|

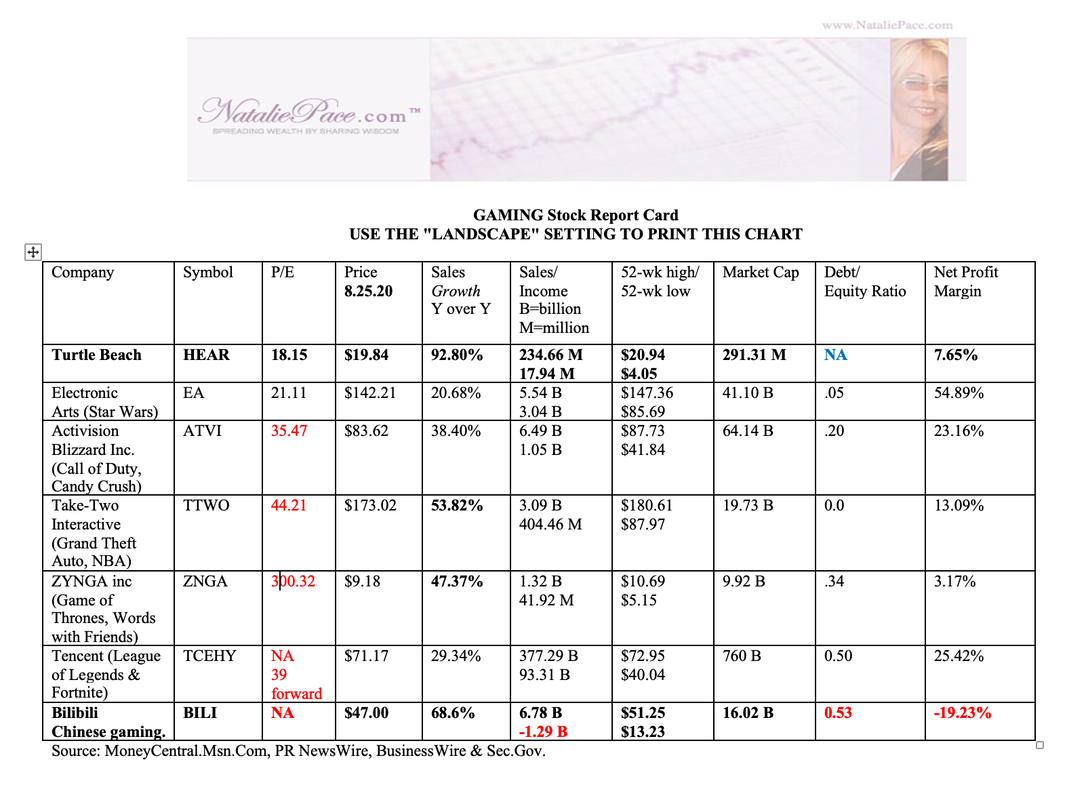

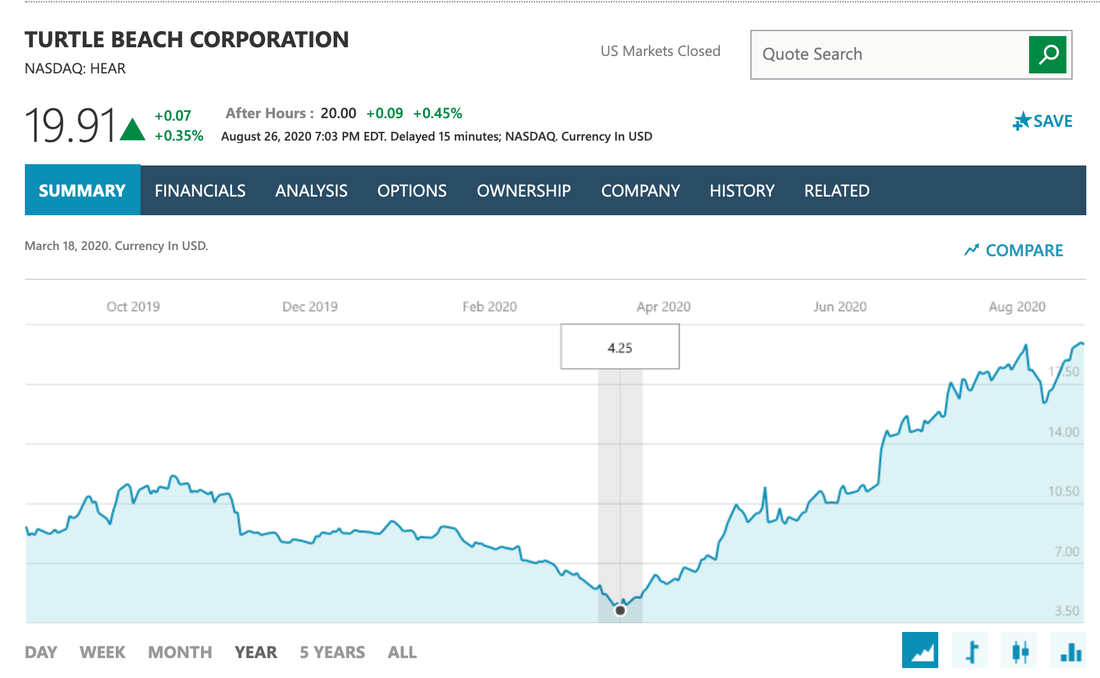

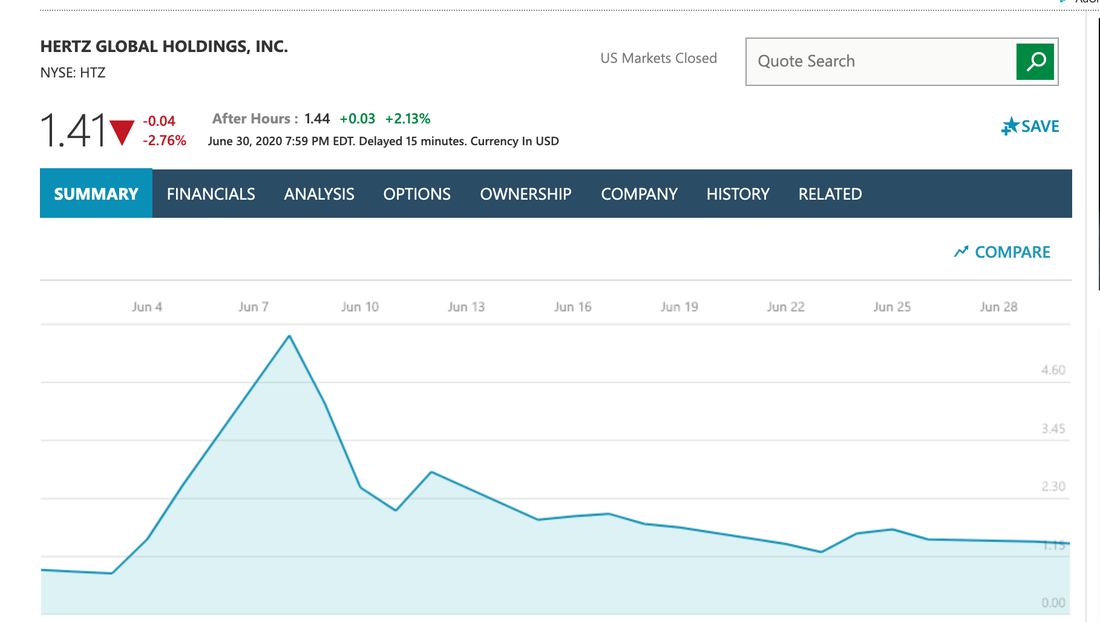

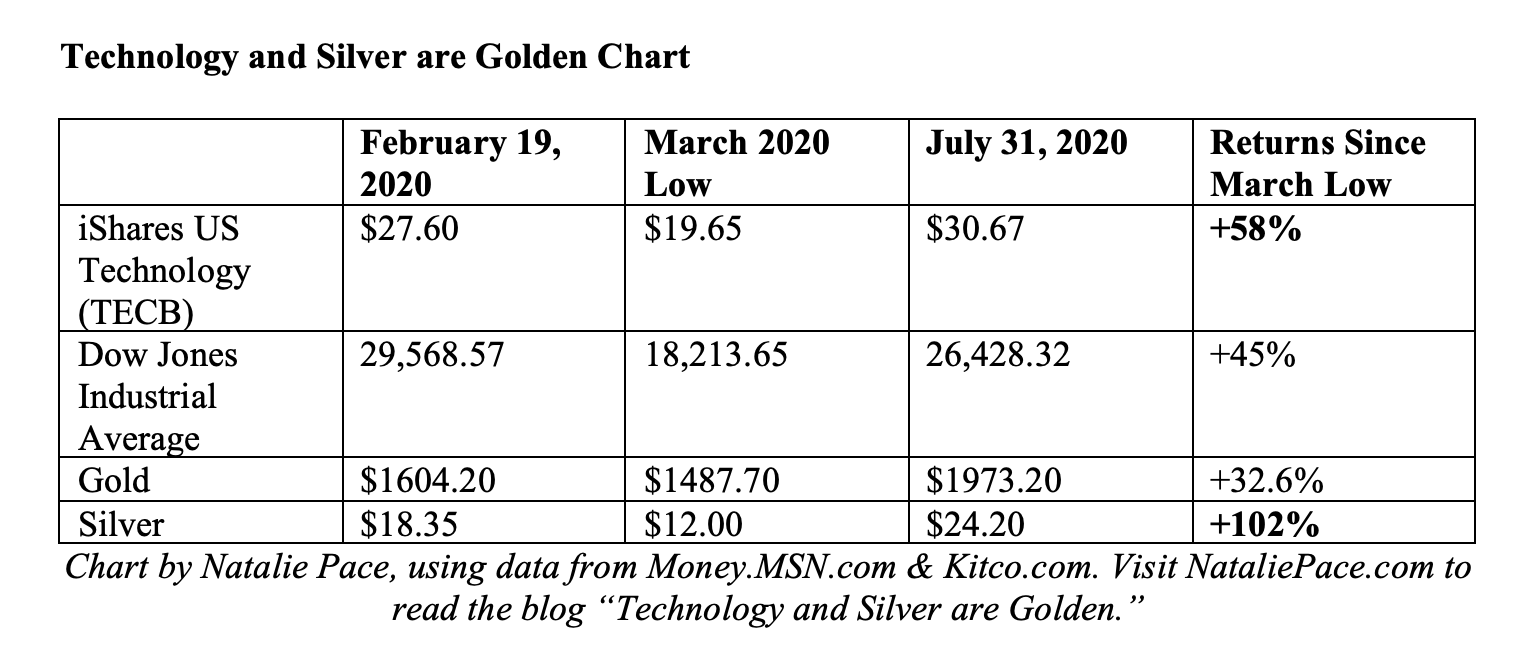

Gaming is having a massive resurgence, thanks to Shelter at Home, Educate at Home, Work from Home, Everything from Home, et al. All of the gaming companies reported an increase in revenue in the 2nd quarter of 2020. However, the clear winner wasn’t the maker of Fortnite (partially owned by Tencent), Call of Duty (Activision) or Grand Theft Auto (Take-Two Interactive), although each of those put in a strong showing. As is often the case, it was the little widget that makes everything work – the headset. As you can see in the Stock Report Card below, Turtle Beach’s revenue almost doubled in the 2nd quarter of 2020 year over year, soaring to sales of $79.7 million. Turtle Beach’s net income was equally impressive, coming in at $8.2 million, compared to $2.4 million in 2Q 2019. While many companies, including Tesla and Apple, have suspended their forward guidance on revenue and EPS, Turtle Beach projects sales of $185 million in the 2nd half of 2020, with net income per share of $0.50. If we assume that each quarter is equal (which is unlikely), then 3Q 2020 revenue should come in at $92.5 million. That would be almost double what the 3rd quarter of 2019 saw, at $46.7 million. The 3rd quarter of 2019 also saw a net loss of $3.1 million. So, the profitability could be noteworthy as well. The 3rd quarter results should be announced around Nov. 6, 2020. According to Juergen Stark, CEO of Turtle Beach, “We believe the demand is … being driven by greater overall engagement of existing gamers, as well as new and lapsed gamers joining the market as new gaming headset users. In addition, non-gamers are buying headsets for at-home work, school and socializing.” Like many gaming companies, Turtle Beach’s seasonally strong quarter is typically Christmas. Last year’s 4th quarter revenue was $101.8 million, with $20.4 million in net income. This year, the strong quarter might be moved to the Back to School season (the 3rd quarter), when parents purchase headsets to be able to work from home, while also monitoring the schooling of their kids. If the 2nd half of the year projection of $185 million in sales is divided equally or weighted toward the coming 3rd quarter, then the 4th quarter 2020 results will not look impressive compared to 2019. So, this is something to monitor when the earnings report is released in November. It’s rare to find the best performer on a Stock Report Card to also be the one with the lowest price/earnings ratio. Turtle Beach has already enjoyed a rally of almost five-fold since the COVID-crisis stock market rout in March. In a recessionary year, it’s important to include macro trends in your buy/sell analysis. It’s clear that Turtle Beach stock can be vulnerable when stocks drop en masse. Between January and March of 2020, Turtle Beach lost more than half of its value. So, if the current market rally peters out, it could drag even great little companies like Turtle Beach down with it. On the other hand, if you purchase and the stock shows continued strong performance, you might have to move swiftly to capture gains. In such a volatile market as we’ve seen in 2020, the right answer tends to be not all and not nothing. It requires a lot of babysitting to be on the right side of the trade in 2020. If you're interested in learning how to pick hot stocks like Turtle Beach, in deepening your financial wisdom or in rebalancing your retirement plans, join me at our Oct. 3-5, 2020 Investor Educational Retreat. Click on the banner ad below for additional information on the Oct. 3-5, 2020 Online Financial Empowerment Retreat. Families receive a discount for attending together. Call 310-430-2397 or email [email protected] for to get rates. "Many people, including educated men and women, often get into trouble when they neglect to follow simple and fundamental rules of the type provided [by Natalie]. This is why I recommend them with enthusiasm." Professor Gary S. Becker. Dr. Becker won the 1992 Nobel Prize in economics for his theories on human "College students need this information before they get their first credit card. Young adults need it before they buy their first home. Empty nesters can use the information to downsize to a sustainable lifestyle, before they get into trouble." Joe Moglia, Chairman, TD AMERITRADE. Other Blogs of Interest Apple & Tesla Stock Splits. Schwab's Chief Fixed Income Strategist on What's Safe. China's Tesla (Nio). 2Q Sales Soar. Why Are You Still Renting? (Errr. There is More Than This to Consider!) MedMen's Turnaround Plan Attracts A-List Board Members. Wealth Myths That Keep You Poor. Prosperity Truths That Make You Rich. Protecting Your Wealth and Home in a Recession. Technology and Silver are Golden. The Economy Contracts 32.9% in the 2nd Quarter of 2020. Real Estate: Feeling Equity Rich? Make Sure That Feeling Isn't Fleeting. Airline Revenue Plunges 86%. 10 Questions for College Success Bank Earnings Season. Crimes. Cronyism. Speculation. Real Estate Solutions for a Post-Pandemic World. Copper and Chile Update. Gold Soars. Some Gold Funds Tank. Will the Facebook Ad Boycott De-FANG Stocks? Why Did My Cannabis Stock Go Down? Which Countries Are Hot in a Global Pandemic? Is Your Financial Advisor Good at Navigating Stormy Seas? $10 Avocados, Lies, Damn Lies, Statistics & Wall Street Secrets. It's Never a Crash. Work From Home and Intergenerational Housing. Biotech Races for a Coronavirus Cure. Are You Worried About Money? May is a Good Time for Rebalancing. Is FDIC-Insured Cash at Risk of a Bank Bail-in Plan? Why Did my Bonds Lose Money? Cannabis Update. Recession Proof Your Life. Free Videocon Monday, May 10, 2020. The Recession will be Announced on July 30, 2020. Apple Reports Terrible Earnings. We Are in a Recession. Unemployment, Rising Stocks. What's Going On? 8 Money Myths, Money Pits, Scams and Conspiracy Theories. 21st Century Solutions for Protecting Your Home, Nest Egg & Job. Wall Street Insiders are Selling Like There is No Tomorrow. Why Are My Bonds Losing Money? Tomorrow is Going to be Another Tough Day. Price Matters. Stock Prices are Still Too High. Should You Ride Things Out? 7 Recession Indicators Corona Virus Update. The Bank Bail-in Plan on Your Dime. NASDAQ is Up 6X. CoronaVirus: Which Companies and Countries Will be Most Impacted. Is Tesla Worth GM and Ford Combined. Artificial Intelligence is on Fire. Is it Time to Buy S'More? Take the Retirement Challenge. 2020 Investor IQ Test. Answers to the 2020 Investor IQ Test. The Cannabis Capital Crunch and Stock Meltdown. Does Your Commute Pollute More Than Planes? Are Health Care Costs Killing Your Budget? 2020 Crystal Ball. The Benefits of Living Green. Featuring H.R.H. The Prince of Wales' Twin Eco Communities. What Love, Time and Charity Have to do with our Commonwealth. Interview with MacArthur Genius Award Winner Kevin Murphy. Unicorns Yesterday. Fairy Tales Today. IPO Losses Top $100 Billion. Price Matters. Will There be a Santa Rally? It's Up to Apple. Harness Your Emotions for Successful Investing. What the Ford Downgrade Means for Main Street. The Dow Dropped Over 1000 Points Do We Talk Ourselves into Recessions? Interview with Nobel Prize Winning Economist Robert J. Shiller. Ford is Downgraded to Junk. Gold Mining ETFs Have Doubled. The Gold Bull Market Has Begun. The We Work IPO. The Highs and Hangovers of Investing in Cannabis. Recession Proof Your Life. What's Your Exit Strategy? It's Time To Do Your Annual Rebalancing. Are You Suffering From Buy High, Sell Low Mentality? Financial Engineering is Not Real Growth. The Zoom IPO. Uber vs. Lyft. Which IPO Will Drive Returns? Boeing Cuts 737 Production by 20%. The Lyft IPO Hits Wall Street. Should you tak Cannabis Doubles. Did you miss the party? 12 Investing Mistakes The High Cost of Free Advice. 2018 Was the Worst December Since the Great Depression. Russia Dumps Treasuries and Buys Gold OPEC and Russia Cut Oil Production. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable. However, NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors.  About Natalie Pace Natalie Wynne Pace is an Advocate for Sustainability, Financial Literacy & Women's Empowerment. She has been ranked as a No. 1 stock picker, above over 835 A-list pundits, by an independent tracking agency (TipsTraders). The ABCs of Money remained at or near the #1 Investing Basics e-book on Amazon for over 3 years (in its vertical), with over 120,000 downloads and a mean 5-star ranking. The 3rd edition of The ABCs of Money was released in 2020. Natalie Pace's easy as a pie chart nest egg strategies earned gains in the last two recessions and have outperformed the bull markets in between. That is why her Investor Educational Retreats, books and private coaching are enthusiastically recommended by Nobel Prize winning economist Gary S. Becker, TD AMERITRADE chairman Joe Moglia, Kay Koplovitz and many Main Street investors who have transformed their lives using her Thrive Budget and investing strategies. Click to view a video testimonial from Nilo Bolden. Apple and Tesla Stock Splits. Should I Invest Now? Investors Ask Natalie. Dear Natalie, What do you think about Apple and Tesla splitting their stocks? Is now a good time to buy? Tempted to Buy Dear Tempted, but Questioning: Good for you to ask the question, rather than just assume that you should buy. I’m not sure what is so alluring about penny stocks and stock splits, but many investors are tempted to shoot from the hip on these events. Doing that is more like investing in Hertz after it declared bankruptcy just because it’s cheap (a losing proposition), or buying one of the new Tesla competitors before they have any sales (with the exception of China’s Nio, which increased sales 147% year over year in the most recent quarter). So, what is a stock split? It’s just a way for a company to make its stock cheaper, so more people can buy it. It would be like a pizzeria that sells giant slices for $8/each, deciding to cut that slice into 4 pieces and sell each piece for $2/each. Does that mean that the pizzeria will sell more slices or that your smaller slice is better than the larger slice? Nope. It’s actually the same thing. Whether you buy 4 small slices for $8 or one large slice for $8, it’s the same amount of pizza. So, you’re back to looking at the Stock Report Card to determine whether or not you should invest in Tesla and Apple, rather than thinking a stock split is a good reason to buy or sell. I just did a blog on Tesla, so read that blog for additional information on whether or not Tesla is a good buy right now. Tesla is trading at 247 times its forward earnings. The historical average price/earnings ratio is in the 16-17 range. Apple’s price/earnings ratio is also outlandish, at 40. So, if you buy right now, it is the equivalent of paying $15 for an avocado. Apple’s sales were $260 billion with $55 billion in net income last year. However, the company is likely overvalued at $2.15 trillion. You’re buying very high if you purchase Apple right now. Remember that successful investing does require buying low and selling high. In addition to looking at the company itself, you also need to consider the following 3 questions.

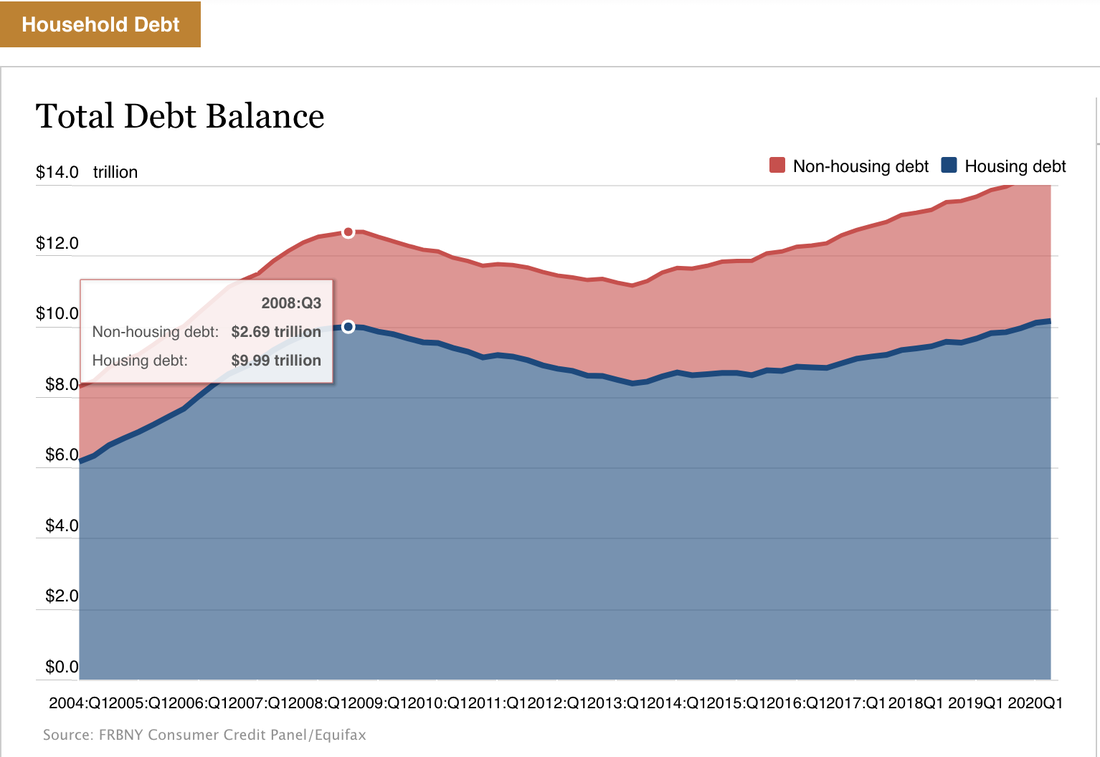

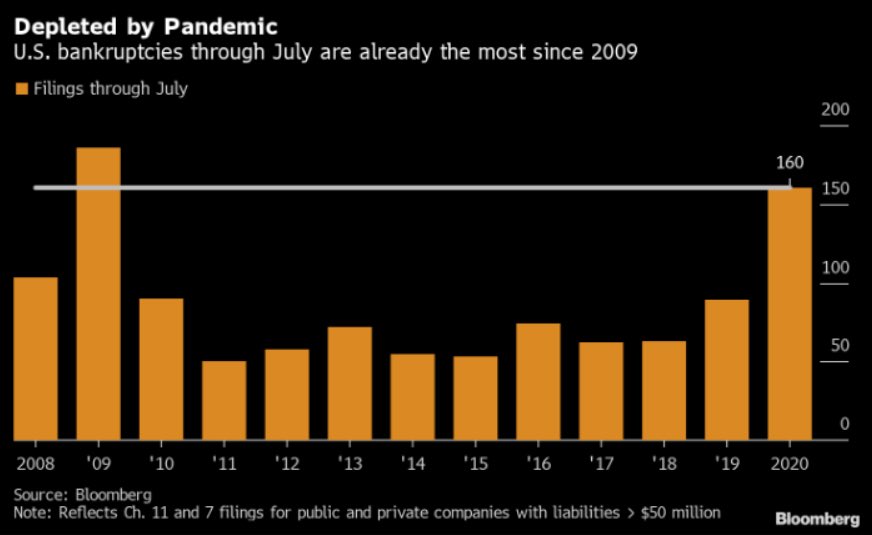

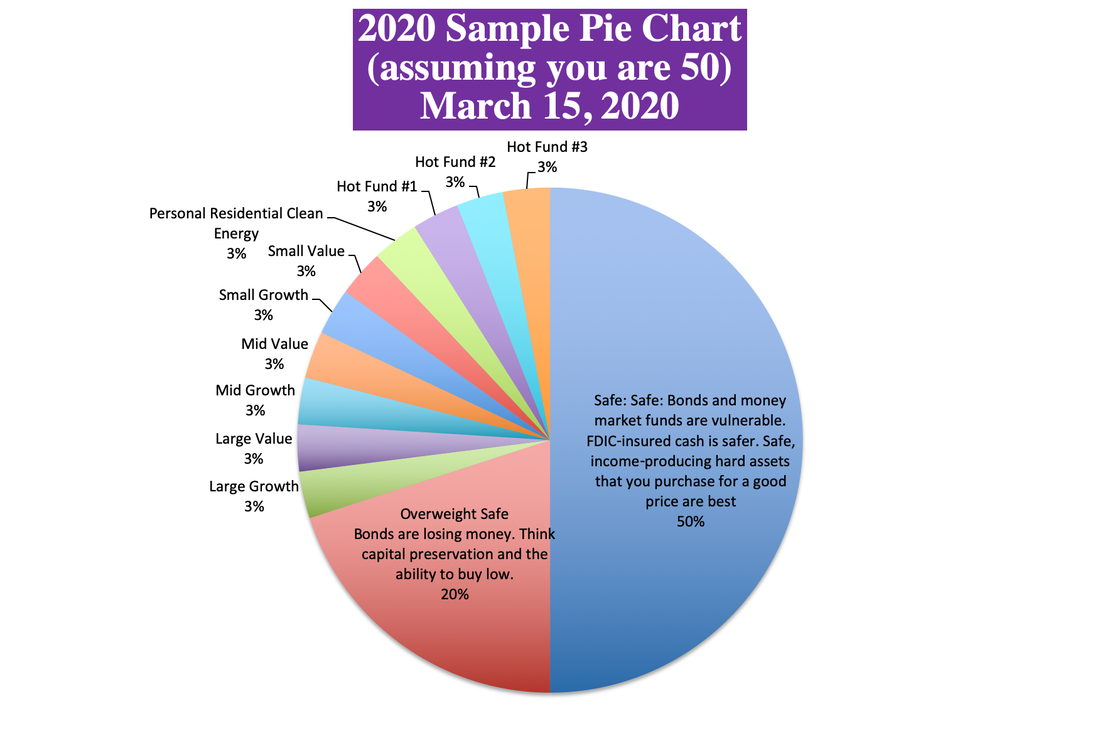

What Can the Industry Do? With regard to autos (even electric vehicles), auto sales typically tank in recessions. Tesla’s 2nd quarter sales were down -4% in the last quarter. It would be a pretty big surprise if the 3rd quarter sales were higher than 2019. As with many companies, Tesla is not providing guidance on what the next quarter will look like. Tesla’s electric vehicles are the hottest trend in auto sales. However, fewer people are willing to take on a car payment when they are afraid of losing their job. There is also $14.27 trillion in consumer debt weighing down the American wallet, of which $1.34 trillion is auto loan debt. So far the delinquencies are low, at 2.26%. However, that could be artificial, based upon general moratoria that have been put in place. As you can see in the chart below, debt is higher than it was before the Great Recession. So is the unemployment rate. That's a formula for big problems. Things are in an artificial lull right now, but that doesn't mean that we're out of the woods yet. Technology has been resilient. Apple’s sales were up 11% in the most recent quarter. If the company brings in the same revenue in the next quarter, then sales will be down -7% year over year. If there are any supply chain disruptions, or if sales are not as robust as they were, then the drop will be more noteworthy. Although technology is hot, and Work and Educate from Home trends require everyone to own a PC and a smart phone or tablet, it is possible that this need has already been satisfied. Also, the $1200/person stimulus paycheck helped folks to purchase in the last quarter. That free money hasn’t materialized yet in this quarter. What Will the General Market Do? We are in an unprecedented recession. Stocks have recovered because the Federal Reserve bought up almost everything to prevent a collapse. There will continue to be defaults and bankruptcies, particularly in those industries that have been hardest hit by the pandemic, including retail, small businesses, oil, hospitality, travel, commercial real estate, malls, casinos, live entertainment, cruise ships and more. As you can see in the chart below, bankruptcies are quite elevated. As Howard Silverblatt, the senior index analyst of the S&P500 ® said on July 31, 2020, this market rally has been built on “fear of losing out by individuals, the need to make the numbers by money managers, and the universal need to believe... As for doomsayers and (shocked) short-sellers, eventually they will be right, but when?” In short, today is actually a 2nd chance for most people to get it right by rebalancing and making sure that they have enough safe. For those of you who rue that you didn’t have Apple or Tesla before these major rallies, then you need to learn more about our pie chart system, which allows you to own up to four hot slices. If you have clean energy or technology in your portfolio, now is a great time to rebalance and capture gains. Additionally, what’s hot and what’s safe changes every year. So, consider whether or not you think that Tesla will continue to be this hot going forward when deciding how much to keep in your portfolio. Split Dates August 28, 2020, for shareholders as of August 24, 2020, for Apple. 4 for 1. August 31, 2020, for shareholders as of August 21, 2020, for Tesla. 5 for 1. If you're interested in learning learning essential investing tools, deepening your wisdom or in rebalancing your retirement plans, join me at our Oct. 3-5, 2020 Investor Educational Retreat. Click on the banner ad below for additional information on the Oct. 3-5, 2020 Online Financial Empowerment Retreat. Families receive a discount for attending together. Call 310-430-2397 or email [email protected] for to get rates. "Many people, including educated men and women, often get into trouble when they neglect to follow simple and fundamental rules of the type provided [by Natalie]. This is why I recommend them with enthusiasm." Professor Gary S. Becker. Dr. Becker won the 1992 Nobel Prize in economics for his theories on human "College students need this information before they get their first credit card. Young adults need it before they buy their first home. Empty nesters can use the information to downsize to a sustainable lifestyle, before they get into trouble." Joe Moglia, Chairman, TD AMERITRADE. Other Blogs of Interest Schwab's Chief Fixed Income Strategist on What's Safe. China's Tesla (Nio). 2Q Sales Soar. Why Are You Still Renting? (Errr. There is More Than This to Consider!) MedMen's Turnaround Plan Attracts A-List Board Members. Wealth Myths That Keep You Poor. Prosperity Truths That Make You Rich. Protecting Your Wealth and Home in a Recession. Technology and Silver are Golden. The Economy Contracts 32.9% in the 2nd Quarter of 2020. Real Estate: Feeling Equity Rich? Make Sure That Feeling Isn't Fleeting. Airline Revenue Plunges 86%. 10 Questions for College Success Bank Earnings Season. Crimes. Cronyism. Speculation. Real Estate Solutions for a Post-Pandemic World. Copper and Chile Update. Gold Soars. Some Gold Funds Tank. Will the Facebook Ad Boycott De-FANG Stocks? Why Did My Cannabis Stock Go Down? Which Countries Are Hot in a Global Pandemic? Is Your Financial Advisor Good at Navigating Stormy Seas? $10 Avocados, Lies, Damn Lies, Statistics & Wall Street Secrets. It's Never a Crash. Work From Home and Intergenerational Housing. Biotech Races for a Coronavirus Cure. Are You Worried About Money? May is a Good Time for Rebalancing. Is FDIC-Insured Cash at Risk of a Bank Bail-in Plan? Why Did my Bonds Lose Money? Cannabis Update. Recession Proof Your Life. Free Videocon Monday, May 10, 2020. The Recession will be Announced on July 30, 2020. Apple Reports Terrible Earnings. We Are in a Recession. Unemployment, Rising Stocks. What's Going On? 8 Money Myths, Money Pits, Scams and Conspiracy Theories. 21st Century Solutions for Protecting Your Home, Nest Egg & Job. Wall Street Insiders are Selling Like There is No Tomorrow. Why Are My Bonds Losing Money? Tomorrow is Going to be Another Tough Day. Price Matters. Stock Prices are Still Too High. Should You Ride Things Out? 7 Recession Indicators Corona Virus Update. The Bank Bail-in Plan on Your Dime. NASDAQ is Up 6X. CoronaVirus: Which Companies and Countries Will be Most Impacted. Is Tesla Worth GM and Ford Combined. Artificial Intelligence is on Fire. Is it Time to Buy S'More? Take the Retirement Challenge. 2020 Investor IQ Test. Answers to the 2020 Investor IQ Test. The Cannabis Capital Crunch and Stock Meltdown. Does Your Commute Pollute More Than Planes? Are Health Care Costs Killing Your Budget? 2020 Crystal Ball. The Benefits of Living Green. Featuring H.R.H. The Prince of Wales' Twin Eco Communities. What Love, Time and Charity Have to do with our Commonwealth. Interview with MacArthur Genius Award Winner Kevin Murphy. Unicorns Yesterday. Fairy Tales Today. IPO Losses Top $100 Billion. Price Matters. Will There be a Santa Rally? It's Up to Apple. Harness Your Emotions for Successful Investing. What the Ford Downgrade Means for Main Street. The Dow Dropped Over 1000 Points Do We Talk Ourselves into Recessions? Interview with Nobel Prize Winning Economist Robert J. Shiller. Ford is Downgraded to Junk. Gold Mining ETFs Have Doubled. The Gold Bull Market Has Begun. The We Work IPO. The Highs and Hangovers of Investing in Cannabis. Recession Proof Your Life. What's Your Exit Strategy? It's Time To Do Your Annual Rebalancing. Are You Suffering From Buy High, Sell Low Mentality? Financial Engineering is Not Real Growth. The Zoom IPO. Uber vs. Lyft. Which IPO Will Drive Returns? Boeing Cuts 737 Production by 20%. The Lyft IPO Hits Wall Street. Should you tak Cannabis Doubles. Did you miss the party? 12 Investing Mistakes The High Cost of Free Advice. 2018 Was the Worst December Since the Great Depression. Russia Dumps Treasuries and Buys Gold OPEC and Russia Cut Oil Production. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable. However, NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors.

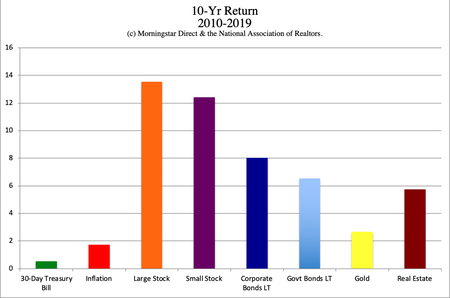

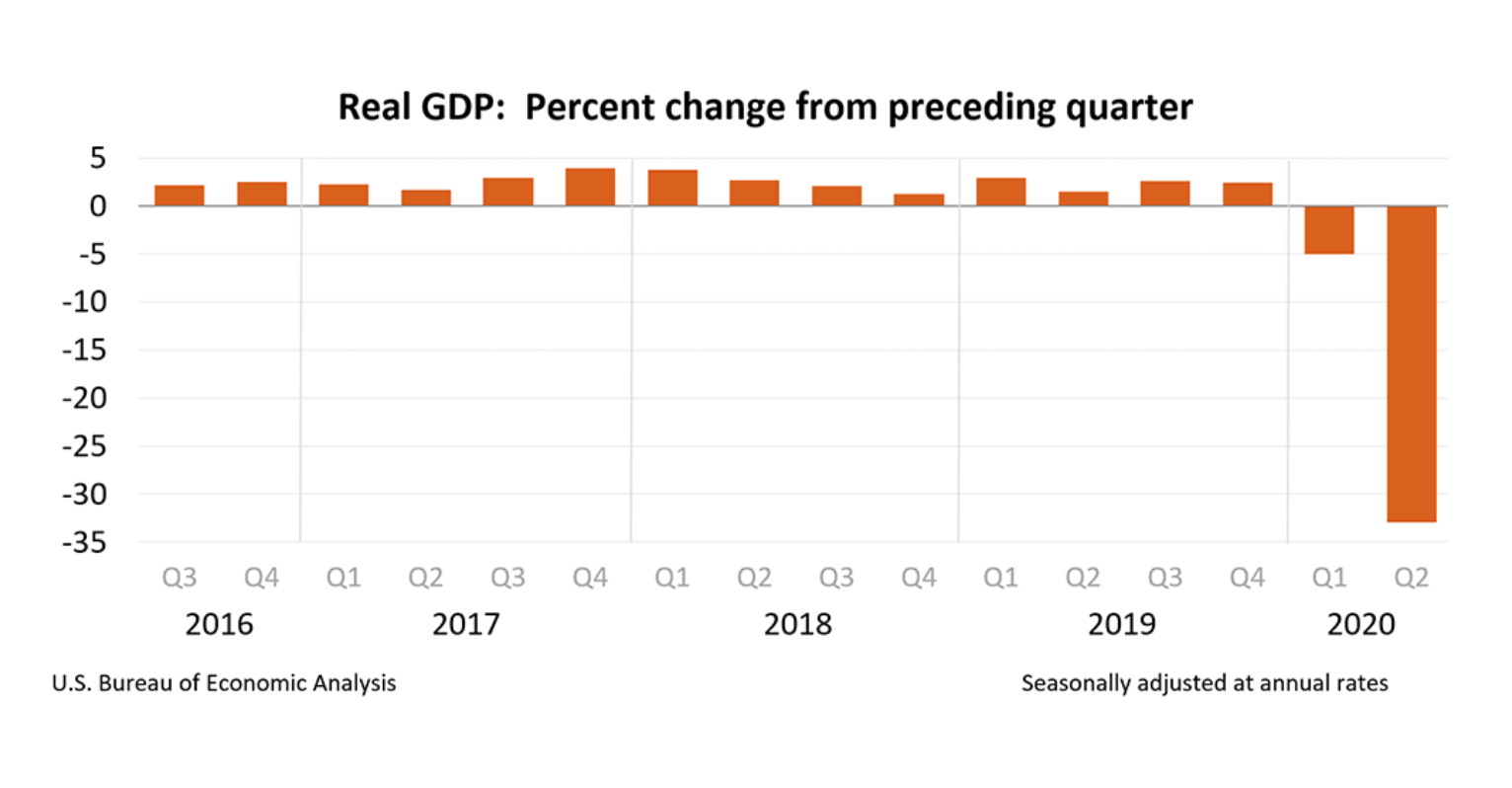

Your 5-Point Stress-Free Money Plan. A conversation with Charles Schwab’s SVP and Chief Fixed Income Strategist Kathy A. Jones. The S&P500 just hit a new record high. Investors have heaved a sigh of relief. However, memories of March and the 35% losses in the Dow Jones Industrial Average still haunt us. The White House boasts of job creation and the stock rally, downplaying the unfavorable data, like the 2Q 2020 GDP contraction of -32.9%, the 10.2% unemployment rate, financial leverage, high price/earnings ratios, junk bonds and the 28 million people who are claiming unemployment benefits. These statistics affect all of our lives. Rather than hope and pray that the storm is over, now is a great time to build a solid financial house. Adopt a strategy that affords you the cash you might need in an emergency, and prevents your retirement from evanescing if stocks turn south. To assist you with your blueprint, I reached out to Kathy A. Jones for her inside perspective and wisdom. Kathy Jones is the Chief Fixed Income Strategist and SVP for Charles Schwab. In a candid and informative conversation, Kathy outlines key strategies each one of us can and should adopt now. Your 5-Point Stress-Free Money Plan.

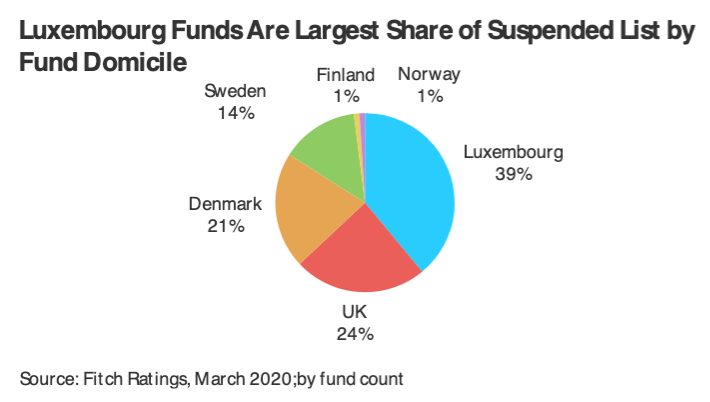

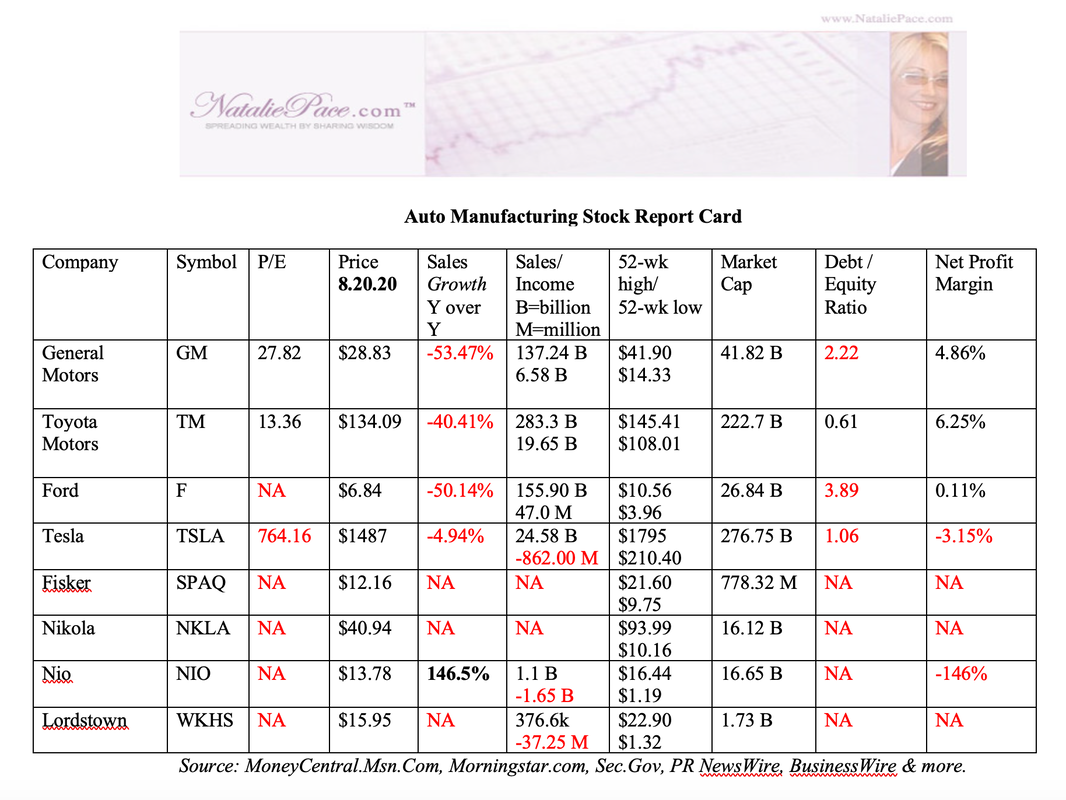

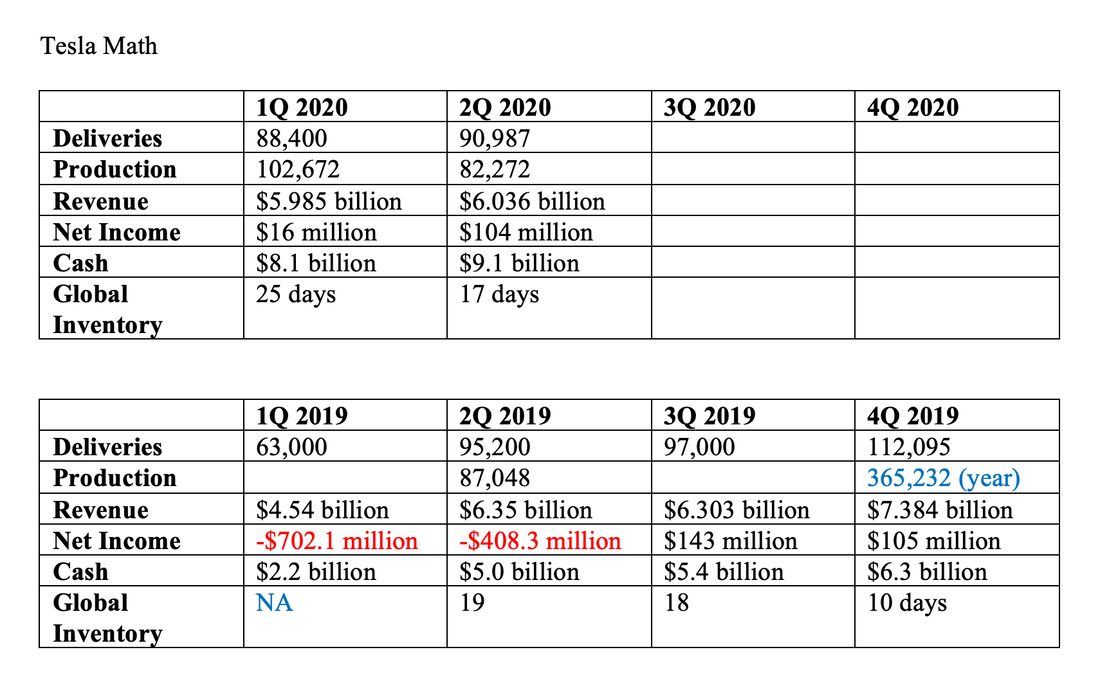

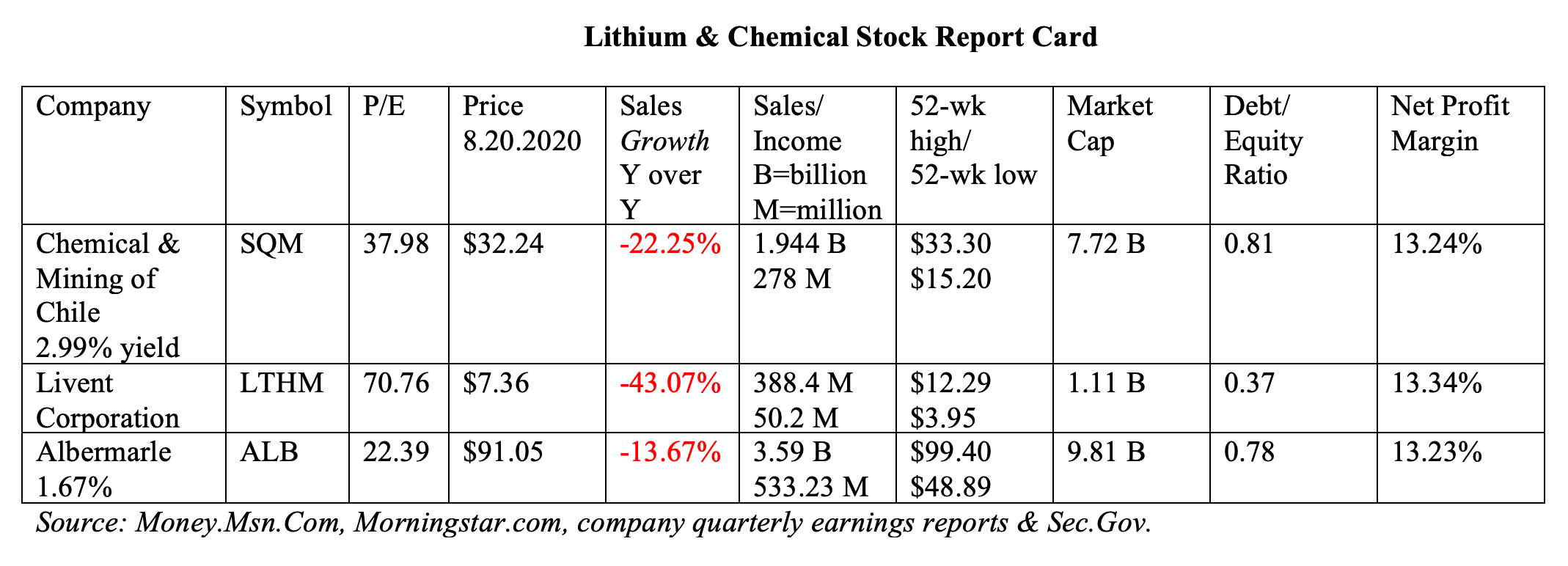

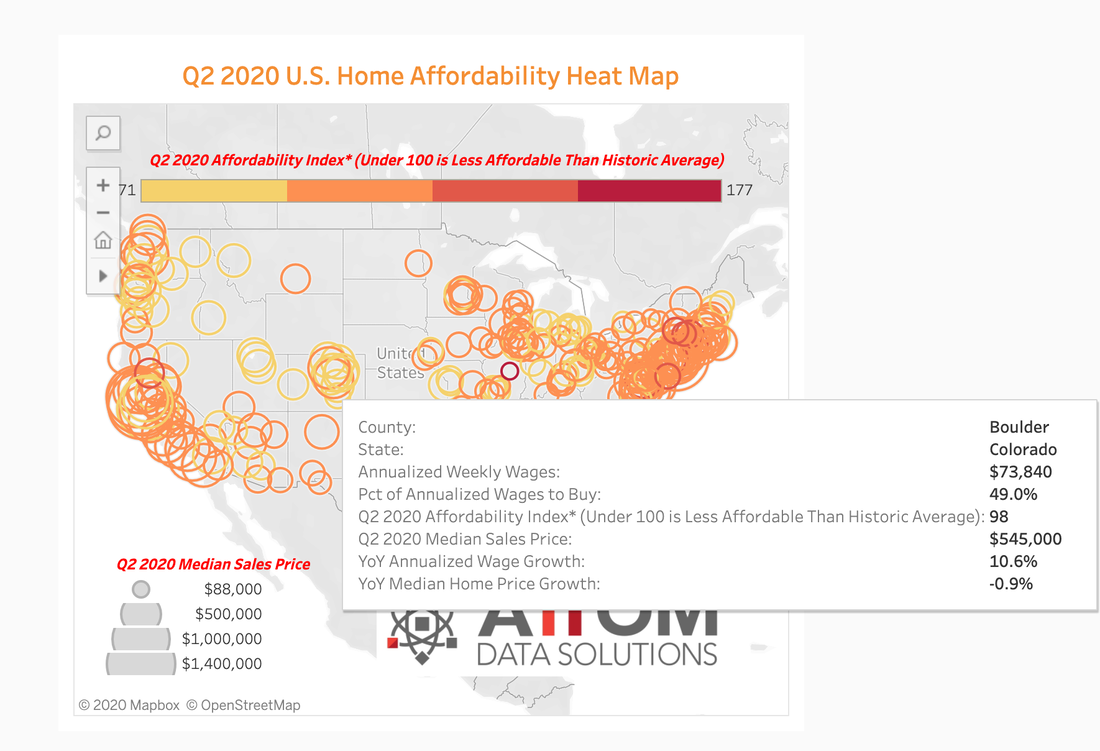

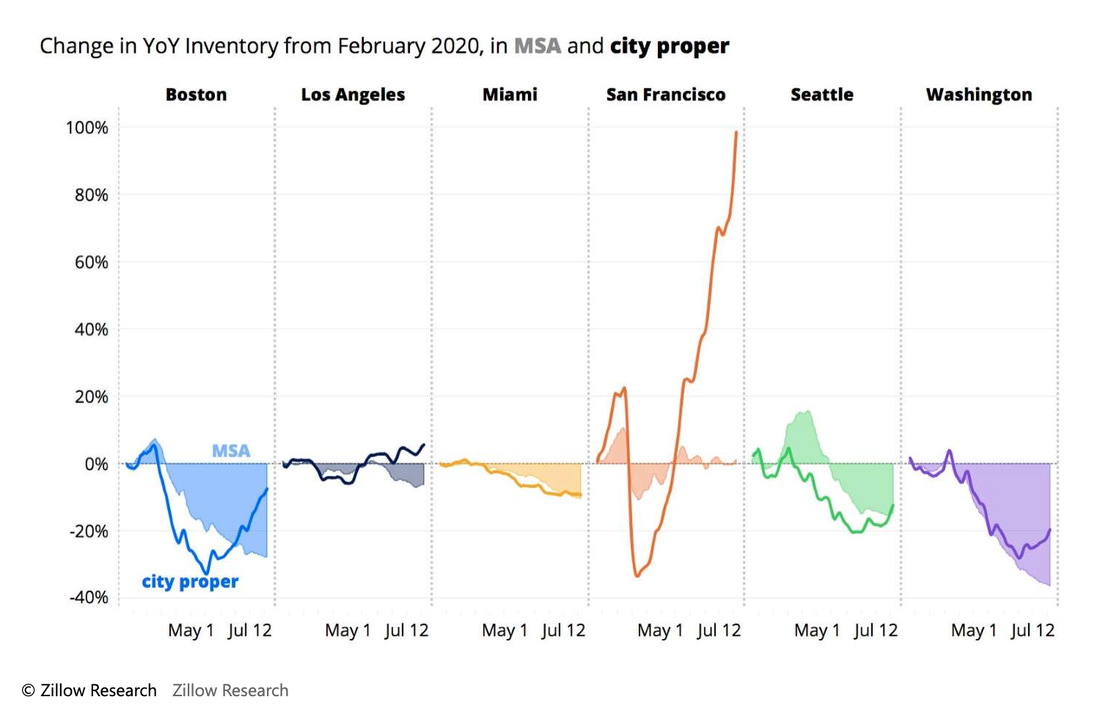

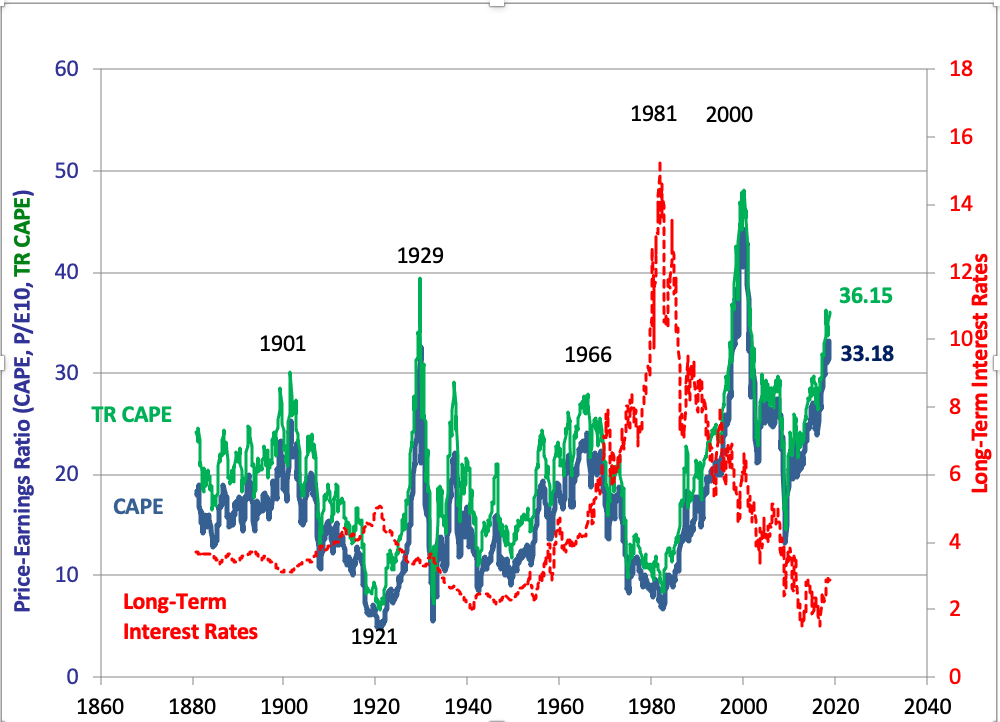

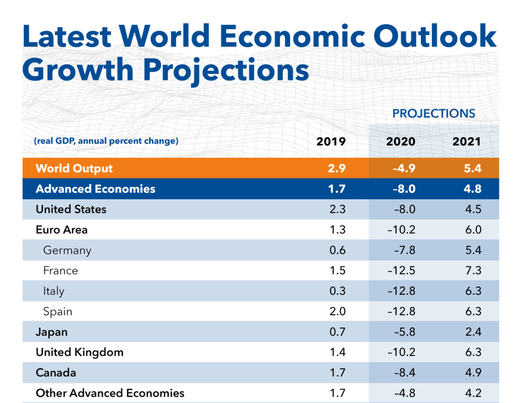

Below is an excerpt of my conversation with Kathy Jones. You can watch the complete interview with Kathy A. Jones on my channel at YouTube.com/NataliePace. Natalie Pace: 2Q 2020 saw the worst economic GDP contraction in recorded history (since at least 1974), at -32.9%. In February and March, the financial markets had frozen up. Even Treasury bills were illiquid. The Federal Reserve Board printed over $3 trillion to prevent a complete financial meltdown, and pushed the public debt up to $26.6 trillion in the bargain. What’s safe in that environment? KAJ: U.S. treasuries are safe. If you hold them to maturity, you’ll get your principal back. I don’t think the U.S. government is going to default on that. NP: The yield on Treasury bills is so low. Who wants to get locked into 1% yield or less, when that barely covers the expenses in many funds? Also, in March, even Treasury bills were illiquid. KAJ: You could see depreciation in [treasuries] between the time you invest and the time they mature. One thing to do is to shorten the maturity or the duration. The longer the term, the more the risk of rates rising and seeing a price decline. With short term, you still have that safety and liquidity, but you’re not taking interest rate risk. NP: Do you think there is a risk of downgrades in the municipal bond space? States and cities have been hit hard with pandemic-related expenses and a massive drop in tax income. KAJ: We do think there is risk of downgrades. I’m worried about the state and local governments. They’re under a tremendous amount of stress from the pandemic. They’re losing tax revenue. They bear a lot of the brunt of the cost of this recovery, particularly with firefighters and hospitals. We suggest that investors focus on the higher-rated bonds, both in corporate and municipal bonds. NP: Most people are not aware of the leverage in the corporate space. More than half of the S&P500 is rated at speculative (junk) or just one downgrade away from junk. Do investors have to look more closely at their corporate bond funds and holdings? KAJ: In the corporate bond market, you want to stay in the A-rated space. Maybe a few BBBs, but you don’t want to get too committed to that space because if they get downgraded they end up in the junk bond space. When a bond gets downgraded, the price will gap down. There is a potential for the company to cascade into a default. Make sure there is not too much debt to repay, and that they are not a business that is really harmed by the pandemic, like tourism or retail. Industries that have been hurt by the pandemic are at risk of a downgrade. NP: What happens in a downgrade? KAJ: Things go down a lot faster than they go up. Know what you own. You want to understand what the dynamics and risks are. Liquidity can disappear really quickly. If you can’t sell your bond at a reasonable price in a reasonable amount of time if you need the money, that can put you in a bad place. NP: There’s a Wall Street aphorism: “Never reach for yield.” How relevant is this today? KAJ: I’m seeing suggestions that people should veer out of Treasuries and other safe, liquid assets and go into higher yielding assets. That’s not a terrible idea, except that most of those assets don’t have the liquidity that safe assets do. If you tie your money up in private equities or other alternative investments, you may have trouble getting that money out when you need it. NP: The Federal Reserve Board has been purchasing bonds and even junk bond ETFs, leading those to trade back near the highs they were at in February, before the pandemic. Do investors need to be more cautious with these speculative issues? KAJ: The market is acting like they are safer than they are. The Feds intended to make sure that the junk bond market had liquidity. It had frozen up. However, we can still see bankruptcies and defaults in there. Know what you own. Be careful. As long as the music keeps playing, people want to keep dancing. You don’t want to be the one left on the dance floor when the music stops. NP: In a recent blog, you talked about how a weaker dollar might benefit emerging market bonds. Please talk a little about that. KAJ: The dollar is poised to move a bit lower from here. That is typically good for emerging market bonds. They are quite volatile, and there are a lot of countries that are still feeling the pain of the pandemic. If you’re willing to take the risk in an emerging market ETF that is broadly diversified, they should be at a point in the cycle where they start to benefit. Argentina, Turkey and South Africa are places where you might not want to be involved. Typically, a diversified ETF or managed fund will give you exposure to a broad range of countries, so that you are not susceptible to a loss in one or two bonds. NP: We’ve seen mutual fund redemption suspensions, mostly in European funds. Should investors be concerned that they will be locked out of access to their money? KAJ: The fund can build in different provisions in their legal documents. It’s one thing to watch for. It’s a very uncomfortable feeling when you can’t get your money when you want to. Sometimes it’s not the worst thing. People panic and sell into an illiquid market. The gates can prevent that from happening. NP: Is the U.S. at risk of a credit downgrade? KAJ: We’ve been put on notice by a couple of the rating agencies. We are running these big deficits. It’s one thing to run a deficit in a recession. However, there doesn’t seem to be the political will to deal with that or make a plan. The rating agencies are telling us that if we don’t come up with a plan or show some concern, they’re going to downgrade us. NP: It sounds like now is a good time to review your financial plan and make sure that you are safe, protected and properly diversified. KAJ: These are difficult times for people. Sit down and look at your portfolio. Ask yourself, “What made me uncomfortable in March? Do I want to change my allocation so that I’m more comfortable? Do I really understand how much risk I am taking on?” Have some cash on hand, so that you are covered if you get laid off or have a problem that needs to get addressed. Now is a great time to do this. The markets are doing better. Things are calming down. You can watch the complete interview with Kathy A. Jones on my channel at YouTube.com/NataliePace. Other Blogs of Interest China's Tesla (Nio). 2Q Sales Soar. Why Are You Still Renting? (Errr. There is More Than This to Consider!) MedMen's Turnaround Plan Attracts A-List Board Members. Wealth Myths That Keep You Poor. Prosperity Truths That Make You Rich. Protecting Your Wealth and Home in a Recession. Technology and Silver are Golden. The Economy Contracts 32.9% in the 2nd Quarter of 2020. Real Estate: Feeling Equity Rich? Make Sure That Feeling Isn't Fleeting. Airline Revenue Plunges 86%. 10 Questions for College Success Bank Earnings Season. Crimes. Cronyism. Speculation. Real Estate Solutions for a Post-Pandemic World. Copper and Chile Update. Gold Soars. Some Gold Funds Tank. Will the Facebook Ad Boycott De-FANG Stocks? Why Did My Cannabis Stock Go Down? Which Countries Are Hot in a Global Pandemic? Is Your Financial Advisor Good at Navigating Stormy Seas? $10 Avocados, Lies, Damn Lies, Statistics & Wall Street Secrets. It's Never a Crash. Work From Home and Intergenerational Housing. Biotech Races for a Coronavirus Cure. Are You Worried About Money? May is a Good Time for Rebalancing. Is FDIC-Insured Cash at Risk of a Bank Bail-in Plan? Why Did my Bonds Lose Money? Cannabis Update. Recession Proof Your Life. Free Videocon Monday, May 10, 2020. The Recession will be Announced on July 30, 2020. Apple Reports Terrible Earnings. We Are in a Recession. Unemployment, Rising Stocks. What's Going On? 8 Money Myths, Money Pits, Scams and Conspiracy Theories. 21st Century Solutions for Protecting Your Home, Nest Egg & Job. Wall Street Insiders are Selling Like There is No Tomorrow. Why Are My Bonds Losing Money? Tomorrow is Going to be Another Tough Day. Price Matters. Stock Prices are Still Too High. Should You Ride Things Out? 7 Recession Indicators Corona Virus Update. The Bank Bail-in Plan on Your Dime. NASDAQ is Up 6X. CoronaVirus: Which Companies and Countries Will be Most Impacted. Is Tesla Worth GM and Ford Combined. Artificial Intelligence is on Fire. Is it Time to Buy S'More? Take the Retirement Challenge. 2020 Investor IQ Test. Answers to the 2020 Investor IQ Test. The Cannabis Capital Crunch and Stock Meltdown. Does Your Commute Pollute More Than Planes? Are Health Care Costs Killing Your Budget? 2020 Crystal Ball. The Benefits of Living Green. Featuring H.R.H. The Prince of Wales' Twin Eco Communities. What Love, Time and Charity Have to do with our Commonwealth. Interview with MacArthur Genius Award Winner Kevin Murphy. Unicorns Yesterday. Fairy Tales Today. IPO Losses Top $100 Billion. Price Matters. Will There be a Santa Rally? It's Up to Apple. Harness Your Emotions for Successful Investing. What the Ford Downgrade Means for Main Street. The Dow Dropped Over 1000 Points Do We Talk Ourselves into Recessions? Interview with Nobel Prize Winning Economist Robert J. Shiller. Ford is Downgraded to Junk. Gold Mining ETFs Have Doubled. The Gold Bull Market Has Begun. The We Work IPO. The Highs and Hangovers of Investing in Cannabis. Recession Proof Your Life. What's Your Exit Strategy? It's Time To Do Your Annual Rebalancing. Are You Suffering From Buy High, Sell Low Mentality? Financial Engineering is Not Real Growth. The Zoom IPO. Uber vs. Lyft. Which IPO Will Drive Returns? Boeing Cuts 737 Production by 20%. The Lyft IPO Hits Wall Street. Should you tak Cannabis Doubles. Did you miss the party? 12 Investing Mistakes The High Cost of Free Advice. 2018 Was the Worst December Since the Great Depression. Russia Dumps Treasuries and Buys Gold OPEC and Russia Cut Oil Production. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable. However, NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors.  About Natalie Pace Natalie Wynne Pace is an Advocate for Sustainability, Financial Literacy & Women's Empowerment. She has been ranked as a No. 1 stock picker, above over 835 A-list pundits, by an independent tracking agency (TipsTraders). The ABCs of Money remained at or near the #1 Investing Basics e-book on Amazon for over 3 years (in its vertical), with over 120,000 downloads and a mean 5-star ranking. The 3rd edition of The ABCs of Money was released in 2020. Natalie Pace's easy as a pie chart nest egg strategies earned gains in the last two recessions and have outperformed the bull markets in between. That is why her Investor Educational Retreats, books and private coaching are enthusiastically recommended by Nobel Prize winning economist Gary S. Becker, TD AMERITRADE chairman Joe Moglia, Kay Koplovitz and many Main Street investors who have transformed their lives using her Thrive Budget and investing strategies. Click to view a video testimonial from Nilo Bolden. Tesla surprised investors with its resilience in the 2nd quarter of 2020, delivering 90,987 vehicles in the quarter, down just 4,213 from the same quarter last year. Tesla’s revenue was down only 5% year over year. Considering this is one of the most unprecedented recessions we’ve seen in history, the demand and delivery are both impressive. When you compare Tesla to Ford and General Motors, which saw revenue sink by half or more, the 2Q 2020 performance of Musk’s clean energy company seems almost too good to be true. Even Toyota Motors saw revenue slide by 40% year over year in the 2nd quarter of 2020. Meanwhile, China’s Nio, a Tesla electric vehicle competitor, reported an increase of 145% in revenue, from USD$218 million to USD$526.4 million. Nio delivered 10,331 vehicles in the 2nd quarter of 2020, compared to 3,553 in 2Q 2019 and 3,838 in 1Q 2020. Nio’s net loss in 2Q 2020 was -$166.5 million, with $1.6 billion cash on hand. Clearly China’s new EV manufacturer, which prices its vehicles aggressively lower than Tesla, is gaining in popularity. Tesla is still the EV leader in China, with 11,041 Model 3’s sold in July of 2020. However, Nio’s challenge is something that Tesla is surely taking notice of. A Spate of SPACs Nio is proving to be quite different from the spate of EV companies that have entered the stock market through a Special Purpose Acquisition Company (SPAC). Fisker, Lordstown and Nikola are seeing their share prices soar, largely through investor FOMO (Fear of Missing Out) rather than car sales. Fisker went bankrupt in 2013 after failing to make a dent in Tesla’s market. Apollo is betting that the company can perform better this time around, though launching the IPO SPAC in the middle of a recession isn’t the best strategy for success. Lordstown, a GM-backed EV truck, won’t have its first full year of sales until 2022. Nikola’s market value is $16 billion, despite having no sales or revenue to date. 3Q 2020 Earnings So, how will the 3rd quarter of 2020 look for auto manufacturers? For the legacy brands like Toyota, GM and Ford, 2Q 2020 was a disaster. The 3Q earnings season will start in October of 2020. If we look back to the Great Recession as an indicator of what happens to car sales in a recession, we see that even the hottest company of the day (Toyota and hybrids) saw revenue drop by 23% in 2009, from 2008. GM & Chrysler both declared bankruptcy in 2009. Toyota’s stock dropped by more than half. GM & Chrysler’s stock became worthless. So, will the 3rd quarter of 2020 hit EVs, including Tesla and Nio, hard? We won’t get our first peek into how the 3rd quarter looks for sales until Tesla’s deliveries report the first week of October. However, perusing the lithium miners’ earnings reports provides some context. While the overall positive trend for EVs is likely to continue once we get past the current economic crisis, Livent Corporation reported on August 19, 2020 that lithium demand was weak as “customers delay planned orders until later in the year.” Livent’s revenue was down 43% year over year in the 2nd quarter of 2020. Albermarle noted that “We expect the impact of low OEM automotive production to be felt more acutely in Q3 2020 [in lithium].” Car Buyers How will Work from Home, Stay at Home Orders, COVID-19, high unemployment and the current recession affect auto purchases in the 3rd quarter of 2020? The New York Federal Reserve Bank reported that there was $1.43 trillion in auto loan debt in the 2nd quarter of 2020. The delinquency rate was quite low at 2.26%. However, this statistic could be rather deceiving, due to the moratorium on collections going on. “Protections afforded to American consumers through the CARES Act have prevented large-scale delinquency from appearing on credit reports and damaging future credit access,” said Joelle Scally, Administrator of the Center for Microeconomic Data at the New York Fed. “However, these temporary relief measures may also mask the very real financial challenges that Americans may be experiencing as a result of the COVID-19 pandemic and the subsequent economic slowdown.” China appears to have arrested the current pandemic. The IMF is predicting that the Chinese economy will produce 1% GDP growth in 2020, while the rest of the world sees rates of contraction never before seen. The U.S. real GDP is predicted to contract by -8% in 2020, with Europe contracting in the -10% range. Price Matters It’s clear from the 2Q 2020 earnings reports that EVs are far more popular than old-school gas guzzlers. However, even if Nio continues its dominance in sales growth and Tesla continues to weather the storm, you are likely to be buying high if you purchase either stock at today’s prices. Most stock prices go down in a recession – even the stock of great companies. Tesla had annual sales of $24.6 billion, with a loss of $862 million in 2019. The company was valued at $350 billion on August 21, 2020. That is a higher valuation than Toyota, GM & Ford combined. Toyota, GM & Ford were all profitable in 2019, and their combined sales were over half a trillion. Tesla's current price-earnings ratio is over 1000. The current stock market rally is built on hope and forbearance policies, not real growth. It’s important to remember that the U.S. 2Q 2020 GDP contraction was the worst since at least 1974 (when the data began to be collected and reported), at -32.9%. Bottom Line Nio’s entry into the electric vehicle space in China is notable. So far, the company seems to be making all the right moves. Nio ranked highest in China’s New-Vehicle Quality Experience Index, conducted by J.D. Power in July of 2019. The company’s cars offer luxury and affordability, coming in far lower-priced than Tesla, while also qualifying for government subsidies to help Chinese buyers with the purchase. Nio’s board boasts of executives with ties to NetEase and TenCent Holdings. Nio (meaning blue skies) could be the car company to watch in the months and years to come, and is on my stock shopping list, waiting for a better price. (Special shout-out to Mitchell for finding Nio at our Oct. 2019 Retreat!) If you're interested in learning how to pick stocks from a No. 1 stock picker, and in learning essential investing tools, join me at our Oct. 3-5, 2020 Investor Educational Retreat. Click on the banner ad below for additional information on the Oct. 3-5, 2020 Online Financial Empowerment Retreat. Families receive a discount for attending together. Call 310-430-2397 or email [email protected] for to get rates. "Many people, including educated men and women, often get into trouble when they neglect to follow simple and fundamental rules of the type provided [by Natalie]. This is why I recommend them with enthusiasm." Professor Gary S. Becker. Dr. Becker won the 1992 Nobel Prize in economics for his theories on human "College students need this information before they get their first credit card. Young adults need it before they buy their first home. Empty nesters can use the information to downsize to a sustainable lifestyle, before they get into trouble." Joe Moglia, Chairman, TD AMERITRADE. Other Blogs of Interest Why Are You Still Renting? (Errr. There is More Than This to Consider!) MedMen's Turnaround Plan Attracts A-List Board Members. Wealth Myths That Keep You Poor. Prosperity Truths That Make You Rich. Protecting Your Wealth and Home in a Recession. Technology and Silver are Golden. The Economy Contracts 32.9% in the 2nd Quarter of 2020. Real Estate: Feeling Equity Rich? Make Sure That Feeling Isn't Fleeting. Airline Revenue Plunges 86%. 10 Questions for College Success Bank Earnings Season. Crimes. Cronyism. Speculation. Real Estate Solutions for a Post-Pandemic World. Copper and Chile Update. Gold Soars. Some Gold Funds Tank. Will the Facebook Ad Boycott De-FANG Stocks? Why Did My Cannabis Stock Go Down? Which Countries Are Hot in a Global Pandemic? Is Your Financial Advisor Good at Navigating Stormy Seas? $10 Avocados, Lies, Damn Lies, Statistics & Wall Street Secrets. It's Never a Crash. Work From Home and Intergenerational Housing. Biotech Races for a Coronavirus Cure. Are You Worried About Money? May is a Good Time for Rebalancing. Is FDIC-Insured Cash at Risk of a Bank Bail-in Plan? Why Did my Bonds Lose Money? Cannabis Update. Recession Proof Your Life. Free Videocon Monday, May 10, 2020. The Recession will be Announced on July 30, 2020. Apple Reports Terrible Earnings. We Are in a Recession. Unemployment, Rising Stocks. What's Going On? 8 Money Myths, Money Pits, Scams and Conspiracy Theories. 21st Century Solutions for Protecting Your Home, Nest Egg & Job. Wall Street Insiders are Selling Like There is No Tomorrow. Why Are My Bonds Losing Money? Tomorrow is Going to be Another Tough Day. Price Matters. Stock Prices are Still Too High. Should You Ride Things Out? 7 Recession Indicators Corona Virus Update. The Bank Bail-in Plan on Your Dime. NASDAQ is Up 6X. CoronaVirus: Which Companies and Countries Will be Most Impacted. Is Tesla Worth GM and Ford Combined. Artificial Intelligence is on Fire. Is it Time to Buy S'More? Take the Retirement Challenge. 2020 Investor IQ Test. Answers to the 2020 Investor IQ Test. The Cannabis Capital Crunch and Stock Meltdown. Does Your Commute Pollute More Than Planes? Are Health Care Costs Killing Your Budget? 2020 Crystal Ball. The Benefits of Living Green. Featuring H.R.H. The Prince of Wales' Twin Eco Communities. What Love, Time and Charity Have to do with our Commonwealth. Interview with MacArthur Genius Award Winner Kevin Murphy. Unicorns Yesterday. Fairy Tales Today. IPO Losses Top $100 Billion. Price Matters. Will There be a Santa Rally? It's Up to Apple. Harness Your Emotions for Successful Investing. What the Ford Downgrade Means for Main Street. The Dow Dropped Over 1000 Points Do We Talk Ourselves into Recessions? Interview with Nobel Prize Winning Economist Robert J. Shiller. Ford is Downgraded to Junk. Gold Mining ETFs Have Doubled. The Gold Bull Market Has Begun. The We Work IPO. The Highs and Hangovers of Investing in Cannabis. Recession Proof Your Life. What's Your Exit Strategy? It's Time To Do Your Annual Rebalancing. Are You Suffering From Buy High, Sell Low Mentality? Financial Engineering is Not Real Growth. The Zoom IPO. Uber vs. Lyft. Which IPO Will Drive Returns? Boeing Cuts 737 Production by 20%. The Lyft IPO Hits Wall Street. Should you tak Cannabis Doubles. Did you miss the party? 12 Investing Mistakes The High Cost of Free Advice. 2018 Was the Worst December Since the Great Depression. Russia Dumps Treasuries and Buys Gold OPEC and Russia Cut Oil Production. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable. However, NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors.  About Natalie Pace Natalie Wynne Pace is an Advocate for Sustainability, Financial Literacy & Women's Empowerment. She has been ranked as a No. 1 stock picker, above over 835 A-list pundits, by an independent tracking agency (TipsTraders). The ABCs of Money remained at or near the #1 Investing Basics e-book on Amazon for over 3 years (in its vertical), with over 120,000 downloads and a mean 5-star ranking. The 3rd edition of The ABCs of Money was released in 2020. Natalie Pace's easy as a pie chart nest egg strategies earned gains in the last two recessions and have outperformed the bull markets in between. That is why her Investor Educational Retreats, books and private coaching are enthusiastically recommended by Nobel Prize winning economist Gary S. Becker, TD AMERITRADE chairman Joe Moglia, Kay Koplovitz and many Main Street investors who have transformed their lives using her Thrive Budget and investing strategies. Click to view a video testimonial from Nilo Bolden. I recently saw an ad that was paid for by a mortgage broker-salesman. It read, “Why are you still renting, when you don’t have to put anything down to buy a home and interest rates are historically low?” This is a prime example of: “Grade your guru before you listen to anything she says.” The mortgage salesman wants you to buy a home, so that she can sell you a mortgage. The same thing happened in 2006 and 2007, and we all know how that story ended (in the Great Recession). If low interest rates and no-down home purchases were the only considerations, then of course, you should run out and buy a home now – particularly if your mortgage is lower than your rent. However, those aren’t the only factors to successful home ownership. And if you fall for the bait, then you could be in serious financial trouble – a debtor’s prison of sorts – for the next decade. So, be sure to apply the seven additional home purchase criteria below before jumping in. 7 Considerations that You Should Also Factor in Before You Buy a Home in 2020 Never Buy High Mortgage Delinquencies Portend a Drop in Prices Home Price Trends in Recessions The Thrive Budget The 4 D’s The Shadow Inventory Interest Rates And here is a little color on each point. Never Buy High Real estate prices are higher than ever, and unaffordable (i.e. costs more than 30% of your income) in 68% of U.S. cities. If you buy high and the price drops, you have trouble on several fronts. Your FICO score drops because your debt now exceeds your asset. Your ability to sell is wiped out, which means you’re locked into where you are, even if a better or more affordable opportunity, including a better career, arises elsewhere. You can’t refinance or get a HELOC, and are hampered on receiving any funds for other needs or ventures, due to owing more than your home is worth. This means you’ll have to borrow on credit cards, at usurious rates, until that last line of credit sinks under a mountain of debt. As you can see in the chart below, if you live in Boulder, you’d need to devote half of your salary to your home purchase. That’s unsustainable. In places like Los Angeles, New York City and San Francisco, housing unaffordability is absolutely eye-popping, costing the average worker 73-110% of her salary (source: AttomData). Mortgage Delinquencies Portend a Drop in Prices The FHA delinquency rate just hit the highest it has ever been since the surveys began in 1979, at 15.65%. This is with a moratorium on foreclosures and evictions. However, the freeze-out will not last forever. High unemployment makes it difficult for people to pay their rent and mortgages. Many people are solving that problem with intergenerational housing. If you buy now, and a boatload of your neighbors lose or give up their homes, then the home prices in your area will fall. As Rick Sharga, the executive vice president at RealtyTrac said in a press release on August 13, 2020, “It’s inevitable that there will be a significant increase in foreclosures once these moratoria have expired, although it’s unlikely that we’ll see default rates reach the levels we saw during the Great Recession.” Home prices are already dropping in San Francisco (4.9%) and New York (4.2%) (source: Zillow). San Francisco has a flood of new listings, putting inventory up 96% year over year. Home Price Trends in Recessions In 2006, the national median existing home sales price hit an all-time high of $221,900. By 2011, it had dropped by 25% to $166,100. Those cities with the greatest speculation and price increases, like Las Vegas, Stockton, Miami and Phoenix, saw their home prices implode by half or more. The largest drop was between 2006 and 2009. However, the low wasn’t hit until 2011. FYI: In June of this year (2020), home prices were back to a median nationwide high of $295,300 (source: The National Association of Realtors). Wages have not kept apace with housing costs, which is why unaffordability has become a buzz word all over the land. The Thrive Budget The mortgage and real estate broker-dealers are not looking out for your ability to stay in your home. They need the sale (particularly in a recession), and will figure out creative solutions to any money challenge that presents the sale – even if it is ultimately toxic for your financial health. Earlier this month, I received seven phone calls from a mortgage broker-salesman in one day! (We saw this in spades in pre-Great Recession.) It is your responsibility to make sure that you purchase a home you can afford (at a reasonable price). If you want to thrive, you’ll need to adopt a budget that allows you room for things other than just basic needs. Basically, you must purchase a home that you can easily afford, and amounts to less than 30% of your income. Being property rich and cash poor is not just a drudge. It is also perilous. Any unpredictable expense could be the tipping point that puts everything you own at risk. Read the Thrive Budget section of The ABCs of Money for additional information. Visit the home page at NataliePace.com to personalize your own Thrive Budget using our free web apps. The 4 D’s Death. Divorce. Disaster. Depression. These are the 4-D’s that you always want to be aware of in real estate. They make a seller desperate, which creates opportunities for the buyer. Two of these D’s – disaster and depression – are already in play. It’s early in the recession, with the foreclosure and eviction moratoria in play until the end of the year. So, you might not be hearing much about just how precarious the economy is – particularly if you are swimming in the news of the S&P500 hitting a new high. However, as elevated levels of unemployment and underemployment continue, and once the bailout and freeze-out are lifted (or the landlords go under and banks start reporting losses), the false veneer that everything is okay will crumble. Therein lies disaster for the person who hasn’t been paying their rent or mortgage, and opportunity for the buyer who wishes to own their own home at a more affordable price. The Shadow Inventory As I mentioned above, it typically takes years for real estate prices to bottom out. However, if you are willing to shop in the shadow inventory, then you might start finding some bargains earlier. The shadow inventory can often offer up to a 30% discount off of the MLS (multiple listing services). So, what is shadow inventory? Most homes that are bank-owned, pre-foreclosure, foreclosed on or up for auction are not listed on the MLS. I would also include the 3.4 million homes that are currently severely underwater (i.e. where the home mortgage is 25% or more than the value of the home) in the shadow inventory. Any homeowner who has a mortgage that is substantially higher than the value of their home right now is in a very bad spot if real estate prices weaken. By educating yourself and the underwater homeowner about possible exit routes and a better plan going forward, you might help them to save their lifeboat – their retirement plans. Without a good strategy, the underwater homeowner is at high risk of draining their retirement plans and then getting foreclosed on any way. Interest Rates Interest rates are at a historic low, and they are predicted to stay at zero for at least two years. According to the Federal Reserve Board’s financial projections, the Fed Fund rate should remain at or near zero through 2022. The longer run projection for the rate is 2.5%. As the FOMC wrote in a press release on July 29, 2020, “The Committee expects to maintain this target range [of 0 to 1/4 percent] until it is confident that the economy has weathered recent events and is on track to achieve its maximum employment and price stability goals.” Inflation could change the game on this. However, so far there are few signs of distress. So, there doesn’t have to be an interest rate risk rush to buy high right now, just to catch historically low interest rates. Bottom Line Being upside down on the mortgage and owing more for your home then it is worth can present a decade of financial hell for you. On the other hand, if you happen to find yourself on the right side of all of the above considerations, then now could be an excellent time to buy. In most markets, prices are at or near all-time highs and are unaffordable to the people who live in the area. The patient buyer will be happy she practiced wisdom and a solid strategy, and waited for (or created) the right opportunity, rather than taking the bait of the real estate or mortgage broker-salesmen and buying at an all-time high. If you're interested in investing in real estate or in buying a new home, learn essential investing tools at our Oct. 3-5, 2020 Investor Educational Retreat. Click on the banner ad below for additional information on the Oct. 3-5, 2020 Online Financial Empowerment Retreat. Families receive a discount for attending together. Call 310-430-2397 or email [email protected] for to get rates. "Many people, including educated men and women, often get into trouble when they neglect to follow simple and fundamental rules of the type provided [by Natalie]. This is why I recommend them with enthusiasm." Professor Gary S. Becker. Dr. Becker won the 1992 Nobel Prize in economics for his theories on human "College students need this information before they get their first credit card. Young adults need it before they buy their first home. Empty nesters can use the information to downsize to a sustainable lifestyle, before they get into trouble." Joe Moglia, Chairman, TD AMERITRADE. Other Blogs of Interest MedMen's Turnaround Plan Attracts A-List Board Members. Wealth Myths That Keep You Poor. Prosperity Truths That Make You Rich. Protecting Your Wealth and Home in a Recession. Technology and Silver are Golden. The Economy Contracts 32.9% in the 2nd Quarter of 2020. Real Estate: Feeling Equity Rich? Make Sure That Feeling Isn't Fleeting. Airline Revenue Plunges 86%. 10 Questions for College Success Bank Earnings Season. Crimes. Cronyism. Speculation. Real Estate Solutions for a Post-Pandemic World. Copper and Chile Update. Gold Soars. Some Gold Funds Tank. Will the Facebook Ad Boycott De-FANG Stocks? Why Did My Cannabis Stock Go Down? Which Countries Are Hot in a Global Pandemic? Is Your Financial Advisor Good at Navigating Stormy Seas? $10 Avocados, Lies, Damn Lies, Statistics & Wall Street Secrets. It's Never a Crash. Work From Home and Intergenerational Housing. Biotech Races for a Coronavirus Cure. Are You Worried About Money? May is a Good Time for Rebalancing. Is FDIC-Insured Cash at Risk of a Bank Bail-in Plan? Why Did my Bonds Lose Money? Cannabis Update. Recession Proof Your Life. Free Videocon Monday, May 10, 2020. The Recession will be Announced on July 30, 2020. Apple Reports Terrible Earnings. We Are in a Recession. Unemployment, Rising Stocks. What's Going On? 8 Money Myths, Money Pits, Scams and Conspiracy Theories. 21st Century Solutions for Protecting Your Home, Nest Egg & Job. Wall Street Insiders are Selling Like There is No Tomorrow. Why Are My Bonds Losing Money? Tomorrow is Going to be Another Tough Day. Price Matters. Stock Prices are Still Too High. Should You Ride Things Out? 7 Recession Indicators Corona Virus Update. The Bank Bail-in Plan on Your Dime. NASDAQ is Up 6X. CoronaVirus: Which Companies and Countries Will be Most Impacted. Is Tesla Worth GM and Ford Combined. Artificial Intelligence is on Fire. Is it Time to Buy S'More? Take the Retirement Challenge. 2020 Investor IQ Test. Answers to the 2020 Investor IQ Test. The Cannabis Capital Crunch and Stock Meltdown. Does Your Commute Pollute More Than Planes? Are Health Care Costs Killing Your Budget? 2020 Crystal Ball. The Benefits of Living Green. Featuring H.R.H. The Prince of Wales' Twin Eco Communities. What Love, Time and Charity Have to do with our Commonwealth. Interview with MacArthur Genius Award Winner Kevin Murphy. Unicorns Yesterday. Fairy Tales Today. IPO Losses Top $100 Billion. Price Matters. Will There be a Santa Rally? It's Up to Apple. Harness Your Emotions for Successful Investing. What the Ford Downgrade Means for Main Street. The Dow Dropped Over 1000 Points Do We Talk Ourselves into Recessions? Interview with Nobel Prize Winning Economist Robert J. Shiller. Ford is Downgraded to Junk. Gold Mining ETFs Have Doubled. The Gold Bull Market Has Begun. The We Work IPO. The Highs and Hangovers of Investing in Cannabis. Recession Proof Your Life. What's Your Exit Strategy? It's Time To Do Your Annual Rebalancing. Are You Suffering From Buy High, Sell Low Mentality? Financial Engineering is Not Real Growth. The Zoom IPO. Uber vs. Lyft. Which IPO Will Drive Returns? Boeing Cuts 737 Production by 20%. The Lyft IPO Hits Wall Street. Should you tak Cannabis Doubles. Did you miss the party? 12 Investing Mistakes The High Cost of Free Advice. 2018 Was the Worst December Since the Great Depression. Russia Dumps Treasuries and Buys Gold OPEC and Russia Cut Oil Production. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable. However, NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors.  About Natalie Pace Natalie Wynne Pace is an Advocate for Sustainability, Financial Literacy & Women's Empowerment. She has been ranked as a No. 1 stock picker, above over 835 A-list pundits, by an independent tracking agency (TipsTraders). The ABCs of Money remained at or near the #1 Investing Basics e-book on Amazon for over 3 years (in its vertical), with over 120,000 downloads and a mean 5-star ranking. The 3rd edition of The ABCs of Money was released in 2020. Natalie Pace's easy as a pie chart nest egg strategies earned gains in the last two recessions and have outperformed the bull markets in between. That is why her Investor Educational Retreats, books and private coaching are enthusiastically recommended by Nobel Prize winning economist Gary S. Becker, TD AMERITRADE chairman Joe Moglia, Kay Koplovitz and many Main Street investors who have transformed their lives using her Thrive Budget and investing strategies. Click to view a video testimonial from Nilo Bolden. MedMen’s turnaround plan has been very impressive, attracting A-list board members and buy-in from landlords and lenders. Will it be enough to keep the company from having to declare bankruptcy? A-List Board Members MedMen is now under the aegis of interim CEO Tom Lynch, who has a background in restructuring companies out of court – something he did as the chairman and CEO of Frederick’s of Hollywood Group. Since Mr. Lynch has taken the reins, the MedMen board has brought in Mel Elias, the former president and CEO of the Coffee Bean & Tea Leaf; Errol Schweizer, former VP of Grocery at Whole Foods Market; and Niki Christoff, SVP of Strategy and Government Relations at Salesforce, among others. This level of board support bodes well for an out-of-court turnaround for this cannabis retailer. Employees are still scoring the management low on Glassdoor. However, the current leadership hasn’t really had the reins long enough for better reviews to start showing up. In fact, the new CEO isn’t even listed there yet. Lender and Landlord Support On July 3, 2020, MedMen announced that their Turnaround Plan had received support from their landlords and lenders. According to the press release, “The Plan will defer approximately US$32 million in cash commitments over the next 12 months and provide additional balance sheet flexibility.” According to MedMen Interim Chief Executive Officer Tom Lynch, “We believe the widespread support we have received from our lenders and landlords will allow us to continue execution of the turnaround, continue to grow our best-in-class retail operations and drive towards positive free cash flow.” The plan turns interest from cash payments into Payment-in-Kind warrants from now through March-June 2021, with a conversion rate of US$0.28-$0.34. MedMen’s share price on August 17, 2020, was US$0.165/share. 4Q 2020 and Full Year Results One thing that could weigh heavily on the turnaround plan is the 4Q and full year 2020 earnings results covering April 1, 2020, through June 30, 2020. Earnings from that period should be announced the last week of October (based upon last year’s date of Oct. 28, 2019). In the 3rd quarter 2020 earnings call on May 27, 2020, Tom Lynch said, “We're down in April overall, but have seen a steady increase since. While we're still not back to our normal levels, pre-COVID, particularly in California, we're optimistic about our ability to recapture traffic as soon as stay at home orders are lifted.” If the 4th quarter 2020 revenue comes in at $46 million, where the 3rd quarter was, then the full year revenue will be in the $180 million range – +38% over last year’s record $130 million. If the 4th quarter revenue is lower (which is likely), it will still be easy for the full year to post gains. MedMen revenue in the 4th quarter of 2019 was $42 million. Macro Trends Another factor that could weigh down MedMen’s share price in the near term is the general marketplace itself. It’s rare for recessions to have more positive than negative months on Wall Street. In 2008, only 1/3 of the months were positive performers (March, April, August and December). So far in 2020, only March has registered negative, with 86% of the months accelerating gains. While the recovering since the March 23, 2020, lows might seem like a boon for investors, when prices become too expensive, that typically portends a slide – especially in a recession. The only two times when stocks have been this expensive are in 1929 (before the Great Depression) and in 2000 (before the NASDAQ Composite Index lost 78% of its value). Liabilities MedMen had liabilities of $739 million, of which $185 million were “current” as of the 3rd quarter 2020 (May 27, 2020 press release). As of March 28, 2020, current assets totaled $123.9 million and included cash and cash equivalents of $31.8 million. The company is looking to sell their Arizona assets and licenses to beef up their cash position. CBD Beverages While all eyes are on which company will produce the Budweiser equivalent of CBD beverages, mixologists are taking it upon themselves to create their own CBD concoctions. You can get CBD beverage recipes, including a cannabis-infused lemonade, and other edible ideas on Ember, MedMen’s Cannabis and Culture online Journal. The new landlord and lender support will help with MedMen’s planned out-of-court turnaround. However, more cost cutting and increased revenue will be necessary for MedMen to get through the COVID crisis without Chapter 11 (bankruptcy) restructuring. Fortunately, interim CEO Tom Lynch has experience doing just that. In the near term, MedMen’s share price could be vulnerable to even further weakening. However, there is now evidence that an executable Turnaround Plan is already in play. MedMen's stock is high risk. However, if it works out, it will yield a high reward. If you're interested in investing in cannabis or other hot stocks, learn essential investing tools at our Oct. 3-5, 2020 Investor Educational Retreat. Click on the banner ad below for additional information on the Oct. 3-5, 2020 Online Financial Empowerment Retreat. Families receive a discount for attending together. Call 310-430-2397 or email [email protected] for to get rates. "Many people, including educated men and women, often get into trouble when they neglect to follow simple and fundamental rules of the type provided [by Natalie]. This is why I recommend them with enthusiasm." Professor Gary S. Becker. Dr. Becker won the 1992 Nobel Prize in economics for his theories on human "College students need this information before they get their first credit card. Young adults need it before they buy their first home. Empty nesters can use the information to downsize to a sustainable lifestyle, before they get into trouble." Joe Moglia, Chairman, TD AMERITRADE. Other Blogs of Interest Wealth Myths That Keep You Poor. Prosperity Truths That Make You Rich. Protecting Your Wealth and Home in a Recession. Technology and Silver are Golden. The Economy Contracts 32.9% in the 2nd Quarter of 2020. Real Estate: Feeling Equity Rich? Make Sure That Feeling Isn't Fleeting. Airline Revenue Plunges 86%. 10 Questions for College Success Bank Earnings Season. Crimes. Cronyism. Speculation. Real Estate Solutions for a Post-Pandemic World. Copper and Chile Update. Gold Soars. Some Gold Funds Tank. Will the Facebook Ad Boycott De-FANG Stocks? Why Did My Cannabis Stock Go Down? Which Countries Are Hot in a Global Pandemic? Is Your Financial Advisor Good at Navigating Stormy Seas? $10 Avocados, Lies, Damn Lies, Statistics & Wall Street Secrets. It's Never a Crash. Work From Home and Intergenerational Housing. Biotech Races for a Coronavirus Cure. Are You Worried About Money? May is a Good Time for Rebalancing. Is FDIC-Insured Cash at Risk of a Bank Bail-in Plan? Why Did my Bonds Lose Money? Cannabis Update. Recession Proof Your Life. Free Videocon Monday, May 10, 2020. The Recession will be Announced on July 30, 2020. Apple Reports Terrible Earnings. We Are in a Recession. Unemployment, Rising Stocks. What's Going On? 8 Money Myths, Money Pits, Scams and Conspiracy Theories. 21st Century Solutions for Protecting Your Home, Nest Egg & Job. Wall Street Insiders are Selling Like There is No Tomorrow. Why Are My Bonds Losing Money? Tomorrow is Going to be Another Tough Day. Price Matters. Stock Prices are Still Too High. Should You Ride Things Out? 7 Recession Indicators Corona Virus Update. The Bank Bail-in Plan on Your Dime. NASDAQ is Up 6X. CoronaVirus: Which Companies and Countries Will be Most Impacted. Is Tesla Worth GM and Ford Combined. Artificial Intelligence is on Fire. Is it Time to Buy S'More? Take the Retirement Challenge. 2020 Investor IQ Test. Answers to the 2020 Investor IQ Test. The Cannabis Capital Crunch and Stock Meltdown. Does Your Commute Pollute More Than Planes? Are Health Care Costs Killing Your Budget? 2020 Crystal Ball. The Benefits of Living Green. Featuring H.R.H. The Prince of Wales' Twin Eco Communities. What Love, Time and Charity Have to do with our Commonwealth. Interview with MacArthur Genius Award Winner Kevin Murphy. Unicorns Yesterday. Fairy Tales Today. IPO Losses Top $100 Billion. Price Matters. Will There be a Santa Rally? It's Up to Apple. Harness Your Emotions for Successful Investing. What the Ford Downgrade Means for Main Street. The Dow Dropped Over 1000 Points Do We Talk Ourselves into Recessions? Interview with Nobel Prize Winning Economist Robert J. Shiller. Ford is Downgraded to Junk. Gold Mining ETFs Have Doubled. The Gold Bull Market Has Begun. The We Work IPO. The Highs and Hangovers of Investing in Cannabis. Recession Proof Your Life. What's Your Exit Strategy? It's Time To Do Your Annual Rebalancing. Are You Suffering From Buy High, Sell Low Mentality? Financial Engineering is Not Real Growth. The Zoom IPO. Uber vs. Lyft. Which IPO Will Drive Returns? Boeing Cuts 737 Production by 20%. The Lyft IPO Hits Wall Street. Should you tak Cannabis Doubles. Did you miss the party? 12 Investing Mistakes The High Cost of Free Advice. 2018 Was the Worst December Since the Great Depression. Russia Dumps Treasuries and Buys Gold OPEC and Russia Cut Oil Production. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable. However, NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors.