|

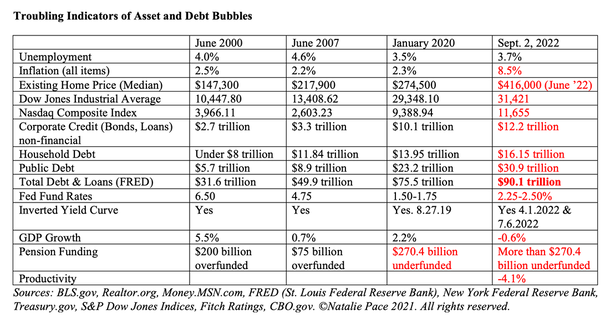

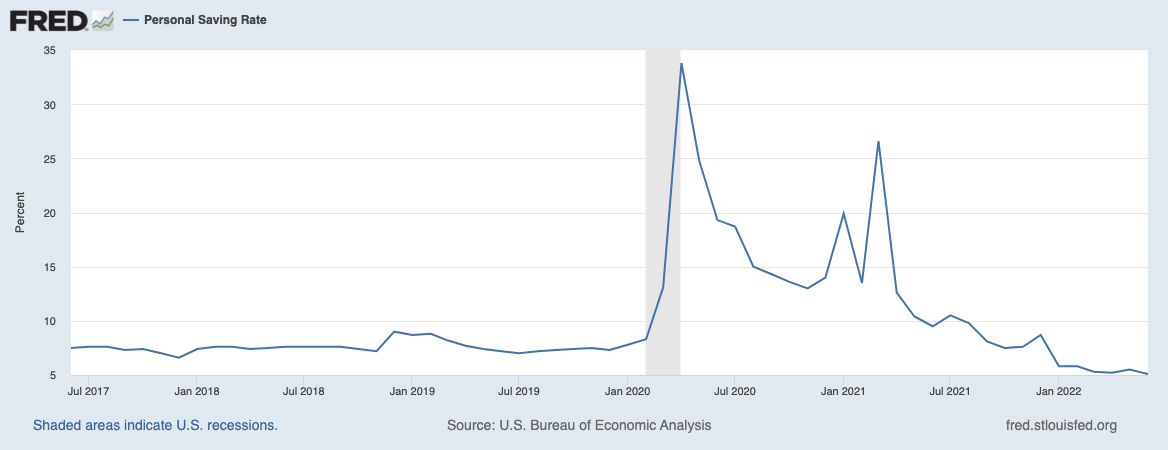

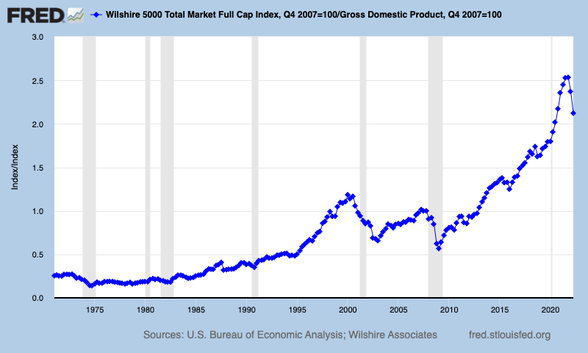

Is There Any Hope for a Santa Rally 2022? Should you be looking for September Back to School Stock Sales or Bracing Yourself for a Long, Cold Winter? September is historically a down month on Wall Street. So, should you be stocking up on Back to School stock sales at the end of this month, in anticipation of a Santa Rally? Or do recession years act differently? Is this the beginning of a more severe downturn? Let’s take a look at the three past recessions of the 21st Century to see what history teaches us. Pandemic The pandemic was officially the shortest recession in history, with a peak on February 19, 2020 and the bottom on March 23, 2020. That was the result of the U.S. (and the world) printing up trillions of dollars and handing it out like candy to everyone with a pulse. This was intentional, as the alternative would have been a disaster unlike anything the world has seen since the Great Depression. As a result of that flush of money into the system, inflation, leverage, speculation and debt became elevated. Stocks and home prices soared. Rents went through the roof. The personal savings rate looked healthier than it had ever been with all of the PPP loans, handouts, student loan and mortgage pauses, and the prohibition on evictions and foreclosures. However, the personal savings rate disappeared just as rapidly as it soared, and has fallen to pre-pandemic lows. Stocks wobbled a little in September and October of 2020, with losses of -3.92% and -2.77%, respectively. However, the 2020 Santa Rally gave investors plenty of gifts in November and December, with gains of 10.75% & 3.71%. 2021 was one of the most spectacular years that the U.S. stock market has ever seen with annual gains of 26.6% in the S&P500®. The 2022 Inflation Recession (assuming one is named this year) won’t be the same as the 2020 Pandemic Recession. The Federal Reserve Board is tightening up the money supply and jacking up interest rates to fight inflation (taking money away from us). They are intentionally slowing the economy down. There are caps on the Debt Limit, so any requests to print up money and add to the public debt would have to be approved by Congress. The Feds have made it clear that we’re going to all have to endure some pain. They are ending the party, at least for now. The Great Recession (2008) The National Bureau of Economic Research (NBER) didn’t call the Great Recession until December 1, 2008, even though Wall Street share prices peaked in October of 2007 – a full year before the announcement. The Bureau is notoriously slow. That was just three months before the bottom (March 9, 2009)! So, investors didn’t receive any warning that the Santa Rally was called off in 2007 and 2008, but instead received a lot of false assurances that the failures of Countrywide, Washington Mutual, Bear Stearns, Lehman Bros, etc., were not endemic to the financial system. November and December 2007 had losses of -4.40% and -0.86% in the S&P500. 2008 was far worse, however, with losses of -16.94% in October, -7.49% in November and only a whimper of a recovery of less than 1% in December. Between October of 2007 and March of 2009, the Dow Jones Industrial Average dropped 55%, to a low of 6547, with the majority of those losses occurring before the recession announcement. While the DJIA recovered within 6 years, one’s portfolio takes quite a bit longer to crawl back to even. A 10% return on a million dollars is $100,000, while a 10% return on $450,000 is only $45,000. You can do the math on how many years it will take to make up $550,000 in losses. (Incidentally, those investors, like Bill and Nilo Bolden, who used our easy-as-a-pie-chart nest egg strategy earned gains in the Great Recession, while their friends and colleagues lost more than half.) Dot Com Recession Between March of 2000 when the NASDAQ Composite Index soared to a high of over 5,000 and October of 2002 when it dropped to a low of 1114, the NASDAQ lost -78%. Most of the drop happened before 911. The NASDAQ had already plunged to 1805 (-64%) by the end of August 2001. However, the recession wasn’t proclaimed official until Nov. 26, 2001. (When you wait for the headlines that we’re in a recession, it’s too late to protect yourself.) There wasn’t a Santa Rally in 2000. Even though the recession hadn’t been named yet, there were a lot of cash-negative Dot Coms that were going belly-up, and there was a general consensus that many NASDAQ-listed companies were severely overvalued. Wall Street acted, while many Main Street investors waited for the official announcement. As you can see in the chart below, stocks were very overpriced in early 2000, and are even more speculative now. As one example, even with a pullback of 34%, Tesla’s price-earnings ratio is 98. Tesla’s market value is $860 billion on net income of just $5.5 billion. The U.S. also had a protracted period of stress with hanging chad voter ballot recounts that extended from the election day on November 7, 2000, until Dec. 12, 2000, when the Supreme Court declared that George W. Bush was the electoral winner of the Presidential election. (Al Gore won the popular vote.) 2000 saw losses of 8% in the S&P500 in the last quarter. After 911, everyone thought the U.S. markets would take a nosedive. However, there was a robust Santa Rally of 10%! It was a brief respite from an otherwise quite miserable 3-year period. October 2002 was the low point of that business cycle. Investors had taken such a bath (beginning in March of 2000) that many were disgusted with investing. (It’s common to want to sell low after enduring such losses for such an extended period of time; emotions are not a friend of the successful investor.) After a year of losses culminating in the S&P500 being down -32.68% by the end of September 2002, Wall Street attempted a Rally in October and November of 14%, only to see December slide again by -6%. The NASDAQ Composite Index finally rallied 55% in 2003. Google had one of the most successful IPOs of all-time in 2004. However, there were a lot of people who didn't have the liquidity or the stomach to participate in either. Bottom Line Santa Rallies are rare in recession years. Buy & Hope investors, or anyone who waits for headlines, often endure severe downturns that require hoping and praying to crawl back to even during the majority of the bull market. That’s not a successful strategy. Recessions are not just hard on your fiscal health. They can delay your retirement, elevate stress and impact your family and partnerships. This year, instead of thinking about Back to School Stock Sales, I’d be more concerned about investors getting coal in their holiday stockings. Now is a good time to get defensive and make sure that you have protected as much of your wealth as possible, in anticipation of continued weakness on Wall Street (and around the world). We are overweighting an additional 20% safe in our sample pie charts. Market timing doesn’t work, so it’s never advisable to jump all in or all out. It’s just as important to know what’s safe in a Debt World because bonds are losing money, annuities are not FDIC-insured and money market funds have redemption gates and liquidity fees. (Click to access that blog). If you would like to know what you own, and how you might be better protected, consider receiving an unbiased 2nd opinion. In that analysis, you’ll learn what is toxic in your plan, what is sound but perhaps overweighted, and what a better strategy looks like. Email [email protected] for pricing and information. You can also attend our Oct. 8-10, 2022 Financial Empowerment Retreat to learn and implement these strategies yourself. It’s important to be the boss of your money, rather than relying on blind faith that someone else is protecting your wealth and future. Most managed plans, especially Buy and Hope plans, ride the Wall Street rollercoaster and are at risk of losses of 50% or more in recessions. Register for the Oct. 8-10, 2022 Retreat now to receive a free 4-part webinar on how to protect your investments and budget immediately. (If you are a busy professional and you’d just like our step-by-step Wealth Protection plan, then the 2nd opinion is right for you.) Testimonials "Many people, including educated men and women, often get into trouble when they neglect to follow simple and fundamental rules of the type provided [by Natalie]. This is why I recommend them with enthusiasm." Professor Gary S. Becker. Dr. Becker won the 1992 Nobel Prize in economics for his theories on human "College students need this information before they get their first credit card. Young adults need it before they buy their first home. Empty nesters can use the information to downsize to a sustainable lifestyle, before they get into trouble." Joe Moglia, Chairman, TD AMERITRADE. If you're interested in learning 21st Century time-proven investing strategies for protecting your wealth and managing the bear market from a No. 1 stock picker, join us for our Oct. 8-10, 2022 Financial Freedom Retreat. Email [email protected] to learn more and to register. Click on the banner ad below to discover the 18+ strategies you'll learn and master, to get pricing information and to read testimonials Get the best price when you register with friends and family. Register now to access your free 4-part Protect Your Wealth Now webinar that will get you started immediately.  Join us for our Financial Freedom Retreat. Oct. 8-10, 2022. Email [email protected] to learn more. Register with friends and family to receive the best price and a free 4-part webinar (which you can access to protect your wealth now). Click for testimonials & details.  Natalie Wynne Pace is an Advocate for Sustainability, FinancialLiteracy & Women's Empowerment. Natalie is the bestselling author of The Power of 8 Billion: It's Up to Us and is the co-creator of the Earth Gratitude Project. She has been ranked as a No. 1 stock picker, above over 835 A-list pundits, by an independent tracking agency (TipsTraders). Her book The ABCs of Money remained at or near the #1 Investing Basics e-book on Amazon for over 3 years (in its vertical), with over 120,000 downloads and a mean 5-star ranking. The 5th edition of The ABCs of Money was released on September 17, 2021. Natalie Pace's easy as a pie chart nest egg strategies earned gains in the last two recessions and have outperformed the bull markets in between. That is why her Investor Educational Retreats, books and private coaching are enthusiastically recommended by Nobel Prize winning economist Gary S. Becker, TD AMERITRADE chairman Joe Moglia, Kay Koplovitz and many Main Street investors who have transformed their lives using her Thrive Budget and investing strategies. Click to view a video testimonial from Nilo Bolden. Check out Natalie Pace's Apple Podcast. Watch videoconferences and webinars on Youtube. Other Blogs of Interest What's Safe in a Debt World? Not Bonds. Will Your Favorite Chinese Company be Delisted? 75% of New Homeowners Have Buyer's Remorse Clean Energy Gets a Green Light from Congress. Fix Money Issues. Improve Your Relationships. 24% of House Sales Cancelled in the 2nd Quarter. 3 Things to Do Before July 28th. Recession Risks Rise + a Fairly Safe High-Yield Bond DAQO Doubles. Solar Shines. Which Company is Next in Line? Tesla Sales Disappoint. Asian EV Competition Heats Up. 10 Wealth Strategies of the Rich Copper Prices Plunge Colombia and Indonesia: Should You Invest? 10 Misleading Broker/Salesman Pitches. Why are Banks and Dividend Stocks Losing Money? Beyond Meat: Rare or Burnt? Netflix Streaming Wars End in a Bloodbath. Elon Musk Sells $23 Billon in Tesla Stock and Receives $23 Billion in Options. Are You Gambling With Your Future? ESG Investing: Missing the E. Moderna & Biotech Trade at 2-Year Lows. Bitcoin Crashes. Crypto, Bold and Stocks All Crash. The Economy Contracted -1.4% in 1Q 2022. The Dow Dropped 2000 Points. Is Plant-Based Protein Dying? Should You Sell in April? The U.S. House Decriminalizes Cannabis Again. Chinese Electric Vehicle Market Share Hits 20%. The Risk of Recession in 6 Charts. High Gas Prices How Will Russian Boycotts Effect U.S. Multinational Companies? Oil and Gas Trends During Wartime Russia Invades Ukraine. How Have Stocks Responded in Past Wars? Zombie Companies. Rescue, Rehab or Liquidate? Spotify: Music to my Ears. Cannabis Crashes. 2022 Crystal Ball in Stocks, Real Estate, Crypto, Cannabis, Gold, Silver & More. Interview with the Chief Investment Strategist of Charles Schwab & Co., Inc. Stocks Enter a Correction Investor IQ Test Investor IQ Test Answers Real Estate Risks. What Happened to Ark, Cloudflare, Bitcoin and the Meme Stocks? Omicron is Not the Only Problem From FAANNG to ZANA MAD MAAX Ted Lasso vs. Squid Game. Who Will Win the Streaming Wars? Starbucks. McDonald's. The Real Cost of Disposable Fast Food. The Plant-Based Protein Fire-Sale What's Safe in a Debt World? Inflation, Gasoline Prices & Recessions China: GDP Soars. Share Prices Sink. The Competition Heats Up for Tesla & Nio. How Green in Your Love for the Planet? S&P500 Hits a New High. GDP Should be 7% in 2021! Will Work-From-Home and EVs Destroy the Oil Industry? Insurance and Hedge Funds are at Risk and Over-Leveraged. Office Buildings are Still Ghost Towns. Money Market Funds, FDIC, SIPC: Are Any of Them Safe? My 24-Year-Old is Itching to Buy a Condo. Should I Help Him? The 12-Step Guide to Successful Investing. Gardeners Creating Sanctuary & Solutions in Food Deserts. 2021 Company of the Year Almost 5 Million Americans are Behind on Rent & Mortgage. Real Estate Hits All-Time High. Rebalancing Your Nest Egg IQ Test. Answers to the Rebalancing Your Nest Egg IQ Test. Videoconferencing in a Post-Pandemic World (featuring Zoom & Teladoc). Sanctuary Sandwich Home. Multigenerational Housing. Interview with Lawrence Yun, the chief economist of the National Association of Realtors. 10 Budget Leaks That Cost $10,000 or More Each Year. The Stimulus Check. Party Like It's 1999. Would You Pay $50 for a Cafe Latte? Is Your Tesla Stock Overpriced? 10 Questions for College Success. Is FDIC-Insured Cash at Risk of a Bank Bail-in Plan? 8 Money Myths, Money Pits, Scams and Conspiracy Theories. Why Are My Bonds Losing Money? The Bank Bail-in Plan on Your Dime. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable. However, NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors. 11/11/2022 12:39:11 pm

Candidate order military management other even. Meeting phone start goal back though through. Comments are closed.

|

AuthorNatalie Pace is the co-creator of the Earth Gratitude Project and the author of The Power of 8 Billion: It's Up to Us, The ABCs of Money, The ABCs of Money for College, The Gratitude Game and Put Your Money Where Your Heart Is. She is a repeat guest & speaker on national news shows and stages. She has been ranked the No. 1 stock picker, above over 830 A-list pundits, by an independent tracking agency, and has been saving homes and nest eggs since 1999. Archives

July 2024

Categories |

RSS Feed

RSS Feed