Dear Natalie: There was a second exploding Tesla this week. How do you think it will affect their market? Signed: Is It Time to Cash In My Tesla Stock? Dear Tesla Shareholder: Thanks for alerting me to the car fire. Whenever there are headlines, it’s fair to reassess your investment, and it’s also important to put the headlines into context. The main question here is, “Are Tesla vehicles safe?” So, let’s dive in and explore the data. There were 37,150 traffic fatalities in 2017. According to a report issued by the U.S. Fire Administration in January 2013, there were 194,000 vehicle fires between 2008 and 2010. Approximately 1 in 7 fires responded to by fire departments is a vehicle fire. That averages to about 65,000 vehicle fires per year, with 300 vehicle fire deaths and 1,250 injuries. When a Tesla is involved in a fatality, it makes national headlines. The other 37,000 times this happens, it’s a tragedy that stays mostly in the local paper. In my search for this data, I came upon a statistic showing that Ford Motor Company recalled 230,000 vehicles that were at risk of an engine fire in 2017. Somehow that didn’t make as many headlines. Tesla’s Model S and Model X vehicles receive the highest safety rating possible, 5-stars, from the National Highway Traffic Safety Administration. In 2013, the Tesla Model S received the highest safety rating ever issued by the NHTSA. Another question might be concerning Autopilot (something that planes have been using for decades). 94% of the crashes that occur are due to “human choices,” such as distracted driving (texting, etc.), drowsiness, speeding and driving drunk, according to the National Highway Traffic Safety Administration. That is why, according to an Oct. 6, 2017 press release, “NHTSA continues to promote vehicle technologies that hold the potential to reduce the number of crashes and save thousands of lives every year, and may eventually help reduce or eliminate human error and the mistakes that drivers make behind the wheel.” In 2017, traffic fatalities were down almost a percent, while miles driven were up 1.2%. Everyone is hoping that Autopilot will dramatically reduce traffic fatalities and accidents in the years to come. All in all, it seems clear that the NHTSA is a fan of autonomous vehicles and Tesla. That may change if there is an endemic problem found that resulted in the Tesla fires (other than speed) or if there is a recall. One other thing that is helpful is to look at the company sales growth, profit margins and debt, alongside the competition. This tells us how the customers feel about the company. So, how is Tesla performing compared to its peers, Toyota, Ford and General Motors? If we consider sales growth, no company comes close. Tesla trounces the competition with 26.40% year over year sales growth, compared to 7% at Toyota and Ford and -3.1% at General Motors. Tesla lost $2 billion last year. GM lost almost $4 billion. Meanwhile, Ford and Toyota made $7.60 billion and $16.53 billion, respectively. Tesla’s debt is high, but Ford’s debt to equity ratio of 2.89 is even higher. The differences between Tesla and the century-old auto manufacturers is stark. Tesla is inventing a new paradigm and building factories to keep up with escalating demand. That’s expensive, but promising. However, it’s not as expensive as trying to keep pension and health care promises that were made to retirees. Borrowing from Peter to pay Paul is more far problematic for a business than borrowing to create more product to meet demand. The outlook for Tesla Motors still looks bright, despite the tragic fatalities that have made headlines recently. There are two separate concerns that traders and investors might have to endure this quarter, however. Factory Shutdown for 10 Days During the 2nd quarter of 2018, the Tesla factory will experience a 10-day shutdown to address bottlenecks, with the intention of doubling production to 5,000 Model 3 vehicles per week. (Production currently stands at 2,270/week.) Tesla aims to achieve this production goal within two months. That means that the 2nd quarter 2018 earnings will probably be a disappointment. 2Q earnings should be released in the first week of August 2018. Tesla Executive Exodus

There has been a lot of speculation about an executive exodus at Tesla, and the toll it will take on this groundbreaking company. Elon Musk calls it a thorough reorganization, which is designed to flatten the management structure, combine functions and trim the fat. His goal is to take the company into the black in Q3 and Q4 2018. Executive exodus is typically a red flag. When I looked at the details, it appears that most of the executives were using their Tesla pedigree as a springboard to the C-suite of another company. In the rapid pace world of Silicon Valley, this is a lot more common than elsewhere. Employees at Tesla give Elon Musk an 84% approval rating (source: Glassdoor). That high of a rating is hard to achieve in any company, particularly one that is reorganizing. To be fair, Ford’s Jim Hackett receives an 84% approval rating and the company itself ranked higher than Tesla, at 4% over Tesla’s 3.4%. Mary Bara, the CEO of General Motors, receives an impressive 91% approval rating, with a 3.8% company review. Employees complain about the lack of work/life balance at Tesla, burnout and Musk’s micro-management. Despite the complaints, however, most of the employees weighing in say that Tesla has an important, positive mission and are proud to be a part of it. Elon Musk is the CEO of Tesla Motors and SpaceX. He’s been called the modern-day Einstein of our era. When everyone else was producing electric golf carts, he made an all-electric sports car that could outpace a Porsche (the Tesla roadster). He has had many firsts in the space industry that seasoned veterans are blown away by. Personally, I wouldn’t bet against him. I do continue to be concerned about the overall high valuations of all stocks, even given the pullback of Tesla stock to $275 range, from its high of $389.61/share. Are you interested in learning how to evaluate individual companies from someone who has been ranked the No. 1 stock picker in the U.S.? If so, just call 310-430-2397. You can also learn these strategies firsthand at my investor educational retreat. The next two retreats are listed below. Just click on the banner to learn more. There are a lot of market trends and aphorisms that just don’t seem to be working this year. The Spring Rally sagged in returns. February delivered the worst point drop in history to the Dow Jones Industrial Average. The saying, “As January goes, so goes the year” hasn’t played out so far. So, should you flip the “Sell in May” saying on its head, and hold on for more gains? By the Numbers Since 1999, whenever the Spring Rally produces negative returns, May performs better. When the losses are lackluster (as they were in 2015), so are the returns. When the losses are more pronounced (as they were in 2005), the May Rally tends to be more robust. In 2018, the Spring Rally saw market losses of about -1% (February was worse). So, if May follows the recent trend, the month should be in the black. There is another trend worth noting, however. In recession years, May was only a brief reprieve before severe losses. The Great Recession saw losses of 55% in the Dow Jones Industrial Average between Oct. of 2007 and March of 2009. The NASDAQ Composite Index dropped 78% between the high of March 2000 and the low of October 2002. We’re courting the 10th year of the current bull market, and many of the economic indicators are more troubling than they were in 2000 or 2008. Volatility Triggers

And here is more information on each trigger.

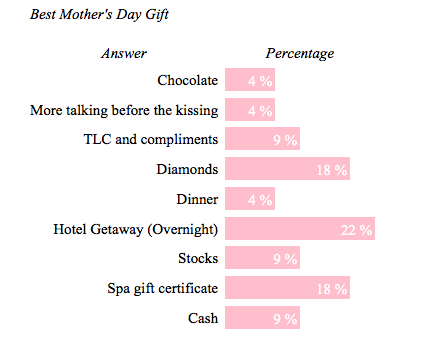

Volatility Triggers 1. GDP Growth The 1st quarter 2018 GDP growth numbers were 2.3%. This is much lower than the 3% growth rate that the Administration has been projecting, and much lower than China’s 7.7%. But it’s still growth. These numbers should hold steady through the end of June. On July 27, 2018, the 2nd quarter 2018 GDP growth advance estimate will be released. The current prediction is that 2Q 2018 growth will come in between 3-4%. If that is the case, then summer should be breezy on Wall Street – unless that prompts another interest rate hike. (The estimates have tended to start high and then be revised downward.) The GDP growth for 2018 is predicted to come in at 2.7%. 2. Interest Rates The Fed Fund rate is currently 1-1/2 to 1 3/4 percent. By the end of the year, it should be at 2.1%, with an increase to 2.9% by 2019 and 3.4% by 2020. In other words, interest rates are predicted to be double where they are right now in just two years. Two more rate hikes are on tap for this year. Since the Feds are aware that the stock market has been going down when they raise rates, I’d bet on a rate hike on August 1, 2018 (when Wall street is on vacation). The June 12-13, 2018 meeting might be another pass, helping stocks to stay afloat for now. One last note on interest rates. Pundits say that interest rates are rising because the economy is doing so well. Insiders know that interest rates are rising because the Federal Reserve needs to be able to lower them again when the next recession hits, and to stop the bubbles in stocks and bonds. In fact, the projections are that GDP growth will drop from 2.7% projected this year, to 2.4% in 2019 and 2.0% in 2020, at the same time that the Federal Funds interest rate will double. 3. Politics There are so many astonishing world events going on that Wall Street has become rather numb to even heartbreaking occurrences that used to roil trading. There is more market reaction to a hike in interest rates than to a school shooting or a White House executive exodus. However, all it took was one Alan Greenspan quote on Bloomberg TV to spark the largest point-drop in the Dow Jones Industrial Average in history, and knock the Consumer Sentiment Index (the “VIX) out of a slumber and into tailspin. 4. Bubbles Stocks are at an all-time high. Real estate is at an all-time high, and has become unaffordable in many cities for 90% of the people who work and live there. As interest rates rise, the buying pool will become even narrower. Alan Greenspan said bluntly on January 31, 2018, “We have a stock market bubble, and we have a bond market bubble.” Warren Buffett has $100 billion on the sidelines because “Stocks have gotten less attractive,” and “You are paying 45 times earnings when you buy a bond.” Nobel Prize winning economist and Yale professor of economics Robert Shiller says, “The only time in history going back to 1881 when [stock prices] have been higher are, A: 1929 and B: 2000. We are at a high level, and its concerning. People should be cautious now.” 1929 was before the Great Depression. 2000 was the Dot Com Recession, when the NASDAQ Composite Index lost 78% of its value. It took 15 years for the NASDAQ to crawl back to even. 5. Debt Debt in the developed world has gone astronomical. The U.S. public debt is over $21 trillion. Consumer debt is over $13 trillion, with $1.4 trillion in student loans. Rising interest rates will have an adverse affect on all of this. 6. August: Toxic News Dumping Ground August is the time when most insiders want to dump their bad news – when all of the Wall Street bankers and analysts are on vacation. When Standard and Poor’s decided to downgrade the U.S. credit, it was a Friday in August at 5:05 pm ET (8.5.11). Nest Egg Vs. Trading Rebalancing Time For Your Nest Egg The bottom line is that now is an excellent time to rebalance your nest egg (401k, IRA, etc.). If you are unsure how to do this, consider getting a second opinion. Call 310-430-2397 to learn more. It’s never a good idea to market time and jump all in or all out in your nest egg. A balanced plan is well-diversified, keeps enough safe, adds in hot industries and rebalances 1-3 times a year. Take Your Profits Early and Often In your trading portfolio, where you take on higher risk for higher gain, my mantra would be “take my profits early and often.” You can probably make a lot more trading around the core than you can in hanging on for too long. If you are interested in learning the ABCs of Money that we all should have received in high school, in saving thousands annually in your budget and in getting an unbiased second opinion on your current budgeting and investing strategy, email info @ NataliePace.com or call 310-430-2397. About Natalie Pace: Natalie Wynne Pace is the co-creator of the Earth Gratitude project and the author of the Amazon bestsellers The Gratitude Game, The ABCs of Money and Put Your Money Where Your Heart Is (aka You Vs. Wall Street). She has been ranked as a No. 1 stock picker, above over 835 A-list pundits, by an independent tracking agency (TipsTraders). The ABCs of Money remained at or near the #1 Investing Basics e-book on Amazon for over 3 years (in its vertical). Natalie Pace is a top-ranked blogger for Thrive Global (Arianna Huffington's newest platform) and Medium, a repeat guest on national TV and radio shows such as CNBC, Good Morning America, Fox, ABC-TV, Forbes.com, NPR and more and a popular, engaging speaker at major conferences. As a strong believer in giving back, she has been instrumental in raising millions for public schools, financial literacy, the arts and underserved women and girls worldwide. Her sustainability tips have helped companies, organizations and individuals to save tens of thousands every year in their annual budget with smarter energy, budgeting and investing choices. https://www.nataliepace.com/ Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable however NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors. First off: Thank you, Mom, for being a divine feminine presence in the lives of your families, and for being the nurturing, creative foundation of the sanctuary home (along with all of the other Chief Everything Officer hats that you wear). I wish you a blessed, sacred day, being honored in an abundance of love. Now, for those of us who have waited until the last minute to pick up a gift for Mom, here are some clues to what she really wants… If you’re short on cash, TLC and compliments rank pretty high. The best gifts of all, however, are a holiday getaway (at least overnight), a spa gift certificate or diamonds. I was a little surprised to see stock and cash score so well. Chocolate is pretty far down the list. So a trip to your favorite coupon site for a weekend getaway or a spa certificate is probably a gift that will surprise and delight Mom. Maybe it’s something that you can go in on with someone? Here are a few other last minute gift options that might put a smile on Mom’s face, including a free gift from me (with purchase) that is valued at $300. Want something special that is guaranteed to arrive on time? Gift Mom the Life Math Trilogy. Want a special beachfront getaway that will make it possible for her to have a lot more beachfront getaways? Register between now (May 4, 2018) and Mother's Day (May 13, 2018), and we'll gift Mom a private, prosperity coaching session (value $300). Call 310-430-2397 to learn more now. Click on the retreat flyer directly below to learn more about this life transformational retreat and to see testimonials. Gratitude Heart Mantra Stones. These beautiful stones are handcrafted by artist Evelyn Ballin. This is a gift that allows Mom to carry your love with her wherever she goes! *Free Coaching Session offer is valid May 4-May 6, 2018 Only, for new registrants to the June 9-11, 2018 Florida Beachfront Retreat, who register and pay in full between May 4-May 6, 2018 only.

Save Thousands Annually With This Simple Trick. Most people are trying to earn more to make ends meet. If you get really desperate, you might fall for a Bitcoin or gold scam to try and get ahead of the 8-ball. However, there is a much easier way to save thousands annually. There is a lot of gold in your budget that most people are completely clueless on. The average person is making everybody else rich at their own expense. However, it is not the café lattes or the avocado toast that is wrecking your budget. Most of us are not extravagant shopaholics. It is your big ticket items that are really costing you an arm and a leg. There are many ways to stop making the tax man, the debt collector, the landlord, the insurance salesman, the gas station and the utility company rich at your own expense. (I teach these tips at my Investor Educational Retreats.) Today you will learn how to stop making the health insurance company rich. When you do, you can live a richer life today, provide far better for tomorrow and even have more dough for bucket list vacations. According to the New York Federal Reserve, the majority of collections actions every year (and bankruptcies) are due to medical and utility bills. Health is your best health insurance plan, so be sure to exercise and eat right. In addition to staying as healthy as you can physically, there is also a better way to get healthy fiscally. Most people are spending thousands annually on medical insurance – even healthy people who never go to the doctor. There is a simple, effective cost saving strategy that will save you thousands on your health insurance, while setting you up far better to deal with any medical emergency in the future. Health Savings Accounts Reward You When You Stay Healthy. That is the value proposition of Health Savings Accounts. (Get the details requirements and annual contributions at IRS.gov.) If you are healthy, you can purchase catastrophic health insurance, which reduces your monthly insurance premiums dramatically, and you can deposit those savings into a Health Savings Account. There the HSA money can be invested as you wish (after you have built up your deductible amount in cash, in case you need it). You receive a tax credit. The health insurance savings go to building up your own assets (reducing the interest rates on all of your borrowing, including your home mortgage). And the more you save in your HSA, the more you have when you retire for medical costs – which are often the biggest and most devastating bill when you hit your fixed income phase of life. Any capital gains you make on investments in your HSA may be tax exempt. This plan works great if you are healthy and rarely visit the doctor. Health Savings Accounts incentivize you to stay healthy by rewarding you financially for doing so. When you don’t go to the doctor, that money goes into your wallet. If you do have to go to the doctor, you have money to cover the deductible and co-pays. What a win-win! Many people prefer alternative treatments, diet and exercise these days (many of which are not even covered by insurance). If Americans knew about this solution, they would definitely embrace it! HSAs have been around for quite awhile now and are well established. Healthcare costs alone make up 18% of the United States budget, totaling $3.2 trillion in 2017. So, staying healthy can go a long way to improving the bottom line of our nation. More than 1/3 of adult Americans are obese, which costs a lot to those individuals personally, and to the U.S. collectively. Sadly, 17% of children are obese, as well. Remember to shop around before you set up your health savings account. Some brokerages offer you stocks, bonds and funds to invest in, with low trading fees, while banks and insurance companies may offer a very limited choices of investments that might be far are more expensive, to boot! You do not have to purchase your HSA from the insurance company that sells you your high deductible medical care plan. About Natalie Pace: Natalie Wynne Pace is the co-creator of the Earth Gratitude project and the author of the Amazon bestsellers The Gratitude Game, The ABCs of Money and Put Your Money Where Your Heart Is (aka You Vs. Wall Street). She has been ranked as a No. 1 stock picker, above over 835 A-list pundits, by an independent tracking agency (TipsTraders). The ABCs of Money remained at or near the #1 Investing Basics e-book on Amazon for over 3 years (in its vertical). Natalie Pace is a top-ranked blogger for Thrive Global (Arianna Huffington's newest platform) and Medium, a repeat guest on national TV and radio shows such as CNBC, Good Morning America, Fox, ABC-TV, Forbes.com, NPR and more and a popular, engaging speaker at major conferences. As a strong believer in giving back, she has been instrumental in raising millions for public schools, financial literacy, the arts and underserved women and girls worldwide. Her sustainability tips have helped companies, organizations and individuals to save tens of thousands every year in their annual budget with smarter energy, budgeting and investing choices. Important Disclaimers

Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable however NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors. |

AuthorNatalie Pace is the co-creator of the Earth Gratitude Project and the author of The Power of 8 Billion: It's Up to Us, The ABCs of Money, The ABCs of Money for College, The Gratitude Game and Put Your Money Where Your Heart Is. She is a repeat guest & speaker on national news shows and stages. She has been ranked the No. 1 stock picker, above over 830 A-list pundits, by an independent tracking agency, and has been saving homes and nest eggs since 1999. Archives

July 2024

Categories |

RSS Feed

RSS Feed