|

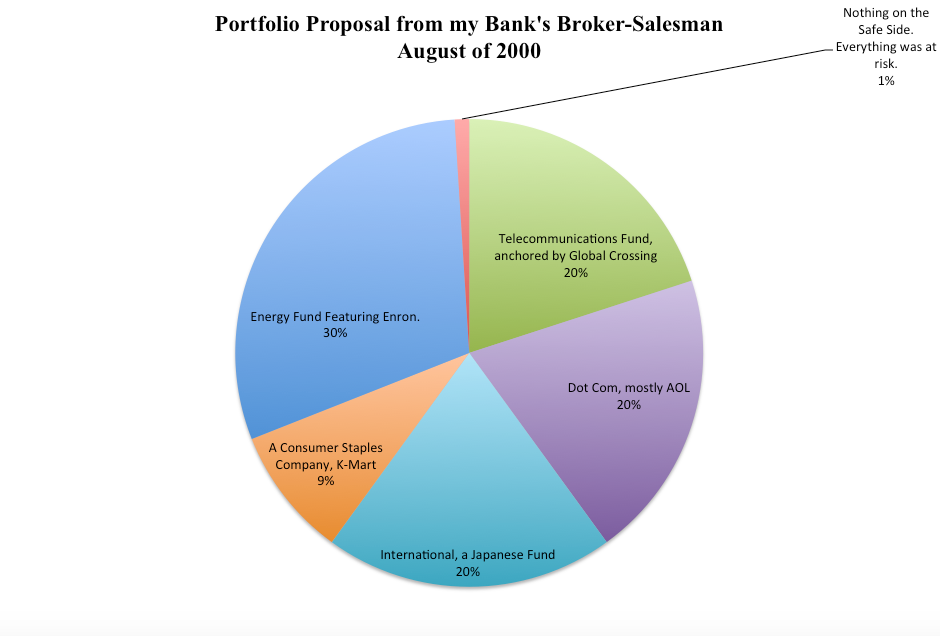

Recently someone asked me, “Natalie, what was the best investment decision you ever made?” I’ve certainly had a few that were rocket ships to the moon, like plunking down a buck a share for the first cloud-based computing company in August of 2001, and watching that investment almost triple in just a few short months. Yup, you read that right. I bought stock the month before 911, and enjoyed the best ROI* I’d ever known, up to that moment. However, the best investment decision was not buying Loudcloud on the cheap. It was the investment decision that I made right before that purchase. The Real Reason That People Don’t Buy Low The reason that most people don’t buy low is because they can’t. Their money is all tied up. Most of the time, when stocks are low, investors are shocked at how much money they’ve lost and are either hoping to recover from their losses, or are tempted to sell low so that they can sleep again at night. If you sold in 2009, then you know intimately how this feels. If you haven’t kept enough safe and diversified, then you would have to sell low in order to buy low. So, how was it that I had money to buy low in August of 2001, when the NASDAQ Composite Index had already lost 64% of its value? Because the best investment decision I ever made was to refuse to buy high. The Best Investment Decision I Ever Made In August of 2000, a banker noticed that I had some cash in a CD that was earning 4.5%. It was at a bank where everyone was incentivized to cross-sale you into other products. So, I was introduced to the bank’s investment advisor. He had a lot of letters behind his name, which he flashed around like a Ph.D., so I assumed that he was an expert. I didn’t know at the time that he was hired as a salesman, which is the primary qualification required to get a job as a broker-salesman. So, this financial advisor laid out his “safe and diversified plan” for me. He told me that he would have to make an exception for me to take me under management because normally he only takes people who buy in at a much higher level than I could. But he’d make that exception if I committed to depositing $450/month into the account, in addition to placing all of my money with him. He also told me that I’d be buying low because “stocks had pulled back about 25% from their highs.” Here’s what his plan looked like. Enron had just been named the Most Innovative Company in the U.S. by Fortune Magazine, for the 6th year in a row, he told me. “But the company is price-gouging!” I objected. “Grandmothers are dying in California,” I said. I would never invest in such an immoral company. He then went on to sing the praises of Global Crossing. As it happened, I worked for a telecom company that purchased wholesale long distance from a Global Crossing competitor. The contract was for 4 cents a minute. However, the company had been overbilling at over ten times that amount for months, and was dragging their feet in adjusting and crediting (even though they kept promising to). “Telecom is cooking the books,” I said. “I’m in the industry.” I objected to Dot Com for being cash negative for five years running. You can’t borrow from Peter to pay Paul forever, and five years seemed a few years too long. “It’s a New Economy!” the CFP piped up! Al Gore was running on a strong economy, boasting that the U.S. had 8 years of prosperity under his tenure while Vice President – something he vowed to continue. I was pretty sure that eight years was too long to go without a correction. And the country was far too divided. No matter who was elected, almost half of the population was going to be mad about it. Besides, my Dad was complaining that K-Mart never stocked anything he needed, so he’d begun just going to Wal-Mart. The broker-salesman told me how stupid I was to keep my money in a CD earning 4.5%, and lied, saying that was under inflation. (It wasn’t.) When our meeting began, he was all sweet talk and compliments. However, toward the end when he tired of my objections and comments and just wanted to close the deal, he got aggressive and brash, shoving the brokerage application toward me and indicating that it was time to pull out my checkbook. He was making an exception for me, after all. I pretended to have a meeting that I was late for, and vowed to learn more before I made any choice to invest. That process took me on a quite a journey over the next 12 months. In August of 2001, when I saw my favorite technology company drop from $12/share in the pre-IPO roadshow period to under $1/share, I was ready to make a significant bet (for me). That decision paid off in spades just a few months later. However, it would have never happened if I’d allowed the CFP to lose all of my money. K-Mart, Enron and Global Crossing all declared bankruptcy; AOL lost over 80% of its value. I can’t even imagine what would have happened to my son and I in that scenario. I’m pretty sure the CFP left the industry. He couldn’t have returned my money, and he wouldn’t have apologized for wrecking my life. I avoided that tragedy by asserting myself and not letting myself be taken in by his bullying. Successful investing requires a time-proven strategy and a lot of discipline. (It’s called “sticking to your knitting,” in the industry.) However, when you are just starting out, the most important move is to avoid being snared in a sales trap. You are the boss. It is your future at stake. That person across from you might be a salesman rather than a market genius. If you understand what a sound, diversified plan really looks like, then you’ll rack up gains, prevent losses and accumulate experience as you journey up the path to financial wisdom. If you don’t, you’re going to find blind faith, fear, stomach acid and euphoria guiding your investment decisions – which means that you’ll always be tempted to sell low and buy high. As a young single mom, I saved myself tens of thousands with the best investment decision. Since then, countless investors have saved millions. This year alone, when the markets are flat on the year, A&A have saved almost $60,000 by moving from a “managed” blind faith plan into a truly safe, diversified and hot strategy. At their age knowing that their future is safe from losses is invaluable to their emotional health, and critically important to their fiscal health. *Return on Investment. If you are interested in receiving an unbiased second opinion on your current investing strategy, email [email protected] or call 310-430-2397. You can learn the ABCs of Money that we all should have received in high school at one of my Investor Educational Retreats. Only 3 seats remain available at the Valentine’s Retreat in Santa Monica. Receive a complimentary private, prosperity coaching session (value $300) when you register for the Colorado Retreat by November 30, 2018. Other Blogs of Interest

Thanksgiving 2018 Stocks Losses. Black Friday Sales. Get a 2nd Opinion on Your Current Investing Strategy. What's Safe for Your Cash? FDIC? SIPC? Money Markets? Under the Mattress? The Real Reason Stocks Fell 602 Points on Veterans Day 2018. Will Ford Bonds Be Downgraded to Junk? 6 Risky Investments. 12 Red Flags. 1 Easy Way to Know Whom to Trust With Your Money. Whom Can You Trust? Trust Results. October Wipes Out 2018 Gains. Will There Be a Santa Rally in 2018? The Dow Dropped 832 Points. What Happened? Bonds are In Trouble. Learn 5 Ways to Protect Yourself. Interest Rates Projected to Double by 2020. 5 Warning Signs of a Recession. How a Strong GDP Report Can Go Wrong. Should I Invest in Ford and General Electric? Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable however NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors. Comments are closed.

|

AuthorNatalie Pace is the co-creator of the Earth Gratitude Project and the author of The Power of 8 Billion: It's Up to Us, The ABCs of Money, The ABCs of Money for College, The Gratitude Game and Put Your Money Where Your Heart Is. She is a repeat guest & speaker on national news shows and stages. She has been ranked the No. 1 stock picker, above over 830 A-list pundits, by an independent tracking agency, and has been saving homes and nest eggs since 1999. Archives

July 2024

Categories |

RSS Feed

RSS Feed