|

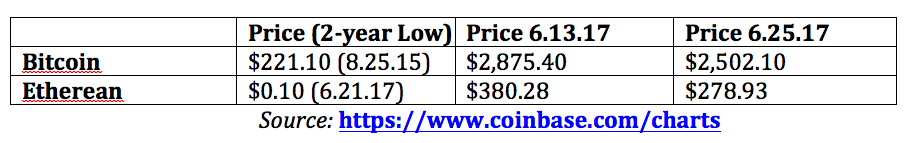

On Wednesday, June 21, 2017, the GDAX (a leading digital asset exchange) experienced a flash crash in its Etherean crypto currency (ETH-USD). The currency dropped from a value of $317.81 to ten cents. Trading was halted, while the GDAX exchange could evaluate what had caused the implosion. So, what happened? The cascade of chaos began as a multi-million dollar sell order. That dropped the price to $224.48, at which point stop-loss orders and margin calls kicked in. The currency is back trading at $271.89 (down 14.4%) and GDAX has promised to credit any customers who had losses as a result of a stop-loss or margin call (with their own money). This is all according to GDAX VP Adam White, in his blog on the matter. There are many lessons to be learned here.

And here are a few details. 1. Think Capture Gains, Not Stop Losses. Exchanges don’t have to refund stop losses or margin calls. It’s important to have a good strategy in place that truly puts you in the best seat possible. In a volatile marketplace with wild price swings, stop losses mean you lose frequently. Capture gains would have you winning frequently in that same scenario. In fact, it has been reported that someone had a buy order at 10 cents for ETH-USD, which the GDAX has vowed to honor. That person made $307 for every dime invested. (Hopefully the entire stratagem wasn’t a scam by the multi-million dollar seller.) 2. Future Flash Crashes Are Possible. All exchanges have a policy toward halting trading for 15 minutes or longer in a single company when there are suspicious circumstances, or when the exchange falls too far too rapidly. (You can search to find the Market Wide Circuit Breaker Policy of each exchange). However, with all of the options and margins alive in the markets today, crashes will still occur – at speeds that are far more rapid than we’ve seen in the past. Multi-million dollar trades do happen. While the market pauses may delay the inevitable and spread it out over a few days (or months), they can't prevent market drops. The Dow Jones Industrial Average fell from a high of over 14,000 in October of 2007, to 6547 on March 9, 2009. 3. Buy Low; Sell High. It's always tempting to buy high in the hopes of selling higher. However, the surefire market rule is, "Buy low, sell high." Sure, the value of crypto currency might go higher. However, you should be aware that you could have purchased almost every crypto currency for pennies on the dollar just a few years ago. Stay Legit

Coinbase (and its digital currency exchange GDAX) is one of the few legitimate crypto currency companies. Coinbase is backed by some of the most respected venture capitalists in technology, including Andreessen Horowitz, with a board that includes Kathryn Haun, a former Dept. of Justice prosecutor. Bitcoin and Crypto Currency Scams Sadly, whenever you have an young, fast-growing business that is posting the kind of gains that crypto currency is posting, it’s like the Wild West, full of Snake Oil salesmen, gunslingers and highway robbery. Trade Coin Club Joff Paradise and his Trade Coin Club, appears to be a MLM proposition that has bathed in Ponzi perfume. The business will kill you in trading fees (25% of your ups) if it gives you anything back at all. There are multiple red flags with this website and the info-videos, and scathing warnings from former recruiters and customers. “Joff” has a LinkedIn page showing a graveyard of past “businesses.” (Just Google “Joff Paradise complaints” to get 11,300 results.) The recruitment video says that trading on other platforms is difficult, boasting that this club makes it easy with “Stop Loss buttons that allow you not to jeopardize your Bitcoin.” Trading Bitcoin is very easy on GDAX (a far more reputable exchange). Stop loss buttons are a terrible idea in a volatile marketplace. (See above.) BitcoinIRA.com is another website that is rife with red flags. It’s a virtual office with an 800 number, with a website that has broken links when you try to find out who is behind the operation. Bitcoin Buyer Beware! Know the executives and board members behind the operation before getting involved. If you're going to travel to the Wild West, make sure that you haven't selected a pistol-packing Ponzi clown as your tour guide. Bitcoin scams are becoming as widely spread as the Nigerian email scams were at the beginning of the Internet. Early Adopters May Want to Take Quick Profits Most investors want an exit strategy within three years of their investment. Traders who are sitting on millions from their small, early investment are going to be itching to turn their paper profits into real cash (and then probably a Tesla) – even if they are crypto-currency philes. It’s never a good idea to buy high. Whenever you see a quick spike, as there has been in both Bitcoin and Etherean, you have to be very cautious about catching a falling knife, when the sellers back up the truck to turn multi millions of crypto into USD. -- as happened on June 21, 2017 with Etherean. Disruptive Technology vs. a Trillion Dollar, Global Industry Bitcoin feels a lot like VOIP and video conferencing, ala Skype 2002. It’s a disruptive technology taking on an entrenched trillion dollar, global industry. Many of us would love to circumvent the banks altogether (particularly after their shenanigans that resulted in the meltdown of the Great Recession). However, the truth is that it is difficult to topple a trillion dollar, global industry. Skype didn’t wipe out telecom, and it’s hard to imagine Bitcoin wiping out banks. The technology will revolutionize the industry, however – something the financial industry is already moving to embrace and to regulate. FINRA (the Financial Industry Regulatory Authority) is hosting a Blockchain Symposium in New York City this July. If you purchased Bitcoin or Etherean two years ago on a respected exchange, like GDAX, then you are the most eligible bachelor/bachelorette in your city. If you're been sold into paradise recently on any other platform, you'd better make sure you aren't kissing a frog, hoping he'll make you a princely sum. Creating a Community. Partnerships are key to success! The Golden Gate Bridge wasn’t built by one person. The more you can partner with like-minded people, the more big problems you can solve. Partnerships can help you to commit to an exercise regimen, to study, to invest and to do almost anything you want to do. The key is getting the right kind of support. For instance, your workout buddy might be a great, fun way to keep regular with your routine. However, s/he is probably not the best person to design your routine. For that, you want someone who is well-schooled in diet and exercise regimens, and who knows how to keep you from hurting yourself. It’s very common for people to pray and meditate individually, and come together each Sabbath to study the scriptures for guidance on how to live a more divine life. Getting wisdom from a qualified source (not just your friends) is key to success. You don't want to get your spiritual practice from Jim Jones, your diet tips from an anorexic model or your financial wisdom from a salesman. Grade your guru before you listen to anything they say. Make sure that they have a Ph.D. in success that spans at least a decade. The most common way that people lose money is by trusting blindly, without verifying, in a friend, family member or commission-based salesman. I want to encourage all of us to learn more about financial literacy, and to form partnerships that help us to take our learning and actions deeper. Our team offers the time-proven systems and solutions that can support you and your community to make sure that you are drinking your #finlit from the well of wisdom (instead of from sales-speak). The more you drink in and apply what works, the better your results will be. Your community can then help you to be disciplined about applying what you learn, and even in forming partnerships that might take on larger projects that you couldn’t handle on your own. Please see below for ways that we can support your continued learning up the path to financial empowerment and wisdom. Also, we are here to help, particularly when you have a hot tip/idea, or are concerned about a popular video or email that is circulating. Some of the hottest companies that I’ve featured came in as a hot tip from our community, as have some of our most valuable investor alerts. Community Resources *21-day coaching program. *Free teleconferences, blogs and online community. *Private, prosperity coaching *Retreats *Master Classes And here is more information on each resource. *21-day coaching program. The Gratitude Game was originally designed as a 21-day coaching series for retreat attendees to do after they attended a retreat, in order to make sure that they were remembering and implementing all of the wisdom and strategies that they had learned. We recommend this book in the audio format, using The ABCs of Money and Put Your Money Where Your Heart Is as textbooks. *Free teleconferences, blogs and online community. You can join me in a monthly teleconference, in my money blogs and access daily money tips. I frequently post links to relevant videos and articles on my Twitter and Facebook pages, and always post when a new blog is up or a teleconference is scheduled. Check out the links below for each page that you should consider following and visiting on a regular basis. If you have a suggestion, hot tip, investor alert or a question for the monthly teleconference, please tag me with it on Twitter or Facebook, or email Heather @ NataliePace.com. Feel free to start your own conversations and share Stock Report Cards on our Facebook.com page. Monthly Teleconferences: http://www.BlogTalkRadio.com/NataliePace Money, Personal Finance, Investor Alerts and Hot Stocks Blogs: http://NataliePace.com/Blog Sustainability Blog: https://Medium.com/@NataliePace/ Twitter: https://Twitter.com/NataliePace Facebook: https://www.Facebook.com/TheABCsofMoney Instagram: https://www.Instagram.com/NatalieWynnePace/ *Private, prosperity coaching This is your chance to make sure that you understand how our time-proven systems in budgeting and investing can apply to your own personal situation. Private prosperity coaching packages can be a great, affordable way to get your life on track. We recommend that you attend a retreat and learn the basics first, so that the private coaching can be more effective. Call 310-430-2397, if you’re interested in learning more. *Retreats Our 3-day Investor Educational Retreats offer the ABCs of Money that we all should have received in high school, taught by a No. 1 stock picker. You can find additional information about the next retreat on the home page at http://www.NataliePace.com/. The next retreat will be Oct. 13-15, 2017 in Southeastern Arizona – our Old West Financial Empowerment and Healing Retreat. This is our most affordable retreat. Receive the best price if you register by July 31, 2017. Receive a complimentary private, prosperity coaching session (value $300), when you register by June 30, 2017. *Master Classes Wonder what news I read? How I know what is happening before it hits the headlines? How I am able to identify great companies before they get a Buy rating from the analysts? Learn my tricks, so that you can match my results. If you wait for the headlines, it’s too late to act and to protect yourself. The Master Class is available to volunteers and repeat retreat attendees only. Recent Blogs To Check Out Will Congress Raise the Debt Ceiling in Time? The Debt Ceiling Must Be Raised By August. The SnapChat IPO Penny Pot Stocks Important Disclaimer: Natalie Pace is not a broker or a financial advisor. She doesn't sell financial products. She is a bestselling author and has been ranked the #1 stock picker. She offers financial education and the ABCs of Money that we all should have received in high school.

Will Congress Raise the Debt Ceiling Before the Summer Recess? How will this affect the U.S. economy, and your income and nest egg?

The House Freedom Caucus will not approve a clean debt ceiling, according to their press release, issued on May 24, 2017. Here are the demands of the Freedom Caucus, which is chaired by Representative Mark Meadows (R: North Carolina). We oppose any clean raising of the debt ceiling, we call for the debt ceiling to be addressed by Congress prior to the August Recess, and we demand that any increase of the debt ceiling be paired with policy that addresses Washington’s unsustainable spending by cutting where necessary, capping where able, and working to balance in the near future. This puts the far right in opposition to Democrats, who have called for a clean debt ceiling bill. Treasury Secretary Mnuchin requested for politics to be put aside for now to get the Debt Ceiling passed before Congress breaks for summer. Twice Secretary Mnuchin was pressed to support a clean Debt Ceiling bill, and twice he iterated that was his preference. However, the White House economic team, headed by Gary Cohn and Mick Mulvaney, wants the Debt Ceiling to be accompanied by a debt reduction and spending reform plan. National Economic Council director Cohn and White House budget director Mulvaney, who founded the Freedom Caucus, have both spoken in interviews this past week assuring Americans (and the world) that the Debt Ceiling will get passed and that there will be no default on payments. However, Mulvaney has also made it clear that The White House Administration would “like to see things attached to it that drive certain spending reforms and debt reforms in the future.” Paul Ryan has little choice, but to go along with the Freedom Caucus. Without their member votes, he will be unable to get the Debt Ceiling raised, unless he writes a bill that caters to the Democrats. Speaker John Boehner went around the Freedom Caucus, and used Democratic support to raise the Debt Ceiling in October of 2015. It cost Speaker Boehner his job. Speaker Ryan could conceivably craft a bill that would get all of the Democrats and a small number of Republicans on his side to get it passed. However, the key number here might not be the roll call. It’s more likely to be Ryan’s age. Speaker John Boehner was 65 when he committed political suicide – a time when he was ready to retire. Speaker Paul Ryan is only 47 years old. Speaker Ryan has been in office since 1999 – for almost two decades. It’s hard to imagine him doing something that would cost him his job. The Debt Ceiling bill is bound to include concessions that the Democrats will find it tough to swallow. However, there is another massive problem. All of this must be done before Congress breaks for summer. If they get too close to the X date – the date when we run out of money to pay our bills – then the U.S. risks a credit downgrade from both Fitch and Moody’s. The Debt Ceiling was hit on March 15, 2017. Secretary Mnuchin has been using extraordinary means to pay bills since then, but warned that tax receipts were weaker than anticipated. This put X date before the Summer Break, rather than fall. In August of 2011, when the U.S. credit was downgraded by Standard and Poor’s after coming too close to the X date, gold soared to its all-time high and stocks sank. Stocks did ultimately recover. However, that was the third year in the bull market cycle, and Moody’s and Fitch Ratings did not downgrade the U.S. credit from its AAA rating. 2017 is entering the 9th year of the bull market – a milestone that is very difficult to achieve. The last two times the economy went 8 years without a correction, the losses were catastrophic. The Dow Jones Industrial Average lost 55% in the Great Recession and the NASDAQ Composite Index lost 78% in the Dot Com Recession (and took 15 years to recover). A political log jam will cause a flood of distress in the world economic system and a downgrade to the U.S. credit by both Moody's and Fitch Ratings. The Powers that Be, both sides of the aisle, understand this. However, the sheer weight of the debt might drown the debate more than investors, and the politicians, are expecting. One thing is for sure. Protecting what you have is your most important job in 2017, just as it was in 2008 and 2000. That is why I’ve scheduled my Florida Financial Empowerment Retreat for Jun 10-12, 2017 – in plenty of time to get safe before the Debt Ceiling starts dominating the headlines. If you wait until the headlines heat up, it will be too late to protect yourself. Those people who used my Easy-as-a-Pie-Chart Nest Egg Strategies earned gains in the last two recessions, and have outperformed the bull markets in between. These strategies also save thousands in your annual budget! Meaning you can live a richer life today, provide far better for tomorrow and enjoy more bucket list vacations. If you’re employing Buy and Hold, then you are riding the Wall Street rollercoaster, and are as vulnerable today as you were in 2000 and 2008. Call 310-430-2397 to get started on your Debt Ceiling-proof asset protection plan now. FYI: I first warned that this Debt Ceiling crisis could be problematic, and that the U.S. AAA credit rating was at risk, on March 16, 2017. Click to view that blog. Check out other important updates regularly at http://www.nataliepace.com/blog. Debt Ceiling Must Be Raised By August

On May 24, 2017, Treasury Secretary Mnuchin warned the House Ways & Means Committee that the Debt Ceiling must be raised by August, before Congress goes on Summer Break. What does this mean to you, your investments and your future? 5 Things the Powers That Be Aren’t Telling You About Our Economy

Here are the details, and how these issues affect you now and in the years to come. 1. Congress must raise the Debt Ceiling by August, Before the Summer Break. May 24, 2017, just a few days before Memorial Day, Treasury Secretary Steven Mnuchin testified before the House Ways and Means Committee. At least two different times, he emphasized that the Debt Ceiling should be raised before Congress leaves for the summer break. He said, “It is absolutely important that this is passed before the August recess. As far as I’m concerned, the sooner, the better.” The same day, White House Budget Director Mick Mulvaney told the House Budget Committee that “The [tax] receipts are coming in slower than expected.” What does this mean for you? Not a whole lot in the near term, if Congress raises the Debt Ceiling in June. If the process is drawn out or gets to close to X date (the date when the Treasury Department can’t make payments to Treasury Bill holders, government employees and/or Social Security recipients), then the U.S. risks a credit downgrade from both Fitch and Moody’s. If that happens, it could be a serious problem, with pandemic economic consequences, beginning as early as August. Other world currencies are gaining strength on the IMF Currency Composition of Foreign Exchange Reserves. The Chinese renminbi was added to the SDR basket of currencies in 2016. The Australian and Canadian dollars are increasing as global FOREX reserve holdings. The U.S. dollar currently makes up 46.8% of the total FOREX reserves (according to the IMF). (The IMF data grossly misrepresents the power of the Chinese renminbi, and the trade exchanges that are going on between Russia and China directly, in their own currencies.) As the U.S. debt continues to balloon, this will continue to force pressure on the buying power of the dollar. Basic supply and demand tells you that a weaker dollar translates into more dollars needed to purchase the same thing. That would put even more pressure on the debt, which will start experiencing larger interest payments in the years to come (no matter what). Switching from the dominance of the U.S. dollar to a basket of world currency is happening incrementally. The Powers That Be are trying to prevent it from becoming a snow ball. The Bottom Line: Cash, though safer than bonds and Money Market Funds, is losing buying power. Safe, income-producing hard assets that you purchase for a good price are a better idea. That’s why we spend a full day on this topic at the Investor Educational Retreat. (Call 310-430-2397 or email Heather @ NataliePace.com to learn more.) 2. Social Security has been cash negative since 2010, and is predicted to run dry in 2034 (in 17 years). Disability Insurance is borrowing from Social Security because it dried up in 2016. $5.5 trillion of the current $20 trillion in debt is social security debt (and climbing). What is a little distressing about these facts is that they are not part of the public debate. In fact, Representative Kevin Brady, the Republican chairman of the House Ways and Means Committee, noted that Medicare and Social Security are the biggest drivers of our debt, yet were absent from Treasury Secretary Mnuchin’s statement dated May 24, 2017, as was any mention of the urgency of raising the Debt Ceiling as soon as possible. 3. GDP Growth is Predicted to Be 2.1-2.3% in 2017 and 2.1-2.6% in 2018, not 3%. Most predictions have the growth under 2% in the years thereafter. (No one ever predicts a recession, until after it has happened.) Meanwhile, The White House Administration and Treasury Department are using 3% GDP growth as rationale for making their tax cuts work. Here’s what Fitch Ratings’ Charles Seville had to say about this (in an email to the press dated May 24, 2017), “The President’s Budget’s proposal to eliminate the federal deficit and reduce the debt/GDP ratio over 10 years rest on an optimistic long-run growth assumption of 3%, which is unlikely to be realized given slowing growth in the labor force.” Mr. Seville is senior director and lead analyst on the U.S. sovereign rating. The GDP growth in the 1st quarter of 2017 was 1.2%. The prediction for the 2nd quarter is currently 3.8%! (Woo hoo! If those predictions hold true.) We will get new projections from the Federal Reserve Board on June 14, 2017, when they have their next meeting. We all want a robust economy, strong jobs and less taxes. The basis of a strong economy is innovation and inventing/building the products of tomorrow that the world can’t live without. 4. The Current Administration’s Tax Cuts Help (A Little) in the Short Term, but are predicted to hurt in the Medium and Long Term. And they aren’t expected to get us to 3% GDP growth. Who doesn’t like lower taxes? People and companies all benefit. The problem is that with $20 trillion in debt, when the government cuts its income (with the tax breaks), it can’t pay off its debt. More military spending also equates with more disability and medical claims from young men. Up to 35% of Iraq/Afghanistan Veterans suffer from PTSD, and over one million veterans from those wars were injured. (The VA stopped publishing data on injured veterans in 2013.) The disability insurance went broke in 2016, and is borrowing from Social Security. Tax cuts mean even more borrowing to try and make ends meet – a recipe for disaster. When cutting taxes and increasing military spending is prioritized at the expense of education and investments that fuel desirable, new industries, then GDP growth is held back by the inability to pay what we already owe and increased social and financing costs. 5. Cash is not the safest investment in today’s Debt World, though it is better than bonds and money market funds. Bonds have lost money over the last decade and are vulnerable in the years to come. Credit risk (bankruptcies and restructurings, ala Detroit, Puerto Rico and the retail stores going belly-up) and interest rate risk are both concerns. Money market funds now have redemption gates and liquidity fees. When currency moves happen, cash can lose buying power overnight. We saw this in the fall of the euro and the British pound in the wake of BREXIT, when both currencies lost 15% or more overnight after the vote. So, what’s safe? Safe, income-producing hard assets that you purchase for a good price. Every word in that sentence is key, particularly now when real estate is higher than it was in 2007, before the Great Recession. Fortunately, our team has identified some great investments that meet these criteria. The annual savings for most people is in the thousands, and for many can add up to tens of thousands in annual cost benefits. That’s the best ROI in today’s world, and also the lowest risk! In short, if you’re getting your news from the mainstream media and your budgeting and investing strategy from salesmen and debt collectors, you’re as vulnerable today as you were in 2007. In the Great Recession, stocks lost 55%, 7 million Americans lost their homes and most of the banks, brokerages and insurance companies were bailed out. Wisdom is the cure. Call 310-430-2397 to get access to budgeting and investing strategies that have worked since 1999 – earning gains in both of the last two (devastating) recessions and outperforming the bull markets in between. If you want to be sure to implement these strategies before August, then attend the June 10-12, 2017 Financial Empowerment Retreat in Cocoa Beach, Florida. About Natalie Pace Natalie Wynne Pace is the co-creator of the Earth Gratitude project and the author of the Amazon bestsellers The Gratitude Game, The ABCs of Money and Put Your Money Where Your Heart Is (aka You Vs. Wall Street). She has been ranked as a No. 1 stock picker, above over 835 A-list pundits, by an independent tracking agency (TipsTraders). The ABCs of Money remained at or near the #1 Investing Basics e-book on Amazon for over 3 years (in its vertical). |

AuthorNatalie Pace is the co-creator of the Earth Gratitude Project and the author of The Power of 8 Billion: It's Up to Us, The ABCs of Money, The ABCs of Money for College, The Gratitude Game and Put Your Money Where Your Heart Is. She is a repeat guest & speaker on national news shows and stages. She has been ranked the No. 1 stock picker, above over 830 A-list pundits, by an independent tracking agency, and has been saving homes and nest eggs since 1999. Archives

July 2024

Categories |

RSS Feed

RSS Feed