|

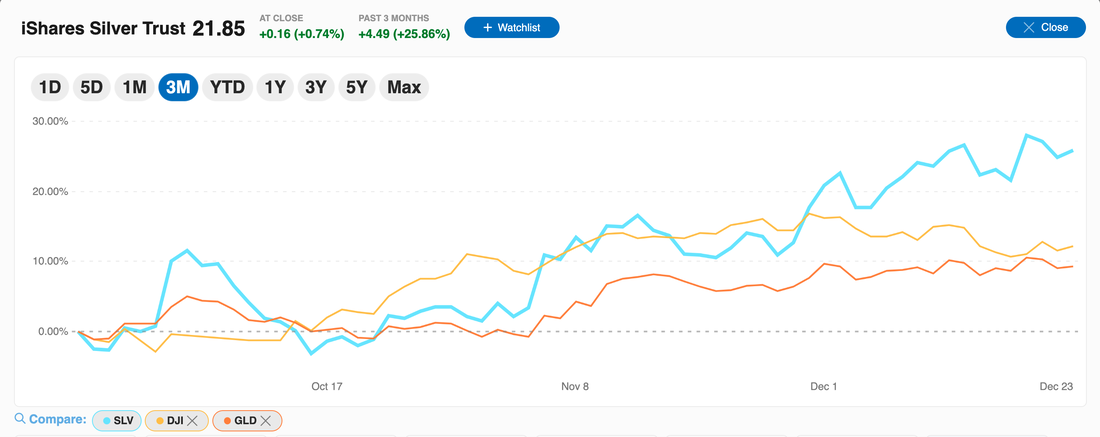

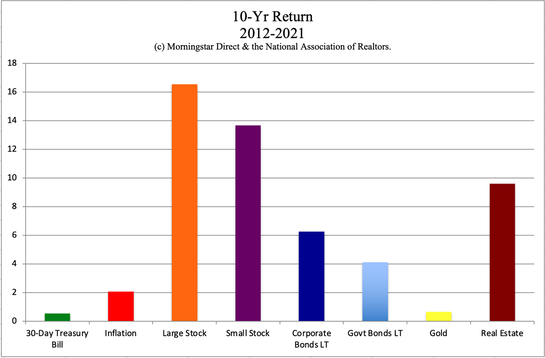

The Quiet Rally of Silver. Silver has soared 35% since its low in October, in a quiet rally that hasn’t made headlines – yet. Over that same period of time, the Dow Jones Industrial Average crawled back 16% (but is still down 10% from the January high), and gold is up about 11%. Even with this recent strength, silver is still a bargain compared to gold. At $22/ounce, silver is less than half of its recent high of $48.70 (on April 28, 2011). Gold hit $2,089/ounce on Jan. 5, 2021, and is down 14%, at just under $1800/ounce. Will Precious Metals Shine in 2023? While stocks weakened in 2022, the dollar increased in value against other currencies. A strong dollar can be negative for safe havens. The U.S. Fed Fund rate soared from zero to 4.5%, making short-term bonds and Treasury bills more attractive, with far less volatility than precious metals. Cryptocurrency has been pulling the younger crowd away from gold and silver for most of the past decade. So there were a lot of things working against gold and silver, and the returns reflect this. Gold was the worst performing asset of the decade. Crypto is in the midst of a crash that has wiped out FTX, Voyager Digital, 3 Arrows, Alameda Research, and is threatening exchanges like Gemini and Binance. The coins themselves have given up most of their pandemic gains. Bitcoin has lost about 75% over the past year. The cryptocurrency turnaround can’t begin until the fallout ends. In the meantime, safe haven seekers might become more interested in gold and silver again. Stocks are predicted to soften in the first half of 2023, which is also positive for precious metals. With the US protected (somewhat) from the European natural gas crisis, the Russian/Ukrainian war, and China’s Covid outbreak, the dollar is predicted to maintain its strength in 2023. Despite that forecast, many of the big bank analysts are bullish on gold and silver with some saying the rally could become “supercharged” if the U.S. enters and recession and the Federal Reserve has to cut interest rates. That’s not predicted to happen until the 4th quarter of 2023 or 2024. However, anything is possible in this crazy world. Will There Be a Recession? The Conference Board is predicting a recession. The Federal Reserve Board is predicting flat growth. There is a small number of analysts, who believe that a soft landing (no official recession) is possible. Many equity seers are predicting rough times for stocks in the first part of the year, testing the 2022 low again. There is also consensus belief that the S&P 500 will rally back to 4000 by the end of 2023, which is 4% above where it is now. Nobody knows for sure which way GDP is going. One thing that is almost assured, however, is that 2023 is unlikely to be calm, cool and collected. FUD and volatility all play into safe havens. Since gold and silver seem to be the only safe haven in town (until cryptocurrency thaws out of its winter), silver could be the shooting star, given that it is the more undervalued. Copper Copper has been coined as the “new oil,” by Goldman Sachs due to the commitment to electrification that is happening worldwide for transport, cooking and heating, powered by renewables, as a cleaner alternative than fossil fuels (oil, natural gas and coal). However, this transition does not afford a reliable rally for copper, safe from sinkholes. Many analysts predict weakness in the first half of the year, with copper testing the 2020 lows, and a robust rally only after the economic storms batter the metal, potentially beginning late 2023 and 2024. Building materials, such as copper and iron tend to suffer early in recessions, and then rally strong once rebuilding begins. Is Crypto in the Crypt for Good? I’ve published many recent blogs about the crypto winter, the bankruptcy of FTX, Voyager Digital, LUNA, et al., and other weaknesses in cryptocurrency, including important information that any claims of FDIC-insurance are probably not true, and red flags to help you avoid the riskiest ventures. It is very likely that more companies will bite the dust. Gemini has frozen customer assets in the Earn program (estimated at $900 million). Their “stablecoin” GUSD has 100% selling activity with no buyers. Binance has exposure to FTX. Email [email protected] if you’d like to get links to those blogs. The bottom line is that right now if you’re being approached to invest in cryptocurrency with the words Defi, Blockchain and a worthless dollar dangling on the rod, it is possible that you are being targeted by a ruthless marketing/salesperson, who is getting paid a lot to to sell you something. (Kim Kardashian isn’t the only celebrity who has been fined for taking money from pump-and-dump scam artists.) No matter what the promises and claims are, you could potentially lose money. The harder the sales tactics and the more Fear, Uncertainty and Doubt the salesman tries to whip up in you, the more likely it is that you are getting rooked. There are many red flags around crypto right now because the space is rife with new money, inexperienced executives, scams, sharks and pay-to-promote celebrities. It doesn’t mean that there isn’t a place for blockchain, decentralized finance and cryptocurrency in the future. Avoiding the flotsam and jetsam to reach the halcyon shore will be tricky. For anyone who already owns crypto, now is the time to know exactly what you own, where it’s held, how much risk you have and to consider adopting a strategy that allows you to profit during the booms, while protecting you from the busts. (Our easy-as-a-pie-chart nest egg strategy works great for this.) Safe Havens Aren’t Always Safe Gold, silver and crypto can have spectacular runups, but they also have extended periods of almost dead. As I mentioned above, gold was the worst asset to own over the past decade. Anybody who bought high in 1980 had to wait a quarter of a century to claw back to even. The easy-as-a-pie-chart nest egg strategy works well for gold, silver and crypto. Regular rebalancing prompts us to sell high when the shoot the moon rally happens, and buy low when the fallout occurs. Right now, people are more interested in bonds than gold and silver. However, bonds are tricky. Email [email protected] with Bonds in the subject line if you’d like to get links to some important blogs. There’s an entire section on bonds in The ABCs of Money, 5th edition, and we spend one full day on this topic at our Jan. 20-22, 2023 Financial Freedom Retreat. Inflation. Recession. Tricky Bonds. Wall Street Rollercoaster. There are economic storms on the horizon. Trying to outsmart the Federal Reserve, politicians, and Wall Street is a losing battle. However, there are some safe, income-producing hard assets that offer a great ROI, which are not in the headlines or on the radar of a lot of folks. We spend one full day offering options for protecting your wealth at our Jan. 20-22, 2023 Financial Freedom Retreat. Most people earn back the price of the retreat within just a few months with the thousands that can be saved annually in the family budget. If you protect your retirement plan, brokerage account and future, that could be worth substantially more. (See the testimonials on the retreat flyer. Click to access.) Join us online. You can attend from the comfort of your living room in your pajamas, and save the cost of travel and lodging. Learn how to get rid of bills, keep the money in the family, stop making everybody else rich at our expense, and step into living a richer life. There are solutions. Wisdom, time proven, 21st century systems and right action are the cures Bottom Line The best safe haven is the money that we don’t spend, particularly with runaway inflation. However, adding a slice or two of silver now and potentially copper if prices tank early next year could be a rewarding way to diversify the at-risk side of our financial plan. New Year, New You Financial Freedom Retreat If you're interested in learning 21st Century time-proven investing strategies for building and protecting your wealth, investing in renewable energy, saving thousands in your budget with smarter energy choices, and managing challenging economic times (from a No. 1 stock picker,) join us for our Jan. 20-22, 2023 Financial Freedom Retreat. Email [email protected] to learn more and to register. Click on the banner ad below to discover the 18+ strategies you'll learn and master, to get pricing information and to read testimonials Get the best price when you register with family and friends. Register now to access your free 4-part Protect Your Wealth Now webinar that will get you started immediately.  Join us for our New Year, New You Financial Freedom Retreat. Jan. 20-22, 2023. Email [email protected] to learn more. Register now to receive a free 4-part webinar (which you can access to protect your wealth now). Click for testimonials & details.  Natalie Wynne Pace is an Advocate for Sustainability, Financial Literacy & Women's Empowerment. Natalie is the bestselling author of The Power of 8 Billion: It's Up to Us and is the co-creator of the Earth Gratitude Project. She has been ranked as a No. 1 stock picker, above over 835 A-list pundits, by an independent tracking agency (TipsTraders). Her book The ABCs of Money remained at or near the #1 Investing Basics e-book on Amazon for over 3 years (in its vertical), with over 120,000 downloads and a mean 5-star ranking. The 5th edition of The ABCs of Money was released on September 17, 2021. Natalie Pace's easy as a pie chart nest egg strategies earned gains in the last two recessions and have outperformed the bull markets in between. That is why her Investor Educational Retreats, books and private coaching are enthusiastically recommended by Nobel Prize winning economist Gary S. Becker, TD AMERITRADE chairman Joe Moglia, Kay Koplovitz and many Main Street investors who have transformed their lives using her Thrive Budget and investing strategies. Click to view a video testimonial from Nilo Bolden. Check out Natalie Pace's Apple Podcast. Watch videoconferences and webinars on Youtube. Other Blogs of Interest Free Holiday Gift. Stocking Stuffers Under $10. Cash Burn & Inflation Toasted the Plant-Based Protein Companies Save Thousands Annually With Smarter Energy Choices Is Your FDIC-Insured Cash Really Safe? Giving Tuesday Tips to Make Your Charitable Contribution a Triple Win. Is Your Pension Plan Stealing From You? The FTX Crypto Fall of a Billionaire (SBF). Crypto, Gold, Silver: Not So Safe Havens. Will Ted Lasso Save Christmas? 3Q will be Released This Thursday. Apple and the R Word. Yield is Back. But It's Tricky. The Real Reason Why OPEC Cut Oil Production. The Inflation Buster Budgeting and Investing Plan. No. Elon Musk Doesn't Live in a Boxabl. IRAs Offer More Freedom and Protection Than 401ks. Will There Be a Santa Rally 2022? What's Safe in a Debt World? Not Bonds. Will Your Favorite Chinese Company be Delisted? 75% of New Homeowners Have Buyer's Remorse Clean Energy Gets a Green Light from Congress. Fix Money Issues. Improve Your Relationships. 24% of House Sales Cancelled in the 2nd Quarter. 3 Things to Do Before July 28th. Recession Risks Rise + a Fairly Safe High-Yield Bond DAQO Doubles. Solar Shines. Which Company is Next in Line? Tesla Sales Disappoint. Asian EV Competition Heats Up. 10 Wealth Strategies of the Rich Copper Prices Plunge Colombia and Indonesia: Should You Invest? 10 Misleading Broker/Salesman Pitches. Why are Banks and Dividend Stocks Losing Money? ESG Investing: Missing the E. Bitcoin Crashes. Crypto, Gold and Stocks All Crash. The U.S. House Decriminalizes Cannabis Again. The Risk of Recession in 6 Charts. High Gas Prices How Will Russian Boycotts Effect U.S. Multinational Companies? Oil and Gas Trends During Wartime Russia Invades Ukraine. How Have Stocks Responded in Past Wars? 2022 Crystal Ball in Stocks, Real Estate, Crypto, Cannabis, Gold, Silver & More. Interview with the Chief Investment Strategist of Charles Schwab & Co., Inc. Stocks Enter a Correction Investor IQ Test Investor IQ Test Answers What's Safe in a Debt World? Money Market Funds, FDIC, SIPC: Are Any of Them Safe? My 24-Year-Old is Itching to Buy a Condo. Should I Help Him? The 12-Step Guide to Successful Investing. Gardeners Creating Sanctuary & Solutions in Food Deserts. The Bank Bail-in Plan on Your Dime. Rebalancing Your Nest Egg IQ Test. Answers to the Rebalancing Your Nest Egg IQ Test. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable. However, NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors. Comments are closed.

|

AuthorNatalie Pace is the co-creator of the Earth Gratitude Project and the author of The Power of 8 Billion: It's Up to Us, The ABCs of Money, The ABCs of Money for College, The Gratitude Game and Put Your Money Where Your Heart Is. She is a repeat guest & speaker on national news shows and stages. She has been ranked the No. 1 stock picker, above over 830 A-list pundits, by an independent tracking agency, and has been saving homes and nest eggs since 1999. Archives

July 2024

Categories |

RSS Feed

RSS Feed