|

2024 Rebalancing Your Nest Egg IQ Test Take this 20-Question IQ Test to see how much you really know about protecting your wealth, diversifying your nest egg, adding in Shoot the Moon performance and other time-proven, 21st-Century strategies. Regular rebalancing of our nest egg is key in the 21st-Century. It is a buy low, sell high plan on auto-pilot. 2024 Rebalancing Your Nest Egg IQ Test

Answers are listed in the "Rebalancing IQ Test Answers 2024" blog at NataliePace.com. https://www.nataliepace.com/blog/ Email info @ NataliePace.com or call 310-430-2397 if you have any questions about this test, or about the answers, or if you are interested in learning time-proven, 21st Century investing, budgeting, debt reduction, home buying solutions that will transform your life. Bottom Line Buy & Hope has been riding the Wall Street rollercoaster, losing half or more in recessions, which means many people have to use the bull markets to make up losses, rather than building wealth. It’s easy to feel complacent when we hear that stocks keep hitting all-time highs, just as it is common to feel depressed in recessions. Proper diversification of an age-appropriate wealth plan that is rebalanced once, twice or three times a year is a buy low, sell high plan on auto-pilot that prompts us to do the right thing – putting us on the right side of the trade. This plan also takes the emotions out of the mix, and instead relies upon a time-proven strategy. Join us at our online June 8-10, 2024 Financial Freedom Retreat. Learn how to protect your wealth, hedge against a weaker dollar, invest and compound your gains, green your retirement plan, easy and efficacious nest egg strategies, how to get hot and diversified (including in artificial intelligence and EVs), how to evaluate IPOs and other stocks, and what's safe in a Debt World. You'll even discover how to save thousands annually with smarter big-ticket choices. Yes, it's a complete money makeover. Email [email protected] to register. Learn the 15+ things you'll master and read testimonials in the flyer on the home page at NataliePace.com. Register with friends and family to receive the best price. "Ten minutes into the first day I was already much smarter about investing than I ever thought I would be in my life and I knew I was in exactly the right place at this retreat. I am amazed at how EASY and FUN it is to make my money work for me and those I love. I think this kind of information should be compulsory in schools. I wish I'd learned this sooner." CM If you’d like an unbiased 2nd opinion on your current wealth plan, email [email protected] for pricing and information.  Join us for our Online June 8-10, 2024 Financial Freedom Retreat. Email [email protected] or call 310-430-2397 to learn more. Register with friends and family to receive the best price. Click for testimonials, pricing, hours & details.  Join us for our Restormel Royal Immersive Adventure Retreat. March 7-14, 2025. Email [email protected] to learn more. Register by May 30, 2024 to receive $200 off the regular price. Click for testimonials, pricing, hours & details. There is very limited availability, and you must register early to ensure that you get the exact room you want. This retreat includes an all-access pass to all of our online training for a full year for two and three 50-minute private, prosperity coaching sessions!  Natalie Wynne Pace is an Advocate for Sustainability, Financial Literacy & Women's Empowerment. Natalie is the bestselling author of The Power of 8 Billion: It's Up to Us and is the co-creator of the Earth Gratitude Project. She has been ranked as a No. 1 stock picker, above over 835 A-list pundits, by an independent tracking agency (TipsTraders). Her book The ABCs of Money remained at or near the #1 Investing Basics e-book on Amazon for over 3 years (in its vertical), with over 120,000 downloads and a mean 5-star ranking. The 5th edition of The ABCs of Money and the 2nd edition of Put Your Money Where Your Heart Is are the most recent releases of these books. Follow her on Instagram. Natalie Pace's easy as a pie chart nest egg strategies earned gains in the last two recessions and have outperformed the bull markets in between. That is why her Investor Educational Retreats, books and private coaching are enthusiastically recommended by Nobel Prize winning economist Gary S. Becker, TD AMERITRADE chairman Joe Moglia, Kay Koplovitz and many Main Street investors who have transformed their lives using her Thrive Budget and investing strategies. Click to view a video testimonial from Nilo Bolden. Check out Natalie Pace's Substack podcast on Apple and Spotify. Watch videoconferences and webinars on Youtube. Other Blogs of Interest Answers to the 2024 Rebalancing IQ Test. May is National Bike Month. Paris and Amsterdam are the Stars. AI, Gold & Copper are on Fire. Sunpower Doubled. Sell in May and Go Away? What About the Election? Vacations that Color Our World Forever. The Magnificent 7 Drop to the Fantastic 5 9 Inflation, Budgeting, Debt Reduction and Investing Solutions. China & Russia Double Their Gold Holdings. 2024 Investment of the Year? The Reddit IPO. Meme Stock or Snap Land? Tesla's Factory in Germany Taken Offline by Activists. Bitcoin Sets a New Record High. The Importance of Rebalancing. Beyond Meat's Shares Surge. Quaker Oats' Pesticide Problem. Stocks are Flying High. Why Aren't Mine? Cut Your Tax Bill in Half. 9 Tips. Celebrity Jet CO2. Green Washing. The Facts. Some Solutions. Copper: Essential to the Clean Energy Transition. Uh. Oh. More Bank Trouble. Are Amazon, Square and Other Tech Companies Ripping Us Off? Housing. Unaffordable. What Works? Case studies and creative solutions. Don't Reach for Yield. Closed-End Funds. 2024 Investor IQ Test. Answers to the 2024 Investor IQ Test. Apple's Woes Drag Down the Dow. The Winners & Losers of 2023. Ozempic, Magnificent 7 & Beyond. 2024 Crystal Ball. The Underperforming DJIA, Full of Fossil Fuels and Forever Chemicals. A Spectacular Year for 3 of the Magnificent 7. The Best ROI* (Almost 40%!) & 7 Life Hacks That Save Thousands. Portugal Eliminates Tax Advantages for Ex-Pats. Earn $50,000 or More in Interest. Safely. Finally. WeWork's Bankruptcy. Half-Empty Office Buildings. Problems in our Personal Wealth Plan. Solutions for Unaffordable Housing. Cruise Ships Give Freebies to Investors. Should You Take the Bait? Should You Take a Cruise? Bonds. Banks. The Treacherous Landscape of Keeping Our Money Safe. 7 Rules of Investing 13 Lifestyle Choices to Reduce Waste, Pollution & CO2 & Save a Boatload of Dough. China Bans Apple 11-Point Green Checklist for Schools. Artificial Intelligence and Nvidia's Blockbuster Earnings Report Biotech in a Post-Pandemic World 10 Wealth Secrets of Billionaires and Royals. What Happened to Cannabis? Bank of America has $100 Billion in Bond Losses (on Paper) Lithium. Essential to EV Life. Fiat. Crypto. Gold. BRICS. Real Estate. Alternative Investments. BRICS Currency. Will the Dollar Become Extinct? Are There Any Safe, Green Banks? 7 Ways to Stash Your Cash Now. Lessons from the Silicon Valley Bank Failure. Which Countries Offer the Highest Yield for the Lowest Risk? Why We Are Underweighting Banks and the Financial Industry. Save Thousands Annually With Smarter Energy Choices Is Your FDIC-Insured Cash Really Safe? Money Market Funds, FDIC, SIPC: Are Any of Them Safe? My 24-Year-Old is Itching to Buy a Condo. Should I Help Him? The 12-Step Guide to Successful Investing. The Bank Bail-in Plan on Your Dime. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable. However, NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors.

0 Comments

Answers to the 2024 Rebalancing Your Nest Egg IQ Test

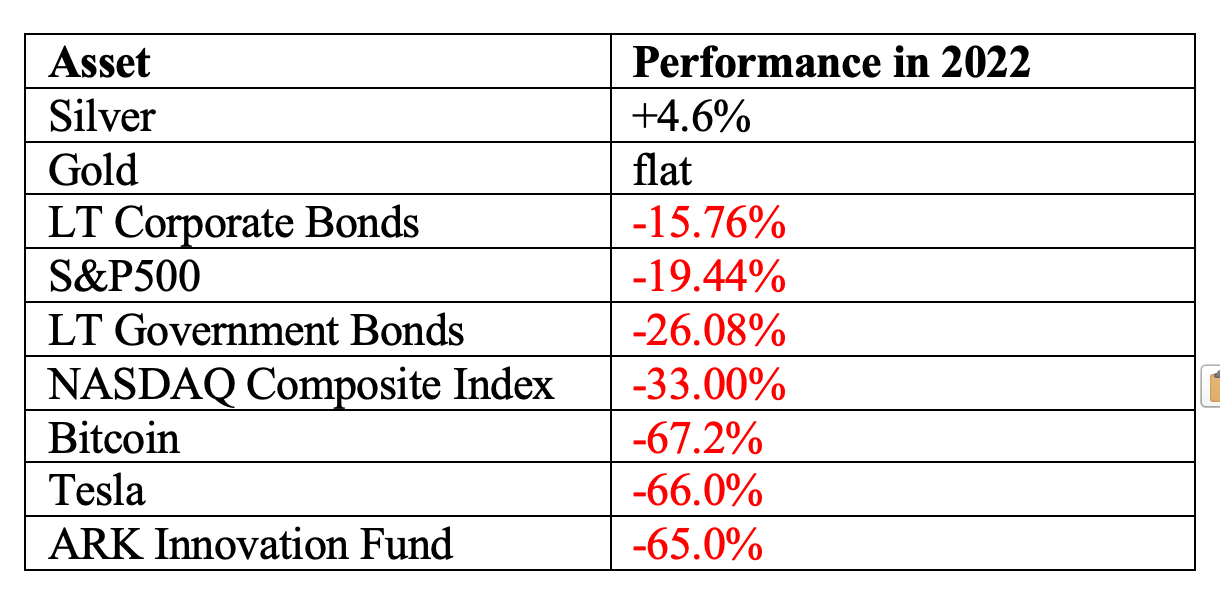

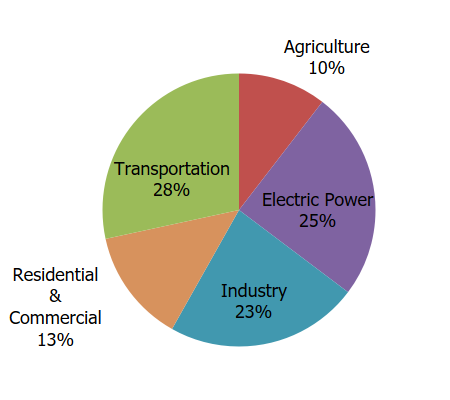

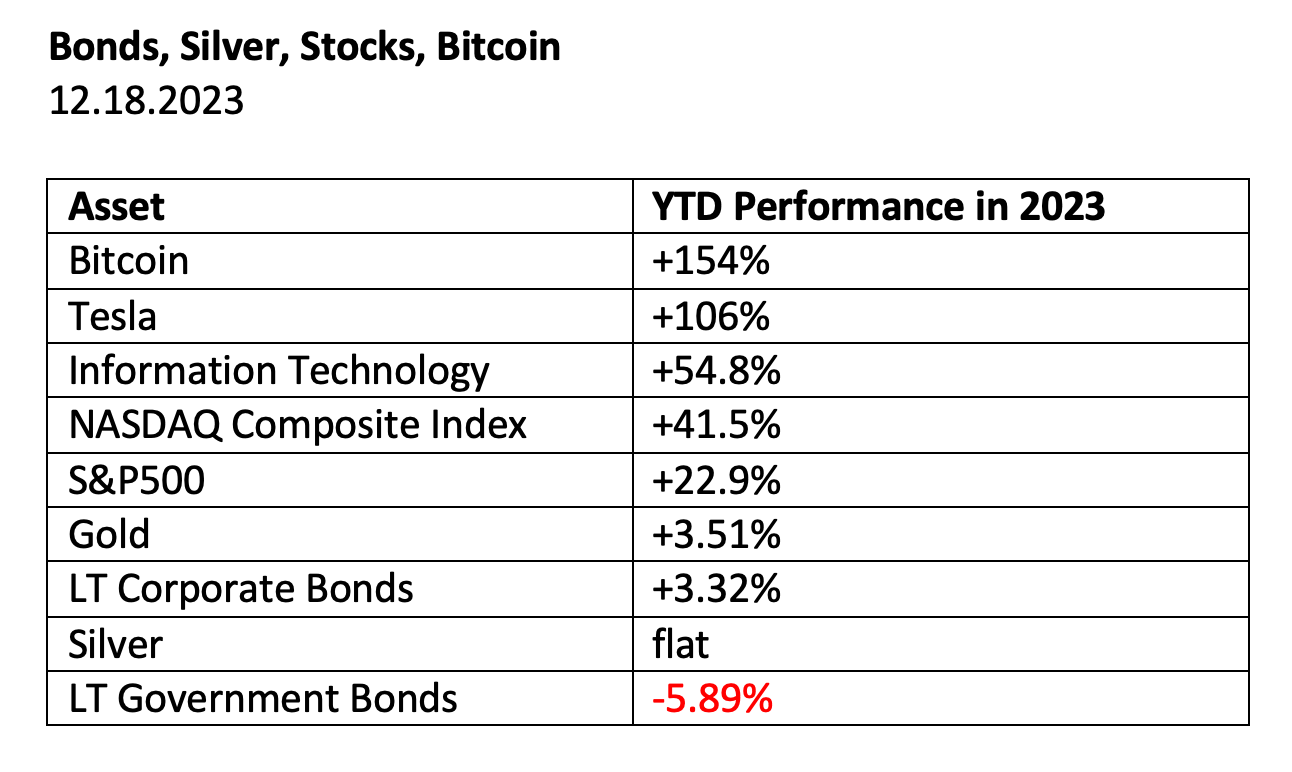

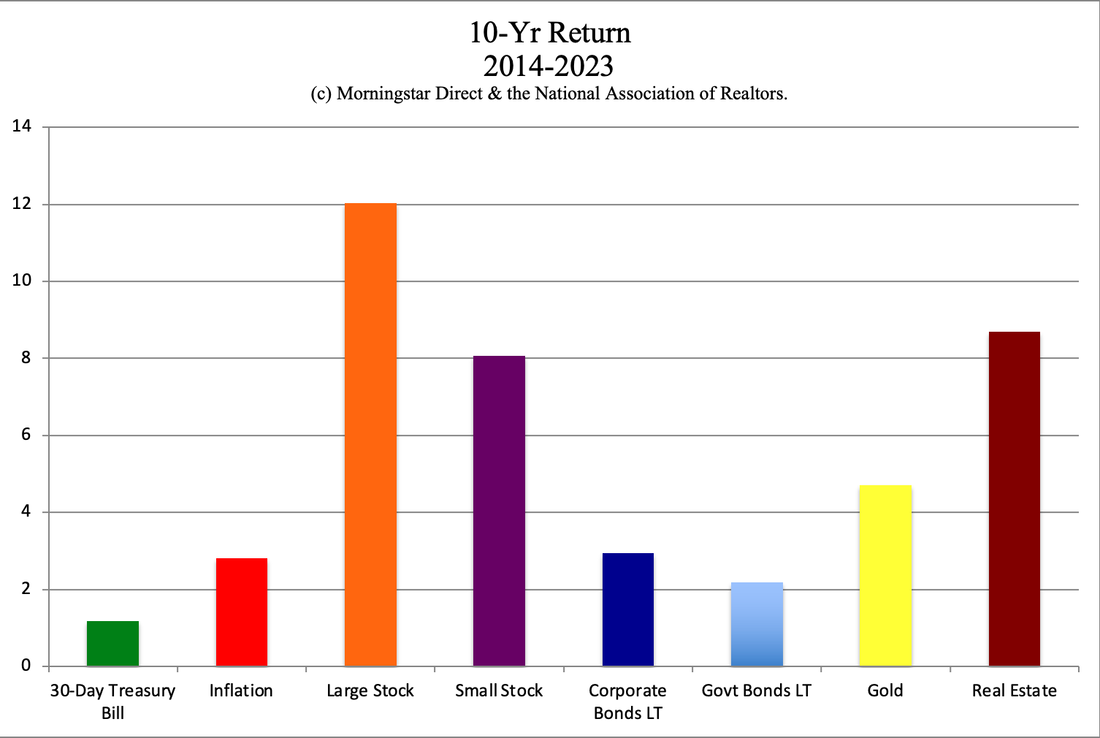

Of course, the devil is in the details. Implementing this strategy will be easier if you attend our Investor Educational Retreat. We also offer a Rebalancing Master Class every year. If you are a busy professional, or if you want to gain greater clarity on this plan (which is the life math that we all should have received in high school), consider getting an unbiased 2nd opinion from me in my private coaching practices. Email [email protected] for pricing and information. You’ll receive personalized pie charts and a wealth game plan in the 2nd opinion, which allows you to be in control and be the boss of your money – even if you have a financial advisor. (I don’t sell financial products, which is why my 2nd opinion is unbiased.) Email info @ NataliePace.com or call 310-430-2397 to register for one of our online training programs. These time-proven, 21st Century investing, budgeting, debt reduction and home buying solutions will transform your life. Join us at our online June 8-10, 2024 Financial Freedom Retreat. Learn how to protect your wealth, hedge against a weaker dollar, invest and compound your gains, green your retirement plan, easy and efficacious nest egg strategies, how to get hot and diversified (including in artificial intelligence and EVs), how to evaluate IPOs and other stocks, and what's safe in a Debt World. You'll even discover how to save thousands annually with smarter big-ticket choices. Yes, it's a complete money makeover. Email [email protected] to register. Learn the 15+ things you'll master and read testimonials in the flyer on the home page at NataliePace.com. Register with friends and family to receive the best price. "Ten minutes into the first day I was already much smarter about investing than I ever thought I would be in my life and I knew I was in exactly the right place at this retreat. I am amazed at how EASY and FUN it is to make my money work for me and those I love. I think this kind of information should be compulsory in schools. I wish I'd learned this sooner." CM If you’d like an unbiased 2nd opinion on your current wealth plan, email [email protected] for pricing and information.  Join us for our Online June 8-10, 2024 Financial Freedom Retreat. Email [email protected] or call 310-430-2397 to learn more. Register with friends and family to receive the best price. Click for testimonials, pricing, hours & details.  Join us for our Restormel Royal Immersive Adventure Retreat. March 7-14, 2025. Email [email protected] to learn more. Register by May 30, 2024 to receive $200 off the regular price. Click for testimonials, pricing, hours & details. There is very limited availability, and you must register early to ensure that you get the exact room you want. This retreat includes an all-access pass to all of our online training for a full year for two and three 50-minute private, prosperity coaching sessions!  Natalie Wynne Pace is an Advocate for Sustainability, Financial Literacy & Women's Empowerment. Natalie is the bestselling author of The Power of 8 Billion: It's Up to Us and is the co-creator of the Earth Gratitude Project. She has been ranked as a No. 1 stock picker, above over 835 A-list pundits, by an independent tracking agency (TipsTraders). Her book The ABCs of Money remained at or near the #1 Investing Basics e-book on Amazon for over 3 years (in its vertical), with over 120,000 downloads and a mean 5-star ranking. The 5th edition of The ABCs of Money and the 2nd edition of Put Your Money Where Your Heart Is are the most recent releases of these books. Follow her on Instagram. Natalie Pace's easy as a pie chart nest egg strategies earned gains in the last two recessions and have outperformed the bull markets in between. That is why her Investor Educational Retreats, books and private coaching are enthusiastically recommended by Nobel Prize winning economist Gary S. Becker, TD AMERITRADE chairman Joe Moglia, Kay Koplovitz and many Main Street investors who have transformed their lives using her Thrive Budget and investing strategies. Click to view a video testimonial from Nilo Bolden. Check out Natalie Pace's Substack podcast on Apple and Spotify. Watch videoconferences and webinars on Youtube. Other Blogs of Interest May is National Bike Month. Paris and Amsterdam are the Stars. AI, Gold & Copper are on Fire. Sunpower Doubled. Sell in May and Go Away? What About the Election? Vacations that Color Our World Forever. The Magnificent 7 Drop to the Fantastic 5 9 Inflation, Budgeting, Debt Reduction and Investing Solutions. China & Russia Double Their Gold Holdings. 2024 Investment of the Year? The Reddit IPO. Meme Stock or Snap Land? Tesla's Factory in Germany Taken Offline by Activists. Bitcoin Sets a New Record High. The Importance of Rebalancing. Beyond Meat's Shares Surge. Quaker Oats' Pesticide Problem. Stocks are Flying High. Why Aren't Mine? Cut Your Tax Bill in Half. 9 Tips. Celebrity Jet CO2. Green Washing. The Facts. Some Solutions. Copper: Essential to the Clean Energy Transition. Uh. Oh. More Bank Trouble. Are Amazon, Square and Other Tech Companies Ripping Us Off? Housing. Unaffordable. What Works? Case studies and creative solutions. Don't Reach for Yield. Closed-End Funds. 2024 Investor IQ Test. Answers to the 2024 Investor IQ Test. Apple's Woes Drag Down the Dow. The Winners & Losers of 2023. Ozempic, Magnificent 7 & Beyond. 2024 Crystal Ball. The Underperforming DJIA, Full of Fossil Fuels and Forever Chemicals. A Spectacular Year for 3 of the Magnificent 7. The Best ROI* (Almost 40%!) & 7 Life Hacks That Save Thousands. Portugal Eliminates Tax Advantages for Ex-Pats. Earn $50,000 or More in Interest. Safely. Finally. WeWork's Bankruptcy. Half-Empty Office Buildings. Problems in our Personal Wealth Plan. Solutions for Unaffordable Housing. Cruise Ships Give Freebies to Investors. Should You Take the Bait? Should You Take a Cruise? Bonds. Banks. The Treacherous Landscape of Keeping Our Money Safe. 7 Rules of Investing 13 Lifestyle Choices to Reduce Waste, Pollution & CO2 & Save a Boatload of Dough. China Bans Apple 11-Point Green Checklist for Schools. Artificial Intelligence and Nvidia's Blockbuster Earnings Report Biotech in a Post-Pandemic World 10 Wealth Secrets of Billionaires and Royals. What Happened to Cannabis? Bank of America has $100 Billion in Bond Losses (on Paper) Lithium. Essential to EV Life. Fiat. Crypto. Gold. BRICS. Real Estate. Alternative Investments. BRICS Currency. Will the Dollar Become Extinct? Are There Any Safe, Green Banks? 7 Ways to Stash Your Cash Now. Lessons from the Silicon Valley Bank Failure. Which Countries Offer the Highest Yield for the Lowest Risk? Why We Are Underweighting Banks and the Financial Industry. Save Thousands Annually With Smarter Energy Choices Is Your FDIC-Insured Cash Really Safe? Money Market Funds, FDIC, SIPC: Are Any of Them Safe? My 24-Year-Old is Itching to Buy a Condo. Should I Help Him? The 12-Step Guide to Successful Investing. The Bank Bail-in Plan on Your Dime. Rebalancing Your Nest Egg IQ Test. Answers to the Rebalancing Your Nest Egg IQ Test. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable. However, NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors. China Sold $102 Billion in U.S. T-Bills. In March of 2023, Mainland China held $869.3 billion in U.S. treasuries. In March of 2024 (the most recent publicly available data), China’s holdings were down to $767.4 billion, for a drop of $101.9 billion (source: U.S. Treasury). Is this a troubling trend? Does it have the potential to thrust the U.S. economy into a tailspin? The Numbers In the statistics above, we see that treasury debt is down $102 billion over the past year. However, it is still far above where it was before the Great Recession. In 2006, China held just $364 billion in Treasury securities, compared to $767.4 billion today. The peak was $1.272 trillion in 2013 (under the Obama Administration). The sell-off started in a meaningful way in 2017, when China sold $94 billion of treasury debt (under the Trump Administration). China actually purchased $18 billion in treasuries in 2021 (Biden Administration), bringing the total up to $1.058 trillion. However, that was short-lived, as the trend since then has been down. (Russia invaded Ukraine on Feb. 24, 2022.) A deeper dive into the total long-term U.S. securities held by China reveals that China’s U.S. equity position has increased over the past few years. Since 2016, the Chinese position in U.S. equities increased from $178 billion to $309 billion (2023), for an increase of 73.6%. (The S&P500 is up 133% over the same period.) Agency debt held by the Chinese is higher than it has been since 2011, at $270 billion vs. $245 billion. There was a $26 billion increase in Chinese ownership of U.S. agency debt between 2022 and 2023. $1.427 trillion in total Chinese ownership of U.S. long-term securities (in 2023) is much more than it was before 2010 (just $682 billion in 2006), but down -22% since the high in 2016 of $1.841 trillion. Can the Chinese Sink the U.S. Economy? There has been no shortage of stress between the U.S. and China of late. U.S. President Joe Biden refers to China’s President Xi Jinping as a “dictator,” and Congress just banned Tiktok (to be enforced in a year). Neither is likely to help matters, especially after #45 called COVID19 the China Virus. President Xi refers to Russian President Putin as his “old friend.” There are wars in Ukraine and Israel, tension in Taiwan, tariffs, and even smart phone reprisals, in the form of blackballs and bans. Each side accuses the other of the frosty relationship. However, the Chinese cannot sink the U.S. economy without severely harming their own (and vice versa). We are China’s biggest customer. (Our economies are quite intertwined. Keep reading.) Both sides state publicly that the end goal is cooperation, not conflict. On April 26, 2024, according to Chinese state broadcaster CCTV, China’s President Xi Jinping proposed three principles to U.S. Secretary of State Antony Blinken, “Mutual respect, peaceful coexistence and win-win cooperation.” In a press conference in Beijing on April 8, 2024, U.S. Treasury Secretary Janet Yellen made it clear that “the United States does not seek to decouple from China.” She said, “Our two economies are deeply integrated, and a wholesale separation would be disastrous for both of our economies.” A Complex Relationship The U.S. is China’s biggest customer, importing $448 billion in 2023 (source: BEA.gov). China is the 3rd largest export market for the U.S. with $195 billion U.S. goods exported to China, behind U.S. exports to Mexico and Canada. China has been the factory to the world, and is largely responsible for clothing prices that are lower today than they were in the 1980s. Fast fashion is one of the few areas that have seen little to no inflation. Tiktok and Temu are two Chinese brands that Americans have become addicted to. Chinese consumers have been loyal to Apple and Tesla. However, Apple is now banned in Chinese government, and there are numerous Chinese EVs competing with Tesla. The fierce competition has brought down EV prices to the point that Treasury Secretary Janet Yellen is concerned about overcapacity. In her press conference in Beijing on April 8, 2024, Secretary Yellen said, ‘When the global market is flooded by artificially cheap Chinese products, the viability of American and other foreign firms is put into question.” She specifically mentioned EVs, lithium-ion batteries and solar. BRICS As I noted in a recent blog, China and Russia Have Doubled Their Gold Holdings Since 2014. Well before Russia’s invasion of the Ukraine (probably anticipating that the U.S. would freeze their assets), Russia reduced their Treasury holdings from $96 billion to $15 billion (in 2018, under the Trump Administration). We reported this on August 18, 2018, when the data became publicly available; click to read the blog. Brazil, Russia, India and South Africa are working to make their BRICS currency viable and relevant – at least between their own countries. It was reported by Reuters on April 26, 2023, that the Chinese yuan overtook the dollar in Chinese cross-border transactions in March of 2023. Who is trading with China using the yuan? Russia, Iran, Venezuela, Indonesia and Argentina. Does this have anything to do with Russian sanctions? Yup. How does this stand in the global marketplace? Small, so far. Is the yuan on a path to dominate the world’s reserve currency? Not yet. Would you want to invest in BRICS currency? Do you think free countries and citizens have full faith in the credit and economic mobility of their BRICS currency? (Check out the Index of Economic Freedom for each country’s ranking.) So, What Should We Do? Be careful taking the bait of panaceas offered by pundits who use scare tactics to have us believe that only gold, or their new MLM cryptocurrency, will be the only thing of value when the dollar becomes “worthless.” These ruses have been rolled out repeatedly over the last two decades (forever, really), enriching the wallets of the con artists, while often bankrupting the gullible who place all of their bets on one egg. If you are interested in gold or an established cryptocurrency such as Bitcoin, it is a good idea to use this as one of your hot slices, not betting everything you’ve got. These “safe havens” can have long winters where losses dominate the weather, and tend to see violent swings of volatility. Bitcoin was the best performer of 2023, with gains of 171%, and the worst of 2022, with losses of -67%. Gold was the worst performing asset of the last decade. Protecting our wealth is very complicated in a Debt World. Even without the Chinese factor, long-term government bonds lost -26% of their value in 2022 and did little (2%) to recover those losses in 2023 (see the 2022 performance chart above). This is why we spend one full day on how to get safe in our Financial Freedom Retreats. (Our next one is June 8-10, 2024 online. Join us.) Hard assets hold their value better than paper when there is too much credit and duration risk. However, inflation and high prices complicate the matter of when to buy and when to sell. Before you buy a new home, sell your existing home, leap into gold or crypto, have blind faith that your “conservative portfolio” is protecting you, or stick your head in the sand and hope that stocks will keep hitting new highs, it’s worth it to learn a time-proven, diversified plan that earned gains in the Financial Meltdown of 2008 and the Dot Com Disaster of 2000-2002, and has outperformed the bull markets in between. That plan is quite literally as easy as a pie chart, with regular rebalancing (just 1-3 times a year). There were a lot of people caught shorthanded during the bank failures of Spring 2023. If you’re worried about the dollar, war, China, debt, etc. there are important steps that each of us can take right now to protect our wealth. This is advisable while stocks are high, and the risk in banks and financials seems to have stabilized. It’s a far better idea to fix the roof while the sun is still shining – before we experience another bank failure, an economic shock, or some other unforeseen and sudden event. Preparation and wisdom keep our financial home safe and secure, rather than scrambling to recover and fix the leaks after the economic storms hit. I get very popular after people have lost a lot of money. I prefer to help you protect your wealth before the recession. You can read about our investing, budgeting, debt reduction and prosperity strategies in my bestselling books, or learn and implement them firsthand at our online 3-day retreat. (The retreat is a complete money makeover that will also teach you how to save thousands annually in your budget). I also offer an unbiased 2nd opinion on your current wealth plan in my private coaching practice, complete with a prosperity blueprint that will protect what you currently have, while positioning you to outperform in the years ahead. Bottom Line China wants to “develop together and prosper independently” with/from the United States. Both countries are aware that what has been called a Cold Peace is worth thawing out a bit. At the same time, there is indeed a BRICS currency, there are too many active wars, debt levels worldwide are eyepopping and tangled up, Taiwan is always at risk of a Chinese invasion, and there is a growing divide between the East and the West. Life is complicated, and protecting our wealth isn’t easy. However, there are certainly areas of risk to avoid and opportunity to lean into. Given that most of us have a great deal more money in our retirement accounts and home equity than we can earn in many years of working, now is the time to protect our wealth. When done in a measured, diversified, and age-appropriate way, we can live a rich life, earn money while we sleep safely, and position our family to thrive (allowing us to try and create greater peace and prosperity in our own home, community and then, the world-at-large). Join us at our online June 8-10, 2024 Financial Freedom Retreat. Learn how to protect your wealth, hedge against a weaker dollar, invest and compound your gains, green your retirement plan, easy and efficacious nest egg strategies, how to get hot and diversified (including in artificial intelligence and EVs), how to evaluate IPOs and other stocks, and what's safe in a Debt World. You'll even discover how to save thousands annually with smarter big-ticket choices. Yes, it's a complete money makeover. Email [email protected] to register. Learn the 15+ things you'll master and read testimonials in the flyer on the home page at NataliePace.com. Register with friends and family to receive the best price. "Ten minutes into the first day I was already much smarter about investing than I ever thought I would be in my life and I knew I was in exactly the right place at this retreat. I am amazed at how EASY and FUN it is to make my money work for me and those I love. I think this kind of information should be compulsory in schools. I wish I'd learned this sooner." CM If you’d like an unbiased 2nd opinion on your current wealth plan, email [email protected] for pricing and information.)  Join us for our Online June 8-10, 2024 Financial Freedom Retreat. Email [email protected] or call 310-430-2397 to learn more. Register with friends and family to receive the best price. Click for testimonials, pricing, hours & details.  Join us for our Restormel Royal Immersive Adventure Retreat. March 7-14, 2025. Email [email protected] to learn more. Register by May 30, 2024 to receive $200 off the regular price. Click for testimonials, pricing, hours & details. There is very limited availability, and you must register early to ensure that you get the exact room you want. This retreat includes an all-access pass to all of our online training for a full year for two and three 50-minute private, prosperity coaching sessions!  Natalie Wynne Pace is an Advocate for Sustainability, Financial Literacy & Women's Empowerment. Natalie is the bestselling author of The Power of 8 Billion: It's Up to Us and is the co-creator of the Earth Gratitude Project. She has been ranked as a No. 1 stock picker, above over 835 A-list pundits, by an independent tracking agency (TipsTraders). Her book The ABCs of Money remained at or near the #1 Investing Basics e-book on Amazon for over 3 years (in its vertical), with over 120,000 downloads and a mean 5-star ranking. The 5th edition of The ABCs of Money and the 2nd edition of Put Your Money Where Your Heart Is are the most recent releases of these books. Follow her on Instagram. Natalie Pace's easy as a pie chart nest egg strategies earned gains in the last two recessions and have outperformed the bull markets in between. That is why her Investor Educational Retreats, books and private coaching are enthusiastically recommended by Nobel Prize winning economist Gary S. Becker, TD AMERITRADE chairman Joe Moglia, Kay Koplovitz and many Main Street investors who have transformed their lives using her Thrive Budget and investing strategies. Click to view a video testimonial from Nilo Bolden. Check out Natalie Pace's Substack podcast on Apple and Spotify. Watch videoconferences and webinars on Youtube. Other Blogs of Interest May is National Bike Month. Are You Driving Less? AI, Gold & Copper are on Fire. Sunpower Doubled. Sell in May and Go Away? What About the Election? Vacations that Color Our World Forever. The Magnificent 7 Drop to the Fantastic 5 9 Inflation, Budgeting, Debt Reduction and Investing Solutions. China & Russia Double Their Gold Holdings. 2024 Investment of the Year? The Reddit IPO. Meme Stock or Snap Land? Tesla's Factory in Germany Taken Offline by Activists. Bitcoin Sets a New Record High. The Importance of Rebalancing. Beyond Meat's Shares Surge. Quaker Oats' Pesticide Problem. Stocks are Flying High. Why Aren't Mine? Cut Your Tax Bill in Half. 9 Tips. Celebrity Jet CO2. Green Washing. The Facts. Some Solutions. Copper: Essential to the Clean Energy Transition. Uh. Oh. More Bank Trouble. Are Amazon, Square and Other Tech Companies Ripping Us Off? Housing. Unaffordable. What Works? Case studies and creative solutions. Don't Reach for Yield. Closed-End Funds. 2024 Investor IQ Test. Answers to the 2024 Investor IQ Test. Apple's Woes Drag Down the Dow. The Winners & Losers of 2023. Ozempic, Magnificent 7 & Beyond. 2024 Crystal Ball. The Underperforming DJIA, Full of Fossil Fuels and Forever Chemicals. A Spectacular Year for 3 of the Magnificent 7. The Best ROI* (Almost 40%!) & 7 Life Hacks That Save Thousands. Portugal Eliminates Tax Advantages for Ex-Pats. Earn $50,000 or More in Interest. Safely. Finally. WeWork's Bankruptcy. Half-Empty Office Buildings. Problems in our Personal Wealth Plan. Solutions for Unaffordable Housing. Cruise Ships Give Freebies to Investors. Should You Take the Bait? Should You Take a Cruise? Bonds. Banks. The Treacherous Landscape of Keeping Our Money Safe. 7 Rules of Investing 13 Lifestyle Choices to Reduce Waste, Pollution & CO2 & Save a Boatload of Dough. China Bans Apple 11-Point Green Checklist for Schools. Artificial Intelligence and Nvidia's Blockbuster Earnings Report Biotech in a Post-Pandemic World 10 Wealth Secrets of Billionaires and Royals. What Happened to Cannabis? Bank of America has $100 Billion in Bond Losses (on Paper) Lithium. Essential to EV Life. Fiat. Crypto. Gold. BRICS. Real Estate. Alternative Investments. BRICS Currency. Will the Dollar Become Extinct? Are There Any Safe, Green Banks? 7 Ways to Stash Your Cash Now. Lessons from the Silicon Valley Bank Failure. Which Countries Offer the Highest Yield for the Lowest Risk? Why We Are Underweighting Banks and the Financial Industry. Save Thousands Annually With Smarter Energy Choices Is Your FDIC-Insured Cash Really Safe? Money Market Funds, FDIC, SIPC: Are Any of Them Safe? My 24-Year-Old is Itching to Buy a Condo. Should I Help Him? The 12-Step Guide to Successful Investing. The Bank Bail-in Plan on Your Dime. Rebalancing Your Nest Egg IQ Test. Answers to the Rebalancing Your Nest Egg IQ Test. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable. However, NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors. May is National Bike Month. Paris and Amsterdam are the Stars. May is National Bike Month. That is a great excuse to do something for ourselves that could be a game changer for us personally. Bikes are great ways to get around that promote physical health, clean air and can save a great deal of money in the budget. Below are some important reasons to ride a bike this month, as well as some possible solutions for safety concerns. Transportation is the #1 CO2 polluter in the U.S. (Australia & Canada, too). Car culture is the reason that most Americans, Australians, Canadians and people in the Middle East have a CO2 footprint that is 3X or more that of many Europeans. Here’s a chart of CO2 per capita of some major countries. Paris is the Star The most recent example of a city shifting away from cars is Paris. Parisian Mayor Anne Hidalgo won her election on a green platform, promising to make Paris bike-friendly and to eliminate plastic. According to her bio, Hidalgo has created over 400 kilometers of bicycle lanes. She is using a model championed by Leon Krier when he designed Poundbury (Dorset, England) in the 1970s – of creating neighborhood hubs with grocery stores, schools, parks, health centers, etc., that denizens can visit with a 15-minute walk. (Learn more about Poundbury by clicking on the blue-highlighted word.) Amsterdam Became a Biking City in the 1970s In the early 1970s, Amsterdam was a city fighting air pollution, vehicular deaths and gridlock. Here’s a link to a 1972 documentary, where kids were writing essays about wanting everyone to switch from driving cars to riding bikes to get rid of pollution and to stop the casualties (watch 1:75 – 2:05). In 1971 alone, it was reported that 3,000 people were killed by cars in Amsterdam, 450 being children. According to the U.S. Department of Transportation, there were almost 41,000 motor vehicle traffic fatalities in the U.S. in 2023. Stop de Kindermoord or “stop the child murder,” led by former Dutch MP Maartjie van Putten, led bicycle protests to the home of the Prime Minister. While it didn’t happen overnight, Amsterdam is now one of the best examples of municipal bike infrastructure. Are You Driving Less? The average person spends over $8,000/year on their personal vehicle, when you factor in the car payment, insurance, gasoline, parking and maintenance. How much time do you spend every week (or day) driving? Could your time and money be better invested elsewhere? When I spoke to Ted Winterer, the former mayor of Santa Monica, California, back in 2019, he revealed that in a family with four adults, they had one car and five bikes. The savings, even considering the taxis they took on occasion, was half of what they were spending on transportation before they made the switch. What About Safety? A lot of people are concerned about safety when they shift to a bike commute. When Jo Esbensen made riding a bike cool back in Venice, California, in the early 2000s, there weren’t very many bike lanes. When Maartjie van Putten lobbied to create safe streets for kids in Amsterdam, gridlock and pollution choked the streets. Citizen Jane Jacobs fought hard to keep the West Village of Manhattan a walking neighborhood. Jonathan and Li Watkins take country roads for their bike commute. (You can see a picture of them at the top of this blog.) Change happens with us, on the ground. I personally walk for almost all of my errands, with my backpack in tow. There are so many examples of ordinary people being the change that our planet needs to heal. When our city, state and national representatives are hounded enough, they find ways to fund the changes that our community needs to move forward. Should you work from home a few days a week to reduce CO2, keep more of your money and invest time in family and friends that you would have wasted commuting? Are you aware that the average American drives about 13,500 miles per year, emitting 8,473 metric tons of CO2 (based on 23 mpg). Are you above or below that average? Can you reduce your CO2 footprint by 20% or more this year? How will you achieve that? I sold my car a few years ago, and reduced my personal transportation CO2 by more than 2/3rds. I enjoy greater health as a result of walking and riding a bike so much more, and I’m saving a ton of money – even given that I sometimes rent a car or take ride-share. I’ve also reduced my business transportation CO2 by 90% by putting most of our retreats, master classes, meetings and training online – something I’ll discuss in greater detail in another blog this month and in a videoconference on Thursday, May 23, 2024 at 4 pm PT. Email [email protected] with VIDEOCON in the subject line, if you’d like to join me live. Riding a bike takes more planning than hopping in a single-occupancy vehicle. However, when we place the planet on the top of our to-do list and get creative, the checks and balances of determining if the travel has a higher purpose, and if there is a creative way to do the same thing without as much CO2 (such as hosting meetings online) help each one of us to be a part of the solution. Wisdom is also key, so that we're not smug in our lifestyle, with blindspots, such us a daily commute, that we might get creative about ameliorating. Also, there is a great deal of greenwashing and misinformation that keeps us customers of gas stations, gas guzzlers, polluting industries, such as plastic and polyester – oil products, and "green" cruises, which are some of the worst polluters in transportation. The Earth Gratitude Project Features Sustainability Projects from Around the World The Earth Gratitude project has a docuseries with five episodes on Food and Health, Kids, Animals and Conservation, Everyday Sustainability Tips and the Power of Gratitude featuring some of the most impactful and exciting projects from around the world. There are so many ways, including walking and biking more, that we can improve our own lives and our community. I encourage you to watch the episode that appeals to you most (and then the others). You will be inspired and educated by all of the great work going on. We would like our next episodes to feature Paris and Amsterdam's transition to clean transportation and plastic reduction. We’re looking for partners to help us produce and distribute the next episodes. (We’ve got an excellent team to write, film and score them.) If you know someone who might be interested, please reach out to discuss this with me personally at [email protected]. Put Earth Gratitude docuseries in the subject line. If you'd like to contribute to this project, email [email protected] for Venmo information. We welcome all contributions, large or small. Bottom Line Biking is great for physical, fiscal and ecological health. Try walking or biking for local errands, at minimum. Can you go a full day, or a full weekend, without driving? Be sure to mark September 22, 2024 on your calendar for the Worldwide Car-Free Day. I want to hear what you’re doing differently this month. Please tag me on Instagram and use #EarthGratitude. https://www.instagram.com/nataliewynnepace/ https://www.instagram.com/earth_gratitude/ Join us at our online June 8-10, 2024 Financial Freedom Retreat. Learn how to protect your wealth, hedge against a weaker dollar, invest and compound your gains, green your retirement plan, easy and efficacious nest egg strategies, how to get hot and diversified (including in artificial intelligence and EVs), how to evaluate IPOs and other stocks, and what's safe in a Debt World. You'll even discover how to save thousands annually with smarter big-ticket choices. Yes, it's a complete money makeover. Email [email protected] to register. Learn the 15+ things you'll master and read testimonials in the flyer on the home page at NataliePace.com. Register with friends and family to receive the best price. "Ten minutes into the first day I was already much smarter about investing than I ever thought I would be in my life and I knew I was in exactly the right place at this retreat. I am amazed at how EASY and FUN it is to make my money work for me and those I love. I think this kind of information should be compulsory in schools. I wish I'd learned this sooner." CM If you’d like an unbiased 2nd opinion on your current wealth plan, email [email protected] for pricing and information.)