|

Banks. Why We are Underweighting the Financial Industry. We are underweighting the U.S. financial services industry in our sample pie charts. Why? There are more than a few headwinds in 2023, including:

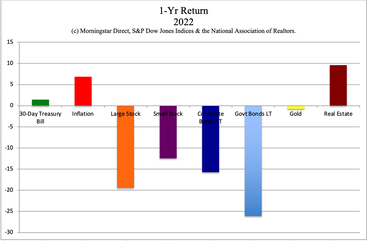

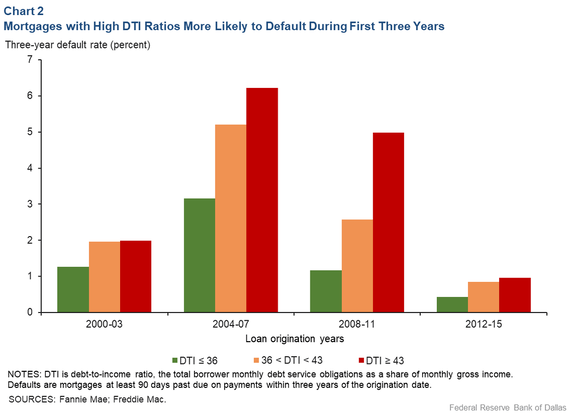

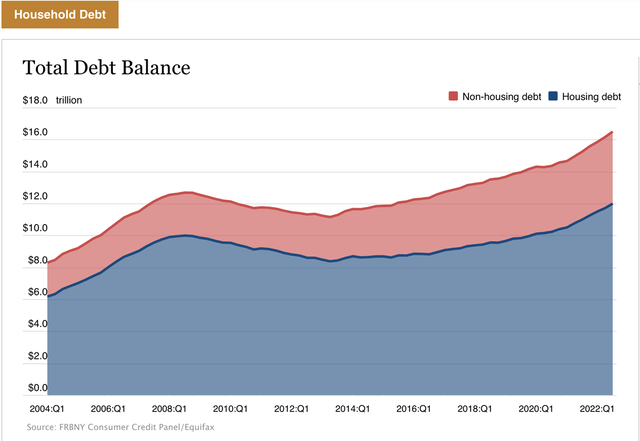

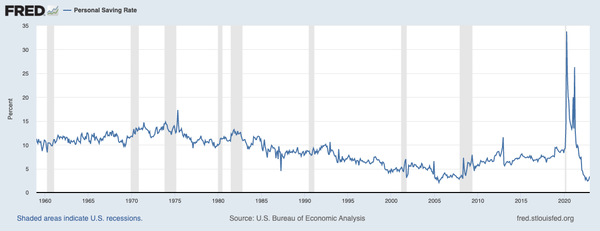

See below for color on each of these headwinds. Banks Begin Conducting Stress Tests Yesterday the Federal Reserve announced the hypothetical scenarios for the 2023 bank stress tests, including a new “global market shock.” Banks must submit results by April 5, 2023. Typically the Federal Reserve publishes the results at the end of June. The results of the tests determine whether or not the bank can continue share repurchases and dividends. In 2020, Wells Fargo suspended its dividend, and all banks suspended buybacks. So, will banks suspend buybacks in 2023? And how will that affect stock performance? Buybacks Curtailed The secular bull market that began in 2009 was supported by robust corporate buybacks. However, in 2023, share repurchases are pretty far down the list of priorities. As Alastair Borthwick, the CFO of Bank of America, said in the 4Q and FY 2022 earnings call, “We've got to, number one, support our clients; we're going to, number two, invest in our growth. Then we plan to just sustain and grow our dividend, and over time, we'll balance building capital and buying back shares.” In the 3rd quarter of 2022, share repurchases by S&P500 financial companies were down by -63% from the robust buying that went on the 3rd quarter of 2021. (4th quarter buybacks are still coming in.) There is a strong correlation with the curtailment of buybacks and market weakness. In the 2nd quarter of 2022, financial buybacks dropped from $54.69 billion to $21.2 billion sequentially (-61.2%). Total S&P500 buybacks were down -21.8% (from $281 billion in 1Q 2022 to $219.6 billion in the 2nd quarter). Without the corporate support, the S&P500 sank by -15.9% in 2Q 2022. How Will Banks Fare in 2023? The IMF issued an alert on Jan. 31, 2023, writing, “[The] build-up of risk in the corporate sector and a doubling of funding costs for even the safest issuers could pose serious problems for many economies and their financial systems.” The U.S. was listed as one of the developed world countries that was at risk, behind Portugal, Norway, Greece, Spain, Iceland, New Zealand, Austria and Italy. On Jan. 19, 2023, S&P Global Ratings issued a report entitled, “U.S. Finance Companies Face Murky Waters Amid Potential Recession, Rising Rates and Weakening Asset Quality in 2023.” The challenges could result in “weakened access to funding and reduced earnings.” We’re already seeing a more challenging climate show up in the earnings results. Many banks are reporting substantially lower net income for 2022, compared to 2021. Goldman Sachs net income dropped from $21.64 billion in 2021 to $11.26 billion in 2022 (-48%). JP Morgan’s net income weakened by -22%, at $37.7 billion, versus $48.3 net income in 2021. The trend was pretty much across the board with most of the major banks. Low Credit Ratings in the Banks Themselves Many banks are rated BBB (at the lowest rung of investment grade), including M&T Bank, Goldman Sachs, Ally Financial, Citigroup, Capital One and Wells Fargo. Block, Inc. is rated BB (below investment grade), as is SLM Corporation (source: S&P Global). JP Morgan and Bank of America both sport A- ratings. LT Bond Exposure Long-term government bonds lost more than the S&P500 last year, while LT corporate bonds were also losers. The safe “fixed income” side of our portfolio is where we want to preserve our capital, not lose principal. Incidentally, the Federal Reserve began reporting “negative net income” in September of 2022 and anticipates that it will take a few years to get back in the black. (Read the minutes of the September 21, 2022 FOMC meeting for details.) Bond strategies in an environment with inflation and rising interest rates are tricky, but doable. If you saw losses on the fixed income side of your wealth plan, it’s a good idea to learn the basics and take steps consistent with the challenges of investing in a Debt World. While banks have sophisticated teams and technology that are designed to manage risk, some do a lot better job of it than others. If the U.S. is included as one of the top countries at risk of corporate debt contagion, according to the IMF, that tells us a lot. There are ample charts offered by FRED (The Federal Reserve Bank of St. Louis) that quantify the issue. Other Headwinds While long-term bonds, credit risk and rising interest rates are the primary concerns cited by the IMF and S&P Global, there are additional headwinds. The work-from-home trend is impacting commercial real estate. M&T Bank CFO Darren King revealed in the 4Q 2022 earnings call on Jan. 19, 2023 that commercial real estate prices have dropped. He also admitted that the bank’s CRE exposure in New York City (one of the weakest markets) is about 15%, and that this is an area of concern for the bank. Online shopping has created a lot of boarded-up mall and retail real estate (typically masked by enticing advertising). Assisted living and senior housing occupancy rates are still below pre-pandemic levels, according to Darren King, due to the inability to fully staff the facilities. High home prices, combined with rising mortgage rates, has stalled out the home buying market. The Spring homebuying season might be disrupted by a new Debt-To-Income (DTI) rule, which was recently reinstated by the Federal Housing Finance Agency. The Mortgage Bankers Association argues that DTIs are confusing, unnecessary and expensive red tape, while economists warn that DTIs that are 43 or higher increase the risk of a mortgage default within a 3-year period. As you can see in the chart below, high DTIs were 4-times more likely to default in the period between 2008 and 2011 (the Great Recession). Additionally, consumer debt is elevated, while savings are pretty much depleted. That means that bank deposits are lower this year than they were when everyone got a free check from the U.S. Treasury. Money Market Funds In the Great Recession, banks and brokerages were bailed out. In the next financial crisis, money market fund rules (redemption gates and liquidity fees) are intended to buoy up the financial services industry. Learn more about the money market fund rules and how they apply to each of us in my 2021 blog. Bottom Line Banks, brokerages, insurance companies (remember AIG?), fund companies and other financial services corporations tend to suffer greatly in recessions. Everyone is hoping that the 2023 recession will be mild. However, it’s a good idea to consider underweighting the financial services industry, particularly in countries that have elevated risks (like the U.S.). (Banks in another country that is featured at our Financial Freedom Retreat is paying double the dividend for less risk.) If you’d like a Bank Stock Report Card, email [email protected] with Bank Stock Report Card in the subject line.  Join us for our Online Financial Freedom Retreat. April 22-24, 2023. Email [email protected] to learn more. Register with friends and family to receive the best price. Click for testimonials, pricing, hours & details.  Natalie Wynne Pace is an Advocate for Sustainability, Financial Literacy & Women's Empowerment. Natalie is the bestselling author of The Power of 8 Billion: It's Up to Us and is the co-creator of the Earth Gratitude Project. She has been ranked as a No. 1 stock picker, above over 835 A-list pundits, by an independent tracking agency (TipsTraders). Her book The ABCs of Money remained at or near the #1 Investing Basics e-book on Amazon for over 3 years (in its vertical), with over 120,000 downloads and a mean 5-star ranking. The 5th edition of The ABCs of Money was released on September 17, 2021. Natalie Pace's easy as a pie chart nest egg strategies earned gains in the last two recessions and have outperformed the bull markets in between. That is why her Investor Educational Retreats, books and private coaching are enthusiastically recommended by Nobel Prize winning economist Gary S. Becker, TD AMERITRADE chairman Joe Moglia, Kay Koplovitz and many Main Street investors who have transformed their lives using her Thrive Budget and investing strategies. Click to view a video testimonial from Nilo Bolden. Check out Natalie Pace's Apple Podcast. Watch videoconferences and webinars on Youtube. Other Blogs of Interest You Stream all the Channels. Should You Invest, Too? NASDAQ is Still Down -26%. Are Meta & Snap a Buy? 2023 Bond Strategy Emotions are Not Your Friend in Investing Investor IQ Test Investor IQ Test Answers Bonds Lost -26%, Silver Held Strong. 2023 Crystal Ball for Stocks, Bonds, Real Estate, Cannabis, Gold, Silver. Tilray: The Constellation Brands of Cannabis New Year, New Healthier You Tesla's $644 Billion Fall From Mars Silver's Quiet Rally. Free Holiday Gift. Stocking Stuffers Under $10. Cash Burn & Inflation Toasted the Plant-Based Protein Companies Save Thousands Annually With Smarter Energy Choices Is Your FDIC-Insured Cash Really Safe? Giving Tuesday Tips to Make Your Charitable Contribution a Triple Win. Is Your Pension Plan Stealing From You? The FTX Crypto Fall of a Billionaire (SBF). Crypto, Gold, Silver: Not So Safe Havens. Will Ted Lasso Save Christmas? 3Q will be Released This Thursday. Apple and the R Word. Yield is Back. But It's Tricky. The Real Reason Why OPEC Cut Oil Production. The Inflation Buster Budgeting and Investing Plan. No. Elon Musk Doesn't Live in a Boxabl. IRAs Offer More Freedom and Protection Than 401ks. Will There Be a Santa Rally 2022? What's Safe in a Debt World? Not Bonds. Will Your Favorite Chinese Company be Delisted? 75% of New Homeowners Have Buyer's Remorse Clean Energy Gets a Green Light from Congress. Fix Money Issues. Improve Your Relationships. 24% of House Sales Cancelled in the 2nd Quarter. 3 Things to Do Before July 28th. Recession Risks Rise + a Fairly Safe High-Yield Bond DAQO Doubles. Solar Shines. Which Company is Next in Line? Tesla Sales Disappoint. Asian EV Competition Heats Up. 10 Wealth Strategies of the Rich Copper Prices Plunge Colombia and Indonesia: Should You Invest? 10 Misleading Broker/Salesman Pitches. Why are Banks and Dividend Stocks Losing Money? ESG Investing: Missing the E. Bitcoin Crashes. Crypto, Gold and Stocks All Crash. The U.S. House Decriminalizes Cannabis Again. The Risk of Recession in 6 Charts. High Gas Prices How Will Russian Boycotts Effect U.S. Multinational Companies? Oil and Gas Trends During Wartime Russia Invades Ukraine. How Have Stocks Responded in Past Wars? 2022 Crystal Ball in Stocks, Real Estate, Crypto, Cannabis, Gold, Silver & More. Interview with the Chief Investment Strategist of Charles Schwab & Co., Inc. Stocks Enter a Correction Investor IQ Test Investor IQ Test Answers What's Safe in a Debt World? Money Market Funds, FDIC, SIPC: Are Any of Them Safe? My 24-Year-Old is Itching to Buy a Condo. Should I Help Him? The 12-Step Guide to Successful Investing. Gardeners Creating Sanctuary & Solutions in Food Deserts. The Bank Bail-in Plan on Your Dime. Rebalancing Your Nest Egg IQ Test. Answers to the Rebalancing Your Nest Egg IQ Test. Important Disclaimers Please note: Natalie Pace does not act or operate like a broker. She reports on financial news, and is one of the most trusted sources of financial literacy, education and forensic analysis in the world. Natalie Pace educates and informs individual investors to give investors a competitive edge in their personal decision-making. Any publicly traded companies or funds mentioned by Natalie Pace are not intended to be buy or sell recommendations. ALWAYS do your research and consult an experienced, reputable financial professional before buying or selling any security, and consider your long-term goals and strategies. Investors should NOT be all in on any asset class or individual stocks. Your retirement plan should reflect a diversified strategy, which has been designed with the assistance of a financial professional who is familiar with your goals, risk tolerance, tax needs and more. The "trading" portion of your portfolio should be a very small part of your investment strategy, and the amount of money you invest into individual companies should never be greater than your experience, wisdom, knowledge and patience. Information has been obtained from sources believed to be reliable. However, NataliePace.com does not warrant its completeness or accuracy. Opinions constitute our judgment as of the date of this publication and are subject to change without notice. This material is not intended as an offer or solicitation for the purchase or sale of any financial instrument. Securities, financial instruments or strategies mentioned herein may not be suitable for all investors. Comments are closed.

|

AuthorNatalie Pace is the co-creator of the Earth Gratitude Project and the author of The Power of 8 Billion: It's Up to Us, The ABCs of Money, The ABCs of Money for College, The Gratitude Game and Put Your Money Where Your Heart Is. She is a repeat guest & speaker on national news shows and stages. She has been ranked the No. 1 stock picker, above over 830 A-list pundits, by an independent tracking agency, and has been saving homes and nest eggs since 1999. Archives

July 2024

Categories |

RSS Feed

RSS Feed