever Made. What's Safe for Your Cash? FDIC? SIPC? Money Markets? Under the Mattress? The Real Reason Stocks Fell 602 Points on Veterans Day 2018. Will Ford Bonds Be Downgraded to Junk? 6 Risky Investments. 12 Red Flags. 1 Easy Way to Know Whom to Trust With Your Money. Whom Can You Trust? Trust Results. October Wipes Out 2018 Gains. Will There Be a Santa Rally in 2018? The Dow Dropped 832 Points. What Happened? Bonds are In Trouble. Learn 5 Ways to Protect Yourself. Interest Rates Projected to Double by 2020. 5 Warning Signs of a Recession. How a Strong GDP Report Can Go Wrong. Should I Invest in Ford and General Electric? Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable however NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors. 21/9/2020 12:35:10 am

Quite acknowledging and educational update you have discussed with us thank you so much for sharing. The people who are looking for the economy update here they can grab here the trusted material and enjoy while having it. Thanks once again for such delighted stuff to share. Comments are closed.

|

AuthorNatalie Pace is the co-creator of the Earth Gratitude Project and the author of The Power of 8 Billion: It's Up to Us, The ABCs of Money, The ABCs of Money for College, The Gratitude Game and Put Your Money Where Your Heart Is. She is a repeat guest & speaker on national news shows and stages. She has been ranked the No. 1 stock picker, above over 830 A-list pundits, by an independent tracking agency, and has been saving homes and nest eggs since 1999. Archives

July 2024

Categories |

RSS Feed

RSS Feed