|

Crypto Winter Enters Its 3rd Year. A lot has happened since Bitcoin hit a high of $69,000 on Nov. 9, 2021.

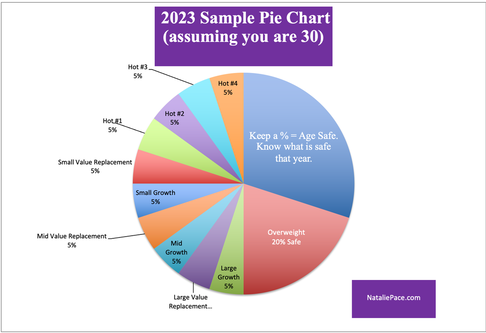

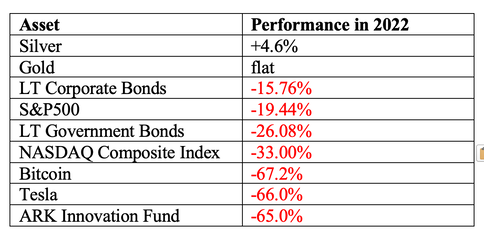

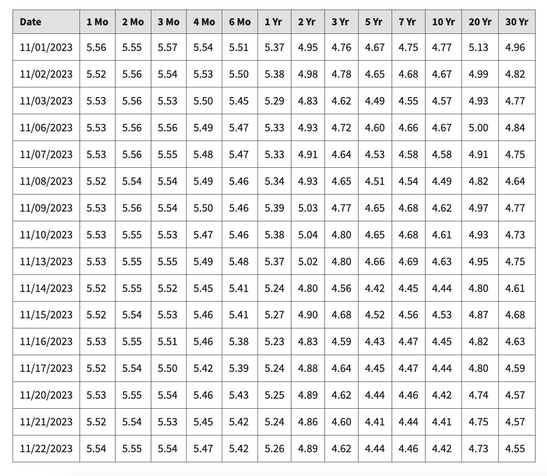

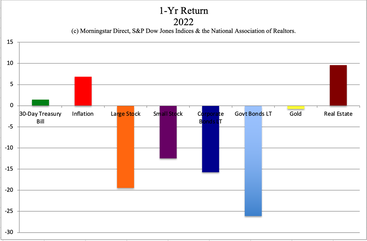

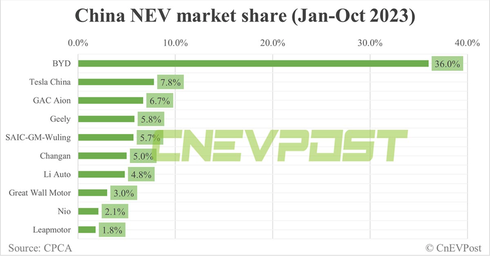

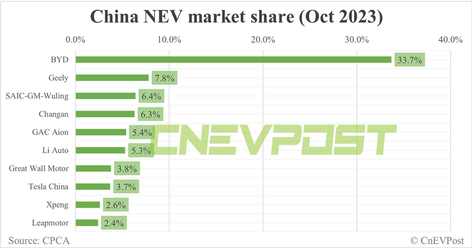

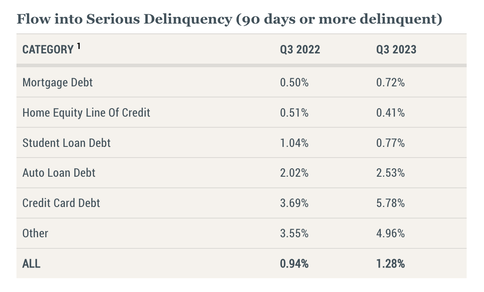

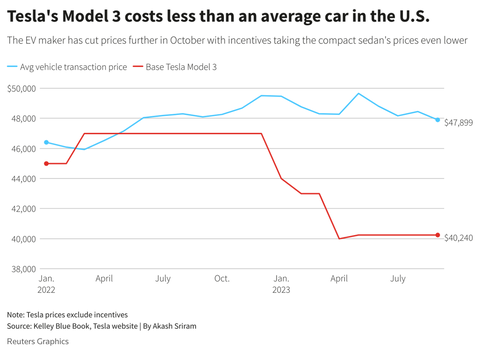

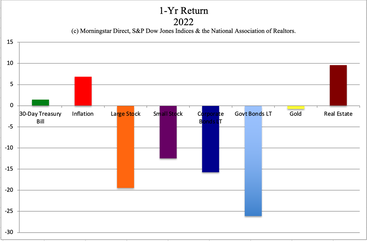

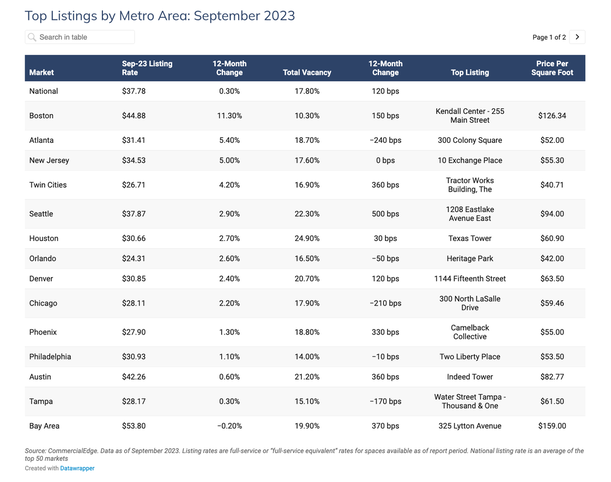

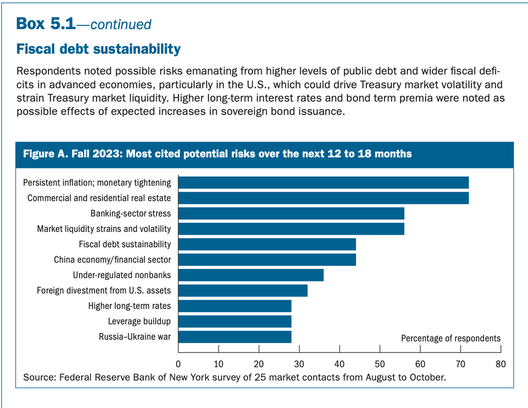

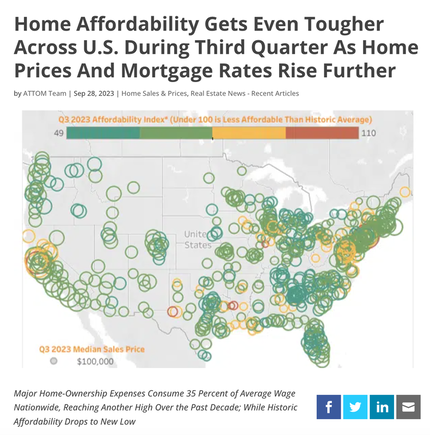

What have we learned from this? Don’t Go All In Rebalance Is Crypto Really a Safe Haven? Is Your Cash Really FDIC-Insured in a Brokerage Account? Will CZ Go to Jail? Bitcoin ETFs And here’s more information on each point. Don’t Go All In We should never go all-in on any one asset. Diversification is key, no matter how good the story is. At our retreats and in my books, I encourage investors to think of cryptocurrency as a hot slice or two of their overall wealth strategy. Below is a sample pie chart based upon a 30-year-old. You can personalize your own pie chart using our free Web App. Email [email protected] for a link to it.  For context of how our pie chart system works, read The ABCs of Money or attend our online Financial Freedom Retreat. Email [email protected] for more information. Rebalance The pie chart system with regular rebalancing prompts us to capture gains at the high, and buy low in the crypto winter (if you still believe in it). Although HODL was popular when crypto was high, few were adhering to it. The average holding time of Bitcoin, Ethereum and Cardano in 2021 was under 90 days. Even today, when investors are frozen from the long period on crypto ice, Bitcoin’s average hold time is just 101 days. Is Crypto Really a Safe Haven? It’s essential to know what’s safe in a world where crypto values are still down by almost half, 4 U.S. banks failed and bonds lost more than stocks. Safe assets are supposed to protect our principal investment. Currencies are not supposed to be worth $69,000 one year and just $37,000 the next. Imagine if the dollar or euro did that! (We spend one full day on What’s Safe at our New Year, New You Financial Freedom Retreat.) Is Your Cash Really FDIC-Insured in a Brokerage Account? As we learned with the failures of Blockfi, Voyager Digital and FTX, FDIC insurance covers failed banks, not brokerages. So, even if the brokerage has a cash sweep program with an FDIC-insured member bank, if the brokerage fails, the cash is not FDIC-insured. Below are blogs with in-depth reviews of getting your cash as safe as possible. Is Your FDIC-Insured Cash Really Safe? https://www.nataliepace.com/blog/is-your-fdic-insured-cash-really-safe-better-double-check#/ Bonds. Banks. The Treacherous Landscape of Keeping Our Money Safe. https://www.nataliepace.com/blog/bonds-banks-the-treacherous-landscape-of-keeping-our-money-safe#/ Monero. Crypto. Cash. BRICS. Videoconference. https://youtu.be/c0Ib__YTaBU Blog https://www.nataliepace.com/blog/monero-a-token-of-trust#/ Will CZ Go to Jail? According to a court filing, Changpeng Zhao’s sentencing is scheduled for Feb. 23, 2024. Speculation has it that he’ll serve under 18 months. The U.S. Department of Justice noted in its filing today that they could argue for up to 10 years. DOJ officials consider CZ to be a flight risk, particularly since the UAE doesn’t extradite to the U.S. No doubt, there will be high drama in this case over the next few months. In the meantime, CZ resigned as CEO of Binance on Nov. 21, 2023. There are other terms to his agreement. Binance will pay over $4.3 billion in fines. Bitcoin ETFs Financial services companies have had a rough year. Many have low credit scores. So, it’s important to purchase your funds from a company that has a strong credit rating, has been around for a long time and is well capitalized. These are just a few of the reasons why we don’t want to purchase our funds from companies that just started up recently, or others that might be trying to hop onto a hot fad. Before you purchase a Bitcoin ETF, know the company that is offering it. If we’ve never heard of the company before, we’ve got a thousand-piece puzzle to complete on that enterprise before we should buy their pitch. If we can’t find the company’s credit rating, it might be best to just say, “No.” Bottom Line Cryptocurrency is not a stable currency yet (unless you’re laundering money, working in the Black Market, or trying to get around sanctions, and care more about the transaction than the stability of the value). Cryptocurrency is still mostly a trading platform. There is still a lot of fraud in this space, from FTX in 2022 to the Trade Coin Club ruse launched by Joff Paradise that we warned our readers of on June 25, 2017. You might be lured in by a celebrity (like FTX had), a cool name (like Monero), FUD of the U.S. dollar (like original Bitcoin buyers were), or a billionaire (like CZ). However, if you’re not willing to trade the coin (buying low and selling high, like the whales are doing), then you could end up HODLing a lot of losses – for years. Join us at our Jan. 13-15, 2024 New Year, New You Financial Freedom Retreat. Learn nest egg strategies, how to get hot and diversified (including in EVs, crypto and AI), and what's safe in a Debt World. You'll even discover how to save thousands annually with smarter big-ticket choices. Yes, it's a complete money makeover. Email [email protected] to register. Learn the 15+ things you'll master and read testimonials in the flyer (link below) and on the home page at NataliePace.com. Register by Nov. 30, 2023 to receive the best price. Many people, including educated men and women, often get into trouble when they neglect to follow simple and fundamental rules of the type provided [by Natalie]. This is why I recommend them with enthusiasm." Professor Gary S. Becker. Dr. Becker won the 1992 Nobel Prize in economics for his theories on human capital  Join us for our Online New Year, New You Financial Freedom Retreat. Jan. 13-15, 2024. Email [email protected] or call 310-430-2397 to learn more. Register by Nov. 30, 2023 to receive the best price. Click for testimonials, pricing, hours & details.  Join us for our Restormel Royal Immersive Adventure Retreat. March 8-15, 2024. Email [email protected] to learn more. Register with friends and family to receive the best price. Click for testimonials, pricing, hours & details. There is very limited availability, and you must register early to ensure that you get the exact room you want. This retreat includes an all-access pass to all of our online training for a full year for two!  Natalie Wynne Pace is an Advocate for SustainabilityFinancial Literacy & Women's Empowerment. Natalie is the bestselling author of The Power of 8 Billion: It's Up to Us and is the co-creator of the Earth Gratitude Project. She has been ranked as a No. 1 stock picker, above over 835 A-list pundits, by an independent tracking agency (TipsTraders). Her book The ABCs of Money remained at or near the #1 Investing Basics e-book on Amazon for over 3 years (in its vertical), with over 120,000 downloads and a mean 5-star ranking. The 5th edition of The ABCs of Money and the 2nd edition of Put Your Money Where Your Heart Is were released in 2021. Follow her on Instagram. Natalie Pace's easy as a pie chart nest egg strategies earned gains in the last two recessions and have outperformed the bull markets in between. That is why her Investor Educational Retreats, books and private coaching are enthusiastically recommended by Nobel Prize winning economist Gary S. Becker, TD AMERITRADE chairman Joe Moglia, Kay Koplovitz and many Main Street investors who have transformed their lives using her Thrive Budget and investing strategies. Click to view a video testimonial from Nilo Bolden. Check out Natalie Pace's Substack on Apple and Spotify. Watch videoconferences and webinars on Youtube. Other Blogs of Interest Earn $50,000 or More in Interest. Safely. Finally. Freebies and Deals for Black Friday and Cyber Monday. Auto Strikes End. EV Price Wars Continue. WeWork's Bankruptcy. Half-Empty Office Buildings. Problems in our Personal Wealth Plan. Solutions for Unaffordable Housing. The Magnificent 7 Drag NASDAQ into Another Correction Cruise Ships Give Freebies to Investors. Should You Take the Bait? Should You Take a Cruise? Bonds. Banks. The Treacherous Landscape of Keeping Our Money Safe. 7 Rules of Investing Air B N Bust? Santa Rally 2023 or Time to Get Defensive? Barbie. Oppenheimer. Strikes. Streaming Wars. Netflix. Monero: A Token of Trust? 13 Lifestyle Choices to Reduce Waste, Pollution & CO2 & Save a Boatload of Dough. China Bans Apple 11-Point Green Checklist for Schools. Artificial Intelligence and Nvidia's Blockbuster Earnings Report Biotech in a Post-Pandemic World 10 Wealth Secrets of Billionaires and Royals. What Happened to Cannabis? Bank of America has $100 Billion in Bond Losses (on Paper) The USA AAA Credit Rating is on a Negative Watch. Lithium. Essential to EV Life. I'm Just Not Good at Investing. Investors Ask Natalie. Should I Buy an S&P500 Index Fund? Investors Ask Natalie. Bonds Lost More than Stocks in 2022. 2023 Company of the Year Do Cybersecurity Risks Create Investor Opportunities? Writers Strike, While Streaming CEOs Rake In Hundreds of Millions Annually. I Lost $100,000. Investors Ask Natalie. Artificial Intelligence Report. Micron Banned in China. Intel Slashes Dividend. Buffett Loses $23 Billion. Branson's Virgin Orbit Declares Bankruptcy. Insurance Company Risks. Schwab Loses $41 Billion in Cash Deposits. Fiat. Crypto. Gold. BRICS. Real Estate. Alternative Investments. BRICS Currency. Will the Dollar Become Extinct? The Online Global Earth Gratitude Celebration 7 Green Life Hacks Fossil Fuels Touch Every Part of Our Lives Are There Any Safe, Green Banks? 7 Ways to Stash Your Cash Now. Lessons from the Silicon Valley Bank Failure. Which Countries Offer the Highest Yield for the Lowest Risk? Solar, EVs, Housing, HSAs -- the Highest-Yield in 2023? Why We Are Underweighting Banks and the Financial Industry. 2023 Bond Strategy Emotions are Not Your Friend in Investing Investor IQ Test Investor IQ Test Answers Bonds Lost -26%, Silver Held Strong. Save Thousands Annually With Smarter Energy Choices Is Your FDIC-Insured Cash Really Safe? Money Market Funds, FDIC, SIPC: Are Any of Them Safe? My 24-Year-Old is Itching to Buy a Condo. Should I Help Him? The 12-Step Guide to Successful Investing. The Bank Bail-in Plan on Your Dime. Rebalancing Your Nest Egg IQ Test. Answers to the Rebalancing Your Nest Egg IQ Test. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable. However, NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors. You Could Be Earning up to $50,000 (or more) in Interest (Finally) Is that enough to retire? One-year treasury bills are paying 5.25% these days. If you have $1 million on the safe side, you could be earning $50,000 in interest annually. The US is still an AA+ rated country, so the risk is pretty low on short-term treasuries. The one-year note is actually paying a higher interest rate, then two years or beyond. So keeping the terms short, and the creditworthiness high is not only a sound policy, it’s also giving us a higher yield. Bonds are tricky these days, so there are a few things to get right in order to earn this income (which is long overdue). Also, if you’re close to retirement, is it going to fill-in the gap between your earned income and what your Social Security and/or pension is going to pay you? Will 5% interest rates still be around next year? Below are a few things we will go over in this blog. Can you earn enough interest to retire? 5% of $1 Million Social Security Benefits Medical Costs Align your mortgage payoff date with your retirement date Reducing Expenses Increasing Income Will interest rates go higher or lower? Keep the terms short and the creditworthiness high Bond Funds And here’s more information on each point below. Can you earn enough interest to retire? A recent retiree was accustomed to earning $150,000 a year. Her Social Security was going to provide her with less than $45,000. She had no pension. The company she worked for was giving her a lump sum of about $250,000. All told, if her expenses and spending stay where they are, she could easily burn through that in 2 1/2 years. Add in the additional $600,000 she has in her other retirement accounts, and she wouldn’t last a decade. It’s a good idea to do the math before we retire, especially in today’s inflationary world! With 5% interest rates, we can finally earn some passive income without too much risk of capital loss. And there may be other ways to reduce expenses and increase income – both of which will be necessary. 5% of $1 Million The retiree mentioned above had closer to $800,000 which would bring her $40,000 annually, if she was earning a 5% interest rate. That’s still about $65,000 shy of what she was accustomed to earning, but it is at least moving in the right direction. Her bills, excluding Medicare, prescriptions and doctor visits, remain above $70,000 a year. That’s still flying too close to the trees for an $85,000 annual income. It doesn’t leave any room for fun or travel. If she has a major plumbing, roof or landscaping repair, or a health crisis, she might be forced to rely on credit cards to get her through. One word of warning. I have coaching clients who have been told that they are earning 5-7% on their “conservative” investments. Since bonds lost more than stocks did last year, those claims might not be truthful. The real return (under 2%, or perhaps even bond losses, once the losses are factored in) is written in the fine print of the statement. Long-term bonds that are low credit quality are the most problematic. (Click to learn more.) Another client was sold into a “safe,” high-yield, private placement REITs (oxymorons & red flags galore!). Read their story in their own words in our blog, “They Trusted Him. Now He Doesn’t Return Phone Calls.” Rather than earning almost 10% yield, they lost -18% of their investment. Again, bonds are tricky (but worth it!), which is why we spend one full day on how to get a safe yield at our Financial Freedom Retreat. Social Security Benefits The interesting thing about Social Security benefits is that there are ways to get more than you think you might, and waiting for the larger amount when you hit 72 doesn’t always add up. if your spouse (or ex-spouse) earned a lot more income than you did, and you were married for longer than 10 years, and you never married again, you might qualify to get up to half of what your spouse or ex is receiving. When considering exactly when you should start taking your Social Security, you also want to factor in the money you’ll miss by waiting until you get the full benefit amount. There are a few things in the fine print that you’ll really want to go through forensically when deciding when the time is right to start drawing on your Social Security benefits. Medical Costs Medical costs are the biggest expenses as we get older, and are the leading cause of bankruptcies in the U.S. (66.5%, source: NIH). Healthcare in the United States makes up 18% of GDP ($3.8 trillion in 2019). Many people are paying a good portion of the small amount of Social Security they receive back to the government for their Medicare premiums. This is one of the reasons that we encourage younger people who are healthy to consider setting up a health savings account for themselves. Health savings accounts offer tax credits, save thousands annually on health premiums, and are also the best long-term healthcare plan in retirement. It’s a great idea to have your own healthcare nest egg for your retirement, which also rewards you throughout your professional life with thousands annually that you don’t spend making the health insurance company and the taxman rich. If you’re close to retirement, and you didn’t establish a health savings account, then it becomes even more imperative that you adjust your expenses to your new income as quickly as possible (downsize). Burning through your 401k and IRAs to stay in a lifestyle that you can no longer afford is a perilous position to put yourself in. Also, remember that health is the best health insurance. Eat right, exercise and have fun to stay strong and spend less money on the doctor. Align your mortgage payoff date with your retirement date Almost everyone earns a lot less in retirement than they did in the workplace. So, before we retire, it’s a really good idea to try to get rid of as many bills as possible. One of the biggest bills is our mortgage payment. So for most of us, it’s going to make a lot of sense to pay off our mortgage before we retire. (if you purchased your home recently or still owe a lot of money on your home loan, then your circumstance might require additional considerations.) Reducing Expenses Reducing our expenses will make retirement bucks go further. Free housing for a home that you own free and clear (with only property taxes, maintenance and upkeep to pay) can save tens of thousands of dollars annually. If we have that HSA, then our medical insurance premiums will be much lower. If we live in a sunny state and have solar, our electric bill could be under $500 a year. Energy efficiency upgrades could cut our electric bill in half. Rethinking transportation could save us $8000 or more annually. We spend one full day on safe, income-producing hard assets that we can purchase for a good price. Many of them pay us a better return on investment than any bond could hope to do (15% annualized or higher). One coaching client is saving about $7,200/year on her utility bill from her $26,700 investment in solar. She’s receiving $8000 in tax credits and will pay off the panels in under three years. Thereafter, she is essentially receiving 38.5% ROI on her solar investment every year, in money that she no longer pays the utility (that she can now spend or invest on things she likes more). Additionally, sometimes the best way to downsize is to think bigger and factor in our family. The goal is always to keep the money in the family, and stop making everyone else rich at our own expense. Increasing Income We’ve talked about how getting a 5% interest-rate on the safe side of our portfolio through a carefully designed plan of short-term, creditworthy bonds or treasury bills can augment our income. Putting a spare bedroom or ADU* on Traveling Nurses or Airbnb could be worth thousands annually (though you’ll have extra work to keep your space desirable and booked). *Auxiliary Dwelling Unit One retiree had a novel approach. She rented out her big house, and then downsized to an efficiency condo. The income from the rental combined with her pension and her 401(k) offered her almost the same annual income that she earned as a professional. With the same income and a dramatically reduced cost of living, she now spends about six months out of the year traveling to her bucket list vacation destinations. Should your kids spend tens of thousands of dollars on rent? Or could that money go toward remodeling and upgrading (or paying off) the family home? There are many case studies examined in the Real Estate section of The ABCs of Money, 5th edition. Will interest rates go higher or lower? Prior to the rate hikes last year, interest rates spent over a decade in the doldrums. You would have to swim in the risk of junk bonds to get a 5% interest rate. And there you risk drowning in losses of your principal, which defeats the purpose of having a safe side of your wealth plan. Forecasters are predicting that interest rates could go lower as soon as next year. That may make it tempting to reach for yield, or take on longer terms. However, this must be done very strategically. Over half of the S&P500 is at or near junk bond status. Banks were failing earlier this year, and not all of the financial services industries are out of the woods. Some sectors, like commercial real estate are already facing dire straits. Read my 'WeWork Files for Bankruptcy' blog for more information. Keep the terms short and the creditworthiness high Getting 5% is very tricky. The newer issuances with shorter terms are paying a higher interest rate with more credit quality and less risk. So a good rule of thumb is to keep the terms short and the creditworthiness high. We’re still not getting paid to reach for yield, when you consider that long-term bonds lost 26% of their value last year and pay a lower interest rate than short-term. We need to be mindful about yield, as we’ve been alerting our retreat attendees and readers for more than a decade now. Yield is back, but it is very tricky. There is still a great deal of duration and credit risk. That won’t abate without some pain and potentially more bankruptcies. There remains a danger of negative yields (from valuation losses and fees), losses in principal and illiquidity (no one would want to take it off your hands without a large discount). Many investors try to salve the wounds of their bond losses by saying they’ll just hold to term. However, we’re seeing terms that are well beyond lifespans. One 70-year-old coaching client had a junk bond that wouldn’t pay him back until 2074. Bond losses were at the heart of the bank failures in 2023. The professionals are having problems! Many of us hold these same troublesome assets in our own nest egg (whether we know it or not). This makes it essential to know exactly what we own and why and to be the boss of our money, rather than having blind faith that someone else is protecting us. Bottom Line There are certain years when protecting our wealth becomes our most important job. Most of us have more in our retirement accounts than we can earn in many years of working. Others need to do the math before we retire or allow ourselves to be furloughed. This is going to require learning the life math that we all should have received in high school and college. Whether you get this information by attending our New Year, New You Financial Freedom Retreat, or by receiving an unbiased 2nd opinion through our private coaching, now is the right time to start the process. When we wait for the headlines that the economy is in troubled times, most people have already lost -40% or more of their wealth. It’s time to fix the roof while the sun is still shining. Join us at our Jan. 13-15, 2024 New Year, New You Financial Freedom Retreat. Learn nest egg strategies, how to get hot and diversified (including in EVs and AI), and what's safe in a Debt World. You'll even discover how to save thousands annually with smarter big-ticket choices. Yes, it's a complete money makeover. Email [email protected] to register. Learn the 15+ things you'll master and read testimonials in the flyer (link below) and on the home page at NataliePace.com. Register by Nov. 30, 2023 to receive the best price. Many people, including educated men and women, often get into trouble when they neglect to follow simple and fundamental rules of the type provided [by Natalie]. This is why I recommend them with enthusiasm." Professor Gary S. Becker. Dr. Becker won the 1992 Nobel Prize in economics for his theories on human capital  Join us for our Online New Year, New You Financial Freedom Retreat. Jan. 13-15, 2024. Email [email protected] or call 310-430-2397 to learn more. Register by Nov. 30, 2023 to receive the best price. Click for testimonials, pricing, hours & details.  Join us for our Restormel Royal Immersive Adventure Retreat. March 8-15, 2024. Email [email protected] to learn more. Register with friends and family to receive the best price. Click for testimonials, pricing, hours & details. There is very limited availability, and you must register early to ensure that you get the exact room you want. This retreat includes an all-access pass to all of our online training for a full year for two!  Natalie Wynne Pace is an Advocate for SustainabilityFinancial Literacy & Women's Empowerment. Natalie is the bestselling author of The Power of 8 Billion: It's Up to Us and is the co-creator of the Earth Gratitude Project. She has been ranked as a No. 1 stock picker, above over 835 A-list pundits, by an independent tracking agency (TipsTraders). Her book The ABCs of Money remained at or near the #1 Investing Basics e-book on Amazon for over 3 years (in its vertical), with over 120,000 downloads and a mean 5-star ranking. The 5th edition of The ABCs of Money and the 2nd edition of Put Your Money Where Your Heart Is were released in 2021. Follow her on Instagram. Natalie Pace's easy as a pie chart nest egg strategies earned gains in the last two recessions and have outperformed the bull markets in between. That is why her Investor Educational Retreats, books and private coaching are enthusiastically recommended by Nobel Prize winning economist Gary S. Becker, TD AMERITRADE chairman Joe Moglia, Kay Koplovitz and many Main Street investors who have transformed their lives using her Thrive Budget and investing strategies. Click to view a video testimonial from Nilo Bolden. Check out Natalie Pace's Substack on Apple and Spotify. Watch videoconferences and webinars on Youtube. Other Blogs of Interest Freebies and Deals for Black Friday and Cyber Monday. Auto Strikes End. EV Price Wars Continue. WeWork's Bankruptcy. Half-Empty Office Buildings. Problems in our Personal Wealth Plan. Solutions for Unaffordable Housing. The Magnificent 7 Drag NASDAQ into Another Correction Cruise Ships Give Freebies to Investors. Should You Take the Bait? Should You Take a Cruise? Bonds. Banks. The Treacherous Landscape of Keeping Our Money Safe. 7 Rules of Investing Air B N Bust? Santa Rally 2023 or Time to Get Defensive? Barbie. Oppenheimer. Strikes. Streaming Wars. Netflix. Monero: A Token of Trust? 13 Lifestyle Choices to Reduce Waste, Pollution & CO2 & Save a Boatload of Dough. China Bans Apple 11-Point Green Checklist for Schools. Artificial Intelligence and Nvidia's Blockbuster Earnings Report Biotech in a Post-Pandemic World 10 Wealth Secrets of Billionaires and Royals. What Happened to Cannabis? Bank of America has $100 Billion in Bond Losses (on Paper) The USA AAA Credit Rating is on a Negative Watch. Lithium. Essential to EV Life. I'm Just Not Good at Investing. Investors Ask Natalie. Should I Buy an S&P500 Index Fund? Investors Ask Natalie. Bonds Lost More than Stocks in 2022. 2023 Company of the Year Do Cybersecurity Risks Create Investor Opportunities? Writers Strike, While Streaming CEOs Rake In Hundreds of Millions Annually. I Lost $100,000. Investors Ask Natalie. Artificial Intelligence Report. Micron Banned in China. Intel Slashes Dividend. Buffett Loses $23 Billion. Branson's Virgin Orbit Declares Bankruptcy. Insurance Company Risks. Schwab Loses $41 Billion in Cash Deposits. Fiat. Crypto. Gold. BRICS. Real Estate. Alternative Investments. BRICS Currency. Will the Dollar Become Extinct? The Online Global Earth Gratitude Celebration 7 Green Life Hacks Fossil Fuels Touch Every Part of Our Lives Are There Any Safe, Green Banks? 7 Ways to Stash Your Cash Now. Lessons from the Silicon Valley Bank Failure. Which Countries Offer the Highest Yield for the Lowest Risk? Solar, EVs, Housing, HSAs -- the Highest-Yield in 2023? Why We Are Underweighting Banks and the Financial Industry. 2023 Bond Strategy Emotions are Not Your Friend in Investing Investor IQ Test Investor IQ Test Answers Bonds Lost -26%, Silver Held Strong. Save Thousands Annually With Smarter Energy Choices Is Your FDIC-Insured Cash Really Safe? Money Market Funds, FDIC, SIPC: Are Any of Them Safe? My 24-Year-Old is Itching to Buy a Condo. Should I Help Him? The 12-Step Guide to Successful Investing. The Bank Bail-in Plan on Your Dime. Rebalancing Your Nest Egg IQ Test. Answers to the Rebalancing Your Nest Egg IQ Test. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable. However, NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors. Black Friday. Cyber Monday. 2023. Happy Thanksgiving! What are you thankful for? Share with us on social media. Among the many things that we’re grateful for, we’re happy to be able to offer the following Black Friday/Cyber Monday deals. Free Ebooks make great stocking stuffers! From Friday, Nov. 24 to Tuesday, Nov. 28 ONLY, you can download Natalie Pace’s bestselling ebooks for free. (Canadians, while the offer might not be available to you, the ebook price is under $5, and our other deals are definitely yours for the taking.) The Power of 8 Billion: It’s Up to Us. Learn the quadruple win of greener choices. Save thousands annually. Healthier You, Healthier Budget, Healthier planet. Put Your Money Where Your Heart Is (2nd edition) Investing Strategies for Lifetime Wealth and a Sustainable Planet. One of the original ESG Investing books that was first in 2008. The ABCs of Money (5th edition) Time-Proven 21st Century Strategies for Debt Reduction, Budgeting, Real Estate, Stocks, Bonds, Crypto, Gold and more. The ABCs of Money for College Get a better degree for up to half the cost. Parents: you want to read this book when your child is born. Teens: if you’re going to have to plan this on your own, there are great tips and resources that you just won’t find with your college counselors and those standardized personality tests. BOGO Coaching Buy 3 and Get 3 Additional Private Prosperity Coaching Sessions Complimentary Call 310-430-2397 or email [email protected] for pricing and information. (You're also receiving a bundling discount on the 3-pack that you purchase.) These sessions can be used for an unbiased 2nd opinion of your current wealth plan. Learn exactly what you own and what a safer, hotter, and more diversified plan looks like. Natalie Pace’s analysis comes with color-coded details of all of your holdings and easy-to-understand instructions that you can choose to use (or not). You’ll learn what’s toxic, what’s safe, what you have too much of and what you’re missing. You’re the boss of your money. Our mission is to provide the news, information, time-proven systems and education to make it easier to navigate through all the noise, hullabaloo and traps, to live a richer life, earn money while you sleep and stop making the billionaires rich at our own expense (also good for the planet). Complimentary Coaching Receive a 50-minute Private Prosperity Coaching Session (value $400) when you register for our New Year, New You Financial Freedom Retreat between Black Friday and Cyber Monday. The above offers expire Tuesday, Nov. 28, 2023 at midnight PT. Save $200 On the New Year, New You Financial Freedom Retreat Now through Nov. 30, 2023, you’ll save $200 when you register for our Jan. 13-15, 2024 online retreat. Bring someone with you and they pay half of the regular price. (Bring a teen or college student for less than many people spend on streaming services!)  Join us for our Online New Year, New You Financial Freedom Retreat. Jan. 13-15, 2024. Email [email protected] or call 310-430-2397 to learn more. Register by Nov. 30, 2023 to receive the best price. Click for testimonials, pricing, hours & details. Sustainability Adventures Treat yourself to a week in a royal manor house in Cornwall, England, with a select group of Brain Trust adventurers. What can you learn by living and visioning as you walk in the footsteps of billionaires who have kept their wealth for centuries? The 2023 Retreat was an epic success. The possibilities are endless when you step into a world of infinite possibilities, where you are in control of what you create and how you live. Check out the testimonials and a short video created by the attendees at the Restormel Retreat flyer on the home page at NataliePace.com.  Join us for our Restormel Royal Immersive Adventure Retreat. March 8-15, 2024. Email [email protected] to learn more. Register with friends and family to receive the best price. Click for testimonials, pricing, hours & details. There is very limited availability, and you must register early to ensure that you get the exact room you want. This retreat includes an all-access pass to all of our online training for a full year for two! The holiday gift of financial freedom is one that will transform your life forever. As Natalie Pace says, “Every cent we own and every moment we spend is always an investment.” Imagine stepping into a life where you feel a return on investment of time, talent and money with every breath you take. Email [email protected] or call 310-430-2397 to learn more now. Happy Thanksgiving!  Natalie Wynne Pace is an Advocate for SustainabilityFinancial Literacy & Women's Empowerment. Natalie is the bestselling author of The Power of 8 Billion: It's Up to Us and is the co-creator of the Earth Gratitude Project. She has been ranked as a No. 1 stock picker, above over 835 A-list pundits, by an independent tracking agency (TipsTraders). Her book The ABCs of Money remained at or near the #1 Investing Basics e-book on Amazon for over 3 years (in its vertical), with over 120,000 downloads and a mean 5-star ranking. The 5th edition of The ABCs of Money and the 2nd edition of Put Your Money Where Your Heart Is were released in 2021. Follow her on Instagram. Natalie Pace's easy as a pie chart nest egg strategies earned gains in the last two recessions and have outperformed the bull markets in between. That is why her Investor Educational Retreats, books and private coaching are enthusiastically recommended by Nobel Prize winning economist Gary S. Becker, TD AMERITRADE chairman Joe Moglia, Kay Koplovitz and many Main Street investors who have transformed their lives using her Thrive Budget and investing strategies. Click to view a video testimonial from Nilo Bolden. Check out Natalie Pace's Substack on Apple and Spotify. Watch videoconferences and webinars on Youtube. Other Blogs of Interest Auto Strikes End. EV Price Wars Continue. WeWork's Bankruptcy. Half-Empty Office Buildings. Problems in our Personal Wealth Plan. Solutions for Unaffordable Housing. The Magnificent 7 Drag NASDAQ into Another Correction Cruise Ships Give Freebies to Investors. Should You Take the Bait? Should You Take a Cruise? Bonds. Banks. The Treacherous Landscape of Keeping Our Money Safe. 7 Rules of Investing Air B N Bust? Santa Rally 2023 or Time to Get Defensive? Barbie. Oppenheimer. Strikes. Streaming Wars. Netflix. Monero: A Token of Trust? 13 Lifestyle Choices to Reduce Waste, Pollution & CO2 & Save a Boatload of Dough. China Bans Apple 11-Point Green Checklist for Schools. Artificial Intelligence and Nvidia's Blockbuster Earnings Report Biotech in a Post-Pandemic World 10 Wealth Secrets of Billionaires and Royals. What Happened to Cannabis? Bank of America has $100 Billion in Bond Losses (on Paper) The USA AAA Credit Rating is on a Negative Watch. Lithium. Essential to EV Life. I'm Just Not Good at Investing. Investors Ask Natalie. Should I Buy an S&P500 Index Fund? Investors Ask Natalie. Bonds Lost More than Stocks in 2022. 2023 Company of the Year Do Cybersecurity Risks Create Investor Opportunities? Writers Strike, While Streaming CEOs Rake In Hundreds of Millions Annually. I Lost $100,000. Investors Ask Natalie. Artificial Intelligence Report. Micron Banned in China. Intel Slashes Dividend. Buffett Loses $23 Billion. Branson's Virgin Orbit Declares Bankruptcy. Insurance Company Risks. Schwab Loses $41 Billion in Cash Deposits. Fiat. Crypto. Gold. BRICS. Real Estate. Alternative Investments. BRICS Currency. Will the Dollar Become Extinct? The Online Global Earth Gratitude Celebration 7 Green Life Hacks Fossil Fuels Touch Every Part of Our Lives Are There Any Safe, Green Banks? 7 Ways to Stash Your Cash Now. Lessons from the Silicon Valley Bank Failure. Which Countries Offer the Highest Yield for the Lowest Risk? Solar, EVs, Housing, HSAs -- the Highest-Yield in 2023? Why We Are Underweighting Banks and the Financial Industry. 2023 Bond Strategy Emotions are Not Your Friend in Investing Investor IQ Test Investor IQ Test Answers Bonds Lost -26%, Silver Held Strong. Save Thousands Annually With Smarter Energy Choices Is Your FDIC-Insured Cash Really Safe? Money Market Funds, FDIC, SIPC: Are Any of Them Safe? My 24-Year-Old is Itching to Buy a Condo. Should I Help Him? The 12-Step Guide to Successful Investing. The Bank Bail-in Plan on Your Dime. Rebalancing Your Nest Egg IQ Test. Answers to the Rebalancing Your Nest Egg IQ Test. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable. However, NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors. Electric vehicles are the fastest growing vertical in the auto industry, and China is the biggest auto market in the world. Tesla and General Motors are the both on the Top 10 Chinese New Energy Vehicle list. Tesla is 2nd behind BYD Auto year to date, with 7.8% and 36.0% market share, respectively (source: CNEVPost.com). However, GM’s joint venture, SAIC-GM-Wuling, just soared to #3 in October, while Tesla sank to #8, with 6.4% and 3.7% market share on the month, respectively. Recently, despite the rapid growth of EVs, both Ford and GM moderated their tone on a move from ICE* to electric. Why is that, and what does that mean for the future of Ford and General Motors? Why are these companies pumping the brakes on their EV launches? *Internal Combustion Engines Will the EV price wars, inflation and uncertain economic times cause struggling or cash-bleed startups to go belly-up? Can Rivian keep losing $32,595 for every vehicle sold? We’ll also cover the following in this blog. Competition is Fierce Chinese EVs Valuations are Volatile Tesla And here is more information on each point. Why are Ford and General Motors pumping the brakes on their EV launches? Both companies have indicated that the price wars, inflation and profitability lie at the heart of a more moderate approach to their EV transition. Electric vehicles made up less than 5% of Ford’s revenue in the most recent quarter. Ford’s CFO John Lawler put a positive spin on the slower adoption. In the company’s 3Q earnings press release, he wrote, “Ford is able to balance production of gas, hybrid and electric vehicles to match the speed of EV adoption in a way that others can’t. That’s obviously good for customers, who get the products they want – and good for us, too, because disciplined capital allocation and not chasing scale at all costs maximizes profitability and cash flow.” What Lawler didn’t mention is that retooling factories from ICE to EV is an expensive game, particularly when your credit rating is at the lowest rung of investment grade (BBB-), and your current liabilities are almost four times the company's cash on hand. Meanwhile, General Motors delivered 541,000 EVs in China in the 3rd quarter of 2023, mostly through its joint venture with SAIC-GM-Wuling (295,000 units). However, GM CEO Mary Barra is dialing back the company’s previously pledged plan of an all-electric future. In the 3Q 2023 Letter to Shareholders of Oct. 24, 2023, Barra wrote, “We are moderating the acceleration of EV production in North America to protect our pricing, adjust to slower near-term growth in demand, and implement engineering efficiency and other improvements that will make our vehicles less expensive to produce, and more profitable.” GM is rated BBB by S&PGlobal. GM’s cash vs. current liabilities is in a similar situation to Ford’s. Both Ford and GM have union labor, pensions and other post-employment benefits weighing on their margins – challenges that Tesla and the Chinese companies do not have (yet). The transition to electric vehicles is similar to the instant switch the world made from ICE to hybrids in 2004 – when the Toyota Prius was named Car of the Year by Motor Trend. After Toyota changed the game with the Prius hybrid, the Big 3 Detroit automakers suffered greatly. Both Chrysler and GM eventually had to declare bankruptcy in 2009. Their stronghold on ICE vehicles helped GM and Ford keep their revenues above $150 billion in 2022 – keeping them in the Top 4 in sales worldwide, behind Toyota (#1) and Stellantis (#2). (Ford Motor Company posted a net loss of -$1.98 billion in 2022.) EVs made up 7.9% of U.S. total industry sales in the 3rd quarter of 2023. The industry has a great ways to go before it puts ICE out of business. Meanwhile the Chinese automakers dominate revenue growth. Li Auto surged 271.6% year over year, Nio gave a strong showing in the 3rd quarter with a 75.4% annual increase in deliveries, Xpeng enjoyed its best month ever in October 2023 with 20,002 deliveries , which will be three times 4Q 2022, if the company continues apace. BYD continues to enjoy the top NEV sales spot, with year-over-year revenue growth of 38.5%. Email [email protected] with Auto Stock Report Card in the subject line if you’d like an updated report. Will the price wars, inflation and uncertain economic times cause struggling or cash-bleed startups to go belly-up? Can Rivian keep losing $32,595 for every vehicle sold? The startup had impressive revenue growth of 149.4% in the most recent quarter. However, Rivian also lost $6.75 billion in 2022. They talk about a pathway to profitability, but can this expensive EV truck (starting at $75,000) get there? Tesla is profitable, but is having its margins squeezed due to the price wars. The company’s net profit was $1.85 billion in the 3rd quarter of 2023, down -44% from $3.29 billion a year ago. Most of the younger EV companies are cash negative. WM Motors, a Chinese EV startup, filed for a pre-restructuring process on October 7, 2023. It hopes to continue operating. Fisker delivered 1097 Ocean vehicles in the third-quarter, which was their first full quarter of deliveries. While that’s impressive, at the same time, the company slashed production by 26%. The price wars, inflation and economic uncertainty are forcing all automakers to conserve capital and manage production, so they don’t build up too much inventory. Competition is Fierce China is already competing in the EV space in other countries. Moody's predicts that China will overtake Japan as the world's #1 exporter of vehicles by the end of this year. Nio cars have won awards in Germany, Sweden and Norway. They are also competing to have the smartest car, the best charging network (or battery swap), the safest vehicles and even the most productive showrooms and sales teams. Europe is so concerned about the Chinese dominance of EV exports that the European Union launched an anti-subsidy probe in September of 2023. With much lower labor costs, the Chinese automakers have the ability to keep prices low and competitive, forcing other carmakers, including Tesla, to lower prices to compete. Because interest rates are now a major consideration in the monthly payment, and most people finance their vehicle purchases, even Tesla has become more measured in its projections, mentioning the phrase “uncertain times” at least five times in their most recent earnings call. Serious delinquencies on credit card debt and auto loans in the U.S. are still low, but are starting to creep up. Chinese EVs As you can see in the chart at the top of this blog, BYD is by far the most popular EV brand in China. Li Auto is doing great with its plug-in hybrid. An emerging preference for hybrids has come about perhaps because drivers just don’t want to queue up at charging stations. Nio makes its charging stations available to other customers, but prioritizes their own customers during high demand. While both Nio and XPeng struggled over the last year, they have completed their new launches with flying colors. Xpeng delivered 40,008 vehicles in the third quarter, which is an increase of 72.4% sequentially and 35.3% year over year. Nio delivered 55,432 vehicles in the third quarter, which is an increase of 75.4% year over year, and more than double the deliveries in the second quarter. Valuations are Volatile Valuations on all EV automakers are very volatile. Tesla’s 52-week range is $100-$300/share. It has soared and plunged to a valuation of over a trillion and a low of $300 billion (still massive compared to its peers). Nio and XPeng are trading very close to their five-year lows. In addition to the various challenges that all auto manufacturers have faced since the pandemic, including rising interest rates, supply chain issues, and the price wars, the Chinese companies have fallen out of favor on Wall Street. Although there is hope that the accounting standards are in better shape than originally thought, not all of the Chinese companies have recovered from the negative sentiment. Tesla Tesla vehicles are beloved around the world. The company had revenue of $81.46 billion, with net income of $12.58 billion, in 2022. The Tesla Model 3 has become more affordable than its ICE competitors, once you factor in tax incentives. Add in gasoline savings and you're really saving money. More recently, however, Tesla's sales growth has slowed to 9% YOY, and net profit margins are getting squeezed. While analysts and investors place a lot of hope for Tesla’s expansion into Mexico and the cyber truck, Elon is tempering expectations on both of these. He believes that it is possible to hit deliveries of a quarter of a million cyber trucks perhaps by 2025, but warns that profitability is a problem with this particular product. High interest rates were another concern touched on repeatedly in the Tesla third quarter 2023 earnings call. According to Elon, “informing people of a car that is great but they cannot afford doesn't really help. So, that is really the thing that must be sold, is to make the car affordable, or the average person cannot buy it for any amount of money.” A lot of American companies, particularly companies in hot industries like electric vehicles and artificial intelligence, are being priced at very high valuations. Tesla’s price earnings ratio is 68. Essentially investors are assigning a value of $772 billion to a company that only had $12.6 billion in net income last year, and is likely to have less in 2023. Bottom Line Electric vehicles, and the emphasis on artificial intelligence and smart cars in this industry, are exciting. EVs continue to be the fastest growing vertical in autos. However, capitalizing as an investor is quite tricky with the squirrelly valuations, price wars, expensive share prices, and the fact that a lot of people are burning through their personal savings to stay afloat in today’s inflationary world. Automakers always suffer greatly when the economy slows down or hits a recession, since 70% of U.S. GDP is directly linked to consumption. Even though Tesla is a clear leader, with brand pizazz, beloved products, and strong sales, that’s already more than priced in. A better choice for many investors, including more passive investors, might be an ETF that targets EVs, such as the iShares IDRV product. That ETF offers exposure to Tesla, BYD, Rivian, XPeng, Li auto and more. Using a dollar-cost-averaging approach, with our pie chart system and regular rebalancing, will help us to stay on the right side of the trade. Join us at our Jan. 13-15, 2024 New Year, New You Financial Freedom Retreat. Learn nest egg strategies, how to get hot and diversified (including in EVs and AI), and what's safe in a Debt World. You'll even discover how to save thousands annually with smarter big-ticket choices. Yes, it's a complete money makeover. Email [email protected] to register. Learn the 15+ things you'll master and read testimonials in the flyer (link below) and on the home page at NataliePace.com. Register by Nov. 30, 2023 to receive the best price. Many people, including educated men and women, often get into trouble when they neglect to follow simple and fundamental rules of the type provided [by Natalie]. This is why I recommend them with enthusiasm." Professor Gary S. Becker. Dr. Becker won the 1992 Nobel Prize in economics for his theories on human capital  Join us for our Online New Year, New You Financial Freedom Retreat. Jan. 13-15, 2024. Email [email protected] or call 310-430-2397 to learn more. Register by Nov. 30, 2023 to receive the best price. Click for testimonials, pricing, hours & details.  Join us for our Restormel Royal Immersive Adventure Retreat. March 8-15, 2024. Email [email protected] to learn more. Register with friends and family to receive the best price. Click for testimonials, pricing, hours & details. There is very limited availability, and you must register early to ensure that you get the exact room you want. This retreat includes an all-access pass to all of our online training for a full year for two!  Natalie Wynne Pace is an Advocate for SustainabilityFinancial Literacy & Women's Empowerment. Natalie is the bestselling author of The Power of 8 Billion: It's Up to Us and is the co-creator of the Earth Gratitude Project. She has been ranked as a No. 1 stock picker, above over 835 A-list pundits, by an independent tracking agency (TipsTraders). Her book The ABCs of Money remained at or near the #1 Investing Basics e-book on Amazon for over 3 years (in its vertical), with over 120,000 downloads and a mean 5-star ranking. The 5th edition of The ABCs of Money and the 2nd edition of Put Your Money Where Your Heart Is were released in 2021. Follow her on Instagram. Natalie Pace's easy as a pie chart nest egg strategies earned gains in the last two recessions and have outperformed the bull markets in between. That is why her Investor Educational Retreats, books and private coaching are enthusiastically recommended by Nobel Prize winning economist Gary S. Becker, TD AMERITRADE chairman Joe Moglia, Kay Koplovitz and many Main Street investors who have transformed their lives using her Thrive Budget and investing strategies. Click to view a video testimonial from Nilo Bolden. Check out Natalie Pace's Apple Podcast. Watch videoconferences and webinars on Youtube. Other Blogs of Interest WeWork's Bankruptcy. Half-Empty Office Buildings. Problems in our Personal Wealth Plan. Solutions for Unaffordable Housing. The Magnificent 7 Drag NASDAQ into Another Correction Cruise Ships Give Freebies to Investors. Should You Take the Bait? Should You Take a Cruise? Bonds. Banks. The Treacherous Landscape of Keeping Our Money Safe. 7 Rules of Investing Air B N Bust? Santa Rally 2023 or Time to Get Defensive? Barbie. Oppenheimer. Strikes. Streaming Wars. Netflix. Monero: A Token of Trust? 13 Lifestyle Choices to Reduce Waste, Pollution & CO2 & Save a Boatload of Dough. China Bans Apple 11-Point Green Checklist for Schools. Artificial Intelligence and Nvidia's Blockbuster Earnings Report Biotech in a Post-Pandemic World 10 Wealth Secrets of Billionaires and Royals. What Happened to Cannabis? Bank of America has $100 Billion in Bond Losses (on Paper) The USA AAA Credit Rating is on a Negative Watch. Lithium. Essential to EV Life. I'm Just Not Good at Investing. Investors Ask Natalie. Should I Buy an S&P500 Index Fund? Investors Ask Natalie. Bonds Lost More than Stocks in 2022. 2023 Company of the Year Do Cybersecurity Risks Create Investor Opportunities? Writers Strike, While Streaming CEOs Rake In Hundreds of Millions Annually. I Lost $100,000. Investors Ask Natalie. Artificial Intelligence Report. Micron Banned in China. Intel Slashes Dividend. Buffett Loses $23 Billion. Branson's Virgin Orbit Declares Bankruptcy. Insurance Company Risks. Schwab Loses $41 Billion in Cash Deposits. Fiat. Crypto. Gold. BRICS. Real Estate. Alternative Investments. BRICS Currency. Will the Dollar Become Extinct? The Online Global Earth Gratitude Celebration 7 Green Life Hacks Fossil Fuels Touch Every Part of Our Lives Are There Any Safe, Green Banks? 7 Ways to Stash Your Cash Now. Lessons from the Silicon Valley Bank Failure. Which Countries Offer the Highest Yield for the Lowest Risk? Solar, EVs, Housing, HSAs -- the Highest-Yield in 2023? Why We Are Underweighting Banks and the Financial Industry. 2023 Bond Strategy Emotions are Not Your Friend in Investing Investor IQ Test Investor IQ Test Answers Bonds Lost -26%, Silver Held Strong. Save Thousands Annually With Smarter Energy Choices Is Your FDIC-Insured Cash Really Safe? Money Market Funds, FDIC, SIPC: Are Any of Them Safe? My 24-Year-Old is Itching to Buy a Condo. Should I Help Him? The 12-Step Guide to Successful Investing. The Bank Bail-in Plan on Your Dime. Rebalancing Your Nest Egg IQ Test. Answers to the Rebalancing Your Nest Egg IQ Test. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable. However, NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors. What WeWork’s Bankruptcy and Half-Empty Office Buildings Have to Do With Our Personal Wealth Plan.9/11/2023