|

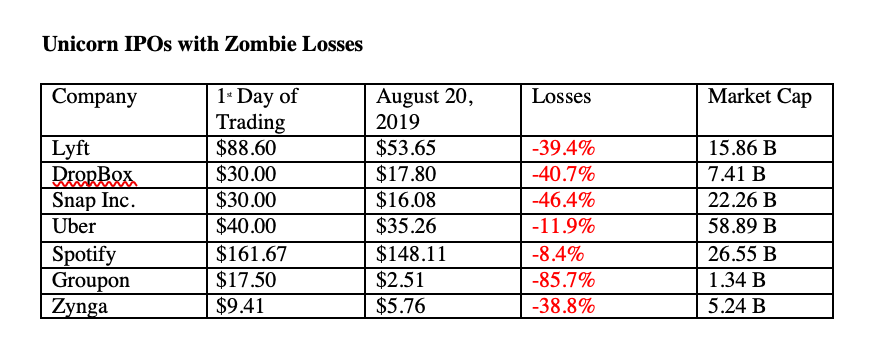

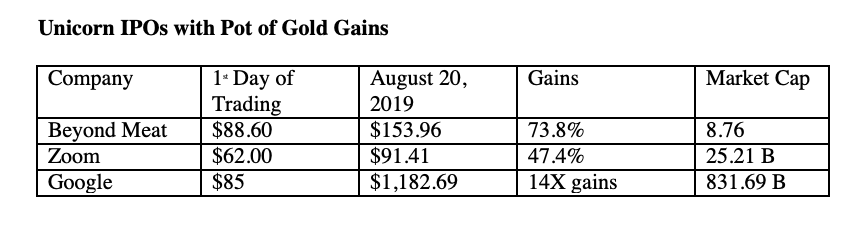

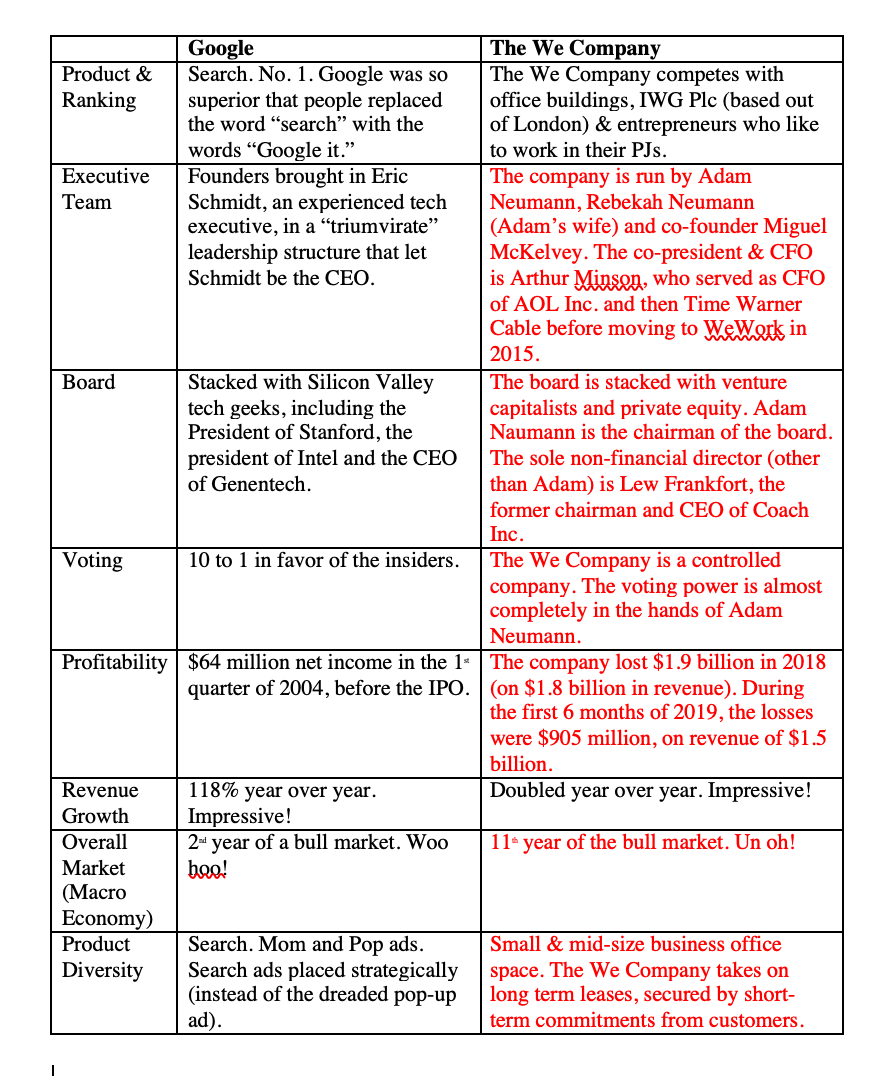

We’ve had a series of Initial Public Offerings lately that would have been better labeled as Insider Liquidity Events. We Work is another in a long series of these, which makes 2019 IPOs look a lot like 2000 all over again. The revenue growth of the We Company is amazing. Sales doubled in 2018 over 2017 and look on track to do that again in 2019. That is as long as the economy doesn’t start weakening (which it is predicted to do). The cash burn and net losses are eyepopping, at $1.9 billion in 2018 and $905 million in the first six months of 2019. Some of the success stories are inspiring, like the fact that Bird Co. launched out of a WeWork shop in Santa Monica, California. Karlie Kloss’ Coding Camp partners with WeWork to inspire teen girls to enter the technology industry. So, the company is indeed bringing a culture and community to office space in a way that companies like Boston Properties and other commercial REITs haven’t. However, the business model itself is troubling. The We Company isn’t a real estate company. In fact, WeWork’s co-founder and CEO buys real estate and leases it back to The We Company. The We Company enters into long-term lease contracts (15-years or more) with Adam Neumann (and others), but banks its own business upon short-term commitments from small and mid-size businesses. This becomes even more troubling when you consider the amount of credit card debt that is held by Americans, many of who are launching their hobby on a dream with high-interest debt. Consumer credit card debt in the U.S. is $870 million. Small companies in the U.S. are so rife with cash negative operations that Charles Schwab’s Chief Investment Strategist Liz Ann Sonders has an underweight on this area of the marketplace. WeWork promotes CEO Adam Neumann as a guru celebrity, in the same way that Apple and Facebook have capitalized upon in the past. Founder CEOs like Jobs and Zuckerberg cement the promise that visionary disrupters are best left unencumbered and highly empowered to lead the company to greatness. However, opportunist founders, like Marc Pincus and Eric Lefkofsky, who cashed out hundreds of millions before the Zynga and Groupon IPOs (respectively) give the idea a black eye. Which type of founder/CEO is Adam Neumann? Although the We Company S-1 filing claims that “the last time Adam sold any shares was October of 2017,” there has been a lot of borrowing against shares to purchase real estate, some of which is then leased back to The We Company. The Wall Street Journal reported on July 18, 2019 that Adam Neumann has cashed out $700 million in stock and loans pre-IPO. If this is true, then Neumann has cashed out far more than Pincus or Lefkofsky before him. (The We Company did not respond to an email requesting additional information on The Wall Street Journal claims.) As you can see in the chart below, companies that launch IPOs while their business is still cash negative haven’t been faring very well on Wall Street. Companies that launch their IPOs once the business is profitable fare far better. Beyond Meat is the exception of a company that was cash negative, but has had an amazing run-up this year, post IPO. With the sole exception of Zoom Video this year (and Google in 2004), the other eight IPOs listed above were cash negative when the company went public. Uber reported a 2nd quarter 2019 net loss of $5.2 billion. The We Company (WeWork) has been cash negative at least since 2016 (the earliest date reported on its IPO filing). The losses in 2018 were $1.9 billion, with $905 million lost so far in the first half of 2019. It’s easy to see the correlation between profitability and IPO success in the above charts.Here is how WeWorks fares compared to Google, when lining up management, business model, first mover advantage, disruption, etc. Click The We Company IPO joins a long list of companies trying to turn paper profits into cash on your dime, now, while the stock markets are still nice and high. (It’s difficult to launch an IPO during a recession.) Although the company’s mission/vision is touchy-feely new-agey (the annual summer camp featured Deepak Chopra), the age-old idea of a beneficent dictator appears to be more in play. Neumann holds all of the voting power, has cashed in big-time on a cash-negative company and doesn’t have enough experienced executives in the C-suite to pivot into profitability when the economic storms hit and venture capital becomes more difficult to access. Additionally, the We Company is grossly overvalued compared to its competitor IWC Plc (based out of London), which is currently profitable and paying dividends. So, the long and short of an investment in WE at this time is that it really doesn’t add up (IMHO). If you'd like to learn stock picking strategies from a #1 stock picker, join Natalie Pace in one of her investor educational retreats. (See links below.) Click to access a link to Natalie Pace's bio. Other Blogs of Interest The Highs and Hangovers of Investing in Cannabis. Recession Proof Your Life. China Takes a Bite Out of Apple Sales. Will the Dow Hit 30,000? A Check Up on the Economy Red Flags in the Boeing 2Q 2019 Earnings Report The Weakening Economy. Think Capture Gains, Not Stop Losses. Buy and Hold Works. Right? Wall Street Secrets Your Broker Isn't Telling You. Unaffordability: The Unspoken Housing Crisis in America. Are You Being Pressured to Buy a Home or Stocks? What's Your Exit Strategy? Will the Feds Lower Interest Rates on June 19, 2019? Should You Buy Tesla at a 2 1/2 Year Low? It's Time To Do Your Annual Rebalancing. Cannabis Crashes. Should You Get High Again? Are You Suffering From Buy High, Sell Low Mentality? Financial Engineering is Not Real Growth The Zoom IPO. 10 Rally Killers. Fix the Roof While the Sun is Shining. Uber vs. Lyft. Which IPO Will Drive Returns? Boeing Cuts 737 Production by 20%. Tesla Delivery Data Disappoints. Stock Tanks. Why Did Wells Fargo's CEO Get the Boot? Earth Gratitude This Earth Day. Real Estate is Back to an All-Time High. Is the Spring Rally Over? The Lyft IPO Hits Wall Street. Should you take a ride? Cannabis Doubles. Did you miss the party? 12 Investing Mistakes Drowning in Debt? Get Solutions. What's Hot in 2019? The Debt Ceiling Was Hit (Again) on March 1, 2019. How Bad Will the GDP Report Be? 2019 Investor IQ Test The State of the Union CBD Oil for Sale. The High Cost of Free Advice. Apple's Real Problem in China: Huawei. 2019 Crystal Ball. 2018 is the Worst December Ever. Will the Feds Raise Interest Rates? Should They? Learn what you're not being told in the MSM. Why FANG, Banks and Your Value Funds Are in Trouble. When the Santa Rally is a Loser, the Next Year is a Bigger Loser. Russia Dumps Treasuries and Buys Gold OPEC and Russia Cut Oil Production. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable however NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors. 27/8/2019 11:31:24 pm

Though I don't have a full understanding of this article for several reasons, I am happy to know that there is a certain growth that we can get from it! Learning about how a company works is a vague thing; especially if your interest is elsewhere. Though it's vague, it is a requirement for you to understand it especially if you are working in corporate world. It will be very hard, but understanding it could also give you better opportunities in life. Comments are closed.

|

AuthorNatalie Pace is the co-creator of the Earth Gratitude Project and the author of The Power of 8 Billion: It's Up to Us, The ABCs of Money, The ABCs of Money for College, The Gratitude Game and Put Your Money Where Your Heart Is. She is a repeat guest & speaker on national news shows and stages. She has been ranked the No. 1 stock picker, above over 830 A-list pundits, by an independent tracking agency, and has been saving homes and nest eggs since 1999. Archives

July 2024

Categories |

RSS Feed

RSS Feed