|

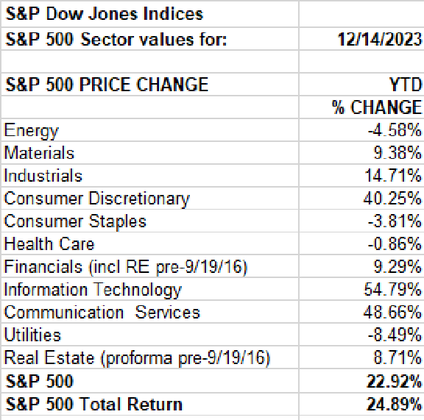

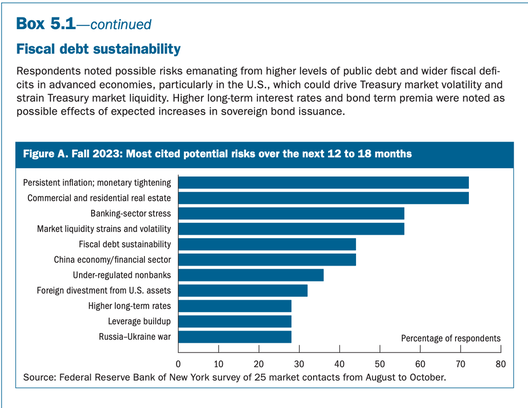

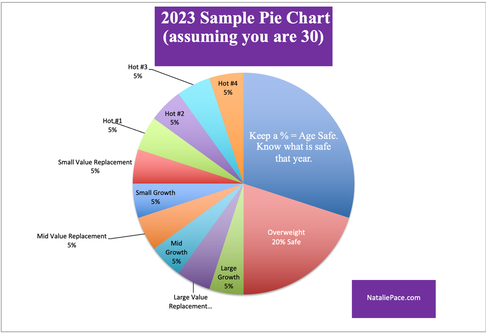

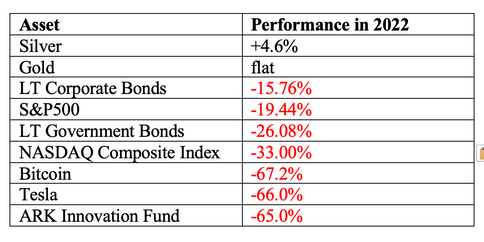

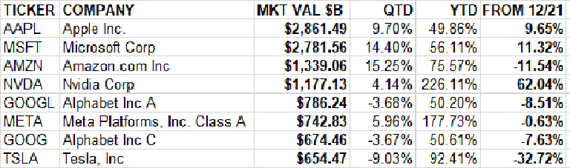

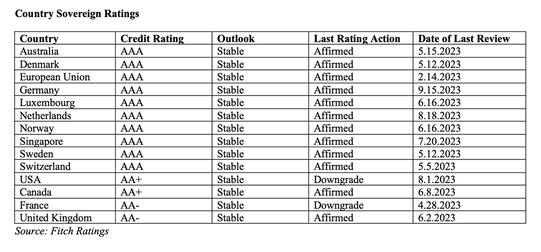

A Spectacular Year for 3 of the Magnificent 7 It’s been a spectacular year for stocks. The S&P500 is up 22.9%. The Dow Jones Industrial Average hit a new intraday high yesterday of 37,347, and has gained 12.5% in 2023. Our retirement plans are happy. However, if we removed just seven stocks from the mix – the Magnificent 7 – the picture is not nearly as rosy. As Michael Hartnett, the chief investment strategist of Bank of America said on NPR, “They were magnificent because everything else was tragic.” That has analysts concerned. When the entire market is riding on the backs of a few companies, it’s more vulnerable than when the rally is more broad-based. The Four Horsemen (Cisco, Dell, Intel and Microsoft) were the Magnificent 7 of 2000, before the Dot Com Recession brought the U.S. economy to its knees. There are a quite few industries that lost value in 2023, including energy, utilities, healthcare and consumer staples. While real estate is still up 8.71% so far this year, commercial real estate is one of the most vulnerable areas of the economy, and has economists quite concerned. What does all of this mean in terms of your year-end and 2024 wealth action plan? Below are the things we’ll cover. The Magnificent Seven Quadruples the Dow The Magnificent Seven as a Hot Slice Growth versus Value Better Yield with Less Risk Volatility Volatility is Smoothed Out by Rebalancing And here is more information on each point. The Magnificent Seven Quadruples the Dow As mentioned above, the 23% gains in the S&P500® year to date is largely due to the Magnificent Seven, Microsoft, Apple, Amazon, Alphabet, Meta, Nvidia and Tesla. If you take them out, the returns are only 6%. Microsoft and Apple have helped the Dow Jones Industrial Average® rise, too. However, technology stocks have soared 53% this year – more than 4 times the gains of the DJIA. This is one of the reasons why investors should always include growth in our nest egg pie chart. It’s also a good idea to lean into technology in our hot slices. The Magnificent Seven as a Hot Slice When we think about the massive returns of the stocks in the Magnificent Seven, we’ve got a great contender for one or more of our hot slices. The TECB ETF offered by iShares has six out of seven of the Magnificent 7 in its top holdings. (We’ve had TECB listed as a hot in our Financial Freedom Retreat for years now.) Using a fund is easier than babysitting individual companies. If you already have TECB and your slice has grown to two slices, it’s a great idea to consider rebalancing to capture gains. If you don’t have this fund and want it, you might consider dollar cost averaging into it, since it’s trading at its all-time high. Growth versus Value In 2022, growth got trounced. As you can see in the performance chart below, the NASDAQ sank by -33%. The Dow Jones Industrial Average was only down -8.8 percent. Four out of the Magnificent Seven are still under their 2021 highs, after 2022’s losses. While Apple, Microsoft and Nvidia are up 10%, 11% and 62%, respectively over the two-year period, Amazon (-11.54%), Alphabet (-8.51%), Meta (-0.63%) and Tesla (-32.72%) are still underwater. Typically value pays higher dividends. In bear markets, value equities can be more buoyant than growth stocks. Growth (performance) and value (stability) play different roles in our portfolio. The problem with value in the U.S. is that with equities at all-time high, with elevated valuations, not much is on sale. Better Yield with Less Risk Many of the 30 DJIA companies have slow growth, elevated levels of debt and high price-earnings ratios. Over half of the S&P500 are at or near junk bond status, including many DJIA components. That is one of the reasons why we are using value replacement funds in our sample pie charts and at our retreats. We can diversify into other countries, where we are often offered a higher yield with lower risk. If you’d like a Stock Report Card of select Dow Jones Industrial Average components, email [email protected]. Volatility In 2019, stocks were at an all-time high. Between February 19 and March 23, 2020, the S&P 500 dropped almost -38%. Stocks soared again in 2021, only to see the S&P500 sink -19.44% in 2022. We’re now back to all-time highs on Wall Street. What a wild ride. We might think the best route is just to Buy and Hold. However, holding onto that rationale requires ignoring what has happened in 21st-century recessions. In the Dot Com Recession, the NASDAQ Composite Index tanked by -78% and took 15 years to recover. The Great Recession saw the Dow Jones Industrial Average sink -55%, to a low of 6547 (yes, 6547!) and took almost 7 years to recover. As we get closer to retirement, we can’t afford to lose half of our wealth and then hope and pray to crawl back to even during the bull market. That is why it is so important to be properly diversified, and to rebalance regularly. The pandemic was hardly a recession at all because we printed up over $5 trillion and handed it out to everybody with a heartbeat, and the corporations and businesses they ran. Liquidity run amok creates inflation. Now it’s expensive and difficult to access capital. Volatility is Smoothed Out by Rebalancing Not only is volatility smoothed out by rebalancing, this strategy also allows you to keep your wealth growing. When stocks are high, you capture gains and trim the slice back to where it should be. Your nest egg grows, and you protect the gains you’ve made. When stocks are low, you have the money to buy low. It’s important to remember that most people do not buy low because they can’t. When you lose too much of your wealth, you don’t have any liquidity to take advantage of the stock and real estate sales that abound. Your FICO score plunges, making it even more costly and cumbersome to borrow. Click to take our Rebalancing IQ Test. It’s important to know exactly what we own and why now, and how diversified and protected we really are. Rather than having blind faith that someone else is protecting our wealth, we must be the boss of our money. It’s important to do this when stocks are high – to fix the roof while the sun is still shining. When we wait for the headlines that a disaster has occurred, it’s too late to protect our wealth. If the plan isn’t sound and we lose a lot, as most people do in bear markets, recessions and other economic shocks, our wealth can drop precipitously before we can take action to protect it. We’ll be in that position of having to hope and pray that we recover losses. Rather than ride the Wall Street Rollercoaster, why not learn the life math that we all should have received in high school and college? Join us at our New Year, New You Financial Freedom Retreat. You can also reach out to our team for an unbiased 2nd opinion. Email [email protected] to learn more. Bottom Line It’s easy to be complacent, and just rejoice when stocks are high. However, that’s exactly when we should be capturing gains, rebalancing, and taking the time to make sure that our safe side is earning 5%, without putting our money at risk. Knowing what we own means that we are aware that many value stocks and funds lost money this year, while 3 companies in the Magnificent 7 soared to new heights, making everyone, even the Dogs of the Dow, look sexy. Modern Portfolio Theory with regular rebalancing is a time-proven, 21st Century strategy. It’s easy-as-a-pie-chart with our tools and information. (Many investors are erroneously told that their plan is based on MPT, when it actually is not properly diversified and protected.) For daily money tips, follow me at @nataliewynnepace on my Instagram Broadcast Channel. Join us at our Jan. 13-15, 2024 New Year, New You Financial Freedom Retreat. Get valuable data and tools on how to best invest and monetize real estate. Learn nest egg strategies, how to get hot and diversified (including in EVs, crypto and AI), and what's safe in a Debt World. You'll even discover how to save thousands annually with smarter big-ticket choices. Yes, it's a complete money makeover. Email [email protected] to register. Learn the 15+ things you'll master and read testimonials in the flyer (link below) and on the home page at NataliePace.com. Register with friends and family to receive the best price. "Ten minutes into the first day I was already much smarter about investing than I ever thought I would be in my life and I knew I was in exactly the right place at this retreat. I am amazed at how EASY and FUN it is to make my money work for me and those I love. I think this kind of information should be compulsory in schools. I wish I'd learned this sooner." CM  Join us for our Online New Year, New You Financial Freedom Retreat. Jan. 13-15, 2024. Email [email protected] or call 310-430-2397 to learn more. Register with friends and family to receive the best price. Click for testimonials, pricing, hours & details.  Join us for our Restormel Royal Immersive Adventure Retreat. March 8-15, 2024. Email [email protected] to learn more. Register with friends and family to receive the best price. Click for testimonials, pricing, hours & details. There is very limited availability, and you must register early to ensure that you get the exact room you want. This retreat includes an all-access pass to all of our online training for a full year for two!  Natalie Wynne Pace is an Advocate for Sustainability, Financial Literacy & Women's Empowerment. Natalie is the bestselling author of The Power of 8 Billion: It's Up to Us and is the co-creator of the Earth Gratitude Project. She has been ranked as a No. 1 stock picker, above over 835 A-list pundits, by an independent tracking agency (TipsTraders). Her book The ABCs of Money remained at or near the #1 Investing Basics e-book on Amazon for over 3 years (in its vertical), with over 120,000 downloads and a mean 5-star ranking. The 5th edition of The ABCs of Money and the 2nd edition of Put Your Money Where Your Heart Is were released in 2021. Follow her on Instagram. Natalie Pace's easy as a pie chart nest egg strategies earned gains in the last two recessions and have outperformed the bull markets in between. That is why her Investor Educational Retreats, books and private coaching are enthusiastically recommended by Nobel Prize winning economist Gary S. Becker, TD AMERITRADE chairman Joe Moglia, Kay Koplovitz and many Main Street investors who have transformed their lives using her Thrive Budget and investing strategies. Click to view a video testimonial from Nilo Bolden. Check out Natalie Pace's Substack on Apple and Spotify. Watch videoconferences and webinars on Youtube. Other Blogs of Interest The Best ROI* (Almost 40%!) & 7 Life Hacks That Save Thousands. Portugal Eliminates Tax Advantages for Ex-Pats. Holiday Gift Giving on any Budget. Including No Budget. Once in a Century Events are Happening Every Day. The Crypto Winter Enters Its 3rd Year. Earn $50,000 or More in Interest. Safely. Finally. Freebies and Deals for Black Friday and Cyber Monday. Auto Strikes End. EV Price Wars Continue. WeWork's Bankruptcy. Half-Empty Office Buildings. Problems in our Personal Wealth Plan. Solutions for Unaffordable Housing. The Magnificent 7 Drag NASDAQ into Another Correction Cruise Ships Give Freebies to Investors. Should You Take the Bait? Should You Take a Cruise? Bonds. Banks. The Treacherous Landscape of Keeping Our Money Safe. 7 Rules of Investing Air B N Bust? Santa Rally 2023 or Time to Get Defensive? Barbie. Oppenheimer. Strikes. Streaming Wars. Netflix. Monero: A Token of Trust? 13 Lifestyle Choices to Reduce Waste, Pollution & CO2 & Save a Boatload of Dough. China Bans Apple 11-Point Green Checklist for Schools. Artificial Intelligence and Nvidia's Blockbuster Earnings Report Biotech in a Post-Pandemic World 10 Wealth Secrets of Billionaires and Royals. What Happened to Cannabis? Bank of America has $100 Billion in Bond Losses (on Paper) The USA AAA Credit Rating is on a Negative Watch. Lithium. Essential to EV Life. I'm Just Not Good at Investing. Investors Ask Natalie. Should I Buy an S&P500 Index Fund? Investors Ask Natalie. Bonds Lost More than Stocks in 2022. 2023 Company of the Year Do Cybersecurity Risks Create Investor Opportunities? Writers Strike, While Streaming CEOs Rake In Hundreds of Millions Annually. I Lost $100,000. Investors Ask Natalie. Artificial Intelligence Report. Micron Banned in China. Intel Slashes Dividend. Buffett Loses $23 Billion. Branson's Virgin Orbit Declares Bankruptcy. Insurance Company Risks. Schwab Loses $41 Billion in Cash Deposits. Fiat. Crypto. Gold. BRICS. Real Estate. Alternative Investments. BRICS Currency. Will the Dollar Become Extinct? The Online Global Earth Gratitude Celebration 7 Green Life Hacks Fossil Fuels Touch Every Part of Our Lives Are There Any Safe, Green Banks? 7 Ways to Stash Your Cash Now. Lessons from the Silicon Valley Bank Failure. Which Countries Offer the Highest Yield for the Lowest Risk? Solar, EVs, Housing, HSAs -- the Highest-Yield in 2023? Why We Are Underweighting Banks and the Financial Industry. 2023 Bond Strategy Emotions are Not Your Friend in Investing Investor IQ Test Investor IQ Test Answers Bonds Lost -26%, Silver Held Strong. Save Thousands Annually With Smarter Energy Choices Is Your FDIC-Insured Cash Really Safe? Money Market Funds, FDIC, SIPC: Are Any of Them Safe? My 24-Year-Old is Itching to Buy a Condo. Should I Help Him? The 12-Step Guide to Successful Investing. The Bank Bail-in Plan on Your Dime. Rebalancing Your Nest Egg IQ Test. Answers to the Rebalancing Your Nest Egg IQ Test. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable. However, NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors. Comments are closed.

|

AuthorNatalie Pace is the co-creator of the Earth Gratitude Project and the author of The Power of 8 Billion: It's Up to Us, The ABCs of Money, The ABCs of Money for College, The Gratitude Game and Put Your Money Where Your Heart Is. She is a repeat guest & speaker on national news shows and stages. She has been ranked the No. 1 stock picker, above over 830 A-list pundits, by an independent tracking agency, and has been saving homes and nest eggs since 1999. Archives

July 2024

Categories |

RSS Feed

RSS Feed