|

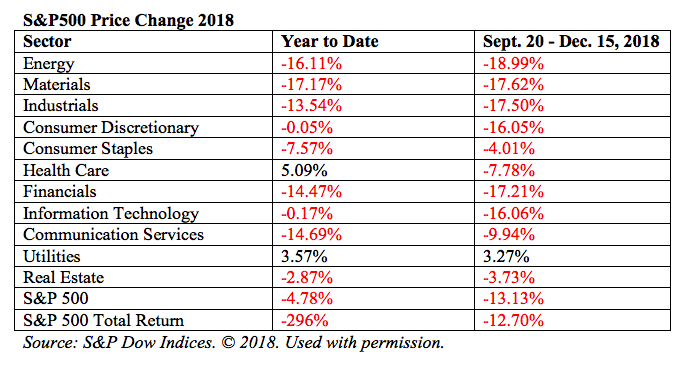

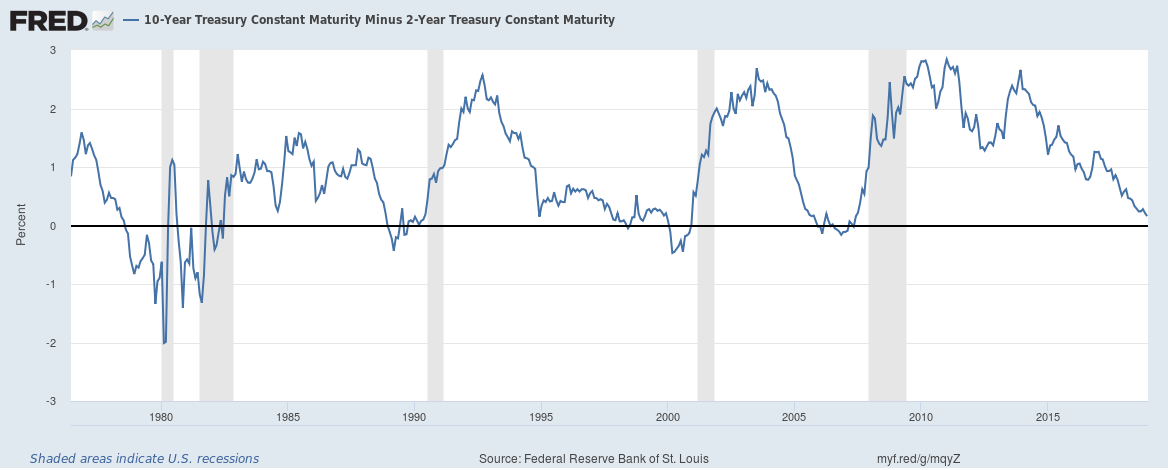

The Dow Jones Industrial Average is down 16% losses on the year from the highs set back in October. The volatility is starting to fray investor nerves. FANG investors who were lured into lofty valuations over the summer have been slammed back to Earth with Netflix stock diving 40% and Nvidia tanking 51%. Those losses are staggering (and heartbreaking). However, this is likely the beginning, not the end, of the trouble. Banks Drag Markets Down. December has been a terrible month for most stocks and bonds. Banks have led in the losses for the year, alongside energy, materials, telecommunications and industrials. See the chart below for an industry breakdown. Energy prices are predicted to rise, since OPEC and non-OPEC countries have agreed to cut production. (Click for more that on that. Goldman Sachs stock is down 40% since March, having lost $35 billion, or 1/3 of its market value. Most banks have lost at least a third of their market cap since March of this year. Morgan Stanley is down $30 billion; Wells Fargo is down $93 billion. JP Morgan is fairing slightly better, with share price losses of 16%. All told, six of the largest U.S. banks have lost more than $372 billion in market values since Spring of this year. Value Funds That’s a problem for value investors as financials were heavily weighted in most large cap value funds, with many carrying higher than 30%. What’s the Problem? The Yield Curve. One of the main issues is the yield curve. An inverted yield curve is associated with recessions, as you can see in the chart below. Currently the yield curve is flat, and on a downtrend. As Liz Ann Sonders, the Chief Investment Strategist of Charles Schwab Inc. explained in my interview that was published on October 22, 2018, “We have taken financials from an outperform down to a neutral. They are only profitable if they can earn the spread between short-term interest rates, which they borrow at, and long-term rates which they lend at. The reason why the inverted yield curve has almost always brought on a recession is the crush that causes for the financial sector, and the implications that has more broadly.” Leverage is Another Big Problem According to the Federal Reserve’s Financial Stability Report, “Credit standards for new leveraged loans appear to have deteriorated over the past six months... Lenders have become more willing to extend loans with fewer credit protections to higher-risk borrowers.” Bond Funds More than half of the investment grade corporations in the U.S. are at the lowest rung. That means there are a lot of bond investors who may not realize just how much risk they have taken on. Corporate bond mutual funds are estimated to hold about one-tenth of outstanding corporate bonds. That is likely why the Vanguard Total Bond Market II Index, had the highest outflows with $5.1 billion exiting the fund in October 2018, according to Morningstar. The problem is that a lot of that money is moving over into money market funds, without understanding that those funds can lose money, too, and have liquidity fees and redemption gates. This underscores the need for you to be the boss of your money, and to know exactly what a healthy nest egg looks like in a world where stocks, bonds and real estate are in a bubble, and leverage is way too high. (Call 310-430-2397 to learn more about The ABCs of Money that we all should have received in high school.) This is Just the Beginning As you can read in my coverage on the Federal Reserve’s Financial Stability Report of November 28, 2018, there are many concerns in today’s economy. As I outlined in my blog, Tariffs + Trade + Interest Rates + Quiet Periods + Leverage + Valuation Issues + The Financial Stability Report = the Wall Street Rollercoaster and Losses to Your Nest Egg. January looks even more vulnerable. When the Santa Rally is a loser, the following year is a bigger loser 2/3rds of the time. That’s why it’s important to get safe, diversified and rebalanced before January 2019, i.e. now. If you’ve been following my blog, you know that my warnings that stocks and bonds were in a bubble began last year. I wasn’t alone. Alan Greenspan, Warren Buffett, Robert Shiller and others were screaming from the rooftops as well. Now is the time to do a checkup on what you own, and make sure that you are safe, protected and hot. The last two downturns cost investors more than half of their retirement, and that was with bonds earning gains. This time around, bonds are already losing money, which means that it is even more important to get a time-proven program now than it was in 2000 or 2008. During the Great Recession, the Dow Jones Industrial Average Lost 55%. During the Dot Com Recession, the NASDAQ Composite Index Lost 78% and Too 15 Years to Crawl Back to Even. The banks have the authority to buy back their own stock, which would stabilize the prices. However, the flat yield curve, the leverage and the capital requirements of banks, combined with the lower valuations, may explain why these mega corporations have allowed their stock to sink. If the bank stocks do start to recover, corporate buybacks, rather than strong fundamentals, could be the reason. So, be careful swallowing the bait. Cryptocurrency isn’t the cure. A time-proven system that earned gains in the last two recessions and outperformed the bull markets in between is. Call 310-430-2397 to learn more now. A diversified, hot plan that is annually rebalanced and underweights the over-leveraged companies and municipalities is your best strategy. Sadly, most people are not diversified, are heavily invested in companies that are drowning in debt and are still using Buy and Hope, instead of Annual Rebalancing and Modern Portfolio Theory. (Many broker-salesmen say they are using MPT; few are, however.) That’s why your first and best step is to Know What You Own. If you’re interested in an unbiased 2nd opinion, which includes a report of what you own, outlining areas of strength and weakness in your current plan, call 310-430-2397 or email [email protected]. Happy Holy Days! Making sure that your financial house is secure enough to withstand the economic storms that are raging will help your winter celebrations to be more bright. You can learn the ABCs of Money that we all should have received in high school at one of my Investor Educational Retreats. Only 3 seats remain available at the Valentine’s Retreat in Santa Monica. Receive a massive discount on a private coaching package (and 2nd opinion), when you register for a retreat by December 23, 2018. Other Blogs of Interest When the Santa Rally is a Loser, the Next Year is a Bigger Loser. Russia Dumps Treasuries and Buys Gold OPEC and Russia Cut Oil Production. Trade Deficit Hits an All-Time High. Wall Street Plunges 800 Points. How to Protect Yourself. Rebalance and Get Safe in December. Here's Why. The Best Investment Decision I Ever Made. Thanksgiving 2018 Stocks Losses. Black Friday Sales. Get a 2nd Opinion on Your Current Investing Strategy. What's Safe for Your Cash? FDIC? SIPC? Money Markets? Under the Mattress? The Real Reason Stocks Fell 602 Points on Veterans Day 2018. Will Ford Bonds Be Downgraded to Junk? 6 Risky Investments. 12 Red Flags. 1 Easy Way to Know Whom to Trust With Your Money. Whom Can You Trust? Trust Results. October Wipes Out 2018 Gains. Will There Be a Santa Rally in 2018? The Dow Dropped 832 Points. What Happened? Bonds are In Trouble. Learn 5 Ways to Protect Yourself. Interest Rates Projected to Double by 2020. 5 Warning Signs of a Recession. How a Strong GDP Report Can Go Wrong. Should I Invest in Ford and General Electric? Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable however NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors. Comments are closed.

|

AuthorNatalie Pace is the co-creator of the Earth Gratitude Project and the author of The Power of 8 Billion: It's Up to Us, The ABCs of Money, The ABCs of Money for College, The Gratitude Game and Put Your Money Where Your Heart Is. She is a repeat guest & speaker on national news shows and stages. She has been ranked the No. 1 stock picker, above over 830 A-list pundits, by an independent tracking agency, and has been saving homes and nest eggs since 1999. Archives

July 2024

Categories |

RSS Feed

RSS Feed