|

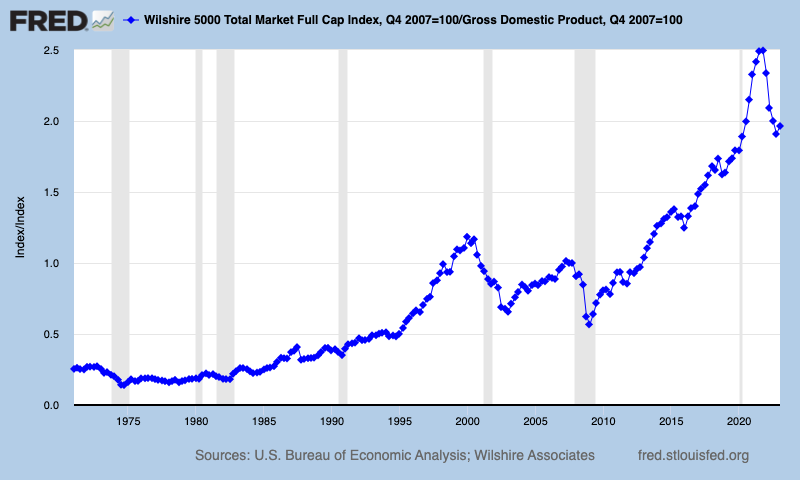

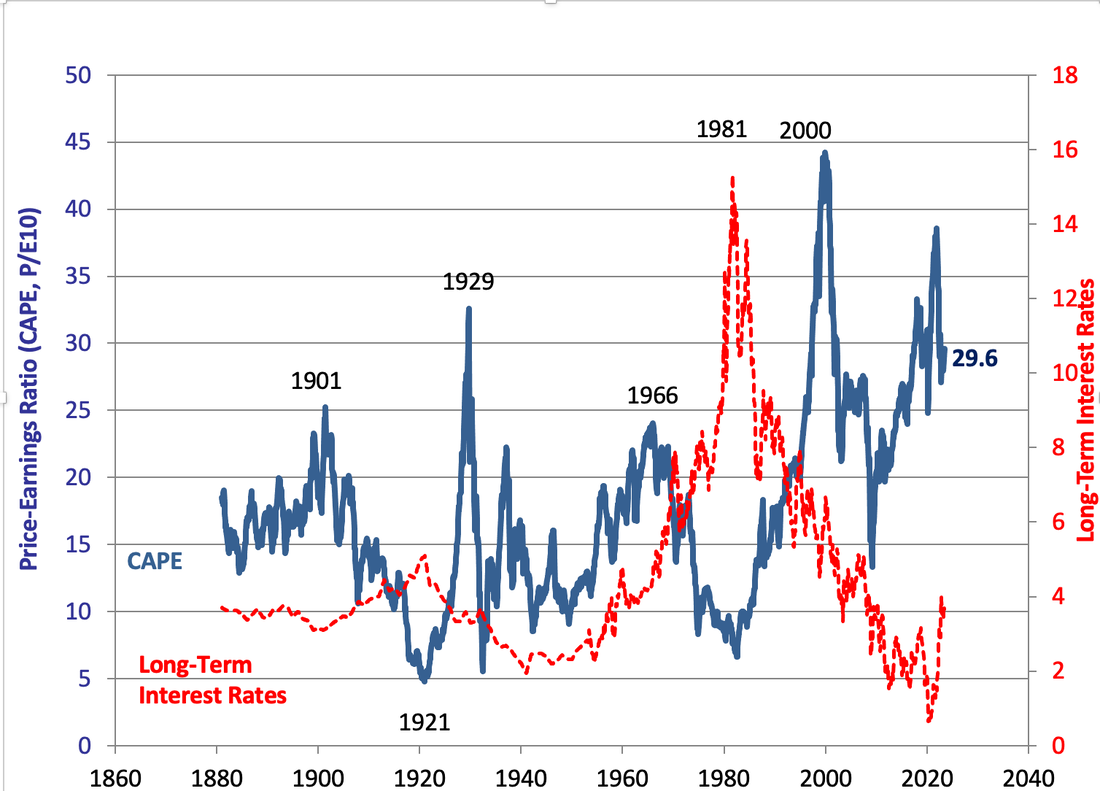

Do Cybersecurity Risks Create Investor Opportunities? So far in 2023, T-Mobile, Yum Brands (KFC, Taco Bell and Pizza Hut), ChatGPT, Chick-fil-A, Activision, Google Fi, Mailchimp and even Norton Lifelock have all experienced attacks and breaches. AT&T and Verizon were both hit last year. While most of the hacks are happening through employee errors and vulnerabilities (something that has to be solved through training and protocols), cybersecurity software and subscriptions have become an essential cost of business to any company or government agency that is going to store payment or private information. Not surprisingly, all of the companies in my Cybersecurity Stock Report Card have year-over-year revenue growth, some with the most spectacular growth on the Street. Email [email protected] if you’d like a copy of our Cybersecurity Stock Report Card. Spectacular Growth Snowflake, Crowdstrike, ZScaler, Cloudflare and Fortinet saw sales growth of 32-50% in the most recent quarter. The 2nd quarter is expected to come in slightly moderated, but still quite respectable. Snowflake, Crowdstrike and ZScaler project 2Q 2023 sales growth to be in the range of 33-36% growth. Cloudflare’s projections are in the 30% range, while OKTA expects revenue to increase at a rate of 18% year over year. Cash Negative Cybersecurity is a fast-growing, innovative, cash-negative business. Staying ahead of the hackers, phishers and government-sponsored cyberattacks requires hiring and retaining the best and brightest computer engineers and programmers, and constant R&D. As a result, many cybersecurity companies are posting net losses. Snowflake and OKTA were the companies with the most losses last year, with -$796.7 million and -$815 million, respectively. Cybersecurity Cash Flow Concerns All of these companies know that having a pathway to profitability and generating free cash flow are essential in 2023. Snowflake’s ending cash position of $653 million might appear to be flying too close to the trees. However, the company also has short-term investments of $3.3 billion. There appears to be enough cash on hand for 2023 in the companies that I examined, particularly if revenue continues to grow in pace with the projections. However, liquidity and cash-burn are two things that any investor must monitor when investing in early-stage, cash-negative companies – particularly with high interest rates, tight credit conditions, and a potential recession on the horizon. Elevated Valuations In my recent Artificial Intelligence blog, I noted that Wall Street’s darling Nvidia had only $5 billion in net income to support its trillion dollar valuation. A Wall Street insider revealed to me that everyone is investing based on what companies will be valued at in three years. Some traders bank on technical analysis, and ignore fundamentals altogether. Greed is high on Wall Street, as are stock prices, as you can see in two valuation charts directly below. Sentiment can change on a dime, however. Stocks fell almost 40% between February 19, 2020 and March 23, 2020. The NASDAQ Composite Index, which includes most of these cybersecurity companies, lost 1/3 of its value in 2022. So, where does cybersecurity fall on the valuation buy low/sell high continuum? Since all of the companies are cash negative, with the exception of the more mature Cisco, Broadcom, Microsoft, VMWare and Akamai, price/sales ratios are helpful indicators. While growth companies can take a higher valuation, most of the price/sales ratios are quite elevated. The pure-play cybersecurity companies all have sales of under $5 billion, with multi-billion market caps. Cloudflare’s 2022 revenue was $975.24 million, yet the company’s valuation, even now trading down -70% from its high of $221/share on Nov. 19, 2021, is $21 billion. Snowflake’s price/sales ratio is even higher than Cloudflare, with a Wall Street value of $55 billion on just $2 billion in sales. High valuations become a crisis when the company hasn’t carved out a pathway to profitability, and starts to run out of cash. With interest rates 5% higher than they were at the start of 2022, borrowing is tight and expensive, placing even more pressure on cash-negative operations. So far things appear to be moving in the right direction for the cybersecurity companies. However, it’s still difficult to justify such expensive stock in such uncertain times. Recessions and bear markets tend to drag all prices down – even those industries that have become essential to all of us. New Kids on the Block Crowdstrike just launched a partnership with Abnormal Security, calling Abnormal the leading behavioral AI-based email security platform. Abnormal Security is pre-IPO and is currently owned by Greylock Partners, with co-founder Evan Reiser as the CEO. It’s a company that I’m putting on my radar. Whenever we see a leader in the industry cherry-pick another company to do business with, it’s worth noting… ETFs vs. Individual Companies Individual companies require babysitting. So, for most investors, purchasing a targeted ETF offers less work and risk. Be diligent about purchasing funds from a fund company with a high credit rating, rather than just searching online. The iShares Cybersecurity ETF (symbol: IHAK) offers exposure to most of the companies featured in our Cybersecurity Stock Report Card. Bottom line Money is hot, fast and greedy on Wall Street these days. We saw Cloudflare (symbol: NET) tumble from an all-time high of $221.64 in November of 2021 to its current price of $62.78. The valuation nosedived from $70 billion to its current value of $21 billion. Most of the companies mentioned in this blog have seen their share prices plunge over the last two years. So, whenever we see growth shoot up to extremely lofty heights, we have to wonder how swift and severe the fall is going to be. Our team has a strategy for investing in hot industries with expensive share prices, like artificial intelligence and cybersecurity. It requires learning our pie chart system, rebalancing regularly (just 1-3 times a year), and applying a dollar-cost-averaging approach to our at-risk slices. This is easy and efficacious, prompts us to do what we are supposed to do, and puts our emotions and actions on the right side of the trade. We teach this time-proven, 21st Century nest egg pie chart system at our Financial Empowerment Retreat. The next one is this weekend, June 10-12, 2023, and will be our last opportunity to get safe, hot and properly diversified before fall. Join us! Email [email protected] or call 310-430-2397 if you are interested in learning time-proven investing, budgeting, debt reduction, college prep, ESG and home buying solutions that will transform your life and heal our planet at our next Financial Freedom Retreat. We spend one full day on what's safe, helping you to protect your wealth and reduce money stress.  Join us for our Online Financial Freedom Retreat. June 10-12, 2023. Email [email protected] to learn more. Register with friends and family to receive the best price. Click for testimonials, pricing, hours & details. This is likely the last retreat before Oct. It's a great idea to protect your wealth before you go on summer vacation.  Join us for our Restormel Royal Immersive Adventure Retreat. March 8-15, 2024. Email [email protected] to learn more. Register with friends and family to receive the best price. Click for testimonials, pricing, hours & details. There is very limited availability, and you must register early to ensure that you get the exact room you want!  Natalie Wynne Pace is an Advocate for Sustainability, Financial Literacy & Women's Empowerment. Natalie is the bestselling author of The Power of 8 Billion: It's Up to Us and is the co-creator of the Earth Gratitude Project. She has been ranked as a No. 1 stock picker, above over 835 A-list pundits, by an independent tracking agency (TipsTraders). Her book The ABCs of Money remained at or near the #1 Investing Basics e-book on Amazon for over 3 years (in its vertical), with over 120,000 downloads and a mean 5-star ranking. The 5th edition of The ABCs of Money was released on September 17, 2021. Natalie Pace's easy as a pie chart nest egg strategies earned gains in the last two recessions and have outperformed the bull markets in between. That is why her Investor Educational Retreats, books and private coaching are enthusiastically recommended by Nobel Prize winning economist Gary S. Becker, TD AMERITRADE chairman Joe Moglia, Kay Koplovitz and many Main Street investors who have transformed their lives using her Thrive Budget and investing strategies. Click to view a video testimonial from Nilo Bolden. Check out Natalie Pace's Apple Podcast. Watch videoconferences and webinars on Youtube. Other Blogs of Interest Writers Strike, While Streaming CEOs Rake In Hundreds of Millions Annually. I Lost $100,000. Investors Ask Natalie. Artificial Intelligence Report. Micron Banned in China. Intel Slashes Dividend. Buffett Loses $23 Billion. Branson's Virgin Orbit Declares Bankruptcy. Insurance Company Risks. Schwab Loses $41 Billion in Cash Deposits. The Debt Ceiling Crisis. What's at Stake? Fiat. Crypto. Gold. BRICS. Real Estate. Alternative Investments. BRICS Currency. Will the Dollar Become Extinct? Empty Office Buildings & Malls. Frozen Housing Market. The Online Global Earth Gratitude Celebration 7 Green Life Hacks The Debt Ceiling. Will the U.S. Stop Paying Bills in June? Fossil Fuels Touch Every Part of Our Lives Are There Any Safe, Green Banks? 8 Fires the Federal Reserve Board Needs to Put Out. 7 Ways to Stash Your Cash Now. Lessons from the Silicon Valley Bank Failure. The 2 Best Solar Stocks Which Countries Offer the Highest Yield for the Lowest Risk? Rebalance By the End of March Solar, EVs, Housing, HSAs -- the Highest-Yield in 2023? Are You Anxious or Depressed over Money? Why We Are Underweighting Banks and the Financial Industry. You Stream all the Channels. Should You Invest, Too? NASDAQ is Still Down -26%. Are Meta & Snap a Buy? 2023 Bond Strategy Emotions are Not Your Friend in Investing Investor IQ Test Investor IQ Test Answers Bonds Lost -26%, Silver Held Strong. 2023 Crystal Ball for Stocks, Bonds, Real Estate, Cannabis, Gold, Silver. Tilray: The Constellation Brands of Cannabis New Year, New Healthier You Tesla's $644 Billion Fall From Mars Silver's Quiet Rally. Save Thousands Annually With Smarter Energy Choices Is Your FDIC-Insured Cash Really Safe? Money Market Funds, FDIC, SIPC: Are Any of Them Safe? My 24-Year-Old is Itching to Buy a Condo. Should I Help Him? The 12-Step Guide to Successful Investing. Gardeners Creating Sanctuary & Solutions in Food Deserts. The Bank Bail-in Plan on Your Dime. Rebalancing Your Nest Egg IQ Test. Answers to the Rebalancing Your Nest Egg IQ Test. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable. However, NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors. Comments are closed.

|

AuthorNatalie Pace is the co-creator of the Earth Gratitude Project and the author of The Power of 8 Billion: It's Up to Us, The ABCs of Money, The ABCs of Money for College, The Gratitude Game and Put Your Money Where Your Heart Is. She is a repeat guest & speaker on national news shows and stages. She has been ranked the No. 1 stock picker, above over 830 A-list pundits, by an independent tracking agency, and has been saving homes and nest eggs since 1999. Archives

July 2024

Categories |

RSS Feed

RSS Feed